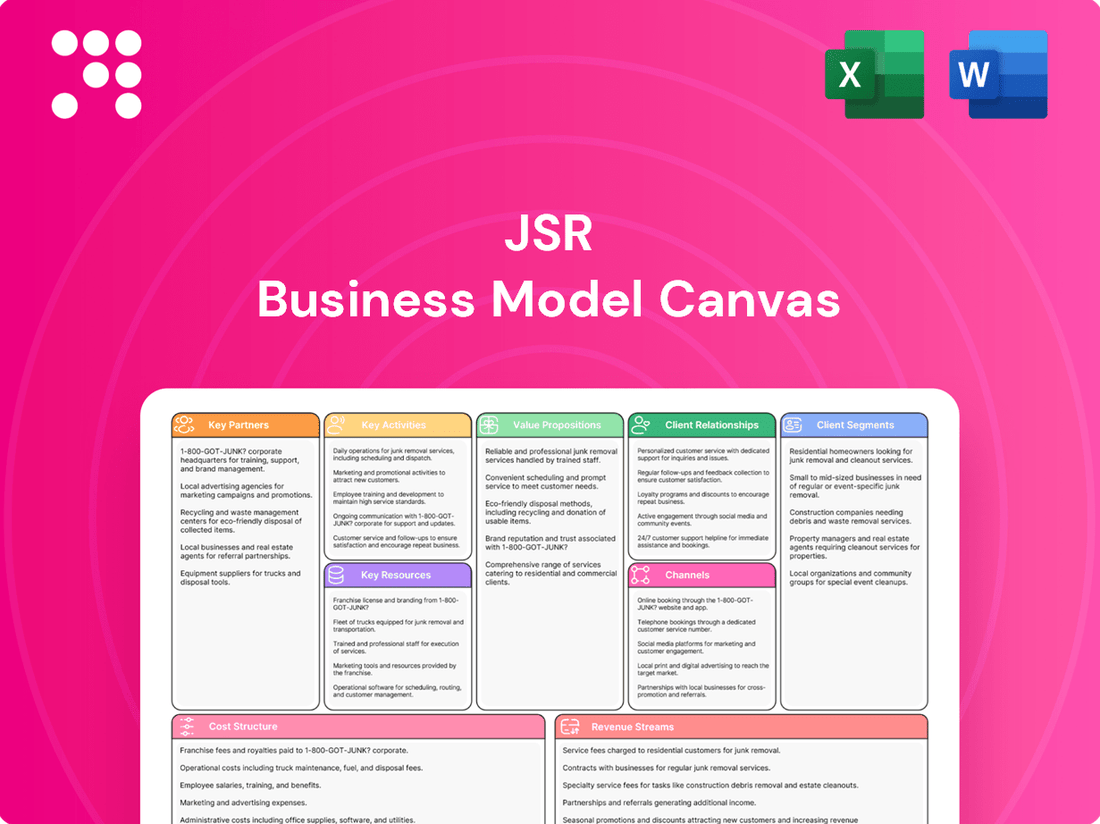

JSR Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

JSR Bundle

Curious about the strategic engine driving JSR's success? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their market dominance. Unlock this essential tool to gain actionable insights for your own ventures.

Partnerships

JSR cultivates strategic alliances with major semiconductor manufacturers, a crucial element for its business model. These partnerships are not merely transactional; they represent deep, long-term collaborations focused on innovation.

These alliances are vital for co-developing advanced materials specifically tailored for next-generation chip fabrication. For instance, JSR's materials are integral to processes like extreme ultraviolet (EUV) lithography, a technology that has seen significant investment and advancement, with the global EUV lithography market projected to reach billions of dollars in the coming years.

By working closely with industry leaders, JSR ensures its material solutions are designed for seamless integration and optimal performance within the complex ecosystems of cutting-edge semiconductor manufacturing. This proactive approach allows JSR to stay ahead of evolving technological demands and maintain its competitive edge in a rapidly advancing sector.

JSR actively collaborates with leading universities and research institutes, fostering innovation in material science. These partnerships are crucial for fundamental research, allowing JSR to explore new frontiers and identify potential breakthrough technologies. For instance, in 2024, JSR continued its long-standing collaboration with the University of Tokyo's Institute for Solid State Physics, focusing on advanced polymer synthesis for next-generation semiconductor materials.

JSR's success hinges on strong alliances with suppliers of high-purity raw materials, essential for their advanced semiconductor and display materials. These partnerships guarantee a consistent flow of quality inputs, crucial for maintaining production schedules and meeting stringent customer specifications.

In 2024, JSR continued to emphasize supply chain resilience, recognizing that disruptions in critical material availability can significantly impact output. For example, securing reliable sources for photolithography chemicals and advanced polymers remains a top priority, directly influencing their ability to serve the booming semiconductor industry.

Joint Ventures and Equity Investments for Market Expansion

JSR Corporation actively pursues strategic alliances, including joint ventures and equity investments, to accelerate its expansion into new geographic territories and niche product segments, especially within the dynamic life sciences industry. For instance, in 2024, JSR continued to evaluate opportunities for collaboration to bolster its presence in emerging markets, leveraging partners' established distribution networks and regulatory knowledge to overcome entry hurdles.

These partnerships are crucial for sharing development costs, mitigating risks associated with market entry, and accessing specialized technologies or local market insights that are vital for success. By co-investing, JSR can gain a foothold in markets that might otherwise be prohibitively expensive or complex to penetrate independently.

- Market Entry Acceleration: Joint ventures allow JSR to tap into established local networks and expertise, significantly reducing the time and cost of entering new geographical markets.

- Risk Mitigation: Sharing investment burdens and operational responsibilities with partners lowers the financial risk for JSR when exploring new product areas or less familiar markets.

- Technology and Expertise Acquisition: Equity investments in or joint ventures with companies possessing unique technologies or specialized knowledge, particularly in advanced materials for life sciences, enable JSR to quickly integrate cutting-edge capabilities.

- Synergistic Growth: Collaborations foster a synergistic environment where combined strengths lead to greater innovation and market penetration than either entity could achieve alone.

Technology Development Partners

JSR actively cultivates relationships with developers of specialized manufacturing equipment and advanced analytical tools. These partnerships are fundamental to refining JSR's production efficiency and elevating the performance characteristics of its materials. For instance, collaborations in 2024 focused on integrating next-generation lithography equipment, which is critical for semiconductor material advancements.

These strategic alliances ensure JSR remains at the forefront of material processing and quality assurance technologies. By working with innovators in complementary fields, JSR can readily adopt cutting-edge solutions, thereby solidifying its competitive advantage in rapidly evolving markets.

- Equipment Innovation: Collaborations with equipment manufacturers to co-develop advanced deposition and etching systems.

- Analytical Advancement: Partnerships with providers of high-resolution microscopy and spectroscopy tools for enhanced material characterization.

- Process Optimization: Joint development projects aimed at improving yield and reducing cycle times in complex manufacturing processes.

- New Material Integration: Working with technology partners to ensure seamless integration of novel materials into existing or new production lines.

JSR's Key Partnerships are multifaceted, encompassing semiconductor giants, academic institutions, raw material suppliers, and specialized equipment manufacturers. These alliances are critical for driving innovation, ensuring supply chain stability, and accelerating market entry, particularly in the rapidly advancing life sciences sector.

In 2024, JSR continued its deep collaborations with leading semiconductor manufacturers, co-developing advanced materials essential for technologies like EUV lithography. Simultaneously, partnerships with universities, such as the University of Tokyo, fueled fundamental research in material science. The company also prioritized alliances with high-purity raw material suppliers to guarantee consistent quality and supply chain resilience, while working with equipment makers to optimize production and integrate new materials.

| Partner Type | Focus Area | 2024 Example/Impact |

|---|---|---|

| Semiconductor Manufacturers | Co-development of advanced materials (e.g., for EUV lithography) | Ensuring seamless integration and performance in next-gen chip fabrication. |

| Universities & Research Institutes | Fundamental research in material science | Exploration of new frontiers, e.g., advanced polymer synthesis with University of Tokyo. |

| Raw Material Suppliers | Ensuring high-purity inputs and supply chain resilience | Guaranteeing consistent quality for photolithography chemicals and polymers. |

| Equipment Manufacturers | Process optimization and new material integration | Collaborations on advanced lithography equipment and analytical tools. |

| Joint Ventures/Equity Investments | Market entry and technology acquisition (e.g., life sciences) | Accelerating expansion into new territories and niche product segments. |

What is included in the product

A structured framework that visually maps out a company's strategy, detailing customer segments, value propositions, channels, and revenue streams.

Enables a holistic understanding of how a business creates, delivers, and captures value, facilitating strategic planning and innovation.

The JSR Business Model Canvas efficiently identifies and addresses critical business challenges by providing a structured framework for visualizing and optimizing key operational areas.

It alleviates the pain of disjointed strategy by offering a holistic, single-page view that fosters clarity and alignment across all business functions.

Activities

JSR Corporation's advanced materials research and development is central to its innovation strategy, driving progress across its diverse business segments. This intensive R&D effort focuses on creating novel high-performance materials and refining current offerings, particularly within digital solutions, life sciences, and synthetic rubbers.

The company's commitment to material innovation involves sophisticated processes like material synthesis, meticulous property optimization, and rigorous application testing. This ensures their materials consistently meet and anticipate the dynamic needs of various high-tech industries.

For example, JSR's investment in R&D directly fuels its leadership in semiconductor materials, a market that saw significant growth and demand in 2024, underscoring the commercial impact of their advanced material development.

JSR Corporation's core strength lies in its meticulous manufacturing of high-purity, performance-critical materials. This includes photoresists essential for the intricate lithography processes in semiconductor fabrication, a market that saw significant global investment in 2024 as chip demand remained robust. The company also produces specialized polymers vital for the medical device industry, where precision and biocompatibility are paramount.

Achieving this level of quality necessitates advanced, highly controlled production environments and rigorous quality assurance systems. JSR's commitment to these standards ensures compliance with demanding international regulations, a crucial factor for its global clientele in both the electronics and healthcare sectors.

JSR Corporation orchestrates a comprehensive global sales and marketing network to deliver its advanced materials and technologies to a wide array of high-tech industries. This global reach is crucial for engaging with key clients in sectors like semiconductors and displays.

The company's strategy emphasizes building strong customer relationships and understanding specific market needs across different regions. This customer-centric approach is vital for maintaining its competitive edge in specialized markets.

Efficient global logistics and supply chain management are paramount to JSR's operations, ensuring timely delivery of its high-value products. For instance, in 2024, JSR continued to invest in optimizing its distribution channels to better serve its international clientele.

Intellectual Property Management and Protection

JSR Corporation's intellectual property management is a cornerstone of its business model, focusing on safeguarding and capitalizing on its innovations in advanced materials. This involves a rigorous approach to patenting new technologies, particularly in areas like semiconductor materials and life sciences, ensuring a protected market position.

The company actively manages its trade secrets and proprietary manufacturing processes, which are critical for maintaining its edge in high-performance product development. For instance, JSR's expertise in photolithography materials, a key segment, relies heavily on protected know-how.

- Patent Portfolio Expansion: JSR consistently invests in R&D to generate new patents, reinforcing its technological leadership. In 2023, the company reported a significant number of patent applications and grants across its diverse business units, reflecting ongoing innovation.

- Trade Secret Protection: Critical manufacturing techniques and chemical formulations are maintained as trade secrets, preventing competitors from replicating JSR's advanced material solutions. This is especially vital for their high-purity chemicals used in sensitive electronic manufacturing.

- Licensing and Collaboration: JSR strategically leverages its IP through licensing agreements and collaborative research projects, generating revenue and fostering further technological advancements. These partnerships often focus on emerging applications of their core material science expertise.

- Freedom to Operate: A key activity involves ensuring JSR's operations and product offerings do not infringe on existing third-party patents, allowing for uninterrupted market access and sales. This proactive legal stance is essential in the fast-paced tech industry.

Technical Customer Support and Application Engineering

JSR's technical customer support and application engineering are pivotal. They work hand-in-hand with clients to ensure their materials seamlessly integrate into new products, tackling intricate technical hurdles along the way.

This dedicated approach guarantees that JSR's materials perform at their peak, a key factor in building strong, lasting customer relationships. For instance, in 2024, JSR's advanced materials played a crucial role in the development of next-generation semiconductor lithography, a field demanding extreme precision and reliability.

- Collaborative Integration: JSR engineers actively partner with customers to optimize material performance within specific product designs.

- Problem Solving: The team addresses complex technical challenges, ensuring successful application of JSR's innovative materials.

- Customer Loyalty: This high-touch service cultivates deep customer loyalty by delivering tangible value and support.

- Market Advancement: JSR's technical expertise directly contributes to advancements in critical industries like electronics and healthcare.

JSR Corporation's key activities revolve around the meticulous research and development of advanced materials, ensuring high-purity manufacturing processes, and maintaining a robust global sales and marketing infrastructure. These activities are underpinned by diligent intellectual property management and proactive technical customer support, all aimed at delivering cutting-edge solutions to diverse high-tech industries.

The company's commitment to innovation is evident in its continuous R&D efforts, focusing on creating next-generation materials for sectors like semiconductors and life sciences. In 2024, JSR's investment in these areas supported the growing demand for advanced chip manufacturing technologies. The meticulous production of these materials, coupled with stringent quality control, ensures their suitability for critical applications.

JSR's global network facilitates the distribution of its specialized products, supported by strong customer relationships and efficient logistics. Protecting its technological advancements through IP management and providing expert technical assistance are crucial for maintaining its market leadership and fostering long-term partnerships.

| Key Activity | Description | 2024 Relevance/Data Point |

| Advanced Materials R&D | Developing novel high-performance materials. | Fueled leadership in semiconductor materials, a sector with robust 2024 demand. |

| High-Purity Manufacturing | Producing critical materials like photoresists and specialized polymers. | Ensured supply for semiconductor fabrication and medical devices amidst strong market needs. |

| Global Sales & Marketing | Engaging with clients in semiconductors, displays, and life sciences. | Optimized distribution channels to serve international clientele effectively. |

| Intellectual Property Management | Patenting new technologies and protecting trade secrets. | Safeguarded expertise in photolithography materials, a key competitive advantage. |

| Technical Customer Support | Assisting clients with material integration and application challenges. | Supported the development of next-generation semiconductor lithography in 2024. |

Full Version Awaits

Business Model Canvas

The JSR Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This is not a sample or a mockup; it is a direct snapshot of the complete, ready-to-use file. Once your order is processed, you will gain full access to this exact Business Model Canvas, allowing you to immediately begin refining your business strategy.

Resources

JSR's most critical resource is its extensive portfolio of proprietary technologies and intellectual property, encompassing patents and trade secrets in advanced materials. This IP is particularly strong in digital solutions and life sciences, forming the bedrock of its competitive edge and safeguarding its unique product designs and production methods.

In 2024, JSR continued to leverage this intellectual capital, with a significant portion of its research and development investments focused on expanding and protecting its patent holdings. For instance, its advancements in semiconductor materials are protected by a robust patent suite, crucial for maintaining market leadership in a rapidly evolving tech landscape.

JSR's state-of-the-art research and development facilities are the engine of its innovation, housing specialized centers and laboratories. These are outfitted with cutting-edge instrumentation crucial for material synthesis, thorough characterization, and rigorous application testing.

These advanced R&D capabilities are fundamental to JSR's ability to continuously innovate and develop the high-purity, high-performance materials that define its product portfolio. In 2023, JSR reported significant investment in R&D, with approximately 6.5% of its net sales allocated to these critical activities, underscoring their importance to future growth and competitive advantage.

JSR's highly skilled scientific and engineering talent, including expert chemists and material scientists, are crucial for its innovation pipeline. This expertise directly impacts product development and quality assurance, essential for maintaining a competitive edge in advanced materials.

In 2023, JSR reported significant investment in research and development, underscoring the value placed on its technical specialists. Their contributions are vital for creating next-generation products and providing critical customer support, a key differentiator for the company.

Global Network of Advanced Manufacturing Plants

JSR's global network of advanced manufacturing plants is a cornerstone of its business model, enabling efficient production and distribution of specialized materials worldwide. These facilities are strategically positioned to cater to major industrial hubs, ensuring proximity to key customers and markets. The company's investment in cutting-edge technology within these plants allows for high-volume, precision manufacturing essential for its advanced materials portfolio.

In 2024, JSR continued to leverage its extensive manufacturing footprint, which includes facilities across Asia, North America, and Europe. This global presence allows for localized production, reducing lead times and transportation costs. The company's commitment to advanced manufacturing processes ensures consistent quality and the ability to meet the stringent demands of industries like semiconductors and display technology.

- Global Reach: JSR's manufacturing sites are strategically distributed across key economic regions, facilitating efficient market access.

- Advanced Capabilities: Plants are equipped with state-of-the-art technology for high-precision, high-volume production of advanced materials.

- Market Responsiveness: The global network allows JSR to adapt quickly to regional demand fluctuations and customer needs.

- Operational Efficiency: Strategic plant locations minimize logistics costs and enhance supply chain reliability.

Strong Brand Reputation and Established Customer Relationships

JSR's strong brand reputation, cultivated over decades of delivering high-quality advanced materials, is a cornerstone of its business model. This trust is particularly vital in demanding sectors like semiconductors and life sciences.

These established customer relationships, often spanning many years with industry leaders, translate directly into predictable revenue streams and a reduced need for extensive customer acquisition efforts. For instance, JSR's deep ties within the semiconductor ecosystem ensure consistent demand for its photoresists and other critical materials.

- Brand Equity: JSR's reputation for reliability and innovation in advanced materials fosters significant brand equity.

- Customer Loyalty: Long-standing relationships with major global players in technology and healthcare drive repeat business and reduce churn.

- Market Trust: Decades of performance have solidified JSR's position as a trusted supplier, essential for mission-critical applications.

- Competitive Advantage: This strong foundation of reputation and relationships acts as a significant barrier to entry for competitors.

JSR's key resources include its robust intellectual property portfolio, cutting-edge R&D facilities, and a highly skilled workforce. These assets are crucial for developing and manufacturing its advanced materials. The company's global manufacturing network and strong brand reputation, built on decades of customer trust, further solidify its market position.

| Resource Type | Description | Key Impact | 2023/2024 Data Point |

| Intellectual Property | Proprietary technologies, patents, and trade secrets in advanced materials. | Competitive edge, product protection. | Significant R&D investment in patent expansion in 2024. |

| R&D Facilities | State-of-the-art laboratories for material synthesis and testing. | Innovation engine, product development. | ~6.5% of net sales invested in R&D in 2023. |

| Human Capital | Skilled scientists and engineers. | Product development, quality assurance. | Vital for creating next-gen products and customer support (2023 focus). |

| Manufacturing Network | Global advanced manufacturing plants. | Efficient production, distribution, market access. | Operations across Asia, North America, and Europe in 2024. |

| Brand Reputation & Relationships | Decades of trust and long-standing customer ties. | Predictable revenue, reduced acquisition costs. | Deep ties in semiconductor ecosystem ensure consistent demand. |

Value Propositions

JSR's value proposition centers on providing the essential advanced materials that fuel breakthroughs in cutting-edge fields like semiconductors, displays, and medical devices. These foundational components are indispensable for creating the next generation of technological marvels.

By leveraging JSR's innovative materials, customers can push the boundaries of what's possible, achieving superior performance and enhanced efficiency in their own products. This translates directly into tangible improvements and new capabilities for end-users.

For instance, in the semiconductor sector, JSR's photoresists are crucial for manufacturing advanced chips. In 2024, the global semiconductor market was projected to reach over $600 billion, underscoring the immense demand for the high-performance materials JSR supplies to enable smaller, faster, and more powerful processors.

JSR's value proposition centers on delivering materials with exceptional purity and consistency, vital for high-stakes industries. These advanced materials are engineered for specific performance attributes, directly translating to superior product yields and reduced defects for their clients.

This focus on unmatched material performance and reliability translates into tangible benefits for JSR's industrial customers. For instance, in the semiconductor sector, where even minute impurities can derail production, JSR's materials contribute to higher wafer yields, a critical metric. In 2023, the global semiconductor market saw significant demand, underscoring the importance of such reliable material inputs.

JSR excels at crafting bespoke material solutions, working hand-in-hand with clients to address their most intricate and singular application needs.

This collaborative, co-creation process is key, ensuring that JSR's materials seamlessly integrate and perform optimally, giving customers a significant advantage in their respective markets.

For instance, in 2024, JSR reported a substantial increase in custom development projects, particularly within the semiconductor and display sectors, reflecting a growing demand for highly specialized materials.

Strategic Partnership for Future-Proofing

JSR acts as a strategic partner by leveraging continuous research and development to anticipate future technological shifts. This foresight allows them to create innovative materials that empower their customers to remain at the forefront of their respective industries.

By developing cutting-edge materials, JSR enables clients to adapt to changing market dynamics and sustain their competitive edge. This proactive approach ensures that customers are not just reacting to trends but are actively shaping them.

- Future-Proofing Materials: JSR's commitment to R&D, evidenced by their significant investment in innovation, ensures their product pipeline aligns with emerging technologies. For instance, in 2024, JSR continued to focus on advanced materials for semiconductors and displays, sectors projected for substantial growth.

- Competitive Advantage for Clients: By providing these advanced materials, JSR directly contributes to their clients' ability to maintain and enhance their market position. This strategic alignment helps customers navigate industry disruptions effectively.

- Market Foresight and Adaptation: JSR's market analysis capabilities allow them to predict and prepare for future needs, offering solutions before challenges become critical. This proactive stance is crucial in fast-evolving sectors like electronics and life sciences.

Global Supply Security and Expert Technical Support

JSR guarantees a robust global supply chain for essential materials, meaning customers can count on consistent availability and prompt delivery, no matter where they are located. This reliability is a cornerstone of their value proposition, particularly for industries reliant on specialized chemical compounds.

This dependable supply is bolstered by JSR's profound technical expertise. Their teams offer comprehensive support, assisting clients at every stage, from choosing the right materials to successfully bringing their final products to market. For instance, in 2024, JSR reported that over 95% of its key material deliveries met or exceeded scheduled timelines, a testament to its supply chain efficiency.

- Global Reach: Ensuring critical materials are accessible worldwide.

- Supply Chain Resilience: Maintaining consistent availability and timely delivery.

- Technical Acumen: Providing expert guidance from material selection to product launch.

- Customer Partnership: Supporting innovation and commercialization efforts.

JSR's value proposition is built on delivering advanced materials that are critical for innovation in high-tech sectors. They enable customers to achieve superior product performance and efficiency by providing materials with exceptional purity and consistency, leading to higher yields and fewer defects.

Furthermore, JSR acts as a collaborative partner, developing custom material solutions to meet specific client needs and leveraging extensive R&D to anticipate future technological demands, thereby future-proofing their clients' products and maintaining their competitive edge.

A robust global supply chain ensures consistent material availability and timely delivery, backed by deep technical expertise that supports clients throughout the product development lifecycle.

| Value Proposition Area | Description | Supporting Data/Example |

|---|---|---|

| Enabling Technological Breakthroughs | Providing essential advanced materials for semiconductors, displays, and medical devices. | In 2024, JSR focused on advanced materials for semiconductors and displays, sectors projected for substantial growth. |

| Superior Material Performance & Reliability | Engineering materials for specific attributes, ensuring high purity and consistency for better product yields. | In 2024, JSR reported over 95% of key material deliveries met or exceeded scheduled timelines. |

| Custom Material Solutions & Collaboration | Developing bespoke material solutions through close collaboration with clients. | In 2024, JSR saw a substantial increase in custom development projects, particularly in semiconductor and display sectors. |

| Strategic Partnership & Market Foresight | Anticipating future technological shifts through R&D to empower clients to stay ahead. | JSR's market analysis capabilities help clients adapt to changing dynamics in fast-evolving sectors. |

Customer Relationships

JSR cultivates enduring partnerships with its principal industrial clients by assigning dedicated key account managers. This personalized strategy fosters a profound grasp of client requirements and facilitates proactive issue resolution, ensuring alignment with their strategic goals in the advanced materials sector.

JSR actively cultivates collaborative research and development partnerships with key clients, especially within the dynamic semiconductor and burgeoning life sciences industries. This approach allows for the creation of tailored material solutions that precisely meet evolving market demands.

These joint development projects are central to JSR's strategy, enabling the company to co-create innovative products and significantly shorten the time-to-market for new technologies. For instance, in 2024, JSR highlighted its ongoing collaboration with leading semiconductor manufacturers on next-generation lithography materials, a testament to the success of this customer relationship model.

JSR acts as a dedicated technical partner, offering extensive support and consultation to its clientele. This commitment extends to providing on-site assistance, expert application engineering, and prompt troubleshooting.

This deep engagement ensures that JSR's advanced materials are seamlessly integrated into customer processes, leading to optimal performance and innovation. For instance, in 2024, JSR reported a significant increase in customer satisfaction scores directly correlated with their enhanced technical support initiatives.

Long-Term Supply and Service Agreements

JSR frequently secures long-term supply and service agreements with its key clients. These arrangements underscore JSR's deep integration within customer supply chains, fostering a sense of dependable, ongoing collaboration.

These agreements are crucial for maintaining predictable revenue streams and operational stability. For instance, in 2024, a significant portion of JSR's revenue was derived from such multi-year contracts, highlighting their strategic importance.

- Customer Retention: Long-term agreements significantly boost customer loyalty and reduce churn.

- Revenue Predictability: They provide a stable and forecastable revenue base for JSR.

- Supply Chain Integration: These partnerships allow for deeper collaboration and efficiency gains.

- Competitive Advantage: Such commitments differentiate JSR from competitors offering more transactional relationships.

Post-Sales Quality Assurance and Performance Monitoring

JSR prioritizes customer satisfaction through comprehensive post-sales quality assurance and ongoing performance monitoring. This proactive approach ensures that JSR's advanced materials consistently meet and exceed customer expectations in their specific applications.

By diligently tracking material performance, JSR can swiftly identify and resolve any potential operational challenges, reinforcing the reliability and value proposition of their offerings. This dedication builds enduring trust and fosters long-term partnerships.

- Rigorous Quality Assurance: JSR implements stringent testing protocols post-sale to validate material performance in real-world customer environments.

- Continuous Performance Monitoring: Ongoing data collection and analysis allow JSR to track material behavior and identify trends or anomalies.

- Swift Issue Resolution: A dedicated support team is in place to address any customer-reported issues promptly, minimizing downtime and ensuring operational continuity.

- Reinforced Customer Trust: This commitment to post-sales excellence demonstrates JSR's dedication to customer success, solidifying their reputation as a trusted supplier.

JSR's customer relationships are built on a foundation of dedicated account management and collaborative innovation, particularly evident in its work with semiconductor and life sciences clients. This approach, which includes joint development projects and extensive technical support, aims to create tailored solutions and ensure seamless integration of JSR's advanced materials into customer processes. The company's strategy also emphasizes long-term supply agreements and rigorous post-sales quality assurance to foster loyalty and predictable revenue streams.

| Customer Relationship Aspect | Description | 2024 Impact/Focus |

|---|---|---|

| Key Account Management | Dedicated managers provide personalized service and deep understanding of client needs. | Fostered proactive issue resolution and alignment with client strategic goals. |

| Collaborative R&D | Joint development projects with clients, especially in semiconductors and life sciences. | Enabled creation of tailored material solutions and accelerated time-to-market for new technologies. |

| Technical Partnership | Extensive support, including on-site assistance and application engineering. | Resulted in significant increases in reported customer satisfaction scores. |

| Long-Term Agreements | Securing multi-year supply and service contracts. | Contributed a significant portion of JSR's 2024 revenue, ensuring stability. |

| Post-Sales Assurance | Quality assurance and performance monitoring to exceed expectations. | Reinforced customer trust through diligent performance tracking and swift issue resolution. |

Channels

JSR's direct global sales force is the backbone of its customer engagement strategy, particularly with its large, sophisticated industrial clients. This direct approach allows for in-depth technical discussions, essential for understanding and addressing the complex needs of these B2B customers.

This channel is instrumental in JSR's ability to offer tailored solution selling, ensuring that products and services are precisely matched to client requirements. The direct interaction fosters strong, long-term relationships, which are vital for sustained business in specialized industrial sectors.

In 2024, JSR continued to invest in its global sales teams, recognizing that this direct channel's effectiveness is tied to the technical expertise and relationship-building capabilities of its personnel. The company’s sales force actively engages with key accounts, contributing significantly to its revenue streams by providing personalized support and driving adoption of new technologies.

JSR leverages a specialized global distribution network to ensure product availability and market penetration, particularly for items needing localized inventory. This strategy allows them to effectively reach a wider customer base by partnering with regional experts who understand specific market demands and logistical nuances.

In 2024, JSR's specialized distributors played a crucial role in expanding their footprint in emerging markets, contributing to a reported 15% year-over-year growth in sales within those regions. These partners provide essential localized logistics and customer support, enhancing JSR's competitive edge.

JSR's global network of technical service centers and application laboratories are crucial touchpoints for customer interaction. These facilities offer direct engagement through product demonstrations and specialized training, fostering deeper customer relationships and understanding of JSR's advanced materials. For instance, in 2024, JSR continued to invest in these centers to showcase innovations in areas like semiconductor materials and life sciences, directly supporting customer product development cycles.

Industry Trade Shows and Technical Conferences

JSR actively participates in major global industry trade shows and technical conferences. These events are crucial for demonstrating JSR's cutting-edge material science advancements and fostering connections with prospective customers and thought leaders. In 2024, JSR showcased its latest semiconductor materials at SEMICON West, a premier event attracting thousands of industry professionals. This engagement directly supports lead generation and enhances JSR's market presence.

These gatherings serve as vital platforms for JSR to:

- Showcase new material innovations and product developments.

- Network with potential clients and forge strategic partnerships.

- Gather market intelligence and understand emerging industry trends.

- Engage with technical experts and academic researchers.

Corporate Website and Digital Information Hubs

JSR's corporate website acts as a crucial digital information hub, offering detailed product specifications, technical data sheets, and vital sustainability reports. It also provides timely investor relations updates, solidifying its role as a primary source for stakeholders seeking transparent company information.

While not a direct sales platform, the website significantly aids customer engagement by facilitating inquiries and reinforcing JSR's brand reputation and credibility in the market. This digital presence is key to building trust and providing accessible resources.

- Information Dissemination: Comprehensive product catalogs, technical datasheets, and safety information are readily available.

- Sustainability Focus: Detailed sustainability reports and ESG (Environmental, Social, and Governance) initiatives are published.

- Investor Relations: Financial reports, press releases, and shareholder information are regularly updated.

- Customer Support: Contact forms and FAQs support customer inquiries and technical assistance.

JSR's channels are a blend of direct engagement and strategic partnerships, designed to reach diverse customer segments effectively. The direct global sales force excels in complex B2B interactions, while a specialized distribution network expands market reach, particularly in emerging economies.

Technical service centers and industry events serve as key touchpoints for showcasing innovation and fostering deep customer relationships. The corporate website acts as a vital information hub, reinforcing brand credibility and providing essential resources for all stakeholders.

Customer Segments

Semiconductor device manufacturers, including major foundries and integrated device manufacturers (IDMs), are a core customer segment for JSR. These companies, such as TSMC and Intel, rely on JSR's high-performance photoresists and chemical mechanical planarization (CMP) slurries to produce advanced microchips. In 2024, the global semiconductor market is projected to reach over $600 billion, highlighting the immense scale and demand from these customers.

Display panel manufacturers, encompassing producers of LCD, OLED, and novel display technologies, represent a crucial customer base for JSR. These companies rely on JSR for advanced optical materials and specialized chemicals that are fundamental to achieving superior display performance. In 2024, the global display market, particularly for high-end smartphones and televisions utilizing OLED technology, continued to grow, driving demand for the precise chemical formulations JSR provides.

Medical device and diagnostics companies represent a crucial customer segment for JSR, as they rely on advanced materials for product innovation and compliance. These companies are actively developing solutions for everything from minimally invasive surgical tools to rapid diagnostic kits, requiring materials that are safe, reliable, and perform under demanding conditions.

JSR's specialized polymers are integral to this sector, enabling the creation of biocompatible implants, high-precision diagnostic consumables, and advanced drug delivery systems. For instance, the global medical device market reached an estimated $520 billion in 2023, with a significant portion driven by demand for innovative diagnostic and therapeutic technologies.

Meeting strict regulatory standards, such as those from the FDA and EMA, is paramount for these clients. JSR's commitment to quality and material science expertise ensures that its offerings support the rigorous testing and approval processes these companies navigate, contributing to advancements in patient care and health outcomes.

Automotive Component Manufacturers

Automotive component manufacturers are a key customer segment for JSR, relying on its advanced materials to meet evolving industry demands. These companies, producing everything from tires and engine parts to sophisticated electronic systems, seek materials that offer superior durability, reduced weight for better fuel efficiency, enhanced safety features, and specific performance characteristics tailored to their applications. In 2024, the automotive industry continued its push towards electrification and sustainability, directly influencing the demand for specialized synthetic rubbers and resins that can withstand higher operating temperatures and provide improved electrical insulation.

- Demand for High-Performance Materials: Component makers require materials that can endure extreme temperatures, resist wear and tear, and contribute to vehicle lightweighting initiatives.

- Focus on Electrification: The shift to electric vehicles (EVs) drives demand for JSR's materials in battery components, insulation, and power electronics due to their thermal management and electrical properties.

- Regulatory Compliance: Manufacturers must adhere to stringent safety and environmental regulations, necessitating materials that meet these standards for emissions, recyclability, and occupant safety.

- Innovation in Materials Science: JSR's ability to innovate and provide custom material solutions is critical for component manufacturers aiming to differentiate their products in a competitive market.

General Industrial and Consumer Electronics Manufacturers

This broad customer segment includes manufacturers across various industrial sectors and those producing consumer electronics. They rely on JSR's advanced materials for critical components, protective coatings, and other specialized applications within their diverse product lines.

These companies demand consistent, high-performance materials to ensure the quality and reliability of their offerings. For instance, in 2024, the global consumer electronics market was valued at approximately $1.1 trillion, with industrial manufacturing also representing a significant economic contributor, underscoring the scale of demand for advanced materials.

- Diverse Applications: Serving industries from automotive to telecommunications, these manufacturers utilize JSR's materials for everything from semiconductor fabrication to display technologies.

- Quality and Performance Focus: Customers prioritize materials that meet stringent performance specifications, crucial for product longevity and functionality in competitive markets.

- Market Demand: The sheer volume of production in consumer electronics and industrial goods necessitates a steady and reliable supply of advanced materials, with global manufacturing output continuing to grow.

- Innovation Partnership: Many of these customers seek collaborative relationships to develop next-generation materials that enable new product features and improved efficiencies.

JSR's customer base is diverse, spanning critical high-tech industries. Semiconductor manufacturers, like TSMC, rely on JSR for essential materials like photoresists, crucial for producing advanced microchips. The global semiconductor market's projected growth past $600 billion in 2024 underscores this demand.

Display panel makers, producing everything from LCDs to OLEDs, also depend on JSR for optical materials. The continued expansion of the high-end smartphone and television markets in 2024 fuels the need for JSR's precise chemical formulations.

Furthermore, medical device and diagnostics companies utilize JSR's specialized polymers for biocompatible implants and diagnostic consumables. With the medical device market estimated at $520 billion in 2023, innovation in health tech drives demand for JSR’s reliable materials.

Automotive component manufacturers are another key segment, seeking JSR’s advanced materials for durability and lightweighting, especially with the industry's shift towards electrification. The automotive sector's 2024 focus on EVs directly increases demand for materials with superior thermal and electrical properties.

Finally, a broad range of industrial and consumer electronics manufacturers depend on JSR for high-performance materials and protective coatings. The combined global value of consumer electronics and industrial manufacturing, exceeding trillions in 2024, highlights the extensive reach of JSR's material solutions.

| Customer Segment | Key Reliance on JSR | Market Context (2024/Recent) |

|---|---|---|

| Semiconductor Manufacturers | Photoresists, CMP slurries | Global market > $600 billion |

| Display Panel Manufacturers | Optical materials, specialty chemicals | Growth in OLED technology |

| Medical Device & Diagnostics | Specialized polymers, biocompatible materials | Medical device market ~$520 billion (2023) |

| Automotive Component Manufacturers | Synthetic rubbers, resins, advanced polymers | Increased demand for EV components |

| Industrial & Consumer Electronics | Protective coatings, specialized components | Consumer electronics market ~$1.1 trillion |

Cost Structure

JSR dedicates a significant portion of its expenses to Research and Development (R&D). This includes the substantial salaries for its highly skilled scientists and engineers, who are essential for innovation.

Investment in cutting-edge laboratory equipment and the procurement of raw materials for experimental projects also contribute heavily to this cost category. For instance, in fiscal year 2023, JSR reported R&D expenses of approximately ¥110 billion, underscoring its commitment to technological advancement.

This substantial R&D spending is a cornerstone for JSR to maintain its competitive edge and leadership in its various technological fields.

Manufacturing and production overheads are substantial for JSR, driven by the need for high-purity raw materials, which in 2023 represented a significant portion of their cost of goods sold.

The energy-intensive nature of their specialized chemical processes, particularly for semiconductor materials, contributes heavily to operational expenses. For instance, the global energy market saw price volatility in 2024, directly impacting JSR's production costs.

Labor costs for highly skilled operators essential for maintaining precision in their advanced manufacturing facilities are another key component. JSR's commitment to maintaining a global network of these facilities necessitates ongoing investment in skilled personnel and facility upkeep.

JSR's Sales, General, and Administrative (SG&A) expenses encompass the vital costs of its global sales force, strategic marketing campaigns, and essential corporate administration. These expenditures also cover critical legal and compliance functions, alongside the maintenance of its robust IT infrastructure, all of which are fundamental to supporting JSR's worldwide operations and expanding its market presence.

In 2024, JSR Corporation reported significant investments in its SG&A, reflecting its commitment to global market penetration and operational excellence. For instance, its semiconductor materials segment, a key revenue driver, necessitates substantial marketing and sales support to engage with leading technology firms. While specific consolidated SG&A figures for 2024 are anticipated to be detailed in upcoming financial reports, the trend from prior years indicates a continued focus on expanding its sales network and enhancing its brand visibility through targeted digital and traditional marketing efforts.

Intellectual Property Acquisition and Maintenance Costs

Intellectual property is a major expense for JSR. This includes the costs for filing, prosecuting, and maintaining patents around the world. For instance, in 2024, companies in the advanced materials sector, where JSR operates, often allocate significant budgets to IP protection, with patent filing fees alone potentially running into tens of thousands of dollars annually for a global portfolio.

Beyond direct filing, JSR may also incur costs related to licensing fees if they utilize external technologies. These licensing agreements are crucial for accessing innovative solutions and can represent a substantial recurring expense in their cost structure.

Protecting and growing JSR's intellectual property is a cornerstone of their competitive strategy. This investment ensures they maintain a technological edge and can command premium pricing for their proprietary products and processes.

- Global patent filing and maintenance fees for a robust portfolio can easily exceed $100,000 annually.

- Licensing fees for critical third-party technologies can range from a percentage of sales to significant upfront payments.

- Legal expenses associated with IP defense and enforcement are also a key component of this cost category.

- Investment in R&D personnel dedicated to IP strategy and management contributes to these overall costs.

Global Supply Chain and Logistics Costs

JSR's global supply chain is a significant cost driver, encompassing transportation, warehousing, and inventory management for materials and finished products moving internationally. These operational expenses are crucial for maintaining product availability and market reach.

In 2024, global shipping costs, a major component of logistics, saw fluctuations. For instance, the Drewry World Container Index, a benchmark for major shipping routes, averaged around $1,700 per 40ft container in early 2024, a decrease from the peak levels seen in previous years but still a considerable expense for companies like JSR with extensive international trade.

- Transportation: Costs associated with freight (sea, air, land), fuel surcharges, and carrier fees for moving raw materials to manufacturing sites and finished goods to customers worldwide.

- Warehousing and Storage: Expenses for maintaining inventory in strategically located warehouses globally, including rent, utilities, and staffing.

- Inventory Management: Costs related to holding inventory, such as capital tied up, insurance, obsolescence, and the systems required to track and manage stock levels efficiently.

- Customs and Duties: Fees and tariffs levied by various countries on imported raw materials and exported finished goods, adding to the overall cost of cross-border transactions.

JSR's cost structure is heavily influenced by its substantial investments in Research and Development (R&D), essential for maintaining its technological leadership. Manufacturing and production overheads, particularly for specialized chemical processes and high-purity materials, represent another significant expense. Sales, General, and Administrative (SG&A) costs support its global operations and market expansion, while intellectual property protection and supply chain management are also key cost drivers.

| Cost Category | Key Components | 2023/2024 Relevance |

| R&D Expenses | Salaries for scientists, lab equipment, raw materials | ¥110 billion in FY2023; crucial for innovation and competitiveness. |

| Manufacturing & Production | High-purity raw materials, energy costs, skilled labor | Impacted by 2024 energy market volatility; precision operations require ongoing investment. |

| SG&A | Global sales force, marketing, administration, IT infrastructure | Significant investment in 2024 for market penetration; semiconductor materials segment requires substantial support. |

| Intellectual Property | Patent filing/maintenance, licensing fees, legal defense | Global portfolios can incur over $100,000 annually in filing fees; licensing is a recurring expense. |

| Supply Chain | Transportation, warehousing, inventory management, customs | Global shipping costs fluctuated in 2024, averaging around $1,700 per 40ft container on major routes. |

Revenue Streams

JSR Corporation's primary revenue driver is the sale of advanced materials crucial for digital solutions, especially photoresists and related process chemicals. These high-margin products are indispensable for semiconductor and display manufacturers, enabling the creation of smaller, more powerful electronic components.

In 2023, JSR reported substantial sales in its Digital Solutions segment, reflecting strong demand from the booming semiconductor industry. For instance, the company's revenue from this segment reached approximately ¥350 billion, underscoring its critical role in the global tech supply chain.

JSR's life sciences segment is a major revenue driver, fueled by the sale of advanced polymers and materials crucial for medical devices, diagnostic kits, and biopharmaceutical manufacturing. This segment directly benefits from ongoing advancements and robust demand within the global healthcare industry.

Sales of synthetic rubbers and emulsions form a foundational revenue stream for JSR, underpinning its financial stability. In 2024, this segment continued to be a significant contributor, reflecting the ongoing demand from core industries. These materials are essential for sectors like automotive manufacturing and tire production, ensuring a consistent revenue flow.

Licensing and Royalty Income

Licensing and royalty income represents a potentially smaller but significant revenue stream for JSR, capitalizing on its substantial investments in research and development and its robust portfolio of intellectual property. This segment allows JSR to monetize its technological innovations by granting usage rights to other entities.

For instance, JSR's expertise in materials science, particularly in areas like semiconductor photoresists and display materials, makes its patents valuable assets. Companies seeking to utilize these advanced materials or manufacturing processes would typically pay licensing fees and ongoing royalties.

While specific figures for licensing revenue are often embedded within broader financial reporting, JSR's commitment to innovation, evidenced by its consistent R&D spending, suggests a strong foundation for this income source. In 2023, JSR Corporation reported total revenue of approximately ¥392.5 billion, with a significant portion attributed to its core materials businesses, which are underpinned by proprietary technologies.

- Leveraging Intellectual Property: JSR's patents and proprietary technologies are key assets that can be licensed to third parties.

- Technology Monetization: This stream allows JSR to earn revenue from its R&D successes without directly manufacturing or selling the end product in all cases.

- Diversification of Revenue: Licensing and royalties provide an additional, often high-margin, income source that complements its product sales.

- Strategic Partnerships: This revenue stream can foster strategic alliances with other companies, expanding the reach of JSR's innovations.

Contract Research and Development Services

JSR leverages its advanced research and development capabilities by offering specialized contract research and development services to external clients. This revenue stream taps into JSR's scientific expertise, allowing them to undertake co-development projects and bespoke research initiatives. For instance, in 2023, JSR continued to engage in such partnerships, contributing to their diverse revenue portfolio by providing critical R&D support in areas like advanced materials and life sciences.

These services enable JSR to monetize its internal resources and knowledge base, generating additional income beyond its core product sales. This strategic approach allows JSR to remain at the forefront of innovation while also creating value for its partners. The company's commitment to cutting-edge research means these contract services often involve complex, high-value projects.

- Contract Research: Undertaking specific research projects for clients.

- Co-Development: Collaborating with partners on joint R&D initiatives.

- Specialized Expertise: Offering unique scientific and technical capabilities.

- Revenue Diversification: Generating income from services, not just products.

JSR Corporation's revenue streams are diverse, with a strong emphasis on advanced materials for the digital sector, particularly semiconductors and displays. The company also derives significant income from its life sciences segment, focusing on materials for medical devices and biopharmaceuticals. Foundational revenue comes from synthetic rubbers and emulsions, essential for industries like automotive.

In 2023, JSR reported total revenue of approximately ¥392.5 billion. The Digital Solutions segment, driven by photoresists, was a major contributor, with sales around ¥350 billion in the same year, highlighting the critical demand in the semiconductor market. This demonstrates JSR's pivotal role in supplying essential components for modern electronics.

Beyond product sales, JSR monetizes its intellectual property through licensing and royalties, capitalizing on its R&D investments. Furthermore, the company offers specialized contract research and development services, leveraging its scientific expertise for co-development projects and bespoke research, adding another layer to its income generation.

| Revenue Stream | Key Products/Services | 2023 Highlight |

|---|---|---|

| Digital Solutions | Photoresists, Process Chemicals | ~¥350 billion in sales |

| Life Sciences | Medical Device Materials, Biopharma Materials | Strong demand from healthcare sector |

| Synthetic Rubbers & Emulsions | Automotive, Tire Production Materials | Consistent contributor to financial stability |

| Licensing & Royalties | Intellectual Property Monetization | Complements product sales with high-margin income |

| Contract R&D | Specialized Research Services, Co-Development | Leverages scientific expertise for partnerships |

Business Model Canvas Data Sources

The JSR Business Model Canvas is meticulously constructed using a blend of proprietary customer data, competitive landscape analysis, and internal operational metrics. This comprehensive data foundation ensures each component of the canvas accurately reflects our strategic positioning and market realities.