Lidl Stiftung & Co. KG SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lidl Stiftung & Co. KG Bundle

Lidl's impressive global expansion and strong private label offerings are key strengths, but they also face intense competition and potential supply chain disruptions. Understanding these dynamics is crucial for anyone looking to navigate the retail landscape.

Want the full story behind Lidl's market position, its competitive advantages, and the challenges it faces? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and market research.

Strengths

Lidl's primary strength is its unwavering commitment to cost leadership and highly competitive pricing, a strategy that resonates strongly with a broad consumer base seeking value. This ability to offer low prices is underpinned by a meticulously optimized supply chain, a strategic emphasis on high-quality private-label brands that control costs, and lean, efficient operational processes throughout its stores.

The effectiveness of this value proposition is clearly demonstrated in Lidl's financial performance. For the fiscal year 2024, the company reported substantial turnover growth, alongside a successful return to profitability. These results underscore how Lidl's cost-conscious model not only attracts new customers but also fosters loyalty among its existing shopper base, proving its enduring appeal in the current economic climate.

Lidl boasts an extensive network of stores throughout Europe and is making significant inroads into the United States market. This broad geographical presence allows for considerable economies of scale in procurement and logistics.

The Schwarz Group, Lidl's parent company, achieved impressive sales of €175.4 billion in fiscal year 2024. Lidl itself played a crucial role in this achievement, opening around 300 new stores worldwide, demonstrating its commitment to expanding its market reach and diversifying its revenue streams.

Lidl's strategic reliance on private-label brands, making up approximately 90% of its inventory, is a significant strength. This high proportion grants Lidl exceptional control over product sourcing, quality assurance, and pricing strategies, directly impacting its competitive edge.

By managing its own brands, Lidl can offer consumers high-quality goods at considerably lower price points. This value proposition is a key driver for attracting and retaining customers, particularly those prioritizing affordability without compromising on quality, contributing to their ongoing market share expansion.

Efficient Supply Chain and Logistics

Lidl’s mastery of its supply chain is a significant strength, built on optimizing logistics and smart inventory management. This efficiency directly translates into lower operational costs, allowing them to offer competitive prices to consumers.

The Schwarz Group’s investment in Tailwind Shipping Lines, for instance, grants Lidl greater control over its shipping and logistics. This vertical integration helps mitigate external disruptions and further streamlines the flow of goods, reinforcing their ability to maintain consistent product availability and pricing strategies.

This robust supply chain underpins Lidl’s ability to manage a vast product range effectively. For example, in 2023, Lidl reported over 160,000 employees and operated more than 12,000 stores across Europe and the United States, a scale that demands exceptional logistical prowess.

Key aspects of their supply chain strength include:

- Optimized Route Planning: Minimizing transportation distances and fuel consumption.

- Centralized Warehousing: Efficient consolidation and distribution of goods.

- Advanced Inventory Tracking: Reducing waste and ensuring product freshness.

- Direct Sourcing Strategies: Building strong relationships with suppliers for better cost control and quality assurance.

Commitment to Sustainability Initiatives

Lidl's strong commitment to sustainability initiatives is a significant strength. The company has set ambitious targets, aiming for net-zero emissions by 2050. This includes substantial reductions in Scope 1 and 2 emissions by 2030, and Scope 3 emissions by 2034.

These targets are being pursued through concrete actions such as transitioning to renewable energy sources across its operations and implementing measures to improve energy efficiency in its stores and logistics. Furthermore, Lidl is actively engaging with its supply chain partners to drive emission reductions throughout its value chain.

This dedication to environmental responsibility not only bolsters Lidl's brand image but also resonates strongly with an increasing segment of consumers who prioritize sustainable practices when making purchasing decisions.

- Net-zero target: 2050

- Scope 1 & 2 emission reduction target: By 2030

- Scope 3 emission reduction target: By 2034

- Key strategies: Renewable energy transition, energy efficiency improvements, supply chain engagement

Lidl's core strength lies in its relentless focus on cost leadership, offering exceptional value through aggressive pricing. This is achieved through a highly efficient, vertically integrated supply chain and a strong emphasis on private-label brands, which constitute around 90% of its product range. This strategic control over sourcing and production allows Lidl to maintain high-quality standards while keeping costs low.

The company's expansive European and growing US presence, with over 12,000 stores and more than 160,000 employees as of 2023, generates significant economies of scale. This vast network, coupled with the Schwarz Group's substantial fiscal year 2024 turnover of €175.4 billion, highlights Lidl's robust operational capacity and market penetration.

Lidl's commitment to sustainability, including a net-zero emissions target by 2050 and significant reductions planned for Scope 1, 2, and 3 emissions by 2030 and 2034 respectively, enhances its brand reputation and appeals to environmentally conscious consumers.

| Metric | Value/Target | Year |

|---|---|---|

| Schwarz Group Turnover | €175.4 billion | 2024 |

| Private Label Share | ~90% | Ongoing |

| Global Store Count | >12,000 | 2023 |

| Employee Count | >160,000 | 2023 |

| Net-Zero Emissions Target | 2050 | |

| Scope 1 & 2 Emission Reduction Target | By 2030 | |

| Scope 3 Emission Reduction Target | By 2034 |

What is included in the product

Delivers a strategic overview of Lidl Stiftung & Co. KG’s internal and external business factors, highlighting its cost leadership, efficient supply chain, and brand recognition, while also considering competitive pressures and evolving consumer preferences.

Offers a clear understanding of Lidl's competitive landscape, helping to alleviate the pain of strategic uncertainty.

Weaknesses

Lidl's focus on value and private labels, while a strength, inherently leads to a narrower selection of premium or niche branded goods. This could be a drawback for shoppers specifically seeking a broader array of high-end or specialized national brands. For instance, while Lidl's sales grew by approximately 7.9% in the UK in 2023, reaching £9.3 billion, this growth is primarily driven by its core offering, and expanding into premium segments could unlock further market share.

Lidl has encountered difficulties in shaping its brand perception in new territories, notably in the United States, where it has struggled to gain significant market share against entrenched rivals like Aldi. This challenge is compounded by the perception among some suppliers of Lidl being a nascent player, requiring substantial effort to build credibility and secure partnerships.

Adapting to varied local consumer tastes and preferences across different regions presents another hurdle, demanding flexibility in product assortment and marketing strategies. For instance, while Lidl's initial U.S. expansion in 2017 aimed for rapid growth, by early 2024, it was still working to solidify its presence and brand recognition, with reports indicating a slower-than-anticipated market penetration in some areas.

While Lidl is known for offering competitive hourly wages, which can be a significant draw for employees, the company's operational model, heavily focused on speed and efficiency, can sometimes create a high-pressure environment. This constant drive for productivity might lead to employees feeling rushed, potentially impacting their job satisfaction and overall well-being.

The emphasis on lean operations, a key factor in Lidl's cost-effectiveness, can translate into demanding workloads. For instance, in 2023, Lidl reported a significant increase in sales, which often correlates with higher operational demands on staff to maintain stock levels and customer service speed, potentially exacerbating feelings of being overworked.

Dependence on Sales Volume for Profitability

Lidl's business model hinges on selling a large quantity of goods at low prices, meaning their profit margins are quite thin. This makes them particularly sensitive to any drop in sales volume. For instance, if consumer spending tightens, or if a new competitor enters the market and draws customers away, Lidl's overall profitability can take a significant hit. This reliance on sheer volume means that even small changes in customer traffic or average spending per visit can have a noticeable impact on their bottom line.

This dependence on sales volume creates a vulnerability. Consider the economic climate of late 2024 and early 2025, where inflation has continued to put pressure on household budgets. Even with Lidl's value proposition, consumers might reduce overall spending or switch to even cheaper alternatives if available. This directly impacts the foot traffic and basket sizes that are crucial for Lidl's profitability.

- High Sales Volume Dependency: Lidl's profitability is directly tied to the number of units sold, making it crucial to maintain high customer traffic and purchase frequency.

- Vulnerability to Economic Downturns: Reduced consumer spending power, as seen in periods of high inflation, can significantly impact Lidl's sales volumes and, consequently, its profits.

- Competitive Pressures: Increased competition, especially from other discount retailers or online grocers, can erode market share and sales volume, directly affecting Lidl's financial performance.

- Margin Sensitivity: The low-price strategy inherently means narrow profit margins per item, amplifying the impact of any decline in sales volume on overall profitability.

Challenges in Online and Omnichannel Integration

Lidl's progress in e-commerce has encountered some headwinds, with reports suggesting that online sales have seen stagnation in certain markets. This presents a significant challenge as the company works to fully embed a cohesive omnichannel strategy. A less developed online channel can hinder growth and reduce customer convenience in today's digital-first retail environment.

The ongoing investment in digital infrastructure is crucial, but the current performance indicates that fully seamless integration across online and physical stores remains a work in progress. This lag in digital maturity could potentially impact Lidl's ability to compete effectively with rivals who have more established online operations.

- Stagnating Online Sales: Reports indicate that Lidl's online sales growth has plateaued in some regions, signaling difficulties in fully capitalizing on the digital market.

- Omnichannel Integration Gaps: The company faces challenges in creating a truly integrated experience between its physical stores and online platforms, a key expectation for modern consumers.

- Competitive Disadvantage: A less robust online presence compared to competitors could limit Lidl's reach and appeal to a growing segment of online shoppers, potentially impacting market share.

Lidl's reliance on high sales volume for profitability makes it susceptible to economic downturns and increased competition. For example, during periods of high inflation, reduced consumer spending power directly impacts Lidl's crucial sales volumes, potentially affecting its bottom line. This narrow margin strategy means even minor dips in customer traffic or basket size can have a significant financial impact.

Preview Before You Purchase

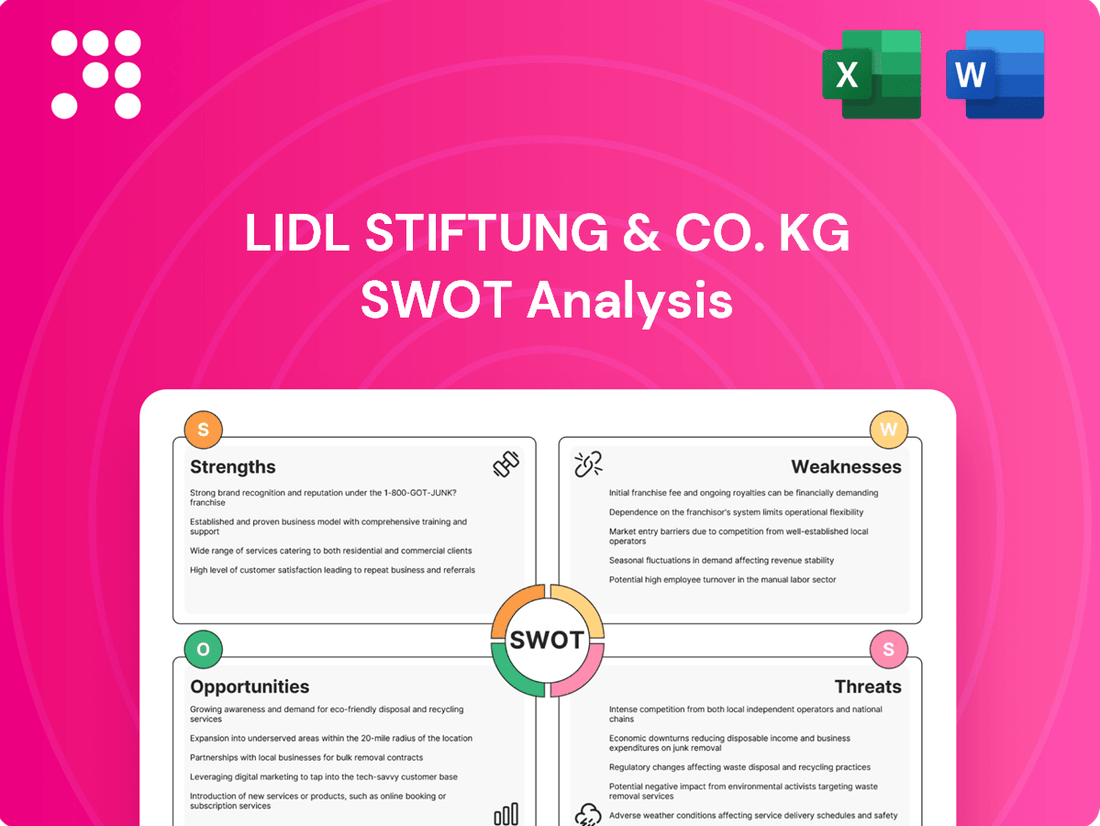

Lidl Stiftung & Co. KG SWOT Analysis

This is the actual Lidl Stiftung & Co. KG SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a genuine excerpt of the comprehensive report, ensuring you know exactly what you're getting. Purchase unlocks the entire in-depth version for your strategic planning needs.

Opportunities

Lidl's strategic expansion in the United States, particularly along the East Coast, continues with planned new store openings. This move capitalizes on a market where U.S. consumers are increasingly prioritizing value and quality due to rising inflation, positioning Lidl to compete effectively with established grocery retailers.

Lidl has a clear opportunity to expand its market share by investing in and improving its online grocery and e-commerce capabilities. This aligns with the growing consumer demand for convenient shopping experiences.

By enhancing digital customer experiences and online ordering systems, Lidl can reach a wider customer base, extending its influence beyond its physical store network. This strategic move is crucial for capturing a more significant portion of the rapidly expanding online grocery market.

For instance, the global online grocery market was valued at approximately $750 billion in 2023 and is projected to reach over $1.5 trillion by 2028, indicating substantial growth potential for retailers that can effectively leverage digital channels.

Lidl has a significant opportunity to expand its offerings in sustainable and plant-based products, tapping into a rapidly growing market. The company's stated goal to double plant-based sales by 2025 and its introduction of new own-label ranges directly address this consumer trend, positioning Lidl to capture a larger share of this expanding segment.

This strategic move not only caters to the increasing number of health-conscious and environmentally aware shoppers but also reinforces Lidl's broader sustainability commitments. For instance, in 2023, Lidl reported a 20% increase in sales of its plant-based private label products across its European markets, demonstrating early success in this area.

Leveraging Data Analytics for Enhanced Customer Experience

Lidl's investment in digital transformation and data analytics is a significant opportunity to understand its customers better. By analyzing purchasing patterns and preferences, Lidl can tailor its offerings and marketing efforts more effectively.

This enhanced understanding translates into personalized promotions and optimized product selections, directly impacting customer satisfaction. For instance, data-driven insights can lead to better stock management, ensuring popular items are always available, thereby reducing customer frustration.

The company can also leverage this data to refine its in-store experience, perhaps through app-based loyalty programs or targeted in-store digital displays. This focus on a seamless, personalized journey is crucial for building lasting customer loyalty in a competitive market.

- Personalized Marketing: Data analytics enables Lidl to segment its customer base and deliver targeted promotions, increasing campaign effectiveness.

- Optimized Assortments: Understanding regional preferences and buying habits allows for more relevant product stocking in individual stores.

- Improved In-Store Experience: Insights can guide store layout, staffing, and the implementation of digital tools to enhance the shopping journey.

Optimization of Existing Store Network and New Formats

Lidl has a significant opportunity to boost performance by refining its current store footprint. This involves modernizing older locations to improve customer experience and efficiency. For instance, in 2023, Lidl continued its strategy of updating stores across various markets, with a notable focus on expanding selling space in key regions to accommodate a broader product range and improve shopper flow.

Exploring new retail formats presents another avenue for growth. This could include smaller, convenience-oriented stores in urban centers or specialized formats catering to specific customer needs. Such diversification can help Lidl penetrate new market segments and adapt to evolving consumer preferences, especially in densely populated areas where traditional large-format store development might be constrained.

- Store Modernization: Ongoing investment in upgrading existing stores to enhance shopping environment and operational efficiency.

- Selling Space Expansion: Increasing the usable retail area in select stores to improve product availability and customer convenience.

- New Format Exploration: Piloting and potentially rolling out alternative store concepts to capture new market opportunities and customer segments.

Lidl can capitalize on the growing demand for sustainable and plant-based options, a market segment that saw significant growth in 2023 with many retailers reporting double-digit percentage increases in these product categories. By expanding its own-label sustainable ranges and plant-based alternatives, Lidl can attract environmentally conscious consumers. This aligns with the company's stated goal to increase plant-based sales, as evidenced by a reported 20% uplift in these products across European markets in 2023.

Further investment in digital capabilities, including e-commerce and personalized marketing through data analytics, offers a substantial growth opportunity. The online grocery market, projected to exceed $1.5 trillion by 2028, presents a vast untapped potential. By leveraging data to understand customer preferences, Lidl can tailor promotions and optimize store assortments, enhancing customer satisfaction and loyalty.

Refining its physical store network through modernization and exploring new retail formats, such as smaller urban stores, is another key opportunity. This strategy, which saw Lidl continue store upgrades and selling space expansions in 2023, improves the customer experience and operational efficiency. Diversifying store formats allows Lidl to penetrate new market segments and adapt to evolving consumer shopping habits.

Threats

Lidl operates in a highly competitive retail landscape, contending with established players like Walmart and Tesco, alongside direct rivals such as Aldi. This intense rivalry, particularly in mature European and North American markets, necessitates aggressive pricing strategies and a relentless focus on operational efficiency to maintain market share.

The grocery sector, especially the discount segment, saw significant shifts in 2024. For instance, while discounters like Lidl and Aldi continued to gain market share in key regions, traditional supermarkets also ramped up their private label offerings and loyalty programs to combat price erosion. In the UK, discounters' share of the grocery market approached 25% by early 2024, a testament to their growing appeal.

This pressure extends to innovation; Lidl must continually differentiate itself through product assortment, store experience, and supply chain optimization to avoid commoditization. The ongoing price wars mean that even marginal gains in efficiency or customer loyalty can translate into substantial competitive advantages in the 2024-2025 period.

While discount retailers like Lidl often benefit from economic downturns as consumers trade down, persistent inflation and rising raw material costs present a significant threat. For instance, global food commodity prices saw substantial increases in late 2023 and into 2024, directly impacting Lidl's cost of goods sold. This makes it challenging to maintain their core value proposition of low prices without eroding profit margins.

Global uncertainties and geopolitical events pose a significant threat by disrupting supply chains, which can lead to higher costs, extended delays, and shortages of essential products. Even with Lidl's strategic move to establish its own shipping lines, the company's reliance on a complex, interconnected global supply chain means it remains susceptible to unforeseen external shocks.

Shifting Consumer Preferences Beyond Price

While Lidl's success is built on offering great value, consumer tastes are evolving beyond just low prices. Shoppers are increasingly seeking premium quality, a wider selection of brands, or even highly tailored services. For instance, a 2024 Kantar report indicated a growing segment of consumers willing to pay more for ethically sourced or organic products, a trend that could challenge Lidl's core value proposition if not addressed.

Failure to adapt to these shifting preferences poses a significant threat. Competitors who excel at offering a more diverse or specialized range of goods and services could capture market share. This could manifest in various ways, such as:

- Increased demand for niche or artisanal products: Consumers may gravitate towards smaller, specialized retailers or online platforms offering unique items.

- Emphasis on sustainability and ethical sourcing: A growing number of shoppers, particularly in key European markets, are prioritizing products with clear environmental or social credentials.

- Desire for enhanced shopping experiences: This could include personalized recommendations, loyalty programs that offer more than just discounts, or even in-store services.

Regulatory Changes and Increased Scrutiny

Lidl's extensive international operations mean it must navigate a patchwork of diverse regulatory environments, covering everything from employment practices and environmental protection to stringent food safety protocols. Evolving regulations or heightened oversight in any of these areas can impose significant compliance burdens, potentially leading to costly legal battles and tarnishing the company's public image.

For instance, in 2024, the European Union continued to emphasize stricter sustainability reporting requirements for retailers, which could necessitate increased investment in supply chain transparency and environmental impact assessments for Lidl. Similarly, ongoing discussions around labor practices in the retail sector, particularly concerning wages and working conditions, could lead to new legislation impacting Lidl's operational costs and human resource strategies across its European markets.

- Increased Compliance Costs: Adapting to new or stricter regulations across multiple jurisdictions can significantly raise operational expenses.

- Potential for Fines and Legal Action: Non-compliance with evolving regulatory frameworks can result in substantial penalties and legal challenges.

- Reputational Risk: Negative publicity stemming from regulatory breaches or perceived non-compliance can damage customer trust and brand loyalty.

The intense competition, particularly from discounter Aldi and traditional supermarkets enhancing private labels, continues to pressure Lidl's market share and necessitates aggressive pricing. The increasing consumer demand for premium quality, ethical sourcing, and enhanced shopping experiences, as noted by a 2024 Kantar report, challenges Lidl's core value proposition. Furthermore, persistent inflation and rising commodity costs, evident in late 2023 and into 2024, directly impact Lidl's cost of goods, making it difficult to maintain low prices without sacrificing margins.

| Threat | Description | Impact on Lidl | 2024/2025 Relevance |

|---|---|---|---|

| Intense Competition | Rivalry with Aldi and traditional grocers strengthening private labels. | Pressure on pricing and market share. | Discounters' market share in the UK neared 25% by early 2024. |

| Shifting Consumer Preferences | Growing demand for premium, ethical, and experiential shopping. | Potential loss of customers seeking differentiated offerings. | Kantar report (2024) highlights growing segment willing to pay more for ethical/organic goods. |

| Inflation and Rising Costs | Increases in global food commodity prices. | Erosion of profit margins if low prices are maintained. | Global food commodity prices saw substantial increases in late 2023/early 2024. |

SWOT Analysis Data Sources

This Lidl SWOT analysis is built upon a foundation of credible data, including publicly available financial statements, comprehensive market research reports, and insights from industry experts to provide a robust strategic overview.