Lidl Stiftung & Co. KG PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lidl Stiftung & Co. KG Bundle

Lidl Stiftung & Co. KG operates within a dynamic global marketplace, significantly influenced by political stability, economic fluctuations, and evolving social consumer behaviors. Understanding these external forces is crucial for strategic planning and maintaining a competitive edge. Our comprehensive PESTLE analysis delves into these critical factors, offering actionable insights tailored for Lidl's unique operational landscape.

Gain an edge with our in-depth PESTEL Analysis—crafted specifically for Lidl Stiftung & Co. KG. Discover how external forces are shaping the company’s future, and use these insights to strengthen your own market strategy. Download the full version now and get actionable intelligence at your fingertips.

Political factors

Lidl's global operations are deeply intertwined with government regulations concerning food safety, product labeling, and general retail practices, varying significantly by country. For instance, in the European Union, the General Food Law (Regulation (EC) No 178/2002) sets stringent standards that Lidl must adhere to across all its member states.

Shifts in international trade policies, including tariffs and import/export restrictions, directly affect Lidl's supply chain and product pricing. The impact of Brexit on UK trade, with new customs procedures and potential tariffs on goods from the EU, has presented challenges for retailers like Lidl, potentially increasing costs and affecting product availability. For example, the UK's reliance on imported food, with around 30% of its food consumed being imported, makes it particularly susceptible to these policy changes.

Lidl's ability to maintain its competitive pricing strategy hinges on its agility in adapting to these dynamic political and regulatory environments. Navigating these complexities requires constant monitoring and strategic adjustments to sourcing and distribution models to mitigate any adverse effects on consumer prices.

Political stability in countries where Lidl operates is a cornerstone of its operational success and strategic planning. Regions with robust governance and predictable political landscapes, such as Germany, Lidl's home base, foster an environment conducive to consistent business operations and long-term investment. For instance, Germany's strong rule of law and stable political system directly supports Lidl's extensive supply chain network and its ability to plan for market expansion without significant geopolitical disruption.

Conversely, political volatility in other operating regions presents considerable risks. Instability can disrupt supply chains, leading to increased costs and potential product shortages. In 2024, for example, geopolitical tensions in Eastern Europe have impacted logistics and raw material sourcing for many retailers, a factor Lidl must actively manage. Such conditions can also deter new investments and necessitate costly contingency planning, directly affecting profitability and market growth strategies.

Government decisions on minimum wage and labor laws significantly affect Lidl's operating expenses, particularly with its extensive global workforce. For instance, Germany, a key market, saw its statutory minimum wage rise to €12.41 per hour in January 2024. This directly impacts Lidl's payroll costs in that region.

Stricter labor regulations or further minimum wage hikes could squeeze Lidl's profit margins, compelling the company to seek cost efficiencies in other areas of its business. This might involve optimizing supply chains or investing in automation to offset increased labor expenses.

Lidl has proactively addressed these pressures by investing in its employees. In 2023, the company announced significant wage increases for its hourly-paid staff in several markets, including the UK where starting pay rose to £11.40 per hour, demonstrating a commitment to staying competitive and compliant with evolving labor standards.

Competition Policy and Antitrust Regulations

Lidl's operations are significantly shaped by competition policy and antitrust regulations across its markets. These rules aim to ensure a level playing field by preventing dominant players from engaging in anti-competitive practices. For instance, the European Commission actively scrutinizes mergers and acquisitions within the retail sector to maintain fair competition, impacting potential strategic moves by Lidl and its rivals.

Regulatory bodies like the UK's Competition and Markets Authority (CMA) play a crucial role in monitoring the grocery sector. In 2024, the CMA continued to investigate market concentration and pricing practices, which could influence Lidl's expansion strategies or pricing decisions. Any significant consolidation among Lidl's competitors, such as large mergers, would necessitate careful strategic adjustments to maintain market share and competitive advantage.

- Antitrust Scrutiny: Lidl, like all major retailers, is subject to antitrust laws designed to prevent market dominance and unfair practices.

- Market Monitoring: Regulatory bodies actively monitor retail markets for anti-competitive behavior, impacting strategic decisions.

- Merger Impact: Competitor mergers or acquisitions can alter the competitive landscape, requiring Lidl to adapt its strategy.

- Regulatory Fines: Non-compliance with competition laws can result in substantial fines, as seen in past cases involving other large retailers in Europe.

Public Health Policies and Food Standards

Governments worldwide are intensifying their focus on public health, directly impacting the food industry. This translates into stricter regulations concerning food content, such as limits on sugar, salt, and fat. Lidl, with its significant private-label portfolio, must diligently ensure compliance with these evolving health standards. For instance, in 2024, the UK government continued its efforts to tackle childhood obesity, with regulations on the placement of unhealthy food items in stores and restrictions on advertising high-fat, salt, and sugar products. This necessitates continuous adaptation in Lidl's product development and sourcing to align with local dietary guidelines and prevailing consumer health consciousness.

These public health policies extend beyond nutritional content to encompass sustainability and ethical sourcing. Lidl must navigate varying regulations across its operating markets regarding environmental impact, waste reduction, and fair labor practices in its supply chain. For example, the European Union's Farm to Fork Strategy, which aims for a more sustainable food system, influences sourcing decisions and product labeling. By 2025, many EU member states are expected to have implemented further measures related to sustainable packaging and reduced food waste, requiring Lidl to proactively integrate these principles into its business model.

- Regulatory Compliance: Lidl must ensure its private-label products meet varying national and supranational food content regulations (e.g., sugar, salt, fat limits) as they evolve, impacting product formulation.

- Advertising Restrictions: Adherence to increasingly stringent rules on advertising food products, particularly those deemed unhealthy, affects marketing strategies and promotional activities.

- Sustainability Standards: Compliance with environmental and ethical sourcing mandates, such as those driven by the EU's Farm to Fork Strategy, influences supply chain management and product development.

- Local Adaptation: The need to adapt to diverse local dietary guidelines and consumer health trends across different markets requires flexibility in product offerings and sourcing strategies.

Government policies and regulations significantly influence Lidl's operational landscape, from food safety standards to labor laws. For instance, the statutory minimum wage in Germany, a key market for Lidl, increased to €12.41 per hour in January 2024, directly impacting payroll costs.

Trade policies, including tariffs and import/export restrictions, also play a crucial role. The UK's post-Brexit trade environment, for example, with its reliance on imported food (around 30%), presents ongoing challenges for retailers like Lidl in managing supply chains and pricing.

Furthermore, public health initiatives, such as efforts to tackle childhood obesity, lead to stricter regulations on food content and advertising, requiring Lidl to adapt its product development and marketing strategies across its diverse markets.

What is included in the product

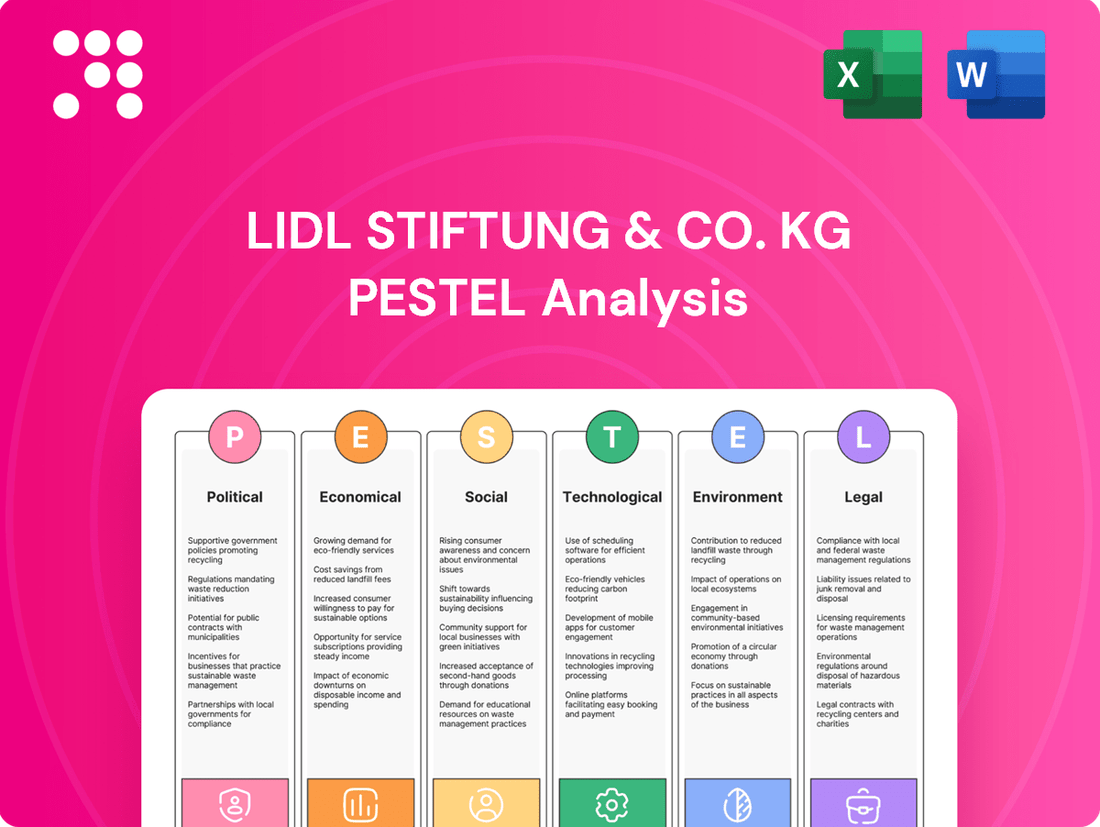

This PESTLE analysis examines the external macro-environmental factors impacting Lidl Stiftung & Co. KG across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights into how these forces shape Lidl's strategic landscape, offering a foundation for informed decision-making and competitive advantage.

This Lidl PESTLE analysis acts as a pain point reliever by providing a clear, summarized version of external factors, enabling quick referencing during meetings and facilitating strategic decision-making.

Economic factors

Persistent high inflation significantly erodes consumer spending power, compelling shoppers to prioritize value. This trend directly benefits discount grocers like Lidl, as consumers actively seek more affordable alternatives for essential goods.

In 2023, Lidl continued to demonstrate robust growth, with reports indicating a substantial increase in turnover and market share across key European markets. For instance, in the UK, Lidl's sales grew by 9.4% in the 12 weeks leading up to early 2024, reaching £9.4 billion annually. This performance underscores consumers' shift towards their value-driven offerings.

Lidl's core business model, built on operational efficiency, a streamlined supply chain, and a strong emphasis on high-quality private-label brands, positions it advantageously during economic downturns. This strategy allows them to maintain competitive pricing, directly appealing to cost-conscious consumers navigating inflationary pressures.

As a global retailer, Lidl's profitability is directly impacted by exchange rate volatility. For example, a stronger Euro could make imported goods cheaper for Lidl in Germany but reduce the value of revenues earned in countries with weaker currencies. Conversely, a weaker Euro could increase procurement costs for goods imported into Germany.

Lidl's strategic emphasis on private-label brands and local sourcing, as seen with Lidl Romania supporting exports of Romanian products to other European markets, helps to naturally hedge against some currency fluctuations by aligning costs and revenues within specific regions.

Global economic shifts continue to influence these currency dynamics. For instance, the Euro experienced fluctuations against the US Dollar throughout 2024, impacting the cost of goods sourced from or sold into the US market.

Economic growth generally boosts consumer spending, but Lidl's value proposition often thrives when consumers are more budget-conscious. For instance, in the US, real GDP growth was projected to be around 2.3% in 2024, according to the Congressional Budget Office. While this growth might encourage some spending, persistent inflation, which averaged 4.1% in 2023 according to the Bureau of Labor Statistics, keeps affordability a key concern for many shoppers.

Conversely, higher unemployment rates directly benefit discount retailers like Lidl. In the Eurozone, unemployment stood at approximately 6.0% in early 2024, a figure that, while relatively low historically, still represents a significant portion of the workforce where cost-saving is a priority. Lidl's model, focusing on efficient operations and private-label brands, is well-positioned to capture market share during periods of economic uncertainty or when consumers actively seek to reduce their grocery bills.

Interest Rates and Investment Climate

Interest rates directly impact Lidl's operational costs and expansion capabilities. For instance, higher rates increase the expense of financing new store constructions or upgrading existing facilities, potentially slowing down growth. Conversely, lower interest rates, such as those seen in many European economies during 2024 and anticipated into 2025, make borrowing cheaper, thus supporting Lidl's ambitious store opening targets.

The overall investment climate, heavily influenced by interest rate policies from central banks like the European Central Bank (ECB), plays a crucial role. A stable and predictable economic environment with manageable inflation and reasonable interest rates encourages significant capital expenditure. Lidl's strategy of opening hundreds of new stores globally in 2024 and 2025 relies on this favorable financial backdrop to secure necessary funding at competitive terms.

- Impact on Borrowing Costs: Higher interest rates increase the cost of debt financing for capital projects.

- Support for Growth: Lower interest rates facilitate Lidl's expansion plans, such as the reported hundreds of new store openings planned for 2024-2025.

- Investment Climate: A positive investment climate, often correlated with stable interest rates, encourages large-scale capital investments by retailers like Lidl.

- Central Bank Influence: Decisions by central banks, like the ECB's monetary policy adjustments, directly shape the interest rate environment affecting Lidl's financial strategy.

Cost of Goods and Supply Chain Efficiency

The cost of essential inputs like raw materials, energy, and transportation directly impacts Lidl's capacity to maintain its signature competitive pricing. For instance, global energy prices saw significant volatility in 2024, with oil prices fluctuating. Lidl's focus on streamlining its supply chain and directly sourcing private-label products is a key strategy for controlling these rising expenses.

Lidl's substantial purchasing volume is a significant advantage, allowing it to negotiate favorable terms with suppliers. This leverage is critical in supporting its low-price strategy, especially as consumer demand for value remains high. In 2024, discounters like Lidl continued to gain market share in many European countries, underscoring the importance of cost management.

- Raw Material Costs: Fluctuations in agricultural commodity prices, such as grains and dairy, directly influence the cost of Lidl's private-label food products.

- Energy Prices: Increased energy costs for refrigeration, logistics, and store operations in 2024 put pressure on margins, necessitating efficiency gains.

- Transportation Efficiency: Optimizing logistics routes and utilizing efficient transport modes are vital for mitigating rising fuel and freight costs.

- Direct Sourcing: Lidl's direct sourcing model for private labels allows for greater control over product quality and cost, bypassing intermediaries.

Persistent inflation continues to drive consumers toward value-oriented retailers like Lidl, as evidenced by its continued market share gains. For example, Lidl's sales in the UK saw a 9.4% increase in the 12 weeks leading up to early 2024, contributing to an annual turnover of £9.4 billion, highlighting the effectiveness of its cost-conscious strategy amid economic pressures.

Exchange rate volatility remains a key economic factor for Lidl, a global operator. Fluctuations in currencies, such as the Euro against the US Dollar throughout 2024, directly impact the cost of imported goods and the value of international revenues. Lidl's strategy of emphasizing private labels and local sourcing helps to mitigate some of these currency risks by aligning costs and revenues regionally.

Interest rates significantly influence Lidl's expansion plans and operational financing. Higher rates increase borrowing costs for new store developments, while lower rates, as observed in many European economies in 2024 and projected into 2025, make capital expenditure more affordable, supporting Lidl's ambitious global store opening targets.

The cost of raw materials and energy directly affects Lidl's pricing strategy. Volatile energy prices in 2024 and fluctuating agricultural commodity costs necessitate efficient supply chain management and direct sourcing of private-label products to maintain competitive pricing and control expenses.

| Economic Factor | Impact on Lidl | Supporting Data (2023-2025) |

|---|---|---|

| Inflation | Drives demand for value retailers | UK sales up 9.4% (early 2024); Consumer spending prioritizes affordability. |

| Exchange Rates | Affects import costs and revenue valuation | Euro fluctuated against USD in 2024, impacting international trade. |

| Interest Rates | Influences financing costs for expansion | Low rates in Europe (2024-2025) support Lidl's hundreds of new store openings. |

| Input Costs (Energy, Materials) | Pressures pricing and margins | Volatile energy prices (2024); Agricultural commodity price fluctuations. |

Preview Before You Purchase

Lidl Stiftung & Co. KG PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Lidl Stiftung & Co. KG covers political, economic, social, technological, legal, and environmental factors impacting the company. You'll gain deep insights into the strategic landscape Lidl operates within.

Sociological factors

Consumers are increasingly prioritizing value, leading many to shift their spending towards discount retailers. This trend has directly benefited Lidl, with reports in late 2024 indicating a notable increase in shopper visits and a corresponding gain in market share across several key European markets. This heightened price sensitivity means shoppers are actively seeking out deals and lower prices, a core tenet of Lidl's business model.

Furthermore, there's a discernible trend towards more localized shopping experiences and a preference for smaller, more convenient store formats. Lidl's strategy of maintaining adaptable store sizes allows it to effectively cater to this demand, fitting into urban environments and neighborhood shopping patterns more readily than larger hypermarkets.

Consumers are increasingly prioritizing health and wellness, driving demand for organic, natural, and sustainably sourced food items. This shift directly impacts Lidl's product selection and the development of its private-label brands, pushing for healthier options.

Lidl must cater to burgeoning trends like vegetarianism, veganism, and flexitarianism. For instance, in 2024, the plant-based food market continued its robust growth, with European sales projected to reach over €7.6 billion by 2025, according to various market analyses. Adapting its offerings to meet this demand while preserving its core value proposition is crucial for Lidl's continued success.

Demographic shifts are significantly shaping how retailers like Lidl operate. For instance, aging populations in many developed markets, such as Germany where Lidl has a strong presence, mean a growing customer base that may prioritize convenience and accessibility. In 2023, Germany's population aged 65 and over represented approximately 22.4% of the total, a figure expected to rise.

Urbanization also plays a crucial role. As more people move into cities, the demand for smaller, conveniently located stores increases. Lidl's strategy of opening mid-sized stores in urban areas caters directly to this trend, allowing for easier access and quicker shopping trips for city dwellers. This also aligns with changing household sizes; with an average household size in the UK, a key market for Lidl, hovering around 2.3 people in recent years, the need for bulk purchases is diminishing, favoring more frequent, smaller shops.

Lifestyle and Convenience Needs

Modern lifestyles increasingly prioritize convenience, fueling demand for quick shopping solutions and ready-to-eat options. Lidl is responding by investing in technologies such as self-scanning apps and self-checkout systems. These innovations aim to streamline the in-store experience, catering to customers who value speed and flexibility. For instance, by the end of 2024, Lidl plans to roll out enhanced self-checkout options across 80% of its German stores, reflecting a significant commitment to this trend.

The company's strategy acknowledges that consumers are often time-poor and seek efficient ways to complete their grocery shopping. This includes not only faster checkout processes but also a wider availability of convenient food items. Lidl's expansion of its fresh and ready-to-eat ranges in 2024, which saw a 15% increase in product offerings, directly addresses this societal shift. This focus on convenience is crucial for maintaining competitiveness in a market where customer time is a valuable commodity.

Ethical Consumption and Brand Trust

Consumers are increasingly scrutinizing the ethical dimensions of their purchases, with a growing emphasis on fair labor standards and environmental stewardship. This societal shift directly impacts how brands are perceived and valued.

Lidl's proactive stance on sustainability, fair wages, and responsible sourcing, as outlined in its Code of Conduct and through robust supplier engagement, cultivates significant brand trust. This resonates strongly with the expanding segment of ethically-conscious shoppers.

- Brand Trust: Lidl's commitment to ethical practices enhances its reputation, making it a preferred choice for consumers prioritizing values.

- Consumer Loyalty: By aligning with ethical consumption trends, Lidl fosters deeper customer loyalty and attracts new market segments.

- Market Differentiation: Demonstrating a genuine commitment to social responsibility sets Lidl apart from competitors in a crowded retail landscape.

Societal shifts towards value are a significant driver for Lidl's success, with consumers increasingly seeking affordability. This is evidenced by Lidl's market share growth in key European regions throughout 2024, directly benefiting from heightened price sensitivity. The company's core model of offering low prices resonates strongly with this trend.

The growing demand for convenience and healthier options, including plant-based foods, is reshaping Lidl's product strategy. With the plant-based market in Europe projected to exceed €7.6 billion by 2025, Lidl's adaptation of its private-label brands to include more organic and vegan choices is crucial for capturing this expanding consumer base.

Demographic changes, such as aging populations and increasing urbanization, necessitate adaptable retail strategies. In Germany, where over 22.4% of the population was aged 65 or older in 2023, convenience and accessibility are paramount. Lidl's mid-sized urban store formats directly address these evolving consumer needs and lifestyle patterns.

Ethical consumerism is a growing force, with shoppers scrutinizing brands' labor and environmental practices. Lidl's commitment to fair wages and responsible sourcing, as detailed in its conduct policies, builds significant brand trust and loyalty among ethically-minded consumers, differentiating it in a competitive market.

| Sociological Factor | Impact on Lidl | Supporting Data/Trend (2024/2025) |

|---|---|---|

| Value Consciousness | Increased customer traffic and market share gains. | Notable increase in shopper visits and market share growth across key European markets (late 2024). |

| Health & Wellness / Dietary Trends | Demand for organic, natural, and plant-based options. | European plant-based food market projected to reach over €7.6 billion by 2025. |

| Demographics (Aging Population) | Focus on convenience and accessibility. | Germany's population aged 65+ was approx. 22.4% in 2023, a figure expected to rise. |

| Ethical Consumerism | Enhanced brand trust and loyalty. | Growing consumer emphasis on fair labor standards and environmental stewardship. |

Technological factors

Lidl is significantly boosting its digital presence, with substantial investments in technology to improve customer engagement. The Lidl Plus loyalty app, for instance, has become a key tool, offering personalized discounts and digital receipts. By the end of 2023, Lidl Plus reported over 50 million downloads globally, showcasing its widespread adoption and impact on customer loyalty.

While its core strength remains in physical stores, technology is vital for operational efficiency and customer convenience. Innovations like self-scanning checkouts are being rolled out across more stores, reducing wait times and enhancing the in-store experience. This digital integration supports Lidl's strategy of providing value through streamlined processes.

Lidl's commitment to advanced logistics and warehouse automation is a cornerstone of its operational efficiency, directly impacting its ability to offer competitive pricing. These technologies streamline inventory management and order fulfillment, crucial for a fast-moving consumer goods retailer.

Significant investments in automated distribution centers, like the substantial facility in Luton, underscore Lidl's strategy to optimize its entire logistical network. This focus on automation helps reduce operational costs and improve delivery speed across its European markets.

Lidl is increasingly leveraging data analytics from its loyalty programs and sales data to gain a deeper understanding of consumer preferences. This allows them to optimize their product assortments, ensuring they stock what customers want most. For instance, by analyzing purchasing patterns, Lidl can identify regional demand for specific ethnic foods or seasonal items, leading to more targeted inventory management.

This data-driven approach directly supports strategic decisions in product development and promotional campaigns. By understanding which promotions resonate most effectively with different customer segments, Lidl can allocate marketing budgets more efficiently. In 2023, Lidl reported a significant increase in loyalty program membership, providing a richer dataset for these personalization efforts, aiming to boost customer retention and average basket size.

In-store Technology and Customer Experience

Lidl is actively integrating in-store technology to boost efficiency and customer satisfaction. The widespread adoption of electronic shelf labels (ESLs) and self-checkout stations streamlines operations. For instance, by the end of 2023, Lidl had implemented ESLs in over 11,000 stores across Europe, significantly reducing manual price changes and improving accuracy.

Further enhancing the customer journey, Lidl is piloting app-based self-scanning features. This allows shoppers to scan items as they shop, offering greater convenience and control over their purchases. This digital innovation is part of Lidl's broader strategy to leverage technology for a more seamless and personalized retail experience.

- Electronic Shelf Labels (ESLs): Implemented across thousands of European stores by end of 2023, improving pricing accuracy and reducing labor costs.

- Self-Checkout Stations: Widely rolled out to expedite the checkout process and offer customers more choice.

- In-App Self-Scanning: Piloted to provide customers with enhanced convenience and control during their shopping trips.

Generative AI for Marketing and Operations

Lidl Stiftung & Co. KG is actively exploring generative AI to enhance its marketing efforts, as seen in its use for campaign development. This adoption highlights a strategic move towards leveraging advanced technology for customer engagement and brand building. For instance, in 2024, many retailers reported increased efficiency in content creation and personalized marketing through AI tools, with some seeing up to a 15% reduction in campaign execution time.

The successful integration of generative AI in marketing suggests a broader potential for its application across Lidl's operations. This could include streamlining content creation for various platforms, personalizing customer communications, and even optimizing internal processes. By embracing AI, Lidl aims to maintain a competitive edge in a rapidly evolving retail landscape.

The implications of generative AI for Lidl's operational efficiencies are significant. Consider these potential applications:

- Automated Content Generation: Creating product descriptions, social media posts, and promotional materials faster and at scale.

- Personalized Customer Experiences: Developing tailored offers and communication based on individual customer data.

- Optimized Marketing Campaigns: Improving ad targeting and creative asset generation for better ROI.

- Enhanced Operational Workflows: Potentially automating tasks in areas like customer service or internal documentation.

Lidl is heavily investing in technology to enhance customer experience and operational efficiency. The Lidl Plus loyalty app, with over 50 million global downloads by the end of 2023, is central to this strategy, offering personalized deals and digital receipts. This digital push complements their strong physical store presence.

Technological advancements are crucial for streamlining operations, from automated distribution centers to in-store innovations like self-checkout stations and electronic shelf labels (ESLs). By the close of 2023, over 11,000 Lidl stores across Europe featured ESLs, improving pricing accuracy and reducing labor. These investments aim to lower costs and speed up delivery.

Lidl is leveraging data analytics from its loyalty program and sales to understand consumer preferences better, optimizing product assortments and marketing. The significant growth in loyalty program membership in 2023 provides a richer dataset for personalization efforts, aiming to boost retention and average basket size.

The company is also exploring generative AI for marketing, with potential applications in content creation, personalized customer communication, and campaign optimization. In 2024, retailers using AI tools reported increased efficiency, with some seeing up to a 15% reduction in campaign execution time.

Legal factors

Lidl Stiftung & Co. KG must navigate a complex web of food safety and hygiene regulations that differ significantly across the European Union and other operating regions. For instance, the EU's General Food Law (Regulation (EC) No 178/2002) sets overarching safety standards, while specific national legislation, like the UK's Food Safety Act 1990, imposes detailed requirements on handling, storage, and labeling.

Failure to comply can result in substantial fines and reputational damage. In 2023, the Food Standards Agency in the UK issued thousands of food hygiene improvement notices and closure orders to businesses failing to meet standards, highlighting the enforcement rigor.

Maintaining impeccable hygiene and safety protocols is not just a legal obligation but a critical factor in preserving consumer trust and brand loyalty, especially for a retailer like Lidl that relies on high sales volumes and customer repeat business.

Consumer protection laws are a significant legal factor for Lidl. These regulations govern everything from product quality and safety to advertising accuracy and fair trading. For instance, in the European Union, the General Product Safety Regulation (2001/95/EC) mandates that products placed on the market must be safe for consumers, impacting Lidl's sourcing and quality control processes.

Lidl must meticulously ensure its marketing campaigns and product descriptions adhere to these consumer protection standards to avoid penalties and maintain customer trust. In 2023, the European Commission reported a notable increase in enforcement actions against misleading advertising, highlighting the critical need for compliance. Lidl's commitment to transparent pricing and product information is therefore paramount in navigating this legal landscape.

Lidl's operations are heavily influenced by labor and employment laws, requiring strict adherence to regulations concerning working hours, employee rights, and fair wages. For instance, in Germany, the Working Time Act (Arbeitszeitgesetz) sets limits on daily and weekly working hours, with provisions for rest periods. Failure to comply can result in significant fines and reputational damage.

The company's strategic moves, such as streamlining head office functions to potentially create more in-store positions, must navigate existing employment legislation. This includes ensuring any restructuring or new job creation aligns with national and regional employment standards, such as those governing redundancy procedures or the terms of new contracts, to avoid legal challenges.

Data Protection and Privacy Regulations (e.g., GDPR)

Lidl's extensive use of digital platforms and loyalty programs necessitates rigorous adherence to data protection and privacy regulations, such as the General Data Protection Regulation (GDPR) in Europe and comparable legislation globally. Failure to safeguard customer data not only erodes consumer trust but can also lead to substantial legal repercussions and fines. For instance, in 2023, the Irish Data Protection Commission fined Meta €1.2 billion under GDPR for data transfer violations, highlighting the significant financial risks involved.

Key considerations for Lidl include:

- Data Minimization: Collecting only the data strictly necessary for operations and loyalty programs.

- Consent Management: Ensuring clear and informed consent for data processing activities.

- Data Security: Implementing robust measures to protect customer information from breaches.

- Transparency: Clearly communicating data usage policies to customers.

Competition and Anti-Monopoly Laws

Lidl's rapid expansion and increasing market share in various regions, particularly in Europe, attract attention from competition authorities. These bodies actively monitor the retail landscape to ensure fair play and prevent any single entity from gaining an unfair advantage that could harm consumers or smaller businesses. For instance, in 2023, the European Commission continued its investigations into various sectors for potential anti-competitive practices, and while specific Lidl actions might not be publicly detailed, the general regulatory environment necessitates compliance.

Lidl must navigate a complex web of national and international competition laws. These regulations are designed to foster a healthy market by preventing monopolies and cartels, ensuring that Lidl's growth strategies, including pricing and supplier agreements, do not stifle competition. Failure to comply can result in significant fines and operational restrictions.

- Regulatory Scrutiny: Competition authorities globally, including the European Commission and national bodies, monitor Lidl's market activities.

- Fair Competition Mandate: Laws aim to prevent market dominance abuse, ensuring fair pricing and consumer choice.

- Compliance Requirements: Lidl must adhere to regulations concerning mergers, acquisitions, pricing strategies, and supplier relationships to avoid penalties.

- Market Share Impact: Aggressive expansion leading to substantial market share can trigger closer regulatory examination.

Lidl's operations are significantly shaped by evolving environmental regulations, particularly concerning waste management, packaging, and carbon emissions. For example, the EU's Circular Economy Action Plan aims to reduce waste and promote sustainable resource use, impacting Lidl's supply chain and product lifecycle management.

The company must also comply with stringent food safety and hygiene standards across its operating countries, as mandated by regulations like the EU's General Food Law. Non-compliance can lead to substantial fines and severe reputational damage, as evidenced by thousands of food hygiene improvement notices issued to businesses in the UK in 2023.

Furthermore, Lidl faces increasing legal scrutiny regarding its labor practices and data protection. Adherence to employment laws, such as Germany's Working Time Act, and data privacy regulations like GDPR, is crucial to avoid penalties. In 2023, data protection authorities issued significant fines, such as a €1.2 billion GDPR penalty against Meta, underscoring the financial risks of non-compliance.

Environmental factors

Lidl Stiftung & Co. KG has committed to achieving net zero emissions across its operations and supply chains by 2050. This ambitious goal involves substantial reductions in Scope 1, 2, and 3 greenhouse gas emissions, reflecting a deep-seated dedication to environmental stewardship.

In 2023, Lidl reported a 13% reduction in CO2 emissions per ton of goods sold compared to 2022, a tangible step towards its net-zero targets. The company is investing heavily in renewable energy sources for its stores and logistics, with over 90% of its electricity consumption already sourced from renewables in 2024.

Lidl is actively pursuing waste reduction, with a significant focus on minimizing plastic packaging across its operations. This commitment is central to its strategy for fostering a circular economy.

In 2023, Lidl announced plans to reduce its own-brand primary plastic packaging by 20% by 2025, building on previous efforts. The company is also investing in projects aimed at identifying innovative solutions for waste reduction and promoting upcycling initiatives.

Lidl is making significant strides in reducing its environmental impact. By 2024, the company aims to power all its German stores with 100% renewable electricity, a commitment that extends to its logistics centers. This transition is a key part of their strategy to lower their overall carbon footprint.

Further demonstrating their dedication, Lidl is actively improving energy efficiency across its operations. This includes upgrading lighting systems to LED technology in stores and warehouses, which can lead to substantial energy savings. They are also exploring the use of alternative fuels, such as green hydrogen, for their vehicle fleet, signaling a move towards decarbonizing their supply chain.

Sustainable Sourcing and Biodiversity

Lidl is actively tackling emissions within agriculture, forestry, and land use (FLAG) sectors, collaborating with its suppliers to establish ambitious climate targets. This focus is crucial as the agricultural sector is a significant contributor to global greenhouse gas emissions. By working with suppliers, Lidl aims to reduce the environmental footprint of its supply chain, a key aspect of sustainable sourcing.

The company's commitment extends to tangible biodiversity initiatives. Examples include creating pollinator-friendly environments at its stores and supporting community garden projects. These actions demonstrate a broader dedication to environmental stewardship beyond just emission reduction, recognizing the interconnectedness of climate and biodiversity.

In 2023, Lidl announced its goal to reduce absolute FLAG emissions by 22% by 2030 compared to a 2019 baseline. This target is part of its broader science-based targets aimed at limiting global warming to 1.5°C. The company's efforts in sustainable sourcing and biodiversity are increasingly important as consumers and regulators demand greater environmental accountability from retailers.

Lidl's approach to sustainable sourcing also involves ensuring responsible practices throughout its value chain, from raw material acquisition to product delivery. This includes:

- Collaboration with suppliers on climate action plans.

- Investment in biodiversity projects, such as habitat creation for pollinators.

- Commitment to reducing FLAG emissions by 22% by 2030.

Environmental Regulations and Reporting

Lidl, like all major retailers, faces a complex web of environmental regulations governing everything from carbon emissions and waste management to the sourcing of materials. For instance, in the EU, the Waste Framework Directive sets ambitious recycling targets, and Lidl must demonstrate compliance through its operational practices and supply chain management. The company's commitment to reducing its environmental footprint is increasingly scrutinized by both consumers and regulatory bodies.

The growing demand for corporate transparency regarding environmental impact means Lidl is under pressure to report on its sustainability efforts. This includes detailing progress on reducing greenhouse gas emissions, improving energy efficiency in its stores and logistics, and implementing more sustainable packaging solutions. For example, many European countries are implementing Extended Producer Responsibility (EPR) schemes that require retailers to manage the end-of-life of their products and packaging, adding another layer of reporting and operational responsibility.

- Emissions Targets: Lidl is working towards science-based targets for emissions reduction, aligning with global climate goals.

- Waste Reduction: The retailer aims to significantly reduce food waste and improve recycling rates across its operations, with specific targets often set by national legislation.

- Sustainable Sourcing: Regulations and consumer expectations are pushing Lidl to ensure its sourcing of products, such as palm oil or timber, meets sustainability criteria.

- Packaging Initiatives: Compliance with evolving packaging waste directives, including those promoting reusable or recyclable materials, is a key focus.

Lidl's environmental strategy is deeply integrated into its operations, aiming for net-zero emissions by 2050. The company reported a 13% reduction in CO2 emissions per ton of goods sold in 2023 compared to the previous year, underscoring its progress. By 2024, Lidl is committed to powering all its German stores with 100% renewable electricity, a significant step in decarbonizing its retail footprint.

Furthering its commitment to sustainability, Lidl aims to slash its own-brand primary plastic packaging by 20% by 2025. The company is also focused on reducing absolute agriculture, forestry, and land use (FLAG) emissions by 22% by 2030, referencing a 2019 baseline. These efforts are crucial as regulatory bodies and consumers increasingly demand environmental accountability from major retailers.

Lidl's environmental initiatives are shaped by evolving regulations and consumer expectations. For instance, compliance with EU directives on waste management and packaging is paramount. The company's transparency in reporting emissions reduction, energy efficiency, and sustainable packaging solutions is vital for maintaining stakeholder trust and meeting legal obligations.

| Environmental Factor | Lidl's Commitment/Action | Target/Metric | Year |

|---|---|---|---|

| Greenhouse Gas Emissions | Net-zero emissions goal | Net-zero by 2050 | 2050 |

| CO2 emissions reduction | 13% reduction per ton of goods sold | 2023 | |

| Renewable Energy | Powering stores with renewables | 100% renewable electricity in German stores | 2024 |

| Plastic Packaging | Reducing plastic in own-brand products | 20% reduction in primary plastic packaging | By 2025 |

| FLAG Emissions | Reducing emissions in agriculture, forestry, and land use | 22% absolute reduction | By 2030 (vs. 2019 baseline) |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Lidl Stiftung & Co. KG is informed by a comprehensive review of official government publications, reputable financial news outlets, and leading market research firms. This approach ensures that our insights into political, economic, social, technological, legal, and environmental factors are grounded in timely and authoritative data.