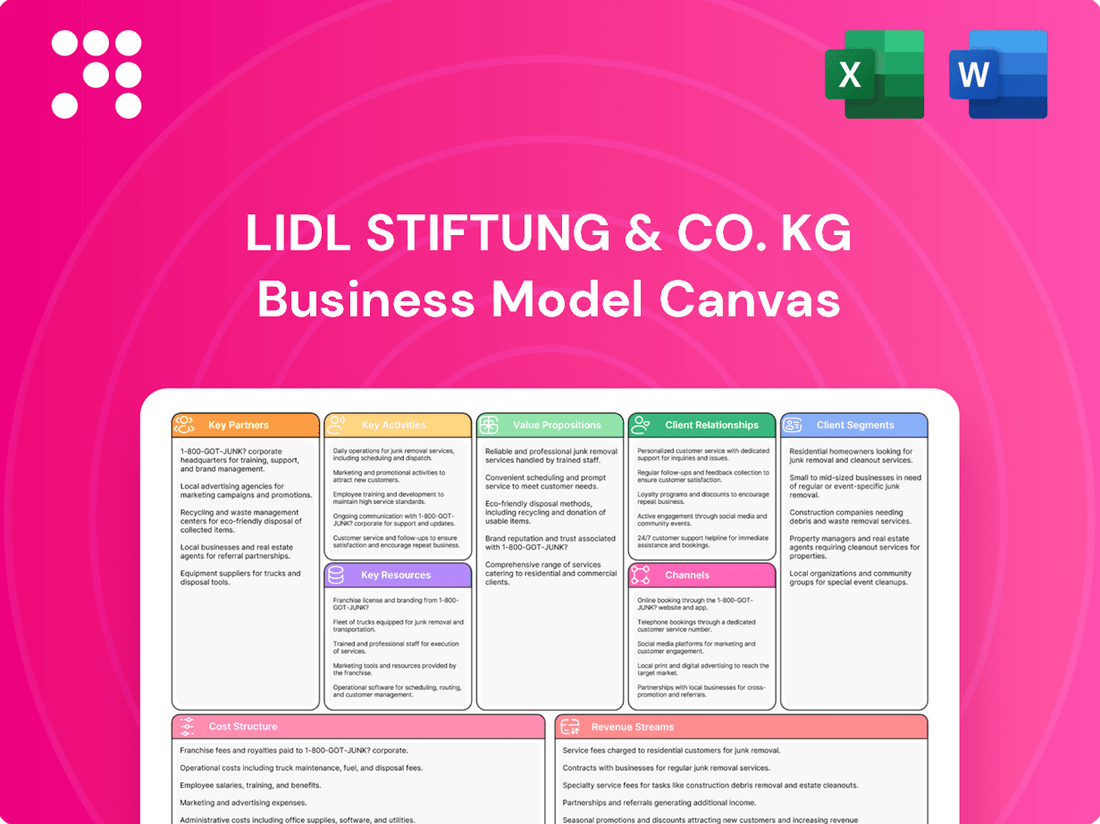

Lidl Stiftung & Co. KG Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Lidl Stiftung & Co. KG Bundle

Unlock the full strategic blueprint behind Lidl Stiftung & Co. KG's business model. This in-depth Business Model Canvas reveals how the company drives value through its efficient supply chain and private label focus, captures market share with its no-frills approach, and stays ahead in a competitive landscape by consistently offering low prices. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into a retail giant's success.

Partnerships

Lidl cultivates deep, enduring alliances with its strategic suppliers, both locally and globally. These partnerships are foundational to guaranteeing a steady influx of high-quality goods, particularly for Lidl's popular private-label brands. This focus ensures product consistency and supports Lidl's value proposition.

In 2024, Lidl Ireland demonstrated its commitment to local economies by boosting its sourcing from Irish businesses to an impressive €1.67 billion. This substantial investment underscores Lidl's dedication to nurturing its local agri-food supplier base and integrating them into its European supply chain.

A prime example of these strategic collaborations is the multi-year, €100 million agreement with Liffey Meats for beef. This significant deal not only secures a key product line for Lidl but also opens avenues for Irish beef exports to Lidl stores across the continent, reinforcing the mutual benefits of their partnership.

Lidl’s discount strategy hinges on a robust supply chain, making logistics and distribution partners crucial. These collaborations ensure goods move efficiently from suppliers to Lidl's network of stores, keeping costs low and product availability high. For instance, in 2024, Lidl continued to expand its distribution center footprint, with significant investments in new facilities across Europe to support its growing store count and optimize delivery routes.

While Lidl invests heavily in its own logistics infrastructure, including state-of-the-art warehouses, it also relies on external specialists. These partnerships often cover fleet management, last-mile delivery solutions, and specialized transportation for temperature-sensitive goods, enabling Lidl to maintain operational flexibility and cost control.

Lidl actively collaborates with technology and digital solution providers to drive its digital transformation and enhance customer experiences. These partnerships are crucial for developing and implementing innovative features, such as the self-scanning functionality within the Lidl Plus app, which saw significant adoption in 2024 as customers increasingly embraced contactless shopping options.

These collaborations extend to operational efficiencies, including the integration of electronic shelf labels across many of its stores. This technology, widely adopted by 2024, allows for real-time price updates and reduces manual labor, contributing to a more streamlined and cost-effective retail environment for Lidl.

By partnering with these tech firms, Lidl aims to optimize the entire customer journey, from browsing to checkout, and improve internal processes. These strategic alliances are fundamental to maintaining Lidl's competitive advantage in the fast-evolving retail landscape, ensuring agility and responsiveness to market demands.

Real Estate Developers and Landlords

Lidl's ambitious growth hinges on strong alliances with real estate developers and landlords. This collaboration is crucial for securing prime locations for both new stores and essential distribution centers, fueling their aggressive expansion across Europe and the United States.

The company prioritizes sites offering high visibility and easy accessibility to maximize customer reach. For instance, Lidl's significant expansion plans in the UK, aiming for hundreds of new stores, and its announcements of numerous new US openings for 2025, underscore the continuous need for these vital real estate partnerships.

- Securing prime retail and logistics locations

- Facilitating store network expansion

- Supporting warehouse and distribution center development

- Enabling market penetration and accessibility

Sustainability and Community Partners

Lidl actively partners with organizations to advance its sustainability objectives, focusing on waste reduction, climate action, and community enrichment. For instance, its collaboration with Business in the Community Northern Ireland for the 'Lidl Green Fund' showcases a commitment to local environmental projects.

These strategic alliances are crucial for embedding environmental and social responsibility throughout Lidl's operations and supply chain. By working with external bodies, Lidl can leverage expertise and resources to achieve ambitious targets, such as those set by the Science Based Targets initiative (SBTi).

- Waste Reduction: Partnerships aid in developing innovative solutions for minimizing food waste and packaging.

- Climate Action: Collaborations support Lidl's efforts to reduce its carbon footprint, aligning with SBTi goals.

- Community Support: Initiatives like the 'Lidl Green Fund' demonstrate a commitment to local environmental and social well-being.

- Supply Chain Integration: Working with partners helps implement sustainable practices across the entire value chain.

Lidl's success is significantly bolstered by its strategic partnerships with a diverse range of entities. These alliances are critical for operational efficiency, market expansion, and achieving sustainability goals.

In 2024, Lidl's commitment to local economies was evident through substantial agreements with suppliers. For example, a €100 million deal with Liffey Meats for beef not only secured a key product but also facilitated Irish beef exports across Europe.

Logistics partners are indispensable, ensuring efficient movement of goods. In 2024, Lidl continued investing in its distribution network, leveraging external specialists for fleet management and specialized transport to maintain cost control and operational flexibility.

Technology collaborations are vital for enhancing customer experience and operational streamlining. The widespread adoption of features like self-scanning via the Lidl Plus app in 2024, and the integration of electronic shelf labels, highlight these fruitful partnerships.

| Partner Type | Key Role | 2024 Impact/Focus |

|---|---|---|

| Suppliers (Local & Global) | Ensuring high-quality product influx, particularly for private labels. | €1.67 billion sourced from Irish businesses by Lidl Ireland; €100 million beef deal with Liffey Meats. |

| Logistics & Distribution | Efficient supply chain management, cost optimization. | Expansion of distribution centers across Europe to support store growth. |

| Technology Providers | Digital transformation, enhanced customer experience. | Development of Lidl Plus app features (e.g., self-scanning); integration of electronic shelf labels. |

| Real Estate Developers | Securing prime locations for store and distribution center expansion. | Support for hundreds of new stores planned in the UK and numerous US openings. |

| Sustainability Organizations | Advancing environmental and social responsibility. | Collaboration on waste reduction, climate action (SBTi alignment), and community projects (e.g., Lidl Green Fund). |

What is included in the product

This Business Model Canvas outlines Lidl's strategy of providing high-quality, private-label groceries at low prices, leveraging efficient operations and a vast store network to attract a broad, price-conscious customer base.

Lidl's Business Model Canvas acts as a pain point reliever by clearly outlining their cost leadership strategy, addressing customer pain points of high grocery prices.

It simplifies complex operations, relieving the pain of understanding intricate supply chains by presenting a clear value proposition focused on affordability and efficiency.

Activities

Lidl's core activity is the meticulous management of its vast supply chain, ensuring a seamless flow from sourcing to shelf. This involves cultivating strong partnerships with thousands of global suppliers and orchestrating operations across a widespread network of distribution centers.

The company's commitment to a lean, vertically integrated model is central to its success. This approach significantly cuts down operational costs, allowing Lidl to consistently offer highly competitive prices to its customers, a key differentiator in the grocery market.

In 2023, Lidl's supply chain handled over 1.5 million deliveries weekly across its European operations, underscoring the sheer scale of its logistics. This efficiency is crucial for maintaining product freshness and availability, directly impacting customer satisfaction and sales volumes.

Lidl heavily relies on its private-label brands, which constitute a substantial part of its product assortment. This necessitates ongoing development, rigorous quality assurance, and strategic sourcing to maintain competitive pricing and consistent quality. In 2023, private labels accounted for approximately 80% of Lidl's sales volume in many markets, demonstrating their critical role in the business model.

Developing and sourcing these private-label products allows Lidl to exert significant control over both product quality and cost. This direct influence is fundamental to delivering on its core value proposition of offering high-quality goods at low prices. For instance, Lidl's investment in its own brands helps it avoid the markups associated with national brands.

Furthermore, Lidl is actively expanding its portfolio of plant-based private-label products. This strategic move directly supports its sustainability objectives and caters to the growing consumer demand for more environmentally friendly and health-conscious options. By 2024, Lidl aims to have over 500 vegan products across its European stores, many under its own brands.

Lidl's core activities revolve around efficiently managing its extensive physical store network. This includes overseeing daily operations, ensuring optimal product merchandising, and delivering excellent customer service across all locations.

A significant focus is on strategic expansion. Lidl plans to open hundreds of new stores in the UK and numerous locations in the United States by 2025, a move designed to capture greater market share and enhance customer accessibility.

Marketing and Brand Promotion

Lidl Stiftung & Co. KG actively pursues marketing and brand promotion to solidify its position as a value-driven retailer. Their strategy centers on highlighting high-quality products at consistently competitive prices. This is achieved through a multi-pronged approach encompassing traditional advertising, a robust digital presence, and engaging promotional offers designed to attract and retain customers.

Key to their promotional efforts is the utilization of digital channels, particularly their user-friendly app, which serves as a hub for exclusive deals and brand interaction. Recent innovative initiatives, like the 'Lidlize' generative AI application, demonstrate a commitment to leveraging cutting-edge technology to boost brand visibility and foster deeper customer engagement. In 2023, Lidl's marketing spend in Germany alone was estimated to be in the hundreds of millions of euros, reflecting the significant investment in maintaining brand awareness and driving sales.

- Targeted Campaigns: Reinforcing the image of high-quality, low-price offerings through multi-channel advertising.

- Digital Engagement: Utilizing their app for promotions and direct customer interaction.

- Innovative Promotion: Employing new technologies like generative AI (e.g., 'Lidlize') to enhance brand awareness and engagement.

- Market Presence: Significant marketing investment, with German ad spending alone reaching substantial figures in recent years.

Sustainability and CSR Initiatives

Lidl’s commitment to sustainability is a core part of its operations, focusing on tangible actions to reduce environmental impact and benefit society. This translates into concrete initiatives that are central to its business model.

These efforts are guided by their comprehensive 'A Better Tomorrow' strategy, which sets clear goals for environmental and social performance. For instance, Lidl aims to significantly cut its carbon footprint across its value chain.

Key activities include minimizing plastic packaging by exploring alternative materials and reducing overall plastic use. In 2023, Lidl announced plans to further reduce plastic in its own-brand packaging by 2025, targeting a 20% reduction compared to 2020 levels.

- Reducing Carbon Footprint: Lidl is investing in energy-efficient stores and logistics, aiming for climate neutrality in its direct operations by 2025.

- Minimizing Plastic Packaging: The company is actively working to make its packaging more sustainable, increasing the use of recycled materials and reducing single-use plastics.

- Supporting Local Communities: Lidl engages in various local initiatives, from donating food to supporting local suppliers, fostering stronger community ties.

- Promoting Responsible Consumption: Through product labeling and awareness campaigns, Lidl encourages customers to make more sustainable choices.

Lidl’s key activities are centered on efficient retail operations and strategic expansion. This includes managing a vast network of physical stores, ensuring optimal product presentation, and delivering a positive customer experience. The company also focuses on its supply chain, maintaining strong supplier relationships and streamlined logistics to ensure product availability and freshness.

The company actively engages in marketing and brand promotion, emphasizing its value proposition of high-quality products at competitive prices. This involves leveraging digital channels, including a dedicated app, and exploring innovative technologies to enhance customer engagement and brand visibility. Lidl’s commitment to sustainability is also a core activity, with initiatives aimed at reducing its environmental impact and promoting responsible consumption.

| Key Activity | Description | 2023/2024 Data Point |

|---|---|---|

| Retail Operations Management | Overseeing daily store functions, merchandising, and customer service. | Hundreds of new store openings planned in the UK and US by 2025. |

| Supply Chain & Logistics | Managing global sourcing, distribution networks, and ensuring product freshness. | Handled over 1.5 million deliveries weekly across European operations in 2023. |

| Marketing & Brand Promotion | Highlighting value, utilizing digital channels, and innovative engagement. | Estimated marketing spend in Germany alone in the hundreds of millions of euros in recent years. |

| Sustainability Initiatives | Reducing environmental impact, plastic use, and promoting responsible consumption. | Aiming for a 20% reduction in plastic in own-brand packaging by 2025 (vs. 2020). |

Full Version Awaits

Business Model Canvas

The Business Model Canvas for Lidl Stiftung & Co. KG that you are currently previewing is the actual document you will receive upon purchase. This is not a sample or a mockup, but a direct representation of the complete, ready-to-use file. You will gain full access to this identical document, ensuring no surprises and immediate usability for your analysis or presentation needs.

Resources

Lidl's extensive store network, exceeding 12,000 locations worldwide, is its most crucial customer interface and the engine of its sales. This vast physical footprint, supported by a robust network of strategically positioned distribution centers, represents a core operational asset.

The company's commitment to its real estate is evident in its ongoing investments in expansion and modernization. These efforts are designed to broaden market penetration and streamline operational efficiency, ensuring Lidl remains competitive.

Lidl's extensive private-label brand portfolio is a critical component of its strategy, enabling it to offer superior quality goods at highly attractive price points. These in-house brands are not just products; they are the very essence of Lidl's value proposition, fostering strong customer allegiance and setting it apart in a crowded retail landscape.

These private labels contribute to a substantial share of Lidl's overall revenue, underscoring their importance to the company's financial performance. For instance, in 2023, private labels represented over 80% of Lidl's sales in many of its core markets, a testament to their customer appeal and the company's successful brand development efforts.

The continuous innovation within these brands, such as the expansion into popular categories like plant-based alternatives, further solidifies Lidl's competitive edge. This commitment to evolving its private-label offerings ensures that Lidl remains relevant and responsive to changing consumer demands and preferences.

Lidl's supply chain is a cornerstone of its business, featuring a highly efficient and largely vertically integrated system. This covers everything from sourcing products to getting them to stores via their own logistics and distribution networks. In 2024, Lidl continued to invest heavily in optimizing this infrastructure, including its extensive network of warehouses and a dedicated transportation fleet.

This robust infrastructure is critical for Lidl's success, enabling them to maintain exceptionally low operational costs. It directly supports their discount model by minimizing expenses associated with getting products onto shelves. A key focus for Lidl in 2024 was the ongoing enhancement of this system to ensure consistent product availability for customers across its European markets.

Human Capital and Expertise

Lidl's extensive global workforce, numbering over 375,000 employees as of early 2024, forms the bedrock of its operational success and customer engagement. This vast human capital includes specialized talent across crucial functions like procurement, supply chain management, store operations, and marketing, all contributing to the efficient execution of Lidl's business strategy.

Strategic investments in employee development and competitive compensation packages are key to Lidl's approach to retaining its skilled workforce. This focus on human capital ensures the consistent delivery of quality service and the ongoing innovation required in the fast-paced retail sector.

- Extensive Workforce: Over 375,000 employees globally in 2024.

- Key Expertise: Skilled personnel in procurement, logistics, retail management, and marketing.

- Retention Strategy: Investment in training and competitive pay to maintain talent.

Financial Capital and Investment Capacity

Lidl's financial capital, bolstered by its position within the Schwarz Group, is a critical resource. This allows for substantial investments in key areas like expanding its store network, enhancing its technological infrastructure, and optimizing its supply chain operations. The group's commitment to growth is evident in its financial figures.

For the 2024 financial year, the Schwarz Group allocated €8.6 billion towards investments. Looking ahead, the company has ambitious plans, projecting an investment of €9.6 billion for the 2025 financial year. This significant financial backing directly supports Lidl's strategic growth initiatives and operational enhancements.

- Financial Strength: Access to the Schwarz Group's considerable financial resources.

- Investment Capacity: Ability to fund major projects such as store expansion and technological upgrades.

- 2024 Investments: Schwarz Group invested €8.6 billion in its 2024 financial year.

- 2025 Investment Plans: Planned investments of €9.6 billion for the 2025 financial year.

Lidl's proprietary IT systems and digital infrastructure are crucial for managing its vast operations, from inventory and logistics to customer engagement and data analytics. These systems enable efficient store operations and provide insights into consumer behavior, driving strategic decisions.

The company's investment in technology extends to optimizing its supply chain and enhancing the in-store experience. In 2024, Lidl continued to roll out upgrades to its point-of-sale systems and explored new digital tools to improve operational efficiency and customer interaction.

Lidl's strong brand reputation and customer loyalty are built on its consistent delivery of high-quality products at low prices. This brand equity is a significant intangible asset, attracting and retaining a large customer base across its international markets.

The company's strategic approach to marketing and its effective communication of its value proposition further reinforce its brand strength. This focus on brand building is key to its sustained market presence and competitive advantage.

| Resource | Description | 2024/2025 Relevance |

|---|---|---|

| IT Systems | Proprietary software for operations, logistics, and data analytics. | Upgrades to POS systems and exploration of new digital tools in 2024. |

| Brand Reputation | Customer loyalty built on quality and low prices. | Key driver for customer acquisition and retention in competitive markets. |

| Marketing Strategy | Effective communication of value proposition. | Reinforces brand strength and market presence. |

Value Propositions

Lidl's core value proposition revolves around competitive pricing and affordability, offering customers high-quality groceries and household goods at prices typically lower than conventional supermarkets. This strategy is a cornerstone of their business model, directly appealing to a broad consumer base seeking value.

This affordability is meticulously crafted through an optimized supply chain, a strong emphasis on high-quality private label brands, and highly efficient, no-frills store operations. For instance, in 2024, Lidl continued its aggressive expansion and pricing strategies across Europe, often undercutting competitors on staple items.

Lidl's consistent focus on delivering exceptional value for money is a powerful driver of customer acquisition and retention. This approach allows them to capture market share, particularly among consumers who are highly sensitive to price points without compromising on the perceived quality of their purchases.

Lidl's commitment to quality private-label products offers customers exceptional value, often rivaling or surpassing national brands. This strategy empowers Lidl to meticulously manage both product quality and production costs, presenting a highly attractive option compared to pricier branded alternatives.

For instance, in 2024, Lidl continued to expand its successful private-label offerings. Their 'Butcher's Specialty' line, focusing on premium meats, and the 'Vemondo Plant!' range, catering to the growing demand for plant-based foods, both exemplify this dedication to high-quality, own-brand goods.

Lidl's stores are meticulously designed for a quick and no-fuss shopping experience. Their curated product selection and streamlined store layouts mean customers can find what they need efficiently. This focus on speed is a core part of their value proposition.

Further boosting convenience, Lidl is embracing digital solutions. Self-checkout stations are becoming more common, and a new self-scanning feature within the Lidl Plus app allows shoppers to scan items as they go. These innovations are geared towards making the shopping trip faster and more adaptable to individual needs.

Diverse Product Range (including Non-Food Specials)

Lidl's value proposition centers on a diverse product range that extends well beyond everyday groceries. Their renowned weekly non-food specials, often referred to as the 'middle aisle' offerings, create a compelling reason for customers to visit regularly. These rotating selections can include everything from home appliances and tools to clothing and sporting goods, adding an element of discovery and impulse purchasing.

This strategy of offering unexpected value in non-food categories is a key differentiator. For instance, in 2024, Lidl continued to expand its non-food categories, with reports indicating strong sales performance in areas like DIY and home furnishings, often priced significantly lower than traditional retailers. This dynamic assortment encourages frequent store visits, as customers anticipate new deals each week.

- Weekly Non-Food Specials: A rotating selection of household goods, electronics, apparel, and more, offering surprise and value.

- Beyond Groceries: This diverse range attracts customers looking for deals on a wide array of products, encouraging repeat visits.

- Catering to Modern Needs: Lidl also emphasizes a growing selection of organic and plant-based food options, meeting evolving consumer dietary preferences.

Commitment to Sustainability and Responsible Sourcing

Lidl's commitment to sustainability resonates deeply with consumers increasingly prioritizing ethical and environmental considerations in their purchasing decisions. This focus on a 'Better Tomorrow' is not just a marketing slogan but a core operational principle.

The company actively works to reduce its environmental footprint through initiatives like minimizing food waste, which saw a 20% reduction in unsold food sent to landfill across its German stores in 2023 compared to 2021. Furthermore, Lidl aims to cut its carbon emissions by 30% by 2030 across its entire value chain compared to a 2019 baseline.

Lidl's dedication to responsible sourcing is evident in its efforts to promote fair labor practices and protect biodiversity. For instance, by the end of 2024, Lidl aims for 100% of its cocoa, coffee, and tea to be sourced from certified sustainable sources.

- Reduced Food Waste: Achieved a 20% reduction in unsold food sent to landfill in German stores by 2023.

- Carbon Emission Reduction: Target of a 30% cut in carbon emissions by 2030 (vs. 2019 baseline).

- Sustainable Sourcing: Aiming for 100% certified sustainable cocoa, coffee, and tea by end of 2024.

- Plastic Reduction: Implementing measures to reduce plastic packaging, such as phasing out single-use plastics.

Lidl's value proposition is built on consistently delivering high-quality products at exceptionally low prices, making it a top choice for budget-conscious shoppers. This affordability is achieved through efficient operations and a strong focus on private-label brands, which in 2024 continued to expand and gain market share.

The retailer also offers a compelling range of non-food items, often referred to as the 'middle aisle' specials, which create excitement and encourage frequent visits. These rotating categories, from home goods to apparel, provide unexpected value beyond everyday groceries.

Furthermore, Lidl is enhancing the shopping experience with digital innovations like self-checkout and app-based scanning, aiming for speed and convenience. They are also increasingly catering to modern consumer needs with expanded organic and plant-based food selections.

Lidl's commitment to sustainability is a growing part of its appeal, with concrete goals like reducing food waste and sourcing certified sustainable products. For instance, they achieved a 20% reduction in unsold food sent to landfill in German stores by 2023.

| Value Proposition Element | Description | Key Differentiator | 2024 Focus/Fact |

|---|---|---|---|

| Affordability & Quality | High-quality groceries and goods at consistently low prices. | Strong private-label brands, optimized supply chain. | Continued aggressive pricing strategies across Europe. |

| Non-Food Specials | Rotating selection of household items, electronics, apparel, etc. | Creates excitement, encourages impulse buys and repeat visits. | Strong sales performance in DIY and home furnishings. |

| Convenience & Digitalization | Streamlined store layouts, quick shopping experience. | Self-checkout, app-based scanning features. | Expansion of digital solutions to improve customer flow. |

| Sustainability | Ethical sourcing, reduced environmental impact. | Growing consumer preference for responsible brands. | 100% certified sustainable cocoa, coffee, tea by end of 2024. |

Customer Relationships

Lidl's customer relationship is built on self-service, allowing shoppers to efficiently find and purchase items with minimal staff interaction. This approach is supported by streamlined store layouts and a high adoption rate of self-checkout kiosks, which in 2023 continued to be a significant focus for the retailer to further enhance speed and reduce operational costs.

The emphasis on self-service directly contributes to Lidl's operational efficiency, enabling them to offer competitive prices. By minimizing the need for extensive customer assistance, Lidl can allocate resources to other areas, such as product sourcing and logistics, ultimately benefiting the consumer through value. This efficiency is a cornerstone of their business model, directly impacting customer satisfaction and loyalty.

Lidl Plus, Lidl's digital loyalty program, is central to its customer relationship strategy, offering personalized discounts and weekly specials to drive repeat business. In 2024, the app continued to be a key engagement tool, with millions of users actively redeeming offers, fostering a direct connection with shoppers. This digital platform not only rewards loyalty but also provides valuable data insights for targeted marketing efforts.

Lidl prioritizes efficient in-store customer service, ensuring staff are available to help shoppers and manage the store's operations smoothly. This interaction is primarily functional, designed to make the shopping experience as seamless as possible.

Staff at Lidl are trained to effectively address customer inquiries and maintain a positive atmosphere within the store. For instance, in 2023, Lidl reported serving over 100 million customers weekly across its global operations, highlighting the scale of their in-store interactions.

Community Engagement and Initiatives

Lidl actively fosters community ties through dedicated initiatives. By championing local suppliers, they not only ensure product freshness but also contribute directly to regional economies. This commitment extends to supporting sustainability-focused community projects, building significant goodwill and deepening the brand's relationship with its customers.

A prime example of this commitment is the 'Lidl Green Fund' in Northern Ireland. Launched in 2021, this fund has supported numerous local environmental projects. For instance, in 2023, the fund allocated £100,000 to 20 community groups across Northern Ireland, demonstrating tangible investment in local environmental improvements and community well-being.

- Support for Local Suppliers: Lidl's procurement practices often prioritize local sourcing, strengthening regional supply chains and fostering economic development.

- Sustainability Initiatives: The company invests in projects that promote environmental consciousness within the communities it serves.

- Community Project Funding: Direct financial contributions, like the Lidl Green Fund, empower local groups to achieve their goals.

- Brand Loyalty: These engagements build trust and a sense of shared purpose, enhancing customer loyalty and brand perception.

Transparent Communication of Value and Quality

Lidl actively communicates its commitment to delivering excellent value and high-quality products. This is achieved through targeted advertising campaigns that emphasize their affordability and product standards. For instance, in 2024, Lidl continued its focus on promoting its relationships with British suppliers, a key element of its quality assurance narrative.

In-store messaging further reinforces this transparent communication. Displays and signage often highlight the quality of Lidl's private-label brands, directly linking them to the company's promise of superior quality at competitive prices. This consistent reinforcement aims to build and maintain customer trust.

- Value Proposition: High-quality products at consistently low prices.

- Quality Assurance: Emphasis on sourcing from reputable suppliers, including a significant number of British producers.

- Communication Channels: Advertising campaigns and in-store marketing materials.

- Customer Trust: Built through reliable delivery on the promise of quality and affordability.

Lidl fosters strong customer relationships through its Lidl Plus loyalty program, offering personalized discounts and driving repeat purchases. In 2024, the app remained a vital tool for engagement, with millions of users actively redeeming offers, building a direct connection. This digital strategy not only rewards loyalty but also provides valuable data for targeted marketing.

Beyond digital engagement, Lidl emphasizes efficient in-store service, ensuring staff are available for functional assistance. This approach, coupled with a focus on self-service options like kiosks, streamlines the shopping experience. Lidl’s commitment to community ties, through supporting local suppliers and environmental projects, further solidifies customer loyalty and brand perception.

Lidl actively communicates its value proposition of high-quality products at low prices through advertising and in-store messaging. This consistent reinforcement, highlighting relationships with suppliers, builds customer trust. For instance, in 2024, Lidl continued promoting its partnerships with British suppliers, reinforcing its quality assurance narrative.

Lidl's customer relationship strategy is a blend of digital loyalty, efficient service, community engagement, and transparent communication, all aimed at delivering exceptional value and fostering long-term loyalty.

| Relationship Aspect | Key Initiatives | Impact/Data Point (2023/2024) |

|---|---|---|

| Digital Loyalty | Lidl Plus App | Millions of active users redeeming offers in 2024; drives repeat purchases. |

| In-Store Experience | Self-service kiosks, efficient staff assistance | Streamlined shopping, operational cost reduction focus. |

| Community Engagement | Support for local suppliers, Lidl Green Fund | Strengthens regional economies, builds goodwill; £100,000 allocated to 20 community groups in Northern Ireland in 2023 for environmental projects. |

| Brand Communication | Advertising, in-store messaging | Emphasizes affordability and quality; continued focus on British supplier relationships in 2024. |

Channels

Lidl's physical retail stores are the backbone of its customer interaction, offering a tangible and accessible shopping experience. These discount supermarkets are strategically positioned throughout Europe and the United States, making them convenient for a wide customer base.

The store format emphasizes efficiency, allowing customers to quickly find and purchase a curated selection of high-quality, private-label goods at competitive prices. This streamlined approach is a key differentiator in the grocery sector.

Lidl's commitment to physical expansion remains strong, with plans for significant new store openings in 2025. For instance, the company has announced substantial investment in its US operations, aiming to open dozens of new locations in the coming year, further solidifying its brick-and-mortar presence.

The Lidl Plus mobile application acts as a primary digital channel, providing customers with personalized discounts and digital coupons, alongside easy access to weekly flyers. This enhances customer engagement by offering tailored promotions and a streamlined way to discover deals.

Further enriching the shopping experience, the app includes store locators and evolving self-scanning functionalities, making in-store navigation and checkout more efficient. By 2024, Lidl reported a significant increase in app adoption, with millions of active users across its European markets, demonstrating its effectiveness in driving digital interaction.

This digital platform is instrumental in fostering customer loyalty, as it centralizes savings and convenience, encouraging repeat business and a deeper connection with the Lidl brand.

Lidl's website serves as a crucial hub for customer engagement, offering detailed product information, highlighting weekly specials, and providing easy access to store locator services. This digital storefront, while not the primary revenue driver, significantly bolsters brand visibility and customer education.

While in-store purchases remain dominant, Lidl's e-commerce efforts, though modest in comparison, do contribute to its overall financial performance. In 2024, reports indicated continued growth in online engagement, with website traffic seeing a steady increase as customers increasingly research deals before visiting physical stores.

Traditional Marketing and Advertising

Lidl leverages a comprehensive mix of traditional marketing and advertising channels to connect with a wide customer base. This includes widespread use of print media like weekly leaflets and flyers, which are crucial for detailing their frequent promotions and product ranges. Television commercials and strategically placed billboards also play a significant role in reinforcing brand awareness and driving foot traffic to their stores.

The company invests heavily in these traditional avenues to ensure consistent market visibility and communicate value propositions effectively. For instance, in 2023, Lidl's marketing expenditure across Europe remained robust, supporting their ongoing efforts to attract and retain customers through compelling offers. This commitment to traditional advertising underscores its importance in their overall customer acquisition strategy.

- Print Media: Weekly flyers and leaflets are a cornerstone, detailing discounts and product availability to millions of households.

- Broadcast Advertising: Television commercials reach a broad demographic, often focusing on seasonal promotions and the brand's affordability.

- Out-of-Home Advertising: Billboards and other outdoor advertising ensure visibility in key urban and suburban areas.

- Significant Investment: Lidl consistently allocates substantial budgets to traditional advertising to maintain its competitive edge and communicate its value proposition.

Social Media and Digital Advertising

Lidl leverages social media platforms like Facebook, Instagram, and Twitter to connect with its customer base. This digital presence allows for direct interaction, product promotion, and the sharing of company updates.

Online advertising is a key component, driving traffic and brand awareness. In 2024, Lidl continued its investment in targeted digital campaigns to reach specific consumer segments.

Innovative digital strategies, such as the generative AI app 'Lidlize,' were employed to foster viral engagement and enhance customer interaction. These initiatives highlight Lidl's commitment to staying at the forefront of digital marketing trends.

- Platform Engagement: Active presence on Facebook, Instagram, and Twitter for customer interaction and promotion.

- Digital Advertising: Targeted online campaigns to boost brand visibility and sales in 2024.

- Innovative Campaigns: Use of tools like the 'Lidlize' AI app to create viral engagement.

Lidl utilizes a multi-channel approach, blending physical stores with robust digital and traditional marketing efforts. Their extensive network of discount supermarkets forms the core of customer interaction, complemented by the Lidl Plus app for personalized deals and engagement. Online presence through their website and social media further broadens reach and reinforces brand visibility.

Print media, particularly weekly flyers, remains a vital channel for communicating promotions to a wide audience. Television commercials and outdoor advertising also contribute significantly to brand awareness and driving foot traffic. In 2024, Lidl continued to invest in targeted digital campaigns and innovative social media strategies, such as the 'Lidlize' AI app, to foster engagement and reach specific consumer segments.

| Channel | Description | Key Metrics/Activities (2024) |

|---|---|---|

| Physical Stores | Discount supermarkets, core customer interaction | Ongoing expansion, significant US investment planned for 2025 |

| Lidl Plus App | Digital channel for discounts, coupons, flyers | Millions of active users across Europe, increased adoption |

| Website | Product info, specials, store locator | Steady increase in website traffic, customer research hub |

| Print Media | Weekly flyers, leaflets | Crucial for communicating promotions to millions of households |

| Broadcast/Outdoor Ads | TV commercials, billboards | Reinforcing brand awareness and driving foot traffic |

| Social Media/Online Ads | Facebook, Instagram, Twitter, targeted campaigns | Direct interaction, product promotion, viral engagement via AI apps |

Customer Segments

Price-sensitive shoppers are Lidl's bedrock, representing a significant portion of their clientele. These individuals and families actively seek out the most affordable options for their daily needs, often prioritizing price over brand name recognition. In 2024, with ongoing inflation concerns, this segment's focus on value for money remains paramount, driving their purchasing decisions at Lidl.

Families and households are a cornerstone of Lidl's customer base, prioritizing value and efficiency in their grocery shopping. They are attracted to Lidl's consistently low prices on everyday essentials, making it easier to manage household budgets effectively. This segment appreciates the convenience of finding a broad selection of goods under one roof for their weekly needs.

Lidl's success in 2024 saw a notable increase in shopper traffic, with new families being a significant contributor to this growth. This surge in visits underscores the appeal of Lidl's value proposition to households actively seeking to stretch their spending power without compromising on quality for their families.

Lidl attracts customers who prioritize getting good quality without overspending. This group recognizes the excellent value found in Lidl's extensive range of private-label products, which often rival national brands in quality but come at a significantly lower price point.

For these value-conscious shoppers, Lidl's commitment to high-quality own brands is a key differentiator, proving that affordability doesn't mean compromising on product standards. In 2024, Lidl continued to expand its private label portfolio, a strategy that resonates strongly with consumers seeking smart purchasing decisions.

Local Communities

Lidl actively seeks to embed itself within the local fabric of the communities it serves. This involves a commitment to sourcing from local suppliers whenever feasible, strengthening regional economies and fostering goodwill among residents. For instance, in 2024, Lidl continued its partnerships with numerous regional food producers across Europe, a strategy that has proven effective in building brand loyalty.

The company's expansion strategy frequently targets areas that are either less served by existing grocery options or possess a high concentration of potential customers. This approach not only addresses market gaps but also contributes to local development by bringing accessible and affordable retail options. Lidl's presence in a new community often translates into job creation and increased economic activity.

- Community Engagement: Lidl regularly participates in and sponsors local events and charitable causes, reinforcing its role as a community partner.

- Local Sourcing: By prioritizing local suppliers, Lidl supports regional agriculture and businesses, contributing to the economic vitality of the areas where it operates.

- Accessibility: Store locations are strategically chosen to ensure convenient access for a broad range of residents, particularly in densely populated urban areas and developing neighborhoods.

Environmentally and Health-Conscious Shoppers

Lidl is seeing growth in customers prioritizing sustainability and health. This segment actively seeks out retailers demonstrating genuine commitment to environmental and social responsibility. In 2024, Lidl continued to expand its organic offerings, with over 400 organic products available across its European stores, catering directly to these health-conscious shoppers.

The company's efforts to reduce plastic packaging, aiming for 20% less by 2025, resonate strongly with environmentally aware consumers. Furthermore, Lidl's focus on lowering its carbon footprint, including a 2030 target for a 30% reduction in operational greenhouse gas emissions compared to 2019 levels, attracts this discerning customer base.

- Growing demand for organic and plant-based options: Lidl's expanded range in 2024 saw a significant increase in sales for its organic and plant-based product lines.

- Commitment to plastic reduction: By 2025, Lidl aims to reduce plastic in its own-brand packaging by 20%, a tangible step for eco-conscious shoppers.

- Emissions reduction targets: Lidl's ambition to cut operational emissions by 30% by 2030 aligns with the values of environmentally concerned consumers.

- Ethical sourcing focus: The retailer's ongoing work on ethical sourcing, particularly for products like coffee and cocoa, appeals to customers seeking responsible consumption.

Lidl's customer base is diverse, but a core segment consists of price-sensitive shoppers who are actively looking for the best deals on everyday essentials. This group prioritizes affordability and value for money, making Lidl's consistently low prices a primary draw. In 2024, with continued economic pressures, these shoppers remain a vital part of Lidl's success.

Families and households also form a significant customer segment for Lidl, appreciating the retailer's ability to help them manage their budgets effectively. They value the wide selection of quality goods available at accessible price points, making Lidl a go-to destination for weekly grocery needs. The consistent growth in family shoppers seen in 2024 highlights this appeal.

Beyond price, Lidl attracts consumers who seek good quality without the premium price tag. This is largely driven by Lidl's extensive range of private-label products, which often match or exceed the quality of national brands at a fraction of the cost. This segment values smart purchasing and the assurance of quality in their chosen brands.

Lidl also caters to a growing segment of customers who are increasingly focused on sustainability and health. These shoppers are drawn to Lidl's expanding organic and plant-based offerings, as well as its commitments to reducing plastic packaging and lowering carbon emissions. Lidl's progress in these areas, such as aiming for 20% less plastic in own-brand packaging by 2025, resonates with this environmentally conscious demographic.

| Customer Segment | Key Characteristics | 2024 Relevance |

|---|---|---|

| Price-Sensitive Shoppers | Prioritize low prices and value for money. | High demand due to ongoing inflation concerns. |

| Families & Households | Seek budget-friendly options for daily needs. | Significant contributor to increased shopper traffic in 2024. |

| Quality-Conscious Value Seekers | Appreciate high quality at affordable prices, especially private labels. | Lidl's expanding private label portfolio in 2024 strengthens this segment's loyalty. |

| Health & Sustainability Focused | Value organic, plant-based options and eco-friendly practices. | Growing segment attracted by Lidl's expanded organic range and environmental targets. |

Cost Structure

Lidl's cost structure heavily relies on the procurement of goods, particularly its vast private-label offerings. The company leverages direct sourcing and significant bulk purchasing to drive down costs and achieve economies of scale. Efficient management of supplier relationships is paramount to maintaining competitive pricing.

Lidl's extensive store network incurs significant operational expenses, encompassing rent for prime retail locations, utilities, ongoing maintenance, and essential supplies. These costs are a foundational element of their business model, directly supporting their physical presence and customer accessibility.

While Lidl is known for its efficient, lean staffing approach, labor costs remain a major expenditure. The company prioritizes competitive wages and benefits to attract and retain a dedicated workforce, understanding that employee satisfaction is key to operational excellence and customer service.

In 2024, Lidl's commitment to its employees was evident as they continued to invest in training and development programs. While specific figures vary by region, reports from late 2023 and early 2024 indicated that Lidl's average hourly wages in many markets were above the national minimum wage, reflecting their strategy to maintain a motivated team.

Lidl's cost structure heavily relies on its efficient logistics and distribution network. This includes significant expenses for warehousing, managing its extensive transportation fleet, and maintaining sophisticated supply chain operations. These costs are fundamental to its ability to offer competitive pricing.

In 2023, Lidl invested heavily in expanding its distribution capacity, with a particular focus on automated warehousing solutions to boost efficiency and reduce labor costs. This ongoing investment in infrastructure, including upgrades to its fleet for more sustainable transport, directly impacts its logistics expenditure.

Marketing and Advertising Expenses

Lidl Stiftung & Co. KG invests heavily in marketing and advertising to build its brand and attract shoppers. These efforts are crucial for communicating their core value proposition of quality at low prices. In 2024, the retail sector saw continued aggressive marketing, with discounters like Lidl leveraging various channels to gain market share.

Their marketing strategy encompasses a broad range of activities. This includes extensive use of television commercials, print advertisements in local publications, and targeted digital campaigns across social media and search engines. Furthermore, Lidl frequently promotes its loyalty program, offering exclusive discounts and incentives to encourage repeat business.

- Extensive Media Presence: Lidl's marketing budget supports a consistent presence across television, radio, and print media, ensuring wide reach.

- Digital Engagement: Significant investment is directed towards online advertising, including social media marketing and search engine optimization, to capture a digitally-native audience.

- Promotional Activities: Loyalty programs and in-store promotions are key components, designed to drive foot traffic and customer retention.

- Competitive Positioning: Marketing spend is essential for Lidl to effectively communicate its price-quality ratio against competitors in the highly saturated grocery market.

Investments in Technology and Infrastructure

Lidl's cost structure heavily features significant investments in technology and infrastructure to drive its digital transformation and physical expansion. This includes substantial capital expenditures on initiatives like the Lidl Plus loyalty app, which aims to boost customer engagement and sales, and the implementation of self-scanning systems and electronic shelf labels to streamline in-store operations and improve efficiency. For instance, in 2023, Lidl continued its aggressive expansion, opening hundreds of new stores across various European markets, requiring considerable investment in real estate and store fit-outs.

These technological upgrades and infrastructure developments are crucial for enhancing the overall customer experience and ensuring operational efficiency across its vast network of stores and distribution centers. The company also invests in expanding its warehousing capacity to support its growing sales volume and to optimize its supply chain. These investments are foundational to Lidl's strategy for sustained growth and maintaining its competitive edge in the discount grocery sector.

- Technology Investments: Focus on digital tools like the Lidl Plus app and in-store tech such as self-scanning and electronic shelf labels.

- Infrastructure Expansion: Capital outlays for new store openings and the development of advanced logistics and warehouse facilities.

- Efficiency Gains: Aim to reduce operational costs and improve the speed of service through technology adoption.

- Customer Experience Enhancement: Investments designed to make shopping more convenient and personalized for Lidl customers.

Lidl's cost structure is characterized by its relentless pursuit of efficiency, driven by bulk purchasing and a strong private-label strategy, which significantly reduces procurement costs. Operational expenses, including rent for prime retail locations and utilities, are managed through lean store formats. Labor costs, while substantial due to competitive wages, are optimized through efficient staffing models and ongoing employee development programs, as evidenced by their continued investment in training throughout 2024.

Logistics and distribution represent a major cost area, with ongoing investments in advanced warehousing and transportation infrastructure, as seen in their 2023 focus on automation. Marketing and advertising are also significant expenditures, essential for maintaining brand visibility and communicating their value proposition in a competitive market, with aggressive campaigns continuing into 2024. Finally, substantial capital is allocated to technology and infrastructure, including digital initiatives like the Lidl Plus app and physical expansion, to enhance customer experience and operational efficiency.

| Cost Category | Key Components | 2023/2024 Focus Areas |

| Procurement | Private-label sourcing, bulk purchasing, supplier relationships | Maximizing economies of scale |

| Operations | Rent, utilities, store maintenance, supplies | Lean store formats, efficient site management |

| Labor | Wages, benefits, training | Competitive compensation, employee development programs |

| Logistics & Distribution | Warehousing, transportation, supply chain management | Warehouse automation, fleet efficiency, supply chain optimization |

| Marketing & Advertising | TV, print, digital campaigns, loyalty programs | Brand building, customer acquisition, promotional activities |

| Technology & Infrastructure | Digital apps, self-scanning, store expansion, warehousing | Digital transformation, new store openings, capacity expansion |

Revenue Streams

Lidl's main income source is selling a wide variety of groceries. This includes fresh fruits and vegetables, meats, dairy products, and freshly baked bread, which are available in all of their stores. These everyday essentials account for the majority of their sales.

The company's strategy of offering good quality at low prices encourages customers to buy in large quantities. For example, in 2023, Lidl reported a significant increase in sales, reaching over €110 billion globally, with grocery sales being the dominant contributor.

Lidl's business model heavily relies on selling its own-brand private-label products, a key revenue stream. These products, often developed with a focus on quality and value, represent a significant portion of their sales. For instance, in 2023, private-label goods accounted for approximately 80% of Lidl's total product assortment, driving substantial revenue.

These private-label offerings typically yield higher profit margins for Lidl compared to national brands. This allows the company to maintain competitive pricing while ensuring healthy profitability. The strategic expansion of these ranges, including a growing selection of plant-based and organic options, further broadens this revenue stream and appeals to a wider customer base.

Lidl significantly boosts its income by offering a diverse range of non-food and seasonal products. These items, often featured in their well-known middle aisles, encompass everything from home goods and electronics to clothing and seasonal decorations.

These special, limited-time offers are a key driver for increased customer visits and spending. For instance, in 2024, Lidl's strategic promotions on items like garden furniture or back-to-school supplies consistently drove foot traffic and encouraged customers to purchase more than just groceries, thereby increasing the average transaction value.

Online Sales (where applicable)

While Lidl is predominantly known for its physical stores, it also taps into online sales in select markets. This digital channel, though currently a smaller contributor than its brick-and-mortar operations, is a growing revenue stream, offering customers the convenience of e-commerce or click-and-collect options. This expansion into online sales aligns with broader retail trends and enhances customer accessibility.

Lidl's online presence is strategically expanding, focusing on markets where it has established a strong logistical and operational base. For instance, in countries like Germany and the UK, Lidl offers a curated selection of non-food items and some groceries online, with options for home delivery or pick-up at designated stores. This hybrid approach caters to evolving consumer preferences for flexible shopping experiences.

- Online Sales Contribution: While specific figures for Lidl's online sales as a percentage of total revenue are not always publicly disclosed, industry reports indicate a steady growth in e-commerce for grocery retailers. For example, in 2023, online grocery sales in many European markets saw continued expansion, with discounters like Lidl aiming to capture a larger share.

- Key Markets for E-commerce: Lidl's online sales efforts are most prominent in markets such as Germany, the UK, and the Netherlands, where it has invested in digital infrastructure and delivery networks. These regions often see a wider range of products available online compared to markets where Lidl is still primarily focused on its core store format.

- Product Categories Online: The online offering typically includes a mix of non-food items, such as seasonal goods, electronics, and home appliances, alongside a growing selection of groceries. This strategy allows Lidl to leverage its online platform for higher-margin products while also testing the waters for broader grocery e-commerce adoption.

Loyalty Program Engagement and Data Monetization (indirect)

The Lidl Plus loyalty program, while not generating direct revenue, significantly boosts sales by fostering customer loyalty and encouraging repeat visits. This increased engagement translates to higher overall transaction volumes.

The valuable customer data collected through Lidl Plus informs targeted marketing campaigns and aids in product assortment decisions, ultimately optimizing sales performance and profitability. For instance, in 2024, Lidl reported a significant uplift in sales from customers actively using the Lidl Plus app.

- Customer Retention: The program incentivizes customers to return, increasing the lifetime value of each shopper.

- Increased Shopping Frequency: Exclusive offers and personalized discounts encourage more frequent store visits.

- Data-Driven Insights: User behavior data allows for more effective marketing and inventory management.

- Sales Uplift: Studies in 2024 indicated that Lidl Plus members spend on average 15% more per shopping trip than non-members.

Lidl's revenue streams are primarily driven by the sale of a vast array of groceries, encompassing fresh produce, dairy, meats, and baked goods, which form the core of its business.

A significant portion of its income comes from private-label products, which accounted for around 80% of its assortment in 2023, offering higher margins and competitive pricing.

The company also generates substantial revenue from non-food and seasonal items, often featured in its middle aisles, which draw customers in for special, limited-time offers, boosting average transaction values.

Lidl is expanding its online sales in select markets, offering a mix of non-food and grocery items, catering to evolving consumer preferences for convenience and accessibility.

The Lidl Plus loyalty program, while not a direct revenue source, drives sales through increased customer loyalty and repeat purchases, with members spending an average of 15% more per trip in 2024.

Business Model Canvas Data Sources

The Lidl Stiftung & Co. KG Business Model Canvas is informed by comprehensive market research, internal operational data, and financial disclosures. These diverse sources provide a robust foundation for understanding Lidl's strategic positioning and operational efficiency.