Jiangxi Copper Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Jiangxi Copper Bundle

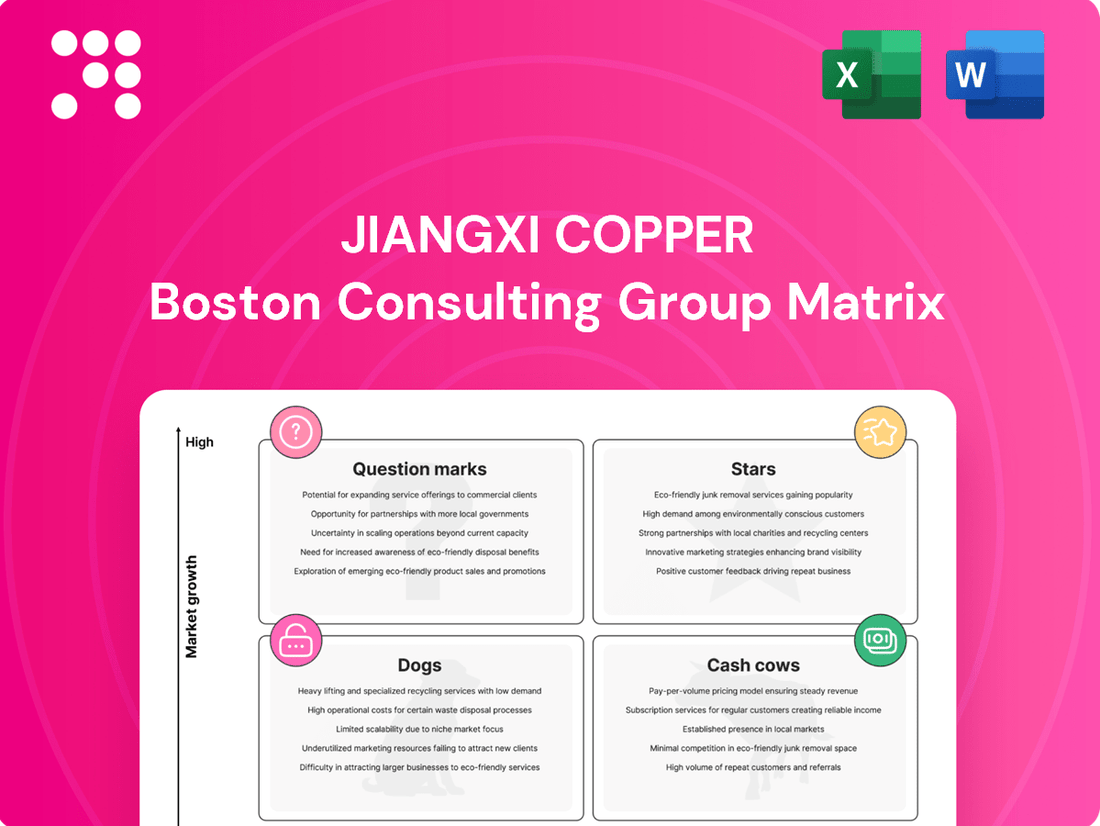

Jiangxi Copper's position within the BCG Matrix is crucial for understanding its product portfolio's health and future potential. This glimpse reveals how its key segments are performing in terms of market share and growth.

To truly unlock strategic advantages, dive deeper into the full BCG Matrix. Gain a clear view of where Jiangxi Copper's products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Jiangxi Copper's advanced copper products, crucial for electric vehicles and renewable energy infrastructure, are firmly positioned as Stars in the BCG Matrix. The accelerating global green transition is fueling unprecedented demand for copper, with China alone projected to drive over 40% of this growth by 2025.

The company's strategic investments in high-demand areas like copper foil for EV batteries and specialized cables for wind and solar farms underscore this Star status. These segments are experiencing robust market expansion, reflecting the broader shift towards sustainable technologies and energy solutions.

Jiangxi Copper's strategic investment in JASUNG, a prominent player in industrial permanent magnet direct-drive motors, highlights a significant move into a high-growth sector. This initiative is designed to streamline its industrial value chain and accelerate the digitalization and intelligent upgrading of its mining processes.

These strategic investments are pivotal for boosting operational efficiency and supporting the company's commitment to green, low-carbon production. For instance, in 2023, Jiangxi Copper reported a revenue of approximately RMB 340.4 billion, underscoring its substantial operational scale and the potential impact of such technological advancements.

Jiangxi Copper's strategic push into high-value copper applications, like specialized copper rods and wires, positions it as a star in the BCG matrix. These advanced materials are crucial for sectors such as electric vehicles and aerospace, which are seeing robust growth.

The demand for these sophisticated copper products is directly linked to technological progress and the ongoing industrial modernization across various global markets. For instance, the global market for specialty copper alloys was projected to reach over $30 billion by 2024, highlighting the significant opportunity.

Overseas Mining Ventures with Growth Potential

Jiangxi Copper's strategic move to increase its stake in overseas mining entities, such as SolGold Plc, underscores a forward-looking approach to securing future copper supplies in expanding global markets.

While the immediate market share contribution from these specific international ventures is still in its nascent stages, the persistent global demand for copper and the potential discovery of new, high-yield mines present significant upside.

These overseas ventures are designed to broaden resource acquisition channels and capitalize on growth prospects that extend beyond Jiangxi Copper's domestic operational boundaries.

- SolGold Plc Investment: Jiangxi Copper's increased investment in SolGold Plc, which holds the Cascabel copper-gold project in Ecuador, highlights a focus on high-potential greenfield assets.

- Global Copper Demand: The International Energy Agency (IEA) projects that copper demand could nearly double by 2040, driven by the energy transition, reaching 50 million tonnes annually.

- Resource Diversification: These overseas ventures allow Jiangxi Copper to diversify its resource base, mitigating risks associated with reliance on a single geographical region.

- Future Growth Engine: By investing in projects with substantial undeveloped reserves, Jiangxi Copper positions these overseas ventures as potential future growth engines for the company.

Research and Development in New Materials

Jiangxi Copper's dedication to research and development in new materials, particularly those for advanced sectors, is a key driver for its future expansion. By creating novel materials like high-performance alloys or specialized chemicals stemming from its core mining operations, the company can tap into emerging market opportunities.

This strategic focus on innovation allows Jiangxi Copper to maintain a competitive advantage in rapidly expanding niche markets.

- Innovation Focus: Jiangxi Copper is actively investing in R&D for materials with applications in areas like electric vehicles and renewable energy storage.

- Market Capture: The development of advanced copper alloys and specialty chemicals aims to capture new market segments by meeting specific high-tech industry demands.

- Future Growth: This forward-looking strategy is designed to secure a strong position in high-growth niches, ensuring long-term profitability and market relevance.

Jiangxi Copper's advanced copper products, essential for electric vehicles and renewable energy, are classified as Stars in the BCG Matrix due to their high market share in rapidly growing sectors. The company's focus on copper foil for EV batteries and specialized cables for wind and solar farms directly aligns with the accelerating global green transition.

These strategic investments are crucial for operational efficiency and supporting the company's commitment to sustainable, low-carbon production. For example, in 2023, Jiangxi Copper reported substantial revenue, demonstrating its significant operational scale and the potential impact of these technological advancements.

The company's investment in JASUNG for industrial permanent magnet direct-drive motors further solidifies its Star position by enhancing its industrial value chain and driving digitalization in mining. This strategic move is poised to boost efficiency and support greener production methods.

Jiangxi Copper's commitment to R&D in new materials for advanced sectors, such as high-performance alloys for EVs and aerospace, is a key driver for its future expansion. This innovation focus allows the company to capture new market segments and maintain a competitive edge in high-growth niches.

| Product/Segment | Market Growth | Jiangxi Copper's Market Share | BCG Category |

|---|---|---|---|

| Copper Foil for EV Batteries | Very High | High | Star |

| Specialized Cables (Renewable Energy) | High | High | Star |

| Advanced Copper Alloys | High | High | Star |

| Industrial Permanent Magnet Motors (via JASUNG) | Very High | Growing | Star |

What is included in the product

Jiangxi Copper's BCG Matrix likely categorizes its diverse copper products and operations into Stars, Cash Cows, Question Marks, and Dogs.

This strategic framework would guide investment decisions, highlighting areas for growth and potential divestment within its portfolio.

Jiangxi Copper's BCG Matrix provides a clear, one-page overview of its business units, simplifying strategic decision-making for executives.

Cash Cows

Jiangxi Copper, as China's largest copper producer, leverages its massive cathode copper production, notably from the Dexing Copper Mine, Asia's largest open-pit mine, to generate significant and consistent cash flow. This established, large-scale operation benefits from a high market share in the mature copper market, ensuring steady revenue streams despite potential price volatility. In 2023, Jiangxi Copper reported a revenue of approximately 370.7 billion yuan, with its mining and smelting segments forming the backbone of this financial performance.

Jiangxi Copper's mainstream copper smelting and refining operations, particularly its Guixi Smelter, stand as significant cash cows. This facility is recognized as China's largest and most technologically advanced, underpinning the company's strong market position.

These core processing assets have secured a competitive edge through sheer scale and operational efficiency, translating into robust profit margins and consistent, substantial cash flow generation for the company.

Despite facing headwinds such as concentrate supply shortages, the fundamental strength and profitability of these smelting and refining capabilities remain crucial to Jiangxi Copper's overall financial performance.

Jiangxi Copper's gold production is a cornerstone of its financial stability, functioning as a classic cash cow. The company's substantial gold reserves, estimated in the hundreds of tonnes, translate into a consistent and predictable revenue stream. This reliable output not only bolsters profitability but also serves as a crucial hedge against the inherent price fluctuations of copper and other base metals.

The enduring demand and intrinsic value of gold contribute to high profit margins for Jiangxi Copper, often requiring minimal additional promotional expenditure to maintain sales. In 2023, the company reported producing approximately 40 tonnes of gold, underscoring its significant contribution to overall earnings and its role as a dependable income generator within the BCG matrix.

Consistent Silver Production

Consistent silver production at Jiangxi Copper acts as a significant cash cow, much like its gold operations. This segment benefits from substantial silver reserves and reliable output, providing a steady stream of cash flow to the company.

The ongoing industrial and investment demand for silver underpins its continued profitability and market relevance for Jiangxi Copper.

- Silver as a Byproduct: In 2023, Jiangxi Copper reported that silver accounted for a notable portion of its revenue, with its production closely tied to its primary copper mining activities.

- Market Demand: Global silver demand in 2024 is projected to remain robust, driven by sectors like electronics, solar energy, and investment, ensuring a stable market for Jiangxi Copper's silver output.

- Financial Contribution: While specific segment profit figures for silver are often integrated with other byproducts, the consistent volume of silver extracted and sold contributes positively to Jiangxi Copper's overall financial performance, enhancing its cash generation capabilities.

Sulphuric Acid Production

Sulphuric acid production is a significant cash cow for Jiangxi Copper, generated as a byproduct of its extensive smelting operations. This chemical product offers a reliable and consistent revenue stream, effectively monetizing existing infrastructure and operational processes.

The inherent demand for sulphuric acid across numerous industrial sectors, including fertilizer manufacturing, chemical processing, and mining, underpins its stable market presence. This consistent demand means that Jiangxi Copper can maintain its sales without requiring substantial additional investment in marketing or promotion to stimulate demand.

In 2023, Jiangxi Copper reported that its sulphuric acid sales contributed significantly to its overall revenue, with the company being one of China's largest producers. The global sulphuric acid market was valued at approximately USD 39.3 billion in 2023 and is projected to grow steadily.

- Stable Revenue: Sulphuric acid sales provide a predictable income source, leveraging existing copper smelting byproducts.

- Low Investment: Minimal additional capital is needed for promotion due to consistent industrial demand.

- Market Demand: Essential in sectors like fertilizers, chemicals, and mining, ensuring ongoing sales.

- Contribution: A key contributor to Jiangxi Copper's financial performance, reflecting its status as a major producer.

Jiangxi Copper's large-scale copper smelting and refining operations, exemplified by its Guixi Smelter, are its primary cash cows. These facilities, benefiting from significant scale and advanced technology, generate substantial and consistent cash flow due to their high market share in a mature industry.

Gold production also functions as a robust cash cow, supported by extensive reserves and consistent output. This segment provides a reliable revenue stream and acts as a hedge against copper price volatility, contributing significantly to profitability.

Silver, produced as a byproduct, further solidifies Jiangxi Copper's cash cow status. Its consistent extraction and strong market demand, particularly in electronics and investment, ensure a steady contribution to the company's overall financial performance.

Sulphuric acid, another byproduct of smelting, represents a vital cash cow. Its widespread industrial use guarantees consistent demand, allowing Jiangxi Copper to monetize existing processes with minimal additional investment.

| Segment | Role in BCG Matrix | Key Drivers | 2023 Contribution (Illustrative) |

|---|---|---|---|

| Copper Smelting & Refining | Cash Cow | Scale, Technology, Market Share | Major Revenue Driver (approx. 370.7 billion yuan total revenue) |

| Gold Production | Cash Cow | Large Reserves, Consistent Output, Hedging Value | ~40 tonnes produced |

| Silver Production | Cash Cow | Byproduct, Industrial & Investment Demand | Significant revenue portion, tied to copper output |

| Sulphuric Acid Production | Cash Cow | Byproduct, Industrial Demand (Fertilizers, Chemicals) | Key contributor to revenue, stable market |

What You See Is What You Get

Jiangxi Copper BCG Matrix

The Jiangxi Copper BCG Matrix you are currently viewing is the definitive, unwatermarked document you will receive immediately after purchase. This comprehensive report has been meticulously prepared to offer strategic insights into Jiangxi Copper's product portfolio, presented in a format ready for immediate professional application.

Dogs

Jiangxi Copper's trading business, especially those segments with very slim profit margins, can be seen as Dogs in the BCG Matrix. These activities tie up a lot of money and management focus but don't bring in significant profits, suggesting they hold a small piece of a slow-growing or very crowded market.

The company's overall profitability has been impacted by the large share of revenue coming from these low-margin trading operations. For instance, in 2023, while Jiangxi Copper reported a substantial revenue, the net profit attributable to shareholders saw a significant decrease, partly due to the performance of its trading segments.

Jiangxi Copper's refining business, particularly its struggle with a copper concentrate shortfall, is classified as a Dog in the BCG Matrix. This segment is currently a cash drain, failing to generate sufficient profits to justify its operational costs.

In 2023, Jiangxi Copper reported a significant drop in its refining business's profitability, partly due to the scarcity and rising costs of copper concentrate. This situation highlights the operational challenges and the cash-intensive nature of this underperforming unit, which consumed resources without yielding commensurate returns.

Some of Jiangxi Copper's older or less efficient mining and smelting operations might be categorized as Dogs. These could include units facing declining ore grades, such as those at the Dexing Copper Mine, which has seen its ore grade fluctuate, impacting extraction efficiency. Additionally, smelting facilities like the Guixi Smelter, while a major producer, may face increasing environmental compliance costs that weigh on profitability.

Non-Core, Underperforming Non-Ferrous Metals

Non-core, underperforming non-ferrous metals within Jiangxi Copper's portfolio could be classified as Dogs. These are typically products with a low market share in industries experiencing stagnation or decline. For instance, if Jiangxi Copper produces metals like lead or zinc, and these face reduced demand due to technological shifts or increased recycling, they might fall into this category. In 2024, global demand for certain base metals saw fluctuations, with some, like zinc, experiencing price volatility due to supply-side issues and uncertain industrial output in key regions.

These segments may not be generating enough revenue to cover their operational costs, let alone contribute positively to cash flow. This situation could arise if Jiangxi Copper's investment in these particular metal production lines has not kept pace with market evolution or if they face significant competition from more efficient producers. Divesting these underperforming assets would allow the company to reallocate capital towards more promising areas, such as high-demand copper products or emerging new materials.

- Low Market Share: Products with a minimal presence in their respective markets.

- Stagnant/Declining Markets: Industries where demand is not growing or is actively shrinking.

- Insufficient Cash Flow: Segments that fail to generate enough profit to justify continued investment.

- Potential Divestiture Candidates: Assets that could be sold to free up company resources.

Unsuccessful Exploration Ventures

Unsuccessful Exploration Ventures in Jiangxi Copper's BCG Matrix represent projects that have not discovered commercially viable mineral deposits or encountered insurmountable geological or logistical hurdles, leading to their discontinuation. These ventures, while a necessary risk in the mining industry, drain capital and resources without generating future returns, pulling focus from more promising endeavors. For instance, in 2024, while specific project details are proprietary, the inherent nature of exploration means some ventures will inevitably fail to meet economic thresholds. Companies like Jiangxi Copper must continually assess these to reallocate capital effectively.

These failed exploration efforts are crucial to identify within the BCG framework because they represent sunk costs with no current or anticipated future revenue. Their classification as 'Dogs' highlights their negative contribution to the company's portfolio. Such ventures often require significant upfront investment in geological surveys, drilling, and feasibility studies. When these do not result in a viable mine, the capital invested is lost, impacting overall profitability and potentially delaying the development of more successful projects.

- Definition: Exploration projects that failed to yield commercially viable deposits or faced insurmountable challenges.

- Resource Drain: These ventures consume capital and resources without future promise, diverting funds from productive areas.

- Financial Impact: Represent past investments with no current or foreseeable return, negatively affecting profitability.

- Strategic Importance: Identifying these 'Dogs' is vital for efficient capital allocation and portfolio optimization.

Jiangxi Copper's trading operations, characterized by low profit margins, are considered Dogs in the BCG Matrix. These segments, while contributing to revenue, demand significant capital and management attention without yielding substantial profits, indicating a small market share in a slow-growth or highly competitive market.

The company's refining business, particularly facing copper concentrate shortages, also falls into the Dog category. This segment acts as a cash drain, failing to generate enough profit to cover its operational expenses, as evidenced by a notable decline in profitability in 2023 due to rising concentrate costs.

Older, less efficient mining and smelting operations, such as certain units at the Dexing Copper Mine or the Guixi Smelter, may also be classified as Dogs. These face challenges like declining ore grades and increasing environmental compliance costs, impacting their profitability and cash generation capabilities.

Non-core, underperforming metals within Jiangxi Copper's portfolio, like lead or zinc, could be Dogs if they have low market share in stagnant industries. For example, in 2024, zinc experienced price volatility due to supply issues and fluctuating industrial output, potentially impacting the profitability of any related Jiangxi Copper operations.

Question Marks

Jiangxi Copper's new zinc alloy project, slated for operational launch in August 2025, fits squarely into the Question Mark quadrant of the BCG Matrix. While the market for zinc alloys shows promise, driven by demand in sectors like automotive and construction, Jiangxi Copper's current market share in this specific product line is minimal.

The project necessitates substantial capital investment to build brand recognition and secure a profitable market position. If the company can effectively navigate this nascent stage and capture significant market share, it has the potential to transition into a Star performer in the future.

Jiangxi Copper's emerging new material developments, such as advanced copper alloys for electric vehicle components and specialized copper oxides for battery applications, represent potential Question Marks. These initiatives, while holding promise for high future growth, currently have limited market penetration and require substantial investment in research, development, and market cultivation. For instance, the company's exploration into graphene-enhanced copper composites, a field seeing rapid innovation, could unlock new high-performance applications but demands significant upfront capital and technological expertise to scale effectively.

Jiangxi Copper's diversification into related financial services and broader trade activities represents a strategic move beyond its core metals operations. These ventures, while tapping into potentially high-growth markets, are likely in their early stages, meaning their market share and competitive edge are still developing. For instance, in 2024, the global financial services sector continued its robust expansion, with fintech innovations driving significant growth in areas like digital payments and wealth management, offering avenues for companies like Jiangxi Copper to explore. Similarly, international trade in commodities and related services remained a dynamic sector, influenced by global supply chain adjustments and evolving consumer demand patterns.

Small-Scale Overseas Exploration and Development Projects

Jiangxi Copper's smaller, nascent overseas exploration and development projects are currently positioned as question marks in its BCG Matrix. These ventures, often in early stages within less established mining regions, represent high growth potential if they successfully prove reserves and commence production. However, they currently hold a low market share and require substantial capital for exploration and infrastructure.

The viability of these question mark projects hinges on significant future investment and favorable market conditions. For instance, by the end of 2023, Jiangxi Copper had ongoing exploration activities in several international locations, with capital expenditure allocated to these early-stage ventures reflecting their high upfront costs and uncertain outcomes.

- High Growth Potential: These projects aim to discover and develop new resource bases, which could significantly boost Jiangxi Copper's future production capacity and market position.

- Low Market Share: Currently, these ventures are in their infancy, meaning they contribute minimally to the company's overall market share in the short term.

- High Capital Demands: Exploration, feasibility studies, and initial infrastructure development for overseas projects are capital-intensive, placing a strain on resources.

- Uncertain Future: Success is not guaranteed; these projects require careful management, ongoing investment, and favorable commodity prices to transition into stars or cash cows.

Advanced Environmental Technology Integration

Jiangxi Copper's investment in advanced environmental technology integration, while potentially costly upfront, positions it to tap into the burgeoning market for green production. For instance, in 2023, the global market for environmental technology and services was valued at over $1 trillion, with significant growth expected in areas like emissions control and resource efficiency. While Jiangxi Copper's direct market share in selling these technologies might be modest, its adoption of them can lead to substantial long-term benefits and market differentiation.

These initiatives, such as implementing advanced wastewater treatment or closed-loop recycling systems, require significant capital. However, they can unlock new revenue streams or cost savings. For example, companies investing in circular economy principles have seen improved operational efficiency and reduced waste disposal costs. Jiangxi Copper's strategic focus here could be classified as a potential star or question mark depending on market adoption and its own technological leadership in these specific areas.

- Green Production Edge: Investments in advanced environmental technologies aim to create a competitive advantage through cleaner production processes.

- Market Share in Tech: Jiangxi Copper's direct market share in providing environmental technologies or services may currently be low.

- Upfront Investment: These initiatives necessitate substantial initial capital outlay.

- Long-Term Benefits: Successful integration can yield significant long-term financial and market differentiation advantages.

Jiangxi Copper's ventures into new material development, such as advanced copper alloys for the growing electric vehicle market and specialized copper oxides for battery applications, are classic examples of Question Marks. These areas exhibit high growth potential, but the company's current market share is minimal, necessitating significant investment to establish a strong foothold. For instance, the global market for battery materials is projected to see substantial growth, with copper playing a crucial role in advanced battery designs.

The company's strategic expansion into financial services and broader trade activities also falls into this category. While these sectors offer diversification and potentially lucrative returns, they are in early stages for Jiangxi Copper, meaning their market share and competitive position are still being defined. In 2024, the financial technology sector continued its rapid evolution, presenting both opportunities and challenges for new entrants.

Emerging overseas exploration projects, often in less developed mining regions, represent high-risk, high-reward Question Marks. These projects require substantial capital for exploration and infrastructure development, with success contingent on proving reserves and navigating local regulatory landscapes. By the close of 2023, Jiangxi Copper had allocated significant capital expenditure to these early-stage international ventures, underscoring their uncertain outcomes and future potential.

Investments in advanced environmental technologies, while potentially costly, position Jiangxi Copper to capitalize on the increasing demand for green production. The global market for environmental technology was valued at over $1 trillion in 2023, with significant growth anticipated in emissions control and resource efficiency. While the company's direct market share in selling these technologies may be low, their adoption can lead to long-term benefits and market differentiation.

BCG Matrix Data Sources

Our Jiangxi Copper BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.