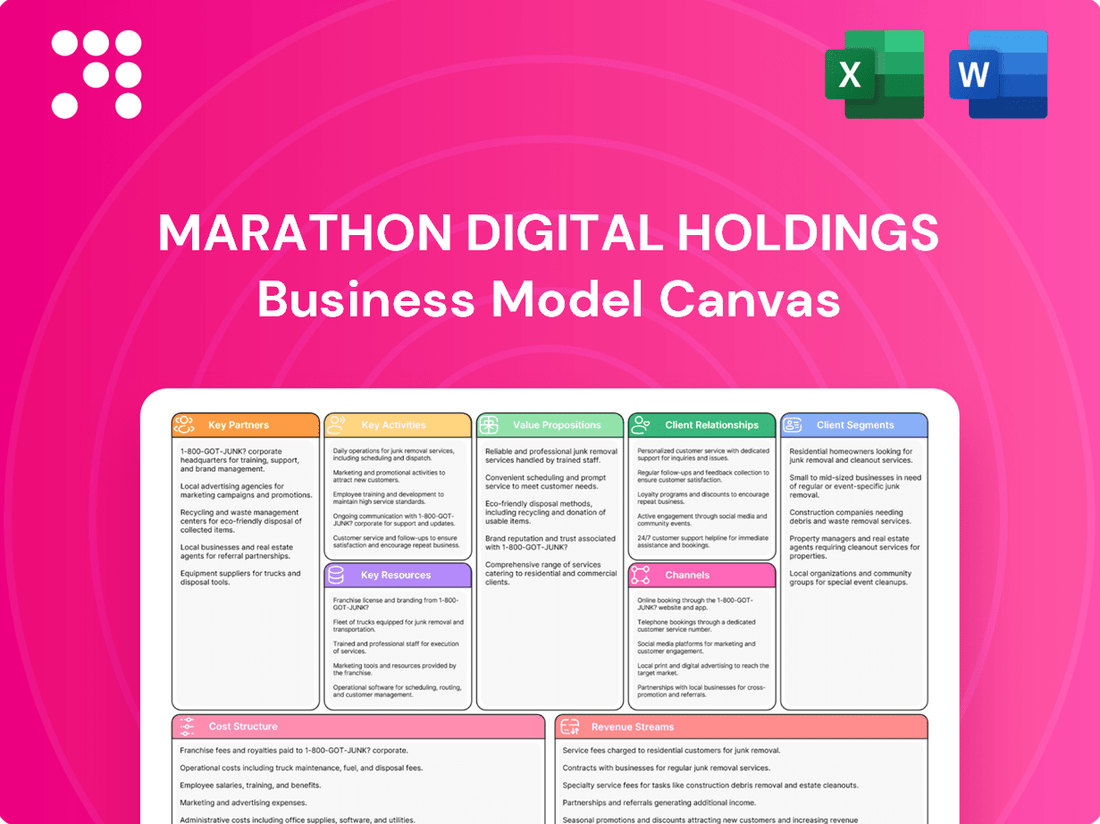

Marathon Digital Holdings Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marathon Digital Holdings Bundle

Unlock the strategic blueprint of Marathon Digital Holdings with our comprehensive Business Model Canvas. Discover how they leverage key resources and partnerships to deliver their value proposition in the rapidly evolving digital asset mining sector.

This in-depth analysis reveals Marathon's customer segments, revenue streams, and cost structure, offering invaluable insights for anyone looking to understand their competitive edge.

Download the full Business Model Canvas today to gain a deeper understanding of their operational strategy and potential for future growth.

Partnerships

Marathon Digital Holdings actively partners with energy providers and grid operators to ensure access to affordable and sustainable power for its Bitcoin mining activities. This strategic approach is crucial for managing the significant energy demands of their operations.

A prime example of this collaboration is Marathon's acquisition of energy assets, such as a wind farm in Texas. This move not only diversifies their power sources but also directly contributes to securing lower, more predictable energy costs, a critical factor in profitability for mining companies.

These partnerships are designed to optimize energy management, reduce overall operational expenditures, and bolster the reliability of their power supply. For instance, in 2024, Marathon continued to explore and implement strategies to leverage excess energy and participate in demand response programs, aiming to further lower their cost of energy per Bitcoin mined.

Marathon Digital Holdings collaborates with leading technology and hardware manufacturers to secure the most advanced and efficient Bitcoin mining rigs. This strategic alignment is vital for Marathon to maintain a high and competitive hash rate, a critical factor in its mining operations. For instance, in 2024, Marathon continued to deploy next-generation ASICs from manufacturers like Bitmain, aiming for improved energy efficiency and processing power.

Beyond simply acquiring hardware, Marathon actively invests in ASIC manufacturing capabilities through its stake in entities like Orivine. This forward-thinking approach not only secures future hardware supply but also allows Marathon to influence the development of more powerful and cost-effective mining solutions, potentially giving them an edge in the rapidly evolving mining landscape.

Marathon Digital Holdings continues to leverage relationships with data center operators and hosting partners. These collaborations are crucial for scaling its mining operations and accessing specialized infrastructure, even as the company pursues greater self-sufficiency. For instance, in 2023, Marathon announced a significant hosting agreement with a new partner to deploy an additional 50,000 miners, underscoring the ongoing importance of these external relationships.

Strategic Joint Ventures

Marathon Digital Holdings actively pursues strategic joint ventures to broaden its international presence and capitalize on specialized regional knowledge in digital asset infrastructure. A prime example is their Abu Dhabi venture, designed to tap into that market's unique opportunities and expertise.

These collaborations enable shared capital deployment and risk mitigation when establishing substantial, state-of-the-art mining operations. For instance, in 2024, Marathon continued to explore and solidify partnerships that could significantly scale its operational capacity and geographic diversification.

- Global Expansion: Joint ventures like the Abu Dhabi initiative provide access to new markets and regulatory environments.

- Risk Sharing: Partnering allows Marathon to share the financial burden and operational risks associated with large-scale mining projects.

- Leveraging Expertise: These collaborations enable Marathon to benefit from the local knowledge and established infrastructure of its partners.

- Capital Efficiency: Shared investments in advanced technology and infrastructure can lead to more efficient capital allocation for growth.

AI/HPC Compute OEMs and Solution Providers

Marathon Digital Holdings is actively forging key partnerships with AI/HPC compute Original Equipment Manufacturers (OEMs) and specialized solution providers. These collaborations are fundamental to Marathon's strategic pivot beyond Bitcoin mining into the burgeoning AI and high-performance computing sectors. For instance, by teaming up with companies that supply the necessary hardware and integrated solutions, Marathon can accelerate its deployment of pilot programs.

These partnerships are crucial for developing the specialized, low-latency infrastructure that AI inference workloads demand. This means working with providers who can deliver the modular and efficient computing environments required for real-time AI applications. As of early 2024, Marathon has been vocal about exploring these avenues, aiming to leverage existing infrastructure and expertise to tap into new revenue streams.

- AI/HPC Compute OEMs: Collaborations with hardware manufacturers to secure specialized compute units and infrastructure components.

- Solution Providers: Partnerships with firms that offer integrated AI/HPC solutions, including software, networking, and cooling.

- Pilot Program Rollout: These alliances are critical for the successful implementation and testing of Marathon's AI inference infrastructure.

- Infrastructure Development: Joint efforts to build out the modular, low-latency computing environments necessary for AI workloads.

Marathon Digital Holdings' key partnerships are vital for its operational efficiency and strategic expansion. Collaborations with energy providers and grid operators, exemplified by their Texas wind farm acquisition, secure affordable and reliable power, crucial for managing high energy demands. In 2024, these efforts focused on demand response programs to further optimize energy costs per Bitcoin. Strategic alliances with ASIC manufacturers, including investments in Orivine, ensure access to cutting-edge, energy-efficient mining hardware, with continued deployment of next-generation ASICs from manufacturers like Bitmain in 2024.

Furthermore, partnerships with data center operators and hosting providers, such as the 2023 agreement to deploy 50,000 miners, are essential for scaling operations. Joint ventures, like the Abu Dhabi initiative, facilitate global expansion and risk sharing in new markets. Marathon's pivot into AI/HPC involves teaming up with compute OEMs and solution providers to build specialized, low-latency infrastructure, accelerating pilot programs as of early 2024.

| Partnership Area | Key Partners | Strategic Importance | 2024 Focus/Examples |

|---|---|---|---|

| Energy & Grid | Energy Providers, Grid Operators | Affordable, reliable power; cost optimization | Demand response programs; leveraging excess energy |

| Hardware Manufacturing | ASIC Manufacturers (e.g., Bitmain), Orivine | Access to advanced, efficient mining rigs; future supply | Deployment of next-gen ASICs; influencing hardware development |

| Data Centers & Hosting | Data Center Operators, Hosting Partners | Operational scaling; infrastructure access | Expanding hosting capacity (e.g., 50,000 miners in 2023) |

| International Expansion | Joint Venture Partners (e.g., Abu Dhabi) | Market access; risk mitigation; local expertise | Solidifying partnerships for capacity scaling and diversification |

| AI/HPC Compute | AI/HPC OEMs, Solution Providers | Developing specialized infrastructure; entering new markets | Accelerating pilot programs for AI inference workloads |

What is included in the product

Marathon Digital Holdings' business model focuses on large-scale Bitcoin mining operations, leveraging a distributed network of data centers and a strategy of acquiring and deploying energy-efficient mining hardware to maximize hash rate and minimize operational costs.

This model is designed to generate revenue primarily through Bitcoin mining rewards, with a focus on securing strategic energy sources and optimizing infrastructure for sustained profitability and growth in the cryptocurrency market.

Marathon Digital Holdings' Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot of their complex Bitcoin mining operations, simplifying understanding for stakeholders and investors.

This canvas efficiently addresses the pain point of information overload by condensing Marathon's strategy into a digestible format, enabling quick review and comparison with industry peers.

Activities

Marathon Digital Holdings' primary activity is large-scale Bitcoin mining, utilizing advanced infrastructure to generate new Bitcoin. This involves managing significant energy consumption and sophisticated mining hardware to maximize efficiency and Bitcoin output.

In the first quarter of 2024, Marathon mined 28,577 BTC, a substantial increase from prior periods, showcasing their growing operational capacity. Their installed hash rate reached approximately 28.7 EH/s by the end of Q1 2024, demonstrating a continuous effort to expand and optimize their mining operations.

Marathon Digital Holdings is deeply invested in building and overseeing its digital asset infrastructure. This includes not just data centers but also crucial energy assets, showcasing a commitment to a robust operational foundation.

The company is strategically transforming into a vertically integrated digital energy and infrastructure entity. This move is designed to give Marathon greater control over its operations and improve how efficiently it uses its capital.

By the end of 2023, Marathon had significantly expanded its fleet, reaching a total installed capacity of 20.1 EH/s. This growth underscores their aggressive approach to infrastructure development and management.

Marathon Digital Holdings' key activities include the strategic management and optimization of its energy resources. This involves actively acquiring access to low-cost energy sources, a critical component for their energy-intensive Bitcoin mining operations.

A significant aspect of this strategy is leveraging high-intensity computing, not just for mining but also to monetize excess energy. This dual approach helps improve overall power management and creates additional revenue streams.

For example, in the first quarter of 2024, Marathon Digital Holdings reported that its energy costs per Bitcoin mined were approximately $5,000, a figure they aim to continually reduce through these optimization efforts. Their focus on securing power agreements with renewable energy providers, like wind farms, underpins this cost-efficiency drive.

Bitcoin Treasury Management

Marathon Digital Holdings actively manages its Bitcoin treasury, primarily adopting a HODL strategy to accumulate Bitcoin for long-term growth. This approach focuses on holding mined assets, anticipating future value appreciation rather than frequent trading.

The company also strategically utilizes opportunistic sales of its Bitcoin holdings. These sales are crucial for funding ongoing operations, covering capital expenditures, and maintaining necessary liquidity.

For example, in the first quarter of 2024, Marathon Digital Holdings reported generating $117.7 million in revenue, with a significant portion of their Bitcoin holdings contributing to their financial flexibility. By the end of Q1 2024, the company held approximately 17,266 BTC.

- HODL Strategy: Accumulating and holding mined Bitcoin for long-term value appreciation.

- Opportunistic Sales: Selling Bitcoin to fund operations and manage liquidity.

- Treasury Size: Held 17,266 BTC as of March 31, 2024, contributing to financial flexibility.

- Revenue Generation: $117.7 million in revenue in Q1 2024, supported by treasury management.

Research and Development in Digital Energy Technologies

Marathon Digital Holdings actively invests in research and development, focusing on advancing digital energy technologies. This includes exploring and implementing cutting-edge solutions like immersion cooling systems for their mining hardware.

The primary goals of this R&D are to significantly boost operational efficiency and extend the lifespan of their critical mining equipment. By improving cooling methods, Marathon aims to reduce downtime and maximize the performance of its digital asset mining operations.

Furthermore, their research into digital energy technologies is geared towards identifying and developing new revenue streams beyond traditional mining. This strategic focus on innovation is crucial for long-term growth and market positioning.

- Investment in Advanced Cooling: Marathon is actively researching and deploying immersion cooling, a technology that offers superior heat dissipation compared to traditional air cooling.

- Operational Efficiency Gains: Improved cooling directly translates to higher uptime and more consistent performance from their mining hardware, reducing energy waste.

- Hardware Longevity: By mitigating overheating, Marathon can extend the operational life of its expensive mining rigs, leading to better capital utilization.

- Diversification of Revenue: Exploration of digital energy technologies opens avenues for new business models and income sources, reducing reliance solely on Bitcoin mining.

Marathon Digital Holdings' key activities center on large-scale Bitcoin mining, infrastructure development, and strategic energy management. They are also focused on treasury management and investing in research and development for advanced digital energy technologies.

The company's expansion efforts are evident in its growing hash rate, which reached approximately 28.7 EH/s by the end of Q1 2024, and its installed capacity reaching 20.1 EH/s by the end of 2023. This growth is supported by a focus on low-cost energy acquisition and the strategic monetization of excess energy.

Marathon's treasury management involves a HODL strategy for mined Bitcoin, supplemented by opportunistic sales to fund operations and maintain liquidity. As of March 31, 2024, the company held 17,266 BTC, contributing to their Q1 2024 revenue of $117.7 million.

Furthermore, Marathon is investing in R&D, particularly in areas like immersion cooling, to enhance operational efficiency and explore new revenue streams within the digital energy sector.

| Key Activity | Description | Q1 2024 Data/Metrics |

|---|---|---|

| Bitcoin Mining | Large-scale Bitcoin generation using advanced hardware and infrastructure. | 28,577 BTC mined; ~28.7 EH/s installed hash rate. |

| Infrastructure Development | Building and managing data centers and energy assets. | 20.1 EH/s installed capacity by end of 2023. |

| Energy Management | Acquiring low-cost energy and monetizing excess power. | Energy cost per BTC mined ~ $5,000. |

| Treasury Management | Holding mined Bitcoin (HODL) and opportunistic sales. | 17,266 BTC held as of March 31, 2024; $117.7 million revenue. |

| Research & Development | Investing in digital energy technologies like immersion cooling. | Focus on improving efficiency and exploring new revenue streams. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas you're previewing for Marathon Digital Holdings is the exact document you'll receive upon purchase. This isn't a sample or a mockup; it's a direct snapshot of the comprehensive analysis that will be delivered to you. Upon completing your order, you'll gain full access to this same detailed document, ready for your strategic review and utilization.

Resources

Marathon Digital Holdings operates a significant fleet of state-of-the-art Bitcoin mining hardware, crucial for its revenue generation. As of the first quarter of 2024, the company reported a self-mined Bitcoin production of 2,851 BTC, demonstrating the scale of its mining operations.

The company consistently invests in expanding and upgrading its mining infrastructure to maintain a competitive edge. This focus on advanced hardware, such as the latest ASIC miners, directly translates to a higher hash rate and improved energy efficiency, which are key drivers of profitability in the Bitcoin mining industry.

Marathon Digital Holdings owns and operates a substantial and expanding network of large-scale data centers. These facilities are the backbone for its Bitcoin mining operations, providing the essential physical infrastructure to house and power its extensive fleet of specialized computing equipment. As of early 2024, Marathon reported a significant increase in its operational hashrate, directly correlating with the growth and efficiency of these data center assets.

Marathon Digital Holdings leverages substantial energy assets and capacity as a cornerstone of its business model. This includes ownership of wind farms and strategic access to low-cost power sources, which is vital for cost-effective mining operations.

This control over energy supply directly translates into enhanced profitability by minimizing operational expenses. For instance, Marathon has secured access to significant power capacity, aiming to reach 100% renewable energy sources for its operations, a key differentiator in the industry.

Bitcoin Holdings (Treasury)

Marathon Digital Holdings' substantial treasury of Bitcoin, held on its balance sheet, functions as a significant digital asset. This accumulated Bitcoin is a crucial financial resource, underpinning the company's long-term value proposition and operational strategy.

- Bitcoin Holdings: As of March 31, 2024, Marathon Digital Holdings reported holding approximately 17,857 BTC in its treasury.

- Strategic Asset: This Bitcoin reserve is not merely an investment but a core component of their business model, providing a hedge and a potential growth driver.

- Financial Strength: The value of these holdings directly impacts Marathon's financial standing and its ability to fund operations and future growth initiatives.

Proprietary Technology and Expertise

Marathon Digital Holdings' proprietary technology and expertise are cornerstones of its business model. This includes deep knowledge in blockchain technology and digital asset infrastructure, crucial for its Bitcoin mining operations. Their development of liquid immersion cooling systems, for instance, significantly enhances operational efficiency and reduces energy consumption.

Furthermore, Marathon's proprietary firmware, MARA Pool, plays a vital role in optimizing mining performance and managing their extensive fleet of mining hardware. This technological know-how and intellectual property are not just about current operations but are also key drivers for future innovation in the rapidly evolving digital asset space.

As of the first quarter of 2024, Marathon reported a hash rate capacity of 23.1 EH/s, a testament to their advanced infrastructure. Their focus on proprietary technology allows them to maintain a competitive edge.

- Blockchain Technology Expertise: Deep understanding of blockchain protocols and digital asset infrastructure.

- Liquid Immersion Cooling: Advanced cooling solutions for enhanced efficiency and hardware longevity.

- Proprietary Firmware (MARA Pool): Optimized software for mining operations and fleet management.

- Innovation Focus: Continuous development of new technologies to improve mining performance and reduce costs.

Marathon Digital Holdings' key resources encompass its extensive Bitcoin mining fleet, significant energy assets, a substantial Bitcoin treasury, and proprietary technological expertise. These elements collectively form the foundation of its operational capacity and competitive advantage in the digital asset mining sector.

| Resource Category | Specific Asset/Capability | Key Metric/Attribute (Q1 2024) |

| Mining Hardware | State-of-the-art ASIC Miners | Operational Hash Rate: 23.1 EH/s |

| Energy Assets | Owned Wind Farms & Low-Cost Power Access | Aiming for 100% Renewable Energy Sources |

| Digital Assets | Bitcoin Treasury | 17,857 BTC Holdings (as of March 31, 2024) |

| Proprietary Technology | Liquid Immersion Cooling, MARA Pool Firmware | Enhanced Operational Efficiency & Performance Optimization |

Value Propositions

Marathon Digital Holdings provides efficient and scalable Bitcoin production by leveraging its substantial, technologically advanced mining infrastructure. The company actively grows its hashing power and focuses on reducing energy expenses to boost Bitcoin generation.

In the first quarter of 2024, Marathon produced 2,851 Bitcoin, a significant increase driven by their expanding operational capacity and efficiency improvements.

Marathon Digital Holdings offers investors a unique way to participate in Bitcoin's potential long-term growth. Through its strategic 'HODL' approach, the company accumulates a significant portion of the Bitcoin it mines, rather than selling it immediately. This means shareholders' returns are directly tied to Bitcoin's price appreciation over time, providing a clear correlation to the digital asset's performance.

Marathon Digital Holdings offers digital energy and infrastructure solutions, focusing on monetizing stranded or underutilized energy sources. This strategy moves beyond traditional Bitcoin mining to encompass broader energy optimization and grid stabilization services.

By leveraging its infrastructure, Marathon aims to provide innovative solutions that support the energy transition, making its value proposition more robust than a singular focus on mining.

In 2024, Marathon expanded its energy infrastructure initiatives, aiming to secure favorable power rates and explore new revenue streams beyond Bitcoin production, demonstrating a commitment to this diversified approach.

Diversified Digital Asset Technology Platform

Marathon Digital Holdings is strategically expanding beyond its core Bitcoin mining operations to become a diversified digital asset technology platform. This pivot involves significant investment in areas like artificial intelligence (AI) and high-performance computing (HPC) infrastructure, leveraging their existing energy and data center expertise.

This diversification is designed to unlock new revenue streams and bolster long-term growth prospects. For instance, by the end of 2024, Marathon aimed to have a substantial portion of its energy capacity allocated to non-mining ventures, signaling a tangible shift in its business model.

- Diversification Strategy: Moving beyond Bitcoin mining to include AI and HPC infrastructure.

- New Value Streams: Creating opportunities for growth beyond digital asset production.

- Leveraging Existing Assets: Utilizing energy and data center capabilities for new ventures.

- 2024 Focus: Significant allocation of energy capacity to non-mining digital asset technology initiatives.

Operational Excellence and Capital Efficiency

Marathon Digital Holdings emphasizes operational excellence and capital efficiency through a strategy of vertical integration. This approach allows them to gain more control over their mining infrastructure and associated costs. By acquiring owned sites, Marathon reduces reliance on third-party hosting agreements, which can fluctuate in price.

The company also focuses on implementing advanced cooling technologies. These innovations are designed to optimize energy consumption, a critical factor in Bitcoin mining profitability. For instance, in Q1 2024, Marathon reported a total hash rate of 17.7 EH/s, showcasing their growing operational scale. Their energy efficiency improved to 23.1 J/TH, a testament to these technological advancements.

- Vertical Integration: Gaining control over mining sites and infrastructure.

- Owned Sites: Reducing dependency on third-party hosting for cost predictability.

- Advanced Cooling: Enhancing energy efficiency and lowering operational expenses.

- Optimized ROI: Aiming for better returns on capital investments through these efficiencies.

Marathon Digital Holdings offers efficient and scalable Bitcoin production, enhanced by its substantial, technologically advanced mining infrastructure and a focus on reducing energy expenses. The company is also evolving into a diversified digital asset technology platform, investing in AI and HPC infrastructure to unlock new revenue streams beyond mining.

Their value proposition includes providing investors with a direct way to participate in Bitcoin's growth through a HODL strategy, accumulating mined Bitcoin for long-term value appreciation.

Marathon also leverages its infrastructure for digital energy and grid stabilization solutions, monetizing underutilized energy sources and supporting the energy transition.

Operational excellence is driven by vertical integration, including owning mining sites and implementing advanced cooling technologies to optimize energy consumption and capital efficiency.

| Metric | Q1 2024 | Year-End 2024 Target |

|---|---|---|

| Bitcoin Produced | 2,851 BTC | N/A |

| Total Hash Rate | 17.7 EH/s | 21-23 EH/s |

| Energy Efficiency | 23.1 J/TH | Improved |

| Non-Mining Capacity Allocation | Growing | Substantial portion of energy capacity |

Customer Relationships

Marathon Digital Holdings prioritizes clear and consistent communication with its investors. This includes regular earnings calls, detailed SEC filings, and accessible investor relations channels. For instance, in their Q1 2024 earnings report, Marathon provided specific updates on their operational efficiency and future growth plans, reinforcing their commitment to transparency. This open dialogue builds trust and ensures stakeholders have the necessary information to understand the company's performance and strategic direction.

Marathon Digital Holdings actively manages strategic partnerships with key players like energy providers and technology manufacturers. These collaborations are vital for ensuring smooth operations and driving innovation. For instance, in 2024, Marathon continued to leverage its relationships with hosting providers to secure competitive energy rates and access to advanced mining infrastructure.

Marathon Digital Holdings actively engages with local communities surrounding its mining operations, striving to foster positive and mutually beneficial relationships. This engagement is crucial for maintaining social license to operate and addressing any potential concerns arising from their facilities.

This commitment to community also involves navigating potential challenges, such as addressing community lawsuits that may arise from operational impacts. For instance, in 2024, Marathon continued to focus on transparent communication and proactive measures to mitigate environmental and social effects, aiming to preemptively resolve issues and build trust.

Institutional Engagement and Outreach

Marathon Digital Holdings actively engages with institutional investors and financial analysts, offering detailed insights into its operations, strategic direction, and financial performance. This proactive communication is crucial for shaping market perception and influencing analyst coverage, which directly impacts investor confidence and stock valuation.

The company's outreach efforts aim to clearly articulate its unique position within the digital asset mining sector. By providing transparency on its mining infrastructure, energy strategies, and expansion plans, Marathon seeks to foster a deeper understanding of its business model and long-term growth potential among key financial stakeholders.

- Investor Relations: Marathon Digital Holdings maintains a dedicated investor relations team to facilitate communication with institutional investors and analysts.

- Analyst Briefings: Regular briefings and presentations are conducted to update the financial community on operational milestones, hash rate growth, and financial results.

- Market Sentiment: Effective engagement with institutional players is vital for positively influencing market sentiment and securing favorable analyst ratings, which can impact share price performance.

- Data Transparency: The company provides detailed operational data, including uptime percentages and energy efficiency metrics, to support its investor outreach.

Customer Support for Future Services

As Marathon Digital Holdings (MARA) diversifies beyond Bitcoin mining into areas like AI and High-Performance Computing (HPC) hosting, cultivating strong customer support is paramount. This involves establishing dedicated client management teams capable of addressing the unique technical and operational needs of these new service users.

For instance, in 2024, Marathon reported significant growth in its mining operations, with a hash rate reaching approximately 27.1 EH/s by year-end. This operational scaling provides a foundation for managing increased client interactions as they introduce new services. The company’s focus will shift to ensuring seamless onboarding and ongoing technical assistance for AI/HPC clients, which often require specialized support.

- Dedicated Client Management: Implementing specialized teams to handle inquiries and provide tailored solutions for AI/HPC hosting clients.

- Technical Support Infrastructure: Building out robust technical support channels, including online portals, direct technical advisors, and rapid response mechanisms to address client issues efficiently.

- Service Level Agreements (SLAs): Defining clear SLAs for uptime, performance, and support response times to build trust and ensure client satisfaction in these new, demanding service areas.

- Client Feedback Integration: Establishing mechanisms to gather and act on client feedback to continuously improve service offerings and support processes, fostering long-term relationships.

Marathon Digital Holdings cultivates relationships through transparent investor communications, including regular earnings calls and detailed SEC filings, fostering trust and informed decision-making among stakeholders. Their strategic partnerships with energy providers and technology manufacturers in 2024 were crucial for operational efficiency and innovation, securing competitive energy rates.

The company also focuses on community engagement around its operations, aiming for positive local relationships and addressing potential concerns proactively, as seen in their efforts to mitigate environmental impacts in 2024.

As Marathon expands into AI and HPC hosting, dedicated client management and robust technical support infrastructure become key to building strong customer relationships, supported by clear Service Level Agreements.

| Key Relationship Aspect | 2024 Focus/Data | Impact |

| Investor Communication | Regular earnings calls, SEC filings; Q1 2024 operational updates | Builds trust, informs investment decisions |

| Strategic Partnerships | Leveraged hosting provider relationships for energy rates | Ensures operational efficiency, drives innovation |

| Community Engagement | Proactive mitigation of environmental/social effects | Maintains social license to operate, builds trust |

| New Service Clients (AI/HPC) | Establishing dedicated client management, technical support | Ensures client satisfaction, fosters long-term relationships |

Channels

Marathon Digital Holdings utilizes the NASDAQ stock exchange as a primary channel for its capital-raising activities and for engaging with its investor base. This public listing provides accessibility for both individual and institutional investors to acquire shares and participate in the company's financial journey.

As of early 2024, Marathon Digital Holdings (MARA) traded on the NASDAQ, reflecting its status as a publicly recognized entity. The NASDAQ listing facilitates liquidity for its shareholders and serves as a platform for disseminating crucial financial information and company updates to the market.

Marathon Digital Holdings actively manages its investor relations portal, serving as a primary hub for official company communications. This includes easy access to crucial SEC filings like 10-K annual reports and 10-Q quarterly reports, ensuring transparency for stakeholders.

The company leverages these channels to regularly update investors on its financial performance, strategic initiatives, and adherence to corporate governance standards. For instance, Marathon's 2023 annual report, filed with the SEC, detailed significant growth in digital asset holdings and operational capacity.

Financial news platforms are also utilized to disseminate timely information, reaching a broader audience of potential and existing investors. This multi-channel approach is vital for building trust and providing clear, consistent updates on Marathon's business trajectory.

Marathon Digital Holdings utilizes its corporate website as the primary source for official company announcements, including press releases and detailed operational updates, offering stakeholders a comprehensive view of its strategic trajectory. This digital presence ensures transparency and accessibility to crucial information regarding its Bitcoin mining operations and future plans.

Social media channels are also leveraged to broaden public engagement and disseminate timely updates, fostering a connection with a wider audience. This dual approach to digital communication allows Marathon to manage its corporate narrative effectively and maintain consistent communication with investors and the general public.

Industry Conferences and Events

Marathon Digital Holdings actively participates in prominent industry conferences, such as the Bitcoin 2024 conference, to highlight its operational achievements and future strategies. This engagement is crucial for networking with potential collaborators and investors in the digital asset and energy sectors.

These events provide a platform to demonstrate Marathon's commitment to innovation and sustainable Bitcoin mining practices. For instance, at events throughout 2024, the company has shared updates on its expanding fleet and has discussed its approach to energy efficiency.

- Showcasing Technological Advancements: Demonstrating proprietary cooling solutions and advanced mining hardware.

- Strategic Vision Engagement: Presenting on the future of Bitcoin mining and its integration with renewable energy sources.

- Investor and Partner Outreach: Facilitating direct conversations with stakeholders to explore growth opportunities and collaborations.

Direct Client Engagement for New Services

Marathon Digital Holdings is prioritizing direct client engagement for its new AI and high-performance computing (HPC) services. This means actively reaching out to potential enterprise customers and original equipment manufacturers (OEMs) for compute solutions.

The company is focusing on building relationships through dedicated business development efforts. This includes running pilot programs to showcase the capabilities of their services and delivering customized presentations that highlight tailored solutions for specific client needs.

- Direct Outreach: Engaging enterprise clients and compute OEMs for AI/HPC services.

- Business Development: Actively pursuing new partnerships and service adoption.

- Pilot Programs: Demonstrating service value through hands-on trials.

- Tailored Solutions: Presenting customized offerings to meet specific client demands.

Marathon Digital Holdings leverages its NASDAQ listing as a key channel for investor relations and capital raising, with its stock (MARA) actively traded throughout 2024. The company also maintains a robust investor relations portal, offering direct access to SEC filings like the 2023 10-K, which detailed significant operational growth.

Additionally, Marathon utilizes its corporate website and social media for broad communication, alongside participation in industry events such as Bitcoin 2024 to showcase its advancements in mining technology and sustainability efforts.

For its new AI and HPC services, Marathon is prioritizing direct client engagement through dedicated business development, pilot programs, and tailored presentations to enterprise customers and OEMs.

| Channel | Purpose | Key Activities/Data (2023-2024) |

|---|---|---|

| NASDAQ Listing | Capital Raising, Investor Access | MARA stock performance, Market Cap |

| Investor Relations Portal | Official Communications, Transparency | Access to SEC filings (10-K, 10-Q), Shareholder information |

| Corporate Website & Social Media | Public Engagement, Information Dissemination | Press releases, Operational updates, Community interaction |

| Industry Conferences | Networking, Technology Showcase | Presentations on mining efficiency, AI/HPC services, Renewable energy integration |

| Direct Client Outreach (AI/HPC) | Service Adoption, Partnerships | Pilot programs, Customized solutions for enterprise clients and OEMs |

Customer Segments

Equity investors, both individual and institutional, are a core customer segment for Marathon Digital Holdings. They are drawn to Marathon's stock for direct exposure to the burgeoning Bitcoin ecosystem and the company's ambitious growth trajectory within the digital asset mining industry. These investors are primarily motivated by the pursuit of financial returns, seeking capital appreciation and dividends, while also valuing strategic insights into the evolving digital asset landscape.

Marathon Digital Holdings serves the vast Bitcoin network, acting as a crucial contributor to its security and decentralization. By actively mining Bitcoin, Marathon bolsters the network's overall hash rate, making it more resilient and robust against potential attacks.

This segment directly benefits from the increased hash rate and the reliable, powerful infrastructure that Marathon deploys. As of early 2024, Marathon Digital Holdings has consistently been one of the largest publicly traded Bitcoin miners by hash rate, demonstrating their significant impact on the network's health.

Energy sector participants, including power producers and utility companies, represent a key customer segment for Marathon Digital Holdings. These entities can leverage Marathon's Bitcoin mining operations as a flexible load to absorb excess energy, thereby enhancing grid stability and reducing curtailment. For instance, in 2024, Marathon has actively pursued agreements with energy providers to utilize their surplus power, demonstrating the practical application of this synergy.

Future AI and High-Performance Computing (HPC) Clients

Marathon Digital Holdings is actively targeting future clients in the burgeoning AI and High-Performance Computing (HPC) sectors. This strategic diversification aims to leverage their existing infrastructure for new, high-demand computing applications beyond traditional Bitcoin mining.

These clients will require substantial, low-latency computing power for tasks such as AI model training and inference, scientific simulations, and complex data analysis. Marathon's expansive data center operations provide a scalable foundation to meet these demanding requirements.

The company's expansion into this market segment is supported by significant investments in infrastructure. For instance, in 2024, Marathon continued to expand its operational capacity, aiming to reach over 50 exahashes per second (EH/s) of computing power by the end of the year, a substantial portion of which could be reallocated to HPC workloads.

- AI and HPC Demand: The global AI market is projected to grow significantly, with HPC solutions being integral to its advancement.

- Infrastructure Advantage: Marathon possesses large-scale, energy-efficient data centers crucial for power-intensive AI and HPC operations.

- Diversification Strategy: Moving into AI/HPC represents a key strategic pivot to broaden revenue streams and capitalize on emerging technology trends.

- 2024 Capacity Expansion: Marathon's ongoing build-out of mining capacity in 2024 positions them to offer competitive HPC solutions as demand solidifies.

Strategic Technology and Infrastructure Partners

Marathon Digital Holdings’ strategic technology and infrastructure partners are crucial for its innovation and operational efficiency. These entities collaborate with Marathon to develop and implement cutting-edge solutions. For instance, partnerships in advanced cooling systems are vital for optimizing the performance and longevity of their mining hardware, especially as energy efficiency becomes paramount in the competitive Bitcoin mining landscape.

These collaborations extend to the manufacturing of specialized hardware, like advanced ASIC miners. By working with leading manufacturers, Marathon ensures access to the latest, most powerful, and energy-efficient equipment. In 2024, the company has continued to focus on securing these advanced machines to maintain its competitive edge.

- Partnerships in advanced cooling solutions aim to improve hardware efficiency and reduce operational costs.

- Collaborations with ASIC manufacturers ensure access to state-of-the-art mining hardware, crucial for performance gains.

- These strategic alliances are fundamental to Marathon's strategy of technological advancement and scaling its mining operations.

Marathon Digital Holdings' customer segments extend beyond direct investors to include the Bitcoin network itself, which benefits from their enhanced hash rate and robust infrastructure. Energy sector participants, such as power producers, find value in Marathon’s operations as a flexible load, aiding grid stability by absorbing excess energy, a synergy actively pursued in 2024.

The company is also strategically targeting the Artificial Intelligence (AI) and High-Performance Computing (HPC) sectors, recognizing their substantial demand for computing power. Marathon's existing large-scale data centers are well-positioned to meet these needs, with significant capacity expansion in 2024 aimed at supporting these emerging workloads.

Finally, technology and infrastructure partners are critical, enabling Marathon to access cutting-edge hardware and develop innovative solutions, such as advanced cooling systems, to maintain operational efficiency and a competitive edge in the rapidly evolving digital asset landscape.

| Customer Segment | Value Proposition | 2024 Relevance/Data |

|---|---|---|

| Equity Investors | Direct exposure to Bitcoin ecosystem, growth potential | Focus on capital appreciation; ongoing investor relations for transparency |

| Bitcoin Network | Enhanced security and decentralization via hash rate contribution | Marathon's hash rate is a significant contributor to network security. |

| Energy Sector Participants | Grid stability, reduced curtailment through flexible load | Active pursuit of energy-balancing agreements in 2024. |

| AI/HPC Sector | High-demand computing power for AI training, simulations | Infrastructure expansion targeting over 50 EH/s capacity by end of 2024. |

| Technology/Infrastructure Partners | Access to advanced hardware, operational efficiency improvements | Securing latest ASIC miners and implementing advanced cooling solutions. |

Cost Structure

Electricity is a primary and significant cost for Marathon Digital Holdings, directly tied to powering its extensive Bitcoin mining infrastructure. In 2023, Marathon reported that its total energy costs amounted to approximately $106.7 million, highlighting its sensitivity to energy price fluctuations and its role as a major variable expense.

Marathon Digital Holdings heavily invests in acquiring new Bitcoin mining hardware, a significant capital expenditure. In the first quarter of 2024, the company reported capital expenditures of $108.9 million, largely driven by the purchase of new, more efficient mining equipment to expand their operational capacity and hash rate.

Building out and maintaining data centers, along with other essential infrastructure, represents another substantial cost. This includes expenses for power generation, cooling systems, and site development, all crucial for supporting their growing mining operations and ensuring efficient energy consumption.

Operational and maintenance expenses are critical for Marathon Digital Holdings' Bitcoin mining activities. These costs encompass the day-to-day running of their mining facilities, including essential services like cooling systems to prevent hardware overheating, regular repairs to keep equipment functioning optimally, robust security measures to protect their assets, and the necessary staffing to manage operations.

In 2024, Marathon Digital Holdings continued to invest in these operational necessities. For instance, their focus on improving energy efficiency and facility uptime directly impacts these expenses. While specific figures fluctuate, these costs are directly tied to the scale of their mining operations and the efficiency of their chosen locations and hardware.

Research and Development Investment

Marathon Digital Holdings dedicates significant resources to research and development, focusing on areas like digital energy technologies, advanced immersion cooling systems, and the next generation of ASIC miners. These investments are crucial for enhancing operational efficiency and expanding their service portfolio.

In 2024, Marathon continued to prioritize these R&D efforts, recognizing their importance for long-term competitiveness. The company's commitment to innovation is evident in its ongoing exploration of more sustainable and powerful mining solutions.

- Digital Energy Technologies: Exploring innovative ways to leverage energy sources for mining operations.

- Immersion Cooling: Investing in technologies that improve the thermal management and lifespan of mining hardware.

- ASIC Development: Focusing on the creation of more efficient and powerful application-specific integrated circuits for cryptocurrency mining.

General, Administrative, and Legal Expenses

General, administrative, and legal expenses at Marathon Digital Holdings encompass a range of essential corporate functions and potential liabilities. These costs are critical for day-to-day operations and navigating the complex regulatory landscape of the cryptocurrency industry.

In 2024, Marathon Digital Holdings reported significant investments in these areas. For instance, their general and administrative expenses, which include corporate overhead, administrative salaries, and marketing efforts, were a substantial part of their operational budget. Legal expenses, particularly those related to ongoing litigation and the continuous need for regulatory compliance in the evolving digital asset space, also represent a material cost.

- Corporate Overhead: Costs associated with maintaining the company's physical and virtual infrastructure.

- Administrative Salaries: Compensation for management and support staff essential for business operations.

- Marketing and Sales: Expenses incurred to promote the company's brand and services.

- Legal and Compliance: Costs related to legal counsel, regulatory filings, and managing potential litigation.

Marathon Digital Holdings' cost structure is heavily influenced by electricity, hardware acquisition, and infrastructure development. In 2023, electricity alone cost the company approximately $106.7 million, underscoring its sensitivity to energy prices. Capital expenditures for new mining hardware also represent a significant outlay; for example, Q1 2024 saw $108.9 million spent on equipment.

| Cost Category | 2023 (Approx.) | Q1 2024 (Approx.) | Key Drivers |

|---|---|---|---|

| Electricity | $106.7 million | N/A | Energy prices, hash rate, operational uptime |

| Hardware Acquisition | N/A | $108.9 million | Expansion of mining fleet, efficiency upgrades |

| Infrastructure | Significant | Ongoing | Data center build-out, cooling systems, site development |

| Operations & Maintenance | Significant | Ongoing | Cooling, repairs, security, staffing |

| R&D | Significant | Ongoing | Digital energy tech, immersion cooling, ASIC development |

| G&A / Legal | Substantial | Substantial | Corporate overhead, salaries, marketing, legal/compliance |

Revenue Streams

Marathon Digital Holdings' core revenue generation comes from Bitcoin mining rewards. This encompasses both the fixed block subsidy, which is the new Bitcoin created with each validated block, and the transaction fees paid by users to have their transactions included in those blocks.

In the first quarter of 2024, Marathon Digital Holdings mined 2,850 Bitcoin, a significant increase from the previous year. This highlights the direct correlation between their operational capacity and revenue generation through these mining rewards.

Marathon Digital Holdings primarily holds Bitcoin, but it can sell portions of its treasury to generate cash. For instance, in the first quarter of 2024, Marathon sold 1,500 BTC to fund operations and general corporate needs, demonstrating this revenue stream in action.

These opportunistic sales provide crucial liquidity, allowing the company to cover operational expenses, invest in growth, or manage its financial obligations effectively.

Marathon Digital Holdings is exploring a significant expansion into AI and High-Performance Computing (HPC) hosting. This emerging revenue stream leverages their existing data center infrastructure, designed for energy-intensive operations like Bitcoin mining, to accommodate the substantial computational demands of AI inference and other HPC workloads.

The company's strategy involves repurposing and expanding its facilities to offer specialized hosting services. This diversification aims to capitalize on the rapidly growing market for AI and HPC, which requires robust and scalable computing power. For instance, in the first quarter of 2024, Marathon reported a substantial increase in their energy capacity, reaching 864 MW, a critical asset for supporting these power-hungry applications.

Digital Energy Solutions and Management Fees

Marathon Digital Holdings is increasingly positioning itself as a digital energy company, opening avenues for new revenue streams beyond Bitcoin mining. This strategic shift could involve offering specialized energy management solutions to third parties, leveraging their expertise in optimizing energy consumption for large-scale operations.

Monetizing their substantial energy assets is another key area. This might include providing grid services, such as load balancing, which helps stabilize electricity grids during peak demand periods. In 2024, Marathon continued to expand its operational capacity, with a significant portion of its energy infrastructure designed for flexibility and potential grid interaction.

- Digital Energy Solutions: Offering energy management software and services to optimize power usage for data centers and other energy-intensive industries.

- Grid Services: Participating in demand response programs and providing ancillary services to electricity grid operators, potentially earning revenue for stabilizing the grid.

- Energy Asset Monetization: Exploring opportunities to lease or sell excess energy capacity or participate in energy trading markets.

Strategic Investments and Ventures

Marathon Digital Holdings diversifies its revenue streams through strategic investments in the digital asset and energy technology sectors. This includes stakes in companies like ASIC manufacturers, which can generate returns via equity appreciation or dividends.

These investments are crucial for capturing value beyond direct Bitcoin mining operations. For instance, in 2024, Marathon continued to explore and potentially execute such strategic partnerships, aiming to bolster its overall financial performance and market position.

- Strategic Investments: Equity stakes in companies involved in digital asset mining hardware and energy solutions.

- Value Creation: Returns realized through capital gains on investments or income from dividends.

- Synergistic Opportunities: Potential for operational efficiencies and technological advancements by aligning with key industry players.

Marathon Digital Holdings' primary revenue comes from Bitcoin mining rewards, including block subsidies and transaction fees.

In Q1 2024, they mined 2,850 BTC, demonstrating a direct link between operations and revenue, while also selling 1,500 BTC to fund operations.

The company is expanding into AI and HPC hosting, leveraging its 864 MW energy capacity from Q1 2024 to tap into new markets.

Strategic investments in ASIC manufacturers and energy tech firms also contribute to their diversified revenue streams.

| Revenue Stream | Description | Q1 2024 Data/Notes |

| Bitcoin Mining Rewards | Block subsidies and transaction fees | 2,850 BTC mined |

| Bitcoin Sales | Selling BTC from treasury | 1,500 BTC sold |

| AI/HPC Hosting | Leveraging data center infrastructure for AI/HPC | 864 MW energy capacity |

| Strategic Investments | Equity stakes in industry partners | Ongoing exploration and potential execution |

Business Model Canvas Data Sources

The Marathon Digital Holdings Business Model Canvas is informed by its public financial disclosures, including SEC filings and investor presentations. We also leverage market intelligence reports on the cryptocurrency mining industry and internal operational data to populate each segment.