Jiangxi Copper SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jiangxi Copper Bundle

Jiangxi Copper's strong market position is bolstered by its significant copper reserves and integrated operations. However, it faces challenges from fluctuating commodity prices and increasing environmental regulations. Discover the complete picture behind the company’s market position with our full SWOT analysis. This in-depth report reveals actionable insights, financial context, and strategic takeaways—ideal for entrepreneurs, analysts, and investors.

Strengths

Jiangxi Copper's integrated industrial chain, encompassing everything from exploration and mining to smelting and processing, gives it a significant advantage. This end-to-end control allows for better quality management and cost optimization across its wide range of copper products. For instance, in 2023, the company's refined copper output reached 1.75 million tons, showcasing the scale of its integrated operations.

Jiangxi Copper's strength lies in its diversified product portfolio, extending beyond its core copper business. The company actively produces and markets a variety of other non-ferrous metals, precious metals, and chemical products. This strategic diversification is crucial for mitigating risks tied to a single commodity, ensuring multiple revenue streams and bolstering overall financial resilience.

Jiangxi Copper holds a leading position in China's mining sector, underscoring its significant domestic market presence. This strong foothold allows the company to leverage established infrastructure and benefit from strategic advantages within China's vast industrial landscape. As a key player, it significantly influences the global copper market.

Strong Commitment to Environmental, Social, and Governance (ESG)

Jiangxi Copper shows a strong dedication to Environmental, Social, and Governance (ESG) principles. This commitment is evident in their ambitious goals, aiming for carbon peak by 2030 and carbon neutrality by 2060, aligning with global sustainability trends.

The company actively invests in critical areas like energy conservation and emission reduction. These efforts are crucial for meeting evolving ESG expectations and can lead to improved corporate reputation and better access to green financing opportunities.

- Carbon Peak Target: 2030

- Carbon Neutrality Target: 2060

- Investment Focus: Energy conservation, emission reduction, ecological restoration

Positive Financial Performance

Jiangxi Copper demonstrated robust financial health, reporting a significant increase in net income for the full year ending December 31, 2024. This positive trend continued into 2025, with the company achieving a notable jump in its first-quarter profit.

These results highlight the company's operational efficiency and its ability to navigate fluctuating market environments successfully. The strong financial performance underscores a solid foundation for future growth and investment.

- Full Year 2024 Net Income: Increased year-over-year, demonstrating improved profitability.

- Q1 2025 Profit: Saw a substantial jump, indicating continued positive momentum.

- Financial Resilience: Ability to achieve strong results amidst dynamic market conditions.

Jiangxi Copper's integrated value chain, from mining to processing, provides significant cost control and quality assurance. This operational integration is further supported by its substantial refining capacity, evidenced by its 1.75 million tons of refined copper output in 2023. The company's diversified product range, including other non-ferrous and precious metals, mitigates commodity-specific risks and broadens revenue streams. Its leading position within China's domestic market grants it strategic advantages and influence in the global copper landscape.

| Metric | 2023 Data | 2024 (Full Year Estimate/Actual) | 2025 (Q1 Estimate/Actual) |

| Refined Copper Output | 1.75 million tons | Projected to increase | Continued growth expected |

| Net Income | Increased year-over-year | Reported significant increase | Substantial jump |

What is included in the product

Offers a full breakdown of Jiangxi Copper’s strategic business environment, detailing its internal strengths and weaknesses alongside external market opportunities and threats.

Offers a clear breakdown of Jiangxi Copper's competitive landscape, highlighting areas for strategic improvement and risk mitigation.

Weaknesses

Jiangxi Copper's significant reliance on copper and other metal production means its financial results are closely tied to the unpredictable swings in global commodity markets. For instance, copper prices experienced considerable volatility in late 2023 and early 2024, influenced by factors like global economic outlook and supply chain disruptions.

This exposure makes it difficult for the company to reliably predict its future earnings, as sharp price drops can quickly erode profitability. For example, a 10% drop in copper prices could directly translate to a substantial decrease in Jiangxi Copper's revenue for that period.

Jiangxi Copper, like many in the mining and metals sector, is grappling with escalating operating expenses. These cost pressures, particularly from labor and energy inputs, are a significant concern. For instance, global energy prices saw substantial volatility through 2024, directly impacting smelting and refining costs.

These rising costs directly affect profit margins, potentially squeezing Jiangxi Copper's ability to reinvest or return value to shareholders. In 2024, many copper producers reported higher cost-per-pound figures compared to previous years, a trend that could continue into 2025, impacting overall productivity and competitiveness.

Jiangxi Copper faces a significant challenge with the global tightening of copper concentrate supply. This scarcity directly impacts its smelting operations, a core part of its integrated business. In 2024, the market has seen treatment and refining charges (TC/RCs) climb due to increased demand and fewer available concentrates, putting upward pressure on Jiangxi Copper's raw material costs.

Environmental Compliance and Risks

Jiangxi Copper’s mining and smelting operations inherently carry environmental risks, such as potential habitat disruption and contamination of water and soil resources. These activities are subject to growing environmental scrutiny globally.

While the company has demonstrated commitment to environmental protection, the evolving landscape of environmental regulations, particularly in China, presents a significant weakness. Stricter standards, which are expected to continue tightening through 2024 and 2025, could compel substantial additional investments in pollution control and remediation technologies. For instance, China's continued push for green development and emissions reduction targets will likely impact the copper industry. These necessary upgrades can lead to increased operating costs and pose ongoing compliance challenges, potentially affecting profitability and operational flexibility.

- Potential for increased capital expenditure on environmental upgrades to meet evolving regulations.

- Risk of fines or operational disruptions due to non-compliance with stricter environmental standards.

- Negative impact on brand reputation if environmental incidents occur.

Potential Impact of Domestic Economic Pressures

Broader economic challenges within China, such as deflationary pressures observed in certain industrial sectors like coal due to overcapacity, could indirectly dampen overall industrial demand for copper. These trends, while specific to coal, underscore potential vulnerabilities in the wider Chinese industrial economy that might affect Jiangxi Copper's product demand.

For instance, China's Producer Price Index (PPI) has shown periods of contraction in industrial goods throughout 2023 and into early 2024, indicating weaker pricing power and potentially lower production volumes across various manufacturing segments that consume copper.

- Deflationary Pressures: Persistent deflationary trends in key Chinese industrial sectors could signal reduced manufacturing output and, consequently, lower copper consumption.

- Overcapacity Concerns: Issues like coal overcapacity highlight a broader economic theme of supply-demand imbalances that can ripple through related industrial markets.

- Impact on Industrial Demand: A slowdown in manufacturing, driven by domestic economic headwinds, directly translates to reduced demand for essential industrial metals like copper.

Jiangxi Copper's heavy reliance on commodity prices exposes it to significant earnings volatility, as seen with copper price fluctuations throughout late 2023 and early 2024. This makes future revenue difficult to predict, with a 10% price drop potentially leading to a substantial revenue decrease.

Rising operating costs, particularly for labor and energy, are squeezing profit margins. For example, global energy price volatility in 2024 directly impacted smelting and refining expenses, with many copper producers reporting higher costs per pound in 2024, a trend likely to persist into 2025.

The company faces challenges from a tightening global copper concentrate supply, which drives up treatment and refining charges (TC/RCs), increasing raw material costs for its smelting operations. Environmental risks are also a concern, with evolving regulations in China potentially requiring significant investment in pollution control, impacting costs and compliance through 2024 and 2025.

Broader economic issues in China, such as deflationary pressures in industrial sectors indicated by contracting PPI for industrial goods in 2023-2024, could reduce overall industrial demand for copper.

Preview the Actual Deliverable

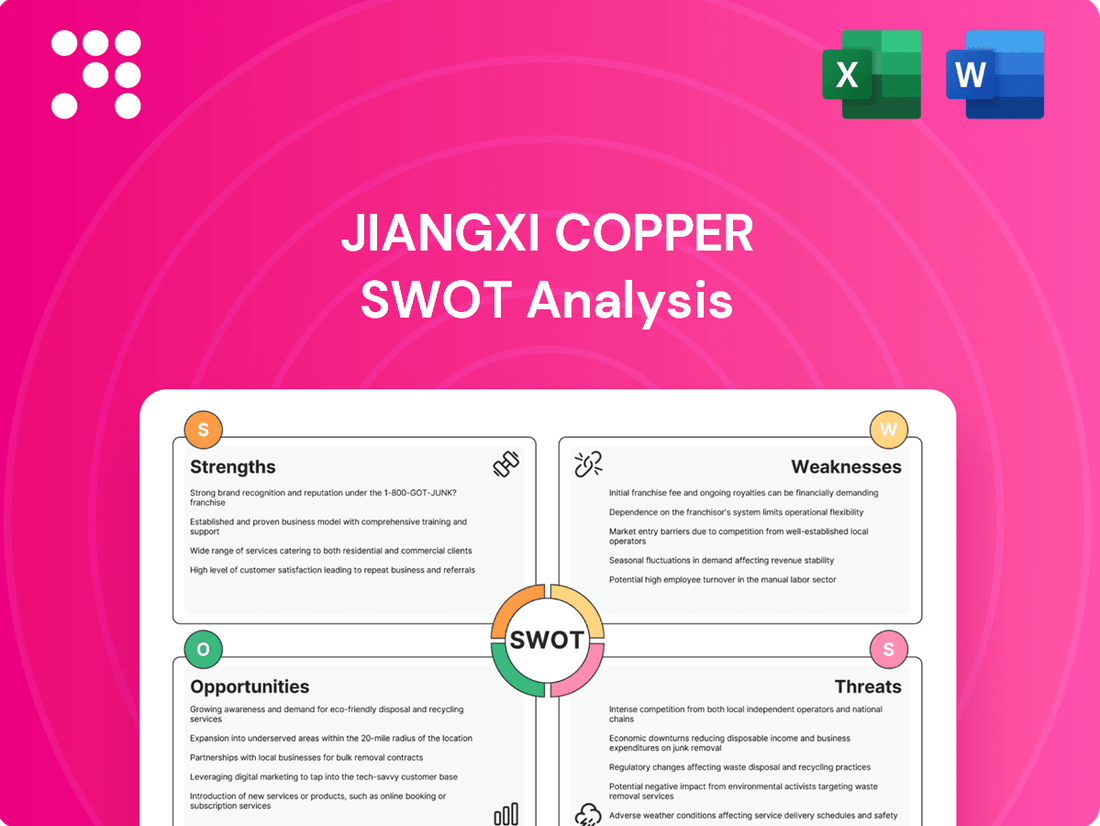

Jiangxi Copper SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. It offers a clear overview of Jiangxi Copper's Strengths, Weaknesses, Opportunities, and Threats, providing valuable insights for strategic planning.

The content below is pulled directly from the final SWOT analysis. Unlock the full report when you purchase, gaining access to a comprehensive breakdown of Jiangxi Copper's competitive landscape and internal capabilities.

Opportunities

The global shift towards green energy, encompassing electric vehicles, solar, and wind power, is significantly boosting copper demand. This transition is a major long-term growth avenue for Jiangxi Copper, as copper is essential for these burgeoning technologies.

Global investments in renewable energy infrastructure and electric mobility are projected to reach trillions of dollars in the coming years. For instance, the International Energy Agency (IEA) anticipates that copper demand from clean energy technologies could more than double by 2040 compared to 2020 levels, reaching approximately 5.3 million tonnes annually.

Technological advancements are a significant opportunity for Jiangxi Copper. Innovations like automation and data analytics can streamline operations, boosting efficiency and lowering costs. For instance, the global mining automation market was projected to reach $15.6 billion by 2027, indicating a strong trend towards adopting these technologies.

Furthermore, techniques such as bioleaching and closed-loop water management present avenues for environmental improvement and resource optimization. These methods can reduce water consumption and waste, aligning with increasing sustainability demands. Improved metal recovery rates, a direct benefit of these technologies, can also enhance profitability.

Jiangxi Copper is strategically positioned to capitalize on the global demand for critical minerals. Chinese firms, including Jiangxi Copper, are increasingly seeking international mining assets to bolster their raw material supply chains. For instance, in 2023, Chinese investment in overseas mining projects saw a notable uptick, driven by the need for resources like copper, lithium, and cobalt.

The company's recent acquisition activities underscore this expansionist approach. These moves are designed to broaden its resource base, enhance its market reach, and secure long-term supply stability. This proactive strategy not only strengthens its competitive advantage but also solidifies its global presence in the mining sector.

Government Stimulus and Infrastructure Development in China

China's ongoing commitment to economic stimulus and infrastructure projects presents a significant tailwind for Jiangxi Copper. These initiatives are designed to inject liquidity into the economy and directly stimulate demand for key industrial materials like copper. For instance, China's fixed-asset investment growth in infrastructure, which reached approximately 4.5% year-on-year in early 2024, underscores this commitment.

This favorable domestic environment is expected to translate into increased sales volumes and production opportunities for Jiangxi Copper. The company is well-positioned to benefit from heightened construction activity and manufacturing output driven by these government-led investments.

- Increased Demand: Government spending on infrastructure projects like high-speed rail and urban development directly boosts copper consumption.

- Economic Liquidity: Stimulus measures improve overall economic activity, leading to greater demand across various industrial sectors that utilize copper.

- Favorable Policy Environment: Continued government support for industrial development creates a stable and predictable market for Jiangxi Copper's products.

- Production Growth: The anticipated rise in demand provides Jiangxi Copper with the impetus to expand its production capacity and operational efficiency.

Growing Demand for By-products and Related Metals

Jiangxi Copper is well-positioned to benefit from the growing demand for by-products and related metals. Beyond its core copper business, the company can leverage its mining operations to extract and market other valuable commodities. This diversification strategy taps into broader market trends and enhances revenue streams.

The increasing global appetite for non-ferrous metals like gold, silver, and molybdenum, often found alongside copper deposits, offers significant upside. For instance, in 2023, the price of gold saw a notable increase, reaching record highs at certain points. Similarly, demand for molybdenum, a key component in steel alloys, has been robust due to infrastructure and manufacturing growth.

Furthermore, chemical products derived from mining processes, such as sulfuric acid, represent another avenue for growth. Jiangxi Copper's integrated operations allow for efficient production and sale of these materials. The company's ability to capitalize on these ancillary markets is a key strength:

- Diversified Metal Portfolio: Jiangxi Copper's operations yield not only copper but also significant quantities of gold and silver, which have experienced strong market demand. For example, in early 2024, silver prices showed upward momentum driven by industrial applications and investment interest.

- By-product Monetization: The company can generate additional revenue by selling sulfuric acid, a common by-product of copper smelting, which is essential for fertilizer production and various industrial processes.

- Market Responsiveness: By actively managing its by-product streams, Jiangxi Copper can adapt to fluctuating commodity prices and capture value from its entire mining output, not just copper.

The global transition to green energy, including electric vehicles and renewable power sources, is significantly increasing the demand for copper. This trend presents a substantial growth opportunity for Jiangxi Copper, as copper is a critical component in these technologies. For instance, the International Energy Agency (IEA) projects that copper demand from clean energy sectors could more than double by 2040, reaching approximately 5.3 million tonnes annually.

Technological advancements in mining, such as automation and data analytics, offer pathways to enhance operational efficiency and reduce costs for Jiangxi Copper. The global mining automation market was expected to reach $15.6 billion by 2027, highlighting the industry's move towards adopting these innovations. Furthermore, sustainable practices like bioleaching and closed-loop water management can improve environmental performance and resource utilization, potentially increasing metal recovery rates and profitability.

Jiangxi Copper is strategically positioned to benefit from China's ongoing economic stimulus measures and infrastructure development projects. These government initiatives are designed to boost economic activity and directly increase the demand for industrial materials like copper. China's fixed-asset investment in infrastructure, which saw growth of around 4.5% year-on-year in early 2024, underscores this supportive domestic environment.

The company can also capitalize on the demand for by-products and related metals found in its mining operations, such as gold, silver, and molybdenum. This diversification strategy can bolster revenue streams. For example, gold prices reached record highs at certain points in 2023, and demand for molybdenum remains strong due to industrial growth.

Threats

Escalating geopolitical conflicts, such as ongoing tensions in Eastern Europe and the Middle East, present a significant threat to global trade stability. These situations can lead to unpredictable disruptions in supply chains for critical minerals, impacting raw material availability and logistics for companies like Jiangxi Copper.

Rising trade protectionism, evidenced by the imposition of tariffs and export restrictions on key commodities, directly affects international market access and pricing. For instance, the US-China trade friction has previously introduced volatility, and similar measures on critical minerals could increase operational costs and limit export opportunities for Jiangxi Copper, which relies on global markets.

The impact of these geopolitical and trade policies creates substantial market uncertainty, influencing commodity price fluctuations and investment sentiment. This environment can make long-term planning and securing stable pricing for Jiangxi Copper's output more challenging, potentially affecting profitability and strategic expansion.

The global copper market is fiercely competitive, with giants like BHP, Freeport-McMoRan, and Chile's Codelco setting the pace. These established players are heavily investing in advanced, sustainable mining practices and cutting-edge technologies. This ongoing innovation presents a significant challenge for Jiangxi Copper, requiring continuous effort to not only hold its ground but also to grow its market presence against these formidable competitors.

A global economic slowdown or recession poses a significant threat to Jiangxi Copper. Reduced industrial activity worldwide directly translates to lower demand for copper, a key industrial metal. This anticipated drop in demand, particularly from major consumers like China, could pressure copper prices downwards throughout 2024 and into 2025.

For instance, if global GDP growth falters significantly, as seen in potential downturns predicted by institutions like the IMF for certain regions in 2024, Jiangxi Copper's sales volumes and profitability would likely be impacted. Lower commodity prices directly erode revenue streams and can squeeze profit margins, especially for large-scale producers reliant on consistent market demand.

Increased Environmental Regulations and Compliance Costs

Global efforts to combat climate change are leading to increasingly stringent environmental regulations. For a company like Jiangxi Copper, this translates to potentially higher operational expenses as they invest in cleaner technologies and adhere to stricter emissions standards. For instance, China's own environmental protection goals, which have intensified in recent years, could necessitate significant capital expenditures for Jiangxi Copper to upgrade its facilities and ensure compliance, impacting profitability.

These evolving environmental mandates can also introduce operational limitations. New regulations might restrict certain mining practices or require more complex waste management procedures, potentially slowing down production or increasing the cost of raw material extraction. The financial implications are substantial; failing to meet these standards can result in hefty fines and reputational damage, further pressuring Jiangxi Copper's bottom line.

The company's financial performance in 2024 and projections for 2025 will likely reflect these pressures. For example, if new wastewater discharge limits are imposed, Jiangxi Copper might need to allocate substantial funds for treatment plant upgrades. The company's reported capital expenditures for environmental protection initiatives will be a key indicator of how it's navigating these challenges.

- Increased capital expenditure for environmental compliance.

- Potential operational restrictions impacting production volume.

- Risk of fines and penalties for non-compliance.

Supply Chain Disruptions Beyond Concentrates

Jiangxi Copper faces a significant threat from widespread supply chain disruptions extending beyond just copper concentrates. These issues could affect access to other crucial raw materials, hinder efficient logistics, and disrupt energy supplies, all of which are vital for maintaining production levels and managing operational expenses. For instance, global shipping container shortages, which saw rates surge by over 100% in early 2024 compared to pre-pandemic levels, could significantly inflate transportation costs for Jiangxi Copper's diverse material needs.

The company's operations are vulnerable to a cascade of potential disruptions stemming from geopolitical instability, natural disasters, or unforeseen global health events. These external shocks can create bottlenecks at various points in the supply chain, from mining equipment to processing chemicals, directly impacting Jiangxi Copper's ability to meet its production targets and potentially leading to increased unit costs. For example, in 2023, extreme weather events in key mining regions globally led to temporary mine closures, highlighting the fragility of raw material sourcing.

- Broader Raw Material Sourcing: Disruptions to the supply of essential elements beyond copper, such as sulfuric acid or reagents used in processing, could halt production lines.

- Logistical Bottlenecks: Port congestion and rising freight costs, which saw a 15% increase in global average ocean freight rates in Q1 2024, can delay the arrival of critical components and finished goods.

- Energy Price Volatility: Fluctuations in global energy markets, with oil prices averaging around $80/barrel in early 2024, directly impact the cost of powering mining and smelting operations.

- Geopolitical Risks: Trade disputes or regional conflicts can restrict the flow of necessary inputs, impacting companies like Jiangxi Copper that rely on international supply networks.

Intensifying global competition from major players like BHP and Freeport-McMoRan poses a significant threat, as they invest heavily in advanced technologies. Jiangxi Copper must continually innovate to maintain its market position against these well-resourced competitors. A slowdown in the global economy, predicted by institutions like the IMF, could reduce demand for copper in 2024-2025, pressuring prices and impacting Jiangxi Copper's revenue.

Stricter environmental regulations, particularly in China, necessitate increased capital expenditure for compliance, potentially raising operational costs and impacting profitability. Supply chain vulnerabilities, exacerbated by factors like shipping container shortages which saw rates surge by over 100% in early 2024, threaten access to crucial raw materials and increase logistics expenses.

| Threat Category | Specific Risk | Potential Impact on Jiangxi Copper | Supporting Data/Example |

|---|---|---|---|

| Competition | Technological Advancement by Rivals | Loss of market share, pressure on margins | Major competitors investing in automation and sustainability. |

| Economic Slowdown | Reduced Industrial Demand | Lower copper prices, decreased sales volumes | IMF forecasts for global GDP growth in 2024-2025. |

| Environmental Regulations | Increased Compliance Costs | Higher operational expenses, potential fines | China's intensified environmental protection goals. |

| Supply Chain Disruptions | Raw Material & Logistics Issues | Production delays, increased input costs | Shipping rates increased by over 100% in early 2024. |

SWOT Analysis Data Sources

This Jiangxi Copper SWOT analysis is built on a foundation of comprehensive data, drawing from the company's official financial reports, in-depth market research, and expert industry analysis to provide a robust and insightful assessment.