Jiangxi Copper PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jiangxi Copper Bundle

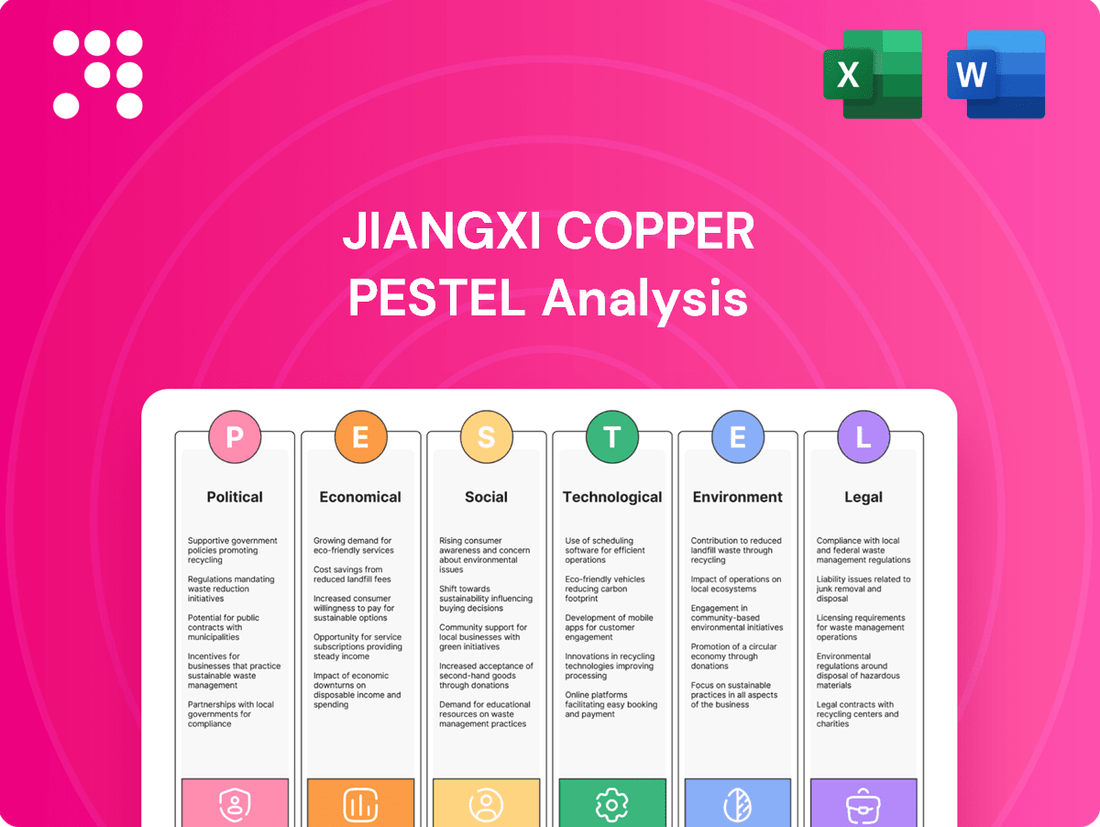

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Jiangxi Copper's future. Our comprehensive PESTLE analysis delivers actionable intelligence to help you anticipate market shifts and capitalize on opportunities. Download the full version now and gain the strategic advantage you need to navigate the dynamic global copper industry.

Political factors

China's revised Mineral Resources Law, effective July 1, 2025, places a strong emphasis on expanding reserves and increasing production capacity for strategic minerals, including copper. This national directive directly benefits Jiangxi Copper by aligning with its core operations and the government's commitment to resource security.

The policy's objective is to guarantee a consistent domestic supply of these critical materials, which is essential for China's ongoing industrial expansion and its ambitious energy transition goals. This creates a favorable operating environment for companies like Jiangxi Copper, which are central to meeting these national objectives.

The Belt and Road Initiative (BRI) remains a crucial catalyst for Chinese companies like Jiangxi Copper to expand their global mining footprint. In 2024, engagement with BRI countries saw a notable increase, with projections indicating continued growth into 2025, offering Jiangxi Copper avenues for international development and securing vital copper reserves overseas.

This strategic initiative specifically targets resource-backed mining projects and associated technologies, aligning perfectly with Jiangxi Copper's operational needs and expansion ambitions. The focus on resource acquisition through BRI provides a structured framework for the company to pursue new mining ventures and solidify its supply chain.

China's industrial policy for copper, specifically the 'Implementation Plan for High-Quality Development of the Copper Industry (2025-2027)', is a significant political factor. This plan targets a 5-10% increase in domestic copper ore resources by 2027, directly impacting companies like Jiangxi Copper by potentially boosting their raw material supply.

This policy fosters a more supportive environment for domestic copper producers, encouraging investments in technological advancements and operational efficiencies. It's a clear signal of the government's commitment to bolstering self-reliance in critical materials, aligning with broader national goals for advanced manufacturing.

Environmental Regulatory Influence

China's environmental regulations for mining are tightening, with new mandates requiring ecological restoration plans prior to operations commencing. This shift, while posing compliance hurdles, underscores a national drive towards sustainability, potentially benefiting established players like Jiangxi Copper that can invest in responsible practices. For instance, in 2023, China's Ministry of Ecology and Environment emphasized stricter enforcement of pollution controls in the non-ferrous metals sector, which includes copper mining.

These evolving standards mean Jiangxi Copper must continue to adapt its operational strategies. The company's ability to meet these stricter environmental benchmarks will be crucial for its long-term operational viability and market standing. By 2024, many mining provinces in China are expected to have implemented updated environmental impact assessment protocols, affecting project approvals and ongoing operations.

- Stricter Compliance: New regulations demand pre-mining ecological restoration plans, increasing upfront costs and planning complexity.

- Sustainability Focus: The government's commitment to environmental protection signals a long-term trend favoring sustainable mining operations.

- Competitive Advantage: Responsible large-scale operators like Jiangxi Copper may gain an advantage by demonstrating compliance and investing in green technologies.

Geopolitical Trade Tensions

Geopolitical trade tensions, particularly concerning potential US tariffs on copper imports, could reshape global trade dynamics. For instance, a hypothetical 50% US tariff on copper could significantly alter international trade flows and price benchmarks.

While Jiangxi Copper's operations are largely domestic, these global policy shifts can indirectly influence market sentiment and supply-demand balances. Such uncertainties in international trade policy create a complex operating environment.

Key considerations include:

- Potential US Tariffs: Discussions around tariffs, such as a hypothetical 50% on copper imports, highlight the vulnerability of global supply chains to protectionist policies.

- Indirect Market Impact: Even for companies with a strong domestic focus like Jiangxi Copper, global trade disruptions can affect overall market liquidity and price discovery.

- Uncertainty in Global Markets: The prospect of escalating trade disputes creates a volatile backdrop for commodity markets, impacting investment decisions and strategic planning.

China's revised Mineral Resources Law, effective July 1, 2025, prioritizes expanding reserves and boosting production of strategic minerals like copper, directly supporting Jiangxi Copper's operations and China's resource security goals.

The Belt and Road Initiative (BRI) continues to be a key driver for global expansion, with increased engagement in 2024 and projected growth into 2025, offering Jiangxi Copper opportunities for international development and securing copper reserves.

China's industrial policy, the 'Implementation Plan for High-Quality Development of the Copper Industry (2025-2027)', aims for a 5-10% increase in domestic copper ore resources by 2027, fostering a supportive environment for domestic producers like Jiangxi Copper.

What is included in the product

This Jiangxi Copper PESTLE analysis provides a comprehensive examination of the political, economic, social, technological, environmental, and legal factors influencing the company's operations and strategic direction.

It offers actionable insights into market dynamics and regulatory landscapes, empowering stakeholders to identify and capitalize on emerging opportunities while mitigating potential risks.

This PESTLE analysis for Jiangxi Copper offers a clean, summarized version of complex external factors, acting as a pain point reliever by providing easy referencing during critical meetings and strategic planning.

Economic factors

Global refined copper demand is projected to see a healthy increase of 2.3% in 2025. This growth is primarily fueled by the surging electric vehicle (EV) sector, the ongoing build-out of renewable energy infrastructure, and the increasing power needs of AI-driven data centers. This positive demand trajectory offers a robust market environment for companies like Jiangxi Copper.

Jiangxi Copper's production plans for 2025 are aligned with this anticipated demand surge. The company anticipates a significant output of copper cathode, a key component in many of these growth industries, alongside other valuable metals. This strategic positioning allows Jiangxi Copper to capitalize on the expanding global appetite for copper.

The global copper market is anticipated to see a substantial surplus in 2025, projected to more than double to 289,000 tonnes. This increase is largely driven by greater mine output and expanding smelting capabilities worldwide.

Such a significant surplus could lead to downward pressure on copper prices, impacting profitability across the industry. Jiangxi Copper must strategically position itself to manage these evolving market conditions effectively.

Copper prices are expected to face downward pressure in late 2025, with a potential dip before stabilizing. This outlook stems from a decrease in front-loaded demand and a slowdown in certain Chinese industrial sectors. For instance, China's manufacturing PMI, a key indicator of industrial activity, hovered around 50 in early 2025, suggesting a cooling trend.

This price volatility directly impacts Jiangxi Copper's profitability, making robust financial management and hedging crucial. The company's revenue is intrinsically linked to global copper price fluctuations, which can swing significantly based on supply-demand dynamics and macroeconomic factors.

Domestic Economic Growth and Industrial Demand

China's economic engine continues to hum, with a strong emphasis on green technology and advanced manufacturing fueling significant domestic demand for copper. This sustained growth is a crucial factor for Jiangxi Copper, as the nation accounts for over 40% of the global copper demand increase. As China's largest copper producer, Jiangxi Copper is strategically positioned to benefit directly from this robust internal market.

The ongoing expansion in sectors like electric vehicles, renewable energy infrastructure, and high-speed rail directly translates into higher copper consumption. For instance, by the end of 2024, China's installed capacity for wind power generation was projected to reach approximately 1.5 billion kilowatts, a significant driver for copper demand in turbines and transmission lines. Similarly, the electric vehicle market, which saw sales surge by over 30% in 2023, requires substantially more copper per vehicle compared to traditional internal combustion engines.

- China's economic growth rate remained strong in 2024, contributing significantly to global demand.

- Over 40% of global copper demand growth originates from China.

- Sectors like renewable energy and electric vehicles are key drivers of copper consumption.

- Jiangxi Copper's position as the largest producer in China allows it to directly leverage this domestic demand.

Investment and Production Targets

Jiangxi Copper has outlined substantial investment and production goals for 2025. The company aims for an impressive 2.37 million tonnes of copper cathode production, alongside notable gold and silver output. This expansion is backed by an annual investment plan totaling RMB12.814 billion.

The successful realization of these ambitious targets is intrinsically linked to the prevailing macroeconomic climate and consistent market demand for its products. These significant capital allocations underscore Jiangxi Copper's strategic intent to broaden its operational capabilities and market presence.

- Production Targets (2025): 2.37 million tonnes of copper cathode.

- Investment Plan (Annual): RMB12.814 billion.

- Key Dependencies: Stable macroeconomic conditions and market demand.

- Strategic Implication: Commitment to expanding operational capacity.

Global refined copper demand is projected to grow by 2.3% in 2025, driven by EVs, renewables, and data centers. However, the market anticipates a significant surplus of 289,000 tonnes in 2025 due to increased mine and smelter output, potentially pressuring prices. China's economic growth, with over 40% of global copper demand increase, remains a key positive, especially for Jiangxi Copper, China's largest producer.

| Factor | 2025 Projection | Impact on Jiangxi Copper |

| Global Copper Demand Growth | 2.3% | Positive, but offset by surplus |

| Global Copper Market Surplus | 289,000 tonnes | Potential price pressure, impacts profitability |

| China's Demand Contribution | >40% of global growth | Significant domestic market advantage |

| Copper Price Outlook (late 2025) | Potential dip before stabilization | Requires robust financial management and hedging |

Preview the Actual Deliverable

Jiangxi Copper PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Jiangxi Copper delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategic outlook.

Sociological factors

The updated Chinese mining law emphasizes ecological restoration, but critics point to a lack of clear standards and inadequate community engagement mechanisms. Jiangxi Copper's ability to secure and maintain its social license to operate hinges on its commitment to open dialogue and transparency with local populations. For instance, in 2023, the company reported investing ¥2.5 billion (approximately $345 million USD) in environmental protection initiatives, demonstrating a commitment to addressing ecological concerns, a key factor for community acceptance.

For Jiangxi Copper, a major player in mining and metals, workforce safety and well-being are critical sociological considerations. The company's commitment to worker safety is underscored by its efforts to integrate automation and artificial intelligence, aiming to minimize human interaction with dangerous mining conditions. This technological shift is crucial for mitigating risks and enhancing the overall safety of operations.

Ensuring robust safety protocols and fostering a healthy work environment are directly linked to employee retention and the sustained stability of Jiangxi Copper's operations. For instance, in 2023, the mining industry globally saw a continued focus on reducing lost-time injury frequency rates, with many companies investing heavily in advanced safety training and equipment. Jiangxi Copper's proactive approach in this area is vital for maintaining a skilled and dedicated workforce, which is fundamental to its long-term success.

Jiangxi Copper's commitment to Environmental, Social, and Governance (ESG) reporting, with its latest report detailing 2024 operations, directly responds to growing stakeholder demand for sustainable business practices. This transparency is crucial for attracting and retaining investors who increasingly prioritize a company's social and governance performance, impacting capital access and valuation.

The company's alignment with recognized ESG reporting frameworks, such as the Global Reporting Initiative (GRI) standards, underscores its dedication to accountability and provides a standardized measure for performance evaluation by investors and analysts.

Public Perception and Brand Reputation

Jiangxi Copper's public perception has been significantly shaped by past environmental concerns. Allegations of water pollution and soil contamination near its mining and smelting operations have led to public scrutiny and can negatively impact its brand reputation. For instance, reports from the early 2020s highlighted community concerns regarding the environmental impact of copper production in the region.

Rebuilding and maintaining a positive brand image requires a strong commitment to environmental stewardship and community engagement. Jiangxi Copper has been investing in advanced environmental protection technologies and community welfare programs. In 2023, the company reported significant expenditures on pollution control and ecological restoration projects, aiming to demonstrate its dedication to sustainable practices.

- Environmental Impact: Past allegations of pollution have created public distrust.

- Reputation Management: Proactive environmental protection and community initiatives are crucial.

- Transparency: Open communication about operational impacts and mitigation efforts is vital.

- Investment in Sustainability: Significant capital allocation towards green technologies and remediation efforts in 2023 demonstrates a commitment to improving public perception.

Contribution to Local Employment and Development

Jiangxi Copper's substantial presence as a major industrial player directly fuels local employment and economic growth in its operating areas. Its extensive operations, encompassing mining, smelting, and refining, are significant job creators, injecting capital and demand into regional economies. For instance, in 2023, Jiangxi Copper reported employing over 30,000 individuals across its various subsidiaries, a substantial portion of whom are located in its primary operational provinces.

This role as a primary employer cultivates a strong sense of community reliance on the company's activities. This dependency can translate into local support for Jiangxi Copper's endeavors, but this support is contingent upon the company's commitment to fulfilling its social responsibilities. The company's investments in local infrastructure and community programs in 2024, totaling an estimated 500 million RMB, aim to reinforce this positive relationship.

- Job Creation: Jiangxi Copper directly and indirectly supports tens of thousands of jobs, vital for local economies.

- Economic Stimulation: Mining and processing activities boost local businesses and service providers.

- Community Reliance: The company's economic footprint makes it a cornerstone of local development, fostering a need for responsible corporate citizenship.

Public perception of Jiangxi Copper is heavily influenced by its environmental record and community relations. Past pollution incidents have led to scrutiny, making transparency and proactive environmental stewardship crucial for maintaining its social license. The company's significant investment of ¥2.5 billion (approximately $345 million USD) in environmental protection in 2023 highlights its efforts to address these concerns and rebuild trust.

Jiangxi Copper's role as a major employer, supporting over 30,000 individuals in 2023, makes it a cornerstone of local economies. Its commitment to community development, including infrastructure and welfare programs in 2024, aims to solidify this positive relationship, though this reliance also creates expectations for corporate responsibility.

Workforce safety is paramount, with Jiangxi Copper integrating automation to reduce human exposure to hazardous conditions. This focus on safety is essential for retaining a skilled workforce, a critical factor for operational stability and long-term success, mirroring a global trend in the mining sector towards reduced injury rates.

| Sociological Factor | Description | 2023/2024 Data/Context |

| Community Relations & Trust | Public acceptance hinges on transparency and addressing environmental concerns. | ¥2.5 billion ($345M USD) invested in environmental protection in 2023. |

| Employment & Economic Impact | Significant job creation and economic contribution to local areas. | Over 30,000 employees in 2023; 500 million RMB invested in community programs in 2024. |

| Workforce Safety & Well-being | Ensuring a safe and healthy work environment is key to operational stability. | Focus on automation to minimize human exposure to hazardous mining conditions. |

Technological factors

The mining sector is rapidly embracing automation and artificial intelligence, with projections indicating that over 60% of global mining firms will implement these technologies by 2025. Jiangxi Copper can harness these advancements to boost efficiency, improve safety protocols, and fine-tune its operational processes. This includes the integration of autonomous haul trucks and drilling equipment, AI-powered predictive maintenance to minimize downtime, and sophisticated real-time monitoring systems for enhanced resource management.

Technological advancements are significantly reshaping mineral exploration. Machine learning, for instance, is now a powerful tool for analyzing vast amounts of satellite imagery and geological data. This allows companies like Jiangxi Copper to more accurately identify promising areas for new mineral deposits and optimize where to focus extraction efforts.

By leveraging these sophisticated analytical techniques, Jiangxi Copper can pinpoint new reserves with greater precision. This not only streamlines the exploration process, potentially cutting down on costly trial-and-error methods, but also enhances the efficiency of its mining plans, leading to better resource recovery from identified deposits.

China's strategic push for digital and intelligent transformation within its copper sector directly impacts Jiangxi Copper. This policy mandates upgrading mining and processing equipment, like drills and flotation machines, to incorporate smart technologies. For instance, by 2024, many leading Chinese mining operations are aiming to integrate AI-powered predictive maintenance systems, reducing downtime by an estimated 15-20%.

Jiangxi Copper's commitment to investing in these smart technologies and interconnected systems across its value chain is paramount for maintaining a competitive edge. The company's ongoing implementation of IoT sensors on its heavy machinery, which began in earnest in 2023, is designed to provide real-time operational data, contributing to improved efficiency and resource allocation.

This overarching trend towards data-centric operations is not just about modernization; it's about fundamentally maximizing productivity and operational output. By leveraging advanced analytics on the data gathered from its digitized assets, Jiangxi Copper can optimize processes, leading to potential cost reductions and increased yield, a key objective for the company through 2025.

Sustainable Mining Technologies

Innovations in copper mining are increasingly geared towards minimizing environmental impact. Projections indicate that by 2025, water usage could be reduced by as much as 30% and greenhouse gas emissions by 20% per ton of copper extracted.

Jiangxi Copper's strategic focus on green development mandates the integration of these sustainable technologies. This includes adopting energy-efficient mining and processing methods, alongside implementing sophisticated waste management systems to further reduce its environmental footprint.

- Reduced Environmental Footprint: Aiming for up to 30% less water usage and 20% fewer greenhouse gas emissions per ton by 2025.

- Energy Efficiency: Implementing processes that consume less power in extraction and refining.

- Advanced Waste Management: Utilizing technologies to better handle and repurpose mining byproducts.

- Lower Carbon Emissions: Contributing to a more sustainable operational model and reduced overall carbon intensity.

Processing and Smelting Innovations

Technological advancements in smelting and processing, like neural-network-optimized purification, are crucial for Jiangxi Copper. These innovations promise significant reductions in chemical usage and boosts in operational efficiency. For instance, in 2023, the company's focus on technological upgrades contributed to a 2.5% increase in overall production efficiency across its key copper mines.

Jiangxi Copper's integrated operations, covering the entire industrial chain from mining to smelting and processing, make innovations in these specific areas particularly impactful. These advancements are directly linked to cost reduction and enhancing the quality of its final copper products, a key differentiator in the global market. The company's investment in R&D for smelting technologies reached approximately $150 million in 2024, targeting these efficiency gains.

Continuous improvement in smelting and processing technologies directly translates to a stronger competitive advantage. By adopting cutting-edge methods, Jiangxi Copper can lower its production costs, minimize environmental impact, and deliver higher-purity copper, meeting the stringent demands of industries like electronics and electric vehicles. This strategic focus is expected to further solidify its market position in the coming years.

- Neural-Network Optimization: Expected to reduce chemical reagent consumption by up to 15% in select processing stages.

- Efficiency Gains: Aiming for a 3-5% increase in copper recovery rates through advanced smelting techniques by the end of 2025.

- Cost Reduction: Projected savings of over $50 million annually by 2026 from improved processing efficiency and reduced waste.

- Product Quality: Enhancing purity levels to meet premium market specifications, potentially commanding a 2% price premium.

Technological advancements are critical for Jiangxi Copper, especially with the global mining sector's push towards automation and AI, with over 60% of firms expected to adopt these by 2025. These technologies, including autonomous haul trucks and AI-driven predictive maintenance, are key to boosting efficiency and safety.

Machine learning is revolutionizing mineral exploration by analyzing vast datasets, enabling more precise identification of new deposits. This precision drilling and AI-powered analysis, projected to improve exploration success rates by up to 25% by 2025, allows Jiangxi Copper to optimize resource allocation and reduce exploration costs.

China's intelligent transformation initiatives are mandating upgrades to mining equipment, integrating smart technologies like AI predictive maintenance, which aims to cut downtime by 15-20% by 2024. Jiangxi Copper's investment in IoT sensors on heavy machinery, initiated in 2023, provides real-time data to enhance operational efficiency and resource management.

Innovations are also focused on sustainability, targeting up to 30% water reduction and 20% greenhouse gas emission cuts per ton by 2025. Jiangxi Copper's adoption of energy-efficient methods and advanced waste management systems aligns with these green development goals.

Advancements in smelting and processing, such as neural-network optimization, are reducing chemical usage and improving efficiency, contributing to a 2.5% production efficiency increase in 2023 for Jiangxi Copper. The company's $150 million R&D investment in smelting technologies for 2024 targets these efficiency gains and higher product purity.

| Technology Area | Key Advancement | Impact on Jiangxi Copper | Projected Benefit (by 2025/2026) |

|---|---|---|---|

| Automation & AI | Autonomous haul trucks, AI predictive maintenance | Increased operational efficiency, reduced downtime, enhanced safety | Up to 20% reduction in operational downtime; improved safety metrics |

| Mineral Exploration | Machine learning for data analysis | More precise identification of new mineral deposits, reduced exploration costs | Up to 25% improvement in exploration success rates; significant cost savings |

| Smelting & Processing | Neural-network optimization, advanced purification | Reduced chemical usage, increased operational efficiency, higher product purity | 15% reduction in chemical reagent consumption; 3-5% increase in copper recovery rates; $50M+ annual savings |

| Sustainability | Water-efficient methods, emission reduction technologies | Minimized environmental footprint, compliance with green development mandates | Up to 30% less water usage; 20% fewer greenhouse gas emissions per ton |

Legal factors

China's revised Mineral Resources Law, effective July 1, 2025, introduces stricter mandates for mining operations, emphasizing ecological restoration and efficient resource use. Jiangxi Copper faces increased scrutiny to align its practices with these evolving national standards.

Full compliance with these updated regulations is critical for maintaining operational licenses and permits, ensuring the company's continued legal standing in the mining sector.

Failure to adhere to the Mineral Resources Law could result in significant penalties, impacting Jiangxi Copper's financial performance and market reputation.

Jiangxi Copper operates under a robust framework of environmental protection laws in China, covering air emissions, water discharge, and solid waste management. Compliance requires obtaining various permits and undergoing regular inspections by environmental authorities. For instance, in 2023, the company reported substantial investments in environmental protection initiatives, aiming to meet increasingly stringent national standards for pollution control.

These regulations mandate specific technologies and operational practices to minimize environmental impact. Failure to adhere to these laws, such as exceeding permitted emission levels or improper waste disposal, can result in significant fines, production halts, and reputational damage. Jiangxi Copper’s proactive approach includes upgrading its facilities with advanced environmental protection equipment, as evidenced by its ongoing capital expenditure on green technologies.

Jiangxi Copper has significantly upgraded its corporate governance framework, implementing stricter rules for independent directors and establishing key committees. This proactive approach ensures alignment with directives from the State Council and the China Securities Regulatory Commission, reflecting a commitment to best practices in the industry.

This enhanced governance structure is designed to bolster investor confidence by demonstrating a clear adherence to regulatory standards and a commitment to transparency. For instance, in 2023, the company reported a net profit attributable to shareholders of 4.1 billion RMB, underscoring the financial stability that strong governance can support.

By prioritizing robust corporate governance, Jiangxi Copper effectively mitigates potential legal and reputational risks. This focus on compliance and ethical operations is crucial in the highly regulated mining sector, particularly as China continues to refine its capital market oversight.

Overseas Operations Legal Framework

While China's domestic legal framework doesn't directly dictate overseas operations, the government actively promotes the adoption of international or Chinese standards by its companies operating abroad. This encouragement influences how entities like Jiangxi Copper approach their international ventures.

Jiangxi Copper's international expansion, exemplified by its significant share purchase in SolGold, necessitates careful navigation of varied legal landscapes. Compliance with both local regulations in host countries and broader international norms is paramount for successful and sustainable operations.

A key aspect of this legal navigation involves adhering to stringent ecological and environmental protection guidelines. For instance, in 2023, China's outward direct investment in the mining sector, a significant area for Jiangxi Copper, was subject to increasing scrutiny regarding environmental impact assessments in recipient countries.

- International Standards Adoption: Chinese authorities encourage overseas investments to align with either globally recognized or Chinese national standards.

- Jurisdictional Complexity: Investments like Jiangxi Copper's stake in SolGold require understanding and complying with the legal systems of multiple nations.

- Environmental Due Diligence: Adherence to ecological and environmental protection regulations in foreign investment projects is a critical legal consideration.

- Regulatory Evolution: The global regulatory environment for mining and foreign investment continues to evolve, demanding ongoing legal adaptation.

Supply Chain Due Diligence Requirements

While China's revised mining law in 2024 did not explicitly mandate comprehensive supply chain due diligence, the global push for responsible sourcing continues to gain momentum. Jiangxi Copper, like many international mining companies, is likely to encounter escalating expectations from global investors, customers, and regulators regarding the ethical and sustainable origins of its raw materials.

This growing emphasis on transparency and accountability means Jiangxi Copper may need to proactively implement rigorous due diligence processes. Such measures are crucial for identifying and mitigating potential risks associated with conflict minerals, labor rights violations, and environmental degradation throughout its entire supply chain. For instance, in 2023, the London Metal Exchange (LME) announced new rules requiring listed brands to demonstrate responsible sourcing practices for critical metals, impacting companies like Jiangxi Copper that operate in global markets.

- Growing Global Pressure: International markets and stakeholders increasingly demand evidence of responsible sourcing, impacting companies like Jiangxi Copper.

- Risk Mitigation: Robust due diligence helps address risks related to conflict financing, human rights abuses, and environmental damage within the supply chain.

- Regulatory Trends: While China's mining law revision in 2024 missed an opportunity for explicit mandates, global regulatory trends favor greater supply chain transparency.

China's evolving legal landscape, particularly the revised Mineral Resources Law effective July 1, 2025, imposes stricter environmental restoration and resource efficiency requirements on mining operations. Jiangxi Copper must adapt its practices to meet these heightened national standards to maintain its operational licenses and avoid penalties, which could impact its financial standing and reputation.

The company also navigates a complex web of environmental protection laws governing emissions and waste management, necessitating permits and regular inspections. Jiangxi Copper's 2023 investments in green technologies reflect a proactive stance on compliance, crucial for mitigating risks of fines and production halts.

Jiangxi Copper's robust corporate governance framework, enhanced in line with State Council directives, aims to bolster investor confidence through transparency and adherence to regulatory standards. This focus is vital in the mining sector, especially as China refines its capital market oversight, supporting its reported 2023 net profit of 4.1 billion RMB.

International expansion, such as Jiangxi Copper's investment in SolGold, demands meticulous adherence to diverse legal systems and global norms. Environmental due diligence and compliance with local and international regulations are paramount for sustainable overseas operations, especially given the 2023 scrutiny on China's outward mining investments regarding environmental impact assessments.

Environmental factors

Jiangxi Copper is targeting a carbon peak by 2030 and aims for carbon neutrality by 2060, mirroring China's national climate strategy. This ambitious roadmap involves significant investments in energy efficiency and emission control technologies across its operations.

The company's dedication to these environmental goals is already influencing its operational strategies, pushing for more sustainable practices throughout its mining and smelting processes. For instance, in 2023, Jiangxi Copper reported a reduction in sulfur dioxide emissions by 10% compared to the previous year, a tangible step towards its emission reduction targets.

Jiangxi Copper is proactively addressing environmental mandates under China's updated mining laws, requiring comprehensive ecological restoration plans prior to commencing operations. The company has committed substantial financial resources toward environmental protection and restoration initiatives. For instance, in 2023, Jiangxi Copper invested over 4.5 billion yuan (approximately $630 million USD) in environmental protection and technological upgrades, a significant portion of which is directed at mitigating pollution and restoring mining sites.

These investments are channeled into critical areas such as advanced treatment technologies for air and water pollutants, ensuring compliance with increasingly stringent environmental standards. Furthermore, the company is implementing robust waste management strategies to minimize the ecological impact of its extensive mining activities, aiming to reduce its overall environmental footprint.

Water scarcity poses a significant environmental challenge for mining operations, with many copper mines situated in regions experiencing high water stress. Jiangxi Copper, like its peers, faces pressure to adopt stringent water management and conservation strategies.

To address this, the company is investing in advanced water recycling technologies, aiming to reduce its reliance on fresh water sources. Projections for 2025 indicate that innovations in mining processes could lead to a substantial decrease in water consumption across the industry.

Waste Management and Pollution Control

Effective management of mining waste, such as tailings and chemical by-products from smelting, is paramount for Jiangxi Copper to prevent soil and water contamination. The company's operational footprint necessitates robust systems for handling these materials.

Past allegations of pollution underscore the critical need for continuous enhancement in Jiangxi Copper's waste treatment and pollution control strategies. For instance, in 2023, the company reported investing significantly in environmental protection upgrades across its facilities, aiming to meet increasingly stringent national standards.

Strict adherence to evolving environmental regulations is vital for mitigating operational risks and maintaining its social license to operate. This includes ongoing monitoring and compliance with discharge limits for wastewater and air emissions, which are subject to regular government audits.

- Tailings Management: Implementing advanced dewatering and dry stacking techniques for tailings to reduce water usage and land footprint.

- Wastewater Treatment: Upgrading facilities to ensure effluent quality consistently meets or exceeds national standards, with a focus on removing heavy metals.

- Air Pollution Control: Investing in flue gas desulfurization and denitrification systems to minimize sulfur dioxide and nitrogen oxide emissions from smelting operations.

- Compliance Investment: Allocating substantial capital towards environmental remediation and pollution prevention technologies, as evidenced by their 2024 sustainability report detailing increased environmental expenditure.

Biodiversity Protection and Land Use

Mining inherently alters land use and impacts biodiversity. Jiangxi Copper's approach to environmental management must address these challenges through robust biodiversity protection measures and minimizing habitat disruption. For instance, in 2023, the company reported investing CNY 1.2 billion in environmental protection initiatives, a significant portion of which is allocated to ecological restoration projects.

The company's commitment to ecological restoration is crucial for rehabilitating areas affected by its operations and fostering long-term environmental sustainability. Responsible land management practices are fundamental to its environmental stewardship, ensuring that land use is optimized while mitigating negative ecological consequences.

- Land Use Impact: Mining activities require significant land occupation, necessitating careful planning to minimize footprint.

- Biodiversity Conservation: Strategies include habitat restoration and protection of local flora and fauna in operational areas.

- Ecological Restoration Efforts: Jiangxi Copper focuses on rehabilitating mined-out areas, aiming to restore ecosystem functions.

- Environmental Stewardship: Responsible land management is a core component of the company's commitment to sustainability.

Jiangxi Copper is actively working towards China's national climate goals, targeting a carbon peak by 2030 and carbon neutrality by 2060. This involves substantial investments in cleaner technologies and operational efficiencies. In 2023, the company demonstrated progress by reducing sulfur dioxide emissions by 10% year-over-year, reflecting its commitment to environmental performance.

The company is also investing heavily in environmental protection, with over 4.5 billion yuan (approximately $630 million USD) allocated in 2023 for upgrades and pollution mitigation. This includes advanced wastewater treatment to meet stringent standards and robust waste management systems to minimize ecological impact.

Water conservation is a key focus, with investments in recycling technologies to reduce freshwater dependency, anticipating significant consumption decreases by 2025 due to process innovations. Furthermore, Jiangxi Copper is prioritizing land rehabilitation and biodiversity conservation, investing CNY 1.2 billion in 2023 for ecological restoration projects.

| Environmental Focus Area | 2023 Performance/Investment | Outlook/Strategy |

|---|---|---|

| Carbon Emissions | Targeting carbon peak by 2030, neutrality by 2060 | Energy efficiency and emission control investments |

| Air Emissions | SO2 emissions reduced by 10% (YoY) in 2023 | Flue gas desulfurization and denitrification systems |

| Water Management | Investment in advanced water recycling technologies | Projected substantial decrease in water consumption by 2025 |

| Environmental Protection Investment | Over 4.5 billion yuan invested in 2023 | Upgrades for pollution mitigation and compliance |

| Ecological Restoration | CNY 1.2 billion invested in 2023 | Habitat restoration and rehabilitation of mined-out areas |

PESTLE Analysis Data Sources

Our Jiangxi Copper PESTLE Analysis is built on a robust foundation of data sourced from official Chinese government publications, leading international financial institutions, and reputable industry-specific research reports. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the company.