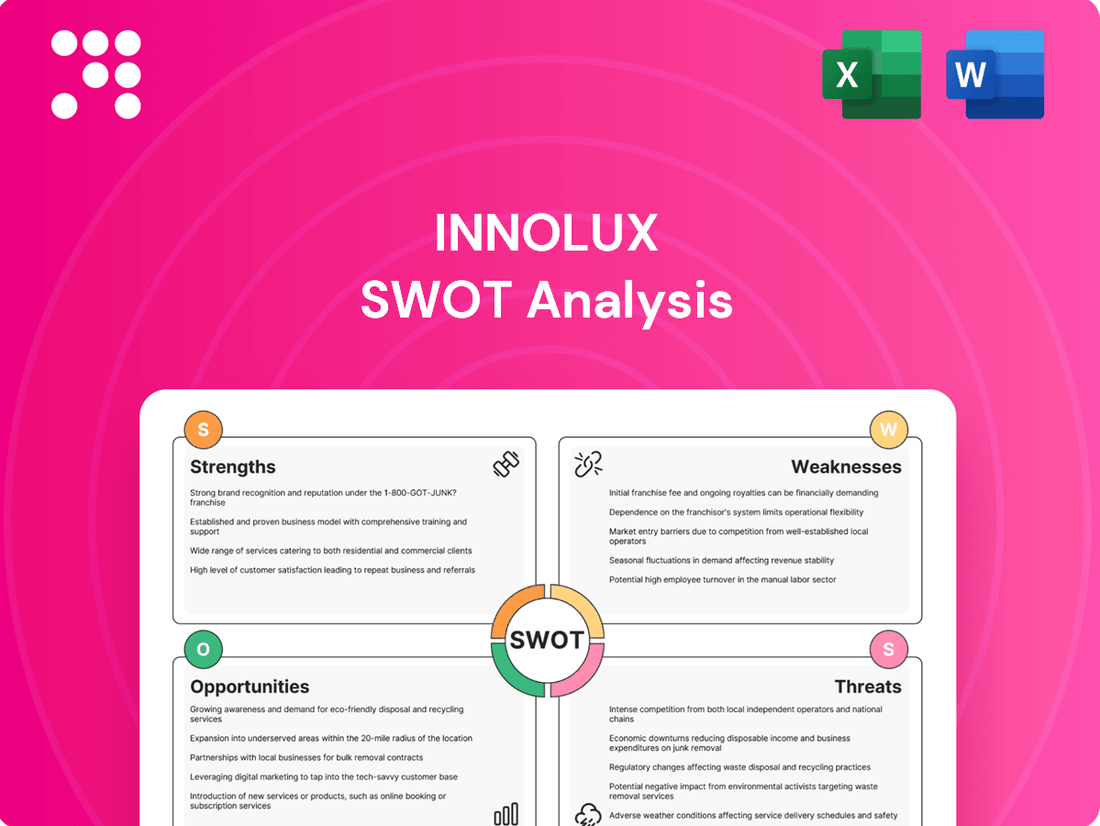

Innolux SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Innolux Bundle

Innolux, a major player in the display industry, boasts significant strengths in its manufacturing scale and technological advancements. However, understanding its vulnerabilities to market fluctuations and competitive pressures is crucial for strategic planning.

Want the full story behind Innolux's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Innolux boasts a diverse product portfolio, encompassing a wide array of LCD and OLED panels. These displays are crucial for everything from the smartphones in our pockets to the large televisions in our living rooms, and even sophisticated automotive dashboards. This breadth means Innolux isn't overly dependent on just one type of product or market, offering a degree of resilience. For instance, in 2023, Innolux reported that its display solutions served a multitude of sectors, underscoring its wide market penetration.

Innolux is strategically diversifying beyond its traditional display business, notably by investing heavily in advanced semiconductor packaging. This move is crucial for mitigating the inherent volatility of the display market.

The company has earmarked a substantial portion of its capital expenditure for 2024-2025 towards these new ventures, signaling a serious commitment to this strategic pivot. This expansion into high-value semiconductor segments is designed to create more stable and diverse revenue streams.

Innolux holds a commanding position in the automotive LCD display market, rivaling major competitors with its substantial market share. This strength is crucial as the automotive industry increasingly demands advanced display technologies for dashboards, infotainment systems, and heads-up displays.

The strategic acquisition of Pioneer Corp. by Innolux's subsidiary, CarUX, is a significant move to bolster its global footprint in automotive electronics. This acquisition is designed to transform Innolux into a Tier 1 supplier for smart auto cockpit systems, directly enhancing its competitiveness and value proposition in the rapidly expanding automotive sector.

Technological Innovation in Advanced Displays

Innolux is a powerhouse in technological innovation, consistently pushing the boundaries in advanced display technologies. They are heavily invested in next-generation solutions like MicroLED and MiniLED, often integrating these with AI for smarter functionalities. This focus on cutting-edge development allows them to stay ahead of the curve and offer differentiated products in a competitive market.

Their commitment to innovation is further evident in their development of advanced packaging technologies, such as MTCOB (Micro-LED Chip on Board). Furthermore, Innolux is pioneering flexible and interactive display solutions. These advancements are finding applications in diverse sectors, including the burgeoning smart city infrastructure and the rapidly evolving automotive cockpit designs, showcasing their versatility and forward-thinking approach.

- Leading R&D Investment: Innolux's significant investment in research and development, particularly in areas like MicroLED and MiniLED, underpins its technological strength.

- AI Integration: The company's strategy to integrate AI-driven solutions with its advanced displays enhances product intelligence and user experience.

- Advanced Packaging: Innovations like MTCOB demonstrate Innolux's capability in developing sophisticated manufacturing processes for next-gen displays.

- Application Diversification: Their focus on flexible and interactive displays for smart cities and automotive cockpits highlights a strategic move into high-growth, future-oriented markets.

Improved Financial Performance and Operational Efficiency

Innolux has shown a significant improvement in its financial performance, returning to profitability with four consecutive quarters of positive earnings leading up to Q1 2025. This marks a strong recovery from the losses experienced in Q2 2024, demonstrating effective strategic execution.

The company's operational efficiency has also seen enhancements, driven by strategic asset sales and a more focused approach to customer engagement. These factors have contributed to the turnaround, solidifying Innolux's financial position.

- Return to Profitability: Achieved four consecutive quarters of positive earnings through Q1 2025.

- Operational Efficiency Gains: Improved through strategic asset sales and targeted customer engagement.

- Financial Turnaround: Successfully recovered from losses reported in Q2 2024.

Innolux's strengths lie in its broad product range, covering LCD and OLED panels for diverse applications like smartphones and automotive displays, reducing reliance on single markets. The company is also making significant strides in advanced semiconductor packaging, a strategic move to offset display market volatility. Their leadership in automotive LCDs, bolstered by the acquisition of Pioneer Corp. via CarUX, positions them as a key player in smart auto cockpits.

Technological innovation is a core strength, with substantial R&D investment in MicroLED and MiniLED, often enhanced by AI integration. This focus is also evident in advanced packaging solutions like MTCOB and the development of flexible, interactive displays for smart cities and automotive interiors. Financially, Innolux has demonstrated a strong recovery, achieving four consecutive quarters of profitability through Q1 2025, a significant turnaround from Q2 2024, driven by improved operational efficiency and strategic focus.

| Key Strengths | Description | Supporting Data/Examples |

| Diverse Product Portfolio | Offers a wide range of LCD and OLED panels for various sectors. | Serves multiple sectors, enhancing market resilience. |

| Strategic Diversification | Investing in advanced semiconductor packaging to mitigate display market risks. | Significant capital expenditure allocated for 2024-2025 in new ventures. |

| Automotive Market Leadership | Strong position in automotive LCD displays and smart auto cockpit systems. | Acquisition of Pioneer Corp. by CarUX to become a Tier 1 supplier. |

| Technological Innovation | Focus on next-generation technologies like MicroLED, MiniLED, and AI integration. | Development of MTCOB packaging and flexible/interactive display solutions. |

| Financial Recovery | Return to profitability with four consecutive positive earnings quarters through Q1 2025. | Turnaround from losses reported in Q2 2024, improved operational efficiency. |

What is included in the product

Delivers a strategic overview of Innolux’s internal strengths and weaknesses, alongside external market opportunities and threats.

Offers a clear, actionable framework to identify and address Innolux's market challenges and leverage its competitive advantages.

Weaknesses

Innolux's significant dependence on the flat-panel display market, despite its attempts at diversification, remains a key weakness. This sector is notoriously cyclical, experiencing periods of high demand followed by sharp downturns, which directly impacts Innolux's financial performance. For instance, the company reported a net loss of NT$11.3 billion (approximately $350 million USD) in the first quarter of 2023, largely attributed to the prevailing weak demand and falling prices in the display market.

This cyclicality creates substantial revenue volatility and profitability challenges for Innolux. The company has faced periods of significant losses, such as the NT$11.3 billion loss in Q1 2023, underscoring the need for ongoing strategic shifts to mitigate these inherent market fluctuations.

The display panel market, especially for TFT-LCDs, is incredibly competitive. Innolux faces strong challenges from manufacturers in mainland China and South Korea.

Chinese panel makers are significantly increasing their global production capacity. This trend puts pressure on prices and can potentially shrink Innolux's market share as these competitors become more dominant.

While the broader display market shows promise, the LCD TV segment is anticipated to shrink in unit sales by 2025, with ongoing price volatility. This market pressure is a significant weakness for Innolux, as it directly impacts revenue and profitability in a key product area.

Innolux's strategic move to decrease its reliance on flat-screen production highlights the financial strain caused by falling LCD panel prices. This shift is a direct response to the challenges of operating in a segment where pricing power is diminishing, forcing the company to seek more lucrative avenues.

Vulnerability to Supply Chain Disruptions

As a global electronics manufacturer, Innolux faces significant vulnerability to disruptions within its extensive supply chain. This includes potential shortages or price volatility for critical components like advanced semiconductors and specialized chemicals, which are essential for display production. For instance, the global semiconductor shortage experienced in 2021-2022 significantly impacted various industries, including electronics, highlighting the systemic risk.

Geopolitical tensions and unforeseen events, such as natural disasters or trade disputes, can further exacerbate these supply chain challenges. These disruptions can lead to unpredictable lead times for raw materials and components, directly affecting Innolux's production schedules and increasing operational costs through higher material prices.

- Component Sourcing: Reliance on a limited number of key suppliers for essential materials creates a bottleneck risk.

- Raw Material Price Fluctuations: Volatility in the prices of glass substrates, chemicals, and rare earth elements directly impacts manufacturing costs.

- Logistics and Transportation: Global shipping disruptions and port congestion can delay the delivery of both raw materials and finished goods.

- Geopolitical Instability: Trade wars, sanctions, or regional conflicts can disrupt the flow of goods and increase import/export costs.

Challenges in Older Fab Lines

Innolux faces challenges with its older fabrication lines. For instance, the company sold its 5.5-generation LCD plant to TSMC, recognizing it was no longer cost-competitive. These older facilities, even as they are being decommissioned or repurposed, can hinder overall operational efficiency and profitability if not strategically managed.

The continued operation or slow divestment of less advanced production capacity can dilute Innolux's competitive edge in the rapidly evolving display market. This situation underscores the need for continuous investment in newer technologies and the timely exit from legacy assets to maintain optimal performance.

- Cost Inefficiency: Older fabs often have higher operating costs and lower yields compared to state-of-the-art facilities, impacting overall profitability.

- Technological Obsolescence: Production lines designed for older display technologies struggle to meet the demands for advanced features like higher resolutions and refresh rates.

- Capital Tie-up: Maintaining or slowly phasing out older plants can tie up capital that could be better invested in next-generation manufacturing capabilities.

Innolux's reliance on the highly competitive and cyclical flat-panel display market, particularly LCDs, presents a significant weakness. The company's financial performance is directly tied to market demand and pricing, as evidenced by a net loss of NT$11.3 billion (approximately $350 million USD) in Q1 2023 due to weak demand and falling prices.

The increasing production capacity from Chinese competitors further intensifies price pressure and threatens Innolux's market share. With the LCD TV segment projected to shrink in unit sales by 2025 and facing ongoing price volatility, Innolux’s revenue and profitability in this key area are significantly challenged.

Innolux also faces operational inefficiencies and technological obsolescence with its older fabrication lines. The company’s sale of its 5.5-generation LCD plant to TSMC highlights the cost disadvantage of legacy facilities, which can hinder competitiveness and profitability in a market demanding advanced features and higher yields.

| Financial Metric | 2023 (Q1) | 2024 (Projected/Early Data) | Notes |

|---|---|---|---|

| Net Loss | NT$11.3 billion | (Data varies by quarter, but market conditions remain challenging) | Reflects weak demand and price pressure in display market. |

| LCD TV Market Share | (Specific share varies by segment) | (Expected to face continued pressure from competitors) | LCD TV segment projected to shrink in unit sales by 2025. |

| Fabrication Line Efficiency | (Older lines less cost-competitive) | (Ongoing need for investment in newer technologies) | Example: Sale of 5.5-gen LCD plant due to cost inefficiency. |

Preview the Actual Deliverable

Innolux SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're viewing a live preview of the actual Innolux SWOT analysis file. The complete version becomes available after checkout, offering a comprehensive understanding of their strategic position.

Opportunities

The market for advanced display technologies like OLED, MicroLED, and flexible screens is booming. By 2034, this sector is expected to hit a massive USD 600 billion, growing at an average annual rate of 8.50% starting in 2025. This presents a substantial opportunity for companies that can innovate in this space.

Innolux is well-positioned to benefit from this trend, having invested heavily in MicroLED and flexible display innovations. Their commitment to developing high-resolution, power-saving display solutions directly addresses the growing demand for these cutting-edge technologies.

The automotive display system market is experiencing significant expansion, with an anticipated compound annual growth rate of 14.9% between 2024 and 2025. This surge is fueled by the growing consumer and industry demand for sophisticated infotainment systems, advanced driver-assistance systems (ADAS), and fully digital instrument clusters.

Innolux is well-positioned to capitalize on this trend, leveraging its established presence in the automotive display sector. The company's strategic acquisition of Pioneer further strengthens its capabilities in smart cockpit solutions, creating a clear pathway for increased market share and the introduction of more premium, higher-value display products.

Innolux's strategic push into semiconductor packaging, particularly panel-level packaging (PLP) for silicon photonics, represents a substantial opportunity. This diversification leverages their existing fab infrastructure and technical know-how, allowing them to enter the rapidly expanding semiconductor sector.

By moving into advanced chip packaging, Innolux can tap into a high-growth market, potentially offsetting the cyclical nature of the traditional display industry. This strategic pivot aims to reduce reliance on display market volatility and capture new revenue streams.

Integration of AI and Smart Display Solutions

The growing integration of AI and machine learning into digital displays is opening up exciting new possibilities for interactive and personalized user experiences. This trend is particularly impactful in sectors like smart cities, retail, and the automotive industry, where intelligent displays can enhance functionality and engagement. For instance, smart city infrastructure can leverage AI-powered displays for real-time information dissemination and citizen interaction, while retail environments can offer personalized shopping experiences through dynamic content. The automotive sector is seeing a surge in demand for AI-driven smart cockpit solutions that provide intuitive interfaces and advanced driver assistance features.

Innolux is strategically positioning itself to capitalize on this evolving market by actively developing AI-driven interactive displays and sophisticated smart cockpit solutions. This focus aligns with the increasing consumer and industry demand for intelligent, user-friendly, and responsive display systems. By investing in AI capabilities for its display technologies, Innolux aims to deliver products that not only meet current market needs but also anticipate future trends in human-machine interaction.

The market for AI-powered displays is projected for significant growth. Analysts predict the global AI in display market to reach approximately $15 billion by 2027, growing at a compound annual growth rate (CAGR) of over 20% during the forecast period. This expansion is driven by advancements in AI algorithms, increased adoption of IoT devices, and the growing need for enhanced user interfaces across various applications.

- AI Integration: The increasing incorporation of artificial intelligence and machine learning into digital displays is creating new avenues for interactive and personalized experiences across various applications, including smart cities, retail, and automotive.

- Innolux's Strategy: Innolux is actively developing AI-driven interactive displays and smart cockpit solutions, positioning itself to meet the evolving demand for intelligent and intuitive display systems.

- Market Growth: The global AI in display market is anticipated to reach around $15 billion by 2027, with a projected CAGR exceeding 20%, underscoring the significant opportunity for companies like Innolux.

- Key Sectors: Smart cities, retail, and automotive are key sectors driving the demand for AI-enhanced display technologies due to their potential for improved functionality and user engagement.

Demand Recovery and Market Balance in Display Industry

The display market is experiencing a much-needed recovery, moving away from earlier oversupply and sluggish demand. Analysts anticipate demand to surpass capacity in the coming year, with panel prices projected to strengthen in the first half of 2025.

This shift towards a healthier supply-demand dynamic, particularly in the large-area display segment, is a significant opportunity. Coupled with a sustained consumer preference for larger screen sizes, Innolux is well-positioned to benefit from more predictable pricing and enhanced profitability.

- Demand Outpacing Supply: Projections indicate demand will exceed available capacity in the display market through 2025.

- Price Rebound Expected: Panel prices are forecasted to see an upward trend in the first half of 2025.

- Growing Large-Area Demand: The market continues to see increased consumer interest in larger display sizes.

- Improved Profitability Potential: The balanced market conditions offer Innolux a path to more stable revenue and better margins.

The advanced display market, including OLED and MicroLED, is set for substantial growth, projected to reach $600 billion by 2034 with an 8.50% CAGR from 2025. Innolux's investments in MicroLED and flexible displays align perfectly with this trend, positioning them to capture demand for high-resolution, energy-efficient screens.

The automotive display sector is booming, expected to grow at a 14.9% CAGR from 2024 to 2025, driven by demand for advanced infotainment and ADAS. Innolux's acquisition of Pioneer strengthens its smart cockpit capabilities, enabling it to offer more premium automotive display solutions.

Innolux's expansion into semiconductor packaging, particularly panel-level packaging for silicon photonics, offers a significant opportunity to diversify into the high-growth semiconductor industry, leveraging existing infrastructure.

AI integration into displays is creating interactive and personalized experiences, with the AI in display market expected to hit $15 billion by 2027, growing at over 20% CAGR. Innolux's development of AI-driven displays and smart cockpit solutions targets this rapidly expanding market.

The display market is recovering, with demand expected to outpace supply in 2025, leading to stronger panel prices in early 2025. This improved supply-demand balance, especially in large-area displays, presents an opportunity for Innolux to achieve greater profitability.

| Opportunity Area | Projected Market Size/Growth | Key Drivers | Innolux's Position |

| Advanced Displays (OLED, MicroLED) | $600 billion by 2034 (8.50% CAGR from 2025) | Innovation in high-resolution, power-saving displays | Investments in MicroLED and flexible display technology |

| Automotive Displays | 14.9% CAGR (2024-2025) | Infotainment, ADAS, digital clusters | Acquisition of Pioneer for smart cockpit solutions |

| Semiconductor Packaging (PLP) | High growth in semiconductor sector | Diversification, leveraging fab infrastructure | Strategic push into silicon photonics packaging |

| AI-Powered Displays | $15 billion by 2027 (20%+ CAGR) | AI/ML integration, IoT adoption | Development of AI-driven interactive displays |

| Display Market Recovery | Demand exceeding supply, price rebound in H1 2025 | Balanced supply-demand, consumer preference for larger screens | Well-positioned for stable revenue and improved margins |

Threats

Ongoing geopolitical tensions, particularly between the US and China, continue to cast a shadow over the global display industry. These tensions can manifest as new tariffs or trade restrictions, directly impacting Innolux's supply chain and access to key components. For instance, the US imposed tariffs on various goods from China in recent years, and the potential for further escalations creates significant uncertainty for manufacturers reliant on international trade.

Such uncertainties can lead to unpredictable shifts in trade policies, potentially increasing Innolux's costs for raw materials or finished goods. Furthermore, these geopolitical dynamics can dampen global demand for electronics, a sector heavily reliant on display technology, creating a challenging operating environment for companies like Innolux.

The display panel market is a battlefield for pricing, with major players, particularly Chinese manufacturers, engaging in aggressive price wars. This intense competition directly impacts Innolux, squeezing profit margins and challenging its ability to command premium prices, especially in the increasingly commoditized LCD sector. For instance, in 2023, the average selling price for many LCD panels saw significant declines year-over-year, a trend expected to continue into early 2024, impacting revenue for all industry participants.

The display industry moves at lightning speed, constantly shifting from older technologies like LCD to newer ones such as OLED, MiniLED, and MicroLED. Innolux must navigate this rapid innovation cycle, as falling behind means its current products could quickly become outdated. This necessitates significant and ongoing investment in research and development to stay competitive.

Economic Slowdown and Consumer Demand Volatility

Global economic uncertainty, with potential downturns looming for 2025, poses a significant threat by dampening consumer spending on electronics. This directly impacts the demand for display panels, a core product for Innolux. For instance, a projected slowdown in major economies could see discretionary spending on devices like smartphones and televisions contract, affecting Innolux's order volumes.

Consumer demand volatility, exacerbated by inflation and interest rate concerns, is another key challenge. Innolux's reliance on consumer electronics means it's particularly susceptible to shifts in purchasing power and confidence. Analysts predict that by mid-2025, consumers may further tighten their belts, leading to unpredictable sales cycles for Innolux's products.

- Economic Uncertainty: Global GDP growth forecasts for 2025 are being revised downwards by institutions like the IMF, indicating a potential slowdown that could reduce consumer electronics demand.

- Consumer Spending Impact: A 5% drop in consumer electronics sales, a plausible scenario in an economic downturn, could directly translate to lower revenue for display panel manufacturers like Innolux.

- Profitability Risk: Reduced demand and potential price pressures in a volatile market could significantly impact Innolux's profit margins in its consumer-facing segments.

- Forecasting Challenges: The unpredictable nature of consumer behavior in 2025 makes accurate sales forecasting more difficult for Innolux, potentially leading to inventory management issues.

Supply Chain Concentration in Asia

Innolux, like many in the display industry, faces significant risks due to its reliance on Asian supply chains, with key manufacturing hubs concentrated in Taiwan, Japan, South Korea, and China. This geographical concentration exposes the company to potential disruptions from events like natural disasters or geopolitical tensions. For instance, a major earthquake in Taiwan, a region prone to seismic activity, could halt production for numerous suppliers.

The concentration of critical components and manufacturing processes within a limited geographic area creates a vulnerability. Should any of these key Asian regions experience unforeseen events, such as severe weather impacting logistics or localized industrial disputes, Innolux's production schedules and delivery timelines could be severely affected. This dependency highlights the need for robust risk management strategies to mitigate the impact of such regional vulnerabilities.

The display industry's supply chain is heavily weighted towards Asia. In 2023, for example, East Asia continued to dominate global display panel production, with China, South Korea, and Taiwan accounting for over 90% of the market share. This overwhelming concentration means that any disruption in this region, whether it be a pandemic-related lockdown or a trade dispute, can have a ripple effect across the entire global supply chain, directly impacting companies like Innolux.

Key aspects of this supply chain concentration include:

- Geographic Concentration: Over 90% of global display panel production is concentrated in East Asia (China, South Korea, Taiwan).

- Vulnerability to Regional Disruptions: Natural disasters, political instability, or localized supply chain issues in these key regions pose significant risks.

- Impact on Production and Delivery: Disruptions can lead to manufacturing halts, increased lead times, and delayed product deliveries for Innolux.

Intense competition, particularly from Chinese manufacturers, is driving down prices for display panels, squeezing Innolux's profit margins. This price war is expected to continue, impacting revenue, especially in the commoditized LCD market where average selling prices saw significant declines in 2023 and are projected to remain under pressure into early 2024.

Rapid technological advancements, such as the shift towards OLED, MiniLED, and MicroLED, necessitate substantial R&D investment to prevent Innolux's current products from becoming obsolete. Failure to keep pace with innovation risks market share erosion.

Global economic uncertainty, with potential slowdowns predicted for 2025, poses a threat by reducing consumer spending on electronics, directly impacting demand for Innolux's display panels. This volatility makes accurate sales forecasting challenging, potentially leading to inventory management issues.

SWOT Analysis Data Sources

This SWOT analysis for Innolux is built upon a foundation of credible data, drawing from official financial filings, comprehensive market research reports, and expert industry analysis to provide a robust and actionable assessment.