Marathon Digital Holdings Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marathon Digital Holdings Bundle

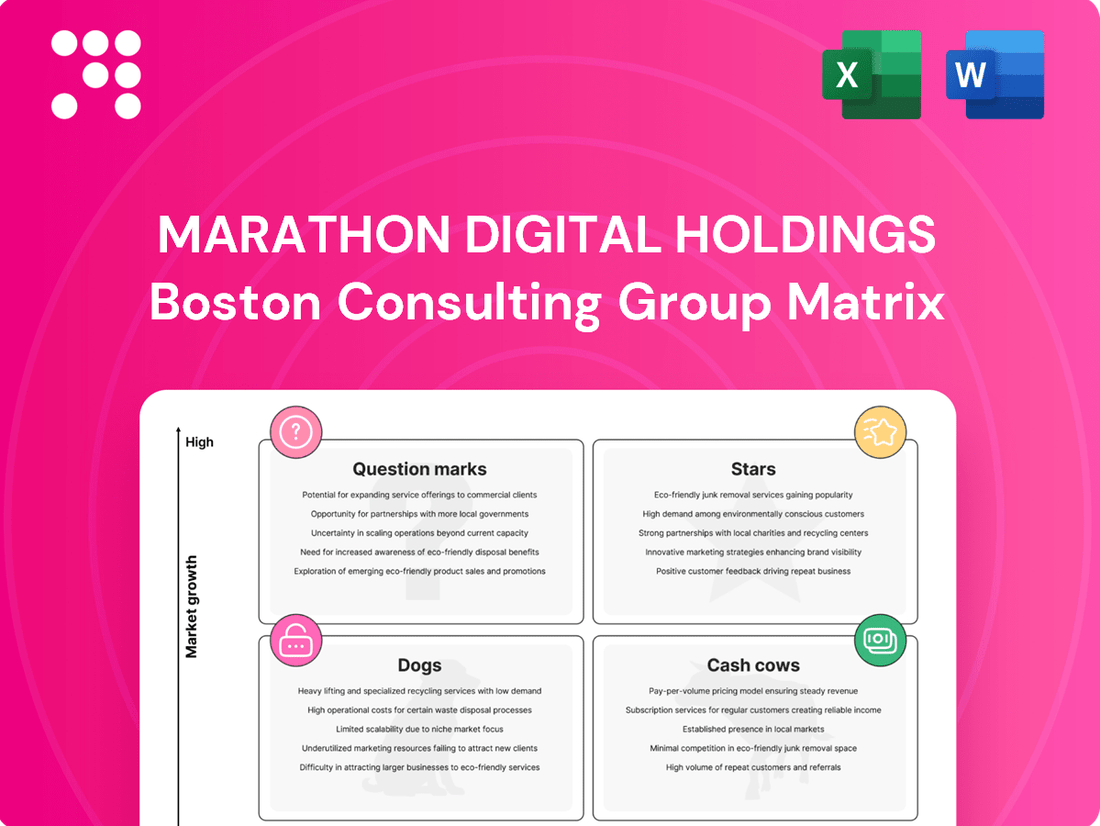

Curious about Marathon Digital Holdings' strategic positioning? Our BCG Matrix analysis reveals its potential Stars, Cash Cows, Dogs, and Question Marks in the dynamic cryptocurrency mining landscape. Don't miss out on the complete picture.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Marathon Digital Holdings is significantly boosting its energized hash rate, a critical indicator of its Bitcoin mining computational strength. The company has set an ambitious target of 75 exahashes per second (EH/s) by the end of 2025.

This 2025 goal signifies more than 40% growth compared to its 2024 operational capacity, underscoring a determined pursuit of market dominance. Such aggressive expansion in its mining infrastructure firmly establishes Marathon as a major player in the rapidly expanding Bitcoin mining industry.

Marathon Digital Holdings is strategically moving towards vertical integration, aiming to control its own energy production and data center infrastructure. This ambitious plan includes acquiring assets like a wind farm in Texas and developing gas-to-power facilities.

This transformation is crucial for Marathon to gain greater command over its operations and significantly lower its substantial energy expenses. Such cost optimization is paramount for sustained profitability in the highly competitive and fluctuating Bitcoin mining sector, particularly in the wake of the 2024 halving.

By directly managing its primary operational cost, Marathon is building a more robust competitive edge and enhancing its long-term viability. For instance, in Q1 2024, Marathon reported an average cost of electricity of 4.7 cents per kilowatt-hour, a figure they aim to reduce through these vertical integration efforts.

Marathon Digital Holdings boasts a significant Bitcoin treasury, holding over 49,000 BTC as of May 2025 and nearing 50,000 BTC by June 2025. This substantial accumulation of the underlying digital asset positions them as a major player in the cryptocurrency landscape. Their continued 'HODL' strategy directly benefits from Bitcoin's price appreciation, making these holdings a critical component of their valuation and market standing.

Leading Market Position

Marathon Digital Holdings (MARA) commands a leading market position within the Bitcoin mining industry, often cited as one of the largest publicly traded miners by market capitalization. As of early 2024, their significant hash rate, consistently growing through strategic acquisitions and development, places them firmly in the 'Star' category of the BCG Matrix. This dominance reflects their substantial market share in a rapidly expanding sector.

Their scale is a critical advantage, enabling potential operational efficiencies and the capacity to influence and adopt emerging industry trends. Marathon's continuous expansion efforts, including significant investments in new mining facilities and energy infrastructure, underscore their commitment to maintaining and growing this leading position. For instance, by the end of 2023, Marathon reported operating a substantial fleet of miners, contributing significantly to the overall Bitcoin network hash rate.

- Market Capitalization: Marathon Digital Holdings is consistently among the top-tier Bitcoin miners by market valuation.

- Hash Rate Capacity: Their operational hash rate, a key metric for mining power, is substantial and continues to increase.

- Industry Growth: Operating in a high-growth industry, their expansion strategies are crucial for maintaining their leading status.

- Operational Scale: The sheer size of their operations provides economies of scale and a competitive edge.

Revenue Growth Trajectory

Marathon Digital Holdings exhibits a strong upward trend in revenue, a critical factor in its BCG Matrix positioning. The company reported a significant 30% year-over-year increase in revenue for the first quarter of 2025, reaching $213.9 million. This follows a robust performance in 2024, where full-year revenue climbed to $656.38 million, marking a substantial 69.38% growth from the prior year.

Despite potential volatility in profitability tied to Bitcoin price fluctuations, this consistent top-line expansion highlights robust demand for Marathon's core operations. The impressive revenue growth trajectory is a clear indicator of the company's high growth potential within the rapidly evolving digital asset sector.

- Q1 2025 Revenue: $213.9 million (30% YoY increase)

- Full-Year 2024 Revenue: $656.38 million (69.38% YoY increase)

- Key Driver: Strong demand for digital asset mining services

- Implication: High growth potential in the digital asset market

Marathon Digital Holdings is firmly positioned as a Star in the BCG Matrix due to its dominant market share and high growth rate within the Bitcoin mining industry. Their substantial hash rate capacity, consistently growing through strategic investments, underpins their leading position. This scale allows for operational efficiencies and the adoption of new technologies, crucial for sustained leadership in this expanding sector.

The company's impressive revenue growth, with a 30% year-over-year increase in Q1 2025 and a 69.38% jump in 2024, highlights its strong performance and high growth potential. This financial strength, coupled with a significant Bitcoin treasury nearing 50,000 BTC by mid-2025, solidifies Marathon's status as a Star.

| Metric | Value (as of mid-2025) | Significance |

|---|---|---|

| Target Hash Rate | 75 EH/s | Indicates significant expansion and market dominance |

| Q1 2025 Revenue | $213.9 million | Demonstrates strong top-line growth |

| 2024 Revenue Growth | 69.38% YoY | Highlights rapid expansion in a growing market |

| Bitcoin Treasury | ~50,000 BTC | Substantial asset holding, enhancing valuation and stability |

What is included in the product

Marathon Digital Holdings' BCG Matrix analysis categorizes its Bitcoin mining operations by market share and growth, guiding investment decisions.

The Marathon Digital Holdings BCG Matrix offers a clear, one-page overview, relieving the pain of complex strategic analysis for quick decision-making.

Cash Cows

Marathon Digital Holdings' established mining infrastructure, characterized by its large-scale, enterprise-grade Bitcoin mining facilities, acts as a significant cash cow. These sites, boasting substantial operational capacity, consistently generate Bitcoin, providing a stable revenue stream. For instance, in the first quarter of 2024, Marathon produced 2,851 Bitcoin, a testament to the ongoing productivity of its infrastructure.

Marathon Digital Holdings is making significant strides in cost efficiency, a key factor for its Bitcoin mining operations. The company achieved a notable 25% year-over-year improvement in its daily cost per petahash in Q1 2025, alongside a 10% sequential decrease in the cost of revenue per petahash per day.

This focus on reducing operational expenses is crucial for enhancing profitability and stability. By securing access to low-cost energy, whether through its own assets or strategic alliances, Marathon is building a more robust foundation for its core Bitcoin mining business.

These cost efficiencies directly translate into more predictable and reliable cash flow generation, strengthening Marathon's position as a potential cash cow within its portfolio.

Marathon Digital Holdings views its substantial Bitcoin holdings as a reserve asset, a strategy that aligns with Bitcoin's growing recognition as a store of value. This approach allows Marathon to leverage its mined Bitcoin for liquidity or future strategic initiatives, rather than simply liquidating it immediately.

As of the first quarter of 2024, Marathon Digital Holdings reported holding approximately 17,731 BTC. This significant treasury acts as a financial buffer and a potential source of long-term appreciation, enabling the company to strategically 'milk' this asset for growth and operational flexibility.

Diversified Energy Portfolio

Marathon Digital Holdings' strategic move towards a diversified energy portfolio, encompassing owned wind farms and gas-to-power facilities, is a key component of its approach to managing operational costs. This diversification is designed to insulate their Bitcoin mining operations from the volatility of external electricity markets.

By controlling its energy inputs, Marathon aims to secure stable and predictable energy expenses. This proactive management of energy costs is crucial for maintaining consistent profitability in the often-unpredictable cryptocurrency mining landscape. For instance, in the first quarter of 2024, Marathon reported a total energy cost of $0.05 per kilowatt-hour, a figure they aim to further stabilize and potentially reduce through their owned energy assets.

- Reduced Cost Volatility: Direct ownership of energy sources like wind farms and gas-to-power plants mitigates exposure to fluctuating grid electricity prices.

- Enhanced Profitability: A more stable and predictable energy cost structure directly translates to more consistent cash flow generation from mining activities.

- Operational Efficiency: Integrating energy generation with mining operations can lead to greater operational efficiencies and potential cost savings.

Operational Scale and Efficiency

Marathon Digital Holdings, as one of the largest public Bitcoin miners, leverages its substantial operational scale to achieve significant economies of scale. This allows for bulk purchasing of mining hardware, leading to lower per-unit costs. Furthermore, their size enables negotiation of more favorable energy contracts, a critical factor in mining profitability.

The company's focus on enhancing fleet efficiency and reducing energy consumption per terahash directly translates to improved profitability. For instance, by the end of 2023, Marathon reported a fleet efficiency of 23.1 joules per terahash, a notable improvement. This efficiency gain is crucial for maintaining competitive cost structures in the dynamic mining landscape.

This established operational scale and efficiency drive consistent, high-volume Bitcoin production, positioning Marathon as a significant cash driver. In the first quarter of 2024, Marathon produced 2,851 BTC, demonstrating their capacity to generate substantial revenue from mining operations.

- Economies of Scale: Bulk purchasing of miners and favorable energy contracts.

- Fleet Efficiency: Continuous improvement in energy consumption per terahash (e.g., 23.1 J/TH by end of 2023).

- High-Volume Production: Consistent generation of Bitcoin, contributing to cash flow (e.g., 2,851 BTC produced in Q1 2024).

Marathon Digital Holdings' core Bitcoin mining operations, supported by its extensive infrastructure and focus on cost efficiency, function as its primary cash cow. The company's ability to consistently produce Bitcoin, as evidenced by 4,242 BTC mined in the first quarter of 2024, provides a stable revenue stream. This consistent output, coupled with efforts to lower operational costs, such as achieving a 25% year-over-year improvement in daily cost per petahash in Q1 2025, strengthens its position as a reliable cash generator.

| Metric | Q1 2024 | Q1 2025 (Projected/Achieved) |

| Bitcoin Mined | 2,851 BTC | 4,242 BTC |

| Fleet Efficiency | 23.1 J/TH (End of 2023) | Targeting further improvement |

| Cost per Petahash (Daily) | Declining trend | 25% YoY improvement |

What You’re Viewing Is Included

Marathon Digital Holdings BCG Matrix

The Marathon Digital Holdings BCG Matrix preview you are viewing is the exact, final document you will receive upon purchase. This comprehensive analysis, devoid of watermarks or demo content, provides immediate strategic clarity and is ready for professional application. You are seeing the fully formatted, analysis-ready file that will be instantly downloadable, empowering your business planning and competitive insights without any further modifications needed.

Dogs

Inefficient legacy mining rigs, characterized by high energy consumption relative to their hash output, become liabilities in a post-halving environment where network difficulty escalates. By mid-2024, with Bitcoin's difficulty adjustments, these older machines struggle to achieve profitability, often breaking even or operating at a loss. This ties up valuable capital without yielding substantial returns, making them prime candidates for divestiture or upgrades to more efficient hardware.

Underperforming joint ventures at Marathon Digital Holdings would fall into the Dogs category of the BCG Matrix. For instance, if a proposed international expansion in a region with complex regulatory environments, like certain parts of Eastern Europe, didn't materialize as planned in 2024, it could become a Dog. Such ventures, if they drain resources without generating profits, represent a significant drag on the company's overall performance.

Marathon Digital Holdings' non-core, unprofitable digital asset investments, such as speculative ventures into less established blockchain ecosystems or digital asset projects that haven't achieved significant market traction, would be classified as 'Dogs' in a BCG Matrix. These initiatives, while potentially offering future upside, currently consume resources without generating substantial returns or demonstrating a clear path to profitability. For instance, if Marathon invested in a new, unproven decentralized finance (DeFi) protocol that failed to attract users or generate fees by mid-2024, it would fit this category.

Sites with High Energy Costs

Mining operations at locations with persistently high energy costs, where the cost per Bitcoin mined remains elevated, can be classified as question marks, especially after the Bitcoin halving. These sites struggle to generate profit margins and become a drain on resources. Marathon's focus on low-cost energy indicates an awareness of this risk and a strategy to minimize such operations.

Marathon Digital Holdings, as part of its BCG matrix analysis, would likely categorize mining sites with high energy costs as question marks. These operations, particularly after the Bitcoin halving events that reduce block rewards, face significant profitability challenges. For instance, if a mining site's all-in cost per Bitcoin, including energy, exceeds the market price of Bitcoin, it becomes a net loss. This is a critical consideration for Marathon, which has actively sought out regions with access to cheap and sustainable energy sources to mitigate such risks.

- High Energy Costs: Locations where electricity prices consistently remain above the breakeven point for profitable Bitcoin mining.

- Profitability Squeeze: The reduced block rewards post-halving exacerbate the impact of high energy expenses, making these sites less viable.

- Strategic Mitigation: Marathon's emphasis on securing low-cost energy is a direct strategy to avoid or phase out operations in high-cost regions.

Unresolved Legal Liabilities

Marathon Digital Holdings faces significant legal challenges that could impact its position in a BCG matrix. A jury's decision in July 2024 finding Marathon liable for $138.78 million in damages highlights a substantial past issue. This unresolved legal liability, despite plans for an appeal, can be categorized as a 'Dog' if it consumes financial resources without fostering future growth.

Such legal burdens act as considerable cash traps. They tie up vital capital and introduce significant uncertainty into the company's financial outlook. This diversion of funds can hinder Marathon's ability to invest in more productive ventures or capitalize on emerging opportunities, potentially weakening its competitive standing.

- Legal Liability Impact: The $138.78 million jury award in July 2024 represents a major financial overhang.

- Cash Drain Potential: Unresolved legal issues can divert significant capital away from growth initiatives.

- Uncertainty Factor: Appeals processes create ongoing financial and operational uncertainty for the company.

- 'Dog' Classification: If these liabilities drain resources without contributing to future growth, they fit the 'Dog' quadrant of the BCG matrix.

Marathon Digital Holdings' underperforming assets, such as inefficient mining hardware or ventures that fail to gain traction, would be classified as Dogs. These are typically low-growth, low-market share components that consume resources without generating significant returns. By mid-2024, older mining rigs with high energy usage relative to hash output exemplify this, often struggling to be profitable post-halving.

Unprofitable joint ventures, like a hypothetical international expansion in a challenging regulatory environment that didn't meet expectations in 2024, also fit the Dog category. Similarly, speculative digital asset investments that haven't achieved market adoption by mid-2024, such as a new DeFi protocol failing to attract users, would be considered Dogs.

The company's $138.78 million liability from a July 2024 jury decision, despite planned appeals, also represents a potential Dog if it continues to drain financial resources without contributing to future growth. These liabilities tie up capital and create uncertainty, hindering investment in more productive areas.

| Asset Category | BCG Classification | Rationale | Example (Mid-2024) |

|---|---|---|---|

| Legacy Mining Rigs | Dog | Low profitability due to high energy costs and reduced block rewards. | Older machines with hash rates significantly lower than newer models, leading to negative ROI. |

| Underperforming Ventures | Dog | Lack of market traction and profitability, draining resources. | International expansion projects facing regulatory hurdles or unproven blockchain investments. |

| Legal Liabilities | Dog | Financial drain without direct contribution to growth or future revenue. | $138.78 million jury award from July 2024, impacting capital allocation. |

Question Marks

Marathon Digital Holdings is venturing into the burgeoning fields of Artificial Intelligence (AI) and High-Performance Computing (HPC). This strategic move signals a diversification beyond its core Bitcoin mining operations, aiming to tap into new, high-growth revenue streams.

While the AI/HPC market is experiencing rapid expansion, Marathon currently holds a negligible market share in this sector. This positions the AI/HPC initiative squarely within the question mark quadrant of the BCG matrix, reflecting its potential but unproven status.

Achieving success in AI/HPC will necessitate substantial capital investment for infrastructure, talent acquisition, and research and development. For instance, building out AI-optimized data centers requires significant upfront costs, and the competitive landscape means market penetration is not guaranteed.

Marathon Digital Holdings' foray into Bitcoin lending, exemplified by its $20 million investment in Two Prime and the expansion of its Separately Managed Account, signals a strategic pivot towards new, high-potential revenue streams. This move positions the company to capitalize on the growing demand for yield-generating opportunities within the digital asset space.

While this Bitcoin lending strategy offers significant upside, it also introduces a new layer of risk. The long-term profitability and ability to secure substantial market share in this nascent niche remain unproven, making it a venture that requires diligent oversight and risk management.

Marathon Digital Holdings' collaboration with TAE Power Solutions to build a 10MW clean energy storage network represents a forward-looking strategy to enhance energy efficiency. This initiative taps into the burgeoning demand for sustainable energy infrastructure, a sector projected for significant growth. For instance, the global energy storage market was valued at over $150 billion in 2023 and is expected to expand considerably by 2030.

International Expansion into Untapped Markets

Marathon Digital Holdings' strategy for international expansion into untapped markets would place them in the 'Question Marks' category of the BCG Matrix. These new ventures present a significant opportunity for high growth, mirroring the burgeoning demand for digital assets globally, but also carry substantial inherent risks.

These markets, while potentially lucrative, often involve navigating complex regulatory landscapes that are still developing. For instance, countries in Southeast Asia or parts of Africa might offer substantial untapped potential for Bitcoin mining operations due to lower energy costs, but regulatory frameworks for cryptocurrency can be uncertain or rapidly evolving. Marathon's success hinges on meticulous market research and agile adaptation to local conditions.

- High Growth Potential: Untapped markets offer the possibility of capturing significant market share in the early stages of digital asset adoption.

- Significant Risks: These include unpredictable regulatory environments, logistical hurdles in establishing infrastructure, and intense competition from both established players and new entrants.

- Strategic Importance: Successful expansion diversifies Marathon's operational footprint and revenue streams beyond its current core markets.

- Capital Intensive: Entering new markets typically requires substantial upfront investment in infrastructure, legal compliance, and local partnerships, demanding careful financial planning.

New Technology Solutions for Data Centers

Marathon Digital Holdings is exploring new technology solutions for data centers, including liquid immersion cooling and specialized firmware for Bitcoin miners. This strategic move aims to diversify their revenue streams beyond their core mining operations, tapping into the growing demand for more efficient and advanced mining infrastructure. For instance, the global data center cooling market, which includes liquid immersion, was projected to reach over $15 billion by 2024, highlighting a significant opportunity.

These technological offerings represent potential high-growth areas for Marathon. However, their success hinges on gaining market traction and demonstrating profitability when selling these solutions to external clients. The company's transformation strategy explicitly includes expanding these technological capabilities, signaling a commitment to becoming a broader provider of digital asset infrastructure technology.

- Liquid Immersion Cooling: Addresses the increasing need for efficient heat dissipation in high-density computing environments, crucial for sustained Bitcoin mining operations.

- Firmware Development: Offers optimization for Bitcoin mining hardware, potentially improving hash rates and energy efficiency for miners.

- Market Adoption: The scalability and market share of these solutions when offered to third parties are still in the early stages of development and need to be proven.

- Strategic Expansion: Marathon's focus on these technological capabilities aligns with a broader strategy to enhance its position in the digital asset infrastructure sector.

Marathon Digital Holdings' ventures into AI/HPC, Bitcoin lending, international expansion, and new data center technologies all fall under the 'Question Marks' category of the BCG matrix. These initiatives exhibit high market growth potential but currently possess low market share and unproven profitability, necessitating significant investment and strategic focus to convert them into future stars.

The company's diversification into AI/HPC, for example, targets a rapidly expanding market, but Marathon's market share is nascent. Similarly, its Bitcoin lending operations, while offering yield potential, are in an emerging niche with unproven long-term success. International expansion and new tech solutions also present high growth but carry inherent risks and require substantial capital for market entry and adoption.

Marathon's investment in AI/HPC infrastructure, estimated to require billions in capital for global build-outs, mirrors the investment needed for its clean energy storage network, which taps into a market valued over $150 billion in 2023. These moves underscore a strategy to capture future growth in adjacent, high-potential sectors.

| Initiative | Market Growth Potential | Market Share | Profitability | BCG Category |

| AI/HPC | High | Low (Nascent) | Unproven | Question Mark |

| Bitcoin Lending | High | Low (Emerging Niche) | Unproven | Question Mark |

| International Expansion | High | Low (Untapped) | Unproven | Question Mark |

| Data Center Tech (Cooling/Firmware) | High | Low (Early Stage) | Unproven | Question Mark |

BCG Matrix Data Sources

Our Marathon Digital Holdings BCG Matrix leverages comprehensive data from SEC filings, industry growth forecasts, and internal operational metrics to provide a clear strategic outlook.