Innolux Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Innolux Bundle

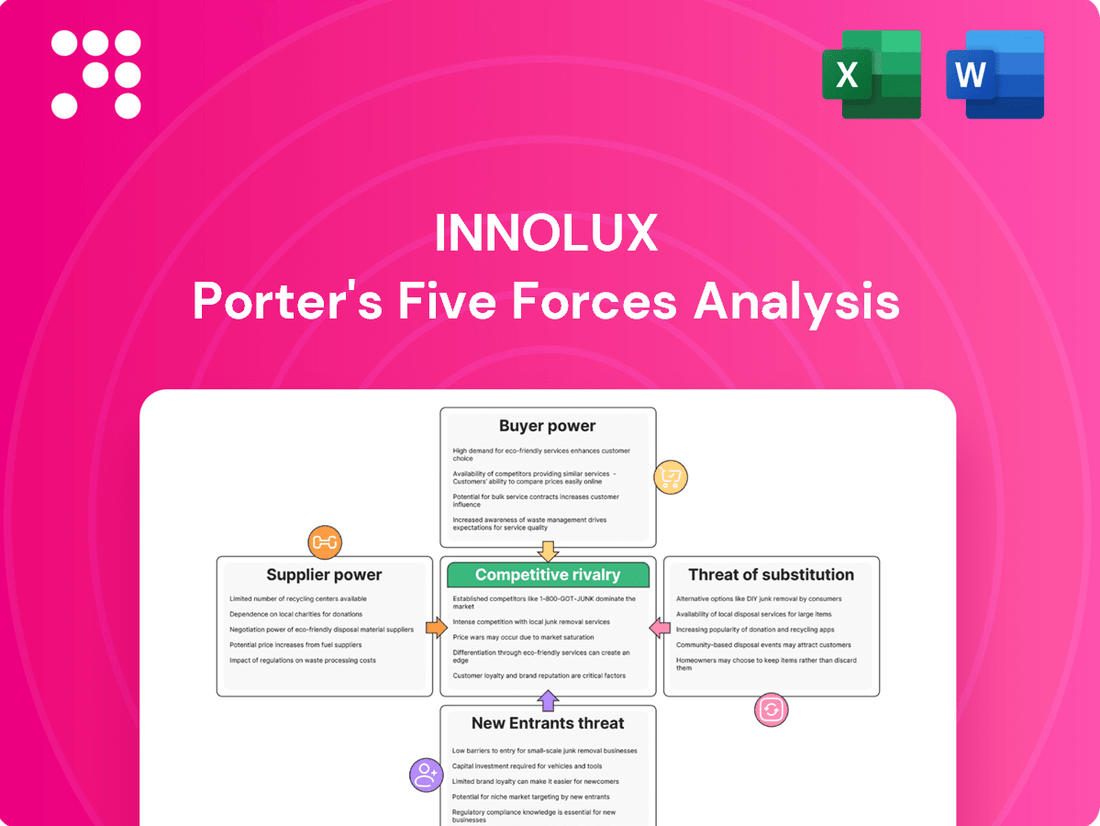

Innolux faces significant competitive rivalry, with intense price pressure from established players and a constant need for innovation. Understanding the bargaining power of both buyers and suppliers is crucial for navigating this dynamic market. The threat of substitutes and new entrants also demands strategic foresight.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Innolux’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The display panel industry, where Innolux operates, is heavily dependent on a limited number of specialized suppliers for essential components such as glass substrates, color filters, and unique chemicals. This concentration means these few suppliers can wield considerable influence over panel manufacturers.

When suppliers are highly concentrated, they gain leverage to dictate terms, including pricing and availability, directly impacting Innolux's production costs and output. For instance, in 2023, the global market for advanced display materials saw significant price fluctuations driven by supply chain constraints, highlighting the power of concentrated suppliers.

To counter this, Innolux must actively work on diversifying its supplier network and fostering robust, long-term partnerships. This strategy helps ensure a more stable supply of critical components and provides greater negotiation power, thereby mitigating the risks associated with supplier concentration.

Suppliers offering unique or patented technologies, like specialized materials for next-generation OLED or MicroLED displays, wield significant bargaining power. Innolux could face cost pressures or production disruptions if its reliance on such proprietary inputs is high, especially if viable substitutes are scarce. For instance, the development of novel quantum dot materials could elevate the leverage of their suppliers.

The costs and complexities for Innolux to switch display panel suppliers are significant. These can include substantial expenses for re-tooling manufacturing equipment, re-calibrating intricate production lines, and the lengthy process of re-qualifying new materials to meet stringent quality standards.

These high switching costs directly enhance the bargaining power of Innolux's existing suppliers. The reluctance to incur these substantial transition expenses means Innolux may be compelled to accept less favorable pricing or terms from its current suppliers, especially within its highly integrated manufacturing operations.

Threat of Forward Integration by Suppliers

Suppliers who can integrate forward into panel manufacturing, like Innolux, present a significant threat. This capability could lead to reduced component availability and heightened competition for Innolux. While not typical for primary display materials, this risk is more pronounced in niche component markets.

The incentive for suppliers to move into panel production is driven by the potential to capture more value in the supply chain. For instance, a supplier of specialized optical films might consider setting up its own lamination process if the margins are attractive enough. This would directly impact Innolux's sourcing options and cost structure.

- Supplier Forward Integration Risk: Suppliers may enter the panel manufacturing space, increasing competition and limiting Innolux's component supply.

- Value Chain Capture: Suppliers are motivated to integrate forward to capture higher profit margins typically associated with manufacturing.

- Niche Market Vulnerability: The threat is amplified in specialized component markets where fewer suppliers exist.

Importance of Innolux to Suppliers

The bargaining power of suppliers is generally diminished when a company like Innolux represents a significant portion of their business. Innolux's substantial order volumes, a key factor in its operations, can provide considerable leverage in negotiations. For instance, in 2023, Innolux reported revenue of approximately NT$260.4 billion (around USD 8.1 billion), indicating the scale of its purchasing power.

Innolux's strategic importance as a customer can significantly reduce supplier leverage. Losing Innolux as a major client would likely have a substantial negative impact on a supplier's revenue streams and market position. This dependence allows Innolux to negotiate more favorable terms, such as pricing and payment conditions.

Innolux's prominent position within the global flat panel display market further bolsters its negotiating stance. Its scale and market influence provide a degree of counter-leverage against suppliers. This allows Innolux to secure better deals on raw materials and components, ultimately contributing to its competitive advantage.

- Innolux's Revenue Impact: With NT$260.4 billion in revenue for 2023, Innolux represents a significant revenue source for its suppliers.

- Leverage through Volume: Large order volumes from Innolux grant it considerable power to negotiate favorable pricing and terms.

- Market Position Advantage: Innolux's standing in the global flat panel display market enhances its ability to counter supplier demands.

- Reduced Supplier Dependence: Suppliers who rely heavily on Innolux as a customer have less bargaining power.

The bargaining power of suppliers for Innolux is moderate, influenced by component concentration and switching costs but mitigated by Innolux's scale. Key components like glass substrates and specialized chemicals are often sourced from a limited number of providers, giving them leverage, especially when supply chains face disruptions, as seen with price volatility in advanced display materials during 2023.

High switching costs for Innolux, involving re-tooling and re-qualification, reinforce the power of existing suppliers. However, Innolux's substantial order volumes, evidenced by its 2023 revenue of approximately NT$260.4 billion (USD 8.1 billion), provide significant counter-leverage, enabling better negotiation on pricing and terms.

| Factor | Impact on Innolux | Example/Data Point |

|---|---|---|

| Supplier Concentration | Increases supplier power | Limited suppliers for glass substrates, color filters |

| Switching Costs | Increases supplier power | High costs for re-tooling, re-qualification |

| Innolux's Scale | Decreases supplier power | 2023 Revenue: NT$260.4 billion (USD 8.1 billion) |

| Supplier Forward Integration | Potential threat | Suppliers entering niche component manufacturing |

What is included in the product

This analysis delves into the competitive forces shaping Innolux's market, examining supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the display industry.

Instantly grasp the competitive landscape of the display industry, identifying key threats and opportunities for Innolux with a clear, actionable framework.

Customers Bargaining Power

Innolux's customer base includes major players in consumer electronics like Samsung and LG, as well as automotive giants such as Toyota and Volkswagen. The concentration of sales among a few large clients gives these customers significant leverage.

For example, a substantial portion of Innolux's revenue can be tied to a handful of these major brands. This dependence allows them to negotiate for lower prices or more favorable contract terms, directly impacting Innolux's profitability.

When LCD panels are highly standardized, meaning there's not much difference between what one maker offers and another, customers typically have more sway. They can readily switch to a different supplier if the price is better, as seen in the competitive landscape where Innolux operates. For instance, the global LCD panel market, valued at approximately USD 100 billion in 2023, often sees intense price competition for standard products.

Customer switching costs are a significant factor in the display panel industry, influencing the bargaining power of Innolux's clients. When a customer decides to switch from one display panel supplier to another, they often incur substantial costs. These can include the expense of redesigning their products, the time and resources needed for validation processes to ensure compatibility and performance, and the complex adjustments required within their existing supply chains to integrate a new component. These costs act as a barrier, making it less appealing for customers to move to a competitor, even if the competitor offers a slightly lower price.

The level of these switching costs directly impacts how much leverage customers have. If switching is easy and inexpensive, customers can readily demand better terms or switch to suppliers offering more favorable pricing or superior technology. Conversely, high switching costs tend to reduce customer bargaining power, as the effort and expense involved in changing suppliers outweigh the potential benefits. For instance, a major automotive manufacturer integrating Innolux displays into multiple vehicle models would face considerable costs in retooling and re-certifying if they switched suppliers mid-production cycle.

Innolux, like many in the industry, strives to mitigate the impact of customer bargaining power by increasing these switching costs. They aim to achieve this by fostering strong, sticky relationships with their clients. This often involves offering integrated solutions that go beyond just the display panel itself, potentially including software, specialized mounting solutions, or dedicated technical support. By embedding their products and services more deeply into a customer's overall product ecosystem, Innolux makes it more challenging and costly for clients to disengage, thereby strengthening their own position.

Customer Price Sensitivity

In highly competitive sectors such as consumer electronics, where margins are often thin, customers exhibit significant price sensitivity. This forces manufacturers to continuously seek cost reductions from their suppliers, including display panel makers like Innolux. For instance, in 2024, the average selling price for LCD panels saw downward pressure due to oversupply in certain segments, directly impacting Innolux's ability to command premium pricing.

This price sensitivity is amplified in the high-volume, commoditized segments of the display market. When a large portion of a customer's product cost is tied to the display, even small price fluctuations can have a substantial impact on their overall profitability and competitiveness. This dynamic compels Innolux to optimize its production costs and explore efficiency gains to remain attractive to these price-conscious buyers.

- Customer price sensitivity in consumer electronics drives demand for lower display panel costs.

- High-volume, commoditized display segments amplify this pressure on suppliers like Innolux.

- Oversupply in 2024 contributed to downward pressure on LCD panel prices, affecting supplier margins.

- Innolux must manage production costs to remain competitive with price-sensitive customers.

Threat of Backward Integration by Customers

Large customers, particularly major electronics manufacturers, possess the financial clout and technical expertise to consider backward integration, meaning they could produce their own display panels. This capability, though requiring significant capital investment, directly enhances their bargaining power by presenting Innolux with a credible alternative. For instance, a leading smartphone brand might explore in-house panel production if it significantly reduces costs or ensures supply chain stability.

While the threat of backward integration is real, it's important to note that the barriers to entry for display panel manufacturing are extremely high. The immense capital expenditure required for advanced fabrication facilities and the complex technological know-how make this a viable option for only a select few customers. Innolux benefits from this high barrier, as it limits the practical ability of most customers to become self-sufficient producers.

Consider the capital costs: establishing a modern display panel fabrication plant can easily run into billions of dollars. For example, new advanced display fabs often cost upwards of $10 billion. This substantial investment, coupled with the ongoing operational expenses and the need for continuous technological upgrades, deters all but the largest and most strategically positioned customers from pursuing backward integration.

- High Capital Requirements: Display panel manufacturing requires billions in investment for advanced facilities.

- Technical Complexity: Operating and innovating in display technology demands specialized expertise.

- Limited Customer Viability: Only a few of Innolux's largest clients could realistically consider backward integration.

- Supply Chain Control: For some very large players, the strategic advantage of controlling panel production might outweigh the costs.

Innolux's bargaining power with customers is significantly influenced by the concentration of its sales among a few major clients, such as Samsung and LG in consumer electronics, and automotive manufacturers like Toyota. These large buyers can leverage their substantial order volumes to negotiate lower prices and more favorable terms, directly impacting Innolux's profitability.

The commoditized nature of many LCD panel segments means customers can easily switch suppliers if better pricing or technology is available. This price sensitivity is particularly acute in high-volume sectors where displays represent a significant portion of a product's cost. For instance, downward price pressure on LCD panels was evident in 2024 due to market oversupply.

While high switching costs, such as product redesign and validation, can mitigate customer leverage, the ultimate threat of backward integration by very large clients remains. However, the immense capital investment, often exceeding $10 billion for advanced fabrication facilities, limits this possibility to only a handful of Innolux's largest customers.

| Factor | Impact on Innolux | Example/Data Point |

|---|---|---|

| Customer Concentration | High leverage for major clients | Sales tied to a few large electronics and auto brands |

| Product Standardization | Enables easy switching, increasing price sensitivity | Global LCD panel market valued at ~USD 100 billion (2023) with intense price competition for standard products |

| Price Sensitivity | Drives demand for lower panel costs, especially in high-volume segments | Oversupply in 2024 led to downward pressure on LCD panel prices |

| Backward Integration Threat | Potential alternative for large clients, though capital-intensive | New advanced display fabs can cost upwards of $10 billion |

Full Version Awaits

Innolux Porter's Five Forces Analysis

This preview showcases the complete Innolux Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape within the display panel industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, providing actionable insights into buyer power, supplier power, the threat of new entrants, the threat of substitutes, and the intensity of rivalry. Rest assured, there are no placeholders or missing sections; what you're previewing is the final, ready-to-use deliverable.

Rivalry Among Competitors

The global display panel market is a crowded arena, featuring major players like Samsung Display, LG Display, BOE Technology Group, and AU Optronics, all vying for market share alongside Innolux. This intense competition, particularly in the established LCD sector, frequently sparks price wars, putting downward pressure on profitability.

The flat panel display market is projected for growth, especially with advancements in OLED and MicroLED technologies. However, the overall pace of this expansion significantly shapes competitive dynamics. For instance, a 2024 market report indicated a projected compound annual growth rate (CAGR) of around 5-7% for the broader display market, but this can vary by segment.

When growth in established display segments, such as traditional LCDs, moderates, companies often intensify their efforts to capture existing market share. This can lead to price wars and increased marketing spend. Innolux, recognizing this, is strategically diversifying its business, exploring opportunities in non-display areas and specialized applications to secure alternative growth drivers.

Innolux actively seeks to differentiate its display products, moving beyond basic price competition. By investing in advanced technologies such as MiniLED, MicroLED, and specialized automotive displays, the company aims to offer unique value propositions to its customers.

This focus on innovation, including developments in flexible and transparent display technologies, is crucial for creating distinct product offerings. For instance, Innolux's advancements in automotive displays cater to a growing demand for integrated and high-performance visual solutions in vehicles, setting them apart from standard panel suppliers.

High Fixed Costs and Exit Barriers

The display panel manufacturing sector, where Innolux operates, is inherently capital-intensive. Companies must make enormous investments in state-of-the-art fabrication plants (fabs) and ongoing research and development to stay competitive. For instance, building a new advanced display fab can easily cost billions of dollars. These substantial upfront and ongoing expenses create a significant barrier to entry and also pressure existing players to maintain high operational levels.

These high fixed costs, combined with substantial exit barriers such as specialized, non-transferable equipment and long-term supply contracts, create a challenging environment. Companies like Innolux are essentially locked into the industry and must strive for high production volumes to spread these fixed costs over as many units as possible. This necessity often leads to aggressive pricing strategies, even when profit margins are thin, to ensure sufficient revenue to cover operational expenses.

- High Capital Expenditure: Building a new Gen 8.6 or Gen 11 fab for advanced displays can cost upwards of $5 billion to $10 billion.

- R&D Intensity: The industry spends a significant portion of revenue on R&D, with major players investing billions annually to develop new display technologies like OLED and MicroLED.

- Asset Specificity: Display manufacturing equipment is highly specialized and cannot be easily repurposed for other industries, increasing the cost and difficulty of exiting the market.

- Production Volume Imperative: Companies must operate fabs at high utilization rates, often above 90%, to achieve cost efficiencies and cover fixed costs, driving competitive pricing.

Strategic Alliances and Consolidations

Strategic alliances and consolidations significantly shape the competitive rivalry within the display industry. For instance, the eLEAP Strategic Alliance, which includes Innolux and Japan Display Inc. (JDI), exemplifies this trend. Such collaborations can lead to more formidable players with enhanced production capabilities and improved cost efficiencies.

These partnerships can fundamentally alter the competitive landscape. By pooling resources and expertise, allied companies can achieve economies of scale and technological advancements that smaller, independent competitors may struggle to match. This dynamic increases pressure on those not participating in such consolidations.

- Innolux's participation in the eLEAP Strategic Alliance with JDI aims to strengthen its market position.

- Alliances can lead to optimized production and cost structures, benefiting participating firms.

- Consolidations and strategic partnerships increase competitive pressure on standalone display manufacturers.

The display panel market is fiercely competitive, with Innolux facing established giants like Samsung Display and BOE Technology. This intense rivalry, especially in mature LCD segments, often triggers price wars, impacting profitability. For example, in 2024, the market saw continued price pressures on standard LCD panels due to oversupply in certain categories.

Innolux differentiates itself through innovation in areas like MiniLED and automotive displays, moving beyond pure price competition. The company's investment in advanced technologies aims to create unique value propositions, as seen in its specialized automotive display solutions catering to increasing in-car screen demands.

The capital-intensive nature of display manufacturing, with new fabs costing billions, creates high barriers to entry and exit. This forces companies like Innolux to maintain high production volumes, often leading to aggressive pricing to cover substantial fixed costs.

Strategic alliances, such as Innolux's eLEAP alliance with JDI, aim to bolster market position and achieve economies of scale. These collaborations increase competitive pressure on companies operating independently.

| Key Competitors | Market Focus | 2024 Market Share (Estimated) |

|---|---|---|

| Samsung Display | OLED, QD-OLED, LCD | ~30-35% |

| BOE Technology Group | LCD, OLED | ~25-30% |

| LG Display | OLED, LCD | ~15-20% |

| AU Optronics (AUO) | LCD, OLED | ~5-8% |

| Innolux | LCD, Specialized Displays | ~5-8% |

SSubstitutes Threaten

Innolux, a major player in LCD and OLED panel manufacturing, faces a threat from alternative display technologies. These substitutes aim to meet similar consumer demands, potentially impacting Innolux's market share.

Emerging technologies such as MicroLED, Quantum Dot, and flexible displays represent a significant long-term threat. For instance, MicroLED offers enhanced brightness and contrast, while flexible displays open up entirely new product categories. Companies like Samsung have been investing heavily in MicroLED development, with some consumer products already available, indicating market traction.

The threat of substitutes for Innolux's display products hinges on the performance-price trade-off. If alternative technologies, like advanced OLED or emerging MicroLED, offer superior features such as higher brightness or better energy efficiency at a similar or lower cost, they pose a significant challenge. For instance, while traditional LCDs remain prevalent, the increasing affordability and performance improvements in OLED panels for premium applications directly impact market share.

Innolux's strategic investment in MicroLED technology underscores its recognition of this threat. By developing and potentially mass-producing MicroLED displays, Innolux aims to offer a next-generation solution that surpasses current performance benchmarks, such as exceptional brightness and contrast, while striving for competitive pricing to counter existing and emerging substitutes in the premium display market.

Customer willingness to adopt new display technologies hinges on the perceived benefits and how easy it is to switch. For consumer electronics, things like a dazzling new screen or a much better user experience can really push people to try something different. For example, the rapid adoption of OLED displays in smartphones, driven by superior contrast and color, shows how quickly consumers can embrace substitutes when the benefits are clear.

However, in more demanding sectors like industrial equipment or automotive displays, the story changes. Here, factors such as proven reliability and the existence of established, dependable supply chains often make companies hesitant to jump on new technologies too quickly. This means that even if a new display technology offers some advantages, its adoption in these areas might be a much slower process, as businesses prioritize stability and proven performance over novelty.

Evolution of Non-Display Solutions

Beyond traditional screen replacements, the threat of substitutes for Innolux's display business can emerge from non-display technologies that serve similar information delivery purposes. For instance, the growing capabilities of augmented reality (AR) and virtual reality (VR) devices, while not direct replacements for many current display applications, could carve out niches in specific markets. Imagine AR glasses overlaying information directly onto a user's field of vision, reducing the need for a separate handheld or mounted display in certain contexts.

While these technologies are still evolving, their potential to disrupt traditional display markets is significant. By 2024, the global AR/VR market was projected to reach hundreds of billions of dollars, indicating substantial investment and rapid development. This growth suggests that while Innolux’s core strength lies in physical displays, it’s prudent to monitor advancements in immersive technologies and alternative information interfaces that could, over time, present a more indirect but impactful competitive pressure.

Consider these potential substitute impacts:

- Augmented Reality (AR) Integration: AR systems could deliver contextual information directly to users, bypassing the need for traditional screens in applications like industrial maintenance or navigation.

- Virtual Reality (VR) Immersion: VR environments offer fully simulated experiences, potentially replacing the need for physical displays in entertainment and training sectors.

- Advanced Projection Systems: Sophisticated projection technologies could create dynamic visual interfaces on various surfaces, offering an alternative to static or mounted displays.

Innovation and R&D in Substitute Technologies

The threat of substitutes for Innolux is heightened by rapid innovation and substantial R&D investments in alternative display technologies. Competitors and new market entrants are continuously improving the viability of these substitutes, potentially eroding Innolux's market share. For instance, the increasing adoption of microLED technology in premium devices, driven by significant R&D from companies like Samsung and Apple, presents a direct challenge to traditional LCD and OLED panels that Innolux produces.

Innolux must proactively monitor these advancements and allocate significant resources to its own research and development for next-generation display solutions. Failing to do so risks being outpaced by superior substitute technologies. The global display market saw R&D spending increase by approximately 7% in 2024, with a notable portion directed towards emerging technologies like flexible displays and advanced microLED architectures.

- Rapid advancements in microLED and QD-OLED technologies pose a significant threat to Innolux's traditional display offerings.

- Global R&D investment in display technology is escalating, with a focus on next-generation solutions that could displace current market standards.

- Innolux's strategic response requires substantial, ongoing investment in its own R&D to maintain competitiveness against emerging substitute technologies.

The threat of substitutes for Innolux's display products is multifaceted, encompassing both direct technological replacements and alternative ways of presenting information. Emerging technologies like MicroLED and advanced Quantum Dot displays offer superior performance, such as higher brightness and better color accuracy, directly challenging Innolux's existing LCD and OLED offerings. For example, by 2024, MicroLED had begun to appear in high-end televisions and wearables, demonstrating its growing viability and consumer appeal.

Furthermore, the rise of immersive technologies like Augmented Reality (AR) and Virtual Reality (VR) presents a more indirect, yet significant, substitute threat. These technologies can deliver information and experiences directly to users, potentially reducing reliance on traditional flat-panel displays in certain applications. The global AR/VR market was projected to exceed $200 billion by 2024, reflecting substantial investment and rapid innovation in these alternative interfaces.

| Substitute Technology | Key Advantages | Potential Impact on Innolux | Market Traction (as of 2024) |

|---|---|---|---|

| MicroLED | Exceptional brightness, contrast, energy efficiency | Direct competitor to high-end OLED and LCD | Emerging in premium consumer electronics and commercial displays |

| Quantum Dot (QD) Displays | Enhanced color gamut, brightness | Improves LCD performance, potential for QD-OLED | Growing adoption in mid-to-high-end TVs and monitors |

| Augmented Reality (AR) | Contextual information overlay, hands-free operation | Reduces need for separate displays in specific industrial/consumer use cases | Increasing use in enterprise, gaming, and navigation |

| Virtual Reality (VR) | Immersive experiences, simulation | Potential replacement for entertainment and training displays | Steady growth in gaming and specialized training applications |

Entrants Threaten

The display panel manufacturing industry is incredibly capital-intensive, demanding billions of dollars to establish and outfit advanced fabrication plants, often referred to as fabs. For instance, building a new cutting-edge fab for advanced display technologies can easily cost upwards of $10 billion. This massive upfront investment creates a substantial hurdle for any new company looking to enter the market.

Established players like Innolux leverage substantial economies of scale in manufacturing and supply chain operations. For instance, Innolux's large-scale production facilities allow for lower per-unit costs. A new entrant would find it incredibly difficult to achieve similar cost efficiencies, as building comparable infrastructure requires massive upfront capital investment and time to ramp up production volumes.

Innolux faces a significant threat from new entrants due to the substantial intellectual property held by established display panel manufacturers. These companies possess extensive patent portfolios and proprietary manufacturing techniques, creating a high barrier to entry. For instance, in 2024, the display industry continued to see massive R&D investments, with major players like Samsung Display and LG Display heavily protecting their innovations in OLED and microLED technologies.

Access to Distribution Channels

Innolux, like other display panel manufacturers, faces a significant threat from new entrants regarding access to distribution channels. Establishing robust relationships with global consumer electronics giants, demanding automotive manufacturers, and specialized industrial clients is a lengthy and resource-intensive process.

New players would need to invest heavily in building extensive sales networks, providing comprehensive technical support, and demonstrating a reliable track record to even be considered by these major buyers. This creates a substantial barrier, as gaining customer trust and securing shelf space or integration slots within established supply chains is incredibly difficult.

For instance, securing a contract with a major automotive OEM often involves years of qualification and rigorous testing, a hurdle that new entrants would find exceptionally challenging to overcome quickly. The established players have already navigated these complex and often exclusive distribution pathways.

- Distribution Channel Barriers: New entrants must overcome the established relationships and trust Innolux has built with key global clients in consumer electronics, automotive, and industrial sectors.

- Sales Network Investment: Significant capital and time are required to build the necessary global sales infrastructure and provide the technical support demanded by large-scale customers.

- Customer Trust and Qualification: Gaining credibility and passing the stringent qualification processes of major buyers, particularly in the automotive industry, presents a substantial obstacle for newcomers.

Government Policy and Regulations

Government policies and regulations significantly shape the threat of new entrants in the display industry. For instance, governments might offer subsidies to bolster domestic manufacturing, as seen with various national initiatives aimed at securing semiconductor and display supply chains. Conversely, stringent environmental regulations, such as those concerning waste disposal or energy consumption in manufacturing processes, can increase the capital expenditure and operational complexity for newcomers. In 2024, many regions are focusing on sustainability, potentially raising compliance costs for new display factories. Trade policies, including tariffs or import restrictions, can also act as barriers, making it more challenging for foreign companies to enter established markets.

Consider the following impacts of government policy:

- Subsidies: Government financial support can lower the cost barrier for new domestic players, increasing competitive pressure.

- Environmental Standards: Stricter regulations necessitate higher upfront investment in compliance technology, deterring some potential entrants.

- Trade Policies: Tariffs and quotas can make it economically unviable for overseas companies to compete in certain markets.

- Local Content Requirements: Mandates for using locally sourced components can complicate supply chain setup for new entrants.

The threat of new entrants for Innolux remains moderate due to significant capital requirements and established economies of scale, though evolving technologies like microLED present potential entry points. The sheer cost of building advanced fabrication facilities, often exceeding $10 billion, acts as a primary deterrent. Furthermore, existing players benefit from optimized supply chains and production efficiencies that newcomers struggle to replicate quickly, impacting cost competitiveness.

| Factor | Impact on New Entrants | Example (2024/2025 Trend) |

|---|---|---|

| Capital Intensity | High Barrier | New fab construction costs continue to rise, with advanced OLED fabs potentially costing $15 billion+. |

| Economies of Scale | Significant Advantage for Incumbents | Innolux's large production volumes allow for lower per-unit costs, making it difficult for smaller new entrants to compete on price. |

| Technology & IP | Moderate Barrier, Potential Opportunity | While established players hold extensive patents, rapid advancements in areas like microLED could lower entry barriers for specialized niche players. R&D spending by leaders remains high. |

| Distribution & Customer Relationships | High Barrier | Securing contracts with major electronics or automotive clients requires years of qualification and trust, a hurdle for new entrants. |

Porter's Five Forces Analysis Data Sources

Our Innolux Porter's Five Forces analysis is built upon a foundation of diverse data sources, including Innolux's official annual reports, financial statements, and investor relations disclosures. We also integrate insights from reputable industry research firms, market intelligence platforms, and macroeconomic databases to provide a comprehensive view of the competitive landscape.