Lidl Stiftung & Co. KG Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lidl Stiftung & Co. KG Bundle

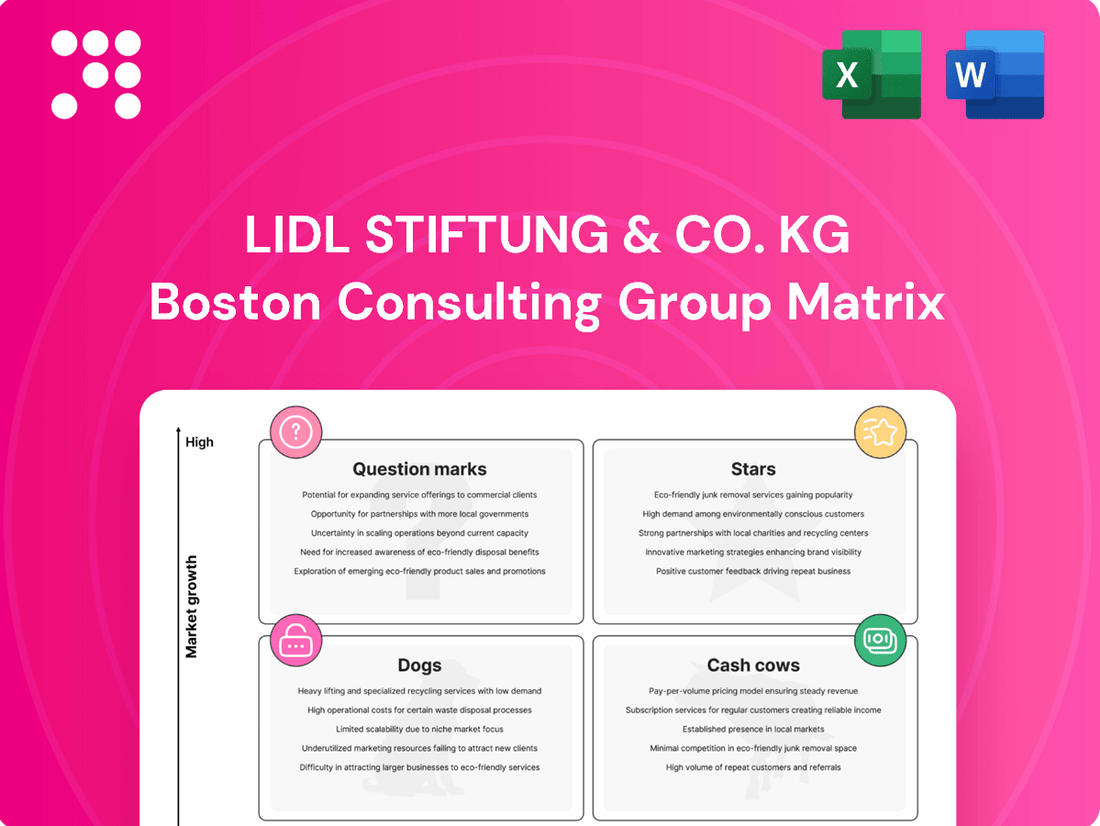

Curious about Lidl's strategic product positioning? Our BCG Matrix analysis reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks, offering a glimpse into their market dominance and potential.

Unlock the full strategic picture by purchasing the complete Lidl Stiftung & Co. KG BCG Matrix report. Gain access to detailed quadrant placements, actionable insights, and a clear roadmap for optimizing their product portfolio and future investments.

Don't miss out on the comprehensive breakdown that goes beyond this preview. Invest in the full BCG Matrix to equip yourself with the data-driven intelligence needed to make informed decisions and drive Lidl's continued success.

Stars

Lidl's aggressive US expansion, primarily on the East Coast and in key cities like New York and Atlanta, positions it as a significant player in the competitive grocery market. The company is investing heavily, with plans to open a substantial number of new stores by the close of 2025, signaling a strong commitment to capturing market share in this high-growth region.

Lidl's private label brands are a cornerstone of its success, driving growth by offering consumers high-quality products at attractive price points. This strategy directly appeals to value-seeking shoppers, fostering strong customer loyalty and expanding market penetration. For instance, Lidl's commitment to its private label portfolio is evident in its continuous expansion, with new offerings like the Butcher's Specialty line of meats further solidifying its market position.

Lidl's significant investment in digital transformation, including enhanced self-scanning via the Lidl Plus app and improved online services, positions it as a strong contender in the retail innovation landscape. These upgrades focus on customer convenience and personalized experiences.

The company's forward-thinking approach is further evidenced by its use of generative AI for a highly successful viral marketing campaign, demonstrating a commitment to adopting cutting-edge technologies to engage consumers.

Sustainability Leadership

Lidl's commitment to sustainability positions it as a potential Star in the BCG Matrix. The company has set ambitious goals, including carbon neutrality in Ireland by 2025 and achieving net-zero emissions globally by 2050. This focus on environmental responsibility, such as transitioning to renewable energy sources and implementing more sustainable packaging solutions, resonates strongly with an increasing number of eco-conscious consumers.

These forward-thinking sustainability initiatives not only bolster Lidl's brand image but also serve as a key differentiator in the competitive retail landscape. For instance, by 2024, Lidl had already achieved significant milestones in reducing its environmental footprint, with a stated aim to cut Scope 1 and 2 emissions by 40% by 2025 compared to a 2016 baseline, and a commitment to address Scope 3 emissions through supplier engagement and product innovation.

- Carbon Neutrality by 2025 in Ireland: Demonstrates a focused, near-term environmental target.

- Global Net Zero by 2050 Target: Outlines a long-term vision for comprehensive emissions reduction.

- Renewable Energy Transition: A tangible step towards reducing operational carbon emissions.

- Eco-Friendly Packaging Initiatives: Addresses consumer concerns and reduces waste, enhancing brand appeal.

Increased Shopper Loyalty and Market Share Gains

Lidl is demonstrating impressive gains in shopper loyalty and market share, especially within the UK and across various European nations. The company has successfully onboarded hundreds of thousands of new customers, leading to a notable increase in the frequency of shopping trips.

This surge in customer engagement has propelled Lidl's market share to record levels in several key regions. For instance, in the UK, Lidl's market share reached an all-time high of 7.2% in early 2024, according to Kantar data. This growth signifies robust brand appeal and an effective strategy that resonates with consumers prioritizing both value and quality in their grocery purchases.

- Record Market Share: Lidl's market share in the UK hit 7.2% in early 2024, a new benchmark.

- Customer Acquisition: Hundreds of thousands of new shoppers have been attracted to Lidl stores.

- Increased Visit Frequency: Existing customers are shopping at Lidl more often, boosting sales.

- Value Proposition: The company's focus on affordability and quality is driving consumer preference.

Lidl's strong market share growth, particularly in the UK where it reached a record 7.2% in early 2024, combined with hundreds of thousands of new customer acquisitions and increased shopping frequency, clearly indicates its status as a Star in the BCG Matrix. This performance is driven by a compelling value proposition that balances affordability with quality, further enhanced by private label success and digital innovation.

Lidl's commitment to sustainability, including its 2025 carbon neutrality goal for Ireland and a global net-zero target by 2050, also positions it as a Star. These initiatives, like transitioning to renewable energy and improving packaging, resonate with eco-conscious consumers and serve as a significant market differentiator.

The company's aggressive US expansion and significant investments in new store openings by 2025, especially on the East Coast, highlight its high growth potential in a key market. This strategic push, coupled with a focus on digital transformation and innovative marketing like generative AI campaigns, solidifies its Star status by demonstrating strong future prospects and current market leadership.

| Metric | Value | Source/Period |

|---|---|---|

| UK Market Share | 7.2% | Kantar, Early 2024 |

| New Customers | Hundreds of Thousands | Lidl Internal Data |

| Sustainability Goal (Ireland) | Carbon Neutrality | By 2025 |

| Sustainability Goal (Global) | Net Zero Emissions | By 2050 |

| Emissions Reduction Target | 40% Scope 1 & 2 reduction | vs. 2016 baseline, By 2025 |

What is included in the product

This BCG Matrix analysis provides a tailored view of Lidl's product portfolio, categorizing units into Stars, Cash Cows, Question Marks, and Dogs for strategic decision-making.

A clear Lidl BCG Matrix visually clarifies strategic options, easing the pain of resource allocation decisions.

Cash Cows

Lidl's extensive network of stores across mature European markets, including Germany, France, and the UK, acts as a significant cash cow for the company. These established operations benefit from high market penetration and strong brand recognition, consistently generating stable revenue streams. For instance, in 2023, Lidl reported a substantial turnover across its European operations, reflecting the maturity and profitability of these markets.

The efficiency of Lidl's supply chain and its well-honed operational model in these regions directly contribute to high profit margins. This allows the company to generate substantial cash flow from these mature segments, which can then be reinvested in other areas of the business. Lidl's continued focus on cost management and operational excellence in these established markets underpins their status as reliable cash generators.

Lidl's core discount retail model, built on aggressive competitive pricing and streamlined, efficient operations, is a significant cash cow for the company. This approach consistently drives high sales volumes and robust cash flow, proving resilient even in mature, low-growth markets. It's a strategy that continues to resonate with a wide customer base prioritizing value for money.

Lidl's supply chain efficiency, a cornerstone of its business, acts as a significant cash cow. The company has heavily invested in a streamlined logistics network and state-of-the-art distribution centers. For instance, in 2023, Lidl continued its substantial investments in expanding and modernizing its logistics infrastructure across Europe, aiming to further optimize product flow and reduce transit times.

This operational prowess directly minimizes overheads and maximizes product availability, translating into robust cash generation. By keeping operational costs low through these efficiencies, Lidl can maintain its famously competitive pricing, a key driver of its market share and profitability. This operational excellence underpins its ability to generate consistent cash flow.

Strong Brand Reputation for Value

Lidl's enduring image as a provider of excellent value has cemented its customer loyalty in key European markets. This perception translates directly into consistent sales and predictable revenue streams, a hallmark of a cash cow. Customers consistently choose Lidl because they trust the brand to deliver quality at competitive prices.

This strong brand equity is not just about perception; it's backed by tangible results. For instance, in 2023, Lidl reported a turnover of approximately €114.9 billion globally, demonstrating the significant cash flow generated by its value proposition. This consistent performance allows Lidl to invest in other areas of its business or return capital.

- Brand Trust Drives Repeat Purchases: Lidl's reputation for value ensures customers return, creating a stable revenue base.

- Consistent Sales Performance: In 2023, Lidl's global turnover reached around €114.9 billion, reflecting its strong market position.

- Reliable Cash Flow Generation: The predictable demand for its budget-friendly offerings makes Lidl a significant cash generator.

Consistent Profitability in Mature Markets

In its well-established markets, Lidl consistently demonstrates strong profitability. For instance, in fiscal year 2023, Lidl's pre-tax profits saw a significant rebound, reaching €1.8 billion, a substantial increase from previous periods. This financial stability in mature regions allows Lidl to generate substantial cash flow.

This consistent cash generation in its mature markets acts as a vital funding source for the company's strategic objectives. The substantial profits from these established areas enable Lidl to reinvest in growth opportunities, such as expanding into new territories or investing in digital transformation initiatives. In 2023, Lidl’s turnover in Germany alone reached €25.1 billion, underscoring the strength of its core operations.

- Consistent Profitability: Lidl's mature markets are reliable profit generators.

- Financial Stability: Rebounding pre-tax profits, reaching €1.8 billion in FY23, highlight financial health.

- Cash Generation: Strong turnover, like €25.1 billion in Germany for FY23, fuels cash flow.

- Strategic Reinvestment: Generated cash supports investment in growth and innovation.

Lidl's established European operations, particularly in Germany, France, and the UK, function as significant cash cows. These markets benefit from high brand recognition and market penetration, consistently yielding stable revenue. In 2023, Lidl's turnover across its European operations reflected the maturity and profitability of these core regions.

The company's efficient supply chain and optimized operational model in these mature markets translate into robust profit margins. This allows Lidl to generate substantial cash flow, which is then strategically reinvested in areas such as expansion or digital innovation. Lidl's continued focus on cost control and operational excellence in these established territories solidifies their role as reliable cash generators.

Lidl's core strategy of offering exceptional value for money, coupled with streamlined operations, drives high sales volumes and consistent cash flow, even in mature markets. This approach ensures predictable revenue streams, a hallmark of a cash cow. For instance, in 2023, Lidl's global turnover reached approximately €114.9 billion, underscoring the power of its value proposition.

Lidl's mature markets consistently demonstrate strong profitability, contributing significantly to its overall financial health. For example, in fiscal year 2023, Lidl's pre-tax profits saw a notable increase, reaching €1.8 billion. This financial stability in established regions is crucial for generating the cash flow needed to support broader company objectives.

| Metric | 2023 (Approximate) | Significance |

| Global Turnover | €114.9 billion | Demonstrates strong sales volume and cash generation potential. |

| Pre-Tax Profit | €1.8 billion | Indicates healthy profitability in mature markets. |

| German Turnover | €25.1 billion | Highlights the immense cash-generating capacity of a key mature market. |

Delivered as Shown

Lidl Stiftung & Co. KG BCG Matrix

The preview of the Lidl Stiftung & Co. KG BCG Matrix you are currently viewing is the exact, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, meticulously prepared by industry experts, provides a clear strategic overview of Lidl's product portfolio, categorizing them into Stars, Cash Cows, Question Marks, and Dogs. You can confidently proceed with your purchase, knowing you'll obtain a fully formatted and actionable report ready for immediate integration into your business strategy or presentation.

Dogs

Lidl's online sales, despite the company's overall strong performance, have been a weak point. In recent financial years, their e-commerce segment has lagged behind broader market growth trends, indicating underperformance in the digital realm.

While Lidl is actively developing a new omnichannel strategy, the current state of its online sales doesn't significantly boost overall growth or market share. This positions the online sales segment as a 'Dog' within their digital business portfolio, consuming valuable resources without generating the anticipated returns.

While Lidl's US presence is now considered a Star, its initial foray into the American market was marked by a more cautious pace. Early on, the company experienced slower-than-expected growth and some store closures, indicating initial challenges in adapting its established European model to the unique U.S. retail landscape.

Like any major retailer, Lidl likely has specific store locations that aren't performing as well as others. These can be due to things like very strong competition nearby, the local population not being the right fit for Lidl's offerings, or simply picking a less-than-ideal spot for the store. These individual underperformers can act as drains on resources, even if the company is generally doing well in other areas.

In the past, Lidl has indeed closed down some of these less profitable stores. For instance, reports from 2023 indicated store closures in various markets as part of ongoing strategic reviews to optimize the store portfolio and focus on more promising locations. This practice is common in the retail industry to maintain overall profitability and efficiency.

Certain Non-Core Product Categories

Certain non-core product categories within Lidl's extensive offering, despite the company's strong emphasis on private labels, may exhibit characteristics of Dogs in the BCG Matrix. These are typically niche items or seasonal products that consistently underperform in terms of sales volume and market share.

These underperforming categories, if not actively managed, can become a drain on resources. They occupy valuable shelf space and tie up inventory, diverting attention and capital from Lidl's more successful core private-label brands. For instance, while specific data for these niche categories is not publicly detailed, a general trend observed in the grocery sector is that highly specialized or limited-demand items can struggle to gain traction against dominant private labels.

- Low Sales Volume: These products generate minimal revenue, failing to meet internal sales targets.

- Low Market Share: They hold a negligible position within their respective product segments.

- Inventory and Shelf Space Tie-up: They consume resources without proportional returns, impacting operational efficiency.

- Strategic Focus on Core Private Labels: Lidl prioritizes investment and marketing efforts on its high-performing, established private-label brands.

Legacy IT Systems in Transition

Lidl's digital transformation efforts highlight the challenge of legacy IT systems. These older technologies, while functional, often represent a drag on resources due to high maintenance costs and a lack of integration with newer, more efficient platforms. In 2024, many retailers are grappling with similar issues, where the cost of maintaining outdated systems can divert funds from innovation and growth initiatives.

These legacy systems can hinder Lidl's ability to adapt quickly to market changes and customer demands. They might not support advanced data analytics, personalized customer experiences, or seamless omnichannel operations. For instance, an outdated inventory management system could lead to stockouts or overstocking, directly impacting sales and customer satisfaction. The investment required to upgrade or replace these systems is substantial but often necessary to remain competitive.

- High Maintenance Costs: Legacy systems can consume a significant portion of IT budgets, estimated to be up to 70-80% of IT spending for some organizations, leaving less for modernization.

- Operational Inefficiencies: Outdated infrastructure can lead to slower processing times, data silos, and increased risk of system failures, impacting daily operations.

- Security Vulnerabilities: Older systems are often more susceptible to cyber threats, posing a significant risk to sensitive customer and business data.

- Lack of Scalability: Legacy IT may not be able to scale effectively with business growth or adapt to new technological demands, such as AI integration or cloud computing.

Certain non-core product categories within Lidl's extensive offering, despite the company's strong emphasis on private labels, may exhibit characteristics of Dogs in the BCG Matrix. These are typically niche items or seasonal products that consistently underperform in terms of sales volume and market share.

These underperforming categories, if not actively managed, can become a drain on resources. They occupy valuable shelf space and tie up inventory, diverting attention and capital from Lidl's more successful core private-label brands.

For instance, while specific data for these niche categories is not publicly detailed, a general trend observed in the grocery sector is that highly specialized or limited-demand items can struggle to gain traction against dominant private labels.

These products generate minimal revenue, failing to meet internal sales targets, and hold a negligible position within their respective product segments.

Question Marks

Lidl's expansion into promising, yet highly competitive US cities like specific New York City boroughs or burgeoning Southeast markets positions them as Stars in the BCG matrix. These areas offer significant growth potential, but the substantial investments needed to gain traction against established rivals mean their future success is still uncertain. For instance, in 2024, Lidl continued its strategic rollout across the US, with a particular focus on markets demonstrating strong demographic growth and consumer spending power.

Lidl's enhanced omnichannel strategy, particularly its push into non-food categories like Parkside and Crivit, positions these as Question Marks within the BCG framework. The company is investing heavily to expand its online presence and diversify its product assortment, aiming to capture a larger share of the competitive e-commerce market.

Lidl's ongoing rollout of advanced digital features, such as self-scanning capabilities integrated into the Lidl Plus app, positions these initiatives as Question Marks within the BCG matrix. While these digital enhancements are designed to boost customer convenience and operational efficiency, their ultimate success in terms of widespread customer adoption and tangible contributions to market share and profitability across diverse international markets remains an open question. The significant capital investment required for these technological advancements means that the return on investment is still in the process of being realized and validated.

Expansion into New Store Formats/Concepts

Lidl's exploration of new store formats, such as compact city-center locations or specialized outlets, positions them within the Stars quadrant of the BCG matrix. These experimental ventures, while currently possessing a low market share, are designed to tap into high-growth potential by addressing specific urban consumer needs and evolving shopping habits.

For example, Lidl has been observed testing smaller format stores in densely populated urban areas. These initiatives are crucial for capturing market share in environments where larger footprint stores are impractical. The success of these pilot programs could lead to significant expansion, mirroring the growth trajectory of a Star. In 2024, Lidl continued to refine its strategy for these smaller formats, aiming to optimize product assortment and operational efficiency for urban consumers.

- New Store Formats: Lidl's pilot programs for smaller, urban-focused stores represent a strategic move to capture high-growth urban markets.

- Low Current Market Share: These experimental formats currently hold a minimal share of the overall market, reflecting their early stage of development.

- High Growth Potential: Successful adaptation and rollout of these concepts could lead to substantial market penetration and revenue growth.

- Testing and Adaptation: Significant investment in testing and refinement is required before these new formats can be widely implemented.

Deepening Local Sourcing Initiatives

While Lidl's commitment to British sourcing is a notable strength, the expansion of local sourcing initiatives into less established international markets presents a classic Question Mark scenario for the company's BCG Matrix. This strategic move requires substantial upfront investment in cultivating new supplier relationships and optimizing complex logistics networks in diverse regions.

The success of these expanded local sourcing programs, particularly in terms of boosting market share and resonating with varied consumer preferences, remains uncertain. For instance, while Lidl reported a 5.2% increase in UK sales in 2023, replicating this localized success across emerging markets requires careful calibration.

- Investment in new markets: Significant capital is needed to build robust local supply chains in regions where Lidl's presence is still developing.

- Uncertain market adoption: The degree to which consumers in these new markets will favor locally sourced products over established international offerings is yet to be fully determined.

- Sustainability alignment vs. market challenges: While aligning with sustainability goals, the practicalities of integrating these initiatives into diverse and potentially less developed market infrastructures pose integration hurdles.

Lidl's foray into new product categories, such as its increasing emphasis on organic and plant-based offerings, can be viewed as Question Marks. These ventures require substantial investment to build brand recognition and compete with established players, with their ultimate market share and profitability yet to be solidified. For example, in 2024, Lidl continued to expand its private label organic range, aiming to capture a growing segment of health-conscious consumers.

The company's strategic investments in emerging markets, where its brand awareness and market share are still relatively low, also fall into the Question Mark category. These markets present high growth potential but also significant risks and require considerable capital for store development, marketing, and supply chain establishment. Lidl's cautious approach to international expansion, often involving pilot programs before full-scale rollouts, reflects the uncertain nature of these investments.

Lidl's ongoing efforts to expand its private label offerings into premium or niche segments, like gourmet foods or specialized beverages, represent Question Marks. While these initiatives aim to differentiate Lidl and attract a more affluent customer base, they require significant marketing investment and face intense competition from established premium brands. The success of these ventures hinges on Lidl's ability to effectively communicate value and quality to consumers in these new segments.

| Initiative | Category | Investment Level | Market Share Potential | Uncertainty Factor |

|---|---|---|---|---|

| Expansion into Organic & Plant-Based Foods | Question Mark | High | High | Consumer adoption, competition |

| Entry into Emerging Markets | Question Mark | Very High | Very High | Market infrastructure, brand recognition |

| Premium Private Label Expansion | Question Mark | Medium | Medium | Brand perception, competitive landscape |

BCG Matrix Data Sources

Our Lidl BCG Matrix is informed by comprehensive data, including internal sales figures, market share reports, and competitor analysis, to accurately position each business unit.