JSR PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

JSR Bundle

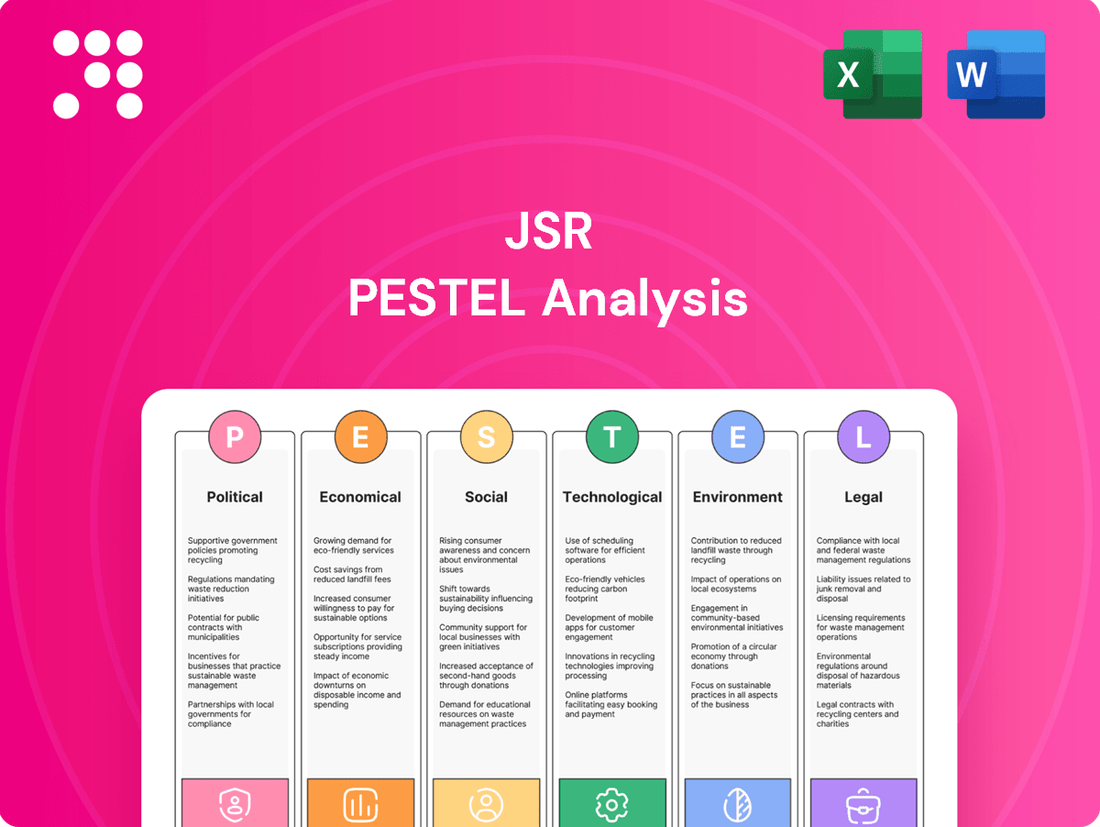

Unlock the strategic forces shaping JSR's future with our comprehensive PESTLE analysis. Understand how political, economic, social, technological, legal, and environmental factors are influencing its operations and market position. This expertly crafted report provides actionable insights for investors, strategists, and decision-makers. Download the full version now to gain a critical competitive advantage.

Political factors

Global political instability, including ongoing conflicts and escalating trade tensions, significantly impacts JSR's supply chains. These disruptions are particularly acute for critical raw materials vital to semiconductor and advanced materials manufacturing, areas where JSR holds significant market share.

For instance, the ongoing geopolitical shifts in East Asia, a key region for semiconductor component sourcing, present direct risks to material availability and pricing for JSR. Companies like JSR are compelled to adapt their strategies, prioritizing risk mitigation and long-term supply chain resilience to effectively navigate these volatile international conditions.

The increasing trend of trade protectionism and the implementation of tariffs by major economies, such as the United States and China, pose significant challenges for JSR's global operations. These policies can disrupt established supply chains, making it more expensive for JSR to import raw materials and export its advanced materials. For instance, in 2023, the U.S. continued to maintain tariffs on goods from China, impacting various sectors, and similar protectionist measures were observed in other regions.

This evolving trade landscape compels JSR to critically assess its international sourcing and distribution strategies. A proactive approach might involve diversifying suppliers, exploring regional manufacturing hubs, or adopting nearshoring practices to reduce reliance on long-distance trade routes vulnerable to policy changes. This strategic shift aims to build greater resilience against geopolitical trade tensions and ensure business continuity.

Governments, including Japan's, are actively backing key industries like semiconductor materials. For instance, the Japan Investment Corporation's acquisition of JSR in 2023, a deal valued at approximately ¥910 billion (around $6.5 billion USD at the time), highlights this commitment. This political endorsement can offer JSR a significant edge, driving innovation in crucial technological areas.

International Regulations and Export Controls

JSR's global operations are significantly influenced by evolving international regulations and export control laws, particularly concerning advanced materials and technologies. These regulations, often targeting dual-use items, can directly affect JSR's market access and sales of its high-performance products worldwide. Navigating these complex and frequently changing compliance landscapes is essential for maintaining operational continuity and avoiding substantial penalties.

For instance, the United States Department of Commerce's Bureau of Industry and Security (BIS) regularly updates its Entity List and Export Administration Regulations (EAR), impacting companies like JSR that deal in advanced semiconductor materials and display technologies. As of early 2024, continued scrutiny on supply chains for critical technologies means JSR must remain vigilant about any new restrictions or licensing requirements that could affect its international sales channels, especially to regions with heightened geopolitical tensions.

- Export Control Landscape: International bodies and individual nations are increasingly implementing stricter export controls on advanced technologies, including those relevant to semiconductor manufacturing and advanced displays.

- Compliance Burden: JSR faces a continuous need to invest in robust compliance programs to understand and adhere to diverse and often conflicting international trade regulations, which can add significant operational costs.

- Market Access Impact: Non-compliance or changes in export control policies can lead to restricted market access, potentially impacting JSR's revenue streams from key international markets and its ability to serve global customers effectively.

Political Stability in Key Markets

Political stability in JSR's key operating and sourcing markets is a critical consideration. Unstable political landscapes can introduce significant operational risks, from supply chain interruptions to heightened security concerns for personnel and assets. For instance, geopolitical tensions in East Asia, a region crucial for semiconductor materials, could impact JSR's access to raw materials and its manufacturing capabilities. In 2023, global political instability, as measured by various indices, remained a significant concern, with ongoing conflicts and shifts in trade policies creating a volatile environment for multinational corporations.

Policy changes stemming from political shifts can directly affect JSR's business. This includes alterations in trade agreements, environmental regulations, and taxation policies, all of which can influence JSR's cost structure and market access. For example, a sudden imposition of tariffs on imported chemicals in a major market could increase JSR's production costs, impacting its competitiveness. The World Bank's Ease of Doing Business report, while discontinued in its previous format, highlighted in its final 2020 iteration that regulatory environments are heavily influenced by political stability, with countries experiencing greater stability generally offering more predictable business conditions.

- Impact on Supply Chains: Political unrest in sourcing regions can lead to material shortages and price volatility.

- Regulatory Uncertainty: Frequent changes in government or policy can disrupt long-term business planning and investment.

- Operational Disruptions: Instability may necessitate increased security measures or even temporary shutdowns of facilities.

- Market Access: Shifting political alliances and trade policies can affect JSR's ability to export products or import necessary components.

Government support for strategic industries, such as semiconductors, is a significant political factor for JSR. Japan's 2023 acquisition of JSR by the Japan Investment Corporation, valued at approximately $6.5 billion USD, underscores this commitment and can foster innovation. This political endorsement provides JSR with a strong foundation for growth in critical technological sectors.

What is included in the product

The JSR PESTLE analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal factors impacting the company's operating landscape.

This comprehensive overview provides actionable insights for strategic decision-making by highlighting key external influences and their potential implications.

The JSR PESTLE Analysis provides a structured framework to proactively identify and address external threats and opportunities, thereby alleviating the pain of unforeseen market disruptions and enabling more confident strategic decision-making.

Economic factors

JSR Corporation's fortunes are intrinsically linked to the health of the global economy and the appetite for advanced technology. When economies are expanding, sectors like semiconductors, displays, and medical devices tend to see increased investment and consumer spending, directly boosting demand for JSR's specialized materials.

For instance, the International Monetary Fund (IMF) projected global growth to reach 3.2% in 2024, a slight uptick from 2023. This growth is crucial for JSR as it underpins the expansion of its key customer industries, such as the semiconductor market, which was forecast to grow by 13.0% in 2024 according to Semiconductor Industry Association (SIA) data.

Furthermore, the demand for high-definition displays in consumer electronics and automotive applications, areas where JSR supplies critical materials, also benefits from a strong economic environment. As disposable incomes rise, consumers are more likely to purchase new devices, driving production and material needs for JSR.

The semiconductor market, a key sector for JSR's digital solutions, is known for its significant ups and downs. While demand for digital infrastructure is expected to drive a rebound, any slowdowns in chip production or sales can directly affect JSR's earnings. For instance, the global semiconductor market experienced a notable contraction in 2023, with some analysts projecting a modest recovery in 2024, though the pace remains uncertain.

JSR's life sciences business navigates the dynamic biotech landscape, with demand for bioprocess materials and diagnostic reagents being key drivers. For instance, the global biopharmaceutical market was valued at approximately $290 billion in 2023 and is projected to grow significantly, indicating robust underlying demand for JSR's offerings.

However, this segment has recently seen revenue and profit declines. This downturn is partly attributed to the over-investment in COVID-19 related products during the pandemic, leading to an industry-wide slump as demand normalized. The slowdown in biotech funding and M&A activity in late 2023 and early 2024 also impacted growth prospects.

Raw Material Price Volatility

Fluctuations in the prices of key raw materials, such as silicon, specialty chemicals, and polymers, directly impact JSR's production costs for its advanced materials, including semiconductors and display components. For instance, the price of polysilicon, a crucial input for semiconductor manufacturing, saw significant swings in 2023 and early 2024, influenced by supply-demand dynamics and energy costs in production regions. This volatility can compress profit margins if not effectively managed through procurement strategies and pricing adjustments.

Geopolitical tensions, trade disputes, and increasing resource scarcity are significant drivers of this raw material price volatility. Events impacting major producing nations or shipping routes can create supply chain disruptions, leading to price spikes. For example, disruptions in rare earth mineral supply chains, essential for certain electronic components, have been a recurring concern, highlighting the need for robust risk mitigation.

JSR's ability to navigate these price swings depends on efficient supply chain management and the implementation of hedging strategies. By diversifying suppliers and exploring long-term contracts, JSR can secure more stable pricing. Additionally, financial instruments like futures contracts can be employed to hedge against adverse price movements, ensuring greater predictability in input costs and protecting profitability.

- Silicon Price Trends: Polysilicon prices experienced a notable increase in late 2023, with spot prices for solar-grade polysilicon reaching over $15 per kilogram, driven by strong demand and production constraints in China.

- Specialty Chemical Costs: The cost of certain advanced polymers and photoresists, critical for JSR's semiconductor materials, has been influenced by upstream petrochemical market fluctuations and energy prices.

- Supply Chain Resilience: Companies like JSR are investing in supply chain visibility and dual-sourcing strategies to mitigate risks associated with geopolitical instability in regions like Southeast Asia, a key manufacturing hub.

- Hedging Effectiveness: The effectiveness of hedging strategies in the raw material sector for companies like JSR is often measured by the reduction in earnings volatility attributed to commodity price swings.

Foreign Exchange Rate Impact

JSR, as a global player, faces significant exposure to foreign exchange rate volatility. Fluctuations in currency values directly impact the cost of raw materials sourced internationally and the pricing of its products in different markets. For instance, a stronger Japanese Yen (JPY) against the US Dollar (USD) could make JSR's exports more expensive for American customers, potentially reducing sales volume.

The translation of earnings from overseas subsidiaries into JSR's reporting currency, the JPY, is also heavily influenced by exchange rates. A weaker foreign currency would result in lower reported profits when converted back to Yen, even if the underlying business performance remained stable. This can create a disconnect between operational success and reported financial results.

In 2024, the global economic landscape saw continued currency shifts. For example, the Euro (EUR) experienced fluctuations against the JPY, impacting European sales and operations. Similarly, the performance of emerging market currencies against the JPY can significantly alter JSR's profitability in those regions.

- Impact on Imports: A stronger JPY can lower the cost of imported materials, potentially improving JSR's cost of goods sold.

- Impact on Exports: Conversely, a weaker JPY can make JSR's products more competitive in international markets, boosting export demand.

- Translation of Earnings: Exchange rate movements directly affect the value of profits earned by JSR's foreign subsidiaries when translated into JPY.

- Hedging Strategies: JSR likely employs currency hedging strategies to mitigate the risks associated with foreign exchange rate fluctuations, aiming to stabilize financial performance.

Economic growth directly fuels demand for JSR's advanced materials across its core segments. The semiconductor industry, a major consumer, was projected to see robust growth, with global sales expected to increase by 13.0% in 2024, according to the Semiconductor Industry Association (SIA). This expansion translates into higher demand for JSR's photoresists and other critical materials used in chip manufacturing.

The life sciences sector also benefits from economic health, as increased healthcare spending and investment in biotechnology research drive demand for JSR's bioprocess materials and diagnostic reagents. The global biopharmaceutical market, valued at approximately $290 billion in 2023, continues its upward trajectory, signaling sustained opportunities for JSR.

However, economic downturns can dampen consumer spending on electronics and automotive products, impacting JSR's display materials business. Furthermore, fluctuations in raw material prices, such as polysilicon, which saw spot prices for solar-grade polysilicon exceed $15 per kilogram in late 2023 due to supply constraints, can affect JSR's production costs and profit margins.

Currency exchange rates also play a significant role, with the Yen's strength against currencies like the US Dollar impacting export competitiveness and the translation of foreign earnings. For instance, shifts in the Euro-Japanese Yen exchange rate in 2024 directly influenced JSR's European sales performance.

| Economic Factor | Impact on JSR | 2024/2025 Data/Trend |

|---|---|---|

| Global Economic Growth | Drives demand for semiconductors, displays, and life sciences products. | IMF projected 3.2% global growth in 2024. |

| Semiconductor Market Growth | Increases demand for JSR's photoresists and related materials. | SIA forecast for 13.0% growth in global semiconductor sales for 2024. |

| Raw Material Price Volatility | Affects production costs and profit margins. | Polysilicon prices exceeded $15/kg in late 2023; upstream petrochemical costs impact specialty chemicals. |

| Currency Exchange Rates | Impacts export pricing, import costs, and translated profits. | Fluctuations in USD/JPY and EUR/JPY rates affect international sales and earnings. |

Preview Before You Purchase

JSR PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive JSR PESTLE Analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the industry. You'll gain valuable insights to inform your strategic decisions.

Sociological factors

Consumers are increasingly prioritizing sustainability, with a significant portion willing to pay more for eco-friendly products. For instance, a 2024 survey indicated that over 60% of consumers consider environmental impact when making purchasing decisions, directly impacting sectors reliant on JSR's advanced materials like automotive and electronics.

This heightened awareness translates into a demand for materials with a lower carbon footprint and improved recyclability, pushing companies like JSR to innovate. The automotive industry, a key market for JSR, is seeing a surge in demand for lightweight, sustainable components, driven by both regulatory pressures and consumer preference for greener vehicles.

Demographic shifts are profoundly impacting global markets, with aging populations becoming a significant trend, especially in developed nations. This demographic evolution directly translates into a heightened demand for medical devices and advanced healthcare solutions. For companies like JSR, whose expertise lies in life sciences materials, this presents a substantial growth avenue, particularly within their medical and diagnostic segments.

The increasing number of older individuals worldwide is driving up the need for sophisticated medical technologies. For instance, by 2050, the proportion of people aged 65 and over is projected to reach 16% globally, a significant jump from 9.3% in 2020. This demographic reality fuels demand for JSR’s specialized materials used in everything from diagnostic imaging equipment to implantable devices, positioning the company to capitalize on this expanding market.

JSR faces intense competition for skilled talent in the high-tech sector, particularly in materials science and semiconductor manufacturing. The demand for specialized engineers and researchers remains exceptionally high, making it a constant challenge to attract and keep the best minds. For instance, in 2024, the global semiconductor talent shortage was estimated to affect over 200,000 positions, highlighting the critical nature of this issue.

To counter this, JSR must prioritize investment in its human capital. This includes offering competitive compensation and benefits, but also crucially, fostering an environment that encourages innovation and professional growth. A 2025 survey of tech professionals indicated that opportunities for learning and development are almost as important as salary for retention.

Work-Life Balance and Employee Well-being

Societal expectations are increasingly prioritizing work-life balance and overall employee well-being, directly influencing how companies like JSR structure their operations and employee benefits. This shift means that businesses must actively foster supportive environments to attract and retain talent.

JSR's commitment to health management, including programs focused on physical and mental wellness, plays a crucial role in boosting employee satisfaction and, consequently, productivity. A healthy workforce is a more engaged and efficient workforce.

For instance, in 2024, companies that invested in comprehensive wellness programs saw an average 15% reduction in employee absenteeism. Furthermore, a 2025 survey indicated that 70% of employees consider work-life balance a key factor when choosing an employer.

Here are some key aspects of this trend:

- Employee Expectations: A growing number of employees, particularly younger generations, expect employers to support their well-being and offer flexible work arrangements.

- Productivity Link: Studies consistently show a correlation between employee well-being and higher productivity, with companies prioritizing wellness often reporting better financial performance.

- Talent Attraction: Robust health and well-being initiatives are becoming a competitive advantage in the war for talent, helping JSR attract and retain skilled professionals.

- Corporate Culture: Fostering a culture that values work-life balance can lead to reduced stress, lower turnover rates, and a more positive and innovative work environment.

Ethical Considerations in AI and Technology Development

As artificial intelligence and advanced technologies become more integrated into society, ethical considerations surrounding their creation and use are increasingly critical. JSR, as a supplier of materials essential for AI hardware, must actively engage with these evolving societal dialogues. This engagement is vital for safeguarding its corporate reputation and ensuring that its contributions to technological advancement are rooted in responsible innovation.

Public trust in AI is a significant factor, with surveys in 2024 indicating that a substantial portion of the population expresses concerns about AI's potential misuse, particularly regarding data privacy and algorithmic bias. For JSR, this translates to a need for transparency in its supply chain and a commitment to supporting the ethical development of downstream AI applications. Failing to address these concerns could impact market acceptance of products utilizing JSR's materials.

Key ethical considerations impacting JSR and the broader technology sector include:

- Data Privacy: Ensuring that the materials used in AI systems do not compromise user data security and privacy.

- Algorithmic Bias: Addressing potential biases in AI algorithms that could be exacerbated by the underlying hardware, impacting fairness and equity.

- Job Displacement: Considering the societal impact of AI-driven automation on employment and JSR's role in enabling these technologies.

- Accountability and Transparency: Establishing clear lines of responsibility for AI system outcomes and promoting transparency in their design and operation.

Societal expectations are shifting towards greater emphasis on employee well-being and work-life balance, directly influencing JSR's operational strategies and talent management. Companies prioritizing these aspects, such as offering robust wellness programs, are seeing tangible benefits in employee satisfaction and retention. In 2025, a survey revealed that 70% of employees consider work-life balance a critical factor when selecting an employer, underscoring its importance for talent attraction and retention in the competitive tech landscape.

Technological factors

Breakthroughs in semiconductor manufacturing, like Extreme Ultraviolet (EUV) lithography, are driving demand for highly specialized materials. JSR's core business relies on these advanced photoresists, which are critical for creating smaller, more powerful chips. The company's ability to innovate in this area directly impacts the pace of technological advancement in the electronics industry.

JSR's business is significantly shaped by advancements in new materials. The creation of innovative polymers, composites, and ceramics offering improved strength, reduced weight, and greater adaptability directly influences JSR's product development and market reach. For instance, the automotive sector's demand for lightweight materials, driven by fuel efficiency goals, presents a substantial opportunity for JSR's advanced polymer solutions, a trend expected to continue through 2025 and beyond.

JSR's strategic advantage is significantly boosted by the integration of AI and digitalization in materials science. This technological shift accelerates R&D, allowing for faster discovery and design of novel materials, which is crucial in dynamic markets like semiconductors and displays. For instance, AI platforms are increasingly used to predict material properties and optimize synthesis routes, potentially cutting development cycles by years.

AI's role extends to optimizing JSR's manufacturing processes and supply chain. By leveraging AI for demand forecasting and inventory management, the company can improve efficiency and reduce waste, ensuring timely delivery of critical components. In 2024, many leading chemical companies reported double-digit percentage improvements in production efficiency and a reduction in lead times through AI-driven supply chain optimization.

Innovation in Life Sciences and Medical Technologies

Technological leaps in life sciences and medical tech are reshaping JSR's market. Advancements in biopharmaceutical drug development, like novel therapeutic modalities, and improvements in bioprocess materials are key drivers for JSR's strategic direction. The company's focus on next-generation protein A resins and support for microbiome medicine highlights its adaptation to these evolving fields.

JSR is actively investing in these areas. For instance, their biopharmaceutical segment saw significant growth, contributing to their overall revenue stream. The demand for advanced diagnostic reagents, crucial for personalized medicine and early disease detection, is also a major technological factor influencing JSR's product pipeline and research and development efforts.

- Biopharmaceutical Innovation: Development of new biologics and gene therapies creates demand for specialized materials and purification technologies.

- Bioprocess Efficiency: Innovations in cell culture media and single-use technologies aim to streamline drug manufacturing, impacting JSR's material offerings.

- Diagnostic Advancements: The rise of liquid biopsies and advanced molecular diagnostics fuels the need for high-performance reagents and substrates.

- Microbiome Research: Growing understanding of the microbiome's role in health and disease opens new avenues for JSR in therapeutic and diagnostic applications.

Emergence of 5G Technology and Smart Cities

The widespread rollout of 5G technology is significantly boosting the need for sophisticated materials. This expansion, coupled with the growth of smart cities, creates a direct demand for advanced components in telecommunications infrastructure, sophisticated sensors, and a wide array of electronic devices. JSR's expertise in materials science, particularly for displays and other digital solutions, positions them to capitalize on these burgeoning markets.

The global 5G infrastructure market was valued at approximately $40 billion in 2023 and is projected to reach over $300 billion by 2030, indicating substantial growth. Smart city initiatives worldwide are also accelerating, with investments expected to reach $2.5 trillion globally by 2026. These trends highlight the critical role of advanced materials in enabling these technological advancements.

- 5G Infrastructure Growth: The increasing deployment of 5G networks necessitates advanced materials for base stations, antennas, and fiber optic cables.

- Smart City Components: Smart city development requires materials for IoT sensors, advanced displays for public information systems, and components for connected vehicles.

- JSR's Material Relevance: JSR's portfolio, including materials for semiconductors and advanced displays, is directly applicable to the components powering these 5G and smart city ecosystems.

Technological factors are pivotal for JSR, particularly in semiconductor manufacturing where advancements like EUV lithography drive demand for specialized photoresists. The company's innovation in new materials, such as advanced polymers for the automotive sector, directly impacts its market reach and product development. Furthermore, the integration of AI in R&D and manufacturing processes accelerates material discovery and optimizes operations, a trend seen across the chemical industry in 2024 with reported efficiency gains.

The life sciences sector presents significant opportunities, with breakthroughs in biopharmaceuticals and diagnostics requiring JSR's advanced materials and reagents. The expansion of 5G technology and smart city initiatives also fuels demand for sophisticated components, aligning with JSR's expertise in semiconductors and displays. The global 5G infrastructure market's projected growth to over $300 billion by 2030 underscores the critical role of materials science in enabling these advancements.

Legal factors

JSR, operating within the chemical manufacturing sector, faces a complex web of legal mandates. Compliance with Japan's Chemical Substances Control Law (CSCL) is paramount, requiring meticulous adherence to notification timelines for novel chemical compounds and strict observance of prohibitions on substances like per- and polyfluoroalkyl substances (PFAS).

The global regulatory landscape further intensifies these obligations. For instance, in 2024, the European Union's REACH regulation continued to scrutinize and potentially restrict a wider array of chemicals, impacting JSR's international market access and product development strategies.

Failure to navigate these legal frameworks can result in significant penalties, including fines and operational disruptions. JSR's proactive engagement with evolving chemical control legislation, such as anticipated updates to the Toxic Substances Control Act (TSCA) in the United States for 2025, is crucial for maintaining its license to operate and competitive edge.

JSR faces increasingly stringent environmental regulations, particularly concerning carbon emissions and water usage in its manufacturing processes. For instance, the European Union's Fit for 55 package aims for a 55% net reduction in greenhouse gas emissions by 2030 compared to 1990 levels, directly influencing JSR's energy consumption and production methods.

Compliance with these evolving environmental standards, including those related to chemical management and waste disposal, is critical for JSR's continued operations and market access. Proactive investments in sustainable technologies and processes are therefore essential to mitigate risks and maintain a competitive edge in a global market prioritizing environmental responsibility.

Protecting JSR's innovations, particularly in cutting-edge areas like semiconductor materials and life sciences, is paramount for sustaining its market leadership. Global patent laws directly influence JSR's capacity to secure its proprietary technologies and prevent infringement.

As of late 2024, JSR continues to invest heavily in research and development, with a significant portion of its budget allocated to patent applications and enforcement. The company's robust patent portfolio, covering advanced lithography materials and biopharmaceutical components, is a key asset in its competitive strategy.

Product Liability and Safety Standards

JSR Corporation's advanced materials, particularly those integral to medical devices and semiconductor manufacturing, face stringent product liability and safety regulations globally. For instance, in the semiconductor sector, materials must meet exacting purity and performance standards to prevent costly chip defects, a critical concern for clients in 2024. Failure to comply can lead to significant recalls and legal challenges, impacting JSR's reputation and financial performance.

Adherence to these evolving standards is not just a legal necessity but a cornerstone of maintaining customer confidence and market leadership. In 2023, the global medical device market, a key area for JSR's specialty polymers, was valued at over $500 billion, with safety and efficacy being paramount. JSR's commitment to rigorous quality control and compliance with bodies like the FDA and EMA is therefore essential for continued success.

- Product Liability: JSR's materials used in sensitive applications like implantable medical devices are subject to strict liability laws, meaning defects can lead to severe penalties even without negligence.

- Safety Standards: Compliance with ISO 13485 for medical devices and SEMI standards for semiconductors is crucial for market access and client trust.

- Regulatory Landscape: Navigating diverse international regulations, such as REACH in Europe and TSCA in the US, requires continuous investment in compliance and testing.

- Market Impact: In 2024, reports highlighted that companies with strong product safety records often experience higher customer retention and fewer product-related lawsuits, directly benefiting JSR's long-term strategy.

Data Privacy and Digital Regulations

JSR faces a complex web of data privacy and digital regulations as its operations become increasingly digital and AI-driven. Compliance with evolving laws like the GDPR and CCPA is paramount to safeguard sensitive customer and operational data. For instance, the global data protection landscape saw significant activity in 2024, with new enforcement actions and guidance issued by regulatory bodies worldwide, impacting how companies like JSR handle personal information.

The implications for JSR are substantial, requiring robust data governance frameworks and continuous adaptation to new digital policies. This includes ensuring transparency in AI data usage and maintaining secure data storage practices across its international subsidiaries. By 2025, the focus on algorithmic transparency and data minimization is expected to intensify, presenting both challenges and opportunities for innovation in data management.

- Global Data Protection Landscape: Ongoing updates to regulations like the GDPR and similar frameworks in Asia and the Americas necessitate continuous monitoring and adaptation by JSR.

- AI and Data Ethics: JSR must navigate emerging ethical guidelines and regulations surrounding the use of AI, particularly concerning data bias and algorithmic decision-making.

- Cross-Border Data Flows: Restrictions and requirements for transferring data internationally, a common practice for global corporations like JSR, demand careful legal and technical consideration.

- Cybersecurity Mandates: Increasingly stringent cybersecurity regulations, often tied to data protection, require JSR to invest in advanced security measures to prevent breaches.

JSR's operations are heavily influenced by intellectual property laws, particularly in its advanced materials and life sciences divisions. The company's ability to secure and enforce patents globally is vital for protecting its innovations, as demonstrated by its significant R&D investments in patent applications and enforcement throughout 2024.

Navigating international patent landscapes, including varying protection periods and infringement enforcement mechanisms, requires constant vigilance. JSR's robust patent portfolio, covering critical technologies in semiconductor lithography and biopharmaceuticals, acts as a significant competitive differentiator, underscoring the legal importance of IP protection.

The legal framework surrounding data privacy and digital operations is increasingly critical for JSR. Compliance with regulations like GDPR and CCPA is essential, especially as the company expands its AI-driven initiatives. In 2024, global regulatory bodies issued new guidance and enforcement actions related to data protection, impacting how companies manage sensitive information.

JSR must also contend with evolving cybersecurity mandates, which are often linked to data protection requirements. These regulations necessitate ongoing investment in advanced security measures to prevent data breaches and maintain client trust. By 2025, the emphasis on algorithmic transparency and data minimization is expected to grow, presenting both challenges and opportunities for JSR's data management strategies.

| Legal Area | Key Regulations/Considerations | Impact on JSR | 2024/2025 Focus |

|---|---|---|---|

| Intellectual Property | Global Patent Laws, IP Enforcement | Protection of R&D investments, market exclusivity | Strengthening patent portfolio, monitoring infringement |

| Data Privacy | GDPR, CCPA, Global Data Protection Laws | Safeguarding customer and operational data, compliance costs | Enhancing data governance, adapting to new enforcement actions |

| Cybersecurity | Data Breach Notification Laws, Security Standards | Preventing data breaches, maintaining client trust | Investing in advanced security measures, compliance with new mandates |

Environmental factors

The semiconductor industry, crucial for JSR's operations, is a major source of carbon emissions. In 2023, the global semiconductor manufacturing sector's energy consumption was estimated to be around 100 terawatt-hours (TWh), contributing significantly to greenhouse gas output.

JSR has publicly committed to achieving net-zero emissions by 2050, a target that necessitates substantial investment in and development of cleaner manufacturing processes and environmentally friendly materials.

This commitment means JSR must innovate to reduce its carbon footprint, potentially through adopting renewable energy sources for its facilities and developing materials that require less energy to produce and use.

Semiconductor manufacturing, a core business for JSR, demands significant water resources. In 2023, the industry globally consumed an estimated 10 billion cubic meters of water, with fabrication plants being the largest users. JSR's commitment to sustainable operations necessitates robust water resource management, directly impacting its operational continuity and environmental footprint.

Addressing water scarcity is paramount. JSR is actively investing in advanced water recycling and purification technologies, aiming to reduce its fresh water intake by 15% by 2027. This focus on minimizing water consumption and wastewater generation is crucial for maintaining production efficiency and complying with increasingly stringent environmental regulations worldwide.

The electronics industry, a key sector for JSR, faces significant environmental challenges, particularly concerning waste from Printed Circuit Boards (PCBs) and Integrated Circuits (ICs). Efforts to reduce this waste and embrace circular economy models are becoming increasingly critical. For instance, the global e-waste generation reached an estimated 62 million tonnes in 2024, a figure projected to rise.

JSR's commitment to developing sustainable materials and refining manufacturing processes directly addresses these environmental pressures. By focusing on materials that are easier to recycle or have a lower environmental footprint, JSR can help mitigate the impact of electronic waste. This aligns with global trends where companies are investing in eco-friendly design and end-of-life management for their products.

Chemical Management and Hazardous Substances

The chemical industry, including companies like JSR, faces increasing pressure regarding the management of hazardous substances. Regulations around chemicals, especially per- and polyfluoroalkyl substances (PFAS), are becoming more stringent globally. For instance, the European Chemicals Agency (ECHA) has proposed a broad restriction on PFAS, impacting numerous industrial applications.

JSR's commitment to sustainability necessitates ongoing research and development into greener chemical alternatives and processes. This is crucial for compliance with evolving environmental laws and to mitigate risks associated with substances facing potential bans. The company's investment in R&D for eco-friendly materials is a direct response to these environmental factors.

Key considerations for JSR include:

- Regulatory Compliance: Staying ahead of evolving chemical regulations, particularly concerning PFAS, across key operating regions.

- Innovation in Alternatives: Investing in the development and adoption of safer, environmentally friendly chemical substitutes.

- Supply Chain Scrutiny: Ensuring that suppliers also adhere to strict chemical management standards.

- Product Lifecycle Management: Assessing and minimizing the environmental impact of chemicals throughout the entire product lifecycle.

Energy Consumption and Renewable Energy Adoption

The semiconductor industry, including companies like JSR, faces significant energy demands, particularly in sophisticated manufacturing processes like those found in semiconductor fabrication plants. This high consumption underscores the critical importance of developing and adopting energy-efficient technologies. For instance, in 2023, the global semiconductor industry's energy consumption was estimated to be substantial, reflecting the power-intensive nature of chip manufacturing.

JSR's commitment to reducing its environmental footprint is evident in its proactive approach to renewable energy adoption. By investing in cleaner energy sources, JSR aims to mitigate the environmental impact associated with its operations. This aligns with broader industry trends, as many leading technology firms are setting ambitious targets for renewable energy sourcing. For example, as of early 2024, a significant portion of the tech sector is actively pursuing or has already achieved substantial renewable energy usage goals.

- Energy Intensity: Semiconductor manufacturing is inherently energy-intensive, requiring substantial power for cleanrooms, equipment, and process control.

- Renewable Energy Goals: Many technology companies, including those in the semiconductor supply chain, are setting targets to power their operations with 100% renewable energy.

- Efficiency Innovations: JSR's focus on energy efficiency drives innovation in materials and processes that can lead to lower energy consumption across the value chain.

Environmental factors significantly shape JSR's operational landscape, demanding a proactive stance on sustainability. The company is addressing the substantial carbon footprint of semiconductor manufacturing, aiming for net-zero emissions by 2050, a commitment requiring innovation in cleaner processes and materials.

Water scarcity is another critical concern, with semiconductor fabrication plants being major consumers. JSR is investing in water recycling technologies, targeting a 15% reduction in fresh water intake by 2027 to ensure operational continuity and regulatory compliance.

The growing issue of electronic waste, which reached an estimated 62 million tonnes globally in 2024, also impacts JSR. The company's focus on developing recyclable materials and eco-friendly designs aims to mitigate this environmental challenge.

Furthermore, stringent regulations on hazardous chemicals, such as the proposed PFAS restrictions by ECHA, necessitate JSR's investment in greener chemical alternatives and robust management throughout the product lifecycle.

JSR's commitment to renewable energy adoption is a key strategy to combat the high energy intensity of semiconductor manufacturing, aligning with industry-wide trends towards cleaner energy sourcing.

| Environmental Factor | Impact on JSR | JSR's Response/Commitment | Relevant Data (2023-2025) |

|---|---|---|---|

| Carbon Emissions | Semiconductor manufacturing is energy-intensive, contributing to greenhouse gases. | Net-zero emissions target by 2050; investment in cleaner processes and materials. | Global semiconductor manufacturing energy consumption: ~100 TWh (2023). |

| Water Consumption | Fabrication plants require significant water resources. | Investment in water recycling and purification; target 15% fresh water intake reduction by 2027. | Global semiconductor industry water consumption: ~10 billion cubic meters (2023). |

| Electronic Waste (E-waste) | Growing global e-waste poses disposal and material recovery challenges. | Focus on developing sustainable and recyclable materials; eco-friendly design. | Global e-waste generation: ~62 million tonnes (2024). |

| Chemical Management | Increasingly strict regulations on hazardous substances (e.g., PFAS). | R&D into greener chemical alternatives; compliance with evolving environmental laws. | ECHA proposed broad PFAS restriction. |

| Energy Intensity | High power demand for sophisticated manufacturing processes. | Proactive approach to renewable energy adoption; efficiency innovations. | Significant portion of tech sector pursuing 100% renewable energy goals (early 2024). |

PESTLE Analysis Data Sources

Our PESTLE Analysis is grounded in a comprehensive review of official government publications, reputable academic research, and leading industry analysis. This ensures that each factor, from political stability to technological advancements, is informed by credible and current data.