JSR SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

JSR Bundle

Curious about JSR's market edge and potential hurdles? Our SWOT analysis reveals key strengths and opportunities, but also highlights critical threats and weaknesses that could impact future growth.

Want the full story behind JSR's competitive landscape and strategic positioning? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to illuminate their path forward and support your own strategic planning.

Strengths

JSR Corporation is a recognized global leader in advanced materials, especially photoresists, which are indispensable for semiconductor manufacturing. This strong market position in a critical, high-growth technology sector translates into significant competitive advantages and consistent demand for its products.

In 2023, JSR's semiconductor materials segment, which includes photoresists, represented a substantial portion of its revenue, highlighting its critical role in the electronics supply chain. The company's ongoing innovation in this area is fundamental to the continued miniaturization and performance enhancements in electronic devices.

JSR's strategic privatization, finalized with its acquisition by Japan Investment Corporation (JIC) in June 2024, represents a significant shift. This move consolidates ownership, creating a singular focus that can accelerate decision-making processes.

The new private structure is anticipated to boost management efficiency and bolster JSR's competitive edge on the global stage. This partnership is expected to provide a robust financial bedrock, supporting ambitious, long-term strategic objectives.

JSR's strength lies in its diversified high-tech business segments, encompassing digital solutions, life sciences, and synthetic rubbers and plastics. This broad operational scope, including materials for semiconductors, display technologies, and medical devices, mitigates risks associated with dependence on any single industry. For instance, the semiconductor materials segment, a key driver, saw continued demand in 2024, supporting overall company performance.

Robust R&D and Innovation Pipeline

JSR's dedication to research and development is a significant strength, fueling continuous innovation to address the dynamic needs of high-tech sectors. The company is strategically investing in and expanding its capabilities for advanced materials, such as Metal Oxide Resist (MOR) crucial for Extreme Ultraviolet (EUV) lithography. This forward-looking approach solidifies JSR's leadership in materials science and positions it for sustained growth through product differentiation.

- R&D Investment: JSR consistently allocates substantial resources to R&D, aiming to stay ahead in materials innovation.

- EUV Lithography Materials: The company's focus on MOR for EUV lithography directly supports the semiconductor industry's most advanced manufacturing processes.

- Future Growth Driver: This robust innovation pipeline is key to JSR's long-term competitive advantage and market relevance.

Commitment to Sustainability and ESG

JSR's dedication to sustainability is a significant strength, underscored by its ambitious goal of achieving net-zero emissions by 2050. This commitment extends to a target of sourcing 100% renewable energy by the close of 2025, demonstrating a clear path toward environmental responsibility.

These proactive Environmental, Social, and Governance (ESG) efforts not only bolster JSR's corporate image but also attract investors and partners who prioritize sustainability. Furthermore, these initiatives are expected to drive long-term operational efficiencies and reduce risks associated with climate change and regulatory shifts.

- Net-zero emissions target: 2050

- 100% renewable energy goal: End of 2025

- Enhanced reputation with environmentally conscious stakeholders

- Potential for long-term operational cost savings

JSR's core strength lies in its dominant position in the semiconductor materials market, particularly with photoresists essential for advanced chip manufacturing. This leadership is bolstered by significant, ongoing investment in research and development, evidenced by its focus on materials like Metal Oxide Resist (MOR) for EUV lithography, a critical technology for next-generation semiconductors. The company's diversified portfolio across digital solutions, life sciences, and synthetic materials also provides a robust foundation, mitigating sector-specific risks and ensuring broader market relevance.

| Segment | 2023 Revenue (Approx.) | Key Strength |

|---|---|---|

| Semiconductor Materials | Significant portion of total revenue | Market leadership in photoresists, critical for advanced chip production. |

| Life Sciences | Growing contribution | Innovation in medical diagnostics and bioprocessing materials. |

| Digital Solutions | Expanding presence | Materials for display technologies and advanced printing. |

What is included in the product

Delivers a strategic overview of JSR’s internal and external business factors, analyzing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic challenges, transforming potential roadblocks into opportunities.

Weaknesses

JSR's life sciences segment has been a notable area of weakness, marked by substantial operating losses in recent periods. This underperformance is particularly evident in its Contract Development and Manufacturing Organization (CDMO) and Contract Research Organization (CRO) operations, which have faced stagnant demand.

The financial strain from these segments has directly affected JSR's overall profitability, making this underperformance an urgent priority for the company's new ownership. For instance, in the fiscal year ending March 2024, the life sciences segment reported a significant operating loss, a key factor driving the need for strategic reform.

Following its delisting from the Tokyo Stock Exchange in June 2024 after being acquired by Japan Investment Corporation (JIC), JSR has lost direct access to public capital markets for future fundraising initiatives. This transition means the company can no longer readily tap into the public equity markets to secure additional investment capital.

The delisting also significantly diminishes JSR's public visibility and transparency. This reduction in public scrutiny could potentially limit certain forms of investor engagement and make direct market valuation comparisons with publicly traded peers more challenging going forward.

JSR's significant reliance on its digital solutions segment, which supplies critical materials for the semiconductor industry, exposes it to the sector's inherent boom-and-bust cycles. This means that shifts in global demand for electronics, like smartphones or PCs, can directly affect JSR's earnings. For instance, the semiconductor industry experienced a notable slowdown in 2023, impacting many suppliers.

Operational Inefficiencies in Key Segments

JSR's life sciences segment has been hampered by internal operational issues. Disrupted production systems and delays in bringing new facilities online have directly impacted its financial performance, contributing to losses. For instance, in the fiscal year ending March 2024, JSR reported a significant operating loss in its life sciences division, partly attributable to these production setbacks.

These inefficiencies represent a critical weakness that needs immediate attention. Successfully resolving these operational challenges is paramount for JSR to improve the life sciences segment's profitability and, consequently, boost the company's overall financial health. The company is actively working on streamlining these processes, aiming for a turnaround in the coming fiscal periods.

Key areas of concern include:

- Production System Disruptions: Ongoing issues have led to lower output and increased costs.

- New Facility Launch Delays: Postponements in facility openings have delayed revenue generation and market entry.

- Impact on Financials: These operational problems have directly contributed to the life sciences segment's operating losses, as evidenced by financial reports for the 2023-2024 fiscal year.

High Debt Balance Post-Acquisition

As of the first quarter of 2025, JSR Corporation's balance sheet reflects a significant debt burden, totaling approximately 395.56 billion JPY. This substantial debt level, largely a consequence of recent strategic acquisitions, presents a key weakness.

While the acquisition of JSR by a consortium led by Japan Industrial Partners (JIP) in March 2024 aimed to provide financial stability and strategic direction, the high debt load remains a critical factor. This leverage can potentially constrain future capital expenditures and limit financial flexibility, necessitating disciplined financial management to service obligations and maintain operational capacity.

- Significant Debt: JSR carries a debt balance of 395.56 billion JPY as of Q1 2025.

- Acquisition Impact: The debt is primarily a result of recent acquisitions.

- Financial Leverage: High debt implies increased financial leverage, which can impact future investment decisions.

- Management Challenge: Careful management is required to ensure debt servicing and maintain financial flexibility.

JSR's life sciences segment continues to grapple with significant operational inefficiencies. Production system disruptions and delays in launching new facilities have directly impacted revenue generation and increased costs, contributing to the segment's operating losses reported in the fiscal year ending March 2024. These issues necessitate immediate attention to improve profitability and overall financial health.

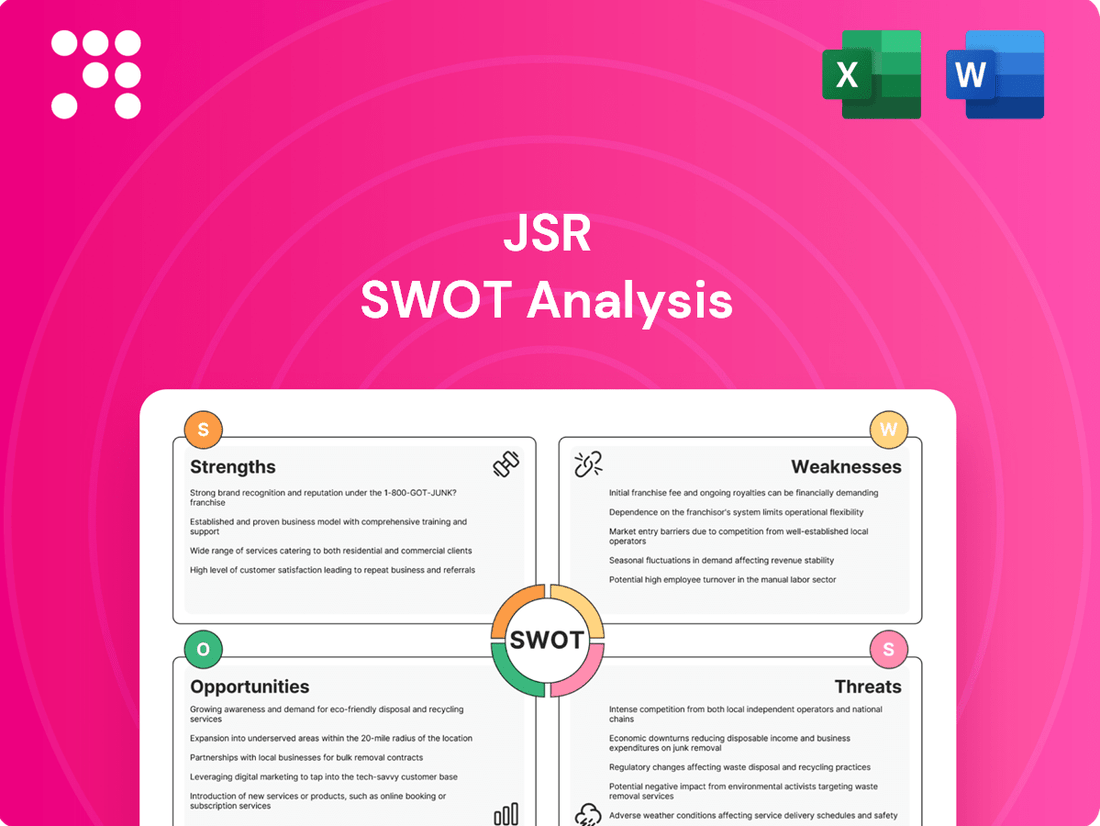

What You See Is What You Get

JSR SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase. This ensures transparency and allows you to assess the quality and content before committing. You're viewing a live preview of the actual SWOT analysis file; the complete version becomes available after checkout.

Opportunities

The semiconductor market is poised for a strong rebound and continued expansion. This growth is largely fueled by the soaring demand for artificial intelligence (AI) applications, the widespread adoption of 5G technology, and the proliferation of Internet of Things (IoT) devices. These trends are creating a significant opportunity for JSR, a key player in advanced semiconductor materials.

This surge in demand directly translates to a greater need for high-performance and increasingly miniaturized semiconductor chips. JSR's expertise in developing and supplying critical materials for these advanced chips positions the company to capitalize on this market dynamic, directly benefiting its core business operations and revenue streams.

JSR's commitment to developing and commercializing advanced photoresists, like Metal Oxide Resist (MOR) for extreme ultraviolet (EUV) lithography, presents a significant growth opportunity. This focus on next-generation materials positions JSR to capitalize on the increasing demand for sophisticated semiconductor manufacturing processes.

By broadening its global development and production capabilities for these cutting-edge photoresists, JSR can reinforce its leading position in the advanced chip manufacturing sector. This expansion is crucial for maintaining and extending its market share in a rapidly evolving technological landscape.

JSR Corporation, with the financial backing of the Japan Investment Corporation (JIC), is well-positioned to execute a roll-up acquisition strategy within the front-end semiconductor processing sector. This approach allows for market consolidation and the creation of more comprehensive, integrated solutions for clients.

A strategic review of JSR's life sciences segment presents an opportunity for potential carve-outs. Such actions could unlock hidden value and significantly enhance the company's overall profitability by focusing resources on core, high-performing areas.

Growth in Display Technologies (OLED)

The market for OLED materials is booming, fueled by their widespread use in smartphones, televisions, and increasingly, flexible displays. This trend is a significant opportunity for JSR, given its established presence in display materials. The company is well-positioned to benefit from the ongoing demand for innovative and cost-effective solutions within this rapidly growing sector.

Specifically, the global OLED materials market was valued at approximately $2.5 billion in 2023 and is projected to reach over $7 billion by 2030, exhibiting a compound annual growth rate (CAGR) of around 15%. This expansion highlights the strong underlying demand.

- Expanding Smartphone Integration: OLED technology continues to penetrate the premium smartphone segment, driving demand for advanced materials.

- Television Market Adoption: The increasing adoption of OLED TVs in households worldwide further bolsters the market for display materials.

- Emergence of Flexible and Foldable Displays: Innovations in foldable phones and other flexible screen applications create new avenues for material suppliers like JSR.

- Demand for Enhanced Performance: Manufacturers are constantly seeking materials that offer improved brightness, color accuracy, and energy efficiency, areas where JSR can innovate.

Leveraging Global Digital Infrastructure Initiatives

Global and national fiscal stimulus packages, especially those focusing on digital infrastructure, are a significant opportunity for JSR's digital solutions business. For instance, the US Bipartisan Infrastructure Law, passed in 2021, allocated billions towards broadband expansion and 5G deployment, directly benefiting companies supplying materials for these advancements.

This increased investment in critical digital infrastructure, such as 5G networks and data centers, is expected to substantially boost the demand for JSR's high-performance materials. Analysts project the global data center construction market alone to reach over $300 billion by 2027, indicating a robust market for JSR's specialized products.

- Increased demand for semiconductor materials: As digital infrastructure expands, so does the need for advanced semiconductors, a key area for JSR.

- Growth in 5G deployment: The ongoing rollout of 5G networks globally requires specialized materials for antennas, base stations, and fiber optics.

- Data center expansion: The surge in cloud computing and data storage necessitates the construction and upgrade of data centers, driving demand for JSR's materials.

- Government support for digital transformation: Fiscal initiatives worldwide are accelerating the adoption of digital technologies, creating a favorable environment for JSR's offerings.

JSR is positioned to benefit from the expanding semiconductor market, driven by AI, 5G, and IoT. The company's expertise in advanced photoresists for EUV lithography is a key advantage, with the global semiconductor materials market expected to grow significantly. Furthermore, JSR's strong position in OLED materials, a market projected to reach over $7 billion by 2030 with a 15% CAGR, offers substantial revenue potential, especially with the increasing adoption of OLEDs in smartphones and televisions, including emerging flexible display technologies.

The company's strategic acquisition capabilities, backed by JIC, could lead to consolidation in the front-end semiconductor processing sector, creating integrated solutions. Additionally, a potential carve-out of the life sciences segment could unlock value and improve overall profitability by focusing resources on core strengths. Government stimulus for digital infrastructure, like the US Bipartisan Infrastructure Law, is also a significant tailwind, boosting demand for JSR's materials used in 5G and data center expansion.

| Opportunity Area | Market Projection (2023-2030) | Key Drivers |

|---|---|---|

| Semiconductor Materials | Continued strong growth | AI, 5G, IoT adoption |

| OLED Materials | $2.5B (2023) to >$7B (2030) (15% CAGR) | Smartphone integration, OLED TV adoption, Flexible displays |

| Digital Infrastructure | Significant growth driven by government investment | 5G deployment, Data center expansion, Digital transformation initiatives |

| Strategic Acquisitions | Market consolidation potential | Roll-up strategy in front-end processing |

| Life Sciences Segment | Potential value unlock | Strategic carve-out opportunities |

Threats

JSR faces significant competitive pressures in its core segments. In semiconductor materials, rivals like Shin-Etsu Chemical and Tokyo Ohka Kogyo are formidable, potentially impacting JSR's market share and pricing power. Similarly, the display materials sector sees strong competition from Idemitsu Kosan and Merck, necessitating continuous innovation.

This intensifying rivalry translates into higher research and development expenditures as JSR strives to maintain its technological leadership. For instance, the semiconductor industry's rapid evolution demands constant investment in advanced materials to meet shrinking transistor sizes and increasing performance demands. As of early 2024, the global semiconductor materials market is projected to grow, but intense competition means market share gains require substantial differentiation and cost management.

Ongoing geopolitical tensions, like the US-China decoupling, create significant uncertainty for JSR. This can disrupt supply chains and affect raw material costs, impacting profitability. For instance, in early 2024, global supply chain disruptions, partly fueled by geopolitical events, led to increased shipping costs for many manufacturers.

Broader economic uncertainties, including persistent inflation and volatile exchange rates, further challenge JSR's operations. These factors can directly influence JSR's revenue and the cost of goods sold, potentially dampening overall market demand for its products. In 2024, many economies grappled with inflation rates exceeding 5%, a trend that continued to impact consumer spending power.

The semiconductor and display industries, where JSR is a key player, are notorious for their breakneck pace of innovation. This means JSR faces a constant battle against obsolescence, where its current products and manufacturing techniques could rapidly become outdated.

To combat this, JSR must commit significant and ongoing investment into research and development. For instance, in fiscal year 2023, JSR allocated approximately ¥50.1 billion (around $330 million USD at current exchange rates) to R&D, a testament to the critical need to stay ahead of the technological curve.

Supply Chain Vulnerabilities and Disruptions

JSR, as a global advanced materials manufacturer, faces significant threats from its intricate supply chain. Geopolitical tensions, like those impacting semiconductor supply chains in 2024, can severely disrupt the availability of critical raw materials. For instance, trade disputes or regional conflicts can lead to increased costs or outright shortages, directly affecting JSR's production capacity and ability to meet customer demand.

Natural disasters, such as the earthquakes experienced in Taiwan in early 2025, pose another substantial threat. These events can cripple manufacturing facilities and transportation networks, causing significant delays and operational inefficiencies. JSR's reliance on a global network means that a localized disruption can have cascading effects, impacting its ability to deliver products on time and potentially leading to substantial financial losses due to production stoppages and expedited shipping costs.

- Supply Chain Dependency: JSR's reliance on a concentrated supplier base for key materials, particularly for semiconductor photoresists, creates a vulnerability. A disruption at a single major supplier could halt production.

- Logistical Bottlenecks: Global shipping challenges, exacerbated by port congestion or labor disputes, can delay the movement of both raw materials and finished goods. The average container shipping cost from Asia to Europe saw significant fluctuations in late 2024, impacting landed costs.

- Geopolitical Instability: Trade sanctions or export controls imposed by governments can restrict access to essential chemicals or equipment, directly impacting JSR's operational capabilities and market reach.

Profitability Challenges in Life Sciences Turnaround

The life sciences segment's ongoing turnaround is a double-edged sword for JSR. If the strategic reforms falter or extend beyond projections, it poses a substantial threat. Continued financial drain from this division could severely hamper JSR's overall fiscal stability and its ability to pursue other growth initiatives.

For instance, if the life sciences segment, which represented a significant portion of JSR's portfolio, continues to underperform, it could lead to a downward revision of earnings forecasts for fiscal year 2025. This scenario might trigger a negative market reaction, impacting JSR's stock price and investor confidence. The company's ability to generate positive cash flow from operations could be further challenged, potentially limiting future capital allocation for research and development or strategic acquisitions in its core semiconductor materials business.

- Extended Turnaround Time: Delays in achieving profitability in life sciences could push the breakeven point beyond 2025, requiring sustained financial support.

- Resource Diversion: Significant investment needed for the life sciences turnaround might divert crucial capital from more promising areas, such as advanced semiconductor materials development.

- Impact on Credit Rating: Persistent losses could negatively affect JSR's creditworthiness, potentially increasing borrowing costs for future financing needs.

JSR faces intense competition from established players like Shin-Etsu Chemical and Idemitsu Kosan in its key semiconductor and display materials markets. This rivalry necessitates continuous, substantial investment in R&D to maintain technological edge, with JSR allocating approximately ¥50.1 billion ($330 million USD) to R&D in fiscal year 2023. Geopolitical instability and supply chain disruptions, such as those impacting semiconductor materials in 2024, pose significant threats, potentially increasing costs and limiting production. Furthermore, the life sciences segment's ongoing turnaround presents a risk, as delays could strain financial resources and divert capital from more profitable areas, potentially impacting JSR's fiscal stability and credit rating.

SWOT Analysis Data Sources

This JSR SWOT analysis is built upon a robust foundation of data, drawing from official company financial reports, comprehensive market research, and expert industry analysis to ensure a thorough and accurate assessment.