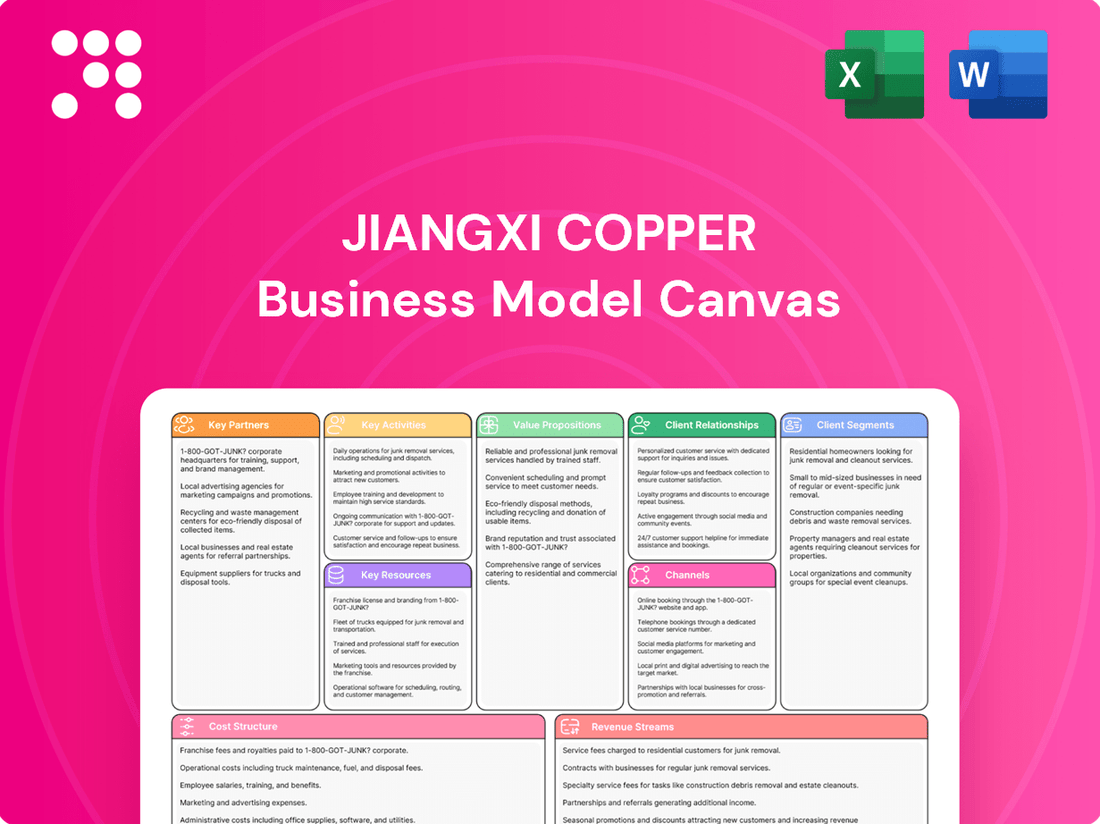

Jiangxi Copper Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jiangxi Copper Bundle

Discover the strategic engine driving Jiangxi Copper's dominance in the global copper market. This comprehensive Business Model Canvas unveils their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. Perfect for anyone seeking to understand industry giants or refine their own business strategy.

Partnerships

Jiangxi Copper's strategic alliances with global mining giants are a cornerstone of its business model. These partnerships allow for the pooling of technical know-how and operational assets, with a target to boost joint ventures by 30% by 2025. This collaborative approach is crucial for securing essential raw materials and broadening the company's reach into international markets.

Jiangxi Copper actively collaborates with technology and research institutions to drive innovation in copper extraction and material science. These partnerships are vital for developing more efficient processes and exploring novel copper-based materials.

In 2023, Jiangxi Copper demonstrated its commitment to this area by investing around RMB 500 million in research and development, directly supporting these crucial collaborations and their ambitious goals.

Jiangxi Copper actively partners with a diverse range of logistics and supply chain providers to ensure the seamless movement of its products. These collaborations are crucial for transporting raw materials like ore and concentrate to its smelters, as well as delivering refined copper and other metals to customers worldwide. For instance, in 2023, the company’s total output of refined copper reached 1.75 million tons, highlighting the sheer volume requiring efficient logistical solutions.

These partnerships are foundational to maintaining a resilient supply chain, managing risks associated with global transportation, and optimizing delivery timelines. By working with specialized logistics firms, Jiangxi Copper can navigate complex international shipping regulations and ensure timely arrivals, which is critical for meeting market demand and maintaining strong customer relationships. The company's commitment to efficient operations is underscored by its significant production scale.

Environmental Technology Companies

Jiangxi Copper's strategic alliances with environmental technology firms are crucial for advancing its sustainability agenda. These partnerships focus on areas like advanced waste recycling processes, which can recover valuable materials and minimize landfill impact. They also drive energy conservation initiatives, aiming to optimize operational efficiency and reduce overall consumption. A key objective is the significant reduction of carbon emissions, with a target set to decrease them by 20% by the year 2025, a commitment that requires cutting-edge technological solutions.

These collaborations are instrumental in implementing innovative solutions for environmental protection within Jiangxi Copper's operations. For instance, partnerships can facilitate the adoption of new technologies for treating wastewater, ensuring compliance with stringent environmental regulations. Furthermore, they support the development and deployment of cleaner energy sources or more efficient energy management systems across their mining and smelting facilities. This proactive approach not only addresses environmental concerns but also enhances the company's long-term operational resilience and social license to operate.

Key areas of collaboration include:

- Waste Valorization: Implementing technologies to convert mining by-products and waste materials into usable resources, thereby reducing waste disposal and creating potential revenue streams.

- Emissions Control: Partnering on the development and application of advanced systems for capturing and treating air pollutants, particularly sulfur dioxide and greenhouse gases, to meet or exceed regulatory standards.

- Water Management: Collaborating on sophisticated water treatment and recycling technologies to minimize fresh water intake and reduce the discharge of contaminated water.

- Energy Efficiency: Jointly exploring and implementing energy-saving technologies in smelting and refining processes, contributing to the company's goal of reducing its carbon footprint.

Financial Institutions

Jiangxi Copper's financial institution partnerships are crucial for its operational and strategic growth. These relationships facilitate essential financial services, including managing trade finance and securing vital funding. For instance, in 2023, the company actively engaged with numerous domestic and international banks to support its extensive mining and smelting operations.

These partnerships are fundamental for obtaining the capital required for significant capital expenditures, such as the development of new mines or upgrades to existing facilities. This access to finance ensures Jiangxi Copper can undertake ambitious projects and maintain its competitive edge in the global market.

- Banking Relationships: Partnerships with major banks provide credit lines and working capital, essential for day-to-day operations and managing commodity price volatility.

- Investment Firms: Collaborations with investment firms can help in raising equity or debt financing for long-term projects and strategic acquisitions.

- Trade Finance: Financial institutions are key to facilitating international trade, providing letters of credit and other instruments necessary for importing raw materials and exporting finished products.

Jiangxi Copper's extensive network of key partnerships is vital for its operational success and strategic expansion. These collaborations span across global mining giants, technology innovators, logistics providers, environmental specialists, and financial institutions, all contributing to the company's robust business model.

| Partner Type | Purpose | 2023/2024 Impact/Focus |

|---|---|---|

| Global Mining Giants | Resource access, technical expertise, joint ventures | Targeting 30% boost in joint ventures by 2025; securing raw materials. |

| Tech & Research Institutions | Innovation in extraction, material science | RMB 500 million invested in R&D in 2023 to support these collaborations. |

| Logistics & Supply Chain | Efficient product movement, risk management | Supporting 1.75 million tons of refined copper output in 2023. |

| Environmental Tech Firms | Sustainability, waste valorization, emissions control | Aiming for 20% carbon emission reduction by 2025. |

| Financial Institutions | Funding, trade finance, capital expenditure | Active engagement with banks in 2023 for mining and smelting operations. |

What is included in the product

This Jiangxi Copper Business Model Canvas provides a comprehensive, pre-written overview of the company's strategy, detailing its customer segments, channels, and value propositions.

It reflects Jiangxi Copper's real-world operations and plans, organized into 9 classic BMC blocks with full narrative and insights for informed decision-making.

Jiangxi Copper's Business Model Canvas acts as a pain point reliever by providing a clear, visual roadmap of their operations, allowing for swift identification of inefficiencies and strategic adjustments.

Activities

Jiangxi Copper's primary activities revolve around comprehensive geological exploration to discover new copper deposits and the efficient mining of this ore. This crucial initial phase underpins their entire integrated industrial operations, ensuring a steady supply of raw materials.

In 2023, Jiangxi Copper reported significant progress in its exploration efforts, adding substantial new reserves to its portfolio. For instance, exploration work in the Zhesan area alone increased copper ore reserves by over 1.5 million tons, demonstrating the company's commitment to expanding its resource base.

Jiangxi Copper's core operations revolve around large-scale smelting and refining. Their Guixi Smelter, a significant global facility, is a testament to this, producing high-purity copper cathodes. This process is crucial for transforming raw copper concentrate into usable metal for various industries.

In 2023, Jiangxi Copper's smelting and refining capacity reached approximately 2.1 million tons of copper. This robust capacity underpins their position as a leading copper producer, enabling them to meet substantial market demand for refined copper products.

Jiangxi Copper's key activities extend beyond mining and smelting to the intricate processing and manufacturing of copper products. This includes transforming raw copper into high-value items such as copper rods, foils, and various semi-finished goods. These products are essential components for a wide array of industries, from electronics and automotive to construction and aerospace.

In 2023, Jiangxi Copper reported significant progress in its downstream processing capabilities. The company's refined copper output reached approximately 1.8 million tonnes, with a growing portion dedicated to specialized copper products. This strategic focus on deep processing allows Jiangxi Copper to capture more value and meet the evolving demands of global markets for advanced copper materials.

Production and Sale of Non-Ferrous and Precious Metals

Jiangxi Copper's core activities revolve around the production and sale of a diverse range of metals. Beyond its primary copper output, the company extracts and markets other non-ferrous metals like molybdenum, and precious metals such as gold and silver. These valuable byproducts are generated through its extensive mining and smelting processes, significantly broadening its revenue streams and market presence.

This diversification is a strategic advantage, allowing Jiangxi Copper to capitalize on fluctuations in different metal markets. For instance, in 2023, the company reported substantial contributions from its gold and silver operations, which helped to offset some of the volatility experienced in the copper market. This multi-metal approach strengthens its overall financial resilience.

- Copper Production: Jiangxi Copper is a leading producer of refined copper in China.

- By-product Metals: The company also extracts and sells molybdenum, gold, and silver as valuable by-products.

- Market Diversification: This broad product portfolio allows for revenue generation across multiple commodity markets.

- Operational Synergy: Mining and smelting operations are integrated to efficiently recover all valuable metals.

Financial Services and Trading

Jiangxi Copper actively participates in financial services and trading, which supplements its core mining operations. These activities are crucial for managing the inherent volatility of copper prices and enhancing overall profitability. For instance, in 2023, the company’s financial segment contributed to its diversified revenue streams, although specific figures for this segment are often integrated within broader financial reporting.

The company leverages its market position and commodity expertise to engage in trading activities, often involving futures and hedging strategies. This not only generates revenue but also serves as a vital risk management tool against adverse price movements in the global copper market. By doing so, Jiangxi Copper aims to stabilize its financial performance despite external market fluctuations.

- Financial Services: Offers related financial services to support its core business and generate additional income.

- Commodity Trading: Engages in trading activities, including futures and hedging, to manage price risks.

- Revenue Diversification: These activities contribute to a more diversified revenue base, reducing reliance solely on copper sales.

- Risk Management: Utilizes financial instruments to mitigate the impact of copper price volatility on its financial results.

Jiangxi Copper's key activities are deeply integrated, starting with extensive geological exploration and efficient mining to secure raw copper ore. This is followed by large-scale smelting and refining, notably at their Guixi Smelter, to produce high-purity copper cathodes. The company further processes this into various copper products like rods and foils, serving diverse industrial needs.

Beyond copper, Jiangxi Copper extracts and markets valuable by-products such as molybdenum, gold, and silver, enhancing revenue streams and market resilience. Additionally, they engage in financial services and commodity trading, utilizing futures and hedging to manage price volatility and stabilize financial performance.

| Activity | Description | 2023 Data/Impact |

|---|---|---|

| Exploration & Mining | Discovering and extracting copper ore. | Increased reserves by over 1.5 million tons in Zhesan area. |

| Smelting & Refining | Processing ore into high-purity copper cathodes. | Capacity reached approximately 2.1 million tons of copper. |

| Copper Product Manufacturing | Transforming refined copper into semi-finished goods. | Refined copper output reached ~1.8 million tonnes, with growing focus on specialized products. |

| By-product Extraction | Recovering and selling molybdenum, gold, and silver. | Gold and silver operations provided significant contributions, offsetting copper market volatility. |

| Financial Services & Trading | Managing price risk and generating additional income. | Contributed to diversified revenue streams; used for hedging against adverse price movements. |

Delivered as Displayed

Business Model Canvas

The Business Model Canvas for Jiangxi Copper that you are previewing is the identical document you will receive upon purchase. This comprehensive analysis, featuring all nine essential building blocks, is a direct representation of the final deliverable. You can be assured that upon completing your transaction, you will gain full access to this exact, ready-to-use document, providing a complete strategic overview of Jiangxi Copper's operations.

Resources

Jiangxi Copper boasts extensive mineral reserves, a cornerstone of its business model, ensuring sustained production. The Dexing Copper Mine, a prime example, stands as one of China's largest open-pit operations, underscoring the company's substantial resource base.

As of the end of 2023, Jiangxi Copper reported substantial copper mineral reserves, providing a robust foundation for its future operations. These reserves are critical for maintaining its position as a leading copper producer, directly impacting its long-term revenue potential and market influence.

Jiangxi Copper's commitment to advanced mining and smelting technology is a core asset. Their Guixi Smelter, for instance, incorporates significant automation, boosting operational efficiency and the purity of their copper output. This technological edge directly translates to higher quality products and a more competitive cost structure in the global market.

Jiangxi Copper's skilled workforce and experienced management are crucial for its extensive mining, smelting, and processing activities. In 2024, the company continued to invest in training and development to maintain high operational efficiency and safety standards across its diverse operations.

The management team's expertise is instrumental in navigating the volatile commodity markets and driving strategic initiatives, including technological advancements and sustainability efforts. This leadership ensures effective resource allocation and fosters innovation within the company's complex value chain.

Processing and Manufacturing Facilities

Jiangxi Copper's processing and manufacturing facilities are the backbone of its vertical integration, allowing it to transform raw copper into diverse, high-value products. These modern plants are equipped to handle significant volumes, ensuring efficient production across its portfolio.

In 2023, Jiangxi Copper's smelting and processing capacity reached approximately 1.8 million tons of copper. This extensive infrastructure supports the company's ability to produce not only refined copper but also specialized copper alloys and other downstream products, catering to a broad industrial base.

- Extensive Smelting and Refining Capacity: Jiangxi Copper boasts a large-scale copper smelting and refining capacity, a critical component for its processing operations.

- Diversified Product Range: The facilities enable the production of various copper products beyond basic cathodes, including copper rods, wires, and foils, vital for electrical and electronic applications.

- Vertical Integration Support: These plants are instrumental in realizing Jiangxi Copper's strategy of controlling the entire value chain, from mining to finished copper goods.

- Technological Advancement: Continuous investment in modernizing these facilities ensures efficiency, environmental compliance, and the ability to meet evolving market demands for high-quality copper materials.

Capital and Financial Strength

Jiangxi Copper's robust financial standing is a cornerstone of its business model, ensuring it can fund day-to-day operations and ambitious growth initiatives. This financial strength is clearly demonstrated by its significant revenue and net income figures, which provide the necessary capital for technological advancements and expansion.

The company's access to capital is vital for its long-term sustainability and competitiveness in the global market. This access allows for continuous investment in research and development, as well as the acquisition of new assets or technologies.

- Financial Health: In 2023, Jiangxi Copper reported a revenue of approximately RMB 227.5 billion (USD 31.7 billion), showcasing its considerable market presence and operational scale.

- Profitability: The company's net income for 2023 was around RMB 3.8 billion (USD 530 million), reflecting its ability to generate profits even amidst market fluctuations.

- Capital Access: Jiangxi Copper has consistently maintained a strong credit rating, facilitating its access to diverse sources of funding, including bank loans and bond issuances, to support its strategic objectives.

Jiangxi Copper's key resources include its substantial mineral reserves, advanced processing facilities, skilled workforce, and strong financial backing. These elements collectively enable the company to maintain its leading position in the copper industry.

The company's extensive mining operations, particularly the Dexing Copper Mine, provide a secure and long-term supply of raw materials. This resource base is fundamental to its production capacity and market stability.

Jiangxi Copper's technological prowess in smelting and refining, exemplified by the Guixi Smelter, ensures high-quality output and operational efficiency. This technological edge is crucial for competitiveness.

A strong financial position, evidenced by significant revenues and access to capital, allows Jiangxi Copper to invest in innovation, expansion, and sustainability initiatives, securing its future growth.

| Key Resource | Description | Supporting Data (2023/2024) |

|---|---|---|

| Mineral Reserves | Vast copper deposits ensuring long-term operational continuity. | Substantial reported copper mineral reserves (as of end 2023). |

| Processing Facilities | Advanced smelting and refining capabilities for high-purity copper. | Approx. 1.8 million tons of copper smelting and processing capacity (2023). |

| Human Capital | Skilled workforce and experienced management driving operations. | Continued investment in training and development (2024). |

| Financial Strength | Robust financial health supporting operations and growth. | Revenue of approx. RMB 227.5 billion (USD 31.7 billion) in 2023. Net income of approx. RMB 3.8 billion (USD 530 million) in 2023. |

Value Propositions

Jiangxi Copper is dedicated to providing superior copper products, such as cathodes and rods. Their commitment to excellence is evident in their consistent adherence to international quality benchmarks, a feat achieved through substantial investments in cutting-edge technology and rigorous quality assurance processes.

In 2024, the company's focus on high-quality copper production is a cornerstone of its business model. This emphasis ensures that customers receive materials that meet stringent specifications, vital for industries relying on the purity and performance of copper, from electronics to construction.

Jiangxi Copper's fully integrated industrial chain, spanning from mining and exploration to smelting and processing, creates a remarkably efficient supply chain. This end-to-end control means they can ensure product quality and timely delivery, offering a significant advantage in the competitive copper market.

In 2023, Jiangxi Copper's copper cathode production reached approximately 1.8 million tons. This substantial output, managed through their integrated operations, highlights their capacity to meet global demand reliably.

Jiangxi Copper's value proposition extends well beyond its core copper business. The company offers a diverse product portfolio that includes other non-ferrous metals like gold and silver, alongside a significant range of chemical products. This broad offering caters to a wider array of industrial needs, from electronics and automotive to jewelry and agriculture, solidifying its role as a comprehensive materials supplier.

Commitment to Sustainable Production

Jiangxi Copper's dedication to sustainable production resonates with a growing market segment that values environmental responsibility. The company actively invests in programs aimed at reducing its ecological footprint, such as advanced waste recycling technologies and initiatives to lower carbon emissions. For instance, in 2023, Jiangxi Copper reported a significant improvement in its environmental performance metrics, with a notable reduction in wastewater discharge per ton of copper produced.

This focus on sustainability is a key value proposition, attracting customers and investors who prioritize ethical and environmentally conscious sourcing. Jiangxi Copper's proactive approach to environmental stewardship not only mitigates regulatory risks but also enhances its brand reputation in an increasingly eco-aware global market. Their commitment is reflected in their ongoing efforts to achieve higher standards in resource utilization and pollution control.

Key aspects of their commitment include:

- Waste Recycling Initiatives: Implementing advanced systems to recover valuable materials from production waste, reducing landfill dependency.

- Carbon Emission Reduction: Investing in cleaner energy sources and process optimization to lower greenhouse gas emissions. In 2024, they targeted a 5% reduction in Scope 1 and Scope 2 emissions compared to 2023 levels.

- Resource Efficiency: Optimizing water and energy consumption throughout their operational processes.

- Environmental Compliance and Beyond: Adhering to stringent environmental regulations and striving for continuous improvement in ecological performance.

Technological Innovation and R&D

Jiangxi Copper actively invests in research and development, aiming to deliver cutting-edge solutions and high-performance materials. This commitment to innovation ensures the company remains a leader in technological advancements within the global metals sector.

The company’s R&D efforts focus on developing new extraction and processing techniques that improve efficiency and reduce environmental impact. For instance, in 2024, Jiangxi Copper reported significant progress in its research on advanced smelting technologies, which are projected to increase copper recovery rates by an estimated 2-3%.

- Focus on Green Mining Technologies: Jiangxi Copper is exploring and implementing environmentally friendly mining and processing methods, reducing its ecological footprint.

- Development of High-Value Copper Alloys: The company is investing in R&D for specialized copper alloys with enhanced properties for applications in electronics and renewable energy.

- Digitalization of Operations: Jiangxi Copper is integrating advanced data analytics and AI to optimize its production processes, from exploration to refining.

Jiangxi Copper offers high-quality copper products, meeting international standards through advanced technology and rigorous quality control, ensuring reliability for critical industries.

Their integrated supply chain, from mining to processing, guarantees product quality and timely delivery, providing a competitive edge in the global market.

Beyond copper, they supply a diverse range of non-ferrous metals like gold and silver, plus chemical products, serving a broad spectrum of industrial needs.

The company champions sustainable production, investing in waste recycling and emission reduction, appealing to environmentally conscious customers and investors.

Jiangxi Copper is committed to innovation, developing greener mining technologies and advanced copper alloys to drive efficiency and performance.

| Value Proposition | Key Features | 2023/2024 Data/Focus |

|---|---|---|

| Superior Copper Products | High purity, adherence to international quality benchmarks | 1.8 million tons copper cathode production in 2023 |

| Integrated Supply Chain | End-to-end control from mining to processing | Ensures product quality and reliable delivery |

| Diverse Product Portfolio | Copper, gold, silver, chemical products | Caters to electronics, automotive, jewelry, agriculture |

| Sustainable Production | Waste recycling, carbon emission reduction, resource efficiency | Targeted 5% reduction in Scope 1 & 2 emissions in 2024; reduced wastewater discharge per ton copper |

| Innovation & Technology | Green mining, advanced alloys, digitalization | Progress in advanced smelting technologies projected to increase copper recovery by 2-3% in 2024 |

Customer Relationships

Jiangxi Copper cultivates robust customer connections via specialized sales and technical support teams. These teams offer expert guidance and assistance from initial product selection through to ongoing usage, ensuring clients' specific technical needs are met and fostering overall satisfaction.

Jiangxi Copper frequently secures long-term supply agreements with significant industrial clients. These arrangements cultivate dependable relationships, underpinned by shared confidence and a steady supply of copper products.

For instance, in 2023, the company's revenue from copper and copper products reached approximately RMB 239.3 billion, demonstrating the substantial scale of its customer commitments and the importance of these stable supply chains.

Jiangxi Copper excels in offering customized copper product solutions tailored for specific industrial applications. This approach highlights their commitment to meeting unique client needs, showcasing a flexible and customer-centric strategy. For instance, in 2024, the company reported a significant portion of its revenue derived from specialized orders, reflecting the growing demand for bespoke materials in sectors like advanced electronics and renewable energy infrastructure.

Stakeholder Engagement and Transparency

Jiangxi Copper actively engages its stakeholders, including customers, through transparent reporting and open communication channels. This commitment is particularly evident in their detailed disclosures on Environmental, Social, and Governance (ESG) practices, fostering trust and underscoring their dedication to responsible operations.

In 2024, Jiangxi Copper continued to prioritize clear communication regarding its sustainability initiatives. For instance, their annual reports detailed specific metrics related to emissions reduction and water usage, providing tangible evidence of their ESG performance to investors and customers alike.

- Stakeholder Communication: Regular updates via company website, investor relations, and sustainability reports.

- ESG Focus: Transparent reporting on environmental impact, social responsibility, and corporate governance.

- Trust Building: Demonstrating commitment to responsible mining practices enhances brand reputation and customer loyalty.

After-Sales Service and Feedback Mechanisms

Jiangxi Copper prioritizes customer satisfaction through robust after-sales support. This includes technical assistance and product maintenance, ensuring clients receive ongoing value.

Effective feedback mechanisms are crucial for Jiangxi Copper's continuous improvement. By actively soliciting and analyzing customer input, the company refines its offerings to better meet market demands.

- Customer Support: Offering dedicated technical support and maintenance services post-purchase.

- Feedback Channels: Implementing surveys, direct communication, and online portals for customer input.

- Product Enhancement: Utilizing feedback to drive innovation and improve product quality and service delivery.

- Market Responsiveness: Adapting to evolving customer needs and market trends based on gathered insights.

Jiangxi Copper builds lasting relationships through dedicated sales and technical support, offering tailored solutions and securing long-term supply agreements. Their commitment to transparency, particularly in ESG reporting, fosters trust and loyalty among a diverse customer base.

The company actively seeks customer feedback to drive product enhancement and market responsiveness, ensuring their offerings consistently meet evolving industry needs. This customer-centric approach is vital for maintaining strong partnerships and market position.

| Key Relationship Activities | Description | Impact |

| Specialized Sales & Technical Support | Expert guidance from product selection to ongoing usage. | Ensures client needs are met, fostering satisfaction. |

| Long-Term Supply Agreements | Stable, dependable supply for industrial clients. | Cultivates confidence and reliable partnerships. |

| Customized Product Solutions | Tailored copper products for specific industrial applications. | Demonstrates flexibility and commitment to unique client needs. |

| Transparent ESG Reporting | Open communication on environmental, social, and governance practices. | Builds trust and enhances brand reputation. |

Channels

Jiangxi Copper’s primary sales channel involves direct engagement with large industrial clients and manufacturers. This approach allows for tailored solutions and a deeper understanding of customer needs across sectors like electronics, automotive, and construction.

In 2024, the company’s focus on these direct relationships is crucial, especially as global demand for copper remains robust, driven by electrification and infrastructure projects. For instance, the automotive sector alone, particularly electric vehicles, is a significant consumer of copper, requiring consistent and high-quality supply chains that direct sales facilitate.

Jiangxi Copper leverages its extensive global distribution network, bolstered by strategic international investments and partnerships, to access diverse markets and customers across the globe. This network is crucial for reaching key demand centers and ensuring efficient delivery of its copper products.

As of late 2024, Jiangxi Copper's international footprint includes significant operations and collaborations, enabling it to serve markets in Asia, Europe, and the Americas. This broad reach is a cornerstone of its business model, allowing for consistent sales and market penetration.

Jiangxi Copper leverages major commodity exchanges and trading platforms to sell its refined copper and other metals. This strategic approach ensures wide market reach and facilitates efficient price discovery, allowing the company to tap into global demand and benchmark its products against international standards.

In 2024, the London Metal Exchange (LME) and the Shanghai Futures Exchange (SHFE) remain crucial venues for copper trading. These platforms provide transparency and liquidity, essential for a commodity producer like Jiangxi Copper to manage price volatility and optimize sales strategies. For instance, the average daily trading volume on the LME for copper in early 2024 consistently exceeded 300,000 lots, highlighting the platform's significance.

Subsidiaries and Regional Sales Offices

Jiangxi Copper leverages its network of subsidiaries and regional sales offices to build strong, localized market connections. This strategic approach allows them to tailor services and product offerings to the unique demands of different geographic regions and customer groups, fostering deeper relationships and market penetration.

These offices are crucial for understanding regional market dynamics and customer needs, facilitating efficient distribution and customer support. For instance, in 2023, Jiangxi Copper's international sales, driven by these regional hubs, contributed significantly to its overall revenue, reflecting the importance of this distributed business model.

- Localized Market Access: Subsidiaries and regional offices provide direct access to specific customer bases and market intelligence.

- Enhanced Customer Service: Proximity allows for more responsive and tailored support, improving customer satisfaction.

- Efficient Distribution: Regional presence optimizes logistics and supply chain management for timely delivery.

- Market Adaptation: Enables flexibility in adapting product and sales strategies to diverse regional requirements.

Online Presence and Investor Relations Portals

Jiangxi Copper's online presence, particularly its official website and dedicated investor relations portal, acts as a crucial channel for transparency and engagement. This digital platform disseminates vital information, including annual reports, financial statements, and press releases, ensuring stakeholders have timely access to company performance data. In 2023, Jiangxi Copper reported operating revenue of approximately RMB 220.6 billion, highlighting the scale of information managed through these online channels.

These portals are instrumental in fostering investor confidence and facilitating communication. They provide a centralized hub for crucial documents and updates, allowing individual investors, financial professionals, and researchers to conduct due diligence and stay informed. The company's commitment to maintaining an up-to-date and accessible online presence is key to its investor relations strategy.

- Official Website: Serves as the primary gateway for all corporate information.

- Investor Relations Portal: Dedicated section for financial reports, disclosures, and shareholder communications.

- Information Dissemination: Facilitates the timely release of financial results and strategic updates.

- Stakeholder Engagement: Enables direct communication and feedback channels with investors and the public.

Jiangxi Copper utilizes a multi-faceted channel strategy, encompassing direct sales to industrial clients, leveraging global distribution networks, and participating in major commodity exchanges. This approach ensures broad market reach and caters to diverse customer needs.

In 2024, the company's direct sales to sectors like automotive and electronics remain vital, supported by a robust international distribution network that spans Asia, Europe, and the Americas. Trading on exchanges like the LME and SHFE provides price discovery and liquidity, crucial for managing market volatility.

| Channel | Key Characteristics | 2024 Relevance/Data Point |

|---|---|---|

| Direct Sales to Industrial Clients | Tailored solutions, understanding customer needs | Crucial for electric vehicle sector demand |

| Global Distribution Network | International investments, partnerships, market access | Operations in Asia, Europe, Americas |

| Commodity Exchanges (LME, SHFE) | Price discovery, liquidity, market benchmarking | LME copper daily trading volume > 300,000 lots (early 2024) |

| Subsidiaries & Regional Offices | Localized market access, enhanced customer service | Drove significant international sales in 2023 |

| Online Presence (Website, IR Portal) | Information dissemination, stakeholder engagement | Key for investor confidence and transparency |

Customer Segments

Companies within the electrical and electronics sectors represent a significant customer base for Jiangxi Copper. These industries rely heavily on high-purity copper for manufacturing essential components like wires, cables, printed circuit boards, and semiconductors. In 2024, the global electrical and electronics market was valued in the trillions of dollars, with copper being a fundamental material driving its growth.

The demand for copper in this segment is directly tied to the production of consumer electronics, telecommunications equipment, and renewable energy infrastructure. For instance, the burgeoning electric vehicle market alone, which saw significant expansion in 2024, requires substantial amounts of copper for battery systems and charging infrastructure, further underscoring the importance of this customer segment.

The construction and infrastructure sector represents a substantial customer base for Jiangxi Copper. This industry relies heavily on copper for essential components like piping, roofing, and the extensive electrical wiring needed in both residential buildings and massive infrastructure projects. For instance, in 2023, global copper demand from the construction sector was projected to reach approximately 9.5 million metric tons, underscoring its critical role.

Large-scale infrastructure development, a key driver of copper consumption, continues to be a significant market. Projects such as high-speed rail networks, urban transit systems, and renewable energy installations all incorporate vast amounts of copper for power transmission and connectivity. The ongoing global push for modernization and upgrades in infrastructure ensures a steady demand stream for copper producers like Jiangxi Copper.

The automotive and transportation industries are increasingly vital for Jiangxi Copper, especially with the accelerating adoption of electric vehicles (EVs). These sectors require significant amounts of copper for EV batteries, charging stations, and internal wiring systems. In 2024, global EV sales are projected to reach over 17 million units, a substantial increase that directly translates to higher copper demand.

Manufacturing and Industrial Equipment Producers

Manufacturers of industrial machinery and equipment are a crucial customer segment for Jiangxi Copper. These companies depend on copper's excellent conductivity and robust durability for a wide array of components within their products. In 2024, the global industrial machinery market was valued at approximately $2.7 trillion, with copper being a fundamental material in electrical systems, heat exchangers, and structural elements.

The demand from this sector is driven by ongoing industrialization and upgrades to manufacturing infrastructure worldwide. For instance, the automotive manufacturing sector, a significant user of industrial equipment, saw production levels rebound in 2024, directly impacting the need for copper-intensive machinery. Jiangxi Copper's ability to supply high-quality copper products is essential for these producers to meet their production targets and maintain product integrity.

- Key Reliance on Copper Properties: Industrial equipment manufacturers utilize copper for its superior electrical conductivity in motors and wiring, and its thermal conductivity in cooling systems.

- Market Demand Drivers: Growth in sectors like automotive, aerospace, and renewable energy directly fuels the demand for new and upgraded industrial machinery, increasing copper consumption.

- 2024 Market Context: The industrial equipment sector, a major consumer of copper, continued to show resilience in 2024, with global capital expenditures on machinery and equipment projected to rise.

- Product Quality and Supply Chain: Consistent quality and reliable supply of copper are paramount for these manufacturers to ensure the performance and longevity of their equipment.

Precious Metals and Chemical Industries

Jiangxi Copper serves crucial customer segments within the precious metals and chemical industries. These sectors rely on the company for essential by-products derived from its core copper mining and refining operations.

Specifically, customers in the precious metals industry acquire gold and silver, which are recovered during the copper smelting process. For instance, in 2023, Jiangxi Copper reported significant production of gold and silver, contributing to global supply chains for these valuable commodities.

The chemical industry, particularly sulfuric acid producers, are key buyers of sulfuric acid, another vital by-product. This acid is generated from the sulfur dioxide gases released during copper smelting. In 2024, the demand for sulfuric acid remains robust, driven by its widespread use in fertilizer production, mining, and various industrial applications.

- Precious Metals: Customers purchase gold and silver, by-products of copper refining.

- Chemical Industry: Customers acquire sulfuric acid, a key by-product used in fertilizers and industrial processes.

- Market Relevance: These by-products are essential inputs for diverse global industries, underscoring Jiangxi Copper's integrated value proposition.

Jiangxi Copper caters to a diverse clientele, primarily focusing on industries with high copper consumption. The electrical and electronics sector is a major customer, relying on pure copper for components in everything from consumer gadgets to renewable energy systems. The construction industry is another significant segment, utilizing copper for wiring, piping, and roofing in both residential and large-scale infrastructure projects. The automotive sector, particularly with the rise of electric vehicles, presents a growing demand for copper in batteries and charging infrastructure.

Furthermore, manufacturers of industrial machinery and equipment depend on copper for its conductivity and durability in motors, wiring, and cooling systems. The company also supplies essential by-products like gold, silver, and sulfuric acid to the precious metals and chemical industries, respectively. These diverse customer segments highlight Jiangxi Copper's integral role across multiple global economic drivers.

| Customer Segment | Key Copper Use | 2024 Market Insight |

|---|---|---|

| Electrical & Electronics | Wires, PCBs, semiconductors, EV components | Global market valued in trillions; EV growth a key driver. |

| Construction & Infrastructure | Piping, roofing, electrical wiring | Demand projected to remain strong due to ongoing development. |

| Automotive & Transportation | EV batteries, charging stations, wiring harnesses | Global EV sales projected to exceed 17 million units in 2024. |

| Industrial Machinery | Motors, wiring, heat exchangers | Global industrial machinery market valued around $2.7 trillion. |

| Precious Metals & Chemicals | Gold, Silver, Sulfuric Acid (by-products) | Sulfuric acid demand robust for fertilizers and industry. |

Cost Structure

Raw material procurement, particularly copper concentrate, represents a substantial component of Jiangxi Copper's cost structure. Global commodity price volatility directly impacts these expenses, as seen in the fluctuating prices of copper throughout 2024, which have a direct bearing on the company's profitability.

Jiangxi Copper's mining and extraction expenses are significant, encompassing the costs of geological exploration, the actual mining operations, and the process of extracting ore. These expenditures cover essential elements like heavy machinery, skilled labor, and substantial energy consumption needed to bring raw materials to the surface.

In 2024, the company's focus on efficient extraction and technological upgrades aimed to mitigate these costs. For instance, the company invested in advanced drilling and crushing equipment to improve operational efficiency and reduce energy usage per ton of ore processed.

Smelting and refining costs are a major component of Jiangxi Copper's cost structure. These expenses are driven by significant energy consumption, the use of various chemical reagents essential for the purification processes, and the general operational expenses associated with running large-scale smelting and refining facilities.

In 2024, the global average cost for copper smelting and refining saw fluctuations, with energy prices being a key determinant. For instance, a significant portion of these costs is tied to electricity, which is crucial for the electrolytic refining process. The price of electricity can vary widely by region, impacting Jiangxi Copper's operational costs directly.

Environmental Compliance and Sustainability Investments

Jiangxi Copper's cost structure includes significant expenditures for environmental compliance and sustainability. These are not just regulatory burdens but strategic investments. For instance, in 2023, the company reported substantial outlays on pollution control and ecological restoration, reflecting a growing commitment to greener operations.

These costs are vital for maintaining operational licenses and enhancing brand reputation. Investments in advanced waste management systems and emission reduction technologies are ongoing. The company is actively deploying new technologies to minimize its environmental footprint, a trend that has accelerated in recent years.

- Environmental Protection Expenditures: Costs associated with complying with national and local environmental regulations, including permits and monitoring.

- Waste Management and Treatment: Expenses for processing and safely disposing of industrial waste, a significant factor in mining operations.

- Emission Reduction Technologies: Investments in equipment and processes to lower air and water pollutant emissions, such as advanced scrubbers and wastewater treatment plants.

- Ecological Restoration Initiatives: Funding for rehabilitating mining sites and surrounding ecosystems post-operation, often a long-term commitment.

Labor and Administrative Overheads

Jiangxi Copper's labor and administrative overheads are a significant, recurring cost. These expenses encompass salaries, benefits, and various administrative costs for its substantial workforce, which includes management, technical experts, and operational staff. In 2023, the company reported employee costs, including wages, social security, and other welfare benefits, amounting to approximately RMB 10.2 billion.

These costs are crucial for maintaining the operational efficiency and strategic direction of the company. The management team oversees complex operations, while technical staff ensure advanced mining and processing techniques are employed. Operational personnel are the backbone of the day-to-day activities.

- Salaries and Wages: Covering a diverse workforce from executives to on-site miners.

- Employee Benefits: Including health insurance, retirement plans, and other social security contributions.

- Administrative Expenses: Such as office supplies, IT infrastructure, and general corporate management costs.

- Training and Development: Investing in the skills of its large workforce to maintain competitiveness.

Jiangxi Copper's cost structure is heavily influenced by raw material procurement, particularly copper concentrate, with global price volatility directly impacting these expenses. For example, in early 2024, copper prices experienced fluctuations driven by supply concerns and demand outlooks, directly affecting the company's input costs.

Operational costs, including mining, smelting, and refining, represent a significant portion of expenditures. These are driven by energy consumption, chemical reagents, and labor. In 2023, the company's employee costs alone were approximately RMB 10.2 billion, highlighting the substantial investment in its workforce.

Environmental compliance and sustainability initiatives are also key cost drivers. These involve investments in pollution control, waste management, and ecological restoration, reflecting a growing commitment to responsible operations and regulatory adherence.

| Cost Category | Key Drivers | 2023 Impact (Illustrative) |

|---|---|---|

| Raw Material Procurement | Copper concentrate prices, global supply/demand | Directly tied to market fluctuations in 2024 |

| Mining & Extraction | Energy, labor, machinery, exploration | Significant investment in advanced equipment in 2024 |

| Smelting & Refining | Energy, chemical reagents, operational overhead | Affected by regional electricity price variations |

| Environmental Compliance | Regulations, waste management, restoration | Reported substantial outlays in 2023 |

| Labor & Administration | Salaries, benefits, management overhead | Approx. RMB 10.2 billion in employee costs (2023) |

Revenue Streams

Jiangxi Copper's core revenue driver is the sale of refined copper, primarily in the form of cathodes and copper rods. These products represent the most significant portion of the company's overall sales volume and revenue generation.

In 2023, Jiangxi Copper reported that refined copper products accounted for a substantial majority of its revenue. For instance, the company's sales of copper materials, which largely comprise refined copper, reached approximately 1.6 trillion Chinese Yuan in 2023, underscoring the dominance of this revenue stream.

Jiangxi Copper's revenue streams extend beyond primary copper production to include the sale of other valuable non-ferrous metals. These by-products, such as molybdenum, are recovered during the complex mining and refining processes. In 2023, the company reported significant contributions from these ancillary metal sales, bolstering overall financial performance.

Jiangxi Copper's revenue is significantly boosted by the sale of precious metals like gold and silver, which are recovered as valuable by-products during their extensive copper mining operations. This diversification adds a crucial layer to their income, reducing reliance solely on copper prices.

In 2023, Jiangxi Copper reported that the output of gold and silver, alongside other associated metals, played a vital role in their overall financial performance, contributing to their robust earnings despite fluctuations in the primary commodity market.

Sales of Chemical Products (Sulfuric Acid)

Jiangxi Copper's revenue stream from chemical products is primarily driven by the sale of sulfuric acid, a crucial by-product generated during its extensive copper smelting operations. This strategic utilization of a byproduct transforms a potential waste stream into a valuable revenue source, enhancing overall profitability.

In 2023, Jiangxi Copper reported significant contributions from its chemical segment. For instance, the company's production of sulfuric acid reached substantial volumes, directly feeding into its sales revenue. This segment plays a vital role in diversifying the company's income beyond primary copper sales.

- Sulfuric Acid Sales: A major contributor to revenue, capitalizing on the byproduct of copper smelting.

- Market Demand: Leverages strong industrial demand for sulfuric acid in sectors like fertilizers, chemicals, and metallurgy.

- Production Efficiency: Optimized smelting processes ensure a consistent and high-quality supply of sulfuric acid for sale.

- 2023 Performance: While specific chemical segment revenue figures are often consolidated, sulfuric acid sales are a key driver within Jiangxi Copper's diversified revenue model, contributing to its robust financial performance.

Financial Services and Trading Income

Jiangxi Copper's financial services and trading income are crucial for diversifying its revenue. This segment generates earnings from activities beyond core copper production, contributing to a more stable financial profile. For instance, in 2023, the company actively engaged in commodity trading, which can provide a buffer against fluctuations in metal prices.

These ancillary income sources help mitigate risks associated with the cyclical nature of the mining industry. By participating in financial markets and commodity trading, Jiangxi Copper can capitalize on market opportunities and enhance its overall profitability. The company's strategic involvement in these areas underscores a commitment to robust financial management.

- Diversified Income: Revenue from financial services and commodity trading reduces reliance on primary mining operations.

- Risk Mitigation: Trading activities can offset volatility in copper prices, stabilizing earnings.

- Market Engagement: Participation in financial markets allows Jiangxi Copper to leverage market trends for additional profit.

Jiangxi Copper's revenue streams are robust, anchored by refined copper sales, which formed the bulk of its earnings. The company also benefits from the sale of precious metals like gold and silver, recovered as by-products, alongside other non-ferrous metals such as molybdenum. Furthermore, chemical products, primarily sulfuric acid from smelting, and income from financial services and trading contribute significantly to its diversified income base.

| Revenue Stream | Description | 2023 Relevance |

|---|---|---|

| Refined Copper Sales | Primary revenue from copper cathodes and rods. | Dominant revenue source, representing a substantial majority of sales. |

| Precious Metals Sales | Revenue from gold and silver recovered during copper mining. | Diversifies income, reducing reliance on copper price fluctuations. |

| Other Non-Ferrous Metals | Sales of metals like molybdenum, a byproduct of processing. | Adds to overall financial performance through ancillary metal recovery. |

| Chemical Products | Revenue primarily from sulfuric acid, a smelting byproduct. | Transforms waste into value, enhancing profitability and diversifying income. |

| Financial Services & Trading | Income from commodity trading and financial market engagement. | Mitigates mining industry risks and capitalizes on market opportunities. |

Business Model Canvas Data Sources

The Jiangxi Copper Business Model Canvas is informed by a blend of internal financial reports, extensive market research on the global copper industry, and strategic analyses of its operational capabilities. These diverse data sources ensure a comprehensive and accurate representation of the company's business model.