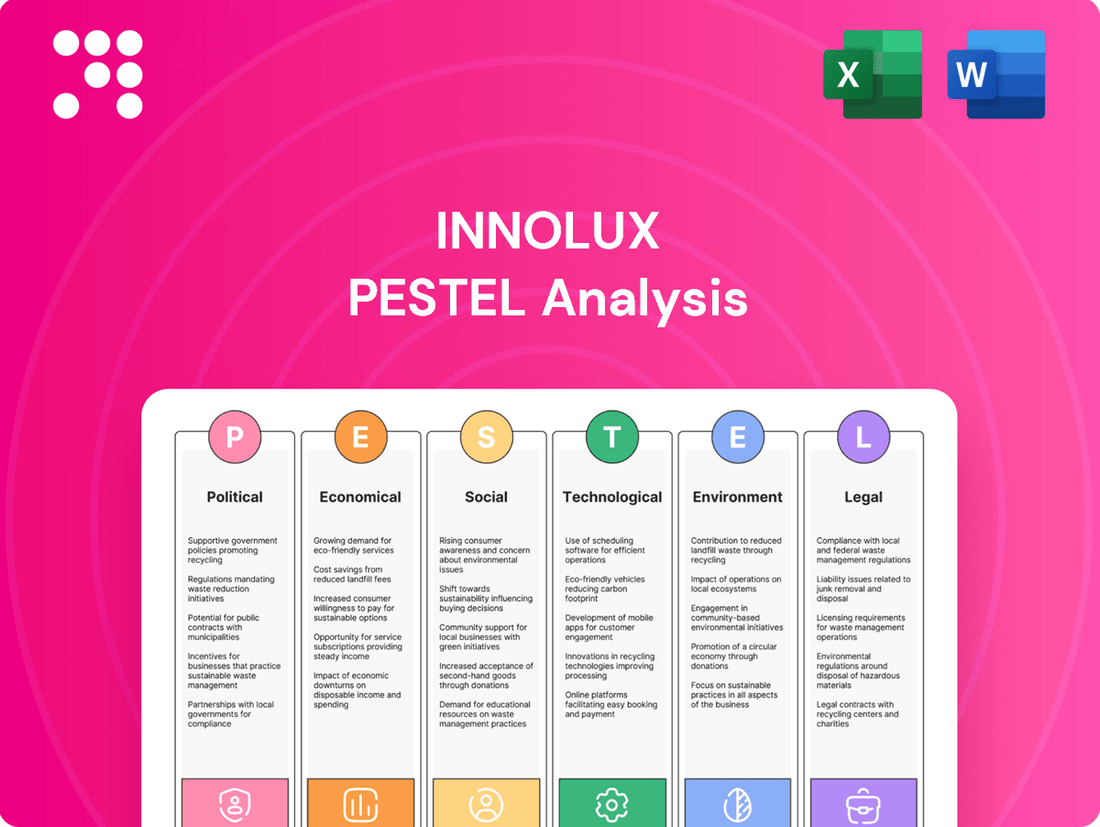

Innolux PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Innolux Bundle

Uncover the critical political, economic, social, technological, environmental, and legal factors shaping Innolux's trajectory. Our PESTLE analysis provides essential intelligence for strategic planning and competitive advantage. Download the full version to gain actionable insights and make informed decisions.

Political factors

Innolux, a key player in Taiwan's display manufacturing sector, faces significant risks from escalating geopolitical tensions, particularly the ongoing US-China trade friction. Renewed tariff threats, especially if former President Trump returns to office in 2025, could directly impact Innolux's export-oriented business model. For instance, the US imposed tariffs on various goods from China, and similar measures targeting electronics components could raise costs for Innolux or its customers.

Taiwan's strategic position in the global technology supply chain, particularly in displays, has led to its designation as a 'national security' linchpin. This classification could influence how international trade policies and alliances are shaped, potentially creating both opportunities and challenges for Innolux. For example, the US CHIPS and Science Act of 2022, while focused on semiconductors, highlights the growing emphasis on securing critical technology supply chains, a trend that could extend to display manufacturing.

The Taiwanese government's robust support for its display industry, a sector crucial for companies like Innolux, remains a significant political factor. This backing often materializes through direct funding, tax incentives, and research and development grants, aiming to foster innovation and maintain global competitiveness.

Innolux has publicly advocated for the continuation and expansion of these industrial subsidy programs, particularly beyond their current 2025 expiration. This highlights the company's reliance on government assistance to navigate market fluctuations and invest in future technologies.

Furthermore, there are ongoing governmental efforts to fortify the display industry's supply chain, especially as global funding priorities increasingly shift towards artificial intelligence and semiconductor manufacturing. This strategic redirection could impact the availability and cost of essential components for Innolux.

Such government backing provides Innolux with a vital competitive edge, helping to offset the substantial capital expenditures inherent in display manufacturing and mitigating potential financial headwinds.

The political relationship between Taiwan and mainland China remains a critical factor for Innolux. Any significant escalation in cross-strait tensions, such as increased military exercises or trade restrictions, could create substantial operational disruptions. This uncertainty directly impacts Innolux's manufacturing facilities and its extensive global sales network, given its position as a major display panel supplier.

In 2024, the geopolitical climate continues to be a key consideration. For instance, the ongoing trade disputes and technological competition between the US and China, which often involve Taiwan, can create ripple effects. Innolux, with its substantial production capacity in Taiwan and mainland China, must navigate these complexities to ensure supply chain resilience and continued market access for its products.

Tariff Policies and Trade Agreements

Changes in global tariff policies and trade agreements significantly impact Innolux's operational costs and market competitiveness. For example, the US imposition of tariffs on goods from China could lead Innolux, a Taiwanese company, to benefit if its production is not similarly taxed or if it receives government aid to mitigate such effects. This dynamic highlights the importance of monitoring trade relations for strategic supply chain adjustments.

Innolux's financial performance is directly tied to these trade policies. For instance, in 2023, the global electronics industry faced disruptions due to ongoing trade tensions, impacting component pricing and demand. Companies like Innolux must navigate these shifts to maintain cost advantages and market access.

- Tariff Impact: Increased tariffs on display components could raise Innolux's manufacturing costs, potentially affecting its pricing strategy.

- Trade Agreements: Favorable trade agreements, such as those involving Taiwan and key markets, can reduce import duties, enhancing Innolux's export competitiveness.

- Supply Chain Reshaping: Geopolitical shifts and trade disputes in 2024-2025 are prompting electronics manufacturers to diversify their supply chains away from single-country dependencies, potentially creating opportunities for Taiwanese firms like Innolux.

- Market Access: Trade barriers can limit Innolux's access to crucial international markets, necessitating strategic market entry and pricing adjustments.

National Security and Supply Chain Resilience

Governments are increasingly prioritizing national security in critical technology sectors like display manufacturing. This focus can drive policies encouraging domestic production or shifting supply chains away from areas deemed risky. For Innolux, this presents a dynamic landscape where strategic location and supply chain diversification become paramount for navigating potential trade restrictions or incentives.

The push for supply chain resilience, particularly in advanced electronics, intensified following global disruptions. Innolux, as a major display panel manufacturer, is directly impacted by these geopolitical considerations. For instance, the US CHIPS and Science Act of 2022, while primarily focused on semiconductors, signals a broader trend of governments investing in domestic high-tech manufacturing to reduce reliance on foreign sources, potentially influencing future investment decisions and market access for companies like Innolux.

- National Security Lens: Governments view display technology as a strategic asset, influencing trade and investment policies.

- Supply Chain Diversification: Policies may encourage or mandate reduced reliance on specific geopolitical regions for critical components.

- Onshoring Initiatives: Governments are exploring incentives for domestic manufacturing of advanced technologies, potentially impacting global production footprints.

- Geopolitical Risk: Innolux must adapt to evolving international relations that could affect market access and operational costs.

Geopolitical tensions, particularly US-China trade friction, pose significant risks to Innolux's export-reliant business model, with potential tariff increases under a future Trump administration impacting costs. Taiwan's designation as a critical technology hub, as seen with the US CHIPS Act, underscores a global trend towards securing supply chains, which could benefit or challenge display manufacturers like Innolux.

Government support remains crucial for Innolux, with the company advocating for continued R&D grants and tax incentives beyond their 2025 expiration to maintain competitiveness. The ongoing redirection of global funding towards AI and semiconductors could also affect component availability and pricing for Innolux.

Cross-strait relations between Taiwan and China are a critical factor, as escalated tensions could disrupt Innolux's operations and global sales network. In 2024, navigating US-China technological competition is vital for Innolux's supply chain resilience and market access, given its production presence in both Taiwan and mainland China.

Changes in global trade policies directly influence Innolux's costs and market competitiveness, with trade barriers potentially limiting access to key markets and necessitating strategic adjustments.

What is included in the product

This Innolux PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal factors influencing the company's operations and strategic decisions.

It provides a comprehensive understanding of the external landscape, enabling informed strategic planning and risk management.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering immediate clarity on Innolux's external landscape to streamline strategic decision-making.

Economic factors

The global flat panel display market is poised for continued expansion, fueled by the insatiable demand for smart devices and the burgeoning Internet of Things (IoT) ecosystem. This growth is further accelerated by the adoption of cutting-edge display technologies such as OLED and Micro-LED, promising enhanced visual experiences.

Innolux's financial performance mirrors these industry dynamics. The company reported revenue growth in 2024, demonstrating its ability to capitalize on the increasing demand for display solutions. Furthermore, Innolux's strategic push into non-display sectors in 2025 underscores its proactive approach to diversifying revenue streams and mitigating reliance on the cyclical display market.

Inflationary pressures in 2024 and 2025 continue to impact the cost of essential raw materials for display manufacturers like Innolux. The price of glass substrates, specialized chemicals, and rare earth elements, critical for advanced display technologies, has seen significant upward movement, directly affecting production expenses.

Innolux's profitability is intrinsically linked to the stability and cost-effectiveness of its global supply chain. Disruptions, whether due to geopolitical events or logistical bottlenecks, can lead to material shortages and increased component prices, impacting Innolux's ability to maintain competitive pricing in a highly price-sensitive market.

For instance, the average cost of key semiconductor components, vital for display driver ICs, experienced a notable increase of 8-12% in late 2024, a trend expected to persist into early 2025, necessitating careful cost management by Innolux to preserve its profit margins.

The flat panel display market is notoriously competitive, with intense price pressure, especially from Chinese competitors, frequently squeezing profit margins for companies like Innolux. This dynamic means that even with strong demand, maintaining healthy profitability requires constant vigilance.

Looking ahead to the first half of 2025, industry analysts anticipate a rebound in panel prices, as demand is projected to outpace available production capacity. This presents an opportunity, but Innolux's sustained profitability will hinge on its ability to innovate effectively and maintain strict control over its production expenses.

Consumer Spending and Market Segments

Consumer behavior is a significant economic factor influencing Innolux. In 2024 and heading into 2025, many consumers are exhibiting cautious spending habits due to ongoing global economic uncertainties, including inflation and geopolitical tensions. This directly impacts the demand for consumer electronics, a core market for Innolux's display solutions.

Innolux's strategy to mitigate these risks involves its diversified product portfolio. By catering to multiple sectors such as automotive, which has shown resilience, and exploring opportunities in emerging areas like healthcare and retail technology, Innolux can better navigate downturns in any single market segment. For instance, the automotive display market is projected for continued growth, offering a stable revenue stream.

- Consumer electronics demand: Global consumer spending on electronics can fluctuate significantly with economic sentiment.

- Automotive sector growth: The automotive industry's increasing reliance on advanced displays provides a more stable demand base for Innolux.

- Diversification benefits: Innolux's presence in multiple end-markets, including potential expansion into healthcare and retail, reduces dependence on any one sector.

- Economic uncertainty impact: Persistent inflation and interest rate concerns in major economies in 2024 continue to shape consumer purchasing decisions.

Currency Fluctuations and Exchange Rates

Currency fluctuations significantly impact Innolux, a global display panel manufacturer. A strengthening New Taiwan Dollar (NT$) against currencies like the US Dollar or Euro can make its products more expensive for international buyers, potentially reducing export sales and revenue. For instance, if the NT$ appreciates by 5% against the USD, Innolux's USD-denominated sales would translate into fewer NT$.

Conversely, a strong NT$ can lower the cost of imported raw materials and components, which Innolux relies on. However, this benefit might be outweighed by reduced export revenue. In early 2024, the NT$ saw periods of volatility, trading in a range that could influence Innolux's cost structure and pricing strategies in key markets.

- Impact on Revenue: A stronger NT$ can decrease the competitiveness of Innolux's exports, potentially leading to lower sales volumes or reduced profit margins on foreign sales.

- Impact on Costs: Conversely, a stronger NT$ can reduce the cost of imported components and raw materials, offering a potential cost advantage.

- Exchange Rate Exposure: Innolux's financial results are directly exposed to exchange rate movements, as a significant portion of its revenue and costs are denominated in foreign currencies.

- 2024/2025 Outlook: Analysts are closely monitoring the NT$ against major trading partners' currencies to assess the potential impact on Innolux's profitability in the coming fiscal years.

Economic factors significantly shape Innolux's operating environment. Persistent inflation in 2024 and into 2025 has increased the cost of critical raw materials like glass substrates and specialized chemicals, impacting production expenses. Consumer spending caution, driven by economic uncertainties, directly affects demand for consumer electronics, a key market for Innolux.

Innolux's financial health is also tied to currency fluctuations. A stronger New Taiwan Dollar (NT$) can make exports more expensive, potentially reducing revenue, although it can also lower the cost of imported components. The automotive sector's resilience offers a more stable demand base, complementing Innolux's diversification strategy into areas like healthcare and retail technology.

| Economic Factor | Impact on Innolux | 2024/2025 Data/Outlook |

|---|---|---|

| Inflation | Increased raw material costs (glass, chemicals) | Upward pressure on production expenses. |

| Consumer Spending | Reduced demand for consumer electronics | Cautious spending habits due to economic uncertainty. |

| Currency Exchange Rates (NT$) | Impacts export revenue and import costs | NT$ volatility in early 2024; potential for 5% appreciation impact. |

| Automotive Sector Demand | Stable demand for advanced displays | Projected continued growth, providing a stable revenue stream. |

Preview the Actual Deliverable

Innolux PESTLE Analysis

The preview shown here is the exact Innolux PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. You'll get a comprehensive breakdown of Innolux's external environment.

The content and structure shown in the preview is the same Innolux PESTLE Analysis document you’ll download after payment, providing valuable insights for strategic planning.

Sociological factors

Consumers are increasingly demanding higher resolutions, better power efficiency, and lighter displays for a more immersive experience. This shift is fueling the adoption of advanced technologies such as OLED, QLED, and Micro-LED.

In 2024, the global market for advanced display technologies is projected to reach over $150 billion, with a significant portion driven by these evolving consumer preferences. Innolux, like its competitors, must invest heavily in R&D to keep pace.

The pervasive nature of display technology is undeniable, with smartphones, smart TVs, and even emerging VR/AR headsets becoming central to daily routines. This deep integration means consumers spend more time interacting with screens than ever before. For instance, by 2024, the average person is projected to spend over 7 hours daily on internet-connected devices, highlighting a significant reliance on display-driven experiences.

Innolux, as a display manufacturer, directly benefits from this digital lifestyle, as demand for screens across various devices continues to grow. However, this trend also brings societal considerations, particularly regarding the health implications of prolonged screen time. Concerns about eye strain, sleep disruption, and the broader impact on well-being are increasingly part of public discourse, potentially influencing consumer choices and regulatory approaches to display technology.

The increasing consumer appetite for smart and connected devices, from wearables to smart home appliances, directly fuels the demand for advanced display technologies. These devices, including smartwatches and fitness trackers, require displays that are not only compact and sharp but also energy-efficient.

Innolux's expertise in integrated display modules and touch solutions positions it well to capitalize on this trend. The global market for the Internet of Things (IoT) is projected to reach nearly $1.6 trillion by 2030, with consumer electronics being a significant driver, underscoring the substantial opportunity for display manufacturers.

Workforce Demographics and Talent Acquisition

Innolux's success hinges on its ability to secure and keep skilled workers, especially in manufacturing and research and development. The availability of this specialized talent directly influences its production efficiency and its capacity for innovation.

The global competition for tech talent presents a significant hurdle for Innolux. Attracting and retaining engineers and technicians in areas like display technology can be challenging, potentially slowing down new product development and affecting overall output.

As of early 2024, the semiconductor and advanced manufacturing sectors faced a notable talent shortage. For instance, reports indicated a deficit of tens of thousands of skilled workers in these fields across Asia, a region where Innolux operates extensively.

- Skilled Labor Needs: Innolux requires a robust pool of talent in advanced manufacturing processes and cutting-edge R&D for display technologies.

- Talent Acquisition Challenges: Competition from other tech giants and the specialized nature of the required skills make attracting and retaining top talent a persistent challenge.

- Impact on Operations: A shortage of skilled workers can directly impede production volumes and slow down the pace of technological advancement and product launches.

- Industry Trends: The broader industry trend of an aging workforce in manufacturing, coupled with the demand for digital skills, further complicates Innolux's talent acquisition strategy.

Sustainability and Ethical Consumerism

Consumers are increasingly prioritizing sustainability and ethical sourcing when making purchasing decisions, which directly impacts the electronics sector. This growing awareness means companies like Innolux need to demonstrate a commitment to eco-friendly production and energy-efficient technologies to resonate with this demographic. For instance, a significant portion of consumers in key markets, often exceeding 60% by 2024, express a willingness to pay more for products that are environmentally sustainable.

Innolux's proactive stance on sustainability, including investments in reducing its carbon footprint and developing energy-saving display solutions, can significantly bolster its brand reputation. By highlighting these efforts, Innolux can attract and retain environmentally conscious customers, a segment expected to continue its growth trajectory through 2025. This focus on green manufacturing not only appeals to consumers but also aligns with evolving regulatory landscapes and investor expectations.

Key aspects of Innolux's sustainability efforts that resonate with consumers include:

- Energy-efficient display technologies: Innolux's advancements in reducing power consumption for its panels directly address consumer demand for lower energy bills and a smaller environmental impact.

- Eco-friendly manufacturing processes: Initiatives aimed at minimizing waste, reducing hazardous materials, and utilizing renewable energy in production facilities enhance brand perception.

- Circular economy principles: Efforts to incorporate recycled materials and design products for easier disassembly and recycling appeal to a growing segment of ethically minded buyers.

Societal trends significantly influence the demand for display technologies, with consumers increasingly seeking immersive and interactive experiences. This is evident in the growing adoption of advanced display types like OLED and Micro-LED, driven by consumer preferences for higher resolutions and better power efficiency.

The pervasive integration of screens into daily life, from smartphones to VR headsets, means consumers interact with displays for extended periods. By 2024, the average person is expected to spend over 7 hours daily on internet-connected devices, underscoring the critical role of display quality and user experience.

Innolux's ability to attract and retain skilled labor is crucial for its operational efficiency and innovation. The global tech talent market is highly competitive, with a notable shortage of specialized engineers and technicians in advanced manufacturing and R&D, as reported in early 2024 across Asia.

Consumers are also prioritizing sustainability, with over 60% in key markets willing to pay more for eco-friendly products by 2024. Innolux's commitment to energy-efficient displays and green manufacturing practices directly addresses this trend, enhancing brand reputation and market appeal.

| Societal Factor | Impact on Innolux | Supporting Data (2024-2025) |

|---|---|---|

| Demand for Immersive Experiences | Drives adoption of advanced display technologies (OLED, Micro-LED) | Global advanced display market projected over $150 billion in 2024. |

| Digital Lifestyle Integration | Increases overall screen time and demand for various devices | Projected average daily screen time: >7 hours per person. |

| Talent Shortage in Tech | Challenges Innolux's ability to innovate and maintain production | Tens of thousands of skilled worker deficit in Asian manufacturing sectors (early 2024). |

| Consumer Sustainability Focus | Boosts demand for eco-friendly and energy-efficient products | Over 60% of consumers in key markets willing to pay a premium for sustainable products (by 2024). |

Technological factors

The display market is experiencing a significant shift, driven by advancements like OLED and Micro-LED. These technologies promise enhanced brightness, superior contrast ratios, and greater durability compared to traditional displays. Innolux is actively investing in and demonstrating its capabilities in these cutting-edge areas, including its AM MiniLED and MicroLED solutions, targeting a wide array of applications.

For instance, the global Micro-LED display market was valued at approximately $1.1 billion in 2023 and is projected to reach over $25 billion by 2030, demonstrating substantial growth potential. Innolux's commitment to these next-generation technologies positions it to capitalize on this expanding market, offering premium visual experiences for consumers and businesses alike.

Innolux is actively integrating Artificial Intelligence (AI) and machine learning across its display manufacturing. This includes using AI for predictive maintenance to optimize production uptime and for enhancing energy efficiency in its factories. For instance, AI algorithms are being deployed to analyze vast datasets from production lines, identifying potential equipment failures before they occur, thereby minimizing costly downtime.

The company is also developing AI-powered display solutions that offer more intelligent features for end-users, such as adaptive brightness and content optimization based on environmental conditions and user behavior. Innolux’s smart manufacturing initiatives leverage AI to streamline operations, improve quality control, and accelerate product development cycles, aiming to stay competitive in a rapidly evolving technological landscape.

The evolution of flexible and foldable displays is revolutionizing device design, opening up new avenues for smartphones, tablets, and even wearables. Innolux's development of AM MiniLED flexible displays, for instance, directly addresses this trend, allowing for more dynamic and adaptable product form factors.

This technological shift is not just about aesthetics; it enables entirely new user experiences and functionalities. For example, foldable phones released in 2024, like Samsung's Galaxy Z Fold6 and Z Flip6, continue to gain traction, indicating a strong consumer appetite for these innovative designs.

High-Resolution and Energy-Efficient Displays

The relentless pursuit of sharper visuals, with 4K and even 8K resolutions becoming more common, is significantly reshaping the display industry. This trend directly impacts companies like Innolux, which must invest in advanced manufacturing processes to achieve these higher pixel densities.

Energy efficiency is no longer a secondary concern; it's a primary driver, especially with increasing environmental regulations and consumer demand for longer battery life in portable devices. Innolux's commitment to developing energy-saving display technologies is therefore crucial for its competitive edge.

For instance, the global market for high-resolution displays is projected for substantial growth. By 2025, the 8K display market alone is expected to reach billions in value, underscoring the importance of Innolux's R&D in this area.

Innolux's strategic focus on:

- Developing next-generation high-resolution panels (4K, 8K)

- Enhancing energy efficiency through advanced backlight and driving technologies

- Meeting stringent energy consumption standards like Energy Star and EU Ecodesign

- Innovating in materials science for brighter, more power-efficient displays

Panel-Level Packaging and Semiconductor Integration

Innolux is actively pursuing advanced packaging technologies, specifically panel-level fan-out packaging (FOPLP). This innovation is crucial for integrating more complex semiconductor functionalities directly onto display panels, a key trend in the electronics industry.

The company is also exploring semiconductor-related applications, signaling a strategic pivot towards higher-value components. This includes potential collaborations with memory manufacturers, particularly in the burgeoning field of AI development, aiming to leverage its display expertise for next-generation computing solutions.

These advancements are designed to bolster Innolux's competitive edge and broaden its technological portfolio beyond traditional display manufacturing. For instance, the integration of advanced packaging can lead to thinner, more powerful devices, a demand driven by consumer electronics and automotive sectors. The global advanced packaging market was valued at approximately $40 billion in 2023 and is projected to grow significantly, underscoring the market opportunity for Innolux's strategic direction.

- Panel-Level Packaging: Innolux's focus on FOPLP allows for the integration of semiconductors at the panel level, reducing form factor and improving performance.

- AI Development Partnerships: Exploring collaborations with memory manufacturers for AI applications signifies a move into high-growth, technology-intensive markets.

- Market Growth: The advanced packaging sector is experiencing robust growth, with projections indicating continued expansion driven by AI, 5G, and IoT devices.

- Diversification: This technological exploration diversifies Innolux's revenue streams and enhances its position in the broader electronics supply chain.

Technological advancements like OLED and Micro-LED are transforming the display market, offering enhanced brightness and contrast. Innolux is investing in these areas, with the Micro-LED market alone projected to exceed $25 billion by 2030. The company is also integrating AI into its manufacturing for predictive maintenance and energy efficiency, a critical factor as the 8K display market is expected to reach billions in value by 2025.

Furthermore, Innolux is developing flexible and foldable displays, responding to trends seen in devices like Samsung's 2024 foldable phones. The company's focus on advanced packaging, such as panel-level fan-out packaging, is key to integrating complex semiconductors, tapping into a global advanced packaging market valued at approximately $40 billion in 2023.

| Technology Area | Innolux Focus | Market Projection/Value |

|---|---|---|

| Next-Gen Displays | OLED, Micro-LED, AM MiniLED | Micro-LED market > $25B by 2030 |

| AI Integration | Manufacturing Optimization, Smart Features | AI in Manufacturing (Predictive Maintenance) |

| Display Resolution | 4K, 8K | 8K Display Market: Billions by 2025 |

| Advanced Packaging | Panel-Level Fan-Out Packaging (FOPLP) | Advanced Packaging Market: ~$40B in 2023 |

Legal factors

The display technology sector is a hotbed of innovation and, consequently, intense competition, often spilling over into intellectual property disputes. Innolux, like its peers, faces the constant challenge of safeguarding its proprietary technologies against infringement while simultaneously being vigilant about potential claims from rivals. This dynamic is particularly pronounced in 2024 and 2025, where significant patent litigation can reshape market access and competitive advantage.

Innolux's strategic approach to intellectual property is crucial. For instance, the company's R&D investments, which have historically been substantial, directly feed into its patent portfolio. As of early 2025, the global display market, valued at over $150 billion, sees a significant portion of its value tied to patented technologies, making IP litigation a direct threat to market share and profitability.

International trade regulations, such as anti-dumping duties and import/export controls, play a crucial role in shaping Innolux's global business. These rules directly influence how Innolux prices its products and manages its supply chain across different countries.

The persistent US-China trade tensions, including the imposition of tariffs, have a tangible effect on Innolux's ability to move display components and finished goods. For instance, in 2023, the US continued to maintain tariffs on various goods from China, impacting the cost structure for electronics manufacturers like Innolux.

These trade dynamics force Innolux to adapt its strategies, potentially diversifying manufacturing locations or adjusting pricing to remain competitive. The company must navigate these complex legal frameworks to ensure smooth international operations and mitigate financial risks.

As Innolux's display technologies increasingly incorporate smart features and AI, navigating a complex web of data privacy and cybersecurity regulations is paramount. The company must adhere to stringent data protection laws, such as the EU's General Data Protection Regulation (GDPR) and similar legislation in other key markets, to ensure the secure handling of user information and preserve customer trust.

Product Safety and Environmental Compliance

Innolux's product portfolio, particularly its display technologies, must navigate a complex web of international product safety standards and environmental compliance regulations. This includes stringent rules around hazardous materials, such as those found in the Restriction of Hazardous Substances (RoHS) directives, and regulations governing electronic waste management, like the Waste Electrical and Electronic Equipment (WEEE) directive. For instance, in 2024, the European Union continued to update its RoHS directive, impacting the chemical composition of electronic components used in Innolux's displays. Failure to comply can result in significant penalties and restrict market access.

Adherence to these evolving legal frameworks is not merely a matter of avoiding fines; it's critical for maintaining market access and a positive corporate reputation. Innolux's commitment to environmental sustainability and product safety directly influences consumer trust and its ability to operate in key global markets. As of early 2025, many countries are also strengthening their e-waste recycling targets, requiring manufacturers like Innolux to invest in more robust end-of-life management solutions for their products.

- RoHS Compliance: Innolux products must meet stringent limits on specific hazardous substances in electrical and electronic equipment.

- WEEE Directive: Regulations mandate the collection, recycling, and recovery of electronic waste, impacting product design and disposal.

- Global Standards: Innolux must comply with varying safety and environmental standards across different regions to ensure market access.

- Supply Chain Scrutiny: Increasingly, regulators are scrutinizing the entire supply chain for compliance, requiring transparency in material sourcing.

Labor Laws and Employment Regulations

Innolux must navigate a complex web of labor laws across its global operations, ensuring fair wages, safe working conditions, and adherence to employee rights. For instance, in Taiwan, where Innolux has a significant presence, the Labor Standards Act mandates minimum wage requirements and regulations on working hours. Failure to comply can result in substantial fines, impacting profitability and operational continuity.

The company's commitment to ethical sourcing also means scrutinizing the labor practices of its suppliers. Reports from organizations like the Responsible Business Alliance (RBA) highlight the importance of audits and compliance checks within supply chains. In 2023, the RBA reported that a significant percentage of its member companies conducted social audits, a practice crucial for mitigating risks associated with forced labor or child labor, which could lead to severe reputational damage and market access issues for Innolux.

Key considerations for Innolux regarding labor laws include:

- Adherence to minimum wage laws and overtime regulations in countries like China and Vietnam, where manufacturing facilities are located.

- Ensuring compliance with health and safety standards to prevent workplace accidents and associated liabilities.

- Upholding employee rights concerning freedom of association and collective bargaining, as stipulated by international labor conventions.

- Managing the complexities of cross-border employment regulations for expatriate staff and local hires.

Innolux operates within a dynamic legal landscape, facing significant challenges related to intellectual property rights and global trade regulations. The company must actively protect its innovations and navigate international trade policies, such as tariffs and anti-dumping measures, which directly impact its cost structures and market access, especially given the ongoing US-China trade tensions observed through 2023 and into 2024.

Furthermore, as smart display technologies advance, Innolux must rigorously adhere to data privacy and cybersecurity laws, including GDPR, to safeguard user information and maintain customer trust. Compliance with product safety and environmental regulations, such as RoHS and WEEE directives, is also critical, with ongoing updates in 2024 by entities like the EU impacting component composition and e-waste management requirements.

Labor laws across Innolux's global operations, including minimum wage, safety standards, and employee rights, demand strict adherence to prevent legal repercussions and reputational damage. The company also faces increased scrutiny on supply chain labor practices, necessitating robust audits to mitigate risks associated with forced or child labor, a trend highlighted by industry initiatives in 2023.

Environmental factors

Taiwan's Climate Change Response Act, effective from 2025, mandates a net-zero emissions target by 2050 and introduces carbon fees for significant polluters. As a major industrial player, Innolux will face these new carbon pricing mechanisms.

Innolux needs to develop and implement robust carbon reduction strategies to comply with these regulations and potentially benefit from preferential carbon fee rates. This proactive approach is crucial for managing operational costs and demonstrating environmental responsibility.

Innolux's display panel manufacturing is inherently energy-intensive, a significant environmental consideration. The company is actively pursuing energy-efficient display technologies, aiming to reduce the power consumption of its products throughout their lifecycle. In 2023, Innolux reported a 1.7% decrease in energy intensity across its operations, a step towards its sustainability goals.

The display industry, including manufacturers like Innolux, faces significant challenges from electronic waste (e-waste). In 2023, global e-waste generation reached an estimated 62 million metric tons, a figure projected to grow. Innolux's proactive engagement with circular economy principles, focusing on incorporating more recyclable materials in its products and implementing robust waste management systems, is vital. This approach not only addresses environmental concerns but also positions the company to meet increasingly stringent regulations and growing consumer demand for sustainable electronics.

Water Usage and Pollution Control

Display panel manufacturing, a core activity for Innolux, is inherently water-intensive, demanding substantial volumes for processes like cleaning and cooling. This usage, however, also leads to the generation of wastewater, which can contain various chemical residues. In 2023, the electronics manufacturing sector globally faced increasing scrutiny regarding water consumption and discharge quality.

In response to these environmental pressures, Innolux is compelled to operate within increasingly stringent water pollution control regulations. These regulations often dictate permissible levels of specific contaminants in discharged water. For instance, in Taiwan, where Innolux has significant operations, the Environmental Protection Administration (EPA) sets strict standards for industrial wastewater discharge, including limits on heavy metals and chemical oxygen demand (COD).

To mitigate its environmental footprint and ensure long-term operational sustainability, Innolux is actively implementing water-saving initiatives. These efforts are crucial not only for regulatory compliance but also for cost reduction and corporate social responsibility. Examples of such initiatives include:

- Advanced water recycling and reuse systems within manufacturing facilities.

- Optimizing cleaning processes to reduce water consumption per unit.

- Investing in state-of-the-art wastewater treatment technologies to ensure discharged water meets or exceeds regulatory standards.

- Monitoring water usage and discharge quality rigorously to identify areas for further improvement.

Supply Chain Environmental Standards

Innolux's commitment to environmental responsibility critically includes its supply chain. Ensuring suppliers adhere to stringent environmental standards is paramount for mitigating operational and reputational risks. This focus on sustainable practices across the entire value chain, from raw material sourcing to product delivery, is key to Innolux's overall environmental stewardship.

In 2023, Innolux reported efforts to enhance supply chain sustainability, including supplier audits and engagement programs focused on environmental compliance. The company aims to foster a greener ecosystem by encouraging suppliers to adopt energy-efficient processes and reduce waste generation. This proactive approach is essential as global regulations on supply chain environmental impact continue to tighten, with many regions implementing stricter carbon reporting and waste management mandates for businesses and their partners.

- Supplier Environmental Audits: Innolux conducts regular audits to assess supplier compliance with environmental regulations and internal sustainability policies.

- Sustainable Sourcing: The company prioritizes suppliers who demonstrate commitment to reducing their environmental footprint, including carbon emissions and water usage.

- Circular Economy Initiatives: Innolux is exploring opportunities to integrate circular economy principles within its supply chain, promoting the reuse and recycling of materials.

- Industry Benchmarking: Innolux aligns its supply chain environmental standards with leading industry practices and international frameworks to ensure robust performance.

Taiwan's new Climate Change Response Act, effective 2025, mandates net-zero emissions by 2050 and introduces carbon fees, directly impacting Innolux's operations and cost structure.

Innolux's energy-intensive display manufacturing requires robust carbon reduction strategies to comply with these evolving regulations and mitigate potential carbon pricing impacts.

The company is actively pursuing energy efficiency, evidenced by a 1.7% decrease in energy intensity in 2023, and addressing the growing global e-waste challenge by integrating recyclable materials.

Water usage in panel production necessitates adherence to strict wastewater discharge standards, with Innolux implementing advanced recycling and treatment systems to ensure compliance and sustainability.

PESTLE Analysis Data Sources

Our Innolux PESTLE analysis is meticulously crafted using data from reputable financial institutions, government publications, and leading market research firms. This ensures a comprehensive understanding of political, economic, social, technological, legal, and environmental factors impacting the display industry.