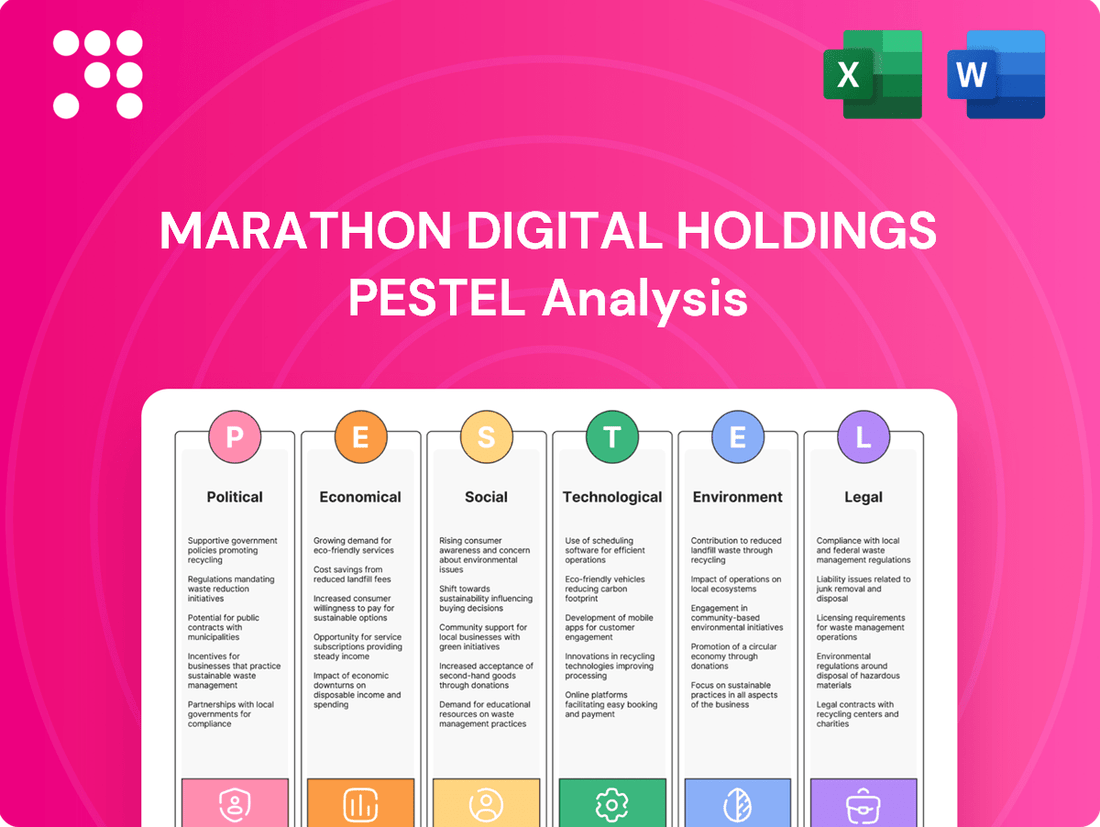

Marathon Digital Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marathon Digital Holdings Bundle

Unlock the critical external factors influencing Marathon Digital Holdings's trajectory. Our PESTLE analysis delves into the political landscape, economic shifts, technological advancements, environmental considerations, and legal frameworks shaping the company's operations and future growth. Gain a competitive edge by understanding these forces.

Don't get left behind in the rapidly evolving digital asset space. This comprehensive PESTLE analysis provides actionable intelligence on Marathon Digital Holdings, empowering you to make informed strategic decisions. Download the full report now and navigate the complexities with confidence.

Political factors

Government regulation of cryptocurrency and Bitcoin mining is a critical factor for Marathon Digital Holdings. New frameworks, such as the European Union's Markets in Crypto-Assets (MiCA) regulation, and evolving rules in the United States, directly shape Marathon's operating environment. These regulations can influence where and how the company conducts its mining operations, impacting expansion plans.

Geopolitical stability is paramount for Marathon Digital Holdings' distributed mining infrastructure. For instance, the ongoing conflicts in Eastern Europe, while not directly impacting Marathon's primary U.S. operations, highlight the potential risks to energy supply chains and global economic stability that could indirectly affect Bitcoin's price and mining profitability.

The global race to attract cryptocurrency mining operations is intensifying. In 2024, several U.S. states, including Texas and Kentucky, continued to offer incentives for data center development, potentially benefiting Marathon through access to competitive energy rates, while other nations are also exploring regulatory frameworks to capture this industry.

Changes in international relations can significantly alter the operational landscape for digital asset miners. A tightening of sanctions or trade disputes, for example, could impact the cost of hardware procurement or the accessibility of international energy markets, posing a challenge to Marathon's expansion plans.

New trade policies and tariffs can significantly disrupt Marathon Digital Holdings' hardware supply chains. For instance, in 2024, ongoing geopolitical tensions and shifts in international trade agreements could lead to increased import duties on specialized mining equipment, directly impacting acquisition costs. This creates uncertainty for the company's expansion plans.

These tariffs can increase the operational expenses for Marathon Digital Holdings by making essential components and machinery more expensive. Such cost pressures can affect profitability and the company's competitive edge in the mining industry, potentially slowing down its growth trajectory.

The unpredictability introduced by evolving trade regulations challenges Marathon's ability to efficiently scale its mining operations. For example, a sudden tariff on semiconductors, crucial for ASIC miners, could halt planned hardware deployments and delay network expansion efforts throughout 2024 and into 2025.

Government incentives or restrictions on energy use for mining

Government policies on energy use for Bitcoin mining significantly shape Marathon Digital Holdings' operational landscape. For instance, the Inflation Reduction Act of 2022 in the United States provides tax credits for clean energy, potentially benefiting Marathon if it utilizes renewable energy sources for its mining operations. Conversely, some jurisdictions have implemented outright bans or stringent limitations on energy consumption for mining, impacting Marathon's ability to secure affordable and reliable power. In 2023, Marathon actively sought to diversify its energy sources, with a notable portion of its energy consumption coming from zero-carbon sources, a strategy directly influenced by evolving regulatory environments.

Marathon's strategic decisions, including site selection and energy procurement, are heavily influenced by these political factors. Regions offering incentives for sustainable energy use in mining, such as Texas with its abundant wind and solar power, can be attractive for expansion. However, the political climate can shift, as seen with potential new regulations or changes in energy policies that could affect profitability. Marathon's 2024 outlook hinges on navigating these diverse regulatory landscapes, aiming to leverage supportive policies while mitigating risks from restrictive ones.

- Incentives for Renewable Energy: The US Inflation Reduction Act offers tax credits for clean energy, potentially reducing Marathon's energy costs if it uses renewables.

- Jurisdictional Restrictions: Bans or strict energy consumption limits in certain regions can hinder Marathon's expansion and increase operational costs.

- Energy Source Diversification: Marathon's strategy to use zero-carbon energy sources is a direct response to political pressures and opportunities related to energy use.

- Strategic Site Selection: Favorable political environments for mining, like those in Texas with strong renewable energy infrastructure, influence Marathon's site development plans.

Political sentiment towards decentralized finance and blockchain

The evolving political sentiment toward decentralized finance (DeFi) and blockchain significantly influences the regulatory landscape for companies like Marathon Digital Holdings. Shifts in government policies, often driven by elections and key appointments, can either accelerate or impede industry growth and investor trust.

A more favorable political climate can unlock innovation and ease regulatory burdens, potentially boosting Marathon's operational efficiency and market position. For instance, in the US, discussions around digital asset regulation are ongoing, with some lawmakers advocating for clearer frameworks that could benefit established players.

- Regulatory Clarity: Political support can lead to clearer rules, reducing uncertainty for blockchain companies.

- Innovation Hubs: Pro-crypto political stances can foster environments conducive to technological advancement.

- Investor Confidence: Stable political backing can improve investor sentiment and capital inflow into the sector.

- Policy Shifts: Key elections in major economies can introduce new regulatory approaches impacting digital asset businesses.

Government policies on energy consumption for Bitcoin mining are a major driver for Marathon Digital Holdings. In 2024, the company continued to emphasize its use of zero-carbon energy sources, a strategy influenced by both regulatory incentives and potential restrictions on carbon-intensive operations. For example, the Inflation Reduction Act of 2022 in the U.S. offers tax credits for clean energy, which Marathon can leverage. Conversely, regions with stricter energy usage regulations could pose challenges to expansion, making strategic site selection crucial for accessing affordable and sustainable power.

The political landscape surrounding cryptocurrency regulation directly impacts Marathon's operational framework. Evolving rules, such as those being developed in the U.S. and the EU's MiCA framework, shape where and how the company can mine. This regulatory uncertainty can affect hardware procurement and expansion plans, as seen in 2024 with ongoing discussions about digital asset oversight.

International trade policies and geopolitical stability are critical for Marathon's hardware supply chain and overall operations. Tariffs on essential mining equipment, for instance, could increase costs, as experienced with ongoing trade tensions. Furthermore, global instability highlights risks to energy supply chains, indirectly affecting Bitcoin's price and mining profitability, a concern for Marathon's 2024 outlook.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Marathon Digital Holdings, covering political, economic, social, technological, environmental, and legal dimensions.

It offers actionable insights and forward-looking perspectives to inform strategic decision-making and identify potential opportunities and threats.

This PESTLE analysis for Marathon Digital Holdings offers a clean, summarized version of complex external factors, making it easy to reference during meetings and presentations, thus alleviating the pain of sifting through raw data.

Economic factors

Bitcoin price volatility remains a central factor influencing Marathon Digital Holdings' financial results. For instance, in Q1 2025, despite a notable increase in revenue driven by higher Bitcoin production, the company reported a substantial net loss, underscoring the direct impact of fluctuating Bitcoin values on profitability.

This inherent unpredictability in Bitcoin's market price directly affects Marathon's revenue streams and can cause significant swings in net income. Effectively navigating these price fluctuations through prudent management of its Bitcoin treasury and a relentless focus on operational efficiency is therefore paramount for the company's sustained profitability.

Energy costs are a substantial factor in Marathon Digital Holdings' operational expenses, directly impacting its bottom line. For instance, in the first quarter of 2024, Marathon reported that its average cost of electricity per kilowatt-hour was 7.4 cents. Fluctuations in these prices can significantly affect mining profitability.

To mitigate the impact of rising electricity prices, Marathon is strategically investing in renewable energy sources. A key initiative is the acquisition of a wind farm, which aims to lower overall energy expenditures and bolster the company's long-term financial resilience and sustainability. This move is crucial for maintaining competitive mining margins.

Broader global economic conditions, such as inflation rates and interest rate policies, directly influence investor sentiment towards digital assets. For instance, in late 2023 and early 2024, persistent inflation concerns and hawkish monetary policy stances from central banks created a risk-off environment, dampening speculative investments in assets like Bitcoin. This sentiment shift can lead to significant price volatility for digital assets, impacting Marathon Digital Holdings' revenue streams, which are largely tied to Bitcoin mining profitability.

Economic downturns, marked by reduced consumer spending and business investment, often trigger a flight to perceived safer assets, pulling capital away from more volatile sectors like digital assets. During periods of economic uncertainty, such as the global slowdown fears in mid-2023, the correlation between traditional markets and digital assets intensified, with declines in major stock indices often mirrored by drops in cryptocurrency prices. This makes Marathon's operational and financial outlook susceptible to macroeconomic trends and the general market's perception of digital assets' stability and future value.

Inflation and interest rates affecting capital expenditure and financing

Inflation and prevailing interest rates significantly impact Marathon Digital Holdings' capital expenditure and financing decisions. Elevated inflation can drive up the costs associated with purchasing new mining hardware and expanding its infrastructure. For instance, the cost of specialized semiconductor components, crucial for Bitcoin mining rigs, can see upward pressure during inflationary periods.

Rising interest rates directly affect the cost of borrowing for companies like Marathon. This is particularly relevant given Marathon's substantial capital needs. In April 2024, Marathon Digital Holdings issued $850 million in convertible senior notes. The interest rate on these notes, and any future debt financing, will be a key consideration, directly impacting the company's cost of capital and overall profitability.

- Increased Hardware Costs: Inflationary pressures can lead to higher prices for ASICs (Application-Specific Integrated Circuits) and other essential mining equipment.

- Financing Expenses: Higher interest rates, such as those influenced by Federal Reserve policy, increase the cost of Marathon's $850 million convertible debt issuance and any potential future borrowings.

- Project Viability: The combined effect of increased capital costs and higher financing expenses can influence the economic viability of new mining facility expansions and hardware acquisitions.

Impact of Bitcoin halving events on mining rewards

Bitcoin halving events directly impact Marathon Digital Holdings' revenue by cutting the block reward, which is the primary incentive for Bitcoin miners. The most recent halving, which occurred in April 2024, reduced the reward from 6.25 BTC to 3.125 BTC per block. This substantial reduction necessitates a strategic pivot for Marathon to sustain profitability.

To navigate the reduced block rewards post-halving, Marathon Digital Holdings is compelled to enhance operational efficiency. This includes aggressive cost management, particularly focusing on reducing energy expenses, which represent a significant portion of mining costs. Furthermore, investing in and deploying newer, more powerful mining hardware is crucial to maintain a competitive edge and maximize Bitcoin output per unit of energy consumed.

- Reduced Block Reward: The April 2024 halving cut the Bitcoin mining reward from 6.25 BTC to 3.125 BTC per block.

- Efficiency Imperative: Marathon must lower its cost per Bitcoin mined to remain profitable.

- Hardware Upgrades: The company is investing in next-generation mining rigs to boost hash rate and energy efficiency.

- Energy Cost Management: Securing lower electricity rates remains a critical strategy for Marathon.

Macroeconomic factors significantly shape Marathon Digital Holdings' operational landscape. Persistent inflation and interest rate hikes, for instance, directly impact capital expenditure by increasing the cost of mining hardware and financing. The company's $850 million convertible note issuance in April 2024 highlights the sensitivity to borrowing costs.

Global economic downturns can lead to a flight to safety, diminishing investor appetite for volatile digital assets like Bitcoin, thereby affecting Marathon's revenue. For example, fears of a global slowdown in mid-2023 saw increased correlation between traditional markets and crypto, impacting Bitcoin prices.

The April 2024 Bitcoin halving, which reduced the block reward from 6.25 BTC to 3.125 BTC, presents a direct economic challenge. This necessitates a strong focus on operational efficiency and cost reduction, especially energy expenses, to maintain profitability.

| Economic Factor | Impact on Marathon Digital Holdings | Relevant Data/Event |

|---|---|---|

| Bitcoin Price Volatility | Directly affects revenue and profitability. | Q1 2025: Revenue increased due to higher Bitcoin production, but a substantial net loss was reported, highlighting price sensitivity. |

| Energy Costs | Significant operational expense impacting mining margins. | Q1 2024: Average electricity cost was 7.4 cents per kilowatt-hour. Company investing in wind farms to reduce costs. |

| Inflation & Interest Rates | Increases hardware costs and financing expenses. | April 2024: Issued $850 million in convertible senior notes, subject to prevailing interest rates. |

| Bitcoin Halving | Reduces mining rewards, necessitating efficiency gains. | April 2024: Block reward halved from 6.25 BTC to 3.125 BTC. |

What You See Is What You Get

Marathon Digital Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Marathon Digital Holdings delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and future growth. Understanding these external forces is crucial for strategic decision-making in the dynamic cryptocurrency mining industry.

Sociological factors

Public perception of Bitcoin mining's substantial energy consumption presents a notable hurdle for Marathon Digital Holdings. Widespread criticism regarding the industry's environmental footprint can directly impact public sentiment and amplify calls for stricter regulatory oversight.

Marathon is proactively tackling these environmental concerns by making significant investments in renewable energy sources, such as solar and wind power. Their strategic aim is to cultivate more sustainable mining operations, thereby improving their corporate image and mitigating potential regulatory backlash.

For instance, in 2023, Marathon reported that approximately 56% of its energy consumption came from zero-carbon sources, a figure they are working to increase further in 2024 and beyond.

Marathon Digital Holdings encounters significant hurdles with community relations and local pushback, especially concerning the noise generated by its Bitcoin mining operations. For instance, residents near their Granbury, Texas facility have voiced concerns about health impacts and have pursued legal action due to persistent low-frequency noise pollution.

These community conflicts underscore the critical importance for Marathon to actively engage with local populations and invest in noise-mitigation technologies. Such proactive measures are essential for maintaining operational licenses and fostering goodwill, as demonstrated by the ongoing legal challenges faced by the company in various locations.

Societal values are shifting, with a noticeable surge in demand for cryptocurrencies that prioritize environmental sustainability. This growing interest in 'green' crypto initiatives directly impacts companies like Marathon Digital Holdings, pushing them towards adopting cleaner energy sources for their mining operations. For instance, by Q4 2023, Marathon Digital Holdings reported that approximately 99% of their energy consumption was powered by zero-carbon sources, showcasing a tangible commitment to this trend.

This focus on eco-friendly practices isn't just about compliance; it's a strategic move to bolster brand image and attract a segment of investors increasingly concerned with environmental, social, and governance (ESG) factors. As of early 2024, the global ESG investing market is valued in the trillions, indicating a significant pool of capital that favors sustainable ventures.

Talent acquisition and retention in a specialized industry

Talent acquisition and retention are paramount for Marathon Digital Holdings within the niche of digital asset technology. The company's operational success hinges on securing individuals with deep knowledge of blockchain, robust infrastructure management capabilities, and expertise in high-intensity computing environments. This specialized skill set is in high demand, making effective human capital management a significant sociological consideration.

Marathon Digital Holdings has implemented strategies to address these talent challenges. For instance, in June 2024, the company expanded its equity incentive plans. This move is designed to make Marathon more attractive to top-tier talent and to foster loyalty among existing employees in a fiercely competitive market for specialized skills.

The digital asset industry, particularly in areas like Bitcoin mining, faces a unique talent landscape. Companies must compete not only within the tech sector but also for individuals who understand the intricacies of energy-intensive computing and decentralized networks. Marathon's approach reflects a broader trend of companies using financial incentives to secure and retain the specialized workforce needed to navigate this evolving technological frontier.

Key aspects of talent management for Marathon include:

- Securing specialized expertise: The need for professionals skilled in blockchain, network operations, and energy management is critical.

- Competitive compensation: Expanding equity incentive plans, as seen in June 2024, aims to attract and retain top talent.

- Industry-specific challenges: The demand for talent in digital asset technology often outstrips supply, necessitating proactive recruitment and retention strategies.

- Employee development: Investing in training and development is crucial to keeping employees' skills current with rapid technological advancements.

Shifting investor demographics and their embrace of digital assets

The investor landscape is evolving, with a growing number of individuals and institutions becoming more comfortable with digital assets. This societal shift signifies a greater acceptance of cryptocurrencies as a viable part of an investment portfolio. Marathon Digital Holdings stands to gain as this trend continues, especially with increasing institutional interest and even sovereign nations exploring digital currencies, broadening the pool of potential investors.

This demographic evolution is clearly demonstrated by the increasing participation of younger investors, often more digitally native, in the cryptocurrency market. For instance, a 2024 survey indicated that over 50% of crypto investors are under 40. This growing segment is actively seeking alternative investment avenues, including digital assets, which directly benefits companies like Marathon Digital Holdings by expanding its addressable market.

- Younger Investor Adoption: A significant portion of new investors entering the digital asset space are millennials and Gen Z, who are generally more tech-savvy and open to innovative financial instruments.

- Institutional Interest Growth: Major financial institutions are increasingly offering crypto-related products and services, signaling a growing legitimacy and acceptance that attracts a wider range of investors.

- Sovereign Exploration: Several countries are actively exploring or implementing central bank digital currencies (CBDCs) and other blockchain-based initiatives, further normalizing digital assets and potentially creating new investment opportunities.

Societal shifts towards valuing environmental sustainability are increasingly influencing the digital asset industry, pushing companies like Marathon Digital Holdings to prioritize clean energy. By Q4 2023, Marathon reported that approximately 99% of its energy consumption stemmed from zero-carbon sources, reflecting a strong commitment to eco-friendly mining practices. This focus on ESG factors is crucial for attracting investors, with the global ESG market valued in the trillions as of early 2024.

Technological factors

Advancements in ASIC mining hardware efficiency are crucial for Marathon Digital Holdings to stay profitable and competitive. The continuous 'mining arms race' demands the use of newer, more energy-efficient machines that provide higher hash rates for each watt of power used.

Investing in the latest hardware, like the Bitmain Antminer S21 Pro, is vital for managing increasing energy expenses and the growing network difficulty. For instance, the S21 Pro boasts an efficiency of 16.5 J/TH, a significant improvement over previous generations.

Marathon Digital Holdings is showcasing its technological edge with custom-built mining firmware, MARAFW, and a control board, MARA UCB 2100. These internal developments are key to boosting the performance, efficiency, and reliability of their Bitcoin mining operations.

By making these advanced technologies available to other miners, Marathon is not only generating additional revenue but also cementing its reputation as a leader in mining technology. This strategy positions them well in a competitive market.

Marathon Digital Holdings is actively integrating AI and HPC into its operational strategy. This isn't just about mining; they're looking to repurpose their existing infrastructure into AI and HPC data centers, tapping into new markets.

This strategic shift aims to diversify revenue beyond Bitcoin mining. By leveraging their expertise in managing large-scale computing operations, Marathon seeks to unlock additional, potentially more lucrative, income streams.

For instance, in the first quarter of 2024, Marathon reported a significant increase in their self-mining hashrate, reaching 17.7 EH/s. This robust infrastructure provides a solid foundation for their AI/HPC ambitions, allowing them to capitalize on the growing demand for specialized computing power.

Improvements in cooling technologies for mining rigs

Marathon Digital Holdings (NASDAQ: MARA) benefits significantly from advancements in cooling technologies for its Bitcoin mining operations. For instance, immersion cooling, which submerges mining hardware in a dielectric fluid, offers substantial efficiency gains. This method can improve hash rate stability by keeping components at optimal temperatures, potentially boosting mining output.

These cooling innovations are crucial for mitigating environmental impact and improving community relations. By reducing the need for large, noisy air-cooling systems, immersion cooling can lower the overall noise pollution from mining facilities. This is particularly relevant as Marathon expands its operations, aiming for better integration with local communities.

The financial implications are also considerable. Lower operating temperatures can extend the lifespan of mining hardware, reducing capital expenditure on equipment replacement. Furthermore, enhanced efficiency translates directly to lower energy consumption per hash, improving Marathon's cost structure and overall profitability in a competitive market.

- Enhanced Efficiency: Immersion cooling can improve hardware performance by maintaining stable temperatures, potentially increasing hash rates.

- Reduced Noise Pollution: Advanced cooling methods contribute to quieter operations, easing community acceptance of mining facilities.

- Extended Hardware Lifespan: Optimal operating temperatures can prolong the life of mining rigs, leading to cost savings.

- Lower Energy Costs: More efficient cooling directly impacts energy consumption per unit of computation, boosting profitability.

Evolution of blockchain technology and alternative digital assets

The rapid evolution of blockchain technology and the growing landscape of alternative digital assets present a dynamic environment for Marathon Digital Holdings. While its core focus remains on Bitcoin mining, Marathon is strategically positioned to capitalize on innovation within the broader digital asset ecosystem. This adaptability is crucial for navigating market shifts and potentially expanding its operational scope.

Marathon's exploration into areas like Kaspa mining exemplifies this forward-thinking approach. By leveraging its existing blockchain infrastructure expertise, the company can identify and invest in promising new digital asset opportunities. This diversification strategy aims to mitigate risks associated with a singular focus and unlock new avenues for growth and revenue generation.

- Blockchain Evolution: Continued advancements in blockchain scalability and efficiency create opportunities for more optimized mining operations and potential integration with new protocols.

- Alternative Digital Assets: The emergence of altcoins with unique use cases and value propositions offers Marathon the chance to diversify its mining portfolio beyond Bitcoin.

- Kaspa Expansion: Marathon's direct involvement in Kaspa mining, a proof-of-work blockchain, demonstrates a tangible step in exploring and capitalizing on alternative digital asset mining.

- Strategic Flexibility: Marathon's ability to adapt its strategy allows it to respond to changing market dynamics and technological advancements in the digital asset space.

Technological advancements are paramount for Marathon Digital Holdings' competitive edge. The company is actively integrating advanced ASIC hardware, such as the Bitmain Antminer S21 Pro, known for its 16.5 J/TH efficiency, to combat rising energy costs and network difficulty. Furthermore, Marathon is developing proprietary technology like MARAFW firmware and the MARA UCB 2100 control board to optimize its Bitcoin mining operations.

Beyond core mining, Marathon is strategically leveraging its infrastructure for Artificial Intelligence (AI) and High-Performance Computing (HPC) data centers, aiming to diversify revenue streams. This expansion is supported by their substantial self-mining hashrate, which reached 17.7 EH/s in Q1 2024, providing a robust foundation for these new ventures.

Marathon is also exploring innovative cooling technologies like immersion cooling, which improves hardware efficiency and stability by maintaining optimal operating temperatures. This not only reduces energy consumption and extends hardware lifespan but also mitigates noise pollution, fostering better community relations as operations scale.

The company's adaptability extends to exploring alternative digital assets, exemplified by its entry into Kaspa mining. This strategic flexibility allows Marathon to capitalize on evolving blockchain technology and new digital asset opportunities, mitigating risks and opening new growth avenues.

Legal factors

The evolving regulatory landscape for cryptocurrencies and mining significantly impacts Marathon Digital Holdings' operational approach. New rules, like the EU's Markets in Crypto-Assets (MiCA) regulation, and ongoing efforts for clearer oversight in the United States, are establishing the legal boundaries for Bitcoin mining operations.

Navigating these diverse and sometimes contradictory regulations is critical for Marathon to avoid legal issues and maintain uninterrupted business activities. For instance, the uncertainty surrounding specific tax treatments of mining revenue or the classification of mining as a regulated financial activity in various jurisdictions presents ongoing compliance challenges.

Marathon Digital Holdings must maintain rigorous adherence to anti-money laundering (AML) and know-your-customer (KYC) regulations. These are critical for preventing financial crime and fostering confidence in digital asset markets.

Global regulators are intensifying scrutiny on these measures, making compliance a paramount concern for companies like Marathon. For instance, the Financial Crimes Enforcement Network (FinCEN) in the U.S. continues to update its guidance for virtual asset service providers, impacting how companies handle customer identification and transaction monitoring.

Marathon's operational framework includes robust policies and procedures to ensure compliance. Non-compliance could result in severe penalties, including regulatory investigations, fines, and limitations on its ability to conduct Bitcoin mining and related transactions, directly affecting its business operations and revenue streams.

The evolving landscape of securities laws significantly impacts Marathon Digital Holdings, particularly concerning the classification of digital assets. Uncertainty persists regarding whether specific cryptocurrencies are deemed securities, a determination that dictates oversight by agencies like the U.S. Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

Legislative efforts in the U.S. throughout 2024 and into 2025 aim to provide much-needed clarity. This regulatory ambiguity can influence Marathon's investment strategies and operational frameworks, as compliance requirements can vary drastically based on asset classification.

Environmental regulations and permitting for mining operations

Environmental regulations are a significant hurdle for Marathon Digital Holdings, requiring specific permits for its mining operations. These rules are tightening globally, focusing on energy usage and overall environmental footprint. For instance, Kuwait's ban highlights the potential for outright restrictions in certain regions.

Marathon must proactively manage these evolving legal landscapes to ensure operational continuity and expansion. Securing the necessary permits is crucial, particularly as the company aims to integrate more renewable energy sources into its power mix, a move that itself may be subject to environmental review and approval processes.

- Permitting Challenges: Marathon faces increasing scrutiny and the need for permits that address energy consumption and environmental impact.

- Jurisdictional Bans: The example of Kuwait demonstrates the risk of outright operational bans due to environmental concerns.

- Renewable Energy Integration: Expansion plans involving renewables still require navigating environmental regulations and securing associated permits.

International legal cooperation and divergent regulatory approaches

Marathon Digital Holdings navigates a complex international landscape due to varying legal frameworks. The absence of unified global regulations concerning digital assets and mining operations presents significant hurdles. For instance, while some nations actively support or have clear guidelines for crypto mining, others maintain strict prohibitions or operate with substantial ambiguity, impacting where and how Marathon can expand its operations.

This divergence necessitates meticulous compliance efforts tailored to each jurisdiction. In 2024, the global regulatory environment for cryptocurrencies continued to evolve, with differing approaches to taxation, anti-money laundering (AML), and Know Your Customer (KYC) requirements across major economies. Companies like Marathon must invest heavily in legal expertise to ensure adherence to these disparate rules, which can affect operational costs and strategic planning.

The need for enhanced international legal cooperation is paramount. Greater harmonization would streamline cross-border operations and reduce the compliance burden. Without it, Marathon faces the challenge of adapting its business model to a fragmented legal reality, potentially limiting growth opportunities in key international markets.

- Divergent Regulations: Countries like El Salvador have embraced Bitcoin mining, while others, such as China, have imposed significant restrictions, creating a patchwork of operational feasibility.

- Compliance Costs: Navigating these varied legal systems requires substantial investment in legal counsel and compliance infrastructure, impacting overall profitability.

- Predictability: A lack of international legal consensus creates uncertainty, making long-term strategic planning more challenging for global crypto mining firms.

Marathon Digital Holdings operates within a dynamic legal framework, particularly concerning cryptocurrency regulations and environmental compliance. As of early 2024, the U.S. continues to refine its approach to digital assets, with ongoing discussions around potential legislation that could clarify the roles of the SEC and CFTC, impacting how mining revenue and operations are classified and taxed.

Environmental regulations are increasingly stringent, requiring permits for energy consumption and emissions, which can affect site selection and operational costs. For instance, the company's commitment to renewable energy sources, while strategically beneficial, must still align with evolving environmental permitting processes in various jurisdictions.

The global regulatory landscape remains fragmented, with differing rules on AML/KYC and digital asset taxation. This necessitates significant investment in legal and compliance expertise to navigate varying international requirements, as seen in the diverse approaches taken by countries like El Salvador versus those with stricter controls.

| Legal Factor | Impact on Marathon Digital Holdings | Key Developments (2024-2025) |

|---|---|---|

| Cryptocurrency Regulation | Affects operational legitimacy, taxation, and compliance burdens. | Ongoing U.S. legislative efforts to define digital asset oversight; EU's MiCA implementation. |

| Environmental Laws | Requires permits for energy use, impacts site selection and operational costs. | Increased global focus on energy efficiency and carbon footprints for mining operations. |

| International Legal Divergence | Creates compliance complexity and strategic challenges for global expansion. | Continued lack of global regulatory harmonization for digital assets and mining. |

Environmental factors

The significant energy demands of Bitcoin mining create a substantial carbon footprint, a critical environmental factor for Marathon Digital Holdings. This has led to increased scrutiny from regulators and environmental advocates globally, with some jurisdictions implementing limitations on mining activities.

Marathon is proactively addressing these concerns by shifting its mining operations towards renewable energy sources. As of Q1 2024, the company reported that approximately 59% of its energy consumption was sourced from zero-carbon or carbon-neutral sources, a figure it aims to increase further.

Marathon Digital Holdings is making significant strides in its transition to renewable energy for its Bitcoin mining operations. This commitment is demonstrated by their acquisition of a wind farm in Texas, a move that positions them to become a vertically integrated digital energy and infrastructure company.

By leveraging low-cost, sustainable power sources like wind, Marathon aims to improve operational efficiency and secure long-term energy cost reductions. This strategic pivot not only addresses environmental, social, and governance (ESG) concerns but also provides a competitive advantage in the increasingly energy-conscious cryptocurrency mining industry.

Noise pollution from Bitcoin mining operations, like those potentially near Marathon Digital Holdings' facilities, is a growing concern. The continuous sound from cooling equipment can significantly disrupt local residents' quality of life. For instance, communities like Granbury, Texas, have seen substantial pushback, including lawsuits and demands for stricter regulations, directly related to the noise generated by these large-scale energy consumers.

Electronic waste generated from obsolete mining hardware

The constant evolution of ASIC mining hardware, driven by the pursuit of greater efficiency, leads to a significant amount of electronic waste from discarded, less powerful machines. This rapid obsolescence presents a growing environmental challenge for the entire Bitcoin mining sector.

While Marathon Digital Holdings' specific e-waste disposal strategies aren't detailed, the industry as a whole faces the critical need for responsible management of this hardware. This includes implementing robust recycling programs and exploring options for repurposing older equipment.

- E-waste challenge: The global generation of e-waste is projected to reach 74 million metric tons by 2030, according to the UN's Global E-waste Monitor 2024. Mining hardware contributes to this figure.

- Industry impact: Bitcoin mining's energy consumption is well-documented, and the lifecycle management of the hardware used is an increasingly important aspect of its environmental footprint.

- Sustainability focus: Companies like Marathon are under increasing pressure from investors and regulators to demonstrate sustainable operational practices, which includes addressing e-waste.

Water usage in cooling systems for large-scale operations

Large-scale Bitcoin mining, like that undertaken by Marathon Digital Holdings, can significantly impact water resources due to the demands of cooling systems. While precise figures for Marathon's water usage aren't publicly detailed, the broader trend shows data centers are increasingly scrutinized for their water footprint. Global concerns around water scarcity mean efficient management is becoming a critical factor for sustainability in these operations.

The industry is seeing a push towards adopting more water-efficient cooling technologies. This shift is driven by the environmental imperative to reduce consumption and manage resources responsibly. For companies like Marathon, investing in these solutions is key to ensuring long-term operational viability and mitigating environmental risks.

- Growing Water Scrutiny: Data centers globally are facing increased attention for their water consumption, impacting companies in the digital asset mining sector.

- Efficiency Investments: Marathon and similar firms are evaluating and potentially adopting advanced cooling methods to minimize water usage.

- Sustainability Mandate: Environmental, Social, and Governance (ESG) considerations are increasingly influencing operational strategies, including water management.

Marathon Digital Holdings is actively addressing the environmental impact of Bitcoin mining, particularly its significant energy consumption. By Q1 2024, the company reported that approximately 59% of its energy consumption came from zero-carbon or carbon-neutral sources, with plans to increase this reliance on renewables. This strategic shift, including the acquisition of a wind farm in Texas, aims to enhance operational efficiency and secure lower energy costs, aligning with growing ESG expectations.

The company also faces the challenge of electronic waste from evolving mining hardware. While specific disposal strategies for Marathon are not detailed, the industry is pressured to implement robust recycling programs for obsolete ASICs. Furthermore, large-scale mining operations, including Marathon's, are being scrutinized for their water usage in cooling systems, prompting a move towards more water-efficient technologies to ensure long-term sustainability and responsible resource management.

| Environmental Factor | Marathon's Position/Action | Industry Context/Data |

|---|---|---|

| Energy Consumption & Carbon Footprint | Aiming for increased reliance on zero-carbon/carbon-neutral energy sources (59% in Q1 2024). | Bitcoin mining's high energy demand is a global concern; renewable energy adoption is a key mitigation strategy. |

| Electronic Waste (E-waste) | Industry-wide challenge of hardware obsolescence; need for responsible recycling. | Global e-waste projected to reach 74 million metric tons by 2030 (UN Global E-waste Monitor 2024). |

| Water Usage | Evaluating and potentially adopting water-efficient cooling technologies. | Data centers, including mining operations, face increasing scrutiny for water footprint due to global water scarcity concerns. |

| Noise Pollution | Potential impact on local communities, leading to regulatory pushback and lawsuits in some areas. | Communities near large mining facilities have experienced significant disruption and have demanded stricter regulations. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Marathon Digital Holdings draws on data from government publications, financial market reports, and technology industry analyses. We integrate insights on regulatory changes, economic trends, and evolving technological landscapes to provide a comprehensive view.