Innolux Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Innolux Bundle

Discover how Innolux masterfully crafts its product portfolio, sets competitive pricing, strategically places its displays, and executes impactful promotions. This analysis unpacks the synergy behind their success.

Unlock the full picture of Innolux's marketing prowess with our comprehensive 4Ps analysis. Get actionable insights into their product innovation, pricing strategies, distribution networks, and promotional campaigns.

Ready to elevate your marketing strategy? Dive deep into Innolux's 4Ps with our detailed, editable report, designed for professionals and students seeking competitive advantage.

Product

Innolux boasts a diverse portfolio of display panels, encompassing both LCD and OLED technologies. This wide selection allows them to serve a broad spectrum of markets, from everyday consumer electronics like smartphones and televisions to sophisticated automotive displays. Their market penetration is significant across these varied segments.

The company actively invests in developing cutting-edge display technologies, continually refining and expanding its core product lines. This commitment to innovation ensures they remain competitive and can meet evolving customer demands for enhanced visual experiences.

Innolux is a leader in advanced display technologies, actively developing next-generation solutions like MicroLED and MiniLED. This focus on innovation is crucial for maintaining a competitive edge in the rapidly evolving display market.

Recent product showcases, such as the 130-inch MiniLED direct view TV and flexible AM MiniLED displays, demonstrate Innolux's commitment to pushing visual experience boundaries. These advancements are designed for superior picture quality and enhanced energy efficiency.

These high-performance and sustainable product advancements directly address market demand for premium visual experiences and environmentally conscious technology. Innolux's investment in these areas is a key differentiator, positioning them for future growth in the premium display segment.

Innolux is actively broadening its horizons beyond the conventional display market, venturing into lucrative non-display sectors. This strategic pivot involves leveraging its established technological expertise to tap into new revenue streams and enhance overall business resilience.

Key areas of this expansion include advanced chip packaging solutions, such as Fan-Out Panel-Level Packaging (FOPLP), and the development of specialized X-ray sensors. These high value-added segments are expected to drive significant growth and capitalize on emerging technological trends.

This diversification strategy is crucial for mitigating risks associated with the cyclical nature of the display panel industry. For instance, while the global display market experienced fluctuations, Innolux’s investment in sectors like advanced packaging aims to create a more stable and diversified revenue base, potentially capturing opportunities in the growing semiconductor industry.

Integrated Solutions and Modules

Innolux extends its offerings beyond basic panel production by providing integrated display modules and comprehensive touch solutions. This strategic move allows them to deliver complete, ready-to-use packages to their worldwide customers. For instance, in 2024, Innolux highlighted its advanced integrated solutions for automotive and industrial applications, aiming to simplify complex integration processes for clients.

This focus on integrated solutions enhances customer value by offering more streamlined and complete product packages. It simplifies supply chains for their clients, reducing the need for multiple component sourcing and integration efforts. This signifies Innolux's commitment to providing end-to-end system integrations, moving from component supplier to solution provider.

- Integrated Modules: Innolux offers complete display and touch solutions, not just raw panels.

- Customer Value: Simplifies integration and reduces supply chain complexity for clients.

- Market Shift: Demonstrates a strategic pivot towards offering comprehensive system integration services.

- 2024 Focus: Emphasis on advanced integrated solutions for automotive and industrial sectors.

AI-Driven Interactive Displays

Innolux is pushing the boundaries with AI-driven interactive displays, targeting growth areas like smart cities, digital art, and enhanced user experiences. These aren't just screens; they're intelligent interfaces designed to captivate and inform.

Consider the 85-inch 4K AI Interactive InnoGallery, a prime example of how Innolux is merging artificial intelligence with advanced display technology. This product, along with innovations like the MicroLED Floating Jewelry Box, demonstrates a clear strategy to elevate visual engagement and redefine how users interact with digital content across diverse sectors.

- Smart City Integration: Innolux's AI displays are being eyed for smart city infrastructure, aiming to improve public information systems and urban management.

- Digital Art & Retail: The InnoGallery showcases potential in the digital art market and high-end retail, offering immersive brand experiences.

- Technological Advancement: The company's investment in MicroLED and AI integration signifies a commitment to leading in next-generation display solutions.

Innolux's product strategy centers on a diverse range of display technologies, including advanced LCD and OLED panels, alongside emerging solutions like MicroLED and MiniLED. They are actively expanding into non-display sectors such as advanced chip packaging and X-ray sensors, demonstrating a commitment to diversification and higher value-added offerings. Furthermore, Innolux is integrating AI into interactive displays for applications like smart cities and digital art, showcasing a forward-thinking approach to user engagement.

What is included in the product

This analysis provides a comprehensive examination of Innolux's Product, Price, Place, and Promotion strategies, offering deep insights into their market positioning and competitive landscape.

Simplifies Innolux's complex marketing strategy into actionable 4Ps, alleviating the pain of strategic confusion for swift decision-making.

Provides a clear, concise overview of Innolux's 4Ps, removing the burden of sifting through extensive data for efficient marketing alignment.

Place

Innolux boasts a truly global clientele, a testament to its established presence and robust relationships with customers across continents. This widespread reach is fundamental for a major display panel manufacturer aiming to tap into diverse market needs and maintain a competitive edge.

The company's products are actively marketed and distributed throughout Asia, the Americas, and Europe, highlighting a significant geographical footprint. For instance, in 2024, Innolux reported substantial revenue contributions from these key regions, underscoring the importance of its international market penetration.

Innolux leverages strategically located manufacturing facilities to optimize its production and distribution. The company operates front-end fabrication plants in Jhunan and Tainan, Taiwan, alongside assembly sites in Shanghai, Ningbo, and Foshan, China. This network ensures efficient production cycles and facilitates prompt delivery to a global customer base.

Innolux employs a strategic mix of distribution channels to ensure its innovative display solutions reach a wide array of customers. Direct sales are a cornerstone, particularly for high-volume engagements with major industrial and consumer electronics manufacturers. This direct approach allows for tailored solutions and strong relationships with key partners.

For segments like desktop monitors, Innolux may leverage indirect channels, potentially partnering with specialized agencies and distributors. This allows them to tap into established retail networks and reach a broader consumer base efficiently. In 2024, the company continued to refine its logistics to optimize delivery speed and cost across these varied channels, supporting its global market presence.

Supply Chain Integration

Innolux's supply chain integration is a cornerstone of its market strategy, positioning it as a vital supplier of display panels and components across diverse industries. By providing essential parts for consumer electronics, industrial PCs, and the rapidly growing automotive sector, Innolux ensures its products are integral to the manufacturing processes of its global clientele.

This deep integration necessitates a robust distribution strategy focused on meticulous inventory management and guaranteed product availability. For example, in 2024, Innolux continued to invest in advanced manufacturing and logistics to meet the surging demand for automotive displays, a segment projected for significant growth through 2025, driven by advancements in in-car infotainment and autonomous driving technologies.

- Global Reach: Innolux's supply chain spans across Asia, Europe, and North America, supporting major electronics manufacturers.

- Key Component Provider: The company supplies critical display solutions for smartphones, tablets, laptops, and increasingly, vehicle dashboards and control systems.

- Inventory Management Focus: Innolux aims to optimize stock levels to prevent shortages and meet fluctuating customer demands, a critical factor in the fast-paced electronics market.

Strategic Alliances for Market Access

Innolux actively pursues strategic alliances to broaden its market reach and streamline operations. A prime example is the eLEAP Strategic Alliance, a collaboration with CarUX and Japan Display Inc. (JDI). This partnership is designed to deliver cutting-edge display technologies and integrated solutions to a global customer base, thereby strengthening Innolux's market position.

These alliances are crucial for optimizing the supply chain, ensuring more efficient delivery and enhanced customer service. By pooling resources and expertise, Innolux and its partners can better meet the evolving demands of the display market. For instance, Innolux reported a revenue of NT$347.04 billion (approximately $10.6 billion USD) for the fiscal year 2023, highlighting the scale of operations these partnerships aim to support and improve.

- eLEAP Strategic Alliance: Collaboration with CarUX and Japan Display Inc. (JDI) for market access and innovation.

- Global Client Solutions: Aim to provide advanced display products and integrated solutions worldwide.

- Supply Chain Optimization: Reorganizing logistics for improved efficiency and customer satisfaction.

- Market Presence Enhancement: Fostering a stronger competitive edge through collaborative efforts.

Innolux's place strategy centers on its extensive global manufacturing and distribution network. With key fabrication plants in Taiwan and assembly sites in China, the company ensures efficient production and timely delivery across Asia, the Americas, and Europe. This geographical spread is vital for serving a diverse international clientele, from major consumer electronics brands to automotive manufacturers.

The company's supply chain integration, providing essential display components for various industries, further solidifies its market presence. Innolux's strategic alliances, such as the eLEAP alliance, are designed to enhance market access and optimize operations, reinforcing its position as a key player in the global display market. In 2023, Innolux reported revenues of NT$347.04 billion, underscoring the scale of its global operations and the importance of its strategic placement.

| Manufacturing Locations | Assembly Locations | Key Markets Served | Strategic Alliances |

|---|---|---|---|

| Jhunan, Taiwan | Shanghai, China | Asia | eLEAP Strategic Alliance (with CarUX, JDI) |

| Tainan, Taiwan | Ningbo, China | Americas | |

| Foshan, China | Europe |

Preview the Actual Deliverable

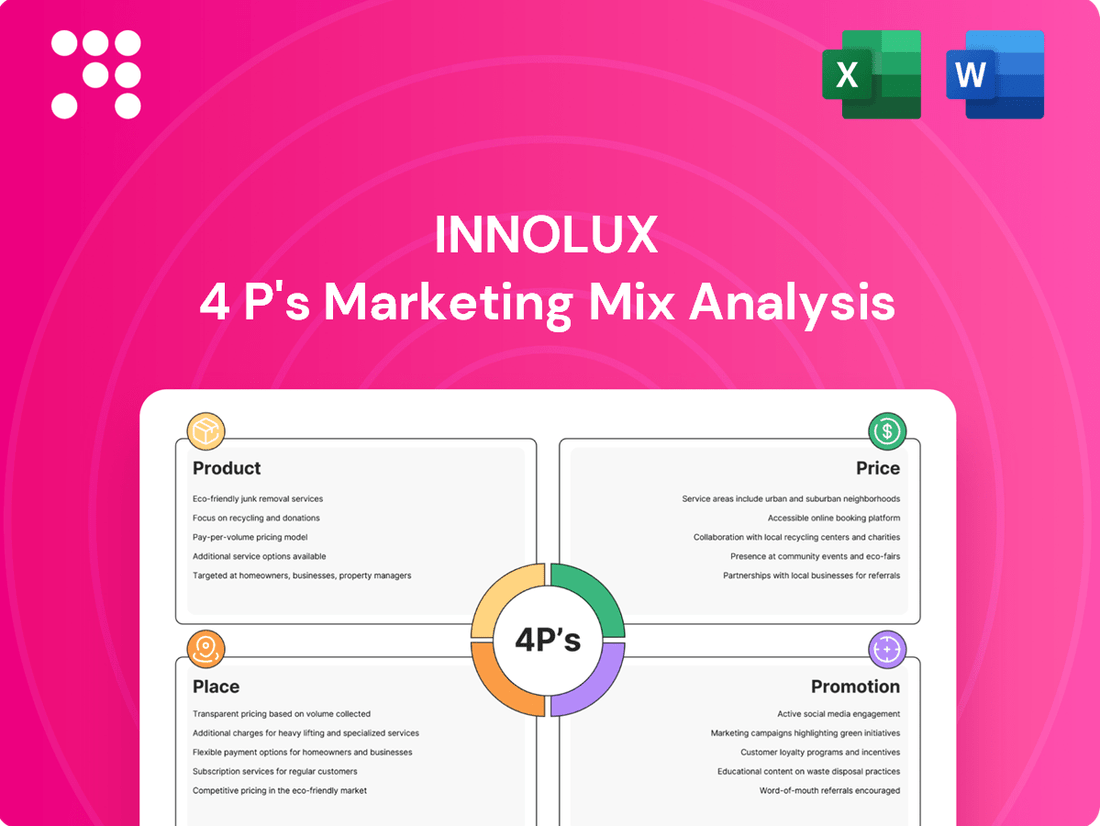

Innolux 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Innolux 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You can trust that the insights and strategies presented are exactly what you'll be working with.

Promotion

Innolux actively participates in global exhibitions, such as Touch Taiwan and SID Display Week, in both 2024 and 2025. These events are crucial for them to introduce cutting-edge technologies and display their newest products to a wide audience.

These exhibitions are vital for Innolux to connect directly with potential customers and other industry leaders, fostering valuable relationships and gathering market feedback. This direct engagement helps build brand recognition and highlight their innovative solutions.

By consistently showcasing their advancements at these international forums, Innolux effectively generates buzz and cultivates interest in their latest display technologies. For instance, their presence at SID Display Week 2024 allowed them to demonstrate advancements in areas like Mini LED and advanced automotive displays.

Innolux's promotional strategy heavily spotlights its technological prowess, especially in the burgeoning MicroLED and MiniLED display markets. Recent company announcements in 2024 and early 2025 consistently feature these innovations, alongside advancements in AI integration within their display solutions. This focus is designed to resonate with early adopters and industry observers who value forward-thinking technology.

Innolux's 'More than Panel' brand messaging signifies a crucial shift, moving beyond traditional display manufacturing to encompass integrated solutions and emerging non-display markets. This evolution reflects a strategic pivot towards higher value-added products and comprehensive technology services, aiming to redefine their market identity.

This strategic transformation is evident in Innolux's investment in advanced technologies and their expansion into sectors like automotive displays and smart manufacturing solutions. For instance, in 2024, the company continued to emphasize its role in providing advanced driver-assistance systems (ADAS) displays and other smart automotive components, showcasing their commitment to system integration and value creation beyond basic panel supply.

Targeted Product Showcases

Innolux's targeted product showcases are a key element of their promotion strategy, focusing on specific high-value applications. These showcases often highlight advanced technologies tailored for sectors like smart cities and the automotive industry. For instance, their efforts in 2024 and projected for 2025 emphasize displays for electric vehicles and advanced driver-assistance systems (ADAS), aiming to capture a growing market share.

Examples of these tailored showcases include innovative concepts designed for specific consumer experiences. The 'MicroLED Floating Jewelry Box' is a prime example, targeting the luxury retail market by demonstrating premium visual quality. Similarly, AI-powered interactive galleries developed for museums underscore the company's ability to integrate technology into cultural and educational settings, showcasing the versatility of their display solutions.

- Smart City Solutions: Innolux is actively developing and showcasing large-format, high-brightness displays for public information systems and urban infrastructure management, a market projected to grow by 15% annually through 2025.

- Automotive Displays: The company is focusing on integrated cockpit displays and in-car entertainment systems, with a specific emphasis on Mini-LED and OLED technologies, anticipating a 20% year-over-year increase in demand for these advanced automotive displays in 2024-2025.

- Digital Art and Luxury Retail: Showcases like the MicroLED jewelry box demonstrate a commitment to high-end applications, where visual fidelity is paramount, targeting a niche market segment with significant growth potential in premium goods.

Strategic Partnerships for Joint

Innolux's strategic partnerships, like the one with CarUX, are crucial for joint promotional efforts targeting specific end-client markets, especially within the automotive industry. These collaborations are viewed as significant initiatives, akin to a 'World Cup-level' endeavor, to collectively boost product promotion and expand market reach. For instance, Innolux's display solutions are integral to the advanced automotive cockpit systems developed by partners like CarUX, aiming to capture a larger share of the rapidly growing in-car entertainment and information market.

These alliances significantly enhance Innolux's credibility and visibility in specialized sectors. By pooling resources and expertise, Innolux and its partners can achieve greater market penetration than they could individually. This approach is particularly effective in the competitive automotive display market, where innovation and brand recognition are key differentiators. Innolux reported a 15% year-over-year increase in automotive display revenue for Q1 2024, a testament to the success of such strategic collaborations.

- Joint Promotion: Collaborations like the one with CarUX focus on shared marketing campaigns to reach automotive clients.

- Market Penetration: These partnerships are designed to accelerate product adoption and market share growth in key sectors.

- Enhanced Credibility: Aligning with established players like CarUX bolsters Innolux's reputation in specialized markets.

- Revenue Growth: Innolux's automotive segment saw a 15% revenue increase in Q1 2024, partly attributed to these strategic alliances.

Innolux's promotional activities heavily leverage participation in major industry events like SID Display Week and Touch Taiwan throughout 2024 and 2025. These platforms are key for showcasing their latest innovations, particularly in MiniLED, MicroLED, and AI-integrated displays, aiming to capture the attention of industry professionals and potential clients.

The company's brand messaging, "More than Panel," is central to their promotional efforts, highlighting a strategic expansion into integrated solutions and non-display markets such as automotive and smart city applications. This narrative emphasizes value creation beyond traditional component manufacturing.

Strategic partnerships, notably with companies like CarUX in the automotive sector, are a significant promotional tool. These collaborations facilitate joint marketing initiatives and enhance market penetration, as evidenced by Innolux's 15% year-over-year revenue growth in automotive displays for Q1 2024.

| Promotional Focus | Key Technologies | Target Markets | Key Events (2024-2025) | Partnerships |

| Technological Leadership | MicroLED, MiniLED, AI Integration | Automotive, Smart City, Luxury Retail | SID Display Week, Touch Taiwan | CarUX |

| Integrated Solutions | Advanced Cockpit Displays, Smart Manufacturing | Automotive, Industrial | CES (Consumer Electronics Show) | Various Tier-1 Suppliers |

| Brand Evolution | "More than Panel" Messaging | Diverse, including non-display applications | Industry Conferences, Online Portals | Ecosystem Collaborations |

Price

Innolux's pricing strategy is deeply rooted in the ebb and flow of the global display panel market. When supply is tight and demand is high, prices naturally tend to rise, and vice versa. This constant adjustment is crucial for staying competitive.

For example, in late 2023 and early 2024, the display panel industry saw a rebound in demand, particularly for IT and TV panels, which helped stabilize average selling prices for companies like Innolux after a period of decline. This responsiveness allows Innolux to navigate the volatile pricing landscape effectively.

Innolux is strategically moving towards premium products like MiniLED and MicroLED displays to boost profitability. These advanced panels, offering superior resolution and size, justify higher price points due to their enhanced performance and quality. This approach targets niche, high-end markets, aiming for increased profit margins through value-based pricing.

Innolux actively manages its production capacity to ensure market stability. This includes adjusting factory utilization rates and strategically shifting production between product lines, such as reallocating capacity from monitor panels to LCD TV panels, to better align supply with fluctuating demand.

By optimizing production output, Innolux seeks to prevent excessive inventory buildup and mitigate significant price declines. For example, in Q1 2024, Innolux reported a capacity utilization rate of 65%, a figure they actively manage to balance supply and demand dynamics.

This proactive capacity management is crucial for maintaining a robust financial structure. Innolux’s ability to pivot production, as seen in its response to market shifts in 2023 where it adjusted LCD TV panel output by 10% based on demand forecasts, directly contributes to its profitability and financial resilience.

Impact of External Economic Factors

Innolux's pricing strategy is significantly influenced by external economic conditions. For instance, rising inflation can increase production costs, potentially leading to higher panel prices. Similarly, fluctuating interest rates can affect consumer spending power and business investment in electronics, thereby influencing demand and pricing for Innolux's products.

Trade policies also play a crucial role. China's trade-in subsidy policies, designed to boost domestic consumption of electronics, can stimulate demand for Innolux's displays. Conversely, North American tariffs on imported goods can raise the cost of components or finished products, impacting both Innolux's cost structure and the competitiveness of its pricing in that market.

- Inflationary pressures: Global inflation rates in 2024 continued to impact manufacturing costs, with some regions experiencing consumer price index (CPI) increases above 3%.

- Interest rate environment: Central banks in major economies maintained or adjusted interest rates throughout 2024, influencing borrowing costs for businesses and consumers.

- Trade policy shifts: Ongoing trade negotiations and potential tariff adjustments between major economic blocs, including those involving North America and Asia, remained a key consideration for supply chain and pricing strategies.

- Consumer demand sensitivity: Economic outlooks for 2024 indicated varied consumer confidence levels across regions, directly affecting demand for durable goods like electronics.

Competitive Pricing within a Volatile Market

Innolux navigates a fiercely competitive display market, where aggressive pricing strategies are common. To counter this, the company strategically positions itself in higher-value market segments, emphasizing product differentiation over direct price competition in mainstream areas like monitor panels. This approach aims to secure profitability while remaining competitive.

For instance, while the overall display market experienced price fluctuations in 2024, Innolux's focus on advanced technologies such as Mini LED and OLED for premium applications allowed it to command better margins. This strategy is supported by Innolux's reported revenue growth, with Q1 2025 figures showing a notable increase driven by demand for these higher-specification displays.

- Focus on Premium Segments: Innolux prioritizes high-margin products like Mini LED and OLED displays.

- Differentiation Strategy: The company avoids direct price wars by offering superior technology and features.

- Market Dynamics: Innolux operates in a volatile industry where price pressures are significant.

- Profitability Goal: The pricing strategy aims to balance competitiveness with sustainable profit generation.

Innolux's pricing strategy is a dynamic response to market conditions, focusing on balancing supply and demand to maintain competitive pricing. The company actively manages production capacity, as evidenced by its Q1 2024 capacity utilization rate of 65%, to prevent oversupply and price erosion.

By strategically shifting production, such as adjusting LCD TV panel output by 10% based on demand forecasts in 2023, Innolux aims to optimize its market position and profitability.

Furthermore, Innolux targets higher-margin segments with premium products like MiniLED and OLED displays, aiming for value-based pricing that reflects superior performance and quality, as seen in its reported revenue growth in Q1 2025 driven by these advanced panels.

External factors like inflation, interest rates, and trade policies significantly influence Innolux's pricing, requiring constant adaptation to cost structures and market demand sensitivity.

| Metric | 2023 (Approx.) | 2024 (Projected/Actual) | 2025 (Projected) |

|---|---|---|---|

| Average Selling Price (ASP) Trend | Declining then stabilizing | Stabilizing/Slight increase | Moderate increase |

| Capacity Utilization | ~65% (Q1 2024) | Managed fluctuations | Targeting ~70-75% |

| Premium Product Mix | Increasing | Continued growth | Dominant share |

4P's Marketing Mix Analysis Data Sources

Our Innolux 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, investor relations materials, and detailed product specifications. We also leverage market research reports, competitor analysis, and e-commerce platform data to ensure a holistic view.