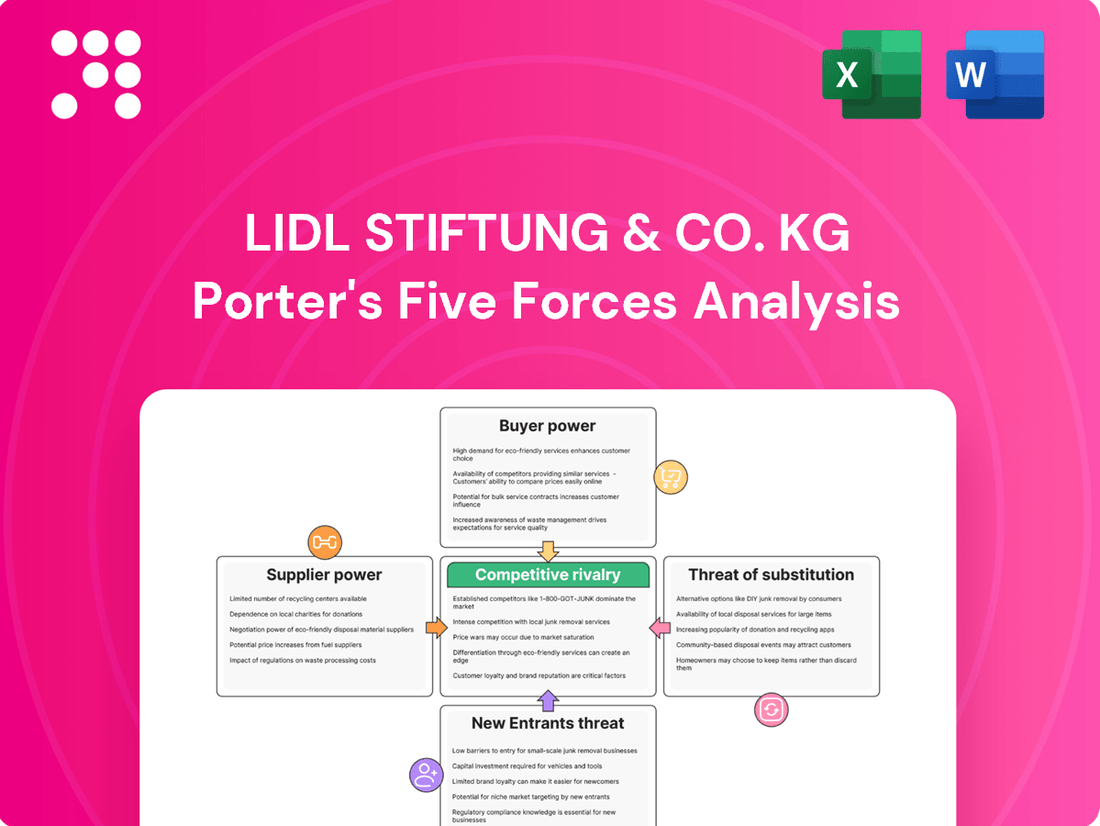

Lidl Stiftung & Co. KG Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lidl Stiftung & Co. KG Bundle

Lidl Stiftung & Co. KG navigates a competitive retail landscape shaped by intense rivalry and significant buyer power. Understanding the nuances of supplier relationships and the threat of substitutes is crucial for their sustained success.

The complete report reveals the real forces shaping Lidl Stiftung & Co. KG’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Lidl's vast European and growing US presence, with over 12,000 stores as of early 2024, translates into immense purchasing volume. This scale allows Lidl to dictate terms to many suppliers, as their orders represent a substantial portion of a supplier's business.

This substantial demand grants Lidl significant leverage, enabling them to negotiate highly favorable pricing and payment terms. Suppliers, eager to secure these large contracts, often find their own bargaining power diminished, making them reliant on Lidl's consistent orders.

Lidl's heavy reliance on private-label brands, making up approximately 90% of its inventory, is a significant factor in its bargaining power with suppliers. This strategy allows Lidl to exert considerable control over its supply chain.

By developing and promoting its own brands, Lidl effectively reduces its dependence on established, third-party brands. This shift in focus means suppliers of these external brands have less leverage over Lidl's purchasing decisions.

This private-label dominance empowers Lidl to set precise product specifications, maintain stringent quality standards, and negotiate favorable pricing. Consequently, the bargaining power of suppliers is considerably weakened as Lidl dictates the terms of engagement.

Lidl's direct sourcing strategy, cutting out middlemen and dealing directly with manufacturers and farmers, significantly bolsters its bargaining power. This streamlined approach, supported by a centralized distribution network, not only slashes costs but also enhances control over product quality and availability. In 2024, this efficiency allowed Lidl to maintain competitive pricing, a key factor in its market strategy.

Ability to Switch Suppliers

The ability for Lidl to switch suppliers significantly curtails supplier bargaining power. Given that many grocery items are commoditized and Lidl heavily relies on its private label brands, the cost and effort involved in changing suppliers are minimal. For instance, in 2024, Lidl continued to expand its private label offerings, which often allows for greater negotiation leverage with manufacturers compared to branded goods. This ease of switching means suppliers must remain competitive on price, quality, and reliability to retain Lidl's business.

This flexibility is a critical tool for Lidl. If a supplier cannot meet the stringent requirements for pricing, product quality, or timely delivery, Lidl has a readily available pool of alternative providers. This dynamic prevents suppliers from dictating terms or increasing prices unilaterally. In the competitive retail landscape of 2024, where operational efficiency is paramount, this agility in supplier management is a key strategic advantage for Lidl.

- Low Switching Costs: The commoditized nature of many grocery products and Lidl's emphasis on private labels minimize the financial and operational costs associated with changing suppliers.

- Supplier Dependence on Lidl: Lidl's substantial purchasing volume makes its business highly valuable to many suppliers, increasing Lidl's leverage in negotiations.

- Competitive Supplier Market: The availability of multiple suppliers for most product categories ensures that if one supplier becomes uncooperative, Lidl can quickly find replacements.

- Deterrent to Price Increases: The ease of switching serves as a strong deterrent against suppliers attempting to impose unfavorable price hikes or terms.

Long-term Supplier Relationships and Investment

Lidl's approach to supplier relationships, particularly with local partners, demonstrates a strategic investment in long-term stability. By fostering these connections, Lidl secures a consistent and high-quality supply chain.

An example of this commitment is seen in Lidl Ireland's 2024 procurement, where they sourced over €1.67 billion in goods and services from Irish businesses. This substantial investment, coupled with stable contracts, underscores Lidl's dedication to its suppliers.

- Investment in Local Economies: Lidl Ireland's €1.67 billion procurement in 2024 highlights a significant commitment to supporting domestic businesses and ensuring a reliable supply of local products.

- Stable Contracts: The provision of stable contracts to suppliers not only guarantees a consistent flow of goods but also builds trust and encourages further investment from these partners.

- Negotiation Leverage: While investing in relationships, Lidl maintains strong negotiation leverage, balancing partnership with the need for competitive pricing and quality.

- Supply Chain Resilience: These long-term partnerships contribute to a more resilient supply chain, mitigating risks associated with fluctuating market conditions and ensuring product availability for consumers.

Lidl's immense purchasing power, driven by its expansive global footprint with over 12,000 stores by early 2024, significantly limits supplier bargaining power. This scale allows Lidl to secure highly favorable terms, making suppliers reliant on their substantial orders.

The company's strategic emphasis on private-label brands, which constitute around 90% of its offerings, further enhances its leverage by reducing dependence on third-party brands and allowing Lidl to dictate product specifications and pricing.

Lidl's direct sourcing model and the commoditized nature of many grocery items mean low switching costs for Lidl, effectively deterring suppliers from attempting unilateral price increases or unfavorable terms.

| Factor | Lidl's Position | Impact on Supplier Bargaining Power |

|---|---|---|

| Purchasing Volume | Extremely High (over 12,000 stores globally by early 2024) | Lowers supplier power significantly due to dependence on Lidl's orders. |

| Private Label Dominance | High (approx. 90% of inventory) | Reduces reliance on branded suppliers, increasing Lidl's control. |

| Switching Costs | Low (for many commoditized goods) | Enables Lidl to easily switch suppliers, limiting supplier leverage. |

| Supplier Dependence | High (for many suppliers reliant on Lidl's volume) | Increases Lidl's negotiation advantage and ability to dictate terms. |

What is included in the product

This analysis unpacks the competitive forces shaping Lidl's market, detailing buyer and supplier power, the threat of new entrants and substitutes, and the intensity of rivalry within the grocery sector.

Effortlessly identify and mitigate competitive threats by visualizing Lidl's strategic positioning against each of Porter's five forces.

Customers Bargaining Power

Lidl's core customer base is defined by a strong preference for value, making them highly attuned to price fluctuations. This segment actively seeks out the lowest prices, and even small differences can influence their purchasing decisions.

In 2024, the average grocery basket price for a typical household continued to be a major concern, with inflation impacting household budgets significantly. Retailers like Lidl, known for their discount model, directly benefit from this consumer behavior, but also face pressure to maintain their cost advantage.

Lidl's commitment to a cost leadership strategy means that customer expectations for low prices are paramount. If competitors offer comparable quality at lower prices, Lidl risks losing market share, highlighting the intense bargaining power of its price-sensitive customers.

The cost and effort for a consumer to switch from Lidl to another grocery retailer are minimal. For instance, in 2024, the average grocery shopper in the UK switched supermarkets at least twice a year, indicating low switching costs.

There are no significant contractual obligations or loyalty programs that create high barriers to exit from Lidl. This ease of switching significantly increases customer bargaining power, as they can readily move to competitors offering better deals or a more appealing shopping experience, impacting Lidl's pricing strategies.

The grocery sector is incredibly crowded, offering consumers a wealth of choices. Beyond direct competitors like Aldi, traditional supermarkets such as Tesco and Walmart, and the growing presence of online grocers like Ocado and Amazon Fresh, all vie for customer attention. This abundance of options directly translates into significant bargaining power for shoppers.

Customers can easily switch between retailers based on price, quality, or convenience. For instance, in 2024, the average UK household reported spending approximately £100 per week on groceries, a figure influenced by competitive pricing strategies across the board. This means Lidl needs to consistently deliver compelling value propositions to keep its customers loyal.

Access to Price Comparison Information

In today's digital landscape, customers wield significant power due to readily available price comparison tools. Websites and apps allow consumers to effortlessly scan multiple retailers, including Lidl, for the best deals and promotions. This transparency directly fuels their ability to negotiate or seek out more competitive pricing elsewhere.

This ease of access to information means customers can quickly pinpoint where they can get the most for their money. For instance, in 2024, the prevalence of price comparison apps in the grocery sector has intensified, with many consumers reporting using them for at least half of their shopping trips. This empowers them to put pressure on retailers like Lidl to maintain competitive pricing strategies.

- Increased Price Transparency: Digital platforms provide instant access to competitor pricing.

- Consumer Empowerment: Customers can easily identify the best value propositions.

- Demand for Competitive Pricing: Retailers like Lidl face pressure to offer attractive deals.

- Impact on Loyalty: Price-sensitive consumers may switch retailers based on readily available information.

Growing Preference for Private Label and Value

Consumers are increasingly prioritizing private-label brands and value-for-money options, a trend that saw significant acceleration in 2024 and is projected to continue through 2025, largely fueled by ongoing inflationary pressures. This shift directly benefits retailers like Lidl, whose business model is built on offering competitive prices through strong private-label assortments.

However, this growing preference for value means customers are more discerning than ever, actively comparing offerings across the entire retail landscape. Lidl's challenge is to not only meet but exceed customer expectations for value within its private label range to secure and retain shopper loyalty.

- Private Label Growth: In 2024, the global private label market continued its upward trajectory, with many regions reporting double-digit growth in market share.

- Value Sensitivity: Surveys from late 2024 indicated that over 60% of consumers were actively seeking out promotions and private-label alternatives to manage household budgets.

- Lidl's Position: Lidl's strategy of focusing on a curated selection of high-quality private-label products positions it well to capture this growing consumer demand for value.

The bargaining power of customers for Lidl is considerably high due to the price-sensitive nature of its core demographic and the highly competitive grocery market. In 2024, consumers continued to be very mindful of grocery costs, with many actively seeking the best deals, which directly empowers them to exert pressure on retailers like Lidl to maintain competitive pricing.

Low switching costs are a significant factor, as customers can easily move between supermarkets without incurring substantial penalties or effort. For instance, the widespread availability of price comparison tools in 2024 meant that consumers could swiftly identify superior offers elsewhere, increasing their leverage.

Lidl's focus on private-label brands, while appealing to value-seeking customers, also means that consumers are comparing these offerings against a broad spectrum of competitors, both discounters and traditional supermarkets. This constant comparison fuels their ability to demand the best possible value.

| Factor | Impact on Lidl | 2024 Data/Observation |

|---|---|---|

| Price Sensitivity | High | Consumers actively sought promotions and discounts due to persistent inflation. |

| Switching Costs | Low | Minimal barriers to switching between grocery retailers were observed. |

| Availability of Information | High | Price comparison apps and online tools provided extensive price transparency. |

| Product Differentiation | Moderate (Private Label Focus) | Customers compared private label quality and price across multiple retailers. |

Preview Before You Purchase

Lidl Stiftung & Co. KG Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—a comprehensive Porter's Five Forces analysis of Lidl Stiftung & Co. KG, detailing competitive rivalry, the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, and the threat of substitute products. You'll gain immediate access to this fully formatted and insightful report, ready for your strategic planning.

Rivalry Among Competitors

Lidl operates in the discount supermarket sector, a space defined by aggressive price competition. Key rivals, such as Aldi, frequently engage in price wars, compelling Lidl to constantly strive for cost leadership to remain competitive.

This relentless price rivalry directly impacts profit margins, demanding exceptional operational efficiency from Lidl. For instance, in 2023, the UK grocery market saw price inflation, with discounters like Lidl and Aldi gaining market share, indicating their price advantage resonated with consumers amidst economic pressures.

Lidl operates in a highly competitive landscape, particularly facing intense rivalry from fellow discount grocers like Aldi. These competitors share a similar operational strategy, emphasizing low prices, a curated selection of products, and a strong reliance on private-label brands. This overlap in business models means they are directly vying for the same price-sensitive consumer base.

The market share contention between these discounters is fierce and ongoing. For instance, in the United States, Aldi and Lidl have both been on aggressive expansion paths, aiming to capture a larger slice of the grocery market. This direct competition for customers and market presence necessitates constant innovation and efficiency from Lidl to maintain its position.

Lidl and its primary competitors are locked in a fierce race for physical expansion, with numerous new store openings planned across both established and emerging markets. Lidl, for instance, has ambitious goals to launch dozens of new locations in the US and UK by the close of 2025, mirroring similar aggressive growth strategies from rivals like Aldi. This widespread physical expansion directly escalates the competition for capturing market share and enhancing customer accessibility.

Marketing and Loyalty Program Battles

Supermarkets, including discounters like Lidl, are heavily investing in marketing and loyalty programs to capture and keep customers. In 2024, this trend intensified as rivals also rolled out enhanced digital platforms and personalized promotions. Lidl itself updated its MyLidl loyalty app, providing weekly discounts and tailored offers to its user base.

This competitive push underscores a strategic shift; brand loyalty is now cultivated through more than just competitive pricing. The effectiveness of these programs is evident in customer engagement metrics, with loyalty app usage becoming a key indicator of customer retention in the grocery sector. For instance, by the end of 2023, major supermarket chains reported significant increases in loyalty program sign-ups, with some seeing double-digit percentage growth year-over-year.

- Increased Marketing Spend: Retailers are allocating more budget to advertising and promotional activities, aiming to stand out in a crowded market.

- Loyalty App Enhancements: Features like personalized discounts, early access to sales, and gamified experiences are becoming standard in loyalty apps.

- Customer Retention Focus: Beyond attracting new customers, the emphasis is on building long-term relationships through consistent value and engagement.

- Data-Driven Personalization: Loyalty programs are increasingly leveraging customer data to deliver highly relevant offers, boosting conversion rates.

Differentiation through Store Experience and Assortment

While Lidl's core strategy revolves around competitive pricing, rivals are increasingly focusing on differentiating through the in-store environment and product selection. This includes aspects like store design, the availability of fresh produce and in-house bakeries, and the overall customer journey. Lidl itself aims to distinguish its offerings through a carefully selected range of private-label goods, imported specialties, and its popular fresh bakery section.

The capacity to deliver both high quality and affordability represents a critical area of competition. For instance, in 2023, discounters like Aldi and Lidl continued to invest in store renovations and expanded their fresh food offerings to attract a broader customer base beyond pure price shoppers. This strategic shift acknowledges that while price remains a primary driver, the shopping experience and product variety are becoming equally important in securing customer loyalty.

- Store Layout and Ambiance: Competitors are enhancing store layouts for better flow and a more pleasant shopping environment.

- Product Assortment Expansion: Beyond core groceries, there's a push to offer a wider variety of private-label premium products and international foods.

- Fresh Offerings: Investments in bakery sections and fresh produce displays are key differentiators, with many stores reporting increased sales in these categories.

- Customer Experience Focus: Efforts are being made to improve checkout efficiency and offer more engaging in-store promotions and sampling.

Lidl faces intense rivalry, particularly from Aldi, in the discount supermarket sector. Both chains compete fiercely on price, store expansion, and the appeal of their private-label brands, directly targeting the same price-conscious consumer. This rivalry extends to marketing and loyalty programs, with Lidl enhancing its MyLidl app in 2024 to offer personalized discounts, mirroring competitors' efforts to foster customer retention beyond just low prices.

The competition also involves differentiation through in-store experience and product selection. While price remains paramount, rivals are increasingly investing in store ambiance, fresh produce, and bakery sections to attract a broader customer base. For instance, by the end of 2023, many supermarket chains saw double-digit growth in loyalty program sign-ups, highlighting the importance of these engagement strategies.

| Competitor | Market Share (UK Grocery, Approx. 2024) | Key Differentiators |

|---|---|---|

| Aldi | ~9-10% | Price leadership, strong private labels, efficient store operations |

| Lidl | ~7-8% | Price leadership, curated private labels, in-store bakery, expanding loyalty program |

| Other Discounters (e.g., B&M Bargains, Home Bargains - Grocery Segment) | Varies | Value for money, non-food focus with grocery add-ons |

SSubstitutes Threaten

The increasing popularity of online grocery delivery services presents a substantial threat of substitutes for traditional brick-and-mortar retailers like Lidl. Consumers are drawn to the unparalleled convenience offered by platforms that deliver groceries directly to their homes or provide easy click-and-collect options.

This shift in consumer preference is not a fleeting trend. The global online grocery market is projected to experience robust growth, with forecasts indicating it will be the fastest-growing segment within the broader e-commerce landscape between 2024 and 2029.

Specialty food stores and farmers' markets present a notable threat of substitutes for Lidl. These venues cater to consumers seeking unique, organic, or locally sourced products, often at a premium. For instance, the organic food market in the US was valued at approximately $60 billion in 2023, indicating a significant consumer shift towards these alternatives.

While Lidl's core strength lies in its discount model, these specialized channels offer a different value proposition. Consumers might choose a farmers' market for fresh produce or a specialty store for imported cheeses, bypassing traditional supermarkets for specific purchases. This fragmentation of the grocery landscape diversifies consumer options, potentially drawing away market share for certain product categories.

The food service industry, encompassing restaurants, fast food, and takeaway options, presents a substantial threat of substitution for grocery retailers like Lidl. When consumers choose to dine out or order prepared meals, they are directly foregoing purchases from grocery stores, impacting sales volume. This shift in consumer behavior represents a significant competitive force.

The financial implications are notable. As of December 2024, the spending gap between dining out and grocery shopping in the broader market exceeded $20 billion. This considerable difference highlights the financial incentive for consumers to opt for convenience and prepared food over home cooking, directly challenging Lidl's core business model.

Meal Kit and Prepared Meal Services

The rise of meal kit and prepared meal services presents a significant threat of substitution for traditional grocery retailers like Lidl. These services offer unparalleled convenience, directly addressing the time constraints faced by many consumers. For instance, the global meal kit delivery service market was valued at approximately USD 15.2 billion in 2023 and is projected to grow substantially, indicating a strong consumer shift towards these alternatives.

These convenient options reduce the necessity for customers to visit supermarkets and purchase individual ingredients, thereby bypassing traditional grocery shopping altogether. This trend is particularly pronounced among younger demographics and busy professionals who prioritize ease and speed in meal preparation. The market for ready-to-eat meals also continues to expand, offering even greater convenience than meal kits.

- Growing Market Value: The global meal kit delivery market reached around USD 15.2 billion in 2023, showcasing significant consumer adoption.

- Convenience Factor: Services provide pre-portioned ingredients or fully prepared meals, saving consumers time on shopping and cooking.

- Target Demographics: Busy professionals and younger consumers are key adopters, prioritizing convenience over traditional grocery shopping.

- Direct Substitution: These offerings directly substitute the need for purchasing raw ingredients from supermarkets like Lidl.

Direct-to-Consumer (DTC) Food Brands

The rise of direct-to-consumer (DTC) food brands presents a growing threat of substitutes for traditional retailers like Lidl. Producers are increasingly bypassing established supply chains to sell directly to consumers, particularly for niche or specialty items. This trend, while still nascent for everyday groceries, offers consumers alternative avenues for purchasing food products.

For instance, in 2024, the global online grocery market continued its expansion, with DTC players capturing a growing share. While specific figures for Lidl's market share erosion due to DTC are not publicly detailed, the overall growth of online food sales, estimated to reach hundreds of billions globally by 2025, indicates a significant shift in consumer behavior. This allows consumers to access unique products or better prices by cutting out intermediaries.

- Growing DTC Market: Online food sales are projected to continue their upward trajectory, offering consumers more direct purchasing options.

- Specialty and Artisanal Focus: DTC models often excel in offering unique or high-quality products that may not be readily available in mainstream supermarkets.

- Potential for Broader Impact: While currently a minor threat for staple groceries, the DTC model's increasing sophistication could expand its reach into broader food categories.

The threat of substitutes for Lidl is multifaceted, encompassing online grocery delivery, specialty food stores, farmers' markets, the food service industry, meal kit services, and direct-to-consumer (DTC) brands. These alternatives offer convenience, unique product selections, or prepared meal solutions that can divert consumer spending away from traditional grocery shopping.

The global online grocery market's rapid expansion, projected to be the fastest-growing e-commerce segment between 2024 and 2029, underscores the growing preference for digital convenience. Similarly, the US organic food market's valuation at approximately $60 billion in 2023 highlights a significant consumer draw towards specialized offerings.

The food service industry's substantial financial impact is evident, with a spending gap exceeding $20 billion in December 2024 between dining out and grocery shopping, indicating a strong consumer inclination towards prepared meals. The meal kit market, valued at USD 15.2 billion in 2023, further exemplifies this trend by offering convenient alternatives to home cooking.

| Substitute Category | Key Value Proposition | Market Indicator (2023/2024 Data) | Impact on Lidl |

|---|---|---|---|

| Online Grocery Delivery | Convenience, Home Delivery | Fastest growing e-commerce segment (2024-2029) | Diversion of routine grocery spend |

| Specialty Food Stores/Farmers' Markets | Unique, Organic, Local Products | US Organic Food Market ~$60 Billion (2023) | Loss of premium product sales |

| Food Service (Restaurants/Takeaway) | Prepared Meals, Dining Out Convenience | Spending gap vs. groceries >$20 Billion (Dec 2024) | Direct loss of food purchase occasions |

| Meal Kit/Prepared Meal Services | Convenience, Reduced Prep Time | Global Meal Kit Market ~$15.2 Billion (2023) | Bypasses ingredient purchasing |

| Direct-to-Consumer (DTC) Brands | Niche Products, Potential Price Advantages | Global Online Food Sales projected to reach hundreds of billions (by 2025) | Erosion of market share for specific items |

Entrants Threaten

Establishing a new grocery supermarket chain, particularly one with a significant physical presence like Lidl, demands considerable upfront capital. This includes the costs of acquiring land, building stores, and developing a robust distribution and logistics network.

For instance, the average cost to build a new supermarket can range from $5 million to $10 million, depending on size and location, a significant hurdle for aspiring competitors. This substantial financial commitment acts as a strong deterrent, effectively limiting the threat of new entrants into the market.

Lidl's formidable supply chain and distribution network, honed over decades of operation, presents a significant barrier to new entrants. This intricate global system is fundamental to Lidl's ability to offer competitive pricing and ensure consistent product availability, making it incredibly difficult for newcomers to match.

Replicating Lidl's logistical prowess demands immense capital, extensive time, and specialized knowledge, effectively deterring potential competitors. For instance, in 2023, Lidl reported a global turnover of over €114 billion, a testament to the scale and efficiency of its operations, which new entrants would need to overcome.

The grocery sector, especially the discount segment, is a battleground of aggressive pricing. Newcomers would immediately grapple with the deeply entrenched low-price strategies of established giants like Lidl and Aldi, who have honed their operational efficiencies to offer consistently competitive prices.

For instance, in 2024, the average price per unit in the discount grocery channel remained significantly lower than in traditional supermarkets, a testament to the cost leadership of incumbents. This intense price pressure makes it incredibly challenging for any new entrant to carve out market share and achieve sustainable profitability without substantial capital and a highly optimized supply chain.

Brand Loyalty and Customer Habits

Lidl has successfully built strong brand loyalty, even within the discount grocery sector. This is evident in their consistent performance and customer retention. For instance, in 2023, Lidl reported a significant increase in sales across key European markets, indicating a solid customer base that continues to choose them over competitors.

Consumer habits are deeply entrenched, making it challenging for newcomers to disrupt the market. Many shoppers have established routines and preferences for where they buy their groceries. Breaking these habits requires more than just a lower price; it necessitates a compelling reason for consumers to switch, which is a considerable hurdle for any new entrant aiming to capture market share from established players like Lidl.

- Brand Loyalty: Lidl's consistent delivery of value and perceived quality has fostered a loyal customer base, making it difficult for new entrants to attract their shoppers.

- Customer Habits: Established shopping routines and preferences create a barrier, as consumers are often resistant to changing their purchasing patterns without significant incentives.

- Market Entry Challenge: New entrants must invest heavily in marketing and offer exceptionally attractive value propositions to overcome existing brand loyalty and ingrained consumer habits.

Regulatory Hurdles and Market Saturation

The grocery retail sector faces significant regulatory burdens, including stringent food safety standards, complex zoning laws for store placement, and evolving labor regulations. For instance, in 2024, many European countries continued to update their food labeling requirements, adding compliance costs for new entrants. Navigating these varied and often costly requirements acts as a substantial barrier, deterring potential new competitors from entering the market.

Furthermore, many key European markets, where Lidl operates, are highly saturated. In 2024, the density of supermarkets and discounters remained exceptionally high in countries like Germany and France. This saturation makes securing desirable retail locations difficult and expensive, as prime spots are already occupied by established players, limiting opportunities for new businesses to gain visibility and market share.

- Regulatory Complexity: Compliance with food safety, zoning, and labor laws presents a significant cost and time investment for new grocery retailers.

- Market Saturation: Established European markets are densely populated with existing grocery stores, making it challenging to find and secure prime retail locations.

- High Entry Costs: The combination of regulatory compliance and the need for prime real estate significantly increases the capital required for new entrants to compete effectively.

The threat of new entrants for Lidl is significantly mitigated by the immense capital required to establish a comparable grocery operation. This includes the substantial costs associated with acquiring prime real estate, constructing modern retail spaces, and building out sophisticated logistics and supply chains. For instance, the average cost to build a new supermarket in 2024 can easily range from $5 million to $10 million, a considerable financial barrier.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Lidl Stiftung & Co. KG is built upon a robust foundation of data, including Lidl's official annual reports, industry-specific trade publications, and comprehensive market research reports from firms like Statista and IBISWorld.