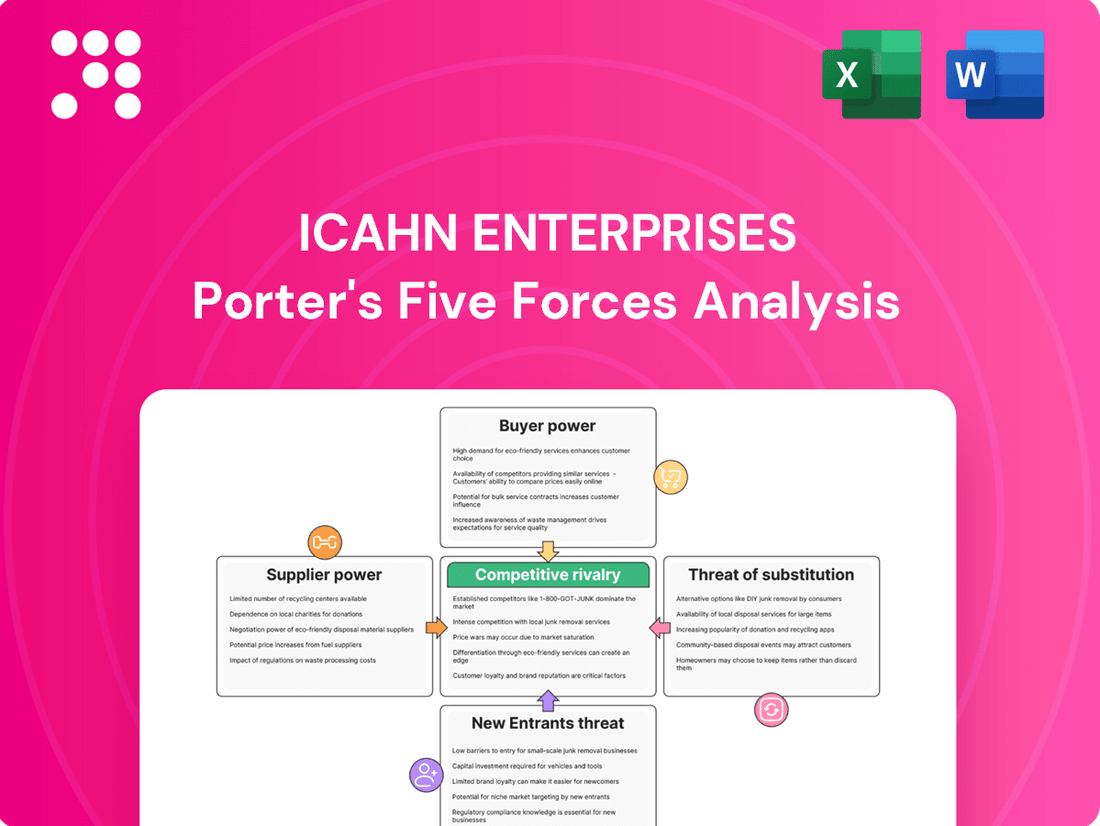

Icahn Enterprises Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Icahn Enterprises Bundle

Icahn Enterprises navigates a complex landscape shaped by intense rivalry and substantial buyer power, influencing its pricing and profitability. Understanding these dynamics is crucial for any investor or strategist looking to grasp its competitive position.

The full Porter's Five Forces Analysis reveals the real forces shaping Icahn Enterprises’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for Icahn Enterprises is a mixed bag, largely depending on the specific industry segment. For instance, in areas like home fashion or certain automotive components, Icahn Enterprises likely benefits from a fragmented supplier landscape. This means there are many suppliers available, which naturally limits any single supplier's ability to dictate terms or prices, giving Icahn more leverage.

However, in other segments, such as energy, the situation can be quite different. Here, specialized equipment or unique raw materials might be sourced from a more concentrated group of suppliers. When there are fewer suppliers capable of providing essential inputs, their bargaining power increases significantly, potentially impacting Icahn Enterprises' costs and operational flexibility.

The bargaining power of suppliers for Icahn Enterprises is significantly influenced by the criticality of their inputs and the degree of differentiation. If a supplier provides a component or technology that is essential for Icahn's core operations and lacks readily available substitutes, their leverage naturally increases. For instance, if a subsidiary relies on a unique, patented material for its manufacturing process, the supplier of that material holds considerable sway.

The bargaining power of suppliers for Icahn Enterprises is significantly influenced by the switching costs its diverse subsidiaries face. If a subsidiary, for instance, in the automotive parts sector, relies on specialized components with unique integration requirements, the cost and time to switch to a new supplier can be substantial. This difficulty in switching directly strengthens the hand of existing suppliers, allowing them to potentially command higher prices or more favorable terms. For example, if a key supplier to Icahn Automotive Group has proprietary technology that requires extensive re-qualification and testing by Icahn's manufacturing clients, that supplier holds considerable leverage.

Supplier's Ability to Forward Integrate

The bargaining power of suppliers is amplified when they possess the credible ability to integrate forward into Icahn Enterprises' operations. This means a supplier could potentially start producing the final goods or services that Icahn's businesses currently offer, thereby becoming a direct competitor.

While this threat is less common for suppliers of basic raw materials, it becomes a significant concern if a critical technology provider or a specialized component manufacturer decides to enter the end-product market. This is particularly relevant for Icahn's interests in sectors like automotive and home fashion, where proprietary technology or unique components can be crucial differentiators.

For instance, if a key supplier of advanced automotive seating technology were to decide to manufacture complete automotive interiors, they could directly challenge Icahn's existing automotive supply chain businesses. Similarly, a unique textile innovator in home fashion could shift from supplying fabrics to launching their own branded home goods lines.

This forward integration capability forces Icahn's businesses to maintain strong relationships and competitive offerings to prevent suppliers from seeing a more lucrative opportunity in competing directly. The potential for a supplier to leverage their expertise and customer relationships to capture a larger share of the value chain represents a substantial threat.

Volume of Purchases by Icahn Enterprises

The volume of purchases made by Icahn Enterprises' diverse subsidiaries from individual suppliers plays a crucial role in its bargaining power. When Icahn's various business segments represent a substantial portion of a supplier's overall revenue, the company gains significant leverage in negotiations.

However, due to the highly diversified nature of Icahn Enterprises, individual operating segments may not always wield substantial purchasing power over large, global suppliers. This means the impact of purchasing volume on bargaining power can vary significantly across different industries and supplier relationships within the conglomerate.

- Diversified Portfolio Impact: Icahn Enterprises' subsidiaries operate across various sectors, meaning the purchasing volume from any single supplier is unlikely to represent a dominant share of that supplier's business, thus limiting leverage in many cases.

- Potential for Consolidation: While individual segments might have limited power, Icahn's ability to potentially consolidate purchasing across its portfolio for certain goods or services could amplify its bargaining strength.

- Supplier Dependency: The bargaining power is inversely related to how dependent the supplier is on Icahn Enterprises. If Icahn is a major customer for a supplier, its power increases.

The bargaining power of suppliers for Icahn Enterprises is a complex factor, varying significantly across its diverse portfolio. For subsidiaries in fragmented markets with numerous suppliers, like certain automotive components or home fashion textiles, Icahn likely enjoys considerable leverage due to ample choice and lower switching costs. However, in specialized sectors such as energy, where critical inputs might come from a limited number of providers, suppliers can wield greater influence, potentially impacting Icahn's cost structure.

The criticality of a supplier's input and the availability of substitutes are key determinants of their power. If a subsidiary relies on unique, proprietary technology or materials with no easy alternatives, the supplier holds substantial sway. This is particularly true when switching to a new supplier involves significant costs, such as re-qualification and testing, as seen in some automotive supply chains. For example, Icahn Automotive Group's reliance on suppliers with unique integration requirements can strengthen those suppliers' negotiating positions.

The threat of suppliers integrating forward into Icahn's business lines also shapes this dynamic. Should a key technology provider or component manufacturer decide to compete directly, it necessitates Icahn's businesses maintaining strong relationships and competitive offerings. This potential for direct competition from suppliers, particularly in sectors like automotive and home fashion, underscores the need for Icahn to manage these relationships proactively.

Icahn Enterprises' purchasing volume from individual suppliers is another critical element. While the conglomerate's diversified nature means individual segments may not represent a dominant share for large global suppliers, the potential to consolidate purchasing could amplify leverage. For instance, if Icahn Automotive Group were to consolidate its procurement of certain common parts across its various repair and distribution networks, its bargaining power with those specific suppliers would increase.

| Supplier Characteristic | Impact on Icahn Enterprises | Example Sector/Scenario |

|---|---|---|

| Fragmented Supplier Base | Lower Supplier Bargaining Power | Home Fashion (numerous textile suppliers) |

| Concentrated Supplier Base / Specialized Inputs | Higher Supplier Bargaining Power | Energy (specialized equipment providers) |

| Criticality of Input / Few Substitutes | Higher Supplier Bargaining Power | Automotive (proprietary component technology) |

| High Switching Costs for Icahn | Higher Supplier Bargaining Power | Automotive (complex integration requirements) |

| Supplier Threat of Forward Integration | Higher Supplier Bargaining Power | Automotive (seating tech supplier entering interior manufacturing) |

| Icahn's Purchasing Volume Dominance | Lower Supplier Bargaining Power | Potential for consolidated purchasing across Icahn Automotive Group |

What is included in the product

Tailored exclusively for Icahn Enterprises, analyzing its position within its competitive landscape by dissecting the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the presence of substitutes.

A clear, one-sheet summary of Icahn Enterprises' five forces—perfect for quickly identifying and addressing competitive pressures.

Customers Bargaining Power

Icahn Enterprises' diverse customer base, spanning institutional investors, industrial clients in food packaging, and individual consumers in home fashion and automotive sectors, significantly dilutes the overall bargaining power of customers. This broad segmentation means that any single customer group's ability to exert pressure is limited, as the company's revenue streams are not overly reliant on any one segment. For instance, in 2023, Icahn Enterprises' various segments contributed to its overall financial performance, with no single segment dominating to the extent that its customers could dictate terms across the entire enterprise.

Icahn Enterprises faces significant customer bargaining power when its products or services are seen as commodities, especially in markets where customers are very sensitive to price. For instance, in the automotive aftermarket sector, where Icahn Enterprises has a presence, customers often compare prices across numerous suppliers, driving down margins for providers.

The availability of numerous alternative suppliers or readily available substitute products dramatically amplifies customer bargaining power. If customers can easily find similar offerings from competitors, they have less incentive to remain loyal and can demand better terms, putting pressure on Icahn Enterprises' pricing strategies and profitability.

Icahn Enterprises' bargaining power of customers can be influenced by customer concentration. In areas like large real estate deals or supplying major food packaging clients, a few significant customers might generate a substantial portion of revenue, giving them considerable leverage.

For instance, in 2023, Icahn Enterprises' Real Estate segment reported revenues of $630 million, with a few key transactions potentially representing a large chunk of that figure, highlighting the impact of large customer dealings.

Conversely, in its more consumer-oriented businesses, the sheer volume of individual customers generally dilutes any single customer's bargaining power, creating a more balanced dynamic.

Information Asymmetry and Switching Costs

Customers gain leverage when they possess comprehensive information regarding pricing and available product alternatives. This knowledge allows them to negotiate more effectively and seek out better deals. For instance, in the diversified industrial sector where Icahn Enterprises operates, readily available online comparisons of similar industrial components can significantly empower buyers.

Low switching costs are a major factor in increasing customer bargaining power. If it’s easy and inexpensive for customers to switch to a competitor, they have less incentive to stay loyal. In 2024, many service-based industries saw customers readily shift providers due to minimal setup fees and readily available data migration tools, directly impacting revenue streams for incumbent firms.

Conversely, Icahn Enterprises benefits when switching costs are high. These can include substantial investments in specialized equipment that is incompatible with competitors' offerings, lengthy contractual obligations, or deeply ingrained brand loyalty. For example, if a client has heavily invested in Icahn’s proprietary technology, their ability to switch to a rival is significantly diminished, thereby reducing their bargaining power.

- Information Asymmetry: Customers with access to detailed pricing and product comparisons, often facilitated by online platforms, can exert greater price pressure.

- Switching Costs: Low switching costs enable customers to easily move to competitors, increasing their bargaining power.

- High Switching Costs: Factors like long-term contracts, specialized integration, or strong brand loyalty reduce customer bargaining power, benefiting Icahn Enterprises.

Threat of Backward Integration by Customers

The threat of backward integration by customers is a significant factor in assessing Icahn Enterprises' bargaining power. If customers possess the capability or a credible threat to produce the goods or services themselves, they can exert considerable pressure on Icahn.

While this threat might be less pronounced for Icahn's diverse consumer base, large industrial or commercial clients could explore backward integration. This is particularly true if the products supplied by Icahn are critical to their operations, readily available from numerous suppliers, or if these clients possess the requisite scale and technical expertise to manufacture them internally.

For instance, if a substantial portion of Icahn Enterprises' revenue comes from supplying components to a few large automotive manufacturers, those manufacturers might investigate producing those components in-house if the cost savings or strategic advantages are significant enough. As of early 2024, major industrial conglomerates often have the capital and engineering resources to consider such moves, especially in sectors where supply chain resilience is paramount.

- Customer Capability: Customers with strong financial backing and in-house technical expertise are more likely to pursue backward integration.

- Product Criticality: If Icahn's products are essential inputs for a customer's core business, the incentive to control that supply chain increases.

- Supplier Availability: A high number of alternative suppliers for a product reduces the customer's need to integrate backward.

- Market Dynamics: Shifts in industry structure or technological advancements can alter the feasibility and attractiveness of backward integration for customers.

Icahn Enterprises' customer bargaining power is generally moderate, influenced by product differentiation, switching costs, and customer concentration. In 2023, the company's diverse revenue streams, from automotive aftermarket parts to home fashion, meant no single customer segment held overwhelming sway.

However, in sectors where Icahn's products are commoditized, like certain industrial supplies, customers with readily available alternatives and low switching costs can exert significant price pressure. For example, in 2024, the ease of comparing industrial components online empowers buyers to seek better terms.

The threat of backward integration by large clients, particularly in industrial sectors, also contributes to customer leverage. If a major client can produce a supplied item internally more cost-effectively, their bargaining power increases.

Conversely, Icahn Enterprises benefits from high switching costs, such as proprietary technology integration or strong brand loyalty in its consumer segments, which diminishes customer leverage.

Same Document Delivered

Icahn Enterprises Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—no surprises, no placeholders. It details Icahn Enterprises' competitive landscape through Porter's Five Forces, analyzing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. This comprehensive assessment provides actionable insights into the strategic positioning and potential challenges faced by Icahn Enterprises.

Rivalry Among Competitors

Icahn Enterprises operates across a wide array of industries, meaning competitive rivalry varies significantly. In its more mature segments, such as certain energy or manufacturing businesses, competition can be intense, often characterized by price sensitivity and pressure on margins. For instance, in 2024, the refining sector, a key area for Icahn, continued to face volatility influenced by global supply and demand dynamics, leading to periods of heightened price competition among major players.

Conversely, in areas like real estate or specialized investment holdings, the competitive landscape is more focused on strategic advantages, asset acquisition, and long-term value creation. Here, rivalry might involve bidding wars for prime properties or competing for exclusive access to unique investment opportunities. The ability to leverage capital and market insights is crucial for success in these less commoditized sectors.

Competitive rivalry within Icahn Enterprises' diverse portfolio is significantly shaped by industry growth rates and market saturation. In mature or slow-growth sectors, such as certain segments of the automotive or energy industries where Icahn has historically invested, rivalry often intensifies. Companies in these areas must fight harder for market share, leading to price wars and increased marketing spend, as seen in the highly competitive refining market where Icahn's refineries operate.

Conversely, Icahn's exposure to potentially faster-growing markets, like technology or specialized manufacturing, can temper direct competitive pressures. For instance, if a subsidiary operates in an expanding market with high demand and limited supply, the need to aggressively undercut competitors may be less pronounced. However, even in growing markets, the threat of new entrants or disruptive innovation can still fuel intense competition.

Icahn Enterprises operates in a varied competitive arena, facing both large, established corporations and smaller, specialized firms. These rivals often pursue distinct strategies, such as aggressively cutting costs to gain market share or focusing on unique product features to attract specific customer segments.

For instance, in the automotive aftermarket parts sector, Icahn's Federal-Mogul competes with giants like Bosch and Denso, which leverage extensive R&D and global supply chains. Simultaneously, it encounters smaller, regional players that excel in niche product categories or offer highly localized service.

Icahn's own strategy frequently involves acquiring underperforming or undervalued companies, often in mature or challenging industries, and then aiming to improve their operational efficiency and profitability. This approach means Icahn Enterprises is no stranger to intense competition, sometimes even entering markets where rivals have significant advantages.

High Fixed Costs and Exit Barriers

Icahn Enterprises operates in sectors often characterized by substantial fixed costs. For instance, its energy segment, which includes refining and marketing, requires significant upfront investment in plant and equipment. This means companies must achieve high operating rates to cover these fixed expenses, naturally intensifying competition as players strive for market share to optimize their cost structures. In 2023, the energy sector, broadly speaking, saw capital expenditures by major players averaging billions of dollars, underscoring the high fixed cost nature of the industry.

Furthermore, exit barriers within Icahn Enterprises' diverse portfolio can contribute to sustained competitive rivalry. In areas like automotive aftermarket or real estate, specialized assets and long-term commitments can make it difficult and costly for companies to withdraw from the market. This can trap less profitable firms, forcing them to compete aggressively even in challenging economic conditions, thereby increasing pressure on all participants. For example, the automotive repair industry, where Icahn has interests, often involves substantial investment in specialized tools and training, making it hard to pivot away.

- High Fixed Costs: Industries like energy infrastructure demand massive capital outlays, pushing companies to maximize capacity utilization to spread these costs, thus fueling rivalry.

- Exit Barriers: Specialized assets and significant closure costs in sectors such as automotive or real estate can prevent firms from leaving unprofitable markets, intensifying competition.

- Capacity Utilization: Companies with high fixed costs are incentivized to run at near-full capacity, leading to price competition to gain volume.

- Market Persistence: High exit barriers can lead to the persistence of weaker competitors, further complicating the competitive landscape.

Brand Identity and Product Differentiation

In sectors where Icahn Enterprises' subsidiaries boast strong brand identity and product differentiation, like certain automotive parts or specialized manufacturing, competition tends to pivot from price wars to innovation, superior quality, and targeted marketing efforts. This allows for potentially higher margins.

Conversely, in more commoditized markets, the absence of significant product differentiation forces rivals, including Icahn's businesses, to compete primarily on price. This intensifies pressure, especially if a subsidiary doesn't hold a distinct cost advantage. For instance, in the highly commoditized refining sector, where Icahn has historically had significant exposure, price fluctuations and operational efficiency are paramount.

- Brand Strength: Companies with strong brands can command premium pricing, reducing direct price competition.

- Product Differentiation: Unique features or services create customer loyalty and lessen the impact of competitor pricing.

- Commoditization Risk: In undifferentiated markets, low prices become the primary competitive tool, eroding profitability.

- Cost Advantage: A significant cost advantage is crucial for survival and profitability in price-sensitive, commoditized industries.

Icahn Enterprises operates in markets with varying levels of competitive rivalry. In mature sectors like energy refining, intense price competition is common due to high fixed costs and the need for capacity utilization. For example, in 2024, the refining sector continued to see price volatility driven by global supply and demand, forcing players like Icahn's subsidiaries to focus on operational efficiency to maintain margins.

Conversely, in areas like specialized manufacturing or real estate, competition often centers on strategic asset acquisition and innovation rather than solely on price. The automotive aftermarket parts segment, where Icahn's Federal-Mogul competes, illustrates this, facing rivals like Bosch and Denso that leverage R&D and global supply chains, while also contending with niche players.

The presence of high exit barriers in industries where Icahn has interests, such as automotive or real estate, means that even less profitable firms may persist, intensifying overall rivalry. This persistence, coupled with the drive to cover substantial fixed costs, often leads to price-based competition to secure market share.

Icahn Enterprises' diverse portfolio means it encounters a spectrum of competitors, from global giants to smaller, specialized firms. Success hinges on adapting strategies, whether it's leveraging brand strength and product differentiation in some segments or focusing on cost advantages and operational excellence in more commoditized markets.

| Icahn Enterprises Segment | Key Competitors | Competitive Intensity Factor | 2024 Data Point/Observation |

|---|---|---|---|

| Energy (Refining) | ExxonMobil, Chevron, Marathon Petroleum | High fixed costs, price sensitivity | Refining margins fluctuated; increased focus on operational efficiency to manage costs. |

| Automotive Aftermarket Parts | Bosch, Denso, Magna International | Brand strength, R&D, product differentiation | Competition driven by innovation and quality; Federal-Mogul navigates both large and niche players. |

| Real Estate | Blackstone, Prologis, Simon Property Group | Asset acquisition, strategic positioning | Bidding wars for prime properties and competition for unique investment opportunities remain key. |

SSubstitutes Threaten

The threat of substitutes is a considerable factor for Icahn Enterprises, particularly as technology races forward. In the energy sector, for example, the increasing adoption of renewable energy sources and the burgeoning electric vehicle market present a clear substitute threat to Icahn's investments in traditional fossil fuels. These emerging technologies offer compelling alternatives that could reduce demand for established energy products.

Evolving consumer preferences and lifestyle shifts present a significant threat of substitutes for Icahn Enterprises' diverse holdings. For instance, in the home fashion sector, a growing trend towards minimalism and sustainable living could lead consumers to opt for fewer, more durable decor items or even DIY solutions, thereby reducing demand for traditional home furnishings and accessories. This shift impacts companies like West Elm, which falls under the broader retail umbrella.

In the automotive industry, where Icahn Enterprises has substantial interests through companies like Pep Boys, the rise of ride-sharing services and the expansion of public transportation infrastructure are increasingly viable substitutes for private car ownership. This trend directly affects the demand for car parts, maintenance, and related services, as fewer privately owned vehicles on the road translate to a smaller customer base for traditional automotive aftermarket providers.

The appeal of substitute offerings for Icahn Enterprises hinges on their price-performance ratio. If alternatives provide similar or better results for less money, they represent a substantial threat. For instance, in the financial services realm, the rise of low-fee index funds and exchange-traded funds (ETFs) directly competes with actively managed investment strategies, attracting investors prioritizing cost efficiency.

Availability and Accessibility of Alternatives

The threat of substitutes for Icahn Enterprises' diverse portfolio is significantly amplified by the widespread availability and ease of access to alternative solutions. When customers can easily switch to a different product or service with minimal friction or expense, Icahn’s businesses face heightened pressure to maintain competitive pricing and deliver superior value. This dynamic is especially pronounced in sectors with a strong consumer-facing element.

For instance, in the automotive sector, where Icahn has significant holdings through companies like Pep Boys, the availability of independent repair shops and DIY maintenance options acts as a potent substitute for dealership services. Data from 2024 indicates that the independent repair market continues to capture a substantial share of automotive service revenue, often offering lower price points than franchised dealerships, thereby exerting constant competitive pressure.

In the energy sector, where Icahn has interests in refining and production, the increasing adoption of electric vehicles (EVs) and alternative energy sources like solar and wind power presents a long-term substitute threat to traditional fossil fuel demand. By the end of 2023, global EV sales had surpassed 13 million units, a figure projected to grow substantially through 2024 and beyond, directly impacting the demand for refined petroleum products.

- Widespread Availability: Substitute products and services are readily obtainable across various markets where Icahn Enterprises operates.

- Low Switching Costs: Customers can often transition to alternatives without incurring significant financial or operational burdens.

- Price Sensitivity: The ease of substitution intensifies pressure on Icahn's businesses to offer competitive pricing to retain customers.

- Technological Advancements: Emerging technologies, such as EVs and renewable energy, are creating new and increasingly viable substitutes for established products.

Regulatory and Environmental Shifts

Regulatory shifts and growing environmental consciousness are powerful forces that can significantly boost the appeal of substitute products or services for Icahn Enterprises. For instance, in 2024, many governments continued to offer substantial incentives for renewable energy adoption. These incentives directly lower the cost of alternatives like solar and wind power, making them more competitive against traditional energy sources, which could impact Icahn's energy-related holdings.

Similarly, evolving health and safety regulations can compel industries to seek out new materials and processes. Imagine new regulations around food packaging in 2024 that might restrict certain plastics, thereby creating a market opportunity for biodegradable or compostable alternatives. This would present a direct threat to companies involved in traditional packaging materials, potentially affecting Icahn's diverse portfolio if it has exposure in this sector.

- Government incentives for clean energy: In 2024, the Inflation Reduction Act in the United States continued to provide significant tax credits for renewable energy projects, accelerating the adoption of solar and wind power as substitutes for fossil fuels.

- Environmental regulations on materials: Several countries and regions in 2024 introduced or strengthened regulations on single-use plastics and certain chemical compounds, driving demand for alternative packaging and manufacturing materials.

- Health and safety standards: Increased scrutiny on product safety, particularly in consumer goods and food, can lead to faster replacement cycles for existing products if newer, safer alternatives emerge due to regulatory pressures.

The threat of substitutes is a significant challenge for Icahn Enterprises, especially in sectors where technological advancements and changing consumer preferences offer viable alternatives. The ease with which customers can switch to these substitutes, often with minimal cost, puts constant pressure on Icahn's businesses to innovate and maintain competitive pricing. For example, the automotive aftermarket, a key area for Icahn through Pep Boys, faces substitutes like mobile repair services and DIY kits, which gained traction in 2024 due to convenience and cost savings.

In the energy sector, Icahn's investments in traditional fossil fuels are increasingly challenged by the rapid growth of renewable energy sources and electric vehicles. Global EV sales continued their upward trajectory in 2024, with projections indicating further substantial growth. This shift directly impacts the demand for gasoline and diesel, thereby threatening the long-term viability of refining and fuel production assets.

The financial services industry also presents substitute threats, with the rise of low-cost index funds and robo-advisors directly competing with traditional asset management. These alternatives offer competitive returns with significantly lower fees, appealing to a growing segment of investors in 2024 who prioritize cost efficiency.

| Sector | Icahn Holding Example | Substitute Threat | 2024 Data/Trend |

| Energy | Refining & Production | Electric Vehicles, Renewable Energy | Global EV sales surpassed 13 million by end of 2023, projected strong growth in 2024. |

| Automotive Aftermarket | Pep Boys | Independent Repair Shops, DIY Solutions, Mobile Mechanics | Independent repair market continued to capture significant share in 2024, often at lower price points. |

| Financial Services | Asset Management (various) | Index Funds, ETFs, Robo-Advisors | Continued investor shift towards low-cost passive investment vehicles in 2024. |

Entrants Threaten

The significant capital required to enter industries where Icahn Enterprises operates, such as energy and real estate, presents a substantial hurdle. For instance, developing a new oil refinery or a large-scale residential project demands billions of dollars, effectively deterring most potential competitors.

Furthermore, Icahn's subsidiaries often leverage considerable economies of scale. In the automotive parts sector, for example, a large, established manufacturer can produce components at a much lower per-unit cost than a new entrant, making it difficult for newcomers to compete on price.

Icahn Enterprises faces a significant threat from new entrants, particularly due to stringent regulatory hurdles and complex licensing requirements. These barriers are especially pronounced in its key sectors like energy and financial services. For instance, in 2024, the energy sector continued to see increased regulatory scrutiny, with new environmental compliance standards adding to the cost and complexity of market entry. Similarly, financial services firms must navigate evolving capital requirements and consumer protection laws, making it a costly and lengthy process to obtain the necessary licenses to operate.

In consumer-focused areas such as home fashion or the automotive aftermarket, established brand recognition and existing distribution networks present formidable barriers for newcomers. For instance, a company like Icahn Enterprises, with its diverse holdings, benefits from decades of building consumer trust and securing shelf space or dealership agreements, making it difficult for new brands to gain traction. This loyalty and established infrastructure require significant upfront capital and time to replicate, effectively deterring many potential competitors.

Proprietary Technology and Intellectual Property

Icahn Enterprises' businesses, particularly those in technology-driven sectors, benefit from proprietary technology and intellectual property. This can include patented processes or specialized know-how that creates a significant barrier to entry for potential competitors. For instance, if a subsidiary holds exclusive rights to a key manufacturing technique, replicating that capability would require substantial investment in research and development or costly licensing agreements, effectively deterring new entrants.

The high cost and complexity associated with acquiring or developing comparable technological assets mean that new companies often cannot compete on a level playing field. This protects Icahn's existing market positions by making it economically unviable for newcomers to match the technological sophistication or efficiency of its established operations. This advantage is crucial in industries where innovation is rapid and the cost of staying ahead is substantial.

- Proprietary technology acts as a shield, making it difficult and expensive for new companies to enter markets where Icahn Enterprises operates.

- Patents and specialized know-how create exclusive advantages, preventing rivals from easily replicating successful business models or production methods.

- The significant investment required to match Icahn's technological capabilities serves as a powerful deterrent to potential new entrants.

Incumbent Reaction and Retaliation

The threat of retaliation from established players significantly impacts new entrants. Incumbents like Icahn Enterprises can engage in aggressive strategies such as price wars, increased marketing expenditures, or even legal battles to deter new competition. This potential for a strong, resource-backed response makes entering markets where Icahn Enterprises operates a more calculated risk.

Icahn Enterprises' history as an activist investor and its substantial financial backing position it as a formidable incumbent. This reputation can serve as a powerful deterrent, making potential new entrants hesitant to challenge its market positions. The prospect of facing a well-resourced and strategically aggressive opponent discourages many from even attempting entry.

Consider the competitive landscape in sectors where Icahn Enterprises has a significant presence, such as automotive or energy. For instance, in the automotive sector, established players often respond to new entrants with intensified advertising campaigns and aggressive pricing strategies. Icahn Enterprises' historical involvement in companies like Hertz Global Holdings, where it pushed for significant operational changes, demonstrates its capacity and willingness to actively defend its interests and influence market dynamics.

- Incumbent Retaliation: Established firms may engage in price cuts, increased advertising, or legal challenges to discourage new entrants.

- Icahn Enterprises' Stance: With substantial resources and an activist approach, Icahn Enterprises is perceived as a strong incumbent, raising the barrier to entry.

- Market Entry Deterrence: The potential for significant pushback from powerful players like Icahn Enterprises makes market entry a more daunting prospect for newcomers.

The threat of new entrants for Icahn Enterprises is generally moderate. Significant capital requirements, particularly in sectors like energy and real estate, act as substantial barriers. For example, the cost to build a new refinery or a large residential project can run into billions, deterring many potential competitors. Furthermore, Icahn's subsidiaries often benefit from economies of scale, allowing them to produce goods or services at a lower per-unit cost than newcomers.

Regulatory hurdles and licensing complexities, especially in energy and financial services, add another layer of difficulty for new players. In 2024, environmental compliance standards in the energy sector became more stringent, increasing entry costs. Similarly, evolving capital requirements in financial services demand significant upfront investment and time for licensing. Established brand recognition and distribution networks in consumer-facing businesses like home fashion also present formidable challenges, requiring substantial capital and time to replicate.

Proprietary technology and intellectual property, such as patented processes, create exclusive advantages, making it difficult and expensive for new companies to enter markets where Icahn Enterprises operates. The high cost of acquiring or developing comparable technological assets deters newcomers from competing on a level playing field. This technological edge is crucial in fast-paced industries where innovation is key.

The threat of retaliation from incumbents like Icahn Enterprises, known for its activist approach and substantial financial backing, also serves as a deterrent. Potential new entrants may hesitate to challenge market positions due to the prospect of facing aggressive strategies such as price wars or increased marketing expenditures. This reputation for strong, resource-backed responses makes market entry a more calculated risk.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Icahn Enterprises is built upon a foundation of publicly available financial disclosures, including annual and quarterly reports filed with the SEC. We also incorporate insights from reputable financial news outlets and industry-specific trade publications to capture current market dynamics and competitive landscapes.