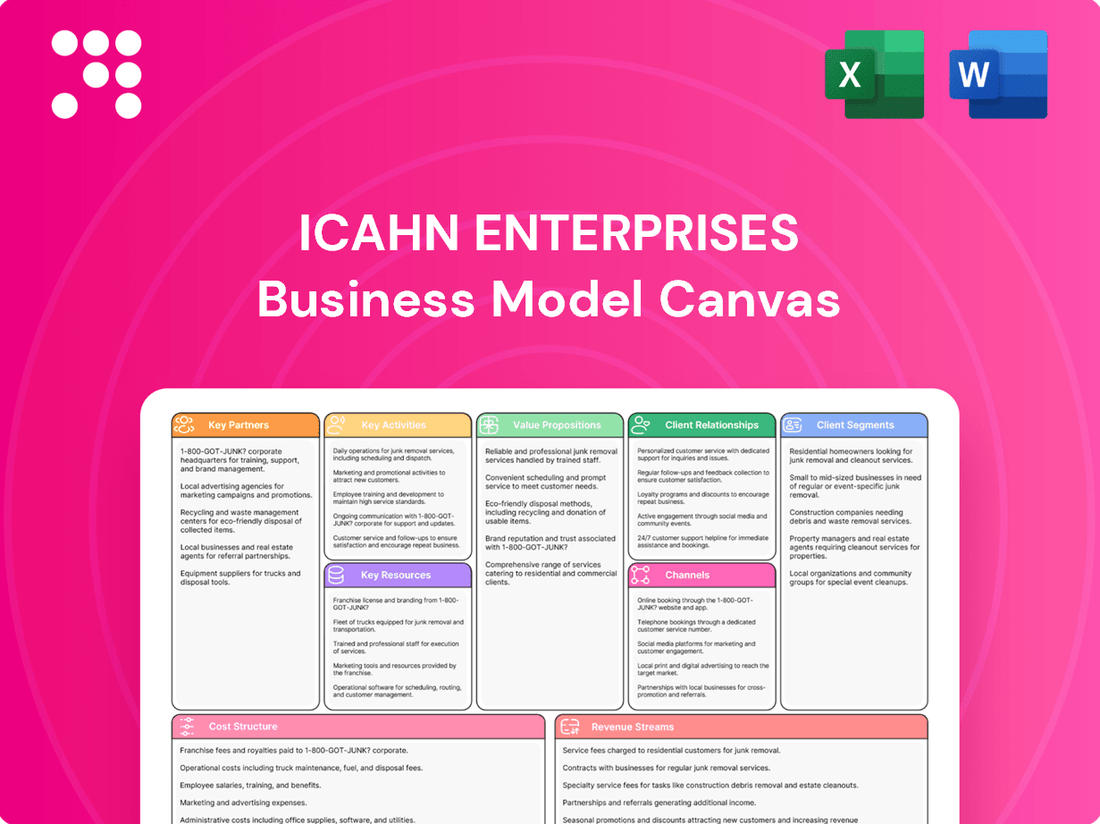

Icahn Enterprises Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Icahn Enterprises Bundle

Unlock the full strategic blueprint behind Icahn Enterprises's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Icahn Enterprises strategically partners through its acquisitions, notably taking significant stakes in companies like CVR Energy and JetBlue. These aren't just passive investments; Icahn often exerts influence to improve their operational value and performance.

For instance, Icahn's activism at CVR Energy has aimed to unlock shareholder value, and his involvement with JetBlue has focused on operational efficiencies and strategic direction. The overarching goal is to boost returns by actively shaping the management and strategy of these acquired businesses.

Icahn Enterprises' partnerships with financial institutions and lenders are fundamental to its operational and investment strategies. These relationships are vital for securing the substantial capital required for acquisitions, ongoing operations, and managing its considerable debt obligations. The company actively engages with these entities through various channels, including the issuance of senior notes and participation in private placements.

In 2024, Icahn Enterprises continued to leverage these partnerships. For instance, in February 2024, the company announced a significant offering of senior notes, demonstrating its ongoing reliance on debt markets to fund its activities. This move, alongside managing existing debt, underscores the critical role financial institutions play in providing liquidity and enabling Icahn Enterprises to pursue its investment objectives and maintain financial flexibility.

Icahn Enterprises' diverse portfolio, spanning automotive, food packaging, real estate, and home fashion, necessitates robust relationships with a broad spectrum of suppliers and vendors. These partnerships are crucial for securing essential raw materials, components, and services across its various operating segments. For instance, in its automotive segment, reliable access to parts and manufacturing equipment is paramount.

The stability and cost-efficiency of these supply chains directly impact the profitability of Icahn Enterprises' subsidiaries. Favorable terms with key suppliers, such as those providing specialized chemicals for its manufacturing operations or packaging materials for its consumer goods, are vital for maintaining competitive pricing and operational efficiency. In 2024, many companies across these sectors experienced fluctuations in raw material costs, making strong supplier relationships even more critical for managing margins.

Regulatory Bodies and Legal Counsel

Icahn Enterprises' relationships with regulatory bodies like the Securities and Exchange Commission (SEC) are paramount. These partnerships are essential for maintaining compliance with financial reporting standards and securities laws, especially given Icahn Enterprises' status as a publicly traded entity. For instance, in 2023, the SEC continued its oversight of public companies, with Icahn Enterprises subject to ongoing scrutiny regarding its disclosures and trading practices.

Engaging specialized legal counsel is another vital partnership. This ensures the company can navigate the intricate legal landscape, manage potential litigation, and uphold its fiduciary responsibilities. Legal experts are crucial for interpreting and adhering to evolving regulations, mitigating risks associated with activist investing strategies, and managing the complexities inherent in Icahn Enterprises' diverse portfolio of businesses.

- Regulatory Compliance: Maintaining adherence to SEC filings and financial regulations, crucial for a publicly traded entity.

- Legal Risk Management: Engaging legal experts to navigate potential litigation and ensure proper corporate governance.

- Navigating Complex Structures: Legal counsel is key to managing the intricacies of Icahn Enterprises' master limited partnership structure.

Industry-Specific Joint Ventures and Collaborations

Icahn Enterprises actively forms industry-specific joint ventures and collaborations to enhance its operational capabilities and market presence. These partnerships are strategic, allowing the company to tap into specialized expertise and share the inherent risks associated with certain ventures.

In the real estate sector, for example, Icahn Enterprises might team up with experienced developers to co-develop properties, thereby pooling resources and knowledge. Similarly, within its pharmaceutical segment, collaborations on research and development are crucial. The company's increased investment in R&D, supporting therapies and clinical development, underscores the importance of these partnerships in advancing its pipeline and bringing new treatments to market.

- Real Estate: Partnerships with developers for property co-development.

- Pharmaceuticals: Collaborations for research and development of new therapies.

- Risk Sharing: Joint ventures allow for the distribution of financial and operational risks.

- Market Expansion: Collaborations facilitate entry into new markets or segments.

Icahn Enterprises' key partnerships extend to financial institutions and lenders, crucial for securing the substantial capital needed for its acquisitions and operations. In February 2024, the company demonstrated this reliance by offering senior notes, highlighting the ongoing importance of debt markets for liquidity and strategic flexibility.

Furthermore, Icahn Enterprises cultivates relationships with a wide array of suppliers and vendors across its diverse segments, from automotive to food packaging. These partnerships are vital for ensuring access to essential raw materials and components, directly impacting profitability and operational efficiency, especially amidst 2024's fluctuating raw material costs.

Industry-specific joint ventures and collaborations are also integral, allowing Icahn Enterprises to leverage specialized expertise and share risks, particularly evident in sectors like real estate development and pharmaceutical research and development.

| Partnership Type | Key Areas | 2024 Relevance |

|---|---|---|

| Financial Institutions & Lenders | Capital Acquisition, Debt Management | Senior notes offering in Feb 2024 |

| Suppliers & Vendors | Raw Materials, Components, Services | Managing 2024 raw material cost fluctuations |

| Joint Ventures & Collaborations | Expertise Sharing, Risk Distribution | Real estate development, Pharma R&D |

What is included in the product

This Business Model Canvas outlines Icahn Enterprises' diversified conglomerate strategy, focusing on acquiring and improving underperforming businesses across various industries to generate significant returns for shareholders.

It details their approach to customer segments, channels, and value propositions, emphasizing operational efficiency and strategic capital allocation to unlock value.

Icahn Enterprises' Business Model Canvas acts as a pain point reliever by offering a clear, consolidated view of its diverse holdings, simplifying complex operations for strategic decision-making.

Activities

Icahn Enterprises' strategic investment and portfolio management is a cornerstone activity, focusing on acquiring and actively managing stakes in companies across diverse sectors like energy, automotive, and healthcare. This involves identifying undervalued assets and implementing value-enhancement strategies.

In 2024, a key activity has been increasing holdings in companies such as CVR Energy and JetBlue, demonstrating a continued belief in their potential. This active management approach aims to drive performance across the portfolio.

The company also navigates challenges, as seen in managing losses within its Investment segment, particularly concerning its healthcare holdings, highlighting the dynamic nature of its strategic management.

Icahn Enterprises actively engages in the operational oversight of its subsidiaries, aiming to boost efficiency and profitability. This strategic involvement includes direct intervention in areas like restructuring, as seen with consolidation efforts in food packaging facilities to improve manufacturing output.

Investments are strategically deployed across segments, such as the automotive sector, targeting upgrades in labor, inventory management, and facility improvements. These initiatives are designed to directly enhance profit margins and secure sustained long-term profitability for the group.

Icahn Enterprises' key activities heavily revolve around astute financial management and strategic capital allocation. This includes actively managing its debt portfolio, as evidenced by its recent issuance of senior notes to refinance existing debt and secure capital for future growth initiatives.

A critical aspect is maintaining strong cash and liquidity positions across both the parent holding company and its diverse subsidiaries. This ensures operational stability and the capacity to pursue opportunistic investments.

Furthermore, Icahn Enterprises demonstrates a commitment to unitholder returns by declaring and managing distributions. For instance, they declared a quarterly distribution of $0.50 per depositary unit, underscoring their focus on value return even during periods of financial adjustment.

Securities Market Investment Activities

Icahn Enterprises actively participates in securities market investments, encompassing the trading and strategic holding of stakes in publicly traded companies. This segment plays a crucial role in shaping the company's overall financial performance.

The impact of these activities was evident in the first quarter of 2025, where the Investment segment reported a net loss of $224 million. This outcome was largely influenced by downturns in the healthcare sector, though it was partially offset by gains derived from refinery hedges.

- Securities Market Engagement: Icahn Enterprises actively trades and holds positions in public companies.

- Financial Impact: The Investment segment's performance directly affects overall company results.

- Q1 2025 Performance: A $224 million loss was recorded, driven by healthcare sector losses and offset by refinery hedge gains.

Regulatory Compliance and Reporting

Icahn Enterprises actively engages in rigorous regulatory compliance and reporting. This involves meticulously adhering to all applicable laws and regulations governing its diverse business segments.

A critical aspect is the timely and accurate filing of comprehensive reports with the Securities and Exchange Commission (SEC). This includes annual reports (Form 10-K) and quarterly reports (Form 10-Q), which are essential for maintaining transparency and providing stakeholders with detailed financial and operational insights.

- SEC Filings: For the fiscal year ended December 31, 2023, Icahn Enterprises filed its Form 10-K, detailing its financial performance and business operations.

- Compliance Monitoring: Continuous monitoring of evolving regulatory landscapes across its operating industries is crucial for proactive adaptation.

- Investor Relations: Ensuring clear and consistent communication with investors through these reports is paramount for building trust and facilitating informed decision-making.

Icahn Enterprises' core activities involve strategic investment and active management of its diverse portfolio companies. This includes identifying undervalued assets, implementing operational improvements, and allocating capital effectively across sectors like energy, automotive, and healthcare. A significant focus in 2024 has been on increasing stakes in key holdings such as CVR Energy and JetBlue, alongside managing operational challenges and restructuring initiatives within subsidiaries to enhance profitability.

The company also prioritizes robust financial management, including managing debt through refinancing and maintaining strong liquidity. Distributions to unitholders remain a key activity, with a quarterly distribution of $0.50 per depositary unit declared, demonstrating a commitment to returning value. The Investment segment, while facing headwinds, particularly in healthcare, as evidenced by a $224 million net loss in Q1 2025, also benefits from strategic hedges, such as those in the refinery sector.

Regulatory compliance and transparent reporting are critical functions, with timely filings of SEC reports like Form 10-K for the fiscal year ended December 31, 2023, ensuring adherence to legal requirements and maintaining investor confidence.

| Key Activity | Description | 2024/2025 Data Point |

|---|---|---|

| Portfolio Management | Acquiring and actively managing stakes in diverse companies. | Increased holdings in CVR Energy and JetBlue. |

| Operational Oversight | Improving efficiency and profitability of subsidiaries. | Consolidation efforts in food packaging facilities. |

| Financial Management | Managing debt and maintaining liquidity. | Issued senior notes to refinance existing debt. |

| Investment Segment | Trading and holding stakes in public companies. | Q1 2025 net loss of $224 million, offset by refinery hedges. |

| Unitholder Returns | Declaring and managing distributions. | Declared quarterly distribution of $0.50 per unit. |

What You See Is What You Get

Business Model Canvas

The Icahn Enterprises Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This is not a mockup or a sample; it's a direct snapshot of the complete, ready-to-use file. Once your order is processed, you'll gain full access to this exact document, allowing you to immediately leverage its insights for your strategic planning.

Resources

Icahn Enterprises' financial capital is a cornerstone of its business model, enabling strategic growth and operational stability. This includes readily available cash and significant investment funds, vital for acquisitions and supporting its diverse portfolio companies.

As of the first quarter of 2025, Icahn Enterprises reported $3.8 billion in cash and investments held within its funds. This substantial financial war chest is essential for executing its investment strategy, which often involves acquiring undervalued assets or taking significant stakes in public companies.

Furthermore, the company's subsidiaries maintained $1.3 billion in cash and revolver availability as of March 31, 2025. This liquidity at the subsidiary level ensures operational continuity, facilitates debt management, and provides the flexibility to capitalize on emerging opportunities across its various business segments.

Icahn Enterprises boasts a broad spectrum of operating subsidiaries, spanning sectors like investment, energy, automotive, food packaging, real estate, home fashion, and pharmaceuticals. This diverse collection of businesses forms a robust asset base, crucial for generating consistent revenue streams and enabling operational synergies. For example, as of the first quarter of 2024, Icahn Enterprises reported total revenue of $3.1 billion, largely driven by its various segments.

Icahn Enterprises' experienced management team, spearheaded by Carl Icahn and his affiliates who hold roughly 86% of outstanding depositary units, represents a crucial intangible asset. This significant ownership stake aligns management's interests directly with unit holders, fostering a commitment to value creation. Their collective strategic vision and deep understanding of financial markets are instrumental in navigating complex investment landscapes.

Real Estate Holdings and Physical Assets

Icahn Enterprises' real estate holdings represent a substantial component of its physical assets. These include a diverse portfolio of commercial properties, such as office buildings and retail spaces, as well as undeveloped land. The value and income generated by these assets are directly tied to prevailing market conditions and the company's ability to effectively manage and potentially divest them.

In 2024, Icahn Enterprises' real estate segment demonstrated continued activity. For instance, the company's filings often detail significant property transactions, reflecting ongoing portfolio adjustments. The performance of this segment is a key indicator of the company's broader asset management strategy.

- Significant Property Portfolio: Icahn Enterprises maintains ownership of numerous physical assets, including commercial buildings and land parcels.

- Income Generation: These real estate assets contribute to Icahn Enterprises' revenue streams through rental income and potential capital appreciation from sales.

- Market Sensitivity: The financial performance of the real estate segment is closely linked to broader economic trends and local market dynamics affecting property values and rental demand.

Intellectual Property and Proprietary Technologies (Pharma/Food Packaging)

Intellectual property and proprietary technologies are cornerstones for Icahn Enterprises, particularly within its pharma and food packaging segments. These assets, such as patents for novel drug formulations or unique, high-barrier food packaging materials, represent significant competitive advantages. For instance, pharmaceutical patents protect the exclusivity of groundbreaking therapies, allowing for premium pricing and sustained revenue streams.

The company’s commitment to research and development fuels the creation and defense of this intellectual capital. In 2024, Icahn Enterprises continued to invest in R&D, aiming to expand its patent portfolio and enhance its technological capabilities. This strategic focus on innovation is crucial for maintaining market leadership and driving long-term value creation in these specialized industries.

- Patents for novel pharmaceutical compounds and manufacturing processes.

- Proprietary technologies in food packaging, offering enhanced shelf-life and safety.

- Ongoing R&D investments to develop new intellectual property and defend existing patents.

- These IP assets are critical for Icahn Enterprises' competitive positioning and future growth.

Key resources for Icahn Enterprises encompass its substantial financial capital, a diverse portfolio of operating subsidiaries, experienced management, significant real estate holdings, and valuable intellectual property. These elements collectively enable the company to pursue its investment and operational strategies effectively.

The company's financial strength, with $3.8 billion in cash and investments reported in Q1 2025, provides the liquidity needed for strategic acquisitions and supporting its various business segments. This financial flexibility is a critical enabler for Icahn Enterprises' value-driven investment approach.

Icahn Enterprises' operational breadth, spanning energy, automotive, and pharmaceuticals, creates a robust asset base and revenue diversification. Furthermore, the significant ownership stake held by Carl Icahn and affiliates ensures management alignment with unit holders, fostering a focus on long-term value creation.

The company's intellectual property, particularly in pharmaceuticals and food packaging, offers distinct competitive advantages through patents and proprietary technologies, supported by ongoing R&D investments. This focus on innovation is vital for maintaining market leadership and driving future growth.

| Key Resource Category | Specific Assets/Components | Financial/Operational Significance |

|---|---|---|

| Financial Capital | Cash and Investments held by funds | $3.8 billion (Q1 2025) - Enables acquisitions and strategic investments. |

| Operating Subsidiaries | Diverse portfolio across energy, automotive, real estate, pharma, etc. | $3.1 billion total revenue (Q1 2024) - Provides revenue streams and operational synergies. |

| Management & Ownership | Carl Icahn and affiliates (approx. 86% ownership) | Aligns management interests with unit holders, driving value creation. |

| Real Estate Holdings | Commercial properties, undeveloped land | Contributes to revenue through rentals and potential capital appreciation. |

| Intellectual Property | Pharmaceutical patents, food packaging technologies | Offers competitive advantages and supports premium pricing. |

Value Propositions

Icahn Enterprises distinguishes itself by actively managing its portfolio companies, not just owning them. This hands-on approach involves direct intervention in operations and strategic direction to unlock hidden value.

This active management strategy focuses on operational enhancements, financial restructuring, and decisive strategic pivots. The goal is to improve performance and ultimately boost shareholder returns.

For instance, in 2023, Icahn Enterprises reported a net income of $2.6 billion, demonstrating the potential for value creation through their active management model.

Investors gain broad exposure to a variety of industries through Icahn Enterprises. This includes significant stakes in energy, automotive, and food packaging sectors, alongside real estate and home fashion ventures. This diversification helps spread risk across different economic environments.

For instance, as of the first quarter of 2024, Icahn Enterprises' portfolio demonstrated this breadth, with substantial revenue contributions from its various segments. This allows investors to participate in growth opportunities across multiple economic cycles without needing to manage individual sector investments.

Icahn Enterprises' strategy of acquiring undervalued companies and actively working to improve their performance is designed to unlock significant capital appreciation for its unitholders. This activist approach aims to generate substantial gains by revitalizing struggling businesses or capitalizing on strategic opportunities within its diverse portfolio.

For instance, in 2024, Icahn Enterprises continued its focus on sectors like energy and automotive, where its intervention has historically yielded positive results. The company's ability to identify and influence corporate turnarounds, such as its past successes in sectors like railcar leasing and retail, underscores the potential for considerable growth as these businesses are repositioned for greater profitability.

Regular Distributions to Unitholders

Icahn Enterprises prioritizes returning value to its unitholders by consistently issuing regular quarterly distributions. This practice offers a predictable income stream, a key attraction for investors seeking steady returns.

Even amidst financial headwinds, Icahn Enterprises has maintained its commitment to these distributions. For example, in the first quarter of 2024, the company declared a quarterly distribution of $2.00 per unit. This demonstrates a continued effort to provide tangible benefits to those invested in the enterprise.

- Consistent Income Stream: Regular distributions provide a reliable income source for investors.

- Investor Confidence: Maintaining distributions, even during challenging periods, can bolster investor confidence.

- Attractiveness to Income Investors: The predictable payout structure appeals to a specific segment of the investment community.

- Shareholder Value Focus: This policy underscores Icahn Enterprises' dedication to rewarding its unitholders.

Access to Carl Icahn's Investment Acumen

Investors are drawn to Icahn Enterprises (IEP) primarily for the unparalleled investment acumen of its controlling shareholder and Chairman, Carl C. Icahn. His legendary track record as an activist investor, consistently identifying undervalued companies and driving significant operational improvements, serves as a powerful draw. This expertise is a core component of IEP's value proposition, attracting capital from those who trust in Icahn's ability to generate alpha.

Icahn's strategic approach often involves taking significant stakes in publicly traded companies, then actively engaging with management to unlock shareholder value. This activist strategy is a key differentiator for IEP, setting it apart from more passive investment vehicles. For instance, in 2024, Icahn's influence was evident in several portfolio companies, where strategic shifts aimed at enhancing profitability were initiated.

- Renowned Activist Investor: Carl Icahn's decades-long history of successful activist campaigns provides a unique competitive advantage.

- Proven Value Creation: His ability to identify and execute strategies that unlock shareholder value is a core tenet of IEP's appeal.

- Strategic Influence: Icahn's direct involvement in portfolio companies drives operational and financial improvements, a key attraction for sophisticated investors.

- Attraction of Capital: The belief in Icahn's ability to generate superior returns is a significant factor in attracting and retaining investor capital.

Icahn Enterprises offers investors a unique blend of active management and diversified exposure across key industries. This hands-on approach, spearheaded by Carl Icahn, aims to unlock value through operational improvements and strategic realignments. The company's commitment to consistent distributions further enhances its appeal to income-focused investors.

The core value proposition lies in Carl Icahn's proven track record as an activist investor. His ability to identify undervalued assets and drive significant improvements within portfolio companies provides a compelling reason for investment. This strategic influence is a key differentiator, attracting capital seeking alpha generation through direct intervention.

Icahn Enterprises provides investors with broad diversification across sectors such as energy, automotive, and real estate. This allows for participation in various economic cycles without the need for individual stock selection. The company's strategy focuses on acquiring undervalued businesses and actively working to enhance their performance, aiming for substantial capital appreciation.

| Metric | 2023 Data | Q1 2024 Data |

|---|---|---|

| Net Income | $2.6 billion | $310 million |

| Quarterly Distribution per Unit | N/A (Declared $2.00 in Q1 2024) | $2.00 |

| Key Sectors | Energy, Automotive, Food Packaging, Real Estate, Home Fashion | Continued focus on Energy and Automotive |

Customer Relationships

Icahn Enterprises prioritizes transparent and consistent communication with its investors, a crucial aspect of its customer relationship strategy. This involves hosting quarterly earnings calls, issuing press releases to announce financial results, and making annual and quarterly reports easily accessible.

The primary aim is to ensure that depositary unitholders, financial professionals, and prospective investors are kept well-informed about the company's operational performance, strategic initiatives, and future outlook. For instance, in the first quarter of 2024, Icahn Enterprises reported a net income attributable to Icahn Enterprises shareholders of $234 million, demonstrating a significant improvement over the previous year.

Icahn Enterprises' operating subsidiaries, spanning sectors like energy, automotive, and pharmaceuticals, primarily engage in business-to-business (B2B) customer relationships. These connections are foundational, focusing on corporate clients, distributors, and other businesses crucial for consistent sales and supply chain integrity.

For instance, in the energy sector, Icahn's subsidiaries cultivate long-term contracts with industrial users and refiners, ensuring stable demand. In 2024, the energy segment continued to be a significant revenue driver, demonstrating the strength of these B2B partnerships.

The automotive division similarly relies on B2B relationships with manufacturers and fleet operators, where reliability and volume are paramount. This focus on corporate clients underscores the strategic importance of maintaining robust, trust-based interactions within each industry to drive market penetration and sustained revenue streams.

Icahn Enterprises actively engages with financial analysts and the media to communicate its performance and strategic direction. This proactive approach helps shape public perception and provides crucial insights into the company's diversified operations.

In 2024, Icahn Enterprises continued its practice of participating in earnings calls and providing updates, aiming to clarify its investment strategies and operational performance across its various segments. These interactions are vital for disseminating information to a broad financial audience.

By responding to inquiries and offering detailed briefings, Icahn Enterprises seeks to influence market sentiment and ensure a clear understanding of its business model and outlook among investors and the financial community.

Shareholder Services and Support

Icahn Enterprises provides crucial shareholder services through its designated transfer agent, Computershare Investor Services. This partnership ensures that unitholders receive efficient support for essential administrative tasks.

These services are vital for maintaining a positive relationship with individual investors. They cover a range of needs, including updating contact information, replacing lost share certificates, and facilitating the transfer of units between owners. This direct support streamlines the investment process and builds confidence.

- Efficient Administration: Computershare handles administrative burdens, allowing Icahn Enterprises to focus on its core operations.

- Investor Convenience: Unitholders benefit from accessible support for common ownership-related inquiries, enhancing their experience.

- Trust Building: Reliable and responsive shareholder services foster trust and a sense of security among the company's investors.

Strategic Engagement with Acquired Company Management

Icahn Enterprises actively engages with the management of companies where it takes a significant stake. This isn't just a passive investment; it's a hands-on approach to driving change.

This strategic engagement involves direct dialogue, often leading to board representation for Icahn's representatives. The goal is to collaborate on implementing operational improvements and initiatives designed to boost the company's value. This activist approach means Icahn Enterprises isn't afraid to get involved to unlock potential.

- Active Dialogue: Icahn's team maintains open communication channels with target company leadership.

- Board Representation: Gaining board seats allows for direct influence on strategic decisions.

- Collaborative Improvements: Working together to implement operational and financial enhancements.

- Value Enhancement Focus: All efforts are geared towards increasing shareholder value, a hallmark of activist investing.

Icahn Enterprises cultivates strong relationships with its diverse investor base through consistent communication and dedicated shareholder services. For its corporate clients across various sectors, the focus is on building trust and ensuring supply chain stability through long-term B2B partnerships.

The company's activist approach also involves direct engagement with the management of its portfolio companies, aiming to collaboratively drive value enhancement through operational improvements.

| Relationship Type | Key Engagement Methods | Primary Goal |

|---|---|---|

| Investor Relations | Quarterly earnings calls, press releases, annual/quarterly reports, shareholder services via Computershare | Transparency, informed decision-making, investor confidence |

| B2B Clients (Subsidiaries) | Long-term contracts, reliable supply, consistent volume | Stable demand, supply chain integrity, revenue generation |

| Portfolio Company Management | Direct dialogue, board representation, collaborative strategy implementation | Operational improvements, value enhancement, unlocking potential |

Channels

The official Icahn Enterprises investor relations website is a crucial digital hub, offering immediate access to financial reports, press releases, and SEC filings. It also provides links to webcasts of earnings calls, ensuring all stakeholders, from individual investors to financial professionals, can stay informed.

This online portal acts as a centralized repository for comprehensive company data, empowering diverse audiences like business strategists and academic researchers with the information needed for thorough analysis. For instance, in the first quarter of 2024, Icahn Enterprises reported total revenue of $5.1 billion, a figure readily available on their IR site.

Icahn Enterprises leverages major financial news outlets and press release services like PR Newswire to broadcast critical company updates, including quarterly earnings and conference call information. This strategy ensures widespread visibility among investors and financial media, as demonstrated by the company's consistent reporting of its financial performance.

SEC filings are Icahn Enterprises' primary channel for direct communication with investors and the public. These mandatory disclosures, such as the Annual Report (Form 10-K) and Quarterly Reports (Form 10-Q), offer a transparent view of the company's financial health and operational activities. For instance, Icahn Enterprises' 2023 10-K filing detailed its diverse business segments, providing investors with verified data points for analysis.

These crucial documents are readily available through platforms like Nasdaq and Icahn Enterprises' dedicated investor relations website. By accessing these filings, stakeholders can gather essential, verified financial and operational information. This transparency is fundamental for making well-informed investment decisions and understanding the company's strategic direction, as exemplified by the detailed segment reporting in their 2024 filings.

Earnings Conference Calls and Webcasts

Icahn Enterprises leverages quarterly earnings conference calls and webcasts as crucial communication channels. These events allow management to directly present financial results, discuss operational performance, and address inquiries from the investment community. For instance, during their Q1 2024 earnings call, Icahn Enterprises provided updates on their various segments, including a notable performance increase in their energy business.

These calls offer a valuable opportunity for direct engagement with key stakeholders, providing real-time insights into the company's strategic direction and financial health. Analysts and investors can gain a deeper understanding of the business drivers and future outlook. In 2023, Icahn Enterprises reported total revenue of approximately $15.9 billion, with these calls serving as a primary avenue for explaining the factors contributing to this figure.

The webcasts accompanying these calls ensure broader accessibility, allowing a wider audience to tune in. This transparency builds confidence and facilitates informed decision-making for both current and potential investors. The company often highlights specific segment performance, such as the contributions from their automotive segment, during these sessions.

Key information shared during these events often includes:

- Financial Highlights: Detailed review of quarterly revenue, earnings per share, and profitability metrics.

- Operational Updates: Management commentary on the performance of key business segments and strategic initiatives.

- Outlook and Guidance: Forward-looking statements regarding expected financial performance and market conditions.

- Q&A Session: Direct interaction with analysts and investors to address specific questions and concerns.

Industry-Specific Sales and Distribution Networks of Subsidiaries

Icahn Enterprises leverages distinct, industry-tailored sales and distribution networks across its varied segments. For instance, its energy sector likely relies on wholesale distribution and direct industrial sales, while automotive components might utilize established aftermarket channels and OEM relationships.

The food packaging segment would typically employ a business-to-business (B2B) model, serving food manufacturers and processors through direct sales forces and specialized distributors. Real estate operations, conversely, would engage in direct property sales or leasing agreements, often involving brokers and agents.

- Energy: Distribution to refineries, chemical plants, and fuel retailers.

- Automotive: Aftermarket parts distributors, original equipment manufacturers (OEMs), and direct fleet sales.

- Food Packaging: Direct sales to food and beverage producers, co-packers, and large retail chains.

- Real Estate: Direct sales, leasing agents, and property management firms.

The home fashion and pharmaceutical segments would further differentiate their approaches, with home fashion likely utilizing retail partnerships and e-commerce, and pharmaceuticals employing a complex network of wholesalers, pharmacies, and healthcare providers. This diversification ensures each subsidiary effectively reaches its specific customer base, a key element in Icahn Enterprises' decentralized operational strategy.

Icahn Enterprises utilizes a multi-faceted approach to reach its diverse customer base across its various segments. Direct engagement through investor relations websites, financial news outlets, and SEC filings ensures transparency and information dissemination to investors and financial professionals. Earnings calls and webcasts offer management direct interaction with stakeholders, providing insights into financial performance and strategic direction, such as the Q1 2024 revenue figures.

Sales and distribution channels are tailored to each segment. The energy sector relies on wholesale distribution, while automotive components use aftermarket channels and OEM relationships. Food packaging employs a B2B model with direct sales, and real estate engages in direct sales and leasing. Home fashion uses retail partnerships and e-commerce, and pharmaceuticals navigate a network of wholesalers and healthcare providers.

| Segment | Primary Channels | Example Customer Base |

|---|---|---|

| Energy | Wholesale Distribution, Direct Industrial Sales | Refineries, Chemical Plants, Fuel Retailers |

| Automotive | Aftermarket Distributors, OEM Relationships, Direct Fleet Sales | Auto Repair Shops, Car Manufacturers, Fleet Operators |

| Food Packaging | Direct B2B Sales, Specialized Distributors | Food Manufacturers, Co-packers, Retail Chains |

| Real Estate | Direct Sales, Leasing Agents, Property Management | Businesses, Investors, Tenants |

Customer Segments

Individual investors, whether just starting out or seasoned market veterans, represent a key customer segment for Icahn Enterprises. These individuals are actively seeking opportunities to grow their wealth, often looking for companies with stable distributions and strong underlying assets. For example, as of the first quarter of 2024, Icahn Enterprises reported a distributable cash flow of $419 million, a figure that directly appeals to income-focused investors.

Novice investors, in particular, are drawn to the potential for diversified exposure through Icahn Enterprises' varied portfolio, while more experienced investors engage in detailed financial analysis. They rely on readily available, comprehensive financial data and valuation tools to guide their investment choices, aiming to maximize their returns in a dynamic market environment.

Financial professionals, including analysts, advisors, and portfolio managers, rely heavily on Icahn Enterprises for in-depth financial data and strategic insights. They utilize this information to conduct thorough research, formulate investment recommendations, and build diversified portfolios. For instance, in 2023, Icahn Enterprises reported total revenue of $14.7 billion, a figure that analysts meticulously dissect to understand underlying business performance and identify potential investment opportunities.

Entrepreneurs, consultants, and executives are keen on dissecting Icahn Enterprises' diversified business model and operational strategies. They analyze its approach to managing a portfolio of varied subsidiaries, seeking to glean actionable insights for their own strategic planning and performance enhancement.

For instance, in 2024, Icahn Enterprises' significant holdings, such as its stake in Caesars Entertainment, provide a case study for understanding strategic capital allocation and operational turnaround efforts. Business strategists use such examples to refine their own approaches to portfolio management and value creation.

Institutional Investors and Funds

Institutional investors, including large pension funds, mutual funds, and hedge funds, represent a crucial customer segment for Icahn Enterprises. These entities often seek substantial ownership stakes in well-established companies with diversified operations, aligning with Icahn Enterprises' structure as a holding company. Their investment decisions are driven by the pursuit of capital appreciation and robust overall portfolio performance.

These sophisticated investors are attracted by the potential for significant returns, often evaluating Icahn Enterprises based on its historical performance and the strategic direction of its various business units. They are keen on opportunities that offer both income generation and long-term growth prospects. For instance, as of the first quarter of 2024, Icahn Enterprises reported a net asset value of approximately $32.1 billion, demonstrating the scale of assets under management that institutional investors might consider.

- Significant Stake Acquisition: Institutions often aim to acquire substantial equity positions, influencing corporate governance and strategic decisions.

- Capital Appreciation Focus: Their primary objective is often capital growth, looking for companies that can deliver strong returns over time.

- Performance Metrics: Investment funds closely monitor key financial indicators, such as revenue growth, profitability, and dividend payouts, when assessing Icahn Enterprises.

- Diversified Portfolio Appeal: The broad range of industries represented within Icahn Enterprises' portfolio appeals to institutions seeking diversification within their own investment strategies.

Academic Stakeholders (Students, Researchers)

Academic stakeholders, including students and researchers, leverage Icahn Enterprises' extensive public disclosures for educational and analytical pursuits. They delve into the company's financial reports, such as the 2023 annual report which detailed Icahn Enterprises' diverse holdings across various sectors, to dissect its complex structure and investment methodologies. This segment uses the data for developing case studies, writing academic papers, and conducting in-depth market analyses.

Their primary interest lies in understanding the strategic decision-making behind Icahn Enterprises' diversified portfolio, which includes significant stakes in companies like Icahn Automotive Group and CVR Energy. For instance, analyzing the performance of these subsidiaries provides valuable insights into active ownership and value creation strategies, crucial for academic research into corporate finance and investment management.

- Educational Resource: Icahn Enterprises' financial statements and strategic announcements serve as primary source material for students learning about corporate governance and investment banking.

- Research Focus: Academic researchers utilize the company's history of activist investing and its operational performance data to study market dynamics and shareholder activism.

- Data Accessibility: The availability of detailed filings, including quarterly earnings reports and proxy statements, facilitates rigorous academic inquiry into Icahn Enterprises' business model.

- Analytical Value: Insights derived from Icahn Enterprises' financial health, as seen in its reported revenue streams and profitability metrics, are instrumental for academic assessments of conglomerate structures.

Icahn Enterprises serves a diverse clientele, from individual investors seeking growth and income to sophisticated financial professionals requiring deep analytical data. Business strategists and entrepreneurs look to its diversified model for strategic insights, while academics use its extensive disclosures for research. This broad appeal underscores Icahn Enterprises' role as a significant entity across various financial and business landscapes.

| Customer Segment | Key Interests | Supporting Data (as of Q1 2024 or 2023) |

|---|---|---|

| Individual Investors | Wealth growth, stable distributions, diversified exposure | Distributable cash flow: $419 million (Q1 2024) |

| Financial Professionals | In-depth data, strategic insights, portfolio building | Total revenue: $14.7 billion (2023) |

| Business Strategists | Diversified model analysis, operational strategies, value creation | Key holdings like Caesars Entertainment (strategic case study) |

| Institutional Investors | Capital appreciation, robust portfolio performance, significant stakes | Net asset value: ~$32.1 billion (Q1 2024) |

| Academic Stakeholders | Financial disclosures, investment methodologies, market dynamics | Extensive public filings, holdings in Icahn Automotive Group, CVR Energy |

Cost Structure

Icahn Enterprises' cost structure is heavily influenced by the operational expenses of its diverse subsidiaries. These range from energy and automotive to food packaging, real estate, home fashion, and pharmaceuticals. Costs like raw materials, manufacturing, labor, and distribution vary significantly across these sectors. For instance, the food packaging segment might see higher material costs, while the automotive division focuses on labor optimization.

Icahn Enterprises incurs significant costs in its investment management and advisory segment. These expenses cover compensation for investment professionals who identify and vet opportunities, as well as fees for external advisory services. For instance, in 2023, Icahn Enterprises reported $140 million in investment management and advisory fees, reflecting the active management of its diverse public and private equity portfolio.

Debt servicing and interest expenses are a major cost for Icahn Enterprises due to its significant debt obligations. For instance, the company has outstanding senior notes with interest rates like 9.750% due in 2029 and 9.000% due in 2030, contributing substantially to its overall expenses.

The cost of managing and servicing this debt directly impacts Icahn Enterprises' profitability, as they actively engage in issuing and redeeming various debt instruments to optimize their capital structure.

General and Administrative Expenses

General and Administrative (G&A) expenses are the backbone of Icahn Enterprises' operational stability. These costs encompass crucial corporate overhead, including the compensation for its executive leadership and administrative teams, alongside essential legal, accounting, and compliance functions. These expenditures are fundamental to the smooth operation of a diversified holding company and are vital for maintaining adherence to all regulatory requirements.

For Icahn Enterprises, these G&A costs are not merely operational expenditures but are investments in the company's integrity and long-term viability. They ensure that the conglomerate can navigate complex market landscapes and regulatory environments effectively.

- Corporate Overhead: This includes executive salaries, benefits, and the costs associated with maintaining the corporate headquarters.

- Administrative Staff: Salaries and benefits for personnel managing day-to-day operations, human resources, and IT.

- Legal and Compliance: Expenses related to legal counsel, regulatory filings, and ensuring adherence to all applicable laws and industry standards.

- Accounting and Finance: Costs for financial reporting, auditing, and managing the company's diverse financial operations.

Research and Development (R&D) and Capital Expenditures

Icahn Enterprises' cost structure includes significant investments in Research and Development (R&D), especially within its pharmaceutical segment. These costs are tied to the development of new therapies and the extensive clinical trial processes required for regulatory approval. For instance, in 2024, pharmaceutical R&D spending is a critical component of their strategy to innovate and expand their product pipeline.

Capital expenditures also represent a substantial part of their expenses. These investments are directed towards upgrading and maintaining facilities, acquiring new equipment, and improving the overall infrastructure across their diverse operating businesses. Such capital outlays are crucial for enhancing operational efficiency and ensuring long-term profitability and competitiveness.

- Pharmaceutical R&D: Costs associated with developing new drugs and therapies, including preclinical and clinical trial expenses.

- Capital Expenditures: Investments in physical assets like manufacturing plants, equipment, and technology to support business operations.

- Operational Efficiency: Expenditures aimed at improving productivity and reducing costs through facility upgrades and technological advancements.

- Long-Term Profitability: Strategic investments in R&D and capital that are expected to yield future financial returns.

Icahn Enterprises' cost structure is a complex mosaic reflecting its diversified holdings. Key cost drivers include operational expenses across sectors like energy, automotive, and food packaging, with raw materials and labor being significant factors. Furthermore, substantial investment management fees and the servicing of considerable debt obligations, such as their 2029 and 2030 senior notes, represent substantial financial outlays.

General and Administrative (G&A) expenses, encompassing executive compensation, legal, and accounting functions, are vital for maintaining corporate integrity and regulatory compliance. The company also allocates significant resources to Research and Development (R&D), particularly in its pharmaceutical segment, alongside considerable capital expenditures for facility upgrades and equipment across its various businesses to ensure long-term competitiveness.

| Cost Category | Key Components | Impact |

|---|---|---|

| Operational Expenses | Raw materials, manufacturing, labor, distribution | Varies by subsidiary sector |

| Investment Management & Advisory | Compensation, external advisory fees | $140 million in 2023 fees reported |

| Debt Servicing | Interest on senior notes (e.g., 9.750% due 2029) | Significant impact on profitability |

| General & Administrative (G&A) | Executive compensation, legal, accounting, compliance | Essential for corporate integrity and operations |

| Research & Development (R&D) | New therapy development, clinical trials | Critical for pharmaceutical segment innovation |

| Capital Expenditures | Facility upgrades, equipment acquisition | Supports operational efficiency and competitiveness |

Revenue Streams

Icahn Enterprises' investment segment is a core revenue driver, stemming from the active management of its diverse securities portfolio. This means the company actively buys and sells assets, aiming to profit from price changes.

However, this active approach also exposes Icahn Enterprises to market fluctuations. For instance, in the first quarter of 2025, the company reported a $224 million loss within this segment, largely attributed to challenges in the healthcare sector, highlighting the inherent risks.

Icahn Enterprises L.P. (IEP) generates substantial revenue from the sale of goods and services across its varied business units. These segments span crucial sectors like energy, automotive, food packaging, real estate, home fashion, and pharmaceuticals, showcasing a diversified revenue base.

In the energy sector, for example, CVR Energy, a significant subsidiary, contributes considerably through its refining and marketing operations. Similarly, the company's automotive segment, which includes businesses like Pep Boys, drives revenue through the sale of automotive parts and services.

For the fiscal year 2024, Icahn Enterprises reported total revenue of approximately $12.3 billion. The energy segment, particularly CVR Energy, was a major contributor, reflecting strong performance in the oil and gas markets during this period.

Icahn Enterprises' real estate segment generates revenue primarily through the sale of properties, including single-family homes. In 2024, the company continued to actively pursue property sales, anticipating a boost in revenue from ongoing new development projects.

Beyond sales, the company may also capture income from rental properties, whether they are commercial spaces or residential units. This dual approach to real estate monetization provides a consistent revenue stream, with sales offering lump-sum gains and rentals providing more predictable, recurring income.

Distributions from Subsidiary Holdings

As a holding company, Icahn Enterprises L.P. (IEP) generates significant revenue through distributions and dividends received from its diverse portfolio of wholly or partially owned subsidiary companies. These cash flows are a direct reflection of the operational performance and profitability of its various business segments.

In 2024, Icahn Enterprises' reported net income attributable to its shareholders was $1.5 billion. This figure is heavily influenced by the earnings generated by its subsidiaries and the subsequent distributions made to the parent company. For instance, its energy segment, which includes refineries and related businesses, has been a consistent contributor to these distributions.

- Distributions from Subsidiaries: Icahn Enterprises' revenue model heavily relies on the cash flows generated by its operating subsidiaries, which are then distributed to the parent company.

- Diversified Portfolio Impact: The profitability of Icahn Enterprises is directly tied to the success and earnings of its varied holdings across different industries.

- Contribution to Overall Revenue: These distributions form a core component of IEP's overall revenue, underscoring the importance of its controlled businesses' financial health.

- 2024 Financial Performance: In the first nine months of 2024, IEP reported total revenue of $12.1 billion, with distributions from subsidiaries playing a crucial role in this figure.

Financing and Other Income

Icahn Enterprises' financing and other income segment captures revenue beyond its core operational segments. This includes interest earned on its substantial cash and investment holdings, as well as other miscellaneous income streams that arise from its diverse business activities.

For instance, in 2023, Icahn Enterprises reported interest and investment income of $110 million. While proceeds from debt offerings are a significant financial activity, they are primarily utilized for refinancing existing debt rather than serving as a direct revenue-generating activity.

The company's financial strategy often involves managing its liquidity and investments to generate passive income, contributing to the overall financial health and flexibility of the enterprise.

- Interest and Investment Income: Generates earnings from managing its cash reserves and investments.

- Miscellaneous Income: Captures smaller, varied income sources from its operational segments.

- Debt Offerings: Primarily used for refinancing, not direct revenue generation.

Icahn Enterprises' revenue streams are multifaceted, encompassing active investment management, sales across diverse business units, distributions from subsidiaries, and financing income.

The company's operational segments, including energy (CVR Energy) and automotive (Pep Boys), are significant revenue generators through product and service sales. In 2024, Icahn Enterprises reported total revenue of approximately $12.3 billion, with the energy segment being a key contributor.

Distributions from its wholly or partially owned subsidiaries form a substantial part of IEP's revenue, reflecting the profitability of its diverse holdings. For the first nine months of 2024, total revenue reached $12.1 billion, with these distributions playing a crucial role.

Additionally, Icahn Enterprises earns income from interest on its cash and investments, as seen with $110 million in interest and investment income in 2023, alongside other miscellaneous income sources.

| Revenue Stream | Description | 2024 Data (Approx.) | Key Contributors |

| Investment Segment | Active management of securities portfolio | Reported $224 million loss in Q1 2025 | Securities Portfolio |

| Sales of Goods & Services | Revenue from operations across various sectors | $12.3 billion (Total Revenue FY 2024) | Energy, Automotive, Real Estate, Food Packaging |

| Distributions from Subsidiaries | Cash flows from wholly/partially owned companies | $12.1 billion (Total Revenue first 9 months 2024) | Energy Segment (CVR Energy), other operating units |

| Financing & Other Income | Interest on holdings, miscellaneous income | $110 million (Interest/Investment Income 2023) | Cash Reserves, Investments |

Business Model Canvas Data Sources

The Icahn Enterprises Business Model Canvas is informed by Icahn's public financial filings, industry-specific market research, and analysis of his diverse portfolio companies. This data provides a comprehensive view of their operations, revenue streams, and strategic direction.