Marathon Digital Holdings Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marathon Digital Holdings Bundle

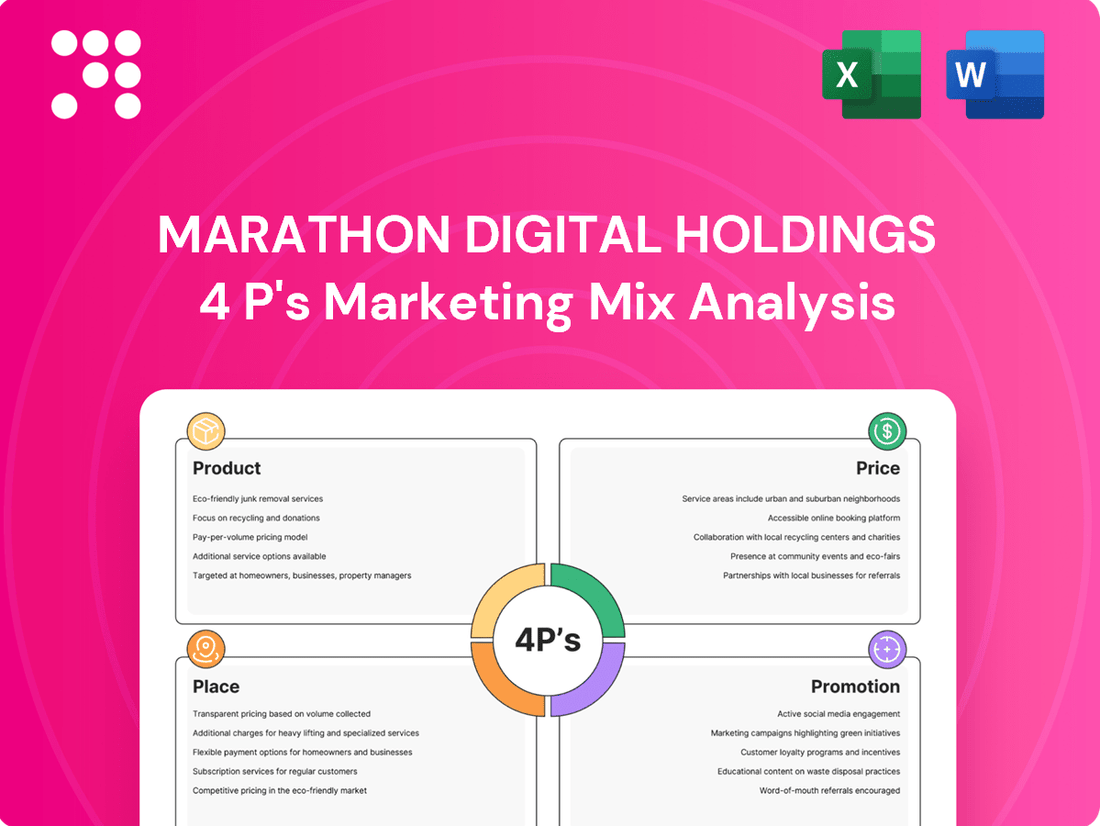

Marathon Digital Holdings' marketing mix is a powerful engine for growth, focusing on innovative Bitcoin mining solutions (Product), competitive pricing strategies (Price), strategic global expansion (Place), and robust digital engagement (Promotion). Understanding these elements is key to grasping their market dominance.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Marathon Digital Holdings' Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Marathon Digital Holdings' core product is the consistent and efficient production of Bitcoin. They achieve this through large-scale mining operations utilizing advanced hardware and proprietary technology to secure the Bitcoin network and earn block rewards. The primary objective is to maximize Bitcoin output while maintaining optimal operational efficiency.

In Q1 2024, Marathon Digital Holdings mined 2,850 BTC, a significant increase from the 2,147 BTC mined in Q1 2023, demonstrating their growing production capacity. Their fleet of approximately 275,000 miners, with a substantial portion being the latest generation S21 models, underpins this output.

Marathon Digital Holdings offers a robust and expanding hash rate capacity, the fundamental measure of its Bitcoin mining computational power. This growing capacity is crucial for investors, signaling Marathon's ability to mine more Bitcoin and its standing in the competitive global mining landscape. As of Q1 2024, Marathon reported a self-mined hash rate of 17.7 EH/s, a significant increase from previous periods, underscoring their commitment to scaling operations.

Marathon Digital Holdings' product is its sophisticated digital asset infrastructure. This encompasses advanced data centers and energy management systems, crucial for efficient cryptocurrency mining. In Q1 2024, Marathon reported a significant increase in their self-mined Bitcoin production, reaching 2,851 BTC, a testament to their operational infrastructure's effectiveness.

Their proprietary software optimizes mining operations, enhancing efficiency and stability. This technological backbone is key to Marathon's competitive edge. The company's infrastructure development is ongoing, with a focus on expanding its operational capacity to meet the growing demands of digital asset mining.

Blockchain Technology Expertise

Marathon Digital Holdings leverages its deep blockchain technology expertise as a core product, enabling them to navigate the complex digital asset ecosystem. This intellectual capital is crucial for identifying and pursuing new revenue streams beyond their primary Bitcoin mining operations.

This expertise translates into tangible strategic value, allowing Marathon to explore and invest in adjacent opportunities. For instance, their ongoing development of the Bitcoin development platform and potential participation in other blockchain-based ventures demonstrate this diversification strategy. This intangible product is a significant differentiator in the evolving digital asset landscape.

Marathon's commitment to blockchain innovation is evident in their investments and strategic partnerships. As of Q1 2024, the company continues to build out its technological capabilities, aiming to solidify its position not just as a miner but as a significant player in the broader blockchain industry. This focus on intellectual capital is a key component of their long-term growth strategy.

- Blockchain Expertise: Marathon's core offering includes deep knowledge of blockchain technology and digital asset markets.

- Adjacent Opportunities: This expertise allows exploration and investment in ventures beyond Bitcoin mining.

- Revenue Diversification: The goal is to create new income streams, enhancing long-term strategic value.

- Intangible Asset: Blockchain technology know-how is a critical, though non-physical, product for the company.

Investment Opportunity

Marathon Digital Holdings (MARA) is positioned as a direct investment vehicle for those seeking exposure to the burgeoning Bitcoin ecosystem. For its target audience, the company itself is the product, offering a publicly traded avenue to participate in Bitcoin's potential price appreciation. This structure allows investors to benefit from the operational scale of a major Bitcoin miner without the complexities of managing their own mining hardware.

Investors are essentially buying into Marathon's mining operations and its significant Bitcoin holdings. As of the first quarter of 2024, Marathon reported a substantial increase in its Bitcoin mining capacity, reaching an impressive 17.7 EH/s. This operational strength translates directly into potential returns for shareholders, mirroring the performance of Bitcoin itself while also factoring in the efficiency and scale of Marathon's mining infrastructure.

- Direct Bitcoin Exposure: MARA provides a regulated, publicly traded way to invest in Bitcoin's growth.

- Operational Leverage: Investors benefit from Marathon's large-scale mining operations and efficiency gains.

- Reduced Complexity: Avoids the technical and logistical challenges of individual cryptocurrency mining.

- Financial Performance: Marathon's Q1 2024 results showcased a significant increase in Bitcoin mined, highlighting operational success.

Marathon Digital Holdings' product is its large-scale Bitcoin mining operation, offering investors direct exposure to the cryptocurrency market. This includes their advanced mining infrastructure, significant hash rate capacity, and substantial Bitcoin holdings. The company's Q1 2024 performance, with 2,850 BTC mined and a hash rate of 17.7 EH/s, underscores the scale and efficiency of their product.

| Product Aspect | Description | Key Metric (Q1 2024) | Significance |

|---|---|---|---|

| Bitcoin Mining Operations | Large-scale, efficient Bitcoin production | 2,850 BTC Mined | Direct revenue generation and Bitcoin accumulation |

| Hash Rate Capacity | Computational power dedicated to mining | 17.7 EH/s | Indicates mining efficiency and competitive standing |

| Digital Asset Infrastructure | Advanced data centers and energy management | ~275,000 Miners (incl. S21 models) | Underpins operational scale and cost-efficiency |

| Blockchain Expertise | Technical knowledge and strategic insights | Ongoing R&D and platform development | Enables diversification and long-term value creation |

What is included in the product

This analysis delves into Marathon Digital Holdings' marketing mix, examining its product (bitcoin mining capacity), pricing (cost of mining vs. bitcoin value), place (global data centers), and promotion (investor relations and industry partnerships) to understand its market positioning.

Condenses Marathon Digital Holdings' 4Ps marketing mix into a clear, actionable format that addresses key industry pain points like energy costs and regulatory uncertainty.

Designed to provide leadership with a high-level overview of how Marathon's strategy alleviates customer concerns regarding Bitcoin mining profitability and operational stability.

Place

Marathon Digital Holdings strategically operates large-scale Bitcoin mining facilities across diverse geographic locations, a key element in their 'Place' strategy. This diversification aims to secure access to cost-effective and stable energy sources, crucial for maintaining profitable mining operations. For instance, as of Q1 2024, Marathon reported a total self-mined Bitcoin of 2,874 BTC, showcasing the output from these distributed physical assets.

Marathon Digital Holdings' stock is readily available to investors through its listing on the Nasdaq, a prominent global exchange. This accessibility broadens its investor base, encompassing both individual retail investors and large institutional players worldwide.

The Nasdaq listing ensures significant liquidity and transparency for Marathon Digital Holdings' shares. This facilitates the efficient buying and selling of its stock, acting as the principal platform where its investment product, the company's equity, is traded.

As of mid-2024, Marathon Digital Holdings (MARA) has demonstrated substantial trading volume on the Nasdaq, reflecting strong investor interest and market participation. This public listing serves as the crucial distribution channel for its investment proposition, enabling capital formation and valuation.

Marathon Digital Holdings (MARA) prioritizes direct investor relations channels, utilizing its corporate website and dedicated investor relations portals. These digital spaces are key 'places' for stakeholders to find crucial information like financial statements and operational updates. For instance, as of Q1 2024, Marathon reported a significant increase in its Bitcoin holdings, underscoring the importance of these direct channels for communicating such performance metrics.

Strategic Energy Partnerships

Marathon Digital Holdings strategically secures its operational 'place' through vital energy partnerships. These collaborations with energy providers and data center operators are fundamental to ensuring a consistent and cost-effective power supply for their Bitcoin mining activities. For instance, in late 2023 and early 2024, Marathon continued to expand its hosting arrangements, notably with Compute North and others, to support its growing fleet of miners. These agreements are not just about power; they are about establishing the physical infrastructure necessary for sustained computational output.

These partnerships directly impact Marathon's ability to scale and maintain operational efficiency. By securing favorable power purchase agreements and reliable hosting solutions, the company mitigates risks associated with energy volatility and infrastructure availability. This focus on the 'place' of operations is a cornerstone of their strategy for predictable performance and growth in the competitive digital asset mining landscape.

- Energy Sourcing: Partnerships ensure access to affordable and reliable electricity, crucial for the energy-intensive nature of Bitcoin mining.

- Infrastructure Deployment: Collaborations provide the physical locations and cooling systems necessary to house and operate mining hardware.

- Operational Uptime: Strategic alliances with energy providers and data center operators are designed to maximize uptime and minimize disruptions.

- Scalability: These relationships are key to facilitating the expansion of mining capacity by securing the necessary power and space.

Digital Presence and Information Access

Marathon Digital Holdings (MARA) extends its 'place' beyond physical mining operations into a robust digital realm. Its official website, www.marathondigitalholdings.com, serves as a crucial hub for investors and stakeholders to access company updates, financial reports, and strategic communications. This digital presence is paramount for global information dissemination.

The company leverages financial news aggregators and investor relations platforms to ensure broad accessibility of its performance data and operational milestones. For instance, Marathon's Q1 2024 earnings report, detailing significant increases in Bitcoin production and hash rate, was widely available through these digital channels, facilitating informed market analysis.

This digital 'place' is essential for maintaining transparency and fostering investor confidence. Marathon's commitment to readily available information supports its engagement with a diverse financial audience, from individual investors to institutional portfolio managers.

Key aspects of Marathon's digital presence include:

- Official Website: A primary source for press releases, SEC filings, and investor presentations.

- Financial News Outlets: Dissemination of company news and performance metrics through major financial media.

- Investor Relations Portals: Platforms offering direct access to financial reports and shareholder information.

- Social Media Channels: Strategic use of platforms for timely updates and community engagement.

Marathon Digital Holdings' 'Place' strategy is multifaceted, encompassing both its physical operational footprint and its digital presence. The company strategically locates its Bitcoin mining facilities in areas with access to affordable and reliable energy, a critical factor for profitability. As of Q1 2024, Marathon reported a total of 17,600 miners deployed, highlighting the scale of its physical 'place'.

Furthermore, Marathon's equity is accessible to a global investor base through its listing on the Nasdaq stock exchange under the ticker MARA. This accessibility ensures broad market participation and liquidity. As of mid-2024, MARA stock has shown significant trading activity, underscoring its availability as an investment vehicle.

The company also maintains a robust digital 'place' through its official website and investor relations portals. These platforms serve as primary channels for disseminating financial reports, operational updates, and strategic communications to stakeholders worldwide. For instance, their Q1 2024 report, detailing a substantial increase in Bitcoin production, was readily available through these digital avenues.

Marathon's 'Place' also involves strategic energy partnerships and hosting agreements, which are crucial for securing the physical infrastructure and power necessary for its mining operations. These collaborations, such as those with energy providers and data center operators, are fundamental to scaling operations and ensuring consistent uptime, directly impacting their computational output.

Full Version Awaits

Marathon Digital Holdings 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Marathon Digital Holdings 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies. You'll gain immediate access to this fully detailed report upon completing your order.

Promotion

Marathon Digital Holdings (MARA) prioritizes investor relations and financial reporting as a core promotional element. The company actively engages its target audience of financial decision-makers through quarterly earnings calls, detailed annual reports, and crucial SEC filings. This commitment to transparency aims to foster confidence and attract vital capital.

Consistent and clear financial reporting serves as a powerful promotional tool for Marathon. For instance, in Q1 2024, Marathon reported a significant increase in revenue, reaching $168.8 million, up from $51.7 million in the prior year's quarter, demonstrating strong operational performance and providing tangible data for investors to evaluate.

Marathon Digital Holdings actively engages in public relations to secure coverage in key financial and industry publications. This strategy highlights operational successes, like their record Bitcoin production in Q1 2024, and technological advancements, such as their expanding energy efficiency initiatives. Such media presence is vital for boosting corporate visibility and solidifying their leadership in the digital asset sector.

Marathon Digital Holdings actively participates in and presents at major industry conferences like the Bitcoin 2024 Miami conference and the Consensus 2024 event. These gatherings are crucial for directly connecting with potential investors, financial analysts, and key industry partners. By showcasing their operational advancements and strategic vision, Marathon aims to build trust and enhance brand awareness within the financial and blockchain communities.

Corporate Website and Digital Content

Marathon Digital Holdings leverages its corporate website as a primary platform for disseminating promotional content. This digital hub provides in-depth details on its Bitcoin mining operations, including hash rate figures and energy consumption, alongside executive bios and strategic outlooks. The site also serves as a conduit for timely news, press releases, and investor relations materials, ensuring transparency and immediate stakeholder engagement.

A robust digital presence is crucial for effective promotion in the current market. Marathon’s website, for instance, acts as a central repository for crucial data points, such as their reported Bitcoin holdings. As of early 2024, Marathon Digital Holdings reported holding a significant amount of Bitcoin, underscoring their core business and commitment to digital asset accumulation.

- Website as a Promotional Hub: Marathon's corporate site offers comprehensive details on its Bitcoin mining strategy and operational efficiency.

- Real-time Updates: News sections and press releases provide stakeholders with immediate access to the latest company performance and strategic announcements.

- Digital Asset Disclosure: The website frequently highlights the company's Bitcoin reserves, a key metric for investors in the digital asset space.

- Stakeholder Engagement: A well-maintained website fosters trust and facilitates communication with investors, partners, and the broader financial community.

Social Media and Thought Leadership

Marathon Digital Holdings actively cultivates its online presence through professional social media channels such as LinkedIn and X, formerly Twitter. This strategy allows them to disseminate company updates, foster community interaction, and position their leadership as authoritative voices in the digital asset space.

This focused digital engagement is crucial for building brand recognition and solidifying Marathon's reputation among investors who are deeply familiar with technology. By sharing insights and participating in industry conversations, they reinforce their credibility.

For instance, as of Q1 2024, Marathon reported a significant increase in its digital footprint, with substantial growth in social media followers and engagement rates across key platforms. This demonstrates the effectiveness of their approach in reaching and resonating with a modern, digitally-native investor audience.

- LinkedIn Presence: Marathon leverages LinkedIn to share detailed operational updates, financial results, and thought leadership articles from its executives, targeting a professional investor base.

- X (Twitter) Engagement: The company uses X for real-time news dissemination, direct interaction with the crypto community, and to amplify key announcements, reaching a broader, often more retail-focused, audience.

- Thought Leadership Content: Marathon's leadership frequently publishes articles and participates in discussions on topics like Bitcoin mining efficiency, energy consumption, and the future of digital assets, establishing expertise.

- Investor Reach: This active social media strategy is designed to directly connect with and inform a tech-savvy investor demographic, enhancing brand awareness and building trust in their operational capabilities and market position.

Marathon Digital Holdings' promotional strategy centers on transparent investor relations, robust digital engagement, and active participation in industry events. This multi-faceted approach aims to build trust and enhance brand visibility within the financial and blockchain sectors.

The company's commitment to clear financial reporting, exemplified by its Q1 2024 revenue surge to $168.8 million, provides concrete data for investor evaluation. Furthermore, Marathon's strategic use of social media and its corporate website ensures continuous stakeholder communication and brand reinforcement.

By highlighting operational successes, such as record Bitcoin production in Q1 2024, and engaging directly at conferences like Bitcoin 2024 Miami, Marathon effectively showcases its leadership and technological advancements.

This consistent communication strategy is designed to attract and retain investor confidence, positioning Marathon as a key player in the digital asset mining industry.

Price

Marathon Digital Holdings' revenue and profitability are intrinsically linked to Bitcoin's price, making Bitcoin's volatility the most significant 'price' determinant for the company's mined assets. For instance, during Q1 2024, Marathon reported a Bitcoin-equivalent production cost of approximately $5,300 per BTC, highlighting how fluctuations in Bitcoin's market price, which averaged around $65,000 in the same period, directly impact their profit margins.

The company's financial health is thus heavily swayed by Bitcoin's market swings, necessitating robust risk management to navigate these external pricing pressures. This reliance on an external, highly volatile asset underscores the unique pricing challenges Marathon faces compared to traditional businesses.

Marathon Digital Holdings' operational cost efficiency directly impacts the effective price of its Bitcoin production. Key expenditures include electricity, which is a significant variable, and the depreciation of their mining hardware. For instance, in Q1 2024, Marathon reported a total cost of revenue of $62.4 million, with electricity costs being a substantial component, highlighting the importance of managing these operational outlays to maintain profitability.

For investors, Marathon Digital Holdings' price is primarily seen in its stock performance and market capitalization. As of late 2024, Marathon Digital Holdings (MARA) traded on the Nasdaq, with its stock price being a direct reflection of investor sentiment and the company's operational performance. The market capitalization, which is the total value of all outstanding shares, provides a broader picture of the company's valuation in the public market.

Strategic Hedging and Treasury Management

Marathon Digital Holdings actively manages price risk through strategic financial operations. This includes exploring hedging instruments to protect the value of its significant Bitcoin reserves and anticipated future mining output against market volatility. For instance, as of Q1 2024, Marathon held approximately 16,930 BTC, valued at roughly $1.1 billion at the time, underscoring the importance of safeguarding these assets.

Effective treasury management is central to optimizing the company's financial position. This involves not only securing its digital assets but also ensuring liquidity and efficient capital allocation. By implementing robust treasury practices, Marathon aims to stabilize its financial performance and enhance shareholder value, directly influencing its effective pricing strategies.

- Hedging Strategies: Marathon may utilize financial derivatives like futures or options contracts to lock in a minimum price for its Bitcoin holdings or future production.

- Treasury Optimization: Focuses on maximizing the yield and security of its digital asset portfolio and cash reserves.

- Financial Stability: These measures aim to create a more predictable financial environment, mitigating the impact of Bitcoin price fluctuations on operational planning and investment decisions.

- Impact on Valuation: Sound treasury and hedging practices can lead to a more stable and potentially higher valuation by reducing perceived risk for investors.

Competitive Landscape and Industry Benchmarking

Marathon Digital Holdings' (MARA) pricing strategy, encompassing operational costs and market valuation, is continuously measured against its peers in the public Bitcoin mining sector. For instance, as of early 2024, MARA's all-in cost per Bitcoin mined was reported to be around $10,000-$12,000, a figure that is closely watched when compared to competitors like Riot Platforms or Hut 8 Mining.

Analyzing competitor pricing, hash rate efficiency, and deployment strategies directly shapes Marathon's operational and financial planning to stay ahead. Companies like CleanSpark have demonstrated aggressive expansion, often impacting the perceived value and cost-efficiency benchmarks within the industry.

The actions of competitors significantly influence Marathon's pricing decisions and strategic investments. For example, if a competitor secures a large, low-cost energy contract, it can pressure Marathon to seek similar advantages to maintain its competitive standing in terms of cost per Bitcoin.

- Operational Cost Benchmarking: Marathon's all-in cost per BTC mined is benchmarked against industry averages, which hovered around $10,000-$12,000 in early 2024, with some competitors achieving lower figures.

- Hash Rate Efficiency: Comparing MARA's hash rate efficiency (TH/s per watt) against leaders like Riot Platforms (which aims for industry-leading efficiency) is crucial for strategic planning.

- Strategic Deployment Influence: Competitors' rapid expansion and deployment of new, more efficient mining hardware, such as the latest Bitmain Antminer models, directly influence MARA's capital expenditure and hardware upgrade cycles.

- Market Valuation Comparison: MARA's market capitalization and enterprise value are constantly compared to its peers, with factors like installed hash rate and operational uptime playing significant roles in investor perception and valuation multiples.

Marathon Digital Holdings' revenue is directly tied to the price of Bitcoin, making BTC's market value the primary driver of its mined asset's worth. In Q1 2024, Marathon's production cost was approximately $5,300 per BTC, while Bitcoin averaged around $65,000, demonstrating the significant impact of BTC price on profit margins.

The company actively manages price risk through financial strategies, including hedging its substantial Bitcoin reserves and anticipated future mining output. As of Q1 2024, Marathon held about 16,930 BTC, valued at roughly $1.1 billion, highlighting the critical need to protect these assets.

Marathon's stock performance and market capitalization reflect its overall valuation. As of late 2024, MARA's stock traded on the Nasdaq, with its price indicating investor sentiment and operational success, while its market capitalization offers a broader view of its public market value.

| Metric | Q1 2024 Value | Context/Impact |

|---|---|---|

| Production Cost per BTC | ~$5,300 | Directly impacts profitability as BTC price fluctuates. |

| Average BTC Price (Q1 2024) | ~$65,000 | Key determinant of revenue and profit margins. |

| Bitcoin Holdings (Q1 2024) | ~16,930 BTC | Valued at ~$1.1 billion, necessitates robust asset protection strategies. |

4P's Marketing Mix Analysis Data Sources

Our Marathon Digital Holdings 4P's Marketing Mix Analysis is grounded in a comprehensive review of publicly available data, including SEC filings, investor relations materials, and official company press releases. We also incorporate insights from industry reports and analyses of their operational strategies and market positioning.