Jiangxi Copper Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jiangxi Copper Bundle

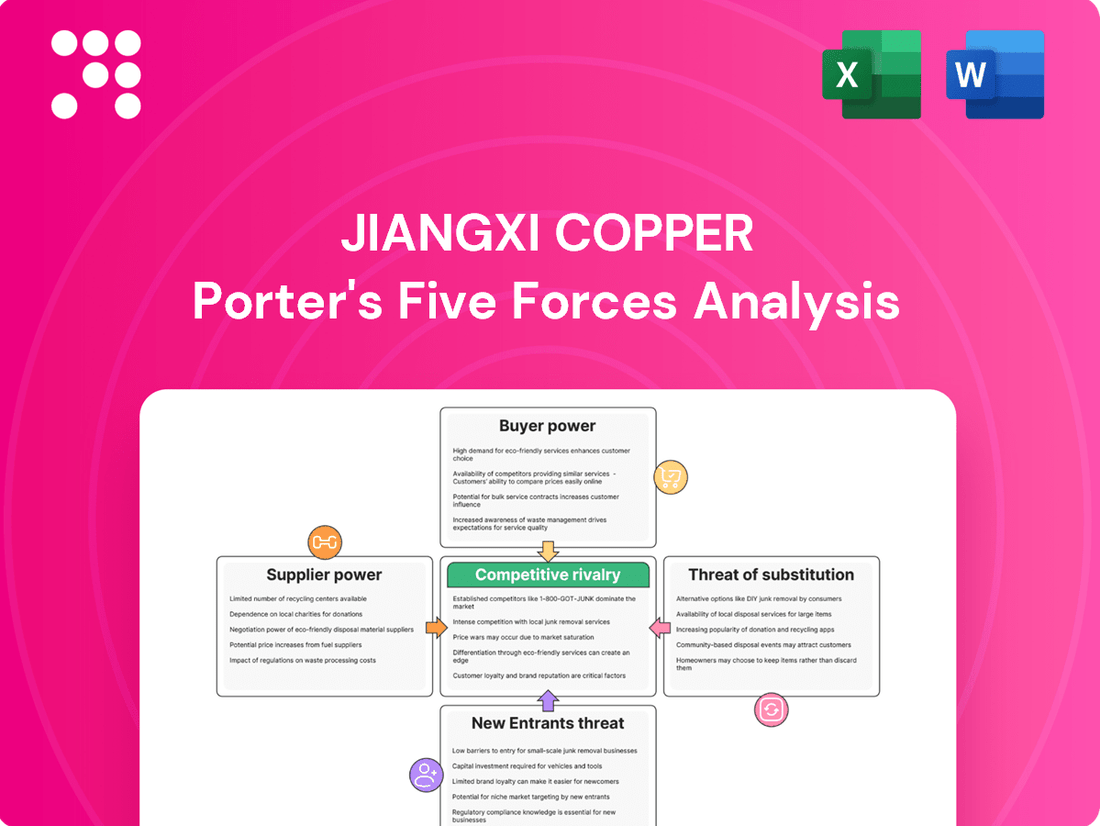

Jiangxi Copper navigates a complex landscape shaped by intense rivalry and significant buyer power, particularly from downstream manufacturers. The threat of new entrants is moderate, given capital-intensive operations, but the availability of substitutes for copper presents a persistent challenge. Supplier bargaining power is a critical factor, influencing raw material costs and ultimately impacting profitability.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Jiangxi Copper’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The availability of raw materials, particularly copper concentrate, is a key factor in determining supplier power for companies like Jiangxi Copper. A tightening global supply of concentrate can significantly shift the balance, giving mining suppliers more leverage. For instance, a projected global deficit in copper concentrate for 2024 is anticipated to bolster the bargaining power of these suppliers.

Geographical concentration of key copper mine sources, like those in Chile and the Democratic Republic of Congo, grants these regions and their mining companies significant leverage. This concentration means fewer suppliers control a larger portion of the essential raw materials.

Jiangxi Copper's dependence on imported concentrate, especially given China's substantial import volume of 70% of its copper, amplifies the impact of any disruptions or price hikes from these concentrated sources. This reliance directly affects their operational costs and profitability.

The bargaining power of suppliers for Jiangxi Copper is significant due to the critical and often unique nature of copper. Industries like electrical, electronics, and renewable energy heavily rely on copper, making it difficult for manufacturers to simply switch to other materials without substantial cost increases or performance compromises. This inherent demand for copper solidifies the leverage of its suppliers.

Supplier Power 4

Technological advancements in mining and extraction significantly shape supplier power for companies like Jiangxi Copper. Innovations such as advanced automation and AI-driven exploration can reduce operational costs for suppliers, potentially strengthening their negotiation position. For instance, the increasing adoption of autonomous drilling systems in 2024 has been noted to improve efficiency by up to 20% in certain operations, allowing suppliers to maintain or even increase profit margins.

While new technologies like bioleaching and SX-EW can expand reserves and enhance efficiency, their adoption by suppliers can also lead to increased production control. If a supplier gains a competitive edge through these technologies, they might leverage this to exert higher pricing power. The global copper market saw a significant surge in demand for processed copper in early 2024, with prices reaching highs not seen in years, partly influenced by efficient extraction technologies.

- Technological Adoption: Suppliers investing in advanced extraction technologies can gain a competitive advantage, potentially increasing their pricing power.

- Efficiency Gains: Innovations like autonomous drilling can improve supplier efficiency, impacting cost structures and negotiation leverage.

- Market Dynamics: Increased demand for processed copper in 2024, coupled with efficient supplier technologies, contributed to price increases.

- Supplier Control: The ability of suppliers to control production through technological means can translate into greater influence over market supply and pricing.

Supplier Power 5

The bargaining power of suppliers to Jiangxi Copper is influenced by market structure. A consolidated supplier market, with fewer dominant mining companies, can exert greater leverage, particularly during periods of tight global supply. This was evident in early 2024 when copper concentrate prices saw significant increases due to limited availability, impacting smelters like Jiangxi Copper.

For instance, in the first half of 2024, spot treatment and refining charges (TC/RCs) for copper concentrate dropped to multi-year lows, reflecting the tight supply and increased demand from Chinese smelters. This situation directly translates to higher input costs for Jiangxi Copper, diminishing its profitability unless it can pass these costs on.

- Consolidation: A shrinking number of large mining firms can dictate terms more effectively.

- Supply Constraints: Periods of global copper concentrate shortages amplify supplier leverage.

- Spot TC/RCs: Low treatment and refining charges in early 2024 demonstrated supplier strength.

- Input Costs: Higher concentrate prices directly impact Jiangxi Copper's operational expenses.

The bargaining power of suppliers for Jiangxi Copper is substantial, driven by the concentrated nature of global copper concentrate sources and increasing demand. In early 2024, spot treatment and refining charges (TC/RCs) for copper concentrate fell to multi-year lows, indicating a strong supplier position. This trend directly translates to higher input costs for Jiangxi Copper, impacting its profitability.

Technological advancements by suppliers also enhance their leverage. For example, the adoption of autonomous drilling systems in 2024 improved operational efficiency by up to 20% for some suppliers, allowing them to command better pricing. The inherent demand for copper across key industries further solidifies supplier influence, as alternatives are often costly or less effective.

| Factor | Impact on Supplier Power | Supporting Data (Early 2024) |

|---|---|---|

| Concentration of Supply | High | Key mining regions (Chile, DRC) control significant output. |

| Demand for Copper | High | Essential for electrical, electronics, and renewable energy sectors. |

| Spot TC/RCs | Strong Supplier Leverage | Fell to multi-year lows, increasing smelter input costs. |

| Supplier Technology | Increasing Leverage | Autonomous drilling efficiency gains up to 20%. |

What is included in the product

This analysis delves into the competitive forces impacting Jiangxi Copper, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the copper industry.

Instantly identify and mitigate competitive threats with a visual breakdown of Jiangxi Copper's market positioning across all five forces.

Streamline strategic planning by quickly assessing the impact of supplier power and buyer bargaining on Jiangxi Copper's profitability.

Customers Bargaining Power

The bargaining power of customers in the copper market, particularly for a company like Jiangxi Copper, is shaped by the diverse applications of copper. Sectors such as electrical, electronics, construction, and transportation utilize copper, which can spread demand across many buyers. This fragmentation can dilute the power of individual customers. For instance, in 2024, the global copper market size was estimated to be around $160 billion, highlighting the vastness of its demand base.

Despite the broad demand, certain segments can concentrate buyer influence. Large industrial consumers or organized purchasing consortia within these sectors can wield considerable power. These groups might negotiate for bulk discounts or favorable contract terms, impacting Jiangxi Copper's pricing and sales agreements. For example, major construction projects or large automotive manufacturers often represent significant portions of a copper producer's sales volume.

Buyer power in the copper market, particularly for a company like Jiangxi Copper, is generally constrained due to the commodity's essential nature and strong demand. The global push towards electrification and renewable energy sources, such as electric vehicles and wind turbines, significantly fuels the need for copper. For instance, the International Energy Agency projects that by 2030, demand for copper in clean energy technologies could double compared to 2022 levels, reaching approximately 10 million tonnes annually.

The bargaining power of customers for Jiangxi Copper is influenced by price sensitivity, which varies significantly across industries. For instance, in 2024, the construction sector, a major consumer of copper, demonstrated increased price sensitivity due to rising material costs and potential economic slowdowns, leading some developers to explore substitute materials or delay projects.

Conversely, industries relying on copper for critical, high-performance applications, such as advanced electronics manufacturing or renewable energy infrastructure, may exhibit lower price sensitivity. These sectors often prioritize reliability and performance over minor price fluctuations, providing a degree of pricing stability for copper producers like Jiangxi Copper.

Buyer Power 4

The bargaining power of customers for Jiangxi Copper is influenced by the availability of substitutes. While copper is currently dominant in many applications, the potential for materials like aluminum or advanced carbon nanotubes to gain traction, even if less efficient now, presents a latent threat. This means buyers can credibly consider switching, which pressures copper producers on pricing.

In 2024, the global aluminum market continued to grow, with production expected to reach over 70 million metric tons. This increasing scale and improving efficiency of aluminum production, particularly in sectors like automotive and construction, directly impacts the perceived value and cost-competitiveness of copper. If these substitutes become more economically viable or technologically advanced, Jiangxi Copper would face intensified price negotiations.

- Substitute Availability: The growing viability of aluminum and emerging materials like carbon nanotubes offers customers alternatives to copper.

- Price Pressure: Customers' ability to switch to substitutes allows them to negotiate lower prices from copper producers like Jiangxi Copper.

- Market Dynamics: The increasing scale and efficiency of aluminum production in 2024 amplifies this buyer power, especially in cost-sensitive industries.

Buyer Power 5

China's position as the world's largest copper consumer, accounting for over 50% of global demand in 2024, grants its buyers substantial bargaining power. This immense demand allows Chinese entities to negotiate favorable pricing and terms, directly impacting producers like Jiangxi Copper.

Fluctuations in China's economic growth and industrial output, which are projected to grow by 5.0% in 2024, have a pronounced effect on global copper prices and demand. Consequently, any shifts in Chinese policy or economic conditions can significantly alter the market landscape for Jiangxi Copper.

- China's Dominance: In 2024, China's share of global copper consumption exceeded 50%, underscoring its significant influence.

- Price Sensitivity: Major Chinese buyers can leverage their volume to negotiate lower prices, pressuring producers.

- Policy Impact: Chinese government policies, such as infrastructure spending or environmental regulations, directly shape copper demand and influence market dynamics for Jiangxi Copper.

- Economic Correlation: China's GDP growth rate, projected at 5.0% for 2024, is closely tied to copper demand, giving Chinese consumers leverage through their purchasing power.

The bargaining power of customers for Jiangxi Copper is generally moderate. While the vast global demand for copper, estimated at around $160 billion in 2024, suggests many buyers, large industrial consumers and purchasing consortia can exert significant influence through bulk orders and negotiations. The essential nature of copper, especially with its increasing demand in electrification, limits the overall power of individual buyers, but concentrated demand in key sectors can still drive price discussions.

| Factor | Impact on Customer Bargaining Power | Notes |

| Demand Diversity | Lowers individual customer power | Copper used across electrical, electronics, construction, transport. |

| Concentrated Buyers | Increases customer power | Large industrial consumers, automotive, construction projects. |

| Substitute Availability | Increases customer power | Aluminum (70+ million metric tons production in 2024) and emerging materials. |

| Price Sensitivity | Varies by sector | Higher in construction (2024 cost pressures), lower in advanced electronics/renewables. |

| China's Market Share | Significantly increases customer power | Over 50% of global demand in 2024, driving negotiations. |

Preview the Actual Deliverable

Jiangxi Copper Porter's Five Forces Analysis

This preview shows the exact, professionally written Porter's Five Forces Analysis of Jiangxi Copper you'll receive immediately after purchase, offering a comprehensive understanding of the competitive landscape. You're looking at the actual document, which details the industry's rivalry, buyer and supplier power, threat of new entrants, and substitute products. Once you complete your purchase, you’ll get instant access to this exact, fully formatted file, ready for your strategic decision-making.

Rivalry Among Competitors

Jiangxi Copper faces intense competition both in China and globally. As China's largest copper producer and a top 10 global player, its domestic rivals include formidable entities like Zijin Mining Group, CHALCO, and CMOC, all vying for market share.

Globally, the competitive landscape is shaped by giants such as Codelco and Freeport-McMoRan. For instance, in 2023, Zijin Mining reported revenues of approximately $46.6 billion, showcasing the scale of its operations and its competitive standing against Jiangxi Copper.

The competitive rivalry within the copper industry, particularly for a company like Jiangxi Copper, is heightened by significant vertical integration. Companies actively participate in exploration, mining, smelting, and refining, creating a dynamic where competition extends across the entire value chain. This integration allows firms to exert greater control over costs and ensure a stable supply of raw materials, intensifying the battle for market share and profitability at each stage.

Competitive rivalry within the copper mining sector is intensifying, particularly driven by the significant expansion of Chinese producers. Market share and production capacity are paramount, with companies like Zijin Mining and Jiangxi Copper rapidly increasing their output.

By 2025, it's projected that Chinese miners, including these key players, will collectively exceed the copper output of major global producers. This substantial growth signifies a major shift, as these domestic giants become increasingly dominant forces on the world stage.

Competitive Rivalry 4

Geopolitical tensions and evolving trade policies, such as the impact of US tariffs on copper imports, significantly influence competitive dynamics in the global copper market. These factors can lead to market volatility and necessitate strategic adjustments in sourcing and sales for companies like Jiangxi Copper.

For instance, in 2023, global copper prices experienced fluctuations influenced by macroeconomic conditions and trade disputes, directly affecting the cost structures and revenue streams of major producers. Companies must navigate these external pressures by diversifying supply chains and exploring new market opportunities to mitigate risks.

- Trade Policy Impact: US tariffs on imported copper, implemented in various forms over recent years, have altered global trade flows, potentially increasing costs for manufacturers relying on these imports and creating advantages for domestic producers.

- Market Volatility: Geopolitical events and trade policy shifts contribute to price swings in the copper market, impacting Jiangxi Copper's profitability and requiring agile responses to market changes.

- Reshaping Trade Patterns: Companies are adapting by seeking alternative suppliers or markets, leading to a reconfiguration of traditional trade routes and competitive landscapes in the copper industry.

Competitive Rivalry 5

The copper mining industry, including players like Jiangxi Copper, experiences intense rivalry. Companies constantly invest in technological advancements and efficiency improvements, such as smart mining technologies and enhanced extraction methods, to gain a competitive edge. Those that successfully innovate to lower operational costs are better positioned in the market.

In 2024, the global copper market saw significant price volatility, influenced by factors like supply chain disruptions and demand from the electric vehicle sector. For instance, major copper producers reported varying cost efficiencies, with some achieving lower production costs per tonne through advanced automation and process optimization. This highlights how technological adoption directly impacts competitive standing.

- Technological Investment: Companies are channeling significant capital into R&D for smart mining, aiming to boost productivity and reduce energy consumption.

- Efficiency Gains: Improved extraction techniques, like advanced flotation and solvent extraction, are crucial for lowering operational expenses and increasing yield.

- Cost Leadership: Innovation in operational efficiency directly translates to a cost advantage, allowing companies to compete more effectively on price.

- Market Share Dynamics: Firms that can consistently reduce their all-in sustaining costs are likely to capture greater market share, especially during periods of lower commodity prices.

Competitive rivalry is a defining characteristic for Jiangxi Copper, given its position as China's largest copper producer and a significant global player. Domestic competitors like Zijin Mining Group and CHALCO, along with international giants such as Codelco and Freeport-McMoRan, actively compete for market share and resources. This intense competition is further fueled by vertical integration across the value chain, from exploration to refining, allowing firms to control costs and supply.

The drive for efficiency and technological advancement is a key battleground. Companies are investing heavily in smart mining and improved extraction techniques to lower operational costs. For example, in 2024, global copper prices remained volatile, influenced by supply chain issues and EV demand, making cost leadership through innovation a critical differentiator. Those that successfully reduce their all-in sustaining costs are better positioned to capture market share.

| Key Competitors (2023/2024 Data) | Revenue (Approx. USD Billions) | Global Ranking (Copper Production) |

|---|---|---|

| Zijin Mining Group | 46.6 | Top 5 |

| Freeport-McMoRan | 21.4 | Top 5 |

| Codelco | N/A (State-owned, revenue not always publicly disclosed) | Top 3 |

| Jiangxi Copper | N/A (Specific 2023/2024 revenue not readily available for direct comparison, but a major player) | Top 10 |

SSubstitutes Threaten

While copper is prized for its excellent electrical conductivity and heat transfer capabilities, substitutes like aluminum are gaining traction, especially in sectors prioritizing weight reduction. For instance, in high-voltage electric vehicle (EV) cables, aluminum is considered as a lighter alternative, though copper generally maintains superior conductivity. In 2023, the global aluminum market was valued at approximately $245 billion, showcasing its significant presence as a viable substitute in various industries.

Emerging materials like carbon nanotubes, such as Galvorn, are presenting themselves as potential substitutes for copper. These advanced materials boast high conductivity, superior strength, and a lighter profile, along with environmental advantages. For instance, early applications are being explored in high-performance cables and lightweight automotive components.

While these properties are promising, a significant hurdle remains in scaling their production for widespread commercial adoption. The cost-effectiveness and manufacturing capacity needed to compete with established copper supply chains are still under development. As of early 2024, the market penetration of these substitutes remains minimal, but ongoing research and investment suggest a future where they could challenge copper's dominance in certain high-value applications.

Miniaturization in electronics, while not a direct substitute for copper, can influence its demand. For instance, advancements in semiconductor technology allow for smaller, more powerful components, potentially reducing the sheer volume of copper needed per device. This trend, however, often drives more efficient copper utilization rather than outright replacement, as copper's conductivity remains critical for many applications.

Threat of Substitution 4

The threat of substitutes for copper, particularly in electrical applications, is a significant consideration. While alternatives like aluminum might offer a lower upfront cost, the performance trade-offs can be substantial. For instance, aluminum’s lower conductivity means larger conductor sizes are needed to carry the same amount of current as copper, impacting space and weight in applications like power transmission lines. In 2024, the price differential between copper and aluminum remained a key factor, though the total cost of ownership, including installation and long-term efficiency, often favors copper for critical infrastructure.

The durability and reliability of copper also present a strong barrier to substitution in many high-demand sectors. Copper’s resistance to corrosion and its superior mechanical strength ensure longevity, especially in harsh environments or applications requiring high levels of safety and performance. For example, in the automotive industry, copper’s excellent heat dissipation and conductivity are crucial for components like radiators and wiring harnesses, where failure is not an option. While advancements in materials science continue to explore alternatives, copper's established performance profile in these demanding uses remains a powerful deterrent to widespread substitution.

Key aspects influencing the threat of substitution include:

- Cost vs. Performance: While cheaper alternatives exist, copper often provides superior conductivity, durability, and system efficiency, justifying its higher price in many critical applications.

- Technological Advancements: Ongoing research into materials like advanced composites or superconductors could potentially offer competitive alternatives, but widespread adoption faces significant technical and economic hurdles.

- Application-Specific Requirements: The suitability of a substitute is highly dependent on the specific demands of the end-use, with copper retaining an advantage in high-performance, high-reliability scenarios.

- Environmental and Regulatory Factors: While recycling rates for copper are high, evolving environmental regulations and the push for sustainability could influence material choices in the long term.

Threat of Substitution 5

Innovation in alternative conductive materials and advancements in superconductor technology present a significant long-term threat to copper's market position. If these substitutes become more cost-effective and scalable, they could erode demand for copper in key sectors.

For instance, the development of advanced aluminum alloys or carbon-based conductors could offer comparable performance in certain electrical applications at a lower price point. The global market for advanced materials is expected to grow substantially, with innovations potentially impacting traditional material demand.

- Advancements in Aluminum Alloys: Research into high-conductivity aluminum alloys continues, aiming to match copper's performance in specific applications like overhead power lines, where weight and cost are critical factors.

- Superconductor Technology: While still largely in niche applications, breakthroughs in high-temperature superconductors could eventually offer lossless electricity transmission, a direct threat to copper's role in grid infrastructure.

- Carbon-Based Conductors: Graphene and carbon nanotubes show promise as lightweight, highly conductive materials, though widespread commercial adoption for bulk applications remains a challenge.

The threat of substitutes for copper is moderate but growing, particularly from aluminum and emerging advanced materials. While copper's conductivity and durability are often superior, cost pressures and specific application needs drive the consideration of alternatives. For example, in 2024, the price of copper remained significantly higher than aluminum, making aluminum an attractive option for weight-sensitive applications like electric vehicle wiring, despite requiring larger cross-sections.

Advanced materials like carbon nanotubes and graphene offer the potential for lighter, highly conductive alternatives, though their widespread adoption is currently limited by cost and scalability. The global advanced materials market is projected for significant growth, which could intensify this threat in the coming years. However, copper's established infrastructure and reliability in critical sectors like power transmission and electronics currently provide a strong defense against widespread substitution.

| Material | Key Advantage | Key Disadvantage | 2024 Price Indication (Relative) |

|---|---|---|---|

| Copper | High Conductivity, Durability | Higher Cost, Weight | High |

| Aluminum | Lower Cost, Lighter Weight | Lower Conductivity, Corrosion Susceptibility | Medium |

| Carbon Nanotubes | Exceptional Strength & Conductivity, Lightweight | High Cost, Scalability Issues | Very High |

Entrants Threaten

The threat of new entrants into the copper mining and smelting sector, impacting companies like Jiangxi Copper, is significantly mitigated by the industry's exceptionally high capital intensity. Establishing a new copper mine and processing facility requires billions of dollars for exploration, land acquisition, heavy machinery, and advanced smelting technology. For instance, developing a new large-scale copper mine can easily cost upwards of $5 billion, making it a formidable barrier for potential competitors.

The threat of new entrants in the copper industry, particularly for a company like Jiangxi Copper, is significantly mitigated by substantial regulatory hurdles and demanding environmental compliance. These requirements act as a powerful barrier, making it difficult and expensive for new players to enter the market and operate legally.

New companies must navigate a complex web of permits and approvals, often involving extensive environmental impact assessments. For instance, in 2023, China's Ministry of Ecology and Environment continued to enforce strict regulations on mining operations, with penalties for non-compliance reaching millions of yuan, deterring potential new entrants who lack the capital and expertise to meet these standards.

The capital investment needed to meet these stringent environmental standards, coupled with the long lead times for obtaining necessary permits, presents a formidable challenge. This financial and temporal burden effectively limits the number of new companies that can realistically challenge established players like Jiangxi Copper, which has already invested heavily in compliant infrastructure and processes.

The threat of new entrants in the copper market, particularly for a company like Jiangxi Copper, is significantly mitigated by the immense capital required to secure proven copper reserves and establish robust, integrated supply chains. Newcomers face substantial hurdles in replicating the scale and efficiency that major players have built over decades.

Jiangxi Copper, a leading global copper producer, benefits from its deeply entrenched relationships with suppliers and customers, a testament to its long operational history. This integration, spanning mining, smelting, and refining, creates formidable barriers to entry, making it exceptionally challenging for new entrants to compete on cost and operational effectiveness.

In 2023, global copper mine production reached approximately 22.4 million metric tons, with significant consolidation among established producers. This landscape underscores the difficulty for new entities to gain traction against incumbents with established market access and economies of scale.

Threat of New Entrants 4

The threat of new entrants in the copper industry, particularly for a major player like Jiangxi Copper, is significantly mitigated by the substantial technological expertise and operational know-how required. Efficient copper production demands mastery of advanced techniques, from initial exploration and extraction to sophisticated smelting and refining. Acquiring or developing this specialized knowledge represents a considerable barrier for potential newcomers.

New entrants face immense capital requirements not only for physical assets but also for research and development to match existing efficiencies. For instance, the global copper mining industry saw significant investment in 2023, with major projects requiring billions of dollars. This high cost of entry, coupled with the need for specialized skills in areas like hydrometallurgy and pyrometallurgy, deters many potential competitors.

- High Capital Investment: Establishing a copper mine and processing facility can cost billions of dollars, a significant hurdle for new companies.

- Technological Sophistication: Advanced drilling, smelting, and refining techniques require specialized knowledge and continuous innovation.

- Regulatory Hurdles: Navigating environmental regulations and obtaining permits for mining operations is a complex and time-consuming process.

- Economies of Scale: Established players like Jiangxi Copper benefit from economies of scale, making it difficult for smaller, new entrants to compete on cost.

Threat of New Entrants 5

The threat of new entrants for Jiangxi Copper is moderately high, but certain factors can temper this. The global copper market, while robust, can experience price volatility. For instance, in early 2024, copper prices saw significant upward movement driven by supply concerns and strong demand, but projections for 2025-2026 indicate potential oversupply scenarios. This volatility, coupled with the substantial capital required for establishing new mining and refining operations, acts as a barrier.

New entrants face significant hurdles in securing exploration rights and developing mines, a process that can take years and billions of dollars. Furthermore, established players like Jiangxi Copper benefit from economies of scale, existing infrastructure, and long-term supplier relationships. These advantages make it difficult for newcomers to compete on cost and efficiency, especially during periods of market oversupply, which is a concern for the 2025-2026 period according to various market analyses.

The regulatory environment also plays a role. Obtaining environmental permits and adhering to stringent mining regulations in China and globally can be a lengthy and costly process. This complexity, combined with the inherent risks of commodity markets, means that while new companies might emerge, the pace and scale of their entry are often constrained.

- Capital Intensity: Establishing new copper mines requires billions in upfront investment, a significant deterrent for potential entrants.

- Price Volatility: Fluctuations in copper prices, with projections suggesting potential oversupply in 2025-2026, increase the financial risk for new players.

- Economies of Scale: Existing large producers like Jiangxi Copper have cost advantages that are difficult for new entrants to match.

- Regulatory Hurdles: Obtaining permits and complying with environmental and mining regulations adds time and cost to market entry.

The threat of new entrants into the copper mining sector, impacting companies like Jiangxi Copper, remains moderately low due to immense capital requirements and established economies of scale. However, potential disruptions could arise from technological advancements or shifts in global supply chains, though the high barriers to entry persist.

New players face significant challenges in securing exploration rights and developing mines, a process that can span years and require billions of dollars. For instance, the average cost to develop a new large-scale copper mine can exceed $5 billion, a prohibitive sum for most potential entrants. Furthermore, established producers like Jiangxi Copper benefit from decades of operational experience, integrated supply chains, and long-standing supplier and customer relationships, creating a formidable competitive moat.

Regulatory complexities, including stringent environmental compliance and the lengthy process of obtaining permits, add further layers of difficulty for newcomers. In 2023, China continued to enforce strict environmental regulations on mining, with non-compliance penalties potentially reaching millions of yuan. This demanding landscape, coupled with the inherent price volatility of commodity markets, makes market entry a high-risk, high-reward proposition.

| Barrier to Entry | Description | Impact on New Entrants |

|---|---|---|

| Capital Intensity | Developing new copper mines requires billions in upfront investment for exploration, equipment, and infrastructure. | Significantly deters new entrants due to prohibitive initial costs. |

| Economies of Scale | Established players like Jiangxi Copper benefit from lower per-unit costs due to large-scale operations. | Makes it difficult for smaller, new entrants to compete on price and efficiency. |

| Regulatory Hurdles | Complex environmental regulations, permitting processes, and compliance requirements add time and cost to market entry. | Lengthens the time to market and increases the overall cost of establishing operations. |

| Technological Expertise | Efficient copper extraction, smelting, and refining require specialized knowledge and continuous innovation. | New entrants need substantial investment in R&D and skilled personnel to match existing efficiencies. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Jiangxi Copper leverages data from annual reports, SEC filings, and industry-specific market research from firms like CRU Group and Wood Mackenzie. This ensures a comprehensive understanding of competitive dynamics, supplier power, and buyer influences within the copper industry.