Marathon Digital Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Marathon Digital Holdings Bundle

Marathon Digital Holdings operates in a dynamic crypto-mining landscape, where the threat of new entrants is significant due to relatively low barriers to entry in some regions, while buyer power is somewhat diffused across various exchanges. The intensity of rivalry among existing miners is high, impacting pricing and profitability.

The complete report reveals the real forces shaping Marathon Digital Holdings’s industry—from supplier influence over energy costs to the ever-present threat of technological obsolescence. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The market for high-performance ASIC miners, essential for Bitcoin mining operations like Marathon Digital Holdings, is highly concentrated. Leading manufacturers such as Bitmain, MicroBT, and Canaan dominate this space, giving them substantial leverage over buyers.

This limited supplier base means companies like Marathon Digital are heavily reliant on these few manufacturers for the cutting-edge technology needed to maintain efficient operations and profitability. The release of new ASIC models with improved energy efficiency is a constant driver, particularly critical for maintaining margins after Bitcoin halving events.

Electricity is a fundamental cost driver for Bitcoin mining operations like Marathon Digital Holdings, making the price and consistent availability of power crucial factors in assessing supplier power. Recent trends show a significant upward pressure on these costs.

In 2025, energy costs experienced a substantial rise, with some reports detailing nearly a doubling of prices for certain mining facilities. This surge directly amplifies the bargaining power of energy suppliers.

In response, Bitcoin miners are actively scouting for regions offering more favorable electricity rates and prioritizing access to renewable energy sources. This strategic shift to secure lower costs can inadvertently consolidate power with energy suppliers in those desirable, cost-effective locations.

The relentless pace of technological advancement in mining hardware significantly bolsters supplier bargaining power. Continuous innovation in ASIC chip design, pushing towards smaller process nodes like 3-nm and 2-nm, renders older equipment obsolete at an accelerated rate. Miners, including Marathon Digital Holdings, are compelled to upgrade to these more efficient machines to maintain profitability amidst rising network difficulty, creating a strong dependency on hardware suppliers.

Access to Capital for Supplier Investment

Suppliers of critical mining infrastructure, such as specialized cooling systems and data center components, can wield significant bargaining power if they possess ample capital for investment and expansion. This access to capital allows them to dictate terms and potentially limit Marathon Digital Holdings' options. For instance, a supplier with substantial investment capacity might be less incentivized to offer competitive pricing if they can readily secure other large contracts.

Marathon Digital's strategic pivot towards vertical integration, aiming to become a digital energy and infrastructure leader, directly addresses this supplier leverage. By bringing more aspects of its supply chain in-house, Marathon seeks to diminish its reliance on external capital-constrained suppliers. This move is crucial for securing stable access to essential hardware and services, especially as the company scales its operations. In 2023, Marathon invested heavily in expanding its mining capacity, highlighting the need for reliable and cost-effective infrastructure sourcing.

- Capital Access Fuels Supplier Power: Suppliers with substantial capital can invest in expanding their production capacity, thereby increasing their ability to serve large clients like Marathon and potentially command higher prices or more favorable contract terms.

- Marathon's Vertical Integration Strategy: By developing its own infrastructure solutions and potentially manufacturing capabilities, Marathon aims to reduce its dependence on third-party suppliers, thereby mitigating their bargaining power.

- Impact on Operational Costs: A strong supplier bargaining position can lead to higher capital expenditures for Marathon, impacting its overall cost structure and profitability in the competitive Bitcoin mining landscape.

Geopolitical and Trade Policies Impacting Supply Chains

Geopolitical shifts and evolving trade policies significantly influence the bargaining power of suppliers for companies like Marathon Digital Holdings. Tariffs and trade restrictions, especially those targeting key manufacturing hubs for ASIC miners, can create immediate supply chain disruptions and inflate operational costs. For instance, increased tariffs on goods originating from China, a primary source for mining hardware, directly impact the cost structure for U.S.-based mining operations. This situation can bolster the leverage of suppliers who can offer alternative sourcing or domestic production capabilities, as companies seek to mitigate risks associated with international trade disputes.

The complexity of global supply chains means that even minor trade policy adjustments can have cascading effects. Marathon Digital, like other major players in the digital asset mining sector, relies on a steady and cost-effective supply of specialized hardware. When geopolitical tensions escalate, leading to new tariffs or export controls, the suppliers of these essential components gain a stronger negotiating position. This is because the demand for their products remains high, while the pool of readily available, compliant suppliers may shrink.

- Tariffs on imported ASIC miners, particularly from China, have been a recurring concern, potentially increasing hardware acquisition costs for Marathon Digital.

- Geopolitical instability can lead to supply chain bottlenecks, giving suppliers who can guarantee timely delivery more pricing power.

- The availability of alternative suppliers or domestic manufacturing options for critical mining hardware directly moderates the bargaining power of existing suppliers.

- Trade restrictions can force companies to diversify their supplier base, potentially leading to higher costs but also reducing reliance on any single geopolitical bloc.

The bargaining power of suppliers for Marathon Digital Holdings is significantly influenced by the concentrated nature of the ASIC mining hardware market. A few dominant manufacturers control the supply of cutting-edge technology, allowing them to dictate terms and prices. This reliance is amplified by the rapid obsolescence of older mining equipment, forcing continuous upgrades and strengthening supplier leverage.

Energy suppliers also hold considerable sway, particularly given the critical role of electricity costs in mining profitability. In 2024, energy prices saw notable increases, with some facilities experiencing near-doubled costs, directly enhancing the power of energy providers.

Marathon's strategy of vertical integration aims to mitigate this supplier power by bringing more supply chain elements in-house. This move is essential for securing stable access to hardware and services as the company scales, as demonstrated by its significant infrastructure investments in 2023.

Geopolitical factors and trade policies further impact supplier leverage. Tariffs and trade restrictions, especially on hardware from key manufacturing regions, can disrupt supply chains and increase costs, giving suppliers with alternative sourcing or domestic capabilities a stronger negotiating position.

| Factor | Impact on Supplier Bargaining Power | Marathon Digital's Response/Mitigation |

|---|---|---|

| ASIC Manufacturer Concentration | High leverage for dominant manufacturers like Bitmain, MicroBT. | Exploring diverse hardware sourcing, potential for in-house development. |

| Energy Costs & Availability | Significant power for energy providers, especially in high-demand regions. | Scouting for favorable electricity rates, prioritizing renewable energy sources. |

| Technological Obsolescence | Drives demand for new, efficient hardware, increasing supplier power. | Continuous investment in upgrading to the latest ASIC models. |

| Geopolitical & Trade Policies | Tariffs and restrictions can inflate costs and create supply bottlenecks. | Diversifying supplier base, monitoring trade policies for risk management. |

What is included in the product

This analysis of Marathon Digital Holdings reveals the intense competitive pressures, the significant bargaining power of buyers and suppliers, and the high barriers to entry within the cryptocurrency mining sector. It highlights the threat of substitutes and the ongoing innovation that shapes the industry.

Effortlessly assess competitive intensity with a pre-built framework, highlighting key pressures on Marathon Digital Holdings' profitability.

Customers Bargaining Power

Marathon Digital Holdings' primary product is mined Bitcoin, meaning its customers are the vast, global market of Bitcoin holders and users. This market is incredibly fragmented, encompassing millions of individual investors and institutional players worldwide.

This widespread distribution means no single customer or even a small consortium of customers possesses enough purchasing power to significantly influence Bitcoin's price or dictate terms to Marathon Digital. For instance, while major exchanges like Coinbase and Binance facilitate transactions for millions, their individual customer base, while large, doesn't represent a consolidated bargaining unit against a miner like Marathon.

While customers can't directly negotiate with Marathon Digital Holdings regarding their mining services, the significant volatility of Bitcoin's market price grants the collective market substantial indirect power. When Bitcoin prices fall, the value of the Bitcoin Marathon mines, and thus Marathon's revenue, decreases. For instance, during periods of sharp decline, such as the significant drops seen in early 2024, Marathon's realized price per Bitcoin can be substantially lower than at other times, directly impacting their profitability.

Marathon Digital Holdings primarily operates as a wholesale Bitcoin miner, selling its mined cryptocurrency into the open market. This means it doesn't engage in direct, individual relationships with end consumers who might otherwise wield significant bargaining power. For instance, in 2023, Marathon sold an average of 12,000 BTC, a substantial volume, but this was to a diffuse market, not to specific large clients who could negotiate terms.

Demand for Digital Assets

The overall demand for digital assets, especially Bitcoin, significantly influences the profitability of Bitcoin mining companies like Marathon Digital Holdings. When customer demand for Bitcoin is strong, its price tends to rise, directly benefiting miners through increased revenue. For instance, Bitcoin’s price saw substantial volatility throughout 2024, with significant rallies driven by factors like institutional adoption and macroeconomic sentiment, directly impacting miner revenues.

A decrease in customer demand for Bitcoin can lead to a price decline. This reduction in Bitcoin's market value directly curtails the revenue and profitability for miners. Consequently, the collective purchasing power and sentiment of customers grant them indirect influence over the mining industry, including Marathon Digital. As of late 2024, the market capitalization of Bitcoin remained in the trillions, underscoring the scale of customer-driven value.

- Customer demand for Bitcoin is a primary driver of miner profitability.

- A drop in demand can reduce Bitcoin’s price, impacting miner revenue.

- The collective actions of customers indirectly empower them as a force against miners.

- Bitcoin’s market capitalization in 2024 demonstrates the significant value attributed by customers.

Emergence of AI/HPC Services as a Customer Segment

Marathon Digital Holdings is actively investigating a move into AI and High-Performance Computing (HPC) services, aiming to serve businesses that need substantial computing capabilities. This new market segment presents a potentially higher customer bargaining power dynamic.

The strength of customer bargaining power in AI/HPC services will largely hinge on how competitive the market becomes and the specific terms negotiated in service contracts. As of early 2024, the demand for AI-driven computing power is rapidly escalating, with companies like NVIDIA reporting record revenues driven by AI chip sales, indicating a strong, albeit potentially evolving, customer demand.

- Emerging AI/HPC Market: Marathon's diversification into AI/HPC services targets businesses requiring significant computational resources.

- Customer Bargaining Power Factors: Power will depend on market competition and contract specifics for these services.

- Market Dynamics: The burgeoning demand for AI computing, exemplified by NVIDIA's strong performance in late 2023 and early 2024, suggests a robust customer base but also potential for competitive pressures influencing pricing and terms.

The bargaining power of customers for Marathon Digital Holdings' core Bitcoin mining operations is relatively low due to the highly fragmented nature of the Bitcoin market. No single customer can dictate terms, and Marathon sells into a global, open market. For instance, in Q1 2024, Marathon generated $152.8 million in revenue, primarily from selling mined Bitcoin, underscoring the wholesale nature of their sales. While customer demand for Bitcoin indirectly influences Marathon's profitability, impacting the price they receive for their mined assets, this is a market-wide effect rather than direct negotiation.

| Metric | Value (Q1 2024) | Significance for Customer Bargaining Power |

|---|---|---|

| Total Revenue | $152.8 million | Indicates sales volume into a broad market, diluting individual customer influence. |

| Bitcoin Mined | 4,242 BTC | Represents production capacity sold on the open market, not to specific large buyers. |

| Average Bitcoin Price Received | $36,020 | Reflects market price, influenced by collective customer demand, not direct negotiation with Marathon. |

What You See Is What You Get

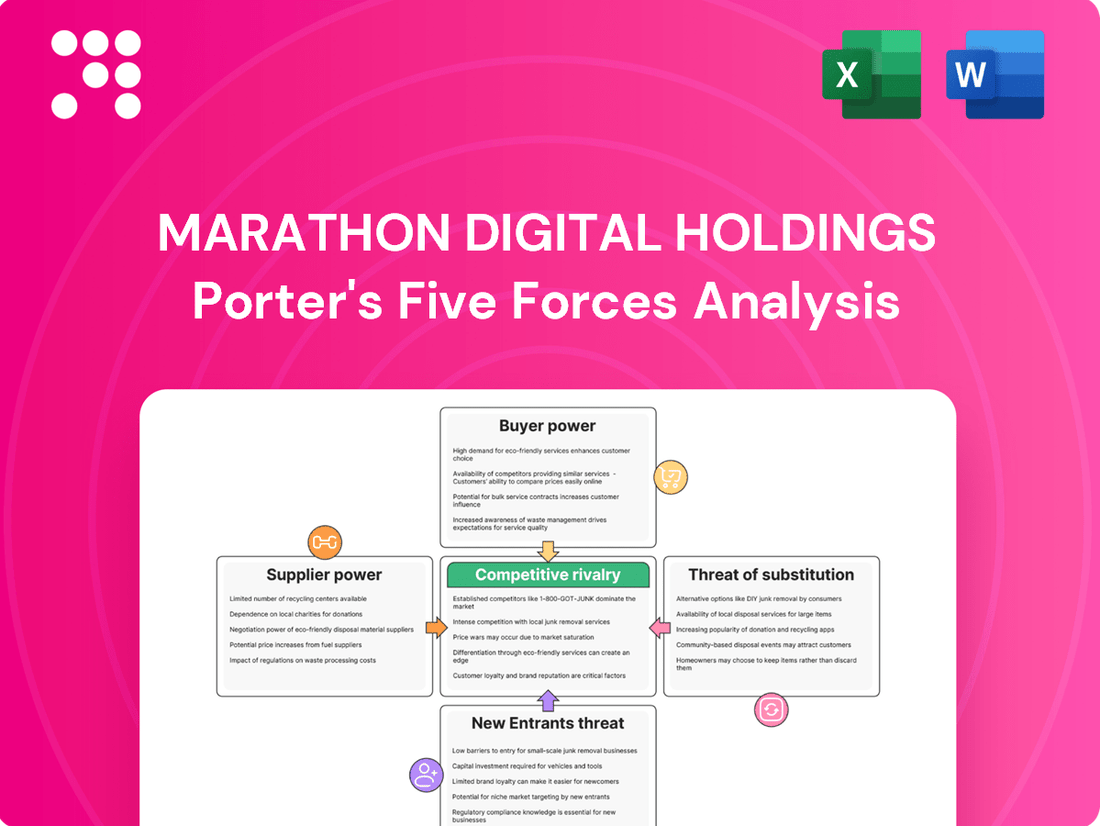

Marathon Digital Holdings Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Marathon Digital Holdings, detailing the competitive landscape impacting its operations. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the cryptocurrency mining industry. The document you see here is exactly what you’ll be able to download after payment, providing a complete and ready-to-use strategic assessment.

Rivalry Among Competitors

The Bitcoin mining landscape is fiercely competitive, driven by a constantly escalating global hashrate and network difficulty. As of early 2024, the Bitcoin network hashrate has surpassed 600 EH/s, a significant increase from previous years, meaning miners need increasingly powerful and efficient hardware to remain competitive.

This rising difficulty directly intensifies rivalry among mining operations like Marathon Digital Holdings. To maintain profitability and secure block rewards, companies must invest heavily in upgrading their mining rigs and optimizing energy consumption, creating a continuous arms race for technological superiority and cost efficiency.

The Bitcoin halving events are a major driver of competitive rivalry within the mining industry, directly impacting companies like Marathon Digital Holdings. These events, which occur approximately every four years, slash the reward miners receive for validating transactions and creating new blocks. The most recent halving in April 2024 reduced the block reward from 6.25 Bitcoin to 3.125 Bitcoin, a 50% cut.

This drastic reduction in revenue per block intensifies competition as miners must become significantly more efficient to maintain profitability. Companies are forced to focus on reducing energy costs, often through securing cheaper power sources or investing in more energy-efficient mining hardware. Those unable to adapt or upgrade their infrastructure face substantial challenges in remaining competitive.

Consequently, the post-halving environment typically sees increased consolidation within the mining sector. Less efficient or well-capitalized miners may struggle to operate profitably, leading to potential shutdowns or acquisitions by larger, more resilient players. This dynamic naturally escalates the competitive rivalry, as the remaining participants vie for market share in a more challenging economic landscape.

Access to cheap and reliable energy is a major competitive advantage for Bitcoin miners like Marathon Digital Holdings. Miners in areas with deregulated energy markets or plentiful renewable power, such as hydroelectric or wind, gain a significant cost edge. This drives intense competition for the most advantageous mining sites and favorable power purchase agreements.

For instance, in 2023, Marathon Digital Holdings secured a new 200-megawatt (MW) agreement in Texas, a state known for its competitive energy market and abundant wind power. This strategic move aims to lower their overall energy costs, a critical factor in the profitability of Bitcoin mining operations, especially as network difficulty increases.

Capital-Intensive Nature of Operations

The capital-intensive nature of Bitcoin mining creates a significant barrier to entry, favoring established players like Marathon Digital Holdings. Substantial investments are needed for specialized mining hardware, energy infrastructure, and cooling systems. For instance, Marathon's significant capital expenditures in 2024, including the acquisition and deployment of new ASIC miners, underscore this requirement.

This high capital demand naturally leads to industry consolidation. Smaller, less-funded operations often struggle to acquire the latest, most efficient equipment, putting them at a disadvantage against larger entities that can leverage economies of scale. This dynamic intensifies competition among those with the financial capacity to invest heavily.

- High Upfront Investment: Acquiring cutting-edge ASIC miners can cost tens of thousands of dollars per unit, with companies like Marathon often purchasing them in bulk.

- Ongoing Capital Needs: Continuous upgrades to hardware and facility improvements are necessary to remain competitive, demanding sustained capital allocation.

- Economies of Scale: Larger operations can negotiate better prices for electricity and equipment, further widening the gap with smaller competitors.

Diversification into High-Performance Computing (HPC)

Marathon Digital Holdings is increasingly moving into high-performance computing (HPC) and artificial intelligence (AI) services to counter the inherent volatility of Bitcoin prices and the impact of halving events. This strategic shift introduces a new competitive arena where companies vie for both Bitcoin mining dominance and clients in the burgeoning HPC sector. For instance, in 2024, Marathon announced plans to deploy 30,000 ASIC miners, but also highlighted its strategy to leverage its infrastructure for enterprise AI and HPC workloads, aiming to generate additional revenue streams beyond mining.

This diversification means Marathon now competes with established cloud providers and specialized HPC firms, adding a layer of complexity to its competitive landscape. Companies are no longer just battling for access to cheap electricity and efficient mining hardware; they are also competing for market share in AI model training and data processing. The demand for GPU compute power, crucial for both AI and certain HPC tasks, saw significant growth in 2024, with companies like NVIDIA reporting record revenues driven by AI demand, indicating the lucrative nature of this new competitive front.

- New Competitive Frontier: Diversification into HPC/AI creates rivalry with cloud service providers and specialized tech companies.

- Dual Revenue Streams: Companies like Marathon now compete for both Bitcoin mining contracts and AI/HPC client workloads.

- Market Growth: The AI and HPC sectors experienced substantial growth in 2024, attracting significant investment and intensifying competition.

The Bitcoin mining industry, including Marathon Digital Holdings, faces intense rivalry due to the escalating global hashrate and increasing network difficulty. As of early 2024, the Bitcoin network hashrate exceeded 600 EH/s, necessitating constant hardware upgrades and energy efficiency improvements to maintain profitability.

The April 2024 Bitcoin halving, which reduced the block reward by 50% to 3.125 BTC, significantly amplified this rivalry. Miners like Marathon must now focus intensely on reducing energy costs and optimizing operations to remain competitive in a landscape where revenue per block is halved.

Access to low-cost, reliable energy is a critical differentiator, driving competition for advantageous power purchase agreements and mining locations, as exemplified by Marathon's 2023 200 MW Texas agreement. Furthermore, Marathon's strategic diversification into high-performance computing (HPC) and AI services introduces competition with established cloud providers and specialized tech firms, creating a dual competitive front.

| Metric | Marathon Digital Holdings (as of early 2024) | Industry Trend |

|---|---|---|

| Network Hashrate | N/A (Network-wide) | Exceeded 600 EH/s |

| Block Reward (Post-Halving) | 3.125 BTC | Reduced by 50% from 6.25 BTC |

| Energy Strategy | Secured 200 MW in Texas (2023) | Focus on cheap, renewable energy |

| Diversification | Expanding into HPC/AI services | Emerging competitive frontier |

SSubstitutes Threaten

While Marathon Digital Holdings primarily mines Bitcoin, the existence of alternative cryptocurrencies presents a threat of substitutes. Many of these, like Ethereum (which transitioned to Proof-of-Stake in 2022), utilize different consensus mechanisms that can be more energy-efficient or offer different functionalities. If these alternatives achieve greater market penetration or develop compelling advantages, they could draw investor and user interest away from Bitcoin, indirectly impacting the demand for Bitcoin mining.

Cloud mining services present a significant threat of substitutes for companies like Marathon Digital Holdings. These platforms allow individuals to rent computing power for cryptocurrency mining, bypassing the need for substantial capital investment in hardware and infrastructure. This accessibility makes them an attractive alternative for those seeking exposure to mining rewards without the operational complexities.

For instance, by mid-2024, the total hashrate of Bitcoin mining was significantly influenced by both in-house operations and cloud mining participation. While exact figures for cloud mining's share are proprietary, its growth indicates a viable alternative for acquiring Bitcoin, potentially diverting capital that might otherwise be invested in direct mining operations or Bitcoin purchases. This ease of entry for smaller players can dilute the market share of larger, dedicated mining firms.

For investors and users, the direct purchase of Bitcoin through exchanges and brokers presents a significant substitute for engaging with mining operations like Marathon Digital Holdings. This method offers immediate access to Bitcoin without the substantial upfront capital, technical expertise, and ongoing operational costs associated with mining. In 2024, the global cryptocurrency exchange market continued to see robust activity, with daily trading volumes often exceeding hundreds of billions of dollars, highlighting the accessibility and liquidity of direct Bitcoin acquisition.

Other Digital Asset Investment Vehicles

The emergence of Bitcoin Exchange Traded Funds (ETFs) and similar regulated investment products presents a significant threat of substitutes for Marathon Digital Holdings. These vehicles allow investors to gain exposure to Bitcoin's price without the complexities of direct ownership or the capital-intensive nature of mining operations.

These ETFs offer a more accessible and often less volatile entry point for many investors compared to direct Bitcoin acquisition or investing in mining companies. For instance, by the end of Q1 2024, spot Bitcoin ETFs in the U.S. had accumulated over $50 billion in assets under management, demonstrating their rapid adoption and appeal as a substitute investment.

- Increased Accessibility: Bitcoin ETFs lower the barrier to entry for retail and institutional investors seeking Bitcoin exposure.

- Reduced Volatility Perception: Regulated products can be perceived as less risky than direct cryptocurrency holdings or mining operations.

- Convenience: Investors can trade ETFs through traditional brokerage accounts, simplifying the investment process.

- Diversification Benefits: ETFs offer a way to diversify a portfolio with Bitcoin exposure without managing private keys or mining hardware.

Energy-Efficient Blockchain Technologies

Advances in blockchain technology that prioritize energy efficiency or employ alternative validation methods, such as sharding or layer-2 solutions, pose a potential substitute threat. These innovations could lessen the reliance on energy-intensive Proof-of-Work (PoW) mining, which is central to Marathon Digital Holdings' current operational model. For instance, the development of Proof-of-Stake (PoS) or other consensus mechanisms that consume significantly less energy could attract developers and users away from PoW chains.

This technological evolution could diminish the demand for traditional PoW mining services. In 2023, Bitcoin mining, the primary focus for Marathon, continued to be a significant energy consumer. However, the growing momentum behind more sustainable blockchain solutions highlights a potential shift in the market landscape.

- Energy Efficiency as a Differentiator: Blockchains utilizing Proof-of-Stake or other low-energy consensus mechanisms are gaining traction, offering a competitive alternative to energy-intensive Proof-of-Work systems.

- Reduced Appeal of PoW: As environmental concerns and energy costs remain prominent, the perceived necessity and attractiveness of traditional PoW mining may decline.

- Technological Obsolescence Risk: Marathon's reliance on PoW mining could face a substitute threat if more efficient and scalable blockchain technologies become dominant.

The threat of substitutes for Marathon Digital Holdings is multifaceted, encompassing alternative cryptocurrencies, cloud mining services, direct Bitcoin acquisition, and regulated investment products like ETFs. These substitutes offer varying degrees of accessibility, convenience, and perceived risk, directly impacting the demand for Marathon's core business of Bitcoin mining.

The rise of Bitcoin ETFs, for example, provides a simplified entry point for investors, with U.S. spot Bitcoin ETFs accumulating over $50 billion in assets by the end of Q1 2024. This demonstrates a clear preference for regulated, accessible investment vehicles over direct mining operations for a significant segment of the market.

Furthermore, the ongoing development of more energy-efficient blockchain technologies presents a long-term substitute threat. As concerns about energy consumption persist, alternative consensus mechanisms could attract users and developers, potentially diminishing the appeal of Bitcoin's energy-intensive Proof-of-Work model and, by extension, the mining operations that support it.

Entrants Threaten

The significant capital investment required for high-performance ASIC miners, specialized infrastructure, and access to substantial and affordable energy acts as a major barrier to new entrants in large-scale Bitcoin mining. This high upfront cost, often running into millions of dollars for a substantial operation, deters smaller players and favors established companies with strong financial backing.

Securing access to affordable and reliable energy is a major hurdle for new entrants in the digital asset mining space. Established players, like Marathon Digital Holdings, often benefit from long-term power purchase agreements, giving them a significant cost advantage. For instance, in Q1 2024, Marathon reported an average energy cost of 3.7 cents per kilowatt-hour, a rate that is difficult for newcomers to match without substantial upfront investment in infrastructure or securing similar favorable contracts.

The increasing difficulty of the Bitcoin network, coupled with events like the April 2024 halving, presents a substantial barrier for new entrants. These factors directly impact mining profitability, requiring newcomers to invest in highly efficient hardware from day one to even stand a chance against established miners who have already recouped initial capital expenditures.

Regulatory and Geopolitical Hurdles

The evolving regulatory landscape and geopolitical considerations present significant barriers for new entrants in the digital asset mining space. Potential mining bans, tariffs on essential hardware, and increasing environmental scrutiny can deter newcomers. For instance, in 2023, several jurisdictions continued to explore or implement restrictions on cryptocurrency mining, citing energy consumption concerns. This necessitates substantial investment in legal counsel and strategic planning to navigate these complexities, effectively raising the entry cost.

New entrants must contend with the risk of sudden policy shifts and international trade disputes that could impact hardware availability and operational costs. For example, tariffs on imported mining equipment, a possibility in various trade agreements, could inflate initial capital expenditures. Furthermore, geopolitical tensions can disrupt supply chains, making it difficult and expensive for new players to acquire the necessary technology. Marathon Digital Holdings, in contrast, has established diversified operational sites and robust supply chain relationships to mitigate these risks.

- Regulatory Uncertainty: New entrants face the challenge of adapting to rapidly changing regulations globally.

- Geopolitical Risks: Tariffs on mining hardware and supply chain disruptions due to international relations are significant hurdles.

- Environmental Scrutiny: Increasing focus on energy consumption requires new entrants to invest in sustainable solutions from the outset.

- Expertise Requirement: Navigating these complex legal and strategic environments demands specialized knowledge, which is a barrier to entry.

Technological Expertise and Operational Efficiency

Building and operating massive Bitcoin mining farms demands significant technical know-how. This includes managing specialized hardware, implementing advanced cooling systems to prevent overheating, and fine-tuning firmware for peak performance. New entrants face a steep learning curve in mastering these intricate operational details.

Achieving the necessary operational efficiency to be profitable is a major hurdle for newcomers. Companies like Marathon Digital Holdings (MARA) have invested heavily in optimizing their infrastructure. For instance, Marathon's focus on energy efficiency and uptime is crucial; in Q1 2024, they reported a fleet-wide uptime of 99.9%, a testament to their operational expertise.

- Specialized Hardware Management: Expertise in sourcing, deploying, and maintaining high-performance ASIC mining hardware.

- Advanced Cooling Solutions: Implementing and managing efficient cooling systems to maintain optimal operating temperatures and extend hardware life.

- Firmware Optimization: Continuously updating and optimizing mining software and firmware for maximum hashing power and energy efficiency.

- Operational Efficiency Benchmarks: New entrants must strive to match or exceed industry leaders in metrics like energy consumption per terahash (TH/s) and facility uptime.

The threat of new entrants in Bitcoin mining is significantly mitigated by the immense capital required for specialized hardware and access to affordable energy. Marathon Digital Holdings, for example, operates at a scale that demands millions in upfront investment, a cost prohibitive for most newcomers. This high barrier to entry, coupled with the need for sophisticated operational expertise, keeps the competitive landscape relatively consolidated.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Marathon Digital Holdings leverages data from Marathon's SEC filings, including 10-K and 10-Q reports, alongside industry-specific market research from firms like CoinMetrics and CryptoCompare.