Icahn Enterprises Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Icahn Enterprises Bundle

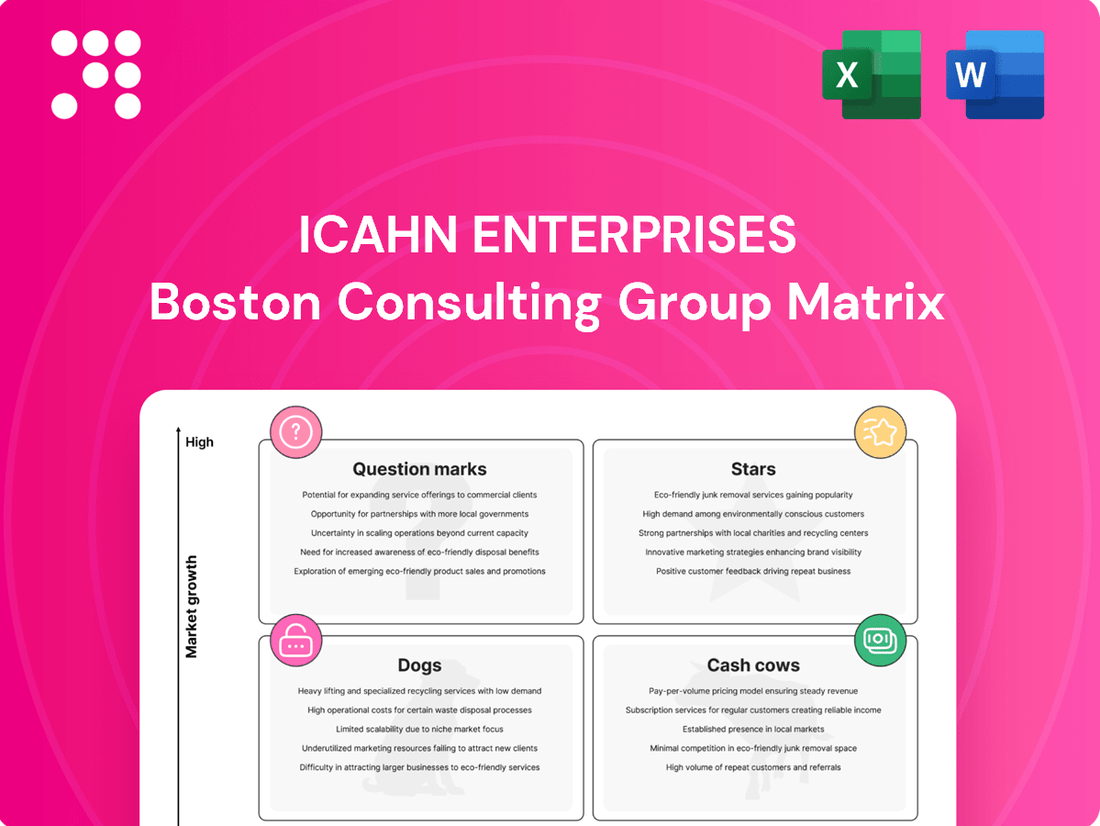

Curious about Icahn Enterprises' strategic product portfolio? Our BCG Matrix preview offers a glimpse into where their businesses might be positioned as Stars, Cash Cows, Dogs, or Question Marks.

Unlock the full picture and gain a clear, actionable understanding of their market standing by purchasing the complete BCG Matrix. This detailed analysis will provide the strategic insights you need to make informed decisions about capital allocation and future growth.

Stars

Icahn Enterprises' real estate segment saw its value jump by $292 million, driven by a property sale agreement and a move to fair-market valuations for its remaining holdings.

Looking ahead, the segment is poised for further growth with an expected uptick in single-family home sales from a new Country Club project, slated to begin by the close of 2025.

Icahn Enterprises' Pharma segment is a growing star, boasting a 13% revenue surge driven by strong prescription growth and successful European market expansion. This impressive performance highlights the segment's current strength and its potential for continued upward trajectory.

Further bolstering its star status, a developmental therapy within the Pharma segment recently achieved a critical FDA milestone. With preparations for clinical trials now in progress, this advancement signals a clear path toward potential future market leadership and significant value creation.

Icahn Enterprises' activist investment strategy, spearheaded by Carl Icahn, is a cornerstone of its operations, focusing on identifying and transforming undervalued public companies. This approach involves acquiring substantial stakes and actively engaging with management to drive strategic and operational enhancements, aiming to unlock significant shareholder value.

A prime example of this strategy in action was Icahn's successful campaign at Xerox in 2018, where he pushed for a shake-up of the board and a revised merger agreement with Fujifilm, ultimately benefiting shareholders. Icahn Enterprises' portfolio often reflects this active management, with a focus on sectors ripe for such interventions, seeking to capitalize on mispriced assets.

Strategic Acquisitions and Opportunities

Icahn Enterprises (IEP) actively pursues strategic acquisitions, leveraging its history of transforming investments into profitable businesses. This proactive approach is crucial for identifying and capitalizing on market inefficiencies.

The company's robust financial position, evidenced by $1.3 billion in cash at the holding company and an additional $900 million at its funds as of the first quarter of 2025, creates a significant capacity for strategic moves. This substantial liquidity acts as a powerful enabler for growth-oriented investments.

- Capitalizing on Opportunities: IEP's financial strength allows it to act decisively on emerging investment prospects.

- Strategic Transactions: The company is positioned to execute significant strategic transactions that can drive future value.

- High Growth Potential: IEP can allocate considerable resources to ventures with substantial growth prospects.

CVR Energy (Potential)

CVR Energy (Potential) currently exhibits characteristics that could position it as a Star within the Icahn Enterprises portfolio. While the company faced challenges, including a notable EBITDA decline and the suspension of cash dividends in late 2024, it is actively pursuing strategic growth avenues. These include potential acquisitions of refining assets, which could substantially broaden its market reach and boost profitability.

Several factors suggest a positive future outlook for CVR Energy. The recent strengthening of crack spreads, a key indicator of refining profitability, is a significant tailwind. Furthermore, the potential resolution of litigation concerning small refinery exemptions could remove a considerable overhang and improve operational certainty. These developments, if realized, could transform CVR Energy into a high-growth, high-market-share Star.

- EBITDA Decline: CVR Energy experienced a decrease in its Earnings Before Interest, Taxes, Depreciation, and Amortization, impacting its immediate financial performance.

- Dividend Suspension: In late 2024, the company made the decision to suspend its cash dividend payments, a move often associated with companies prioritizing reinvestment or facing financial pressures.

- Strategic Transactions: CVR Energy is actively exploring strategic options, including the acquisition of additional refining assets, signaling an intent to expand its operational footprint.

- Improving Crack Spreads: Recent market conditions have led to improved crack spreads, which directly benefit refining margins and CVR Energy's core business.

- Litigation Resolution: The potential positive outcome of litigation related to small refinery exemptions could significantly enhance the company's operating environment and financial stability.

Icahn Enterprises' Pharma segment is a clear Star, demonstrating robust growth with a 13% revenue increase driven by strong prescription uptake and successful expansion into European markets. This segment is further solidified as a Star by a developmental therapy that recently achieved a critical FDA milestone, paving the way for future clinical trials and potential market leadership.

CVR Energy is positioned as a potential Star within Icahn Enterprises' portfolio. Despite an EBITDA decline and dividend suspension in late 2024, the company is actively pursuing growth through strategic acquisitions of refining assets. Favorable market conditions, including strengthening crack spreads and the potential resolution of litigation regarding small refinery exemptions, could propel CVR Energy into a high-growth, high-market-share Star.

What is included in the product

Strategic assessment of Icahn Enterprises' portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

Icahn Enterprises' BCG Matrix offers a pain point reliever by simplifying complex portfolio analysis into a clear, actionable visual.

This allows for rapid identification of star, cash cow, question mark, and dog business units, easing strategic decision-making.

Cash Cows

Icahn Enterprises demonstrates robust liquidity, holding $1.3 billion in cash and equivalents at the holding company level and an additional $900 million within its funds as of the first quarter of 2025. This significant cash hoard functions as a cash cow, readily available to cover essential operational expenditures like administrative costs, research and development initiatives, debt obligations, and regular quarterly distributions to unitholders.

The company's consistent declaration of a $0.50 per depositary unit quarterly distribution underscores its stable cash-generating capabilities. While some of these distributions may be supported by the issuance of new units, the underlying stability of cash flow from its operations is a key characteristic of this cash cow segment.

The Energy segment, largely represented by CVR Energy, Inc., has been a cornerstone of Icahn Enterprises' (IEP) revenue. While facing headwinds such as decreased EBITDA and a pause in dividend payouts, CVR Energy maintains a significant market presence within the energy industry, indicating its Cash Cow status.

CVR Energy's fertilizer operations have been a bright spot, demonstrating robust performance. This strength is attributed to persistently elevated fertilizer prices and high operational utilization rates, which have consistently bolstered the segment's cash flow generation.

Icahn Enterprises' real estate holdings extend beyond development to include the leasing of diverse properties like retail, office, and industrial spaces, as well as land. These established rental assets are prime candidates for the Cash Cows quadrant of the BCG Matrix. They likely benefit from mature market positions, leading to consistent, albeit low-growth, cash flow generation.

Food Packaging Segment (Viskase)

The Food Packaging segment, largely represented by Viskase Companies, Inc., is a prime example of a Cash Cow within Icahn Enterprises' portfolio. This segment operates in a mature market, manufacturing essential casings for processed meats like cellulosic, fibrous, and plastic varieties.

Despite a recent dip in adjusted EBITDA, primarily attributed to shifts in product mix and pricing pressures, Viskase has experienced an uplift in sales volumes. This indicates a strong, established market position, suggesting the segment continues to be a reliable generator of consistent cash flow, even with limited growth potential.

- Segment Performance: For the first quarter of 2024, Viskase reported net sales of $89.5 million, a slight decrease from $90.9 million in the prior year period. Adjusted EBITDA for the segment was $15.6 million, down from $18.7 million in Q1 2023.

- Market Position: Viskase holds a significant market share in the processed meat casing industry, a sector characterized by its stability and consistent demand from food manufacturers.

- Cash Flow Generation: The mature nature of the food packaging market, coupled with Viskase's established presence, allows it to generate substantial and predictable cash flows, which can be reinvested or utilized elsewhere within Icahn Enterprises.

- Strategic Role: As a Cash Cow, the Food Packaging segment's primary strategic value lies in its ability to provide stable financial resources, supporting other, potentially higher-growth or investment-heavy business units within the conglomerate.

Home Fashion Segment

The Home Fashion segment, managed by WestPoint Home LLC, is a key player in manufacturing and distributing consumer home fashion products. This segment is positioned as a cash cow within Icahn Enterprises' portfolio, reflecting its role as a mature business with consistent, albeit modest, growth potential.

In the fourth quarter of 2024, the Home Fashion segment demonstrated a positive trend with improved adjusted EBITDA. This financial uplift was primarily driven by favorable market conditions, specifically lower material costs, and enhanced operational performance through improved manufacturing efficiencies.

- Segment Performance: WestPoint Home LLC manufactures and distributes home fashion consumer products.

- Financial Improvement: Adjusted EBITDA saw an increase in Q4 2024.

- Driving Factors: Lower material costs and improved manufacturing efficiencies contributed to the EBITDA growth.

- BCG Matrix Position: The segment's characteristics align with a cash cow, indicating stable, low-growth revenue generation.

Icahn Enterprises' substantial cash reserves, exceeding $1.3 billion at the holding company level as of Q1 2025, act as a significant cash cow. This liquidity readily covers operational needs and investor distributions. The consistent $0.50 quarterly distribution per unit, while potentially supplemented by new unit issuance, highlights the stable cash-generating capacity of these mature segments.

The Energy segment, primarily CVR Energy, remains a core revenue driver despite facing challenges like reduced EBITDA. Its established market position solidifies its cash cow status, further bolstered by strong performance in fertilizer operations due to high prices and utilization rates.

Icahn Enterprises' real estate portfolio, featuring leased retail, office, and industrial properties, also fits the cash cow profile. These mature assets provide consistent, low-growth cash flow. Similarly, the Food Packaging segment, represented by Viskase, operates in a stable market, generating predictable cash flow despite recent pricing pressures.

The Home Fashion segment, through WestPoint Home LLC, is another cash cow, benefiting from improved operational efficiencies and lower material costs, leading to increased adjusted EBITDA in Q4 2024.

| Segment | Q1 2025 Cash/Equivalents (Holding Co.) | Q1 2024 Net Sales | Q1 2024 Adj. EBITDA | Q4 2024 Adj. EBITDA Trend |

|---|---|---|---|---|

| Overall Holding Co. | $1.3 billion | N/A | N/A | N/A |

| Energy (CVR Energy) | N/A | N/A | Decreased | N/A |

| Food Packaging (Viskase) | N/A | $89.5 million | $15.6 million | Stable/Slightly Down |

| Home Fashion (WestPoint Home) | N/A | N/A | N/A | Improved |

What You’re Viewing Is Included

Icahn Enterprises BCG Matrix

The Icahn Enterprises BCG Matrix preview you're viewing is the complete, unwatermarked document you'll receive immediately after purchase. This comprehensive analysis, meticulously crafted for strategic insight, will be fully accessible for your business planning needs. You can confidently expect the exact same professionally formatted report, ready for immediate application in your decision-making processes.

Dogs

Icahn Enterprises' automotive segment, specifically its Aftermarket Parts business, has been a significant drag on performance. In 2024, this segment saw a substantial 14% drop in net sales, highlighting its ongoing struggles.

The company has been actively winding down this operation, which has been characterized as a cash trap due to its consistent underperformance. This strategic pivot included the closure of 24 underperforming locations to stem further losses.

The decision to exit the aftermarket parts business, largely finalized by the first quarter of 2025, reflects a move away from a low-growth, low-market share venture. This divestiture is a key step in refocusing Icahn Enterprises' portfolio on more promising areas.

Icahn Enterprises' investment funds have experienced a downturn, with a 1.6% decline in Q4 2024 and a significant 8.4% drop in Q1 2025. This underperformance is largely attributable to its healthcare sector holdings, which have weighed heavily on overall fund returns.

These underperforming assets, especially those realizing substantial losses, can be categorized as 'Dogs' within the BCG framework. They represent investments that are consuming capital without generating sufficient profits, signaling a need for strategic review and potential divestment.

Within Icahn Enterprises' diverse portfolio, certain real estate properties are showing signs of weakness, fitting the description of Dogs in a BCG Matrix analysis. These are assets that aren't pulling their weight. For instance, the real estate segment saw its Q4 2024 adjusted EBITDA dip by $5 million, largely due to fewer single-family home sales.

Further illustrating this point, Icahn Enterprises is exiting some automotive real estate locations following early termination payments. These specific underperformers are those properties or developments that are not meeting anticipated revenue targets or are being sold off, indicating they are likely classified as Dogs.

Holding Company Losses

The Holding Company segment of Icahn Enterprises, as analyzed through a BCG Matrix framework, exhibits characteristics of a 'Dog'. This is underscored by its reported net loss of $271 million in the fourth quarter of 2024.

This substantial loss was largely attributable to significant interest expenses and losses incurred on investments. The holding company's role as a cash consumer without generating direct operational revenue solidifies its 'Dog' status.

Addressing this requires a focus on enhancing overall operational efficiency across the enterprise and implementing strategic asset management to mitigate these ongoing financial drains.

- Holding Company Net Loss: $271 million in Q4 2024.

- Primary Drivers of Loss: Interest expenses and investment losses.

- BCG Matrix Classification: 'Dog' due to negative performance and cash consumption.

- Strategic Imperative: Improve operational efficiency and manage assets strategically.

High Debt Obligations

Icahn Enterprises' significant debt obligations place it in the 'Dog' category of the BCG Matrix. The company's total debt stood at $6.81 billion as of the end of fiscal year 2024.

These substantial debt levels translate into considerable financial pressure, with interest payments projected to reach $332 million in 2025. Furthermore, the company faces significant debt maturities in the upcoming years, requiring careful cash flow management.

This heavy debt burden, particularly if operating cash flow proves insufficient to cover these obligations, acts as a drag on Icahn Enterprises. It consumes cash that could otherwise be invested in growth initiatives or returned to shareholders, thereby limiting financial flexibility.

- Total Debt (FY 2024): $6.81 billion

- Projected Interest Payments (2025): $332 million

- Impact: Drains cash, limits financial flexibility

Icahn Enterprises' automotive aftermarket parts business clearly fits the 'Dog' category in the BCG Matrix. This segment experienced a 14% net sales decline in 2024 and is being actively wound down, having been described as a cash trap. The company's strategic decision to exit this low-growth, low-market share venture, with most closures completed by Q1 2025, highlights its underperformance and the need to redirect resources.

Question Marks

Icahn Enterprises' Automotive Services segment is a classic Question Mark in the BCG matrix. The company is actively pivoting away from Aftermarket Parts to concentrate on Automotive Services, a strategic shift requiring significant investment.

In Q1 2025, this transformation manifested as a decline in sales and a negative adjusted EBITDA, reflecting the heavy upfront costs in labor, inventory, equipment, facilities, and marketing. For instance, the company reported a 10% year-over-year decrease in Automotive segment sales for the first quarter of 2025.

Despite the current financial headwinds, the outlook for the second half of 2025 suggests potential for growth. If these substantial investments successfully drive increased sales, improve profitability, and generate positive cash flows, the Automotive Services business could evolve into a Star within Icahn Enterprises' portfolio.

Icahn Enterprises' newest Country Club project, having recently cleared its permitting hurdles, is positioned as a Question Mark within the BCG matrix. This classification stems from its entry into the robust and expanding real estate market, a sector demonstrating significant growth potential.

However, as a new venture, it demands substantial initial capital investment and faces inherent uncertainty regarding its immediate financial returns. The commencement of single-family home sales reservations, slated for late 2025, will be the critical juncture for assessing market reception and confirming its trajectory.

Icahn Enterprises' Pharma segment features developmental therapies that have achieved key FDA milestones, moving them toward clinical trials. These represent potential Stars in the BCG matrix, signifying high growth potential within the pharmaceutical market.

These therapies require substantial investment for development and marketing, and their future market success is uncertain. However, successful clinical trials and strong market adoption could position them as future market leaders.

Food Packaging Restructuring Plan

Icahn Enterprises' Food Packaging segment is currently classified as a Question Mark within the BCG Matrix. This designation stems from its ongoing restructuring plan, which involves consolidating two North American facilities into a single, more efficient location and integrating a new, advanced manufacturing line. The company anticipates this significant operational overhaul to conclude in the latter half of 2025.

The primary objectives of this restructuring are to boost operational efficiency and enhance profit margins. However, the initiative demands substantial capital investment, and its ultimate impact on market share and overall profitability remains uncertain. For instance, in 2024, the company invested approximately $50 million in capital expenditures for this segment, with a significant portion allocated to these facility upgrades and new equipment.

- Restructuring Initiative: Consolidation of two North American facilities and addition of a state-of-the-art manufacturing line.

- Projected Completion: Second half of 2025.

- Strategic Goals: Increase operational efficiency and drive margins.

- Financial Impact: Requires significant investment; future market share and profitability gains are yet to be confirmed.

Activist Targets (e.g., JetBlue, Illumina, Southwest Gas)

Icahn Enterprises' activist strategy frequently targets companies such as JetBlue Airways, Illumina, and Southwest Gas Holdings. These companies are often chosen for their presence in expanding or potentially undervalued sectors.

While these investments represent opportunities in growing markets, the impact of Icahn Enterprises' involvement and the success of these activist campaigns in significantly boosting market share and profitability for IEP are still unfolding. The outcomes are contingent on ongoing market conditions and the effectiveness of strategic implementation.

- JetBlue Airways (JBLU): As of early 2024, JetBlue has been navigating a complex competitive landscape, facing challenges in achieving consistent profitability amidst industry-wide pressures. Icahn's stake, acquired in 2023, aimed to influence strategic direction, potentially focusing on operational efficiency and cost management.

- Illumina (ILMN): Illumina, a leader in DNA sequencing technology, has experienced market volatility. Icahn's activism here has centered on governance and strategic focus, particularly concerning its acquisition of Grail. The company's performance in 2024 reflects ongoing integration challenges and market reception to its strategic decisions.

- Southwest Gas Holdings (SWX): Southwest Gas has been a target for operational improvements and asset optimization. Icahn's investment in 2023 sought to unlock shareholder value through strategic reviews of its regulated utility and natural gas pipeline businesses. Performance in 2024 is being watched for signs of successful strategic shifts.

Icahn Enterprises' Automotive Services segment is a prime example of a Question Mark, requiring significant investment to pivot away from Aftermarket Parts. The company's Q1 2025 performance showed a 10% year-over-year sales decline and negative adjusted EBITDA due to substantial upfront costs in labor, inventory, equipment, facilities, and marketing.

The Food Packaging segment is also a Question Mark, undergoing a restructuring that includes consolidating facilities and integrating a new manufacturing line, expected to conclude in the latter half of 2025. This initiative, which saw approximately $50 million in 2024 capital expenditures, aims to boost efficiency and margins, but its ultimate market impact remains uncertain.

Icahn Enterprises' newest Country Club project, having recently cleared permitting, is a Question Mark entering the growing real estate market. It requires substantial initial capital, and its success hinges on market reception, with single-family home sales reservations starting in late 2025.

Icahn Enterprises' activist investments in companies like JetBlue Airways, Illumina, and Southwest Gas Holdings also represent potential Question Marks. While these target sectors are expanding, the success of Icahn's involvement in boosting market share and profitability is still developing, with outcomes dependent on market conditions and strategic execution.

| Segment/Investment | BCG Classification | Key Factors | Recent Performance/Outlook (2024-2025) |

|---|---|---|---|

| Automotive Services | Question Mark | Strategic pivot, high investment needs, uncertain returns | Q1 2025: 10% sales decline, negative EBITDA due to upfront costs. Potential for growth in H2 2025. |

| Food Packaging | Question Mark | Restructuring, facility consolidation, new manufacturing line, significant CAPEX | 2024 CAPEX: ~$50M. Restructuring completion H2 2025. Aims for efficiency and margin improvement. |

| New Country Club Project | Question Mark | New venture in real estate, high initial capital, market reception uncertainty | Permitting cleared. Sales reservations late 2025. |

| Activist Investments (JBLU, ILMN, SWX) | Question Mark | Targeting expanding/undervalued sectors, activist influence, uncertain strategic impact | Ongoing strategic implementation and market performance monitoring. |

BCG Matrix Data Sources

Our Icahn Enterprises BCG Matrix is built on a foundation of robust data, incorporating financial statements, industry growth rates, and market share analysis from reputable sources.