Icahn Enterprises PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Icahn Enterprises Bundle

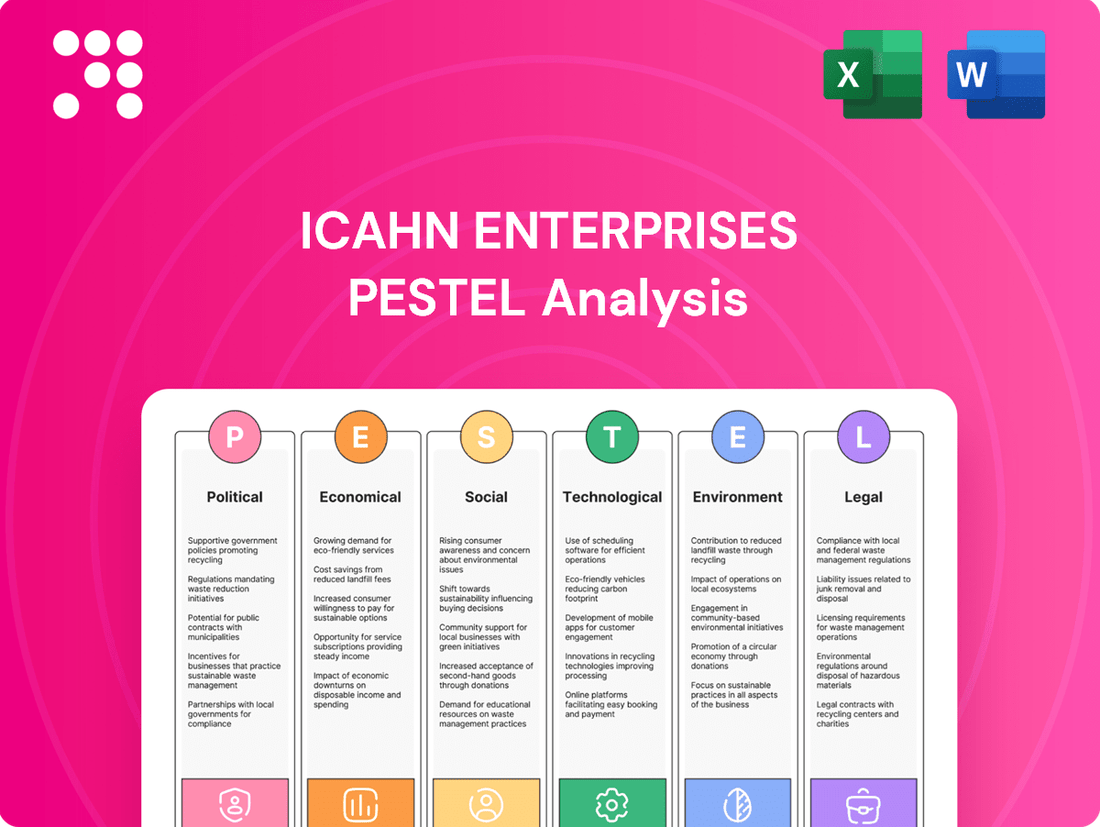

Navigate the complex external landscape impacting Icahn Enterprises with our comprehensive PESTLE analysis. Understand how shifting political, economic, social, technological, legal, and environmental factors are creating both challenges and opportunities for the conglomerate. Gain a strategic advantage by leveraging these critical insights to inform your investment decisions and business strategies.

Ready to unlock a deeper understanding of Icahn Enterprises's operating environment? Our PESTLE analysis delivers expert-level insights into the macro-environmental forces shaping its future. Don't miss out on the actionable intelligence that can refine your market approach. Purchase the full version now and equip yourself with the knowledge to thrive.

Political factors

Icahn Enterprises and its founder Carl Icahn recently reached a settlement with the U.S. Securities and Exchange Commission (SEC) over charges of failing to disclose pledged company securities used as collateral for personal loans. This settlement included substantial civil penalties, underscoring the heightened regulatory oversight on corporate governance and transparency.

The SEC's action against Icahn Enterprises, finalized in early 2024, led to a $185 million penalty. This event serves as a stark reminder of the increasing focus by regulatory bodies on the disclosure practices of public companies and their controlling individuals.

Such legal entanglements can significantly affect investor sentiment, potentially leading to decreased confidence and a higher cost of capital. Consequently, Icahn Enterprises, like other firms facing similar scrutiny, is compelled to implement more rigorous internal compliance protocols to prevent future regulatory breaches and maintain market trust.

Carl Icahn's reputation as a formidable activist investor inherently links his actions to political and corporate governance discussions. His historical success in reshaping corporate boards and championing shareholder rights directly impacts the political environment of companies associated with Icahn Enterprises (IEP).

IEP's strategic success hinges on its capacity to effectively manage these politically charged situations. For instance, Icahn's involvement with companies like Xerox in 2020, where he pushed for strategic changes, highlights the intersection of activist investing and political leverage.

Icahn Enterprises' broad business interests, from energy to automotive, mean it's sensitive to government economic policy. Changes in trade agreements, the imposition of tariffs, or alterations in government spending can significantly impact its subsidiaries' bottom lines and operating expenses. For instance, a shift towards protectionist trade policies could increase costs for its manufacturing arms.

In 2024, the global economic landscape continues to be shaped by geopolitical tensions and evolving trade relationships, which directly influence commodity prices and supply chain stability for Icahn Enterprises' energy and industrial segments. For example, the ongoing trade disputes between major economies in early 2024 have led to increased volatility in raw material costs, potentially affecting Icahn's manufacturing and automotive parts businesses.

Navigating these dynamic political and economic shifts is crucial for Icahn Enterprises. The company must remain agile, constantly assessing how policy changes, such as potential shifts in energy regulations or stimulus packages aimed at specific industries, might create both risks and opportunities across its diverse portfolio.

Energy Sector Policy Changes

Icahn Enterprises' energy segment, a cornerstone of its operations, is particularly vulnerable to shifts in government energy policies. For instance, changes in regulations concerning small refinery exemptions (SREs) directly affect profitability and compliance costs. In 2024, the Environmental Protection Agency (EPA) continued to administer the Renewable Fuel Standard (RFS), impacting refiners like those within IEP.

The outcome of ongoing legal challenges and evolving administrative policies surrounding these exemptions can create significant financial liabilities or provide operational clarity for IEP's refining assets. These political dynamics present a dual-edged sword, offering potential cost savings or imposing unexpected financial burdens.

- Regulatory Uncertainty: The administration of the Renewable Fuel Standard and Small Refinery Exemptions (SREs) remains a key political factor influencing the refining sector.

- Litigation Impact: Court decisions or new administrative rulings on SREs can alter compliance costs and market dynamics for refiners.

- Policy Evolution: Potential shifts in energy policy, including those related to emissions standards or biofuel mandates, could create both risks and opportunities for IEP's energy segment.

Geopolitical Instability Risks

Geopolitical instability, exemplified by ongoing conflicts like the Russia-Ukraine war and heightened tensions in the Middle East, directly impacts global economic stability. These situations can trigger unpredictable shifts in trade, currency exchange rates, and commodity prices, affecting businesses with international footprints. For instance, the conflict in Ukraine has led to significant disruptions in energy markets, with oil prices fluctuating. In 2024, continued instability could mean further volatility in the energy sector, a key area for many industrial holdings.

Such global political dynamics create a challenging operating environment for companies like Icahn Enterprises, whose diverse portfolio spans multiple industries with international supply chains. The imposition of export controls or economic sanctions in response to geopolitical events can disrupt the flow of goods and materials, impacting production schedules and costs. For example, sanctions imposed on Russia in 2022 led to significant reconfigurations of global energy and commodity markets, demonstrating the far-reaching consequences.

Icahn Enterprises must actively monitor and strategize around these broader political uncertainties. The company's ability to navigate these risks depends on its agility in adapting supply chains, managing currency exposures, and potentially diversifying its international operations to mitigate the impact of localized conflicts or sanctions. The ongoing nature of these geopolitical challenges necessitates a proactive and flexible approach to risk management across all its business segments.

- Global Conflicts Impact: Ongoing geopolitical conflicts can lead to significant economic volatility, affecting commodity prices and international trade flows.

- Sanctions and Controls: The potential for export controls and economic sanctions poses a direct risk to international operations and supply chain continuity.

- Industry Exposure: Icahn Enterprises' diverse industrial holdings are susceptible to disruptions in sectors like energy and manufacturing due to geopolitical events.

- Risk Mitigation: Proactive monitoring and adaptive strategies are crucial for managing the financial and operational impacts of geopolitical instability.

Icahn Enterprises' operations are significantly influenced by the political landscape, particularly regarding regulatory environments and trade policies. The SEC settlement in early 2024, resulting in a $185 million penalty, highlights the critical need for robust corporate governance and transparency, impacting investor confidence and capital costs.

Geopolitical tensions and evolving trade relationships in 2024 continue to shape economic stability, directly affecting commodity prices and supply chains for IEP's energy and industrial segments. For instance, trade disputes in early 2024 caused raw material cost volatility, impacting manufacturing and automotive parts businesses.

The energy sector, a core component of IEP, remains sensitive to government energy policies, such as the EPA's administration of the Renewable Fuel Standard and Small Refinery Exemptions (SREs) in 2024, which directly influence profitability and compliance costs.

What is included in the product

This PESTLE analysis examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Icahn Enterprises, highlighting how these external factors shape its strategic landscape and operational environment.

A PESTLE analysis of Icahn Enterprises offers a structured framework to proactively identify and mitigate external threats, alleviating the pain point of unforeseen market disruptions.

By dissecting political, economic, social, technological, environmental, and legal factors, the analysis provides actionable insights to navigate complex market dynamics, reducing strategic uncertainty.

Economic factors

Icahn Enterprises experienced a significant downturn in early 2025, reporting a net loss of $422 million for the first quarter. This marks a substantial increase in losses compared to the prior year, accompanied by a decline in overall revenues.

The challenging economic climate directly impacted Icahn Enterprises' diversified operations, contributing to these financial setbacks. The company's adjusted EBITDA also revealed a considerable loss, underscoring operational headwinds faced during this period.

Icahn Enterprises' net asset value (NAV) saw a notable dip, falling by $336 million to around $3.0 billion by the end of March 2025. This decrease primarily stems from underperformance within its Investment segment, especially concerning its healthcare holdings.

The volatility in NAV is a significant factor for investors evaluating the intrinsic worth of Icahn Enterprises. Understanding the drivers behind these fluctuations, like the healthcare sector's performance, is crucial for informed decision-making.

Icahn Enterprises' recent decision to cut its quarterly distribution from $2.00 to $1.00 per unit in early 2024 highlights a significant economic factor: the sustainability of its payout. This move was partly driven by operating cash flow not consistently covering dividend obligations, necessitating the issuance of new depositary units. For instance, in Q1 2024, the company reported operating cash flow of $777 million, while distributions paid were $874 million, showcasing this funding gap.

The issuance of additional units to fund distributions directly impacts existing unitholders through equity dilution. This practice, while aiming to maintain shareholder returns, can reduce the proportional ownership and earnings per unit for long-term investors. The economic implication is a potential decrease in the value of existing holdings if the market perceives the dilution as a sign of financial strain or an unsustainable policy.

Inflationary Pressures

Inflationary pressures present a significant challenge for Icahn Enterprises, impacting its diverse operational segments. Rising costs for raw materials and shipping directly affect the profitability of businesses like its automotive repair and maintenance division and its food packaging operations. For instance, the Producer Price Index (PPI) for manufactured goods saw a notable increase throughout 2024, directly translating to higher input expenses for Icahn's manufacturing and supply chain activities.

These escalating input costs can compress profit margins across the company's portfolio. In the home fashion segment, for example, increased costs for textiles and transportation can reduce the net income generated from sales. Managing these cost increases effectively is therefore crucial for Icahn Enterprises to maintain its overall profitability and financial health.

- Increased Raw Material Costs: Global commodity prices, including metals and plastics essential for manufacturing, experienced volatility in 2024, directly impacting Icahn's production expenses.

- Higher Shipping and Logistics Expenses: Freight rates remained elevated in many regions during 2024 due to sustained demand and supply chain disruptions, adding to operational costs.

- Margin Compression Risk: The ability to pass on these increased costs to consumers varies by segment, potentially leading to reduced profit margins in price-sensitive markets.

Sector-Specific Economic Headwinds

Icahn Enterprises (IEP) navigates distinct economic headwinds across its varied business segments. For instance, the automotive sector has experienced a slowdown, impacting performance.

Furthermore, certain healthcare investments within IEP's portfolio have incurred losses, adding to the company's financial pressures. These sector-specific challenges demand targeted strategic realignments to bolster profitability and enhance cash generation.

- Automotive Sector Weakness: Reports from late 2024 indicated a cooling demand in certain automotive sub-sectors, potentially affecting IEP's holdings.

- Healthcare Investment Losses: Specific healthcare ventures within IEP's portfolio faced headwinds, with some reporting negative returns in the 2024 fiscal year.

- Diversification Challenges: The very nature of IEP's diverse holdings means that downturns in one sector do not necessarily offset gains in another, requiring careful management of each segment's unique economic environment.

The economic landscape in 2024 and early 2025 presented significant challenges for Icahn Enterprises, marked by a Q1 2025 net loss of $422 million, a substantial increase from the previous year. This financial strain was exacerbated by elevated inflation, which drove up raw material and shipping costs across its diverse portfolio, impacting profit margins. The company's decision in early 2024 to halve its quarterly distribution to $1.00 per unit, partly due to operating cash flow not covering payouts, underscores the economic pressures faced.

| Metric | Q1 2024 | Q1 2025 | Change |

|---|---|---|---|

| Net Loss ($ millions) | (107) | (422) | +305% |

| Net Asset Value ($ billions) | 3.3 | 3.0 | -9.1% |

| Operating Cash Flow ($ millions) | 874 | 777 | -11.1% |

What You See Is What You Get

Icahn Enterprises PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis for Icahn Enterprises delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a detailed overview of the external forces shaping its strategic landscape.

Sociological factors

Evolving consumer preferences are a major sociological factor for Icahn Enterprises (IEP). For instance, in the automotive sector, a growing demand for electric vehicles (EVs) and a shift towards subscription-based car services are reshaping how people buy and use vehicles. This directly affects IEP's automotive aftermarket parts business, as seen by the increasing market share of EV components. In 2024, the global EV market is projected to reach over 15 million units, a significant jump from previous years, indicating a need for IEP to adapt its product lines to cater to this trend.

Similarly, the home fashion segment is experiencing a surge in demand for sustainable and ethically sourced products. Consumers are increasingly prioritizing brands that demonstrate environmental responsibility and social consciousness. This trend is evident in the growth of the sustainable home goods market, which is expected to see a compound annual growth rate of 9.5% from 2023 to 2030, according to market research. IEP's ability to align its home fashion offerings with these values will be crucial for maintaining consumer loyalty and driving sales.

Labor shortages and the availability of a skilled workforce present a significant challenge for Icahn Enterprises' varied business segments. For instance, the automotive service sector, a key area for the company, faces ongoing difficulties in finding qualified technicians. This scarcity directly impacts operational capacity and service delivery.

Industries such as manufacturing and real estate development, also integral to Icahn Enterprises' portfolio, are similarly affected by a lack of sufficient and qualified labor. Reports from the Bureau of Labor Statistics in early 2024 indicated persistent shortages in skilled trades, a trend that directly influences Icahn's ability to staff its facilities and projects efficiently.

These workforce availability challenges can translate into increased labor costs as companies compete for talent, potentially squeezing profit margins. Furthermore, operational inefficiencies can arise from understaffing or the necessity to train less experienced workers, impacting Icahn Enterprises' overall performance across its diverse holdings.

Icahn Enterprises' public perception is significantly shaped by its association with Carl Icahn, a prominent activist investor. Media coverage, including reports from short-sellers and analyses of legal proceedings, can sway public opinion and investor confidence. For instance, in late 2023 and early 2024, Icahn Enterprises faced scrutiny and a substantial stock price decline following a report from Hindenburg Research, highlighting the impact of such events on the company's image.

Maintaining a strong brand image and fostering investor trust are paramount for Icahn Enterprises, particularly after periods of intense public scrutiny. Reputational risks, amplified by high-profile investor involvement, can directly affect market valuation and the company's ability to attract and retain stakeholders. The company's stock performance in early 2024, dropping over 40% at one point, illustrates the tangible consequences of negative public perception.

Demographic Shifts Impacting Real Estate

Demographic shifts are a significant force shaping the real estate market, directly influencing Icahn Enterprises' (IEP) real estate segment. Population growth and migration patterns, for instance, create demand for housing in certain areas while potentially reducing it in others. By 2025, the U.S. population is projected to reach over 337 million, a steady increase that fuels the need for more housing units.

Urbanization continues to be a key trend, concentrating populations in cities and driving demand for both residential and commercial properties in these areas. This trend necessitates strategic real estate development and investment. IEP's focus on single-family home sales from new developments demonstrates a direct response to evolving housing demands, catering to specific market segments seeking homeownership.

- Population Growth: The U.S. population is expected to exceed 337 million by 2025, increasing the overall demand for housing.

- Urbanization: Continued migration to urban centers drives demand for real estate in metropolitan areas, impacting property values and development opportunities.

- Housing Demand: Changing preferences, such as the desire for single-family homes, require developers like IEP to adapt their offerings to meet specific market needs.

Social Responsibility Expectations

Societal expectations for corporate social responsibility (CSR) are growing, impacting how companies like Icahn Enterprises operate. This includes pressure for ethical business practices, fair labor, and community involvement, which can sway investment decisions and business strategies across its diverse subsidiaries. For instance, a growing number of institutional investors, managing trillions in assets, are integrating ESG (Environmental, Social, and Governance) factors into their decision-making, with social factors being a key component. In 2024, reports indicated a significant increase in shareholder proposals related to human capital management and supply chain ethics, signaling a clear trend towards greater accountability.

Adhering to these evolving ethical standards is crucial for Icahn Enterprises to attract both capital and top talent. Companies demonstrating strong CSR performance, including robust diversity and inclusion initiatives and transparent supply chains, often see better access to capital and higher employee retention rates. For example, studies in 2024 showed that companies with strong social performance metrics often outperformed their peers in terms of stock performance and brand reputation, directly influencing their ability to secure favorable financing and attract skilled employees.

- Growing Investor Focus on ESG: In 2024, ESG-focused funds continued to attract substantial inflows, with a notable emphasis on social metrics like employee treatment and community impact.

- Talent Acquisition and Retention: A 2024 survey revealed that over 70% of job seekers consider a company's social responsibility record when evaluating potential employers.

- Reputational Risk: Negative publicity stemming from perceived unethical practices can lead to significant financial repercussions, including boycotts and regulatory scrutiny.

- Supply Chain Scrutiny: Icahn Enterprises, with its broad portfolio, faces increasing pressure to ensure ethical labor practices and environmental standards throughout its entire supply chain.

Consumer preferences are shifting towards sustainability and ethical sourcing across various sectors relevant to Icahn Enterprises. This is particularly evident in home fashion, where demand for eco-friendly products is growing, with the market expected to expand at a 9.5% CAGR from 2023 to 2030. Similarly, the automotive industry is seeing a significant increase in demand for electric vehicles, with global sales projected to surpass 15 million units in 2024, impacting IEP's aftermarket parts business.

Societal expectations for corporate social responsibility (CSR) are also on the rise, influencing investment decisions and business strategies. In 2024, a substantial number of institutional investors were integrating ESG factors, including social metrics, into their decision-making processes. This trend emphasizes the need for companies like Icahn Enterprises to demonstrate strong ethical practices, fair labor, and community involvement to attract capital and talent.

Labor shortages in skilled trades continue to pose a challenge for Icahn Enterprises' operations, particularly in sectors like automotive service and manufacturing. Reports in early 2024 highlighted persistent gaps in qualified workers, potentially leading to increased labor costs and operational inefficiencies. This scarcity directly impacts IEP's ability to staff facilities and projects effectively, influencing overall performance.

Technological factors

Icahn Enterprises' automotive service segment must consistently invest in cutting-edge equipment and innovative service techniques to maintain its competitive edge. This necessitates adapting to evolving vehicle diagnostics, the growing demand for electric vehicle (EV) maintenance, and the integration of digital platforms for enhanced customer engagement. For instance, the global automotive aftermarket services market was valued at approximately $400 billion in 2023 and is projected to grow significantly, driven by the increasing complexity of vehicles and the rising adoption of EVs, which require specialized repair and maintenance capabilities.

Icahn Enterprises' food packaging segment is actively restructuring, notably by integrating a state-of-the-art manufacturing line. This significant investment in advanced technology is designed to directly boost operational efficiency and drive down costs. For instance, companies investing in automation in packaging can see efficiency gains of 15-20%.

The strategic deployment of this new line is crucial for enhancing product quality, a key differentiator in today's market. By embracing modern manufacturing processes, Icahn Enterprises aims to solidify its competitive position and achieve improved profit margins. The global smart packaging market, which includes advanced manufacturing, was valued at approximately $30 billion in 2023 and is projected to grow substantially.

Icahn Enterprises' investment strategy benefits from digital transformation, even if it's not a direct operating segment. For example, its stake in Caesars Entertainment, a company heavily involved in the digital gaming and hospitality space, showcases this indirect exposure. As of early 2024, Caesars reported significant growth in its online gaming segment, demonstrating the real-world impact of digital adoption.

The firm's ability to spot and invest in companies that are either technologically advanced or actively adapting to digital shifts is a core component of its investment approach. This focus allows IEP to capitalize on the evolving landscape, potentially identifying future growth drivers within its diverse portfolio.

Research and Development in Pharma

Icahn Enterprises' pharmaceutical segment heavily relies on substantial research and development (R&D) investments to bring new therapies and products to market. These expenditures are critical for staying competitive in the fast-paced pharma landscape.

For instance, in 2023, the pharmaceutical sector saw significant R&D spending across the industry, with major players investing billions. Icahn Enterprises' own pharma operations, while not always separately detailed in public filings for R&D specifics, are inherently tied to these broader industry trends and the necessity of pipeline development.

The success of these R&D initiatives directly influences future revenue generation. A robust pipeline of innovative drugs is essential for sustained growth and market share in the pharmaceutical industry.

- R&D Investment: Essential for new drug discovery and development.

- Competitive Edge: Continuous innovation is key to maintaining market position.

- Revenue Impact: Successful R&D directly drives future sales and profitability.

- Industry Trend: Pharma companies globally increased R&D budgets in 2023, reflecting its importance.

Cybersecurity and Data Protection

Icahn Enterprises, as a diversified holding company, faces significant technological challenges, particularly concerning cybersecurity and data protection. The escalating sophistication of cyber threats demands ongoing investment in secure IT infrastructure and stringent data privacy protocols to safeguard sensitive financial and operational data across its varied business units.

The financial implications of inadequate cybersecurity are substantial. For instance, in 2023, the average cost of a data breach globally reached $4.45 million, according to IBM's Cost of a Data Breach Report. For a company like Icahn Enterprises, with its broad operational footprint, a breach could expose customer, proprietary, and financial information, leading to severe financial penalties, operational disruptions, and irreparable reputational damage.

- Escalating Cyber Threats: The global landscape of cyberattacks continues to evolve, posing a constant risk to all organizations, especially those handling vast amounts of sensitive data like Icahn Enterprises.

- Regulatory Scrutiny: Increased data protection regulations, such as GDPR and CCPA, impose strict requirements and significant penalties for non-compliance, making robust data protection a critical operational imperative.

- Investment in Security: Continuous investment in advanced cybersecurity technologies, employee training, and incident response planning is essential to mitigate risks and ensure business continuity.

Technological advancements are a critical driver across Icahn Enterprises' diverse portfolio, from automotive services embracing EV maintenance to food packaging adopting automation for efficiency gains. The firm's investment strategy also benefits from digital transformation, as seen in its stake in Caesars Entertainment's growing online gaming segment. Furthermore, the pharmaceutical division's reliance on substantial R&D spending highlights the imperative of innovation for market competitiveness.

Legal factors

Icahn Enterprises and its controlling shareholder, Carl Icahn, settled charges with the SEC in 2023 concerning inadequate disclosure of pledged company securities. This settlement involved a $10 million penalty, highlighting the critical need for transparency in financial dealings.

This legal action serves as a stark reminder of the stringent securities regulations companies must navigate. Failure to comply, as demonstrated by this case, can result in significant financial penalties and damage to public trust.

Icahn Enterprises has faced significant shareholder litigation, including class action lawsuits alleging issues with financial reporting and governance. For instance, a significant class action lawsuit filed in 2020, alleging misleading statements about the company's financial health, was dismissed by a federal judge in early 2024.

While this dismissal offers some relief, the company remains exposed to the risk of ongoing or new litigation. Such legal battles can lead to substantial legal expenses, estimated in the millions for complex cases, and can divert critical management time and resources away from core business operations and strategic initiatives.

Effective legal risk management, including robust compliance programs and transparent communication, is therefore crucial for Icahn Enterprises to mitigate these potential financial and operational disruptions.

Icahn Enterprises operates across various sectors, each burdened by unique regulatory frameworks. For instance, its energy segment faces stringent environmental regulations like the EPA's Clean Air Act, impacting emissions and operational permits. In 2024, the energy sector continued to see increased scrutiny on carbon emissions, potentially affecting capital expenditures for facilities.

Compliance with health, safety, and consumer protection laws is paramount. The automotive segment, for example, must adhere to NHTSA safety standards, while the food packaging division is subject to FDA regulations. Failure to comply can lead to significant penalties; in 2023, the automotive industry saw recalls costing billions due to safety non-compliance.

Non-compliance carries substantial risks, including hefty fines, operational shutdowns, and severe legal liabilities that can erode shareholder value. For example, a major environmental violation in the energy sector could halt production and result in multi-million dollar fines, as seen in past cases impacting similar companies.

Investment Fund Regulatory Compliance

Icahn Enterprises' investment segment navigates a complex web of financial regulations, primarily overseen by the U.S. Securities and Exchange Commission (SEC). These regulations dictate everything from how funds are managed to disclosure requirements, directly influencing operational scope and costs.

The financial services industry has seen significant regulatory shifts, notably with the Dodd-Frank Wall Street Reform and Consumer Protection Act enacted in 2010. While past, its ongoing impact continues to shape compliance landscapes. For instance, increased capital requirements or new reporting mandates can add substantial overhead. As of early 2024, regulatory bodies are continuously evaluating market stability and investor protection, suggesting potential for further adjustments.

- SEC Oversight: The Securities and Exchange Commission (SEC) sets stringent rules for investment funds, impacting Icahn Enterprises' operations.

- Regulatory Impact: Legislation like Dodd-Frank has historically increased compliance burdens and operational costs for financial firms.

- Ongoing Scrutiny: The financial sector remains under continuous regulatory review, with potential for new rules affecting investment activities and profitability.

- Compliance Necessity: Maintaining robust compliance is not just a legal requirement but a critical factor for the investment segment's sustained success and reputation.

Antitrust and Competition Laws

Icahn Enterprises' active approach to acquiring and managing diverse businesses means it must carefully consider antitrust and competition laws. Major acquisitions or strategies aimed at consolidating market share can attract scrutiny from regulators. Failure to comply can lead to significant legal hurdles and penalties, impacting market operations.

For instance, in 2024, the Federal Trade Commission (FTC) and the Department of Justice (DOJ) have continued to focus on preventing anti-competitive mergers, particularly in sectors where Icahn Enterprises operates. The increasing regulatory focus on market concentration means Icahn Enterprises must conduct thorough due diligence on potential acquisitions to ensure they align with current competition frameworks.

- Regulatory Scrutiny: Icahn Enterprises' deal-making activities are subject to review by antitrust authorities like the FTC and DOJ, especially concerning market dominance.

- Compliance Burden: Adhering to evolving competition laws requires ongoing legal counsel and strategic planning to avoid litigation and fines.

- Market Impact: Actions perceived as anti-competitive could result in divestitures or operational restrictions, impacting Icahn Enterprises' portfolio value.

Icahn Enterprises' legal landscape is shaped by stringent securities regulations, as evidenced by the 2023 SEC settlement involving a $10 million penalty for disclosure failures. This underscores the critical importance of transparency and adherence to compliance mandates to avoid financial penalties and reputational damage.

The company has also navigated shareholder litigation, with a significant class action lawsuit dismissed in early 2024, though the risk of ongoing legal battles remains. Such litigation can incur millions in legal fees and divert essential management focus, highlighting the need for robust legal risk management strategies.

Operating across diverse sectors, Icahn Enterprises must comply with sector-specific regulations, from environmental laws affecting its energy segment to safety standards for its automotive interests. Non-compliance can lead to substantial fines, operational halts, and significant liabilities, impacting overall shareholder value.

The investment segment faces complex financial regulations, with the SEC overseeing operations and disclosure requirements. Historical legislation like Dodd-Frank continues to influence compliance costs and operational scope, with ongoing regulatory evaluations suggesting potential for future adjustments impacting profitability.

Antitrust and competition laws are also key considerations, particularly for acquisitions aimed at market consolidation. In 2024, regulators like the FTC and DOJ are actively scrutinizing mergers, requiring Icahn Enterprises to ensure strategic alignment with current competition frameworks to avoid legal challenges and penalties.

Environmental factors

Icahn Enterprises' substantial stake in the energy industry, primarily via CVR Energy, means it's heavily influenced by environmental rules. These regulations cover everything from emissions and waste handling to renewable fuel mandates.

For instance, upcoming changes to biofuel blending requirements, like those potentially impacting the Renewable Fuel Standard (RFS) program through 2025, could significantly alter operating expenses and compliance complexities for CVR Energy's refineries.

In 2023, CVR Energy reported capital expenditures of $320 million, with a portion allocated to environmental compliance and upgrades, reflecting the ongoing need to adapt to evolving regulations.

Icahn Enterprises' (IEP) energy segment, heavily reliant on fossil fuels, faces significant risks from the global shift towards climate change mitigation and a low-carbon economy. This transition can lead to increased regulatory burdens and a devaluation of existing assets.

The pressure to decarbonize means companies like IEP must invest heavily in cleaner technologies or risk their fossil fuel assets becoming stranded. For instance, in 2024, the International Energy Agency reported that investments in clean energy technologies are rapidly increasing, signaling a potential decline in demand for traditional energy sources.

This environmental shift could impact IEP's profitability by increasing operational costs associated with emissions reduction and potentially diminishing the long-term value of its oil and gas holdings. IEP's 2024 annual report highlighted the ongoing challenges in adapting its energy portfolio to evolving environmental standards.

While Icahn Enterprises is a U.S.-based entity, the global push for robust ESG reporting, exemplified by the EU's Corporate Sustainability Reporting Directive (CSRD), creates indirect pressures. This directive, which began applying to large EU companies in fiscal year 2024, mandates extensive sustainability disclosures, setting a de facto global standard.

Investor and stakeholder expectations are increasingly driving demand for comprehensive ESG data, even from companies not directly subject to regulations like CSRD. This can influence Icahn Enterprises' reporting practices and strategic operational choices as it seeks to maintain investor confidence and market access.

For instance, many institutional investors, managing trillions in assets, now integrate ESG factors into their due diligence. In 2024, a significant portion of these investors indicated they would divest from companies lacking sufficient ESG transparency, underscoring the financial implications of reporting gaps.

Waste Management and Pollution Control

Icahn Enterprises' diverse operations, spanning sectors like automotive and energy, inherently involve waste generation and potential pollution risks. For instance, their involvement in automotive manufacturing and aftermarket services can produce hazardous materials and require careful disposal. Similarly, energy-related ventures may deal with emissions and byproducts needing stringent control.

Navigating a complex web of environmental regulations is paramount. This includes adhering to standards for waste disposal, managing air emissions, and controlling water discharge. Failure to comply can lead to significant fines and operational disruptions. For example, in 2024, companies across various industries faced increased scrutiny and penalties for environmental non-compliance, highlighting the financial implications of poor waste management.

Effective waste management and pollution control are not just about avoiding penalties; they are crucial for maintaining a social license to operate. Icahn Enterprises must invest in sustainable practices to mitigate environmental impact.

- Waste Generation: Operations in automotive and energy sectors contribute to waste streams requiring proper handling and disposal.

- Regulatory Compliance: Adherence to environmental laws concerning waste, air, and water is mandatory to avoid legal repercussions.

- Social License: Robust pollution control measures are vital for maintaining public trust and operational continuity, especially with growing ESG expectations in 2024-2025.

- Financial Risk: Non-compliance can result in substantial fines and reputational damage, impacting financial performance.

Supply Chain Environmental Footprint

Icahn Enterprises' (IEP) diverse portfolio means its subsidiaries operate across various industries, each with its own environmental footprint. From the raw materials used in manufacturing to the transportation of goods, these supply chains can have a substantial impact. For instance, their energy segment's operations and their automotive segment's manufacturing processes both involve significant resource consumption and potential emissions.

Growing global attention on the environmental impact of supply chains is pushing companies like IEP to be more transparent and proactive. This means assessing and reducing carbon emissions, waste generation, and water usage throughout their operations. For example, as of 2024, many large corporations are setting ambitious Scope 3 emissions targets, which include supply chain impacts, and IEP will likely face similar pressures.

These sustainability demands can necessitate shifts in how IEP's businesses source materials and manage logistics. Companies are increasingly looking for suppliers with strong environmental credentials and exploring more efficient, lower-impact transportation methods. This trend is particularly relevant for IEP given its broad operational scope.

Key environmental considerations for IEP's supply chains include:

- Greenhouse Gas Emissions: Tracking and reducing emissions from manufacturing, transportation, and energy consumption across all subsidiaries.

- Resource Management: Ensuring responsible use of water, raw materials, and energy, especially in energy-intensive operations.

- Waste and Pollution Control: Minimizing waste generation and properly managing hazardous materials and pollutants.

- Biodiversity Impact: Assessing and mitigating the effects of resource extraction and land use on local ecosystems.

Icahn Enterprises' significant holdings in the energy sector, particularly through CVR Energy, expose it to stringent environmental regulations covering emissions, waste, and renewable fuel mandates.

The global push towards decarbonization and a low-carbon economy presents a substantial risk, potentially increasing operational costs for emissions reduction and devaluing fossil fuel assets, as seen in the growing investments in clean energy technologies reported by the IEA in 2024.

Growing investor and stakeholder demand for comprehensive ESG data, influenced by directives like the EU's CSRD, pressures IEP to enhance its sustainability reporting and practices to maintain market access and investor confidence, with many institutional investors indicating divestment from companies lacking ESG transparency in 2024.

IEP's diverse operations, from automotive to energy, generate waste and pollution risks, necessitating robust compliance with waste disposal, air emission, and water discharge standards to avoid penalties, as highlighted by increased scrutiny and fines for non-compliance in 2024.

PESTLE Analysis Data Sources

Our PESTLE Analysis for Icahn Enterprises draws on a robust blend of publicly available financial reports, regulatory filings, and industry-specific news from reputable business publications. We also incorporate data from economic forecasting agencies and market research firms to ensure comprehensive coverage of political, economic, social, technological, legal, and environmental factors.