Midsona Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Midsona Bundle

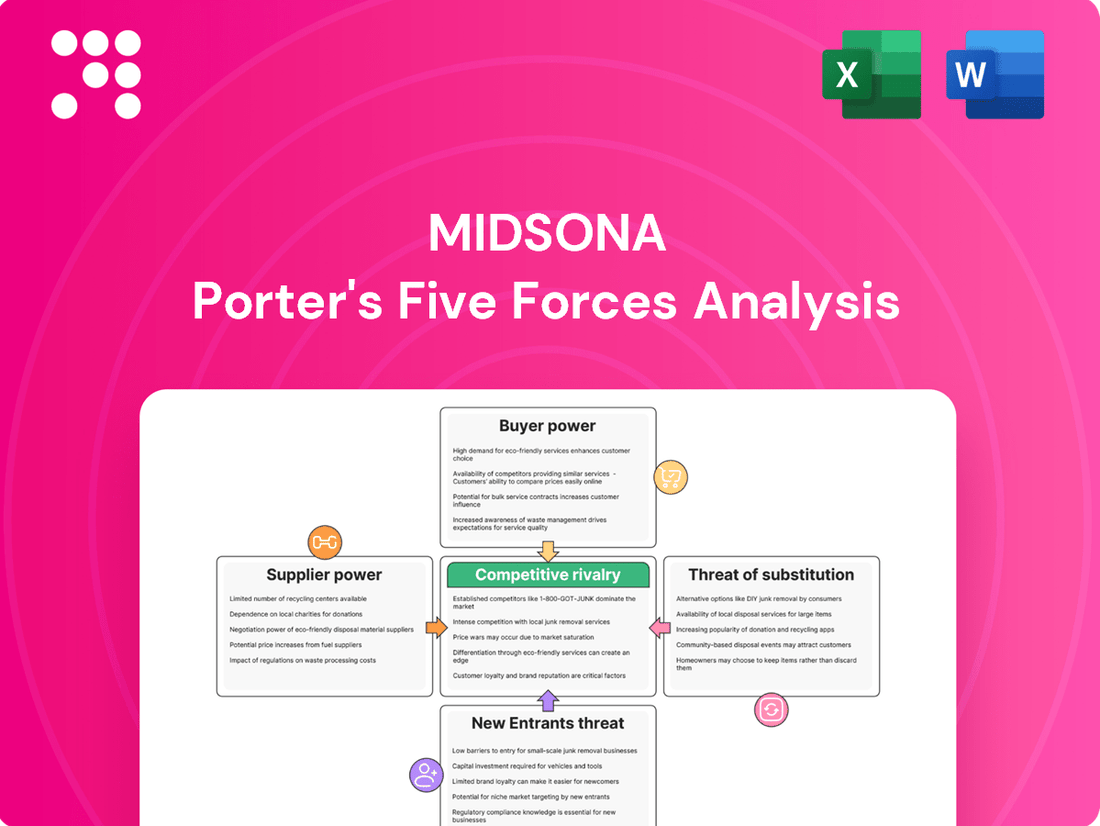

Midsona operates within a dynamic market, facing pressures from buyer bargaining power and the threat of new entrants. Understanding these forces is crucial for navigating its competitive landscape.

The complete report reveals the real forces shaping Midsona’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Midsona's reliance on a concentrated group of specialized organic and natural ingredient suppliers significantly amplifies their bargaining power. For instance, if a particular unique organic berry used in a popular Midsona product is sourced from only two or three global producers, these suppliers can dictate terms and prices, directly impacting Midsona's profitability. This limited supplier pool for critical, specialized inputs means Midsona has fewer alternatives, strengthening the suppliers' ability to demand higher prices or impose less favorable contract conditions.

The bargaining power of suppliers for Midsona is significantly influenced by the switching costs associated with changing suppliers. If it's difficult or expensive for Midsona to shift from one supplier to another, existing suppliers gain more leverage. This difficulty can stem from various factors, including long-term supply agreements that are costly to break, the need for specialized equipment or processes to accommodate new suppliers, or the time and resources required to certify new organic ingredient providers.

Midsona's commitment to organic and natural products introduces an additional layer of complexity. The stringent sourcing requirements and certification processes inherent in these markets can elevate switching costs. For instance, finding and vetting new suppliers who meet rigorous organic standards can be a lengthy and resource-intensive undertaking, thereby reinforcing the bargaining power of established, certified suppliers within Midsona's supply chain.

The bargaining power of suppliers for Midsona is significantly influenced by the uniqueness and importance of the inputs they provide. When suppliers offer highly differentiated, proprietary, or critical ingredients that directly impact Midsona's product quality and brand promise, their leverage increases. For instance, unique organic plant extracts or specialized health-promoting ingredients that are difficult to replicate or source elsewhere give these suppliers considerable sway.

Midsona's commitment to 'natural' and 'organic' product lines means it relies on specific, often limited, supply chains. This reliance on specialized sourcing, such as for rare botanical ingredients or sustainably harvested components, can concentrate power in the hands of a few suppliers. For example, if a key supplier of a unique superfruit extract used in Midsona's popular beverages experiences production issues, it could disrupt Midsona's operations and necessitate price concessions.

Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into finished product manufacturing can significantly bolster their bargaining power against Midsona. This would mean suppliers could bypass Midsona and sell directly to consumers or retailers, potentially capturing more of the value chain. While this threat is typically mitigated in the highly regulated and brand-conscious health and well-being sector, it's a factor to monitor, especially for exceptionally large ingredient providers.

For instance, a major dairy supplier, if it possessed the brand recognition and distribution capabilities, could theoretically launch its own line of branded yogurt or protein drinks, directly competing with Midsona's offerings. This would shift the power dynamic considerably.

- Supplier Forward Integration Risk: Suppliers moving into finished goods production increases their leverage over Midsona.

- Sector Specificity: This threat is generally lower in regulated, branded sectors like health and well-being.

- Key Supplier Consideration: The risk is more pronounced for very large ingredient suppliers with significant market influence.

Availability of Substitute Inputs

The availability of substitute inputs significantly curtails supplier bargaining power. For Midsona, a company focused on organic and natural products, the emergence of new, sustainable, or plant-based alternatives that align with consumer demand could offer more sourcing flexibility. This increased choice directly diminishes the leverage held by existing suppliers.

In 2024, the plant-based food sector continued its robust growth, with innovation in alternative protein and ingredient sourcing. For instance, the market for oat-based ingredients, a common substitute for dairy, saw continued expansion, providing food manufacturers like Midsona with a wider array of options for product formulation. This trend directly impacts the bargaining power of traditional dairy suppliers.

- Increased Sourcing Options: As more sustainable and plant-based ingredients become available, Midsona can diversify its supplier base.

- Reduced Reliance on Single Suppliers: The presence of alternatives lessens dependence on any one supplier, strengthening Midsona's negotiating position.

- Potential for Cost Savings: Competition among suppliers of substitute inputs can lead to more favorable pricing for Midsona.

- Innovation in Product Development: Access to novel ingredients can spur new product development, further enhancing Midsona's market competitiveness.

Midsona's bargaining power with its suppliers is significantly influenced by the concentration of its supplier base and the uniqueness of the inputs it requires. For example, in 2024, the specialized nature of organic and natural ingredients meant that for certain key components, Midsona might only have a few certified suppliers globally. This limited availability grants these suppliers considerable leverage, allowing them to command higher prices or impose stricter terms, directly impacting Midsona's cost structure and profit margins.

| Factor | Impact on Midsona's Supplier Bargaining Power | 2024 Relevance |

| Supplier Concentration | High | Limited number of certified organic suppliers for niche ingredients. |

| Switching Costs | Moderate to High | Certification and vetting processes for new organic suppliers are time-consuming and costly. |

| Input Uniqueness/Importance | High | Specialized organic extracts and health-promoting ingredients are critical to Midsona's brand. |

| Availability of Substitutes | Moderate | Growing plant-based alternatives offer some diversification, reducing reliance on traditional inputs. |

What is included in the product

This analysis dissects the competitive forces impacting Midsona, including the threat of new entrants, the bargaining power of buyers and suppliers, the threat of substitutes, and the intensity of rivalry within its markets.

Quickly identify and mitigate competitive threats with a visual breakdown of industry power dynamics.

Customers Bargaining Power

Midsona's customer base, encompassing both individual consumers and retailers, demonstrates a spectrum of price sensitivity. This is particularly evident in the health and well-being sector, where consumers often accept premium pricing for organic and specialized products. However, broader economic shifts and the availability of competitive alternatives can significantly amplify this sensitivity.

For instance, during periods of economic uncertainty, consumers may become more inclined to seek out value-oriented options, even within the health food market. This necessitates that Midsona maintain rigorous cost management to ensure its product pricing remains attractive and competitive, especially when faced with private label offerings from large retailers.

Customers wield considerable bargaining power when numerous alternative health and well-being products exist. This includes offerings from direct rivals and even traditional, non-specialized options. For instance, in 2024, the global dietary supplements market, a key area for Midsona, was valued at over $170 billion, indicating a vast competitive landscape.

While Midsona’s focus on organic and natural products aids differentiation, consumers can readily shift to other brands if they perceive a lack of value or if alternative products offer greater perceived benefits. This ease of switching intensifies customer leverage, forcing companies to remain competitive on price, quality, and innovation.

Customers today have unprecedented access to information about products and their ingredients, thanks to the internet and online review platforms. This transparency empowers them to make more informed choices. For instance, in 2024, a significant portion of consumers reported actively researching product ingredients and company practices before making a purchase. This trend means that companies like Midsona, which prioritize transparency, are better positioned, but it also intensifies customer bargaining power as they can easily compare offerings and switch to competitors.

Concentration of Retail Channels

Midsona's reliance on a limited number of major retail channels in the Nordic region significantly amplifies customer bargaining power. For instance, if a few dominant grocery chains represent a substantial portion of Midsona's total sales, these entities can leverage their market share to negotiate more favorable terms.

This concentration means that these key retail partners can effectively demand lower prices, increased promotional funding, or exclusive product offerings. Such demands directly pressure Midsona's profitability and can restrict its ability to reach a broader customer base if access through these channels is compromised.

- Concentration of Retail Channels: Midsona's sales are notably concentrated through a few large retail chains in the Nordic market.

- Customer Leverage: These key customers can demand better pricing and promotional support due to their significant market presence.

- Impact on Margins: This concentration can squeeze Midsona's profit margins and affect its overall market access.

Low Switching Costs for Consumers

For end consumers, the cost and effort involved in switching from one brand of dietary supplement, health food, or personal care product to another are generally low. This ease of switching increases customer power. In 2024, the global dietary supplements market, a key segment for Midsona, was valued at approximately $170 billion, with many brands competing for consumer attention. This high competition further empowers consumers to explore alternatives based on price, preference, or perceived benefits.

- Low Switching Costs: Consumers can easily move between brands without significant financial or logistical barriers.

- Price Sensitivity: The ability to switch readily makes consumers more sensitive to price differences.

- Brand Loyalty Challenges: Companies face hurdles in retaining customers when alternatives are easily accessible and often cheaper.

- Market Dynamics: In a market with numerous players, like the $170 billion global dietary supplements sector in 2024, low switching costs amplify customer bargaining power.

Midsona faces significant customer bargaining power due to the sheer volume of choices available. In 2024, the global market for health and wellness products, a core area for Midsona, continued to expand, offering consumers a vast array of alternatives. This abundance of options, from established brands to emerging niche players, allows customers to readily compare prices, ingredients, and benefits, thereby increasing their leverage.

The concentration of Midsona's sales through a few dominant Nordic retailers further amplifies customer power. These large retail chains, representing a substantial portion of Midsona's revenue, can negotiate favorable terms, impacting pricing and promotional activities. For instance, in 2024, the Nordic grocery market saw continued consolidation, strengthening the negotiating position of major players.

| Factor | Impact on Midsona | Supporting Data (2024 Estimates) |

|---|---|---|

| Product Availability | High customer power due to numerous alternatives in health and wellness. | Global health and wellness market valued at over $1.5 trillion. |

| Retailer Concentration | Significant leverage for key Nordic retail partners. | Top 3 Nordic grocery chains account for over 60% of the grocery market share. |

| Switching Costs | Low for consumers, enabling easy brand shifts. | Consumers increasingly prioritize value and are open to trying new brands. |

Preview Before You Purchase

Midsona Porter's Five Forces Analysis

This preview showcases the complete Midsona Porter's Five Forces Analysis, providing an in-depth examination of competitive forces within the company's industry. The document you see here is precisely the same professionally formatted analysis you will receive immediately after purchase, ensuring you get exactly what you need without any discrepancies.

Rivalry Among Competitors

The Nordic health and well-being sector, covering organic foods, supplements, and natural personal care, features a blend of substantial, long-standing companies and a multitude of smaller, specialized brands. This broad array of competitors means Midsona faces significant rivalry as it competes for consumer loyalty and market positioning.

The Nordic market for organic and health-conscious products, a key area for Midsona, is experiencing robust growth, with the overall health food market in the region projected to see a compound annual growth rate (CAGR) of approximately 7% through 2027. However, the competitive landscape is shaped by the maturity of specific product categories. For instance, while plant-based alternatives are rapidly expanding, attracting new entrants, more established segments like organic dairy or gluten-free baked goods may exhibit slower growth, intensifying rivalry among existing players vying for market share.

Midsona's competitive edge hinges on its strong portfolio of organic and natural brands, aiming for differentiation. For instance, in 2024, Midsona continued to invest in marketing its key brands like Urtekram and Semper, emphasizing their natural credentials to foster consumer loyalty.

However, the health and wellness food sector is increasingly crowded. Competitors are actively developing and marketing similar organic and natural products, sometimes at more aggressive price points. This can erode Midsona's differentiation advantage if consumers perceive little meaningful difference in quality or value.

The intensity of this rivalry is evident in the promotional activities observed across the sector. In 2024, numerous competitors ran price discounts and bundled offers on organic staples, directly challenging Midsona's market share and forcing a greater focus on price competitiveness, which can strain profit margins.

High Exit Barriers

Midsona, like many in the health and well-being industry, faces significant exit barriers. The substantial investment in specialized production facilities and the need to maintain specific certifications for product quality contribute to these high costs. For instance, companies often have dedicated lines for supplements or specialized food production, making it difficult and expensive to repurpose or sell these assets.

These exit barriers can trap less profitable competitors within the market. When it’s more costly to exit than to continue operating at a loss, these businesses may persist, adding to the overall competitive pressure. This situation can lead to a more crowded marketplace, even for companies that are struggling to achieve profitability.

The implications for the industry are clear:

- High Fixed Asset Investment: Companies in this sector often have substantial investments in tangible assets, such as manufacturing plants and specialized equipment, which are not easily converted to cash.

- Specialized Production Needs: The production of health and well-being products frequently requires highly specialized facilities and adherence to strict regulatory standards, increasing the cost and complexity of exiting.

- Contractual Commitments: Long-term supply agreements or distribution contracts can also act as exit barriers, obligating companies to remain active in the market.

Strategic Objectives of Competitors

Midsona's competitors, like Orkla and Unilever, often pursue aggressive market share expansion. For instance, Orkla has been actively acquiring smaller players in the Nordic food sector, aiming to consolidate its position.

Diversification is another common strategic objective. Many competitors are moving beyond traditional food products into health and wellness categories, mirroring consumer trends. This includes launching plant-based alternatives and functional foods, as seen with Unilever's increasing investment in its plant-based portfolio.

A focus on price leadership also shapes the competitive landscape. Companies like Axfood, through its private label brands, frequently engage in price wars to capture market share, putting pressure on margins across the industry.

- Market Share Expansion: Competitors like Orkla actively acquire smaller entities to grow their presence.

- Product Diversification: A trend towards health and wellness products, including plant-based options, is evident.

- Price Leadership: Some players utilize private labels to compete aggressively on price.

The competitive rivalry within the Nordic health and well-being sector is intense, driven by a mix of large, established players and numerous niche brands. Midsona faces this dynamic head-on, with competitors like Orkla actively acquiring smaller companies and Unilever expanding its plant-based offerings. This crowded market sees frequent price promotions and a strong push for product differentiation, as seen in Midsona's 2024 marketing efforts for Urtekram and Semper.

The drive for market share means competitors often engage in aggressive strategies. For instance, Axfood's private label brands frequently initiate price competition, impacting profit margins across the board. This pressure is exacerbated by high exit barriers in the industry, such as specialized production facilities and regulatory compliance costs, which can keep less profitable firms in the market, further intensifying rivalry.

| Competitor | Strategy Example | 2024 Impact/Focus |

|---|---|---|

| Orkla | Acquisitions of smaller players | Consolidating market position |

| Unilever | Investment in plant-based portfolio | Mirroring consumer trends, expanding reach |

| Axfood (Private Labels) | Price leadership/wars | Capturing market share, pressuring margins |

SSubstitutes Threaten

Consumers often find readily available conventional alternatives to Midsona's products. For instance, many seek general health or nutritional benefits and can choose non-organic products that fulfill similar needs but at a considerably lower cost. This accessibility of cheaper, conventional options presents a substantial threat to Midsona's premium organic range, particularly for price-sensitive customer segments.

Shifting consumer preferences, like the growing embrace of whole foods and home-cooked meals, present a significant threat of substitution for companies like Midsona. For instance, a 2024 report indicated that 65% of consumers are actively seeking to reduce processed food intake, potentially opting for fresh produce or homemade alternatives over packaged health foods.

The threat of substitutes for Midsona's products is significant, particularly from categories perceived as more effective or convenient. For example, pharmaceutical interventions for certain health conditions might be viewed as a more direct and potent solution than dietary supplements, impacting demand for Midsona's offerings in those specific health areas. This perception can be a powerful driver for consumers seeking immediate or scientifically validated results.

Furthermore, the rise of fresh, unprocessed foods presents a strong substitute for Midsona's packaged health foods. Consumers increasingly prioritize natural, whole ingredients, seeing them as inherently superior to processed alternatives, even those marketed as healthy. This trend, evident in the growing popularity of farmers' markets and direct-to-consumer farm boxes, directly challenges the market share of packaged goods.

Technological Advancements in Health

Innovations in health technology present a significant threat of substitutes for Midsona. For instance, personalized nutrition apps and wearable health trackers offer consumers alternative methods to monitor and manage their well-being, potentially bypassing traditional health products. The global digital health market was valued at over $200 billion in 2023 and is projected to grow substantially, indicating a strong consumer shift towards tech-driven health solutions.

Advanced diagnostics also contribute to this threat. Consumers can access increasingly sophisticated at-home testing kits for various health markers, providing insights that might have previously required professional consultation and associated product purchases. This technological accessibility empowers individuals to take a more proactive, and potentially less product-dependent, approach to their health management.

The increasing adoption of these technologies means consumers may find substitutes that offer comparable or even superior health benefits. This trend could lead to a reduced demand for Midsona's existing product portfolio if they do not adapt or integrate these technological advancements. For example, the market for health wearables alone is expected to exceed $100 billion by 2027.

Key technological advancements posing as substitutes include:

- Personalized Nutrition Apps: Offering customized dietary plans and tracking.

- Wearable Health Trackers: Monitoring vital signs, activity levels, and sleep patterns.

- Advanced At-Home Diagnostics: Providing insights into genetic predispositions or specific health markers.

- Telehealth Platforms: Facilitating remote consultations and health advice.

Do-It-Yourself (DIY) Health Solutions

The rise of do-it-yourself (DIY) health solutions presents a significant threat of substitution for Midsona. Consumers are increasingly preparing their own plant-based meals, fermenting foods, and creating herbal remedies at home. This trend directly competes with Midsona's portfolio of pre-packaged health foods and supplements.

For instance, the global market for fermented foods, a key area for DIY enthusiasts, was valued at approximately $45.5 billion in 2023 and is projected to grow significantly. Similarly, consumer interest in homemade wellness products, from kombucha to natural skincare, is on the upswing. This growing self-sufficiency in health and wellness reduces the demand for commercially produced alternatives, impacting Midsona's market share.

- DIY Health Trend: Consumers are increasingly opting for homemade health solutions, directly challenging manufactured products.

- Market Impact: This trend can decrease the demand for Midsona's pre-packaged health foods and supplements.

- Growth in Substitutes: The fermented foods market, a prime DIY category, was valued at $45.5 billion in 2023, indicating substantial consumer engagement.

The threat of substitutes for Midsona's products is substantial, driven by both conventional alternatives and evolving consumer behaviors. Cheaper, non-organic options fulfill basic nutritional needs, while a growing preference for whole, unprocessed foods and home-cooked meals directly challenges packaged health foods. For example, a 2024 survey revealed that 65% of consumers are actively reducing processed food intake, favoring fresh produce.

Technological advancements also introduce potent substitutes, such as personalized nutrition apps and advanced diagnostics. These tools empower consumers with self-management capabilities, potentially bypassing the need for traditional health products. The global digital health market, exceeding $200 billion in 2023, underscores this shift towards tech-driven wellness solutions.

The rise of DIY health and wellness solutions further intensifies this threat. Consumers are increasingly making their own fermented foods, plant-based meals, and herbal remedies, directly competing with Midsona's offerings. The fermented foods market alone reached approximately $45.5 billion in 2023, highlighting significant consumer engagement in homemade alternatives.

| Substitute Category | Example | 2023 Market Value (Approx.) | Consumer Trend Impact |

|---|---|---|---|

| Conventional Foods | Non-organic groceries | N/A (Vast Market) | Price-sensitive consumers seek lower-cost alternatives. |

| Whole & Unprocessed Foods | Fresh produce, home-cooked meals | N/A (Growing Segment) | Preference for natural ingredients over processed options. |

| Health Technology | Personalized nutrition apps, wearables | Digital Health: $200+ billion | Tech-driven self-management bypasses traditional products. |

| DIY Health Solutions | Homemade fermented foods, herbal remedies | Fermented Foods: $45.5 billion | Increased self-sufficiency reduces demand for packaged goods. |

Entrants Threaten

Entering the organic and natural products market, particularly at a scale comparable to Midsona, demands considerable financial investment. This includes setting up modern production facilities, investing in research and development for new product lines, building robust marketing campaigns, and establishing extensive distribution networks.

The significant capital required for these operations creates a substantial barrier to entry for new companies. For instance, establishing a new food manufacturing plant can easily cost tens of millions of dollars, and this doesn't even account for brand building and market penetration efforts.

In 2024, the global organic food market was valued at approximately $250 billion, and it continues to grow. This attractive market size is tempered by the high upfront costs associated with meeting regulatory standards, securing certifications, and achieving economies of scale necessary to compete with established players like Midsona.

The health and well-being sector, especially for organic and dietary supplements like those Midsona offers, faces significant regulatory hurdles and requires specific certifications. For instance, in the EU, products must comply with Regulation (EC) No 1924/2006 on nutrition and health claims, and in Sweden, the National Food Agency (Livsmedelsverket) oversees compliance. These stringent requirements, along with obtaining certifications like KRAV for organic products, create a substantial barrier to entry for new companies unfamiliar with or unable to meet these demanding standards.

Midsona enjoys a significant advantage due to its deeply entrenched brand loyalty and well-established distribution networks across the Nordic region. This means consumers already trust Midsona's products, making them the go-to choice.

For any new company looking to enter this market, the hurdle of building similar brand recognition and securing shelf space in major retail outlets and popular online platforms is substantial. For instance, in 2024, securing prime placement in a major Nordic grocery chain could involve significant slotting fees and marketing commitments, often running into tens of thousands of euros per product.

This makes the cost and time investment for new entrants incredibly high. They must not only create a compelling product but also overcome the inertia of consumer preference and the logistical complexities of reaching the market effectively, a challenge that can deter many potential competitors.

Access to Specialized Raw Materials and Expertise

The threat of new entrants for companies like Midsona, particularly in the organic and natural food sector, is significantly shaped by access to specialized raw materials and expertise. Sourcing high-quality, certified organic, and natural ingredients consistently presents a substantial hurdle. New players often find it difficult to establish robust supply chains and secure the necessary technical knowledge for product development and formulation within this specific niche.

This difficulty in securing specialized inputs and know-how acts as a barrier. For instance, the global organic food market was valued at approximately $250 billion in 2023 and is projected to grow, increasing demand for these premium ingredients. New entrants must not only find these materials but also possess the formulation expertise to create competitive products, a challenge that requires significant investment and time.

- Supply Chain Complexity: Establishing reliable sourcing for certified organic and natural raw materials is a significant barrier.

- Formulation Expertise: Developing effective and appealing products requires specialized knowledge in natural ingredient formulation.

- Certification Hurdles: Obtaining and maintaining organic certifications adds another layer of complexity and cost for new entrants.

- Market Access: Gaining shelf space and consumer trust in a competitive market, especially for niche products, is challenging without established networks.

Economies of Scale and Cost Advantages

Existing players like Midsona often benefit from significant economies of scale in procurement, production, and marketing. For instance, in 2024, Midsona's substantial purchasing power allowed them to negotiate favorable terms with suppliers, contributing to a lower cost of goods sold compared to smaller, emerging brands. This scale advantage translates directly into lower per-unit costs, making it challenging for new entrants to compete on price.

New entrants may find it difficult to achieve similar cost efficiencies from the outset. Building the necessary production capacity and establishing widespread distribution networks requires substantial upfront investment. Without the volume of sales that Midsona commands, these new players will likely face higher per-unit production and marketing expenses, placing them at a distinct competitive disadvantage from day one.

- Economies of Scale: Midsona leverages its size for cost reductions in sourcing and manufacturing.

- Procurement Power: In 2024, Midsona's large order volumes secured better pricing from suppliers.

- Marketing Efficiency: Spreading marketing costs over a larger sales base lowers per-customer acquisition costs for Midsona.

- Barriers to Entry: New entrants face higher initial costs to match Midsona's operational efficiencies.

The threat of new entrants for Midsona is moderately high, primarily due to the attractive growth of the organic and natural products market. However, significant barriers exist, including the substantial capital required for production, R&D, and marketing, as well as the complexities of regulatory compliance and certification processes, particularly for health and well-being products.

Established brand loyalty and extensive distribution networks held by Midsona present a considerable challenge for newcomers aiming for market penetration. Furthermore, securing reliable supply chains for specialized organic ingredients and possessing the necessary formulation expertise are critical hurdles. Economies of scale enjoyed by Midsona in procurement, production, and marketing also create a cost disadvantage for potential new competitors.

| Barrier Type | Description | Impact on New Entrants | 2024 Market Context |

|---|---|---|---|

| Capital Requirements | High investment needed for facilities, R&D, marketing, and distribution. | Significant financial hurdle. | Global organic food market valued at ~$250 billion. |

| Brand Loyalty & Distribution | Established consumer trust and extensive retail/online presence. | Difficult to gain market share and shelf space. | Securing prime placement can cost tens of thousands of euros. |

| Regulatory & Certification | Stringent rules for organic and health claims (e.g., EU Regulation 1924/2006, KRAV). | Requires specialized knowledge and compliance costs. | National Food Agencies oversee compliance. |

| Supply Chain & Expertise | Access to certified organic ingredients and formulation know-how. | Challenges in sourcing and product development. | Increased demand for premium organic ingredients. |

| Economies of Scale | Lower per-unit costs due to large-scale operations. | Price competition disadvantage for new entrants. | Midsona's procurement power yields better supplier terms. |

Porter's Five Forces Analysis Data Sources

Our Midsona Porter's Five Forces analysis is built upon a robust foundation of data, incorporating annual reports, investor presentations, and public filings from Midsona and its competitors. We also leverage industry-specific market research reports and trade publications to capture nuanced competitive dynamics and emerging trends.