JSR Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

JSR Bundle

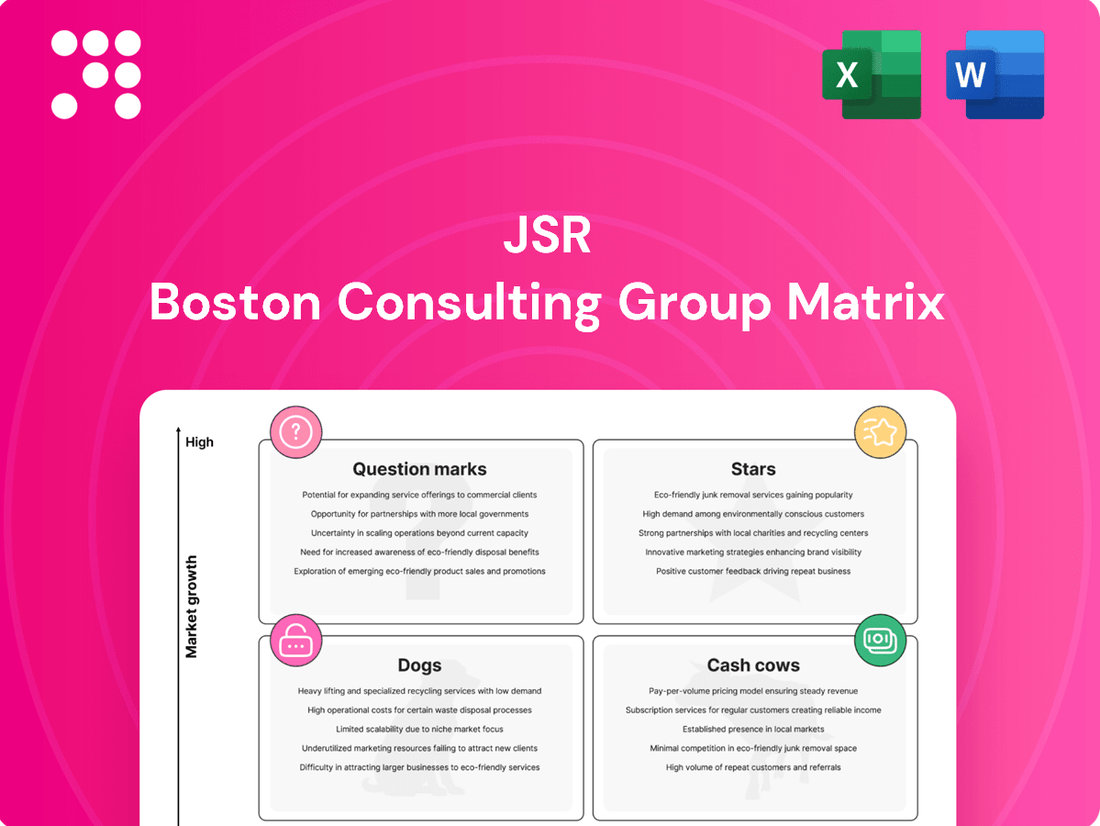

Uncover the strategic positioning of a company's product portfolio with the JSR BCG Matrix. This powerful tool categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a visual roadmap for resource allocation and future investment. Gain a comprehensive understanding of your market share and growth potential.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

JSR's semiconductor materials, especially EUV photoresists crucial for 3nm chip production and future nodes, represent a significant growth engine for the company. This segment is highly competitive and poised for substantial expansion as the semiconductor market recovers, driven by the ongoing build-out of digital infrastructure.

JSR is actively working to solidify and grow its global market share in lithography materials. In 2023, the semiconductor materials segment contributed approximately 70% of JSR's total revenue, highlighting its strategic importance.

JSR's Life Sciences division, particularly its Contract Development and Manufacturing Organization (CDMO) and Contract Research Organization (CRO) segments, is identified as a key growth driver within the BCG matrix. This sector is poised for significant expansion, fueled by increasing demand for specialized biopharmaceutical development and manufacturing services.

The biopharmaceutical market, a core focus for JSR's life sciences operations, continues to exhibit robust long-term growth potential. This is largely attributable to demographic shifts like aging populations and the burgeoning trend towards personalized medicine, creating a sustained need for innovative drug development and production.

JSR has demonstrated a commitment to bolstering its life sciences capabilities through substantial investments. These strategic capital expenditures are aimed at enhancing its capacity to handle complex biopharmaceutical projects, from early-stage research and development through to large-scale manufacturing, ensuring it remains competitive in this dynamic field.

JSR's Display Materials segment, featuring alignment and insulation films for large TV LCD panels and low-temperature cured insulating films for OLED displays, is experiencing robust sales growth, particularly within the Chinese market. This upward trend is supported by the continued expansion of the LCD panel market and the burgeoning OLED sector.

In 2024, the global LCD panel market is projected to reach approximately $100 billion, with China being a dominant force in production and consumption. JSR's specialized films are critical components in these displays, contributing to stable profit generation for the company.

The company's strategic focus on these high-demand materials positions it for significant business expansion. As OLED technology gains further traction, the demand for advanced insulating films is expected to surge, offering JSR a substantial opportunity for growth and market penetration.

Packaging Materials for Semiconductors

JSR's packaging materials segment is a key player in the semiconductor industry's evolution. As demand for advanced technologies like miniaturized chips and 3D packaging grows, JSR's strategic expansion in this area positions it for significant growth. The semiconductor market is projected to reach over $600 billion in 2024, underscoring the importance of JSR's focus on these critical components.

This expansion directly supports the semiconductor industry's recovery and projected growth. JSR's investment in innovative packaging solutions, such as those enabling 5G connectivity and higher processing speeds, aligns with market trends. For instance, the global semiconductor packaging market itself is expected to see robust growth, with some forecasts indicating a compound annual growth rate of around 5-7% in the coming years.

- JSR's packaging materials are crucial for advanced semiconductor applications like 3D packaging.

- The semiconductor industry's projected growth in 2024, exceeding $600 billion, provides a strong market for JSR's offerings.

- Investments in materials supporting 5G and miniaturization are key drivers for JSR's strategic expansion.

- The semiconductor packaging market is experiencing consistent growth, benefiting JSR's product portfolio.

Bioprocess Materials and Diagnostic Reagents

Bioprocess materials and diagnostic reagents, such as diagnostic beads and purification media, are key components within JSR's Life Sciences segment. These products are vital for pharmaceutical production and the development of diagnostic tests, reflecting the broader growth trends in the life sciences industry. For instance, the global bioprocessing market was valued at approximately $20.5 billion in 2023 and is projected to reach $46.7 billion by 2030, indicating a strong compound annual growth rate.

JSR's strategic focus on these areas positions them to capitalize on this expanding market. Their in-house development capabilities allow for innovation in critical areas like cell culture media and chromatography resins, which are essential for manufacturing biologics. The increasing demand for advanced therapies, such as gene and cell therapies, further drives the need for sophisticated bioprocessing solutions.

- Bioprocess Materials: Essential for the manufacturing of biopharmaceuticals, including vaccines and therapeutic proteins.

- Diagnostic Reagents: Crucial for medical diagnostics, enabling accurate and timely disease detection and monitoring.

- Market Growth: The life sciences sector, particularly bioprocessing, is experiencing robust expansion, driven by advancements in biotechnology and healthcare.

- JSR's Role: The company's investment in these segments supports the development and production of life-saving treatments and diagnostic tools.

Stars in the JSR BCG Matrix represent JSR's most promising business units with high market share in high-growth industries. These segments are characterized by significant investment requirements to maintain their competitive edge and capitalize on expanding market opportunities. JSR's semiconductor materials, particularly EUV photoresists, and its Life Sciences CDMO/CRO operations are prime examples of these Star segments.

The semiconductor materials division, contributing approximately 70% of JSR's revenue in 2023, is a clear Star. Its focus on critical components for advanced chip production, like EUV photoresists for 3nm and future nodes, aligns with the semiconductor market's recovery and the ongoing digital infrastructure build-out. This segment is poised for substantial expansion.

Similarly, JSR's Life Sciences division, specifically its CDMO and CRO services, is positioned as a Star. The biopharmaceutical market's robust long-term growth, driven by aging populations and personalized medicine, fuels demand for these specialized services. JSR's strategic investments in enhancing its capacity for complex biopharmaceutical projects further solidify its Star status in this high-growth area.

The Display Materials segment, with strong sales in China for alignment and insulation films used in LCD and OLED panels, also exhibits Star-like characteristics. The projected $100 billion global LCD panel market in 2024, with China as a key player, provides a fertile ground for JSR's specialized films, contributing to stable profits and offering substantial growth opportunities as OLED technology advances.

| JSR Segment | BCG Category | Key Growth Drivers | 2024 Market Context | JSR's Strategic Focus |

|---|---|---|---|---|

| Semiconductor Materials (EUV Photoresists) | Star | Demand for advanced chips (3nm+), digital infrastructure growth | Semiconductor market recovery, >$600 billion in 2024 | Global market share solidification, innovation in lithography |

| Life Sciences (CDMO/CRO) | Star | Biopharmaceutical development, personalized medicine, advanced therapies | Bioprocessing market projected $46.7 billion by 2030 (CAGR ~10%) | Capacity enhancement, complex project handling, R&D investment |

| Display Materials (Alignment/Insulation Films) | Star | LCD panel market expansion, OLED technology adoption | Global LCD panel market ~$100 billion in 2024, OLED growth | Strengthening position in China, advanced insulating films for OLED |

What is included in the product

Strategic analysis of products/business units based on market share and growth.

Quickly identify underperforming units with a clear, visual JSR BCG Matrix, relieving the pain of strategic uncertainty.

Cash Cows

JSR's roots are firmly planted in traditional synthetic rubber, a market that, while mature, remains a significant contributor to its financial strength. This segment, particularly its ABS resins and other synthetic rubber products, consistently generates stable profits and substantial cash flow, underscoring its Cash Cow status within the JSR BCG Matrix.

JSR's general-purpose photoresists, while perhaps not at the forefront of innovation, represent a stable revenue stream. These established products likely command a significant share in more mature segments of the semiconductor industry, offering consistent earnings with reduced research and development demands compared to cutting-edge materials.

In 2024, the semiconductor market continues to see demand across various tiers, and JSR's foundational photoresist offerings are well-positioned to capitalize on this. While specific market share data for general-purpose photoresists isn't always publicly detailed, the broad application of these materials in established semiconductor manufacturing processes ensures their ongoing relevance and profitability for JSR.

JSR's extensive portfolio of industrial polymers and resins, encompassing critical materials like elastomers and adhesives, likely positions them as a dominant player in established industrial sectors such as automotive manufacturing. These products are expected to generate steady, predictable cash flows due to their high market share in mature markets, requiring minimal reinvestment for growth.

Established In-Vitro Diagnostics (IVD) Products

Established in-vitro diagnostics (IVD) products, including existing diagnostic kits, represent a potential cash cow within the Life Sciences segment. These products consistently generate reliable revenue due to their indispensable role in healthcare diagnostics. Their strong market presence ensures a steady cash flow, even as the broader Life Sciences sector experiences growth.

The demand for IVD products remains robust, driven by an aging global population and increasing awareness of early disease detection. For instance, the global IVD market was valued at approximately $100 billion in 2023 and is projected to grow steadily. This stability makes established IVD offerings prime candidates for cash cow status.

- Consistent Revenue Generation: Mature IVD products with established market share provide a predictable and substantial income stream.

- Low Investment Needs: Unlike Stars or Question Marks, cash cows typically require minimal additional investment for maintenance and market support.

- Market Dominance: Strong brand recognition and wide distribution networks contribute to their enduring profitability.

- Funding Growth Areas: The cash generated can be strategically reinvested into other business units, such as high-growth areas within Life Sciences.

Mature Display Material Products

JSR's mature display material products, likely holding a strong market position in established display technologies, represent significant cash cows. These products, while not experiencing rapid growth, generate consistent and substantial cash flow with minimal incremental investment. This stability allows JSR to allocate resources to other strategic areas.

These mature products benefit from economies of scale and established customer relationships, contributing to their profitability. Their reliable cash generation is crucial for funding research and development in emerging technologies and supporting other business units.

- High Market Share: JSR's mature display materials likely command a dominant share in segments like older LCD technologies.

- Low Investment Needs: Reduced marketing and R&D spending is required to maintain their position, boosting cash flow.

- Steady Cash Generation: These products provide a predictable and reliable source of income for the company.

JSR's synthetic rubber business, particularly ABS resins, consistently generates stable profits and substantial cash flow, solidifying its Cash Cow status. These mature products benefit from established markets and economies of scale, requiring minimal reinvestment for sustained profitability.

The general-purpose photoresist segment also functions as a cash cow, providing a stable revenue stream from established semiconductor manufacturing processes. While not at the cutting edge, these materials remain essential and profitable due to their broad application.

Mature industrial polymers and elastomers, crucial for sectors like automotive, represent another strong cash cow. Their high market share in established industries ensures predictable cash flows with limited need for further growth investment.

Established in-vitro diagnostics (IVD) products are prime candidates for cash cow status within Life Sciences. The global IVD market, valued around $100 billion in 2023, offers a stable and growing demand for these essential diagnostic tools.

Mature display materials, likely dominant in older LCD technologies, are significant cash cows for JSR. Their steady cash generation, driven by economies of scale and customer loyalty, is vital for funding innovation in emerging areas.

| Business Segment | Product Example | BCG Category | Key Characteristic |

| Synthetic Rubber | ABS Resins | Cash Cow | Stable profits, substantial cash flow |

| Semiconductor Materials | General-Purpose Photoresists | Cash Cow | Consistent revenue, minimal R&D needs |

| Industrial Polymers | Elastomers | Cash Cow | Dominant market share, predictable cash flows |

| Life Sciences | Established IVD Kits | Cash Cow | Reliable revenue, low investment needs |

| Display Materials | Mature LCD Components | Cash Cow | Steady cash generation, economies of scale |

What You’re Viewing Is Included

JSR BCG Matrix

The JSR BCG Matrix preview you are viewing is the definitive document you will receive upon purchase, offering a complete and unwatermarked strategic analysis tool. This comprehensive report, meticulously crafted for clarity and actionable insights, will be delivered to you exactly as presented, ready for immediate integration into your business planning processes. You can confidently expect the full, professionally formatted JSR BCG Matrix to be available for download, empowering your decision-making without any additional steps or modifications required.

Dogs

JSR Corporation has strategically divested its Emulsions and Fine Chemicals businesses, signaling a move away from segments likely characterized by low growth and market share. This decision aligns with the principles of the BCG Matrix, where such units are often categorized as Dogs.

The completion of the stock transfer for ETEC and Nippon Shokubai's acquisition of Emulsion Technology Co., Ltd. in 2023 solidify these divestitures. These actions suggest JSR is focusing its resources on higher-potential business areas, shedding assets that may have been draining capital without significant returns.

Legacy synthetic rubber products, particularly those with older formulations or in applications facing obsolescence, often fall into the 'dog' category of the BCG matrix. These items typically exhibit low market share due to intense competition from newer materials or specialized alternatives. For instance, certain general-purpose synthetic rubbers might struggle against advanced elastomers offering superior performance in niche markets.

These products are characterized by low growth prospects, reflecting either saturated markets or a decline in demand for their specific functionalities. In 2024, the global synthetic rubber market is expected to see growth, but this is largely driven by high-performance and specialty segments, leaving legacy products behind. Companies with significant exposure to these older product lines may find them breaking even or even consuming cash without generating substantial returns.

Under the JSR BCG Matrix, non-core, underperforming small businesses represent the 'Dogs'. These are typically smaller business units or product lines that lack strategic alignment with JSR's primary growth sectors, namely Digital Solutions and Life Sciences. They are characterized by a low market share and either stagnant or declining growth, often resulting in negative profitability.

For example, if JSR were to identify a legacy chemical subsidiary that is not synergistic with its Life Sciences ambitions and has seen its market share shrink by 15% over the past three years, while its revenue declined by 5% in 2023, this would firmly place it in the 'Dog' category. Such units drain resources and management attention without contributing significantly to the overall corporate strategy.

The strategic imperative for these 'Dog' businesses is clear: divestiture or significant downsizing. In 2024, companies like JSR are increasingly focused on optimizing their portfolios, and shedding these low-return assets allows for the reallocation of capital and management bandwidth towards more promising, high-growth areas. This pruning is essential for maintaining financial health and driving future innovation.

Certain Consumer Electronics Related Plastics

Certain consumer electronics-related plastics can be categorized as dogs in the BCG matrix. This is primarily due to the segment's performance in fiscal year 2023, which saw reduced sales volumes. The decline was directly linked to a slowdown in consumer electronics markets.

While the company managed to sustain its core operating income through price adjustments, the underlying issue of weak demand in specific consumer electronics sectors persists. Plastics products that are heavily dependent on these declining or intensely competitive markets are particularly vulnerable.

- FY2023 Sales Decline: The plastics business saw a decrease in sales volume.

- Market Weakness: This decline was driven by poor performance in consumer electronics.

- Price vs. Volume: Operating income was maintained via price increases, masking volume issues.

- Dog Potential: Products tied to shrinking or highly competitive electronics segments are likely dogs.

Non-Strategic Edge Computing Components

Non-strategic edge computing components, particularly those tied to niche markets like NIR cut filters for smartphones, can easily fall into the dog category of the JSR BCG Matrix. The smartphone market's volatility directly impacts sales, as seen with the recent revenue and profit declines in JSR's Edge Computing Business. This segment experienced a slump, directly linked to the downturn in smartphone sales, which in turn affected NIR cut filter demand.

These components are often characterized by low market share and high susceptibility to economic cycles. If JSR's efforts to expand sales in these areas do not gain significant traction quickly, they risk remaining dogs. For instance, while JSR aims to grow its presence in this sector, the reliance on a single, fluctuating market segment poses a considerable risk.

- Decreased Revenue: JSR's Edge Computing Business saw a revenue decline, largely attributable to the smartphone market slump.

- Profitability Impact: The reduced sales of NIR cut filters directly impacted the profitability of this business segment.

- Market Susceptibility: Components heavily reliant on specific, volatile markets like smartphones are prone to becoming dogs if market conditions worsen.

- Low Market Share Risk: Without rapid market share gains, niche components in declining or stagnant markets are unlikely to improve their strategic position.

Dogs in the BCG Matrix represent business units or products with low market share and low growth potential. These offerings often consume resources without generating significant returns, making them candidates for divestiture or careful management to minimize losses. JSR Corporation's divestiture of its Emulsions and Fine Chemicals businesses in 2023 exemplifies this strategy, moving away from segments likely categorized as dogs.

Legacy synthetic rubber products and certain consumer electronics plastics are prime examples of JSR's potential dog portfolio. These segments face challenges such as intense competition, evolving market demands, and declining sales volumes, as seen in the reduced sales of plastics in fiscal year 2023 due to a consumer electronics slowdown. Similarly, non-strategic edge computing components, like NIR cut filters for smartphones, are vulnerable, with JSR's Edge Computing Business experiencing revenue and profit declines linked to the smartphone market downturn.

The financial performance of these dog-like segments in 2023 highlighted their challenges. For instance, the plastics business saw reduced sales volumes, and while operating income was maintained through price adjustments, this masked underlying demand issues. The Edge Computing Business also reported decreased revenue and profitability. These situations underscore the need for strategic pruning, allowing JSR to reallocate capital and focus on high-growth areas like Digital Solutions and Life Sciences.

Divesting or downsizing these underperforming units is a key strategic imperative for 2024. By shedding low-return assets, JSR can optimize its portfolio and free up resources for innovation and growth in its core strategic sectors. This disciplined approach to portfolio management is crucial for maintaining financial health and driving long-term value creation.

Question Marks

New biopharma CDMO plant initiatives are currently positioned as question marks within the JSR BCG matrix. The Life Sciences CDMO business faced a substantial loss in FY2023, exacerbated by escalating large-scale plant repair expenses and a delayed factory launch. These strategic investments, while targeting a high-growth market, are presently demanding considerable cash outlays with uncertain near-term profitability.

Emerging digital 3D manufacturing solutions represent a significant area for JSR, positioning them within a high-growth market. As a materials provider for this advanced technology, JSR is tapping into a sector projected to reach $50 billion globally by 2027, according to recent industry analyses.

However, to classify these solutions as question marks within the JSR BCG Matrix, a deeper dive into JSR's current market share and profitability specifically within digital 3D manufacturing materials is crucial. If JSR's penetration is currently low despite the market's expansion, these offerings would indeed require substantial investment to capture a more dominant position.

Emerging display technologies like micro-LED and true quantum dot displays represent significant growth opportunities, yet JSR's current dominance in LCD and OLED materials places these advancements in the question mark category. These nascent markets demand substantial investment for JSR to secure a leading position, despite their high potential.

For instance, the micro-LED market, projected to reach over $10 billion by 2027 according to some industry analyses, requires JSR to develop specialized materials for chip fabrication, transfer, and color conversion. Similarly, the true quantum dot display market, which could see significant expansion beyond current QLED applications, necessitates breakthroughs in quantum dot synthesis and encapsulation, areas where JSR may not yet have established a strong foothold.

AI-Driven Materials Science Innovations

JSR's exploration into AI-driven materials science, particularly in chemistry projects and automated polymer design, positions them in a high-growth potential quadrant. These advanced technology applications promise significant future value, aligning with the characteristics of a question mark in the BCG matrix.

While the innovative nature of AI-driven materials science offers substantial long-term prospects, JSR's current commercial viability and market share in these nascent areas are likely low. This necessitates considerable investment in research and development to mature these technologies into commercially successful products and establish a significant market presence.

- AI-driven chemistry and polymer design represent JSR's investment in future growth sectors.

- These initiatives require substantial R&D to achieve market viability and share.

- The potential for high future returns is present, but so is the risk of low current market penetration.

Biomimetic Smart Plastic Materials

JSR's development of biomimetic smart plastic materials for precise antibody recognition places it squarely in the question mark category of the BCG matrix. This cutting-edge technology holds significant promise for niche markets like advanced diagnostics and targeted drug delivery, areas anticipated to see substantial growth. For instance, the global in-vitro diagnostics market, where such materials could find application, was valued at approximately USD 85 billion in 2023 and is projected to grow at a CAGR of around 7% through 2030.

While the innovation is clear, the commercial viability and market penetration are still in the early stages. This means JSR needs to invest strategically to scale production, gain regulatory approvals, and establish market presence. The success of these materials will depend on their ability to outperform existing solutions in terms of specificity, sensitivity, and cost-effectiveness in these specialized applications.

- Innovation: Biomimetic smart plastics for precise antibody recognition.

- Market Potential: High growth expected in specialized medical and analytical applications.

- Current Status: Low market share as a nascent development.

- Strategic Need: Requires further investment for commercialization and market adoption.

Question marks in the JSR BCG matrix represent business units with low market share in high-growth industries. These require significant investment to develop their potential, as their future success is uncertain. JSR's investments in areas like advanced biopharma CDMO, digital 3D manufacturing materials, and emerging display technologies, such as micro-LED, fall into this category. While these markets are expanding rapidly, JSR's current penetration and profitability in these specific segments are still developing, necessitating strategic capital allocation to capture market share and achieve profitability.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.