Innolux Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Innolux Bundle

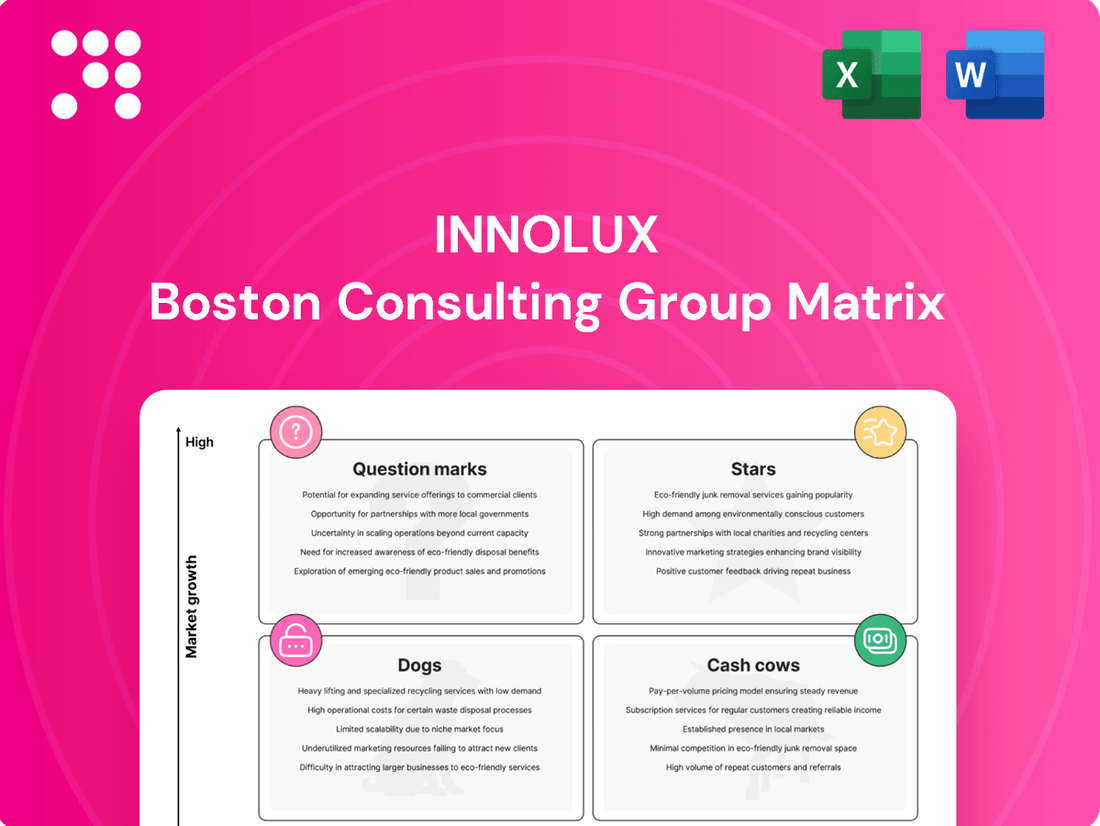

Curious about Innolux's product portfolio performance? This glimpse into their BCG Matrix reveals how their offerings stack up as Stars, Cash Cows, Dogs, or Question Marks. Don't miss out on the full strategic picture; purchase the complete report for actionable insights and a clear roadmap to optimizing your investments.

Stars

Innolux is making substantial investments in cutting-edge automotive displays, such as MicroLED and MiniLED, with the goal of becoming a primary supplier of smart cockpit systems. This strategic move positions them to capitalize on the booming automotive market.

The demand for advanced driver-assistance systems (ADAS) and in-vehicle infotainment is fueling rapid expansion in this sector. Innolux's subsidiary, CarUX, recently acquired Pioneer, a move that strengthens its foothold in the automotive supply chain, especially with its sights set on Japanese car manufacturers.

Innolux is aggressively pursuing MicroLED technology, positioning it as their future growth engine with mass production targeted for 2025. They've demonstrated advanced prototypes, including high-resolution, free-tiling, and transparent MicroLED displays.

These innovations are slated for applications in smart cockpits, retail displays, and large public screens, highlighting a strategic push into high-value markets. The superior brightness, contrast, and energy efficiency of MicroLED suggest a burgeoning market where Innolux aims to be a key player.

Innolux is pushing the boundaries with its advanced MiniLED technologies, including flexible AM MiniLED displays and direct view MiniLED televisions. These innovations are designed for premium markets, offering exceptional clarity, slim profiles, and even bendable capabilities.

The company is targeting high-end applications like outdoor and public displays, as well as the burgeoning smart automotive sector with these cutting-edge MiniLED solutions. This strategic focus highlights Innolux's drive towards higher value-added products within the expanding advanced backlighting market.

AI-Driven Interactive Displays

Innolux is leveraging AI to create interactive display solutions, exemplified by their 85-inch 4K AI Interactive InnoGallery. This product, along with innovations like the MicroLED Floating Jewelry Box, showcases advanced gesture sensing and voice control capabilities, transforming passive displays into engaging experiences. These advancements position Innolux as an early mover in the burgeoning market for AI-enhanced visual technology.

These intelligent displays are designed for smart city applications, including digital museums, therapeutic environments, and premium retail spaces. For instance, the InnoGallery can personalize visitor experiences in museums by responding to user interactions, offering a glimpse into the future of public engagement. This strategic focus on interactive AI displays targets a high-growth segment where early innovation can capture significant market share.

The market for interactive displays, particularly those enhanced by AI, is experiencing rapid expansion. While specific 2024 revenue figures for Innolux's AI-driven displays are still emerging, the broader smart display market is projected for substantial growth. For example, the global interactive flat panel display market was valued at approximately $10.5 billion in 2023 and is expected to grow at a CAGR of over 8% through 2030, according to industry reports.

Innolux's investment in AI-driven interactive displays aligns with broader industry trends:

- Technological Integration: Seamlessly blending AI with display hardware for enhanced user interaction.

- Market Focus: Targeting high-value sectors like smart cities, healthcare, and luxury retail.

- Innovation Leadership: Establishing a competitive edge through early adoption of advanced interactive technologies.

- Future Growth Potential: Capitalizing on the anticipated expansion of the AI-powered display market.

Public and Commercial Displays (Innovative Solutions)

Innolux is actively innovating in the public and commercial display sector, developing solutions like seamless MiniLED public displays and rugged outdoor Human-Machine Interface (HMI) displays. These advancements are designed for applications such as digital signage and electric vehicle charging stations, addressing a significant market need.

The demand for large-scale, high-brightness, and energy-efficient displays in commercial environments is on the rise, positioning Innolux to capture market share. For instance, the global digital signage market was valued at approximately USD 24.7 billion in 2023 and is projected to grow significantly in the coming years.

- Unlimited Splicing MiniLED Public Displays: These offer unparalleled visual continuity for large-scale installations.

- Outdoor HMI Displays: Designed for durability and visibility in challenging outdoor conditions, supporting digital signage and EV charging infrastructure.

- Market Growth: The commercial display market, particularly for digital signage and interactive kiosks, is experiencing robust expansion, driven by digital transformation initiatives across industries.

- Innolux's Position: The company's focus on advanced technologies like MiniLED and robust outdoor solutions highlights its strategy to lead in this dynamic and growing segment.

Innolux's MicroLED and MiniLED technologies are positioned as Stars in the BCG matrix, representing high-growth, high-market-share areas. Their aggressive development and targeted applications in automotive cockpits, smart cities, and premium retail indicate strong future potential. The company's strategic investments and acquisitions, like CarUX's purchase of Pioneer, further solidify their leading position in these emerging high-value segments.

What is included in the product

The Innolux BCG Matrix analyzes its product portfolio to identify Stars, Cash Cows, Question Marks, and Dogs, guiding investment and divestment strategies.

Provides a clear, visual representation of Innolux's product portfolio, simplifying complex strategic decisions.

Cash Cows

Traditional LCD panels for TVs and monitors are likely Innolux's cash cow, despite the company's diversification efforts. This segment operates in a mature market where Innolux has established a strong presence.

Innolux is projected to hold approximately 11.6% of all large-area LCD shipments in 2025, underscoring its significant market share. The company strategically reallocated production capacity from monitors to LCD TV panels, recognizing the greater profitability in the latter.

Standard mobile device displays, encompassing both LCD and OLED technologies, are a significant segment for Innolux. This market is characterized by its maturity and substantial volume, meaning Innolux can rely on consistent, high-volume sales from these products.

While Innolux invests in developing cutting-edge displays for emerging applications, the ongoing demand for standard mobile displays ensures a stable and predictable cash flow. These established product lines benefit from optimized production processes and strong, long-standing relationships with major mobile device manufacturers.

In 2023, the global smartphone display market was valued at approximately $47.8 billion, with LCDs still holding a considerable share despite the rise of OLED. Innolux’s established presence in this high-volume, mature market makes these standard displays a reliable source of revenue, contributing significantly to its overall financial stability.

Innolux's Integrated Display Modules represent a strategic move beyond basic panel production, incorporating touch functionalities and other essential components. This value-added offering caters to a diverse global customer base, leveraging Innolux's established panel manufacturing prowess. These integrated solutions are positioned as a stable revenue generator within a mature market, capitalizing on their existing technological strengths.

Legacy Industrial Displays

Legacy Industrial Displays are a cornerstone for Innolux, positioning them as a Cash Cow within the BCG Matrix. Innolux holds a significant share of industrial display panel shipments, a market projected for continued expansion into 2025.

While 2024 saw some inventory adjustments in specific industrial sectors, the underlying demand in areas such as e-cigarettes and game consoles remains robust. This indicates a stable, though not rapidly accelerating, revenue stream.

This segment provides a consistent and reliable source of cash flow for Innolux, supporting other areas of their business.

- Innolux's strong position in industrial display panel shipments is expected to benefit from market growth into 2025.

- Demand resilience in segments like e-cigarettes and game consoles underpins the stability of this Cash Cow.

- The segment generates steady cash flow, contributing reliably to Innolux's overall financial health.

Automotive TFT-LCD Displays (Standard)

Innolux holds a strong position in the automotive TFT-LCD display sector, a market projected to see substantial growth. This expansion is fueled by the increasing integration of advanced driver-assistance systems (ADAS) and sophisticated in-vehicle infotainment solutions.

While Innolux actively develops cutting-edge display technologies, its continued strength in standard automotive TFT-LCDs offers a stable and significant revenue stream. This established market share in core products underpins its financial performance.

- Market Share: Innolux is a top-tier supplier, consistently ranking among the leading global manufacturers of automotive displays.

- Revenue Contribution: Standard automotive TFT-LCDs represent a substantial portion of Innolux's display revenue, acting as a reliable cash generator.

- Growth Drivers: The automotive industry's shift towards digitalization and enhanced user experiences directly benefits Innolux's standard display offerings.

- Competitive Landscape: Innolux competes effectively by leveraging its scale and established relationships with major automotive manufacturers.

Innolux's traditional LCD panels for TVs and monitors are key cash cows, leveraging its strong market presence in a mature sector. The company's strategic shift to prioritize LCD TV panels over monitors, due to higher profitability, further solidifies this position.

Standard mobile device displays, encompassing both LCD and OLED, also contribute significantly as cash cows. This high-volume, mature market ensures consistent sales, supported by optimized production and strong manufacturer relationships.

Legacy industrial displays, including those for e-cigarettes and game consoles, represent another stable revenue stream. Innolux's established market share in this segment provides reliable cash flow, bolstering its overall financial stability.

Automotive TFT-LCD displays are a substantial cash generator for Innolux, driven by the increasing demand for advanced in-car technology. Innolux's leading position in this sector, supplying standard displays, ensures a consistent and significant revenue contribution.

| Product Segment | Market Maturity | Innolux's Position | Cash Flow Contribution | Key Drivers |

|---|---|---|---|---|

| Traditional LCD Panels (TVs/Monitors) | Mature | Strong Market Share (approx. 11.6% of large-area LCD shipments in 2025) | High, Stable | Established presence, strategic capacity allocation |

| Standard Mobile Displays (LCD/OLED) | Mature | Significant Volume | High, Consistent | High-volume sales, optimized production, strong relationships |

| Legacy Industrial Displays | Mature | Significant Share | Steady, Reliable | Robust demand in niche segments (e-cigarettes, game consoles) |

| Automotive TFT-LCD Displays | Growing | Top-Tier Supplier | Substantial, Growing | Increasing ADAS and infotainment integration |

Full Transparency, Always

Innolux BCG Matrix

The Innolux BCG Matrix document you are currently previewing is the identical, fully finalized report you will receive immediately after completing your purchase. This means you're seeing the complete, unwatermarked analysis, ready for immediate integration into your strategic planning processes without any further modifications or hidden content.

Dogs

The market for commoditized, low-end LCD panels, particularly those used in widely available consumer electronics, often faces intense price wars and slim profit margins. This segment can be categorized as a 'Dog' within the BCG matrix framework.

Innolux has been strategically reducing its direct involvement in highly competitive, price-sensitive segments. This move suggests a deliberate effort to limit further investment in areas characterized by slower growth and reduced profitability, such as these low-end LCD markets.

For instance, while specific 2024 Innolux financial data on this exact segment is proprietary, the broader display industry in 2023 saw significant price erosion in standard TV panels, impacting overall profitability for manufacturers heavily reliant on these products.

Innolux's older generation fab capacity, like its 5.5G factory sold to TSMC, is being phased out or repurposed. This strategic move acknowledges that these older facilities, if left as is, represent low-growth, low-market-share assets in the competitive display manufacturing landscape.

Innolux is reportedly shifting its focus away from certain desktop monitor panels, especially mainstream and lower-end segments, due to persistent profitability challenges. This strategic move suggests these product lines may be categorized as 'Dogs' within the BCG matrix, indicating low market share and low growth potential.

The company's intention to minimize investment in these areas highlights a recognition of their declining appeal or competitive intensity. For instance, in 2023, the overall monitor market experienced a decline in shipments compared to previous years, with a particular slowdown in standard resolution panels.

Products with Declining Demand from Specific Clients

Innolux's fan-out panel-level packaging (FOPLP) technology, initially targeting power management ICs for smartphones, has encountered headwinds due to a slowdown in the smartphone market. This directly impacts clients who have consequently scaled back their plans, pushing these specific FOPLP applications towards a 'dog' status within the BCG matrix.

The global smartphone market experienced a decline in shipments in 2023, with IDC reporting a 3.2% year-over-year decrease. This challenging environment directly affects Innolux's ability to secure new orders for its FOPLP solutions tailored for this sector, highlighting the risk of products tied to declining client demand.

- Declining Smartphone Market: Global smartphone shipments saw a dip in 2023, impacting demand for components like power management ICs.

- Client Plan Revisions: Innolux's clients have adjusted their strategies, leading to reduced orders for FOPLP technology.

- Limited Alternative Applications: The current FOPLP applications are heavily reliant on the smartphone sector, with few immediate alternative uses.

- Potential 'Dog' Status: Products with declining client demand and no clear pivot strategy risk becoming 'dogs' in the BCG matrix.

Non-Strategic, Low-Margin OEM Businesses

Businesses in Innolux's portfolio that are characterized by highly commoditized manufacturing or supply chain activities, offering little differentiation and minimal strategic value, would be classified as Dogs. These are areas where Innolux holds a low market share, indicating a struggle to compete effectively.

Innolux's strategic pivot towards becoming a Tier-1 system supplier signals a deliberate effort to move away from these low-margin, non-strategic Original Equipment Manufacturer (OEM) roles. For example, in 2024, the global display market, particularly for standard LCD panels, continued to face intense price competition, with average selling prices for many mainstream products remaining under pressure, underscoring the challenges of low-margin OEM businesses.

- Low Market Share: Innolux's presence in highly commoditized OEM segments often translates to a smaller slice of the overall market, making it difficult to achieve economies of scale.

- Minimal Differentiation: Products in these segments typically lack unique features or technological advantages, leading to price-based competition.

- Low Profitability: The combination of intense competition and lack of differentiation results in thin profit margins, hindering reinvestment and growth.

- Strategic Shift: Innolux’s stated goal to evolve into a Tier-1 system supplier aims to capture higher value and exert more control over product development and market positioning, moving beyond basic panel manufacturing.

Innolux's 'Dog' segments represent product lines or business areas with low market share and low growth potential, often characterized by intense competition and slim profit margins. These are typically commoditized offerings where differentiation is minimal, such as older generation LCD panels or specific applications within the smartphone component market like FOPLP for power management ICs. The company's strategy involves minimizing investment in these areas and repurposing or divesting older capacity to focus on more promising ventures.

The company's strategic divestment of older fab capacity, such as its 5.5G factory, underscores a recognition of these assets as low-growth, low-market-share entities. This aligns with the BCG matrix classification of 'Dogs,' where continued investment yields diminishing returns. For instance, the global display industry in 2023 continued to see price pressures on standard panels, impacting profitability for manufacturers heavily exposed to these segments.

Innolux's move to reduce focus on certain mainstream and lower-end desktop monitor panels also points to 'Dog' classification due to persistent profitability challenges. The overall monitor market experienced a slowdown in shipments in 2023, particularly for standard resolution panels, reinforcing the low-growth, low-share nature of these offerings.

The company's FOPLP technology, initially aimed at smartphone power management ICs, faces 'Dog' status due to a slowdown in the smartphone market and revised client plans. Global smartphone shipments declined by 3.2% year-over-year in 2023, directly impacting demand for these specialized components and limiting Innolux's ability to secure new orders.

| Business Segment/Product Line | BCG Classification | Market Growth | Market Share | Profitability Outlook |

|---|---|---|---|---|

| Low-end LCD Panels (Commoditized Consumer Electronics) | Dog | Low | Low | Low/Negative |

| Older Generation Fab Capacity (e.g., 5.5G) | Dog | Low | Low | Low/Negative |

| Mainstream/Lower-end Desktop Monitor Panels | Dog | Low | Low | Low |

| FOPLP for Smartphone Power Management ICs | Dog | Low (due to market slowdown) | Low (due to client plan revisions) | Low |

Question Marks

While Innolux does produce OLED panels, their strategic emphasis appears to be shifting towards MicroLED and MiniLED technologies for future expansion. This positions the general consumer OLED market as a potential Question Mark for Innolux.

The broader consumer OLED market is experiencing growth, but it's also highly competitive, with giants like Samsung Display and LG Display dominating market share. Innolux faces a challenge in capturing a significant portion of this growing, yet entrenched, market.

Innolux's Fan-Out Panel-Level Packaging (FOPLP) technology is positioned as a Question Mark in the BCG Matrix. While its potential for diversification, especially in the automotive sector, is high, mass production has faced delays.

This classification stems from the extended verification cycles required for new technologies like FOPLP and the dynamic nature of customer demand shifts. Despite these challenges, FOPLP offers significant future growth opportunities if these hurdles are successfully navigated.

For instance, the automotive display market, a key target for FOPLP, is projected to grow substantially. In 2024, the global automotive display market was valued at approximately USD 14.5 billion and is expected to reach over USD 25 billion by 2030, indicating a strong demand for advanced display solutions that FOPLP could fulfill.

Innolux is exploring the burgeoning field of AI-driven software and hardware integrations, including generative AI for 3D modeling. These initiatives represent early-stage ventures into potentially high-growth markets, aligning with the characteristics of a question mark in the BCG matrix.

The company's focus on these emerging technologies suggests a strategy to capture future market share, even if current adoption and revenue are minimal. For instance, the global AI market was valued at approximately $200 billion in 2023 and is projected to grow significantly, with generative AI alone expected to reach hundreds of billions by 2030, providing a clear indicator of the potential upside for Innolux's investments in this area.

Advanced E-paper Solutions (iLC Papuros)

Innolux's 13.3-inch iLC Papuros display represents a 'Question Mark' within the BCG matrix. This advanced e-paper solution targets growing niche markets like e-readers and electronic billboards, boasting high reflectivity, vibrant colors, and significant energy efficiency.

The classification as a Question Mark stems from the dynamic nature of the e-paper market. While it's expanding, Innolux's current market share and the long-term competitive positioning of iLC Papuros are still solidifying.

- Market Potential: The global e-paper display market is projected to grow, with some estimates suggesting a compound annual growth rate (CAGR) of over 10% in the coming years, driven by demand for eco-friendly and power-saving displays.

- Competitive Landscape: Innolux faces established players and emerging technologies in the e-paper space, making its ability to capture significant market share a key determinant of future success.

- Technological Advancement: The iLC Papuros technology itself, offering color and improved refresh rates compared to traditional e-paper, positions it for potential growth, but its adoption rate and differentiation need to be proven.

- Investment Needs: Continued investment in research and development, alongside aggressive market penetration strategies, will be crucial for iLC Papuros to transition from a Question Mark to a Star.

High-Resolution, Niche Monitor Panels

Innolux is strategically pivoting its monitor panel production towards high-resolution offerings, specifically in the 27-inch and 31.5-inch sizes. This move signifies a departure from their previous focus on more mainstream monitor segments. The company aims to capitalize on the increasing demand for premium display experiences.

This strategic shift places these high-resolution niche panels within the 'Question Mark' category of the BCG Matrix. While the high-end monitor market is showing robust growth, Innolux faces intense competition from established brands with strong brand loyalty and advanced technological capabilities in this specific segment. The success hinges on Innolux's ability to carve out a significant market share against these entrenched competitors.

- Targeting Growth: The market for high-resolution monitors, particularly in the 27-inch and 31.5-inch sizes, is expanding, presenting a significant opportunity for Innolux.

- Competitive Landscape: Established players in the premium monitor space already hold considerable market share, making it challenging for Innolux to gain traction quickly.

- Investment Required: Capturing market share in this niche will likely necessitate substantial investment in research and development, marketing, and brand building.

- Uncertain Future: The ultimate success of this strategy is uncertain, as it depends on Innolux's execution and its ability to differentiate its offerings effectively.

Innolux's foray into generative AI for 3D modeling and related software/hardware integrations represents a classic Question Mark. These are early-stage ventures with high growth potential but uncertain market adoption and revenue generation. The global AI market's substantial growth, with generative AI alone projected to reach hundreds of billions by 2030, underscores the significant upside if Innolux can successfully navigate this nascent field.

The company's 13.3-inch iLC Papuros e-paper display is also a Question Mark. While the e-paper market is expanding, with a projected CAGR over 10%, Innolux's current market share and the long-term competitive positioning of iLC Papuros are still being established. Continued investment in R&D and market penetration will be key for its future success.

Innolux's strategic pivot to high-resolution monitor panels, specifically 27-inch and 31.5-inch, places these products in the Question Mark category. The premium monitor market is growing, but Innolux faces stiff competition from established brands. Success hinges on their ability to differentiate and capture market share in this niche, requiring substantial investment.

| Innolux Question Marks | Market Potential | Competitive Landscape | Investment Needs | Outlook |

| Generative AI for 3D Modeling | High (AI market projected to reach hundreds of billions by 2030) | Nascent, high competition | Significant R&D and market entry | Uncertain but high growth potential |

| 13.3-inch iLC Papuros (e-paper) | Growing (e-paper CAGR > 10%) | Established players and emerging tech | R&D, marketing, brand building | Dependent on market share capture |

| High-Resolution Monitor Panels (27/31.5-inch) | Robust (premium monitor segment) | Intense competition from established brands | Substantial investment in R&D, marketing | Challenging, requires strong differentiation |

BCG Matrix Data Sources

Our Innolux BCG Matrix is built on a foundation of robust market data, incorporating financial reports, industry growth rates, and competitive landscape analysis for informed strategic decisions.