Icahn Enterprises SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Icahn Enterprises Bundle

Icahn Enterprises boasts significant financial strength and a diversified portfolio, but faces challenges in regulatory scrutiny and potential market volatility.

Want the full story behind Icahn Enterprises' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Icahn Enterprises L.P. (IEP) boasts a significant strength in its highly diversified business operations, spanning critical sectors like investment, energy, automotive, food packaging, real estate, and home fashion. This wide-ranging portfolio acts as a natural hedge against industry-specific downturns, fostering resilience. For instance, as of the first quarter of 2024, IEP's diverse segments contributed to its overall financial performance, with its energy segment showing notable activity and its investment segment managing a substantial portfolio.

Icahn Enterprises' (IEP) activist investment strategy, spearheaded by Carl Icahn, is a significant strength, historically driving substantial returns. This approach involves actively seeking out undervalued companies, often taking substantial or controlling stakes.

By engaging directly with management, IEP aims to implement strategic and operational changes designed to unlock shareholder value. For instance, in 2023, Icahn Enterprises reported a net income of $1.4 billion, reflecting successful outcomes from its active management of portfolio companies.

Icahn Enterprises' strategic involvement in its subsidiaries is a core strength, allowing it to actively manage and improve their performance. This hands-on approach means IEP doesn't just hold stakes; it drives direction, as demonstrated by its significant influence over companies like CVR Energy, Inc. This active management is key to unlocking value within its diverse portfolio.

Strong Liquidity Position

Icahn Enterprises (IEP) maintains a robust liquidity position, a key strength that provides significant financial maneuverability. This is particularly important given the company's recent financial performance and ongoing strategic adjustments.

As of the first quarter of 2025, IEP reported substantial cash reserves. Specifically, the holding company held $1.3 billion in cash and cash equivalents. Furthermore, its funds held an additional $900 million in cash.

This combined liquidity of $2.2 billion offers Icahn Enterprises considerable financial flexibility. It allows the company to navigate market volatility, pursue strategic opportunities, and meet its financial obligations without undue strain.

- Holding Company Liquidity: $1.3 billion in cash and cash equivalents as of Q1 2025.

- Funds Liquidity: An additional $900 million in cash held by its funds.

- Total Available Liquidity: Approximately $2.2 billion.

- Benefit: Provides significant financial flexibility for operations and strategic initiatives.

Potential for Turnaround in Underperforming Segments

Icahn Enterprises (IEP) is actively working to revitalize its underperforming business units, demonstrating a clear strategy for improvement. The company is implementing targeted restructuring and making strategic investments, particularly in its automotive and food packaging segments, to address operational inefficiencies.

In the automotive sector, IEP is undertaking measures such as closing underperforming stores and channeling capital into initiatives aimed at enhancing long-term profitability. Simultaneously, the food packaging division is consolidating its facilities, a move designed to boost operational efficiency and cost-effectiveness.

- Automotive Segment Restructuring: IEP is closing underperforming automotive stores to streamline operations and focus on more profitable locations.

- Food Packaging Consolidation: The company is consolidating facilities within its food packaging segment to achieve greater economies of scale and operational efficiency.

- Strategic Investment Focus: IEP is directing capital towards key areas within these segments to drive long-term profitability and market competitiveness.

Icahn Enterprises' (IEP) diversified business model is a significant strength, providing a buffer against sector-specific volatility. This wide-ranging portfolio, encompassing energy, investment, automotive, and more, ensures that weaknesses in one area can be offset by strengths in others. For example, as of the first quarter of 2024, IEP's energy segment demonstrated robust performance, contributing positively to the company's overall financial health.

The company's activist investment strategy, a hallmark of Carl Icahn's leadership, is another key strength. This approach of taking significant stakes in undervalued companies and actively pushing for operational improvements has historically yielded strong returns. In 2023, IEP reported a net income of $1.4 billion, a testament to the effectiveness of this hands-on management style.

IEP's robust liquidity position, with approximately $2.2 billion in cash and cash equivalents as of Q1 2025, provides substantial financial flexibility. This allows the company to pursue strategic opportunities and navigate market fluctuations effectively.

| Segment | Q1 2024 Highlight | Strategic Focus |

|---|---|---|

| Energy | Notable activity and contribution to overall performance. | Continued operational optimization. |

| Investment | Managed a substantial portfolio, contributing to net income. | Active management and value unlocking. |

| Automotive | Undergoing restructuring, including store closures. | Streamlining operations for profitability. |

| Food Packaging | Consolidating facilities for efficiency. | Enhancing operational efficiency and cost-effectiveness. |

What is included in the product

Offers a full breakdown of Icahn Enterprises’s strategic business environment, detailing its internal strengths and weaknesses alongside external market opportunities and threats.

Offers a clear, actionable roadmap by highlighting Icahn Enterprises' competitive advantages and areas for improvement, easing the burden of strategic uncertainty.

Weaknesses

A significant weakness for Icahn Enterprises (IEP) is the high concentration of ownership. As of December 31, 2024, Carl C. Icahn and his affiliates controlled approximately 86% of the outstanding depositary units. This level of concentrated ownership presents a considerable risk.

Such a high concentration can expose IEP to potential market volatility. A large sale of units by the controlling unitholder could significantly impact the unit price. Furthermore, it raises questions about the company's long-term leadership and strategic direction once Carl Icahn eventually transitions out of his active role.

Icahn Enterprises experienced a significant downturn in its financial performance, reporting a net loss of $422 million in the first quarter of 2025. This marks a substantial deterioration from the $38 million loss recorded in the same period of 2024, indicating a worsening financial position.

Further highlighting these challenges, the company's adjusted EBITDA turned negative, showing a loss of $287 million in Q1 2025, a stark contrast to the profitability seen in the prior year. This decline is largely attributed to substantial losses within the Investment segment, with particular weakness identified in its healthcare holdings.

Icahn Enterprises' (IEP) dividend payouts have raised concerns regarding their long-term viability. The company has notably reduced its dividend twice within an 18-month period, slashing it from $2.00 to $0.50 per unit annually. This significant decrease signals potential instability in the company's ability to maintain its dividend distributions.

A key factor contributing to the perceived sustainability of the dividend is the arrangement involving Carl Icahn, the majority owner. Instead of receiving cash dividends, Icahn takes his distributions in the form of additional units. This practice, while beneficial to him, can lead to equity dilution for other unitholders, as the total number of outstanding units increases without a corresponding increase in the company's underlying value for all investors.

Valuation Opacity and Premium to Net Asset Value (NAV)

Icahn Enterprises' valuation is notoriously difficult to pin down, with its stock consistently trading at a substantial premium to its Net Asset Value (NAV). As of March 31, 2025, this NAV had fallen to roughly $3.0 billion.

This premium is a point of concern for many investors, particularly when considering the limited visibility into the performance of its various business segments. The company's holdings include less liquid private assets, and the valuations assigned to these can be optimistic, further contributing to the opacity.

- Valuation Complexity: Icahn Enterprises' stock trades at a significant premium to its NAV.

- Decreasing NAV: The company's NAV stood at approximately $3.0 billion as of March 31, 2025.

- Lack of Transparency: Limited segment-level data makes it hard to justify the premium.

- Private Asset Valuations: Optimistic valuations of illiquid assets inflate the perceived value.

Regulatory and Legal Scrutiny

Icahn Enterprises and its founder, Carl Icahn, have been under significant regulatory pressure. In 2024, the Securities and Exchange Commission (SEC) charged Icahn for failing to disclose pledges of Icahn Enterprises L.P. (IEP) securities used as collateral for personal loans. This resulted in a settlement involving civil penalties, highlighting a weakness in corporate governance and transparency.

The company has also contended with investor lawsuits. These suits often alleged that Icahn Enterprises inflated its share prices and maintained unsustainable dividend payouts. While one such lawsuit concerning these allegations was dismissed, the ongoing legal challenges underscore a vulnerability to shareholder activism and potential financial impropriety claims.

- SEC Charges and Penalties: Icahn Enterprises settled with the SEC in 2024 over allegations of failing to disclose the pledging of IEP securities as collateral for personal loans, agreeing to civil penalties.

- Investor Lawsuits: The company has faced litigation from investors alleging share price inflation and unsustainable dividends, indicating potential risks associated with its financial reporting and operational strategies.

- Reputational Risk: These regulatory and legal actions can damage the company's reputation, potentially impacting investor confidence and access to capital markets.

Icahn Enterprises' financial performance has shown a marked decline, with a net loss of $422 million in Q1 2025, a significant increase from the $38 million loss in Q1 2024. This deterioration is coupled with negative adjusted EBITDA of $287 million in Q1 2025, a reversal from the prior year's profitability, largely driven by the Investment segment's poor performance, especially in healthcare.

The company's dividend policy has also become a point of weakness, with two reductions within 18 months, bringing the annual payout down from $2.00 to $0.50 per unit. This instability is exacerbated by Carl Icahn receiving his distributions in additional units, which can lead to dilution for other unitholders without a commensurate increase in underlying value.

Valuation remains a challenge, with IEP's stock trading at a premium to its Net Asset Value (NAV), which stood at approximately $3.0 billion as of March 31, 2025. This premium is difficult to justify given limited segment transparency and potentially optimistic valuations of less liquid private assets.

Regulatory and legal issues present another significant weakness. In 2024, IEP settled with the SEC over disclosure failures regarding pledged securities, incurring civil penalties. The company has also faced investor lawsuits alleging share price inflation and unsustainable dividends, creating reputational risk and potential financial impropriety concerns.

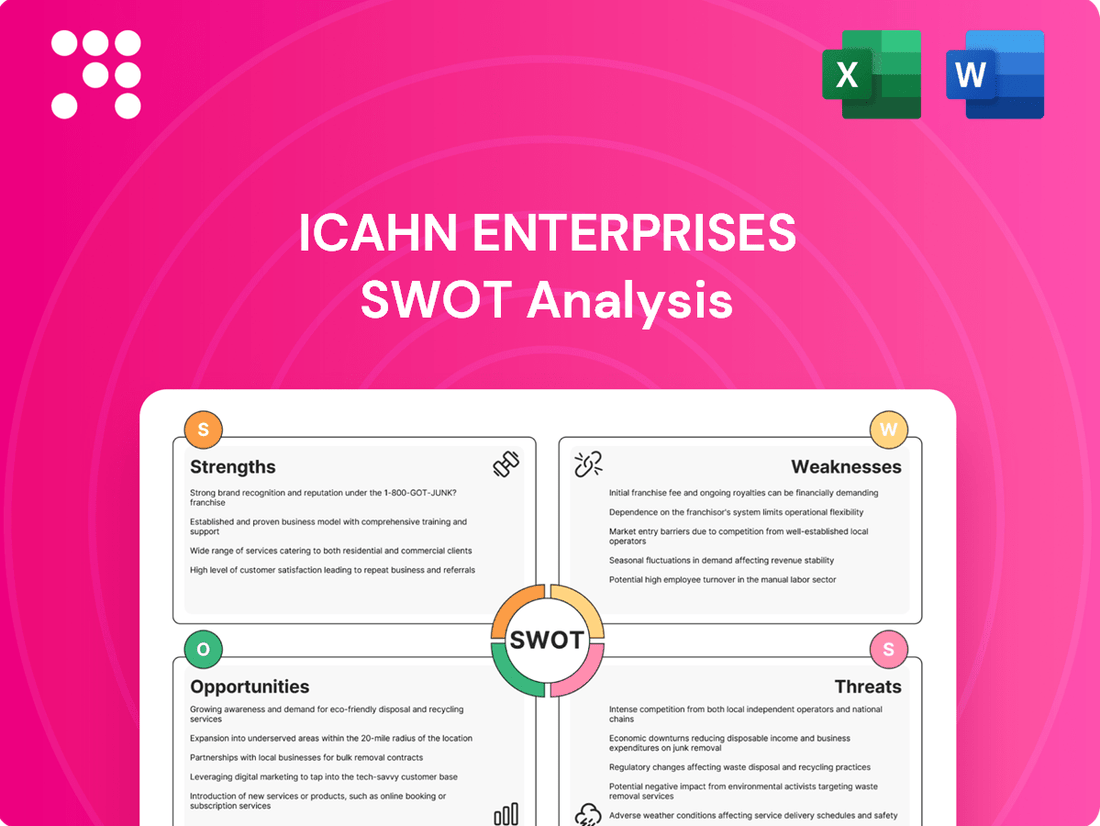

Preview the Actual Deliverable

Icahn Enterprises SWOT Analysis

The preview below is taken directly from the full Icahn Enterprises SWOT report you'll get. Purchase unlocks the entire in-depth version, revealing all strategic insights and actionable recommendations.

This is a real excerpt from the complete Icahn Enterprises SWOT analysis. Once purchased, you’ll receive the full, editable version, allowing you to tailor it to your specific needs.

You’re viewing a live preview of the actual Icahn Enterprises SWOT analysis file. The complete version, detailing every aspect of their Strengths, Weaknesses, Opportunities, and Threats, becomes available after checkout.

Opportunities

Icahn Enterprises can pursue growth by acquiring companies in sectors currently undervalued, a strategy that aligns with Carl Icahn's long-standing investment approach. The company's ability to identify and act on market inefficiencies presents a significant opportunity.

For instance, Icahn Enterprises has a proven track record of successful activist investing, often targeting companies with perceived operational improvements or undervalued assets. This opportunistic acquisition strategy allows them to leverage their expertise to unlock shareholder value.

Icahn Enterprises is actively working to enhance its automotive segment through a strategic restructuring. This involves closing underperforming stores and launching new initiatives designed to boost sales, improve profitability, and strengthen cash flows. For example, by the end of 2024, the company expects to have completed the consolidation of its automotive retail footprint, a move projected to yield approximately $50 million in annual cost savings.

The food packaging division is also undergoing a significant transformation. Plans include consolidating facilities and upgrading manufacturing lines. These efforts are targeted at increasing operational efficiency and driving higher profit margins. By mid-2025, these upgrades are anticipated to contribute an estimated 3% increase in gross margin for the segment.

Icahn Enterprises' real estate segment is poised for further value creation. In the fourth quarter of 2024, the segment's value saw a substantial boost, driven by a strategic property sale agreement and a shift to fair-market value accounting for its remaining holdings. This revaluation highlights the latent worth within IEP's real estate portfolio.

Future growth is anticipated from the planned sales of single-family homes, a segment demonstrating strong market demand. Additionally, the consistent performance of its resort properties offers a stable revenue stream, further enhancing the monetization opportunities for IEP's real estate assets.

Activist Campaigns in New Targets

Carl Icahn remains a prominent force in activist investing, consistently identifying and engaging with new companies to drive strategic changes and enhance shareholder value. His recent focus areas, such as American Electric Power, Illumina, and JetBlue Airways, represent potential avenues for future portfolio growth for Icahn Enterprises (IEP).

These campaigns are not just about influence; they are strategic plays to unlock value. For instance, Illumina faced significant pressure from Icahn regarding its acquisition of Grail, a move that Icahn argued was overvalued and detrimental. By mid-2024, Icahn had successfully pushed for changes at Illumina, highlighting the tangible impact of his activist approach.

- Targeting New Sectors: Icahn's recent engagements span utilities (American Electric Power), biotechnology (Illumina), and airlines (JetBlue), demonstrating a broadening scope beyond traditional industrial sectors.

- Value Unlocking Potential: Successful activist campaigns can lead to significant stock price appreciation for targeted companies, directly benefiting IEP's investment portfolio.

- Illumina Example: Icahn's successful pressure campaign at Illumina in 2023-2024 led to management changes and a renewed focus on shareholder returns, illustrating the effectiveness of his strategy.

Leveraging Strong Cash Position for Future Investments

Icahn Enterprises' robust cash reserves, reported at approximately $3.1 billion as of December 31, 2023, offer significant flexibility for strategic capital deployment. This strong liquidity position allows the company to actively seek out and capitalize on new investment opportunities across diverse sectors, or to bolster its existing portfolio companies. The ability to readily deploy capital is a key advantage in navigating dynamic market environments.

This substantial cash position provides Icahn Enterprises with the agility to:

- Pursue Strategic Acquisitions: Identify and acquire undervalued assets or companies that align with its investment thesis, potentially driving future growth and diversification.

- Fund Organic Growth Initiatives: Provide necessary capital for expansion projects, research and development, or operational improvements within its current business segments.

- Weather Economic Downturns: Maintain financial stability and operational continuity during periods of market volatility or economic slowdown, allowing for opportunistic investments when others may be constrained.

Icahn Enterprises' significant cash reserves, totaling approximately $3.1 billion as of December 31, 2023, provide substantial financial flexibility. This liquidity allows the company to pursue strategic acquisitions, fund organic growth, and maintain stability during economic downturns, enabling opportunistic plays in various markets.

The company's activist investing approach, exemplified by its successful engagement with Illumina in 2023-2024, presents an ongoing opportunity to unlock value in targeted companies. This strategy, which led to management changes and a renewed focus on shareholder returns at Illumina, highlights IEP's ability to drive positive change and potentially boost its portfolio's performance.

Further opportunities lie in the ongoing restructuring of its automotive and food packaging segments. The automotive segment's consolidation, projected to save $50 million annually by the end of 2024, and the food packaging division's upgrades, expected to increase gross margins by 3% by mid-2025, demonstrate a clear path to enhanced profitability and operational efficiency.

The real estate segment also offers avenues for growth, particularly through the planned sales of single-family homes, which are experiencing strong market demand. Coupled with the stable revenue from resort properties, this segment is poised for continued value creation and monetization.

Threats

Icahn Enterprises faces significant risks from market volatility, especially impacting its investment fund performance. For instance, in the first quarter of 2025, the company reported substantial losses within its investment segment, largely due to challenges in the healthcare industry.

The net asset value of Icahn Enterprises is intrinsically tied to how well its investment funds perform. This direct correlation means that broader market downturns or sector-specific struggles can quickly erode the company's overall valuation.

The significant ownership concentration by Carl C. Icahn presents a notable threat regarding leadership continuity. As of early 2024, his substantial stake means his eventual exit could create a vacuum in strategic vision and operational control.

A smooth and effective succession plan is paramount to navigating this potential disruption. Without a clear successor identified and integrated, Icahn Enterprises risks losing the decisive leadership that has defined its investment approach, potentially impacting future performance and shareholder confidence.

Icahn Enterprises faces a considerable challenge with its upcoming debt maturities. The company has significant debt obligations due in 2024, 2025, and 2026, requiring careful financial planning and refinancing strategies.

The current economic climate, characterized by rising interest rates, poses a substantial threat. Refinancing these maturing debts at higher rates will directly increase interest expenses, potentially straining IEP's cash flow and reducing its financial maneuverability.

For instance, as of the first quarter of 2024, Icahn Enterprises reported total debt of approximately $7.3 billion. An increase in interest rates by even a few percentage points on this substantial amount could translate into hundreds of millions of dollars in additional annual interest costs, impacting profitability and the ability to fund future growth initiatives.

Litigation and Regulatory Risks

Icahn Enterprises faces ongoing litigation risks, including those related to small refinery exemptions, which could impact its financial performance and reputation. The company has also encountered regulatory challenges, such as SEC charges for disclosure failures, indicating potential compliance vulnerabilities.

These legal and regulatory pressures could lead to significant fines, operational disruptions, and damage to investor confidence. For instance, the SEC settlement in 2023 regarding alleged disclosure failures highlighted the scrutiny Icahn Enterprises operates under.

- Ongoing Litigation: Exposure to lawsuits, particularly concerning environmental regulations and financial disclosures, presents a persistent threat.

- Regulatory Scrutiny: The potential for increased oversight from bodies like the SEC can lead to compliance costs and penalties.

- Reputational Damage: Legal and regulatory issues can negatively affect public perception and investor trust, impacting market valuation.

Operational Challenges in Key Segments

Icahn Enterprises faces ongoing operational hurdles in critical areas such as automotive and food packaging. Despite strategic initiatives aimed at improvement, these segments grapple with persistent profitability concerns, manufacturing inefficiencies, and escalating material costs. For instance, in the automotive sector, supply chain disruptions and increased labor expenses continued to impact margins throughout 2024.

The company's ability to successfully implement its restructuring plans is paramount to mitigating these persistent operational challenges. Failure to address these inefficiencies could lead to continued underperformance in these key segments, impacting overall financial results. The food packaging division, in particular, saw its operating income decline in the first half of 2024 due to these pressures.

- Profitability Concerns: Automotive and food packaging segments continue to experience pressure on profit margins.

- Manufacturing Inefficiencies: Ongoing efforts are needed to streamline production processes and reduce waste.

- Rising Material Costs: Increased input costs, particularly for raw materials, have a direct impact on segment profitability.

- Restructuring Execution: The success of ongoing restructuring efforts is critical for overcoming these operational threats.

Icahn Enterprises faces significant threats from its substantial debt load, with billions due in the coming years. Rising interest rates, as seen throughout 2024, increase the cost of refinancing this debt, directly impacting cash flow and profitability. For example, as of Q1 2024, Icahn Enterprises held approximately $7.3 billion in total debt, making it vulnerable to interest rate hikes.

The company is also exposed to ongoing litigation and regulatory scrutiny, including past SEC charges for disclosure failures. These issues can lead to substantial fines, operational disruptions, and damage to investor confidence, as highlighted by the 2023 settlement. Furthermore, key operational segments like automotive and food packaging continue to face profitability concerns, manufacturing inefficiencies, and rising material costs, with the food packaging division reporting reduced operating income in early 2024.

| Threat Category | Specific Risk | Impact/Example |

|---|---|---|

| Financial Risk | Debt Maturities & Interest Rate Hikes | Increased interest expenses on ~$7.3B debt (as of Q1 2024) due to rising rates, straining cash flow. |

| Legal & Regulatory | Litigation & SEC Scrutiny | Potential fines, operational disruptions, and reputational damage from ongoing lawsuits and regulatory oversight. |

| Operational Challenges | Segment Underperformance | Profitability concerns and inefficiencies in automotive and food packaging, impacting overall financial results. |

SWOT Analysis Data Sources

This Icahn Enterprises SWOT analysis is built upon a foundation of verified financial filings, comprehensive market research reports, and expert industry commentary. These sources provide the reliable, data-driven insights necessary for a robust strategic assessment.