IAC SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IAC Bundle

Unlock the full potential of IAC's market position with our comprehensive SWOT analysis. This in-depth report dives deep into their unique strengths, potential weaknesses, exciting opportunities, and critical threats, providing you with the strategic clarity needed to make informed decisions.

Want the complete picture behind IAC's competitive edge and future trajectory? Purchase the full SWOT analysis to gain access to a professionally crafted, fully editable report designed to empower your strategic planning, investment research, and competitive analysis.

Strengths

IAC's proven spin-off strategy has been a consistent driver of shareholder value. The company has a strong track record of nurturing businesses, such as Match Group and Vimeo, and then successfully separating them into independent, publicly traded entities. This approach allows IAC to unlock the full potential of its diverse portfolio.

The recent spin-off of Angi in March 2025 exemplifies this strategy, further refining IAC's focus on its more profitable business areas. This move is expected to enhance operational efficiency and allow for more targeted capital allocation, ultimately benefiting shareholders.

IAC's strength lies in its diverse digital business portfolio, notably including Dotdash Meredith, a major player in digital publishing. This broad operational base across online sectors, from publishing to search and emerging ventures, significantly reduces the impact of downturns in any single market. For instance, Dotdash Meredith's strong performance in Q1 2024, with revenue up 2% year-over-year, showcases the resilience of its digital publishing segment.

Further bolstering this diversification are IAC's strategic equity investments. Holding stakes in companies like MGM Resorts International and Turo Inc. provides exposure to different industries and revenue streams, acting as a crucial buffer against sector-specific volatility. This multi-faceted approach to business and investment allows IAC to navigate market fluctuations more effectively.

Dotdash Meredith, a significant contributor to IAC's overall performance, has demonstrated remarkable resilience. Its digital revenue has seen consistent growth, with recent quarters even reporting double-digit increases. This segment is particularly strong in high-value advertising categories such as technology, retail, and beauty & style, commanding premium rates.

Financial Flexibility and Capital Deployment

IAC's financial flexibility is a significant strength, allowing for strategic capital deployment. For instance, in Q1 2024, the company repurchased approximately $180 million of its common stock, demonstrating a commitment to returning capital to shareholders.

The completion of the Angi spin-off in August 2023 has bolstered IAC's financial position. This move generated approximately $1.1 billion in net proceeds, providing substantial capital for future endeavors. This capital infusion enhances IAC's capacity to pursue new acquisition targets or invest in emerging growth areas, thereby supporting long-term strategic objectives and shareholder value.

- Active Share Repurchases: IAC consistently engages in share buybacks, a key aspect of its capital deployment strategy.

- Post-Spin-off Capital: The Angi spin-off provided over $1 billion in net proceeds, enhancing financial maneuverability.

- Strategic Investment Capacity: Freed-up capital enables IAC to explore new acquisitions and strategic investments in promising markets.

Experienced and Strategic Leadership

IAC benefits significantly from its experienced and strategic leadership, particularly Barry Diller. His long-standing track record in building and divesting businesses, including successful spin-offs, provides a clear strategic compass for the company. This leadership style cultivates an environment where portfolio companies can thrive through innovation and adaptability.

Diller's increased involvement following the Angi spin-off underscores a strategic pivot towards prioritizing and nurturing high-growth assets within the IAC portfolio. This hands-on approach is crucial for navigating dynamic market conditions.

- Barry Diller's extensive experience in media and digital businesses provides a unique strategic advantage.

- The leadership fosters an entrepreneurial spirit, encouraging innovation across IAC's diverse holdings.

- Diller's active role post-Angi spin-off highlights a focus on maximizing value from key growth areas.

IAC's core strength lies in its proven ability to generate shareholder value through strategic spin-offs, exemplified by the successful separation of Match Group and Vimeo. The company's diverse digital portfolio, including the robust Dotdash Meredith segment which saw a 2% year-over-year revenue increase in Q1 2024, provides significant resilience against market downturns. Furthermore, IAC's financial flexibility, highlighted by approximately $180 million in share repurchases in Q1 2024 and over $1 billion in net proceeds from the Angi spin-off in August 2023, positions it well for future growth and strategic investments.

| Business Segment | Q1 2024 Revenue Growth (YoY) | Key Strength |

|---|---|---|

| Dotdash Meredith | 2% | Strong digital publishing, high-value advertising categories |

| Overall Portfolio | N/A | Diversification across digital sectors, reducing single-market risk |

| Financial Operations | N/A | Capital flexibility, share repurchases, post-spin-off liquidity |

What is included in the product

Analyzes IAC’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic challenges, alleviating the pain of uncertainty.

Weaknesses

Despite positive contributions from segments like Dotdash Meredith's digital revenue, IAC has seen its overall revenue dip year-over-year in recent quarters. For instance, in the first quarter of 2024, total revenue was $934.6 million, a decrease from $956.8 million in the same period of 2023.

This revenue decline points to broader challenges within IAC's diverse portfolio or external market pressures impacting specific business units. The 'Emerging & Other' segment, in particular, has been a significant drag, with revenue falling to $31.1 million in Q1 2024 from $98.1 million in Q1 2023, largely due to strategic asset sales and underperformance in remaining operations.

IAC's financial results often show significant swings because of unrealized gains and losses from its investments, especially its large holding in MGM Resorts International. For instance, in the first quarter of 2024, IAC reported a net income of $160.3 million, but a substantial portion of this was influenced by investment gains. This makes it tough to see how well its actual businesses are doing on their own.

These investment-related ups and downs can really hide the true operational performance of IAC's core businesses. For example, if the market value of its MGM stake increases, it boosts net income, but this doesn't reflect improvements in its digital services or other segments. This volatility makes it harder for investors to get a clear picture of the company's consistent operating strengths.

A significant chunk of IAC's income, especially from Dotdash Meredith, comes from advertising. This makes the company vulnerable to changes in ad spending, how programmatic ads work, and new trends in online advertising. For instance, a projected slowdown in digital publishing for 2025, driven by lower programmatic earnings and stricter privacy rules, could hit this area hard.

Challenges in Search and Emerging Businesses

IAC's reliance on revenue from search agreements, particularly with major providers, creates a vulnerability. For instance, in Q1 2024, the Search segment's revenue was $209 million, but this is heavily tied to these external partnerships, making it susceptible to changes in those agreements.

The 'Emerging & Other' segment has been a mixed bag, even posting operating losses in certain periods, such as a $12 million operating loss in Q1 2024 for this segment. This indicates ongoing challenges in establishing consistent profitability and growth in newer ventures.

The online search market is intensely competitive, especially with the rapid advancement of AI-driven search technologies. This evolving landscape poses a significant hurdle for IAC to maintain its market position and profitability in its search-related businesses.

- Search Segment Dependency: Revenue generation is significantly dependent on agreements with major search providers, creating a risk if these partnerships change.

- Emerging Business Volatility: The 'Emerging & Other' segment has shown inconsistent performance, including operating losses, highlighting difficulties in achieving stable growth.

- AI-Driven Search Competition: The rise of AI in search presents a continuous challenge to IAC's existing search business models and future growth prospects.

Operational Complexity Post-Spin-offs

While spin-offs can unlock value, IAC's ongoing strategy of incubating and separating businesses, as seen with the planned separation of its Angi Services business in 2024, introduces significant operational complexities. This requires establishing entirely new standalone operations, a strategic realignment for the remaining IAC entity, and the careful management of leadership and resource transitions for each independent business. For example, the spin-off of Dotdash Meredith in 2022 involved complex integrations and divestitures that required substantial management attention.

These complexities can manifest in several ways:

- Establishing new operational infrastructure: Each spun-off entity needs its own IT systems, HR functions, and supply chains, which can be costly and time-consuming to build from scratch.

- Strategic realignment: The remaining IAC entity must redefine its core business and strategic focus post-spin-off, potentially leading to a period of uncertainty or reduced operational efficiency.

- Managing transitions: The smooth handover of leadership, employees, and critical assets is crucial for the success of both the spun-off business and the parent company, demanding meticulous planning and execution.

IAC's reliance on advertising revenue, particularly from Dotdash Meredith, makes it susceptible to shifts in ad spending and privacy regulations, potentially impacting future earnings. The company's search segment, generating $209 million in Q1 2024, is heavily tied to external search provider agreements, posing a risk if these partnerships falter.

The 'Emerging & Other' segment has been a persistent challenge, posting a $12 million operating loss in Q1 2024, indicating difficulties in achieving consistent profitability. Furthermore, the accelerating competition from AI-driven search technologies presents a significant threat to IAC's established search business models.

The company's strategy of spinning off businesses, such as the planned 2024 Angi Services separation, introduces considerable operational complexities and costs in establishing new independent infrastructures and managing leadership transitions.

| Weakness | Description | Relevant Data |

| Advertising Revenue Dependency | Vulnerability to ad market fluctuations and privacy changes. | Dotdash Meredith's revenue is a key contributor, sensitive to digital ad trends. |

| Search Segment Partnership Risk | Heavy reliance on agreements with major search providers. | Search segment revenue was $209 million in Q1 2024, tied to these external deals. |

| Emerging Business Underperformance | Inconsistent results and operating losses in newer ventures. | 'Emerging & Other' segment reported a $12 million operating loss in Q1 2024. |

| AI Search Competition | Threat from advanced AI technologies to existing search models. | Rapid evolution of AI search poses a continuous challenge to market position. |

Preview the Actual Deliverable

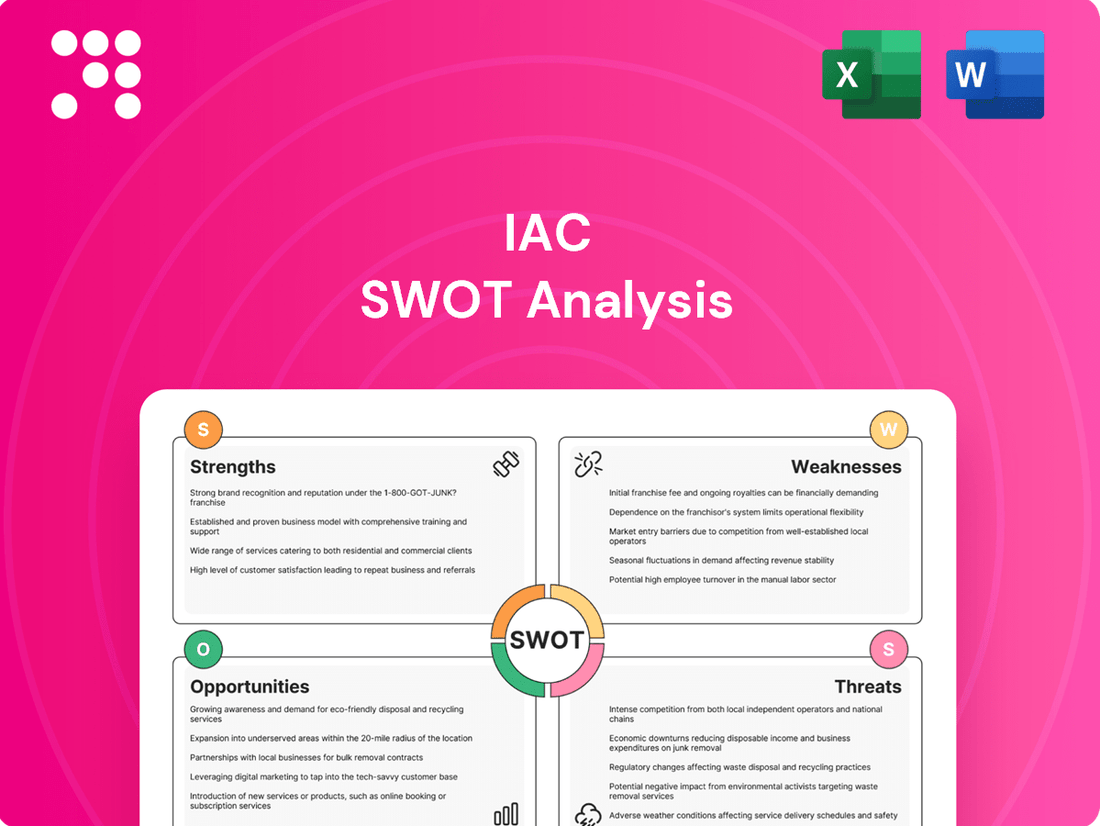

IAC SWOT Analysis

This is the same SWOT analysis document included in your download. The full content is unlocked after payment.

You’re previewing the actual analysis document. Buy now to access the full, detailed report.

This preview reflects the real document you'll receive—professional, structured, and ready to use.

Opportunities

The digital publishing sector is poised for substantial expansion, fueled by AI innovations and a growing appetite for engaging, personalized content. IAC's Dotdash Meredith, a key player, is leveraging AI to enhance content creation and tailor user experiences, aiming to capture a larger share of this evolving market.

This growth trajectory is further supported by the diversification of revenue streams within digital publishing. Dotdash Meredith is exploring avenues like premium subscriptions and interactive content formats, anticipating that these will bolster its financial performance in the coming years.

IAC can significantly enhance its operations by integrating artificial intelligence across its diverse portfolio. AI is revolutionizing online businesses by improving content creation, personalizing user experiences, and optimizing advertising campaigns. For instance, AI-powered chatbots can handle customer service inquiries more efficiently, potentially reducing support costs by up to 30% as seen in early adopters.

By leveraging AI, IAC has a clear opportunity to boost operational efficiency and user engagement. Implementing AI for personalized content recommendations, as seen with platforms like Netflix which credits AI for a significant portion of viewer retention, can lead to higher user satisfaction and increased time spent on IAC's platforms. This enhanced engagement directly translates to more opportunities for targeted advertising and monetization.

Furthermore, AI-driven analytics can optimize advertising spend, ensuring better ROI for IAC's clients and its own ventures. Companies adopting AI in marketing report an average increase in conversion rates by 10-15%. This strategic application of AI promises substantial cost savings and a notable uplift in revenue growth across IAC's various digital businesses.

IAC's history of successful acquisitions and strategic divestitures presents a significant opportunity to acquire businesses in rapidly expanding digital markets. The company's financial flexibility, bolstered by recent spin-offs, positions it well to invest in promising sectors.

For instance, with the spin-off of its Vimeo stake completed in 2021, IAC gained substantial capital. This financial capacity can be strategically deployed into areas experiencing robust growth, such as specialized e-commerce platforms, digital learning solutions, or burgeoning health and wellness applications, ensuring ongoing portfolio evolution.

Expansion into Niche Online Markets

The online business world is booming, especially in specialized areas like subscription boxes and direct-to-consumer (DTC) brands that cater to very specific tastes. For example, the subscription box market alone was valued at over $22.7 billion in 2023 and is projected to reach $65 billion by 2027, demonstrating substantial growth potential in these niche segments.

IAC, with its proven track record in developing and scaling online ventures, is well-positioned to capitalize on this trend. By applying its expertise to these targeted markets, the company can build dedicated customer communities and create offerings that stand out from the competition.

- Targeted Market Entry: Focus on high-growth niche online markets with demonstrated consumer demand.

- Leverage Existing Expertise: Apply IAC's proven online business building and scaling capabilities.

- Customer Loyalty: Cultivate strong, loyal customer bases through specialized offerings and engagement.

- Differentiation Strategy: Create unique value propositions to stand out in a saturated digital landscape.

Enhanced Data Monetization and First-Party Strategies

The decline of third-party cookies and tightening privacy rules present a significant opportunity for IAC to leverage its first-party data. By enhancing its data monetization capabilities, particularly through its Dotdash Meredith properties, IAC can build a more direct and valuable relationship with its audience. This shift allows for deeper user understanding and more sophisticated personalization.

Investing in robust first-party data platforms and real-time analytics will be crucial. This enables hyper-personalization of content and advertising, leading to improved user engagement and more effective monetization of audience insights. For instance, by Q1 2024, many publishers reported increased reliance on first-party data strategies to offset the impact of cookie deprecation.

- Strengthened Competitive Advantage: Dotdash Meredith can differentiate itself by offering superior personalization and ad targeting based on first-party data.

- Increased Revenue Potential: Enhanced data monetization directly translates to higher ad revenue and potentially new data-driven product offerings.

- Improved User Experience: Hyper-personalization leads to more relevant content, boosting user satisfaction and loyalty.

- Adaptability to Regulations: Proactive investment in first-party data positions IAC favorably against evolving privacy landscapes.

IAC is well-positioned to capitalize on the growing demand for specialized online content and services. The company's expertise in building and scaling digital businesses allows it to target high-growth niche markets, fostering customer loyalty through unique offerings.

The evolving digital landscape, particularly the decline of third-party cookies, presents a significant opportunity for IAC to leverage its first-party data. By enhancing data monetization capabilities, especially within Dotdash Meredith, IAC can build stronger audience relationships and improve personalization.

AI integration across IAC's portfolio offers substantial benefits, from enhanced content creation and user personalization to optimized advertising campaigns. Early adopters of AI in customer service have seen cost reductions of up to 30%, highlighting the efficiency gains available.

IAC's strategic financial flexibility, demonstrated by past asset spin-offs like Vimeo, enables investment in promising digital sectors. The subscription box market, valued at over $22.7 billion in 2023, exemplifies the potential in specialized e-commerce.

Threats

IAC operates in a digital arena where competition is fierce, with established giants and nimble newcomers constantly battling for user engagement and advertising revenue. This means IAC's various ventures, from dating services to digital media, are always under pressure from rivals who are quick to adapt and innovate.

For instance, in the online dating sector, IAC's Match Group faces robust competition from companies like Bumble and Hinge, which have carved out significant market share. Similarly, its digital media properties contend with a vast array of content creators and platforms, all vying for eyeballs and ad dollars.

This relentless competition demands continuous investment in product development and marketing to stay ahead. In 2023, for example, Match Group invested heavily in new features and international expansion to defend its market position against emerging threats.

The digital sector faces a growing web of regulations around data privacy, content oversight, and fair competition. For instance, the EU's Digital Services Act, fully applicable in early 2024, imposes significant obligations on online platforms regarding content moderation and user data, potentially increasing compliance burdens for companies like IAC. These evolving rules can restrict operational flexibility and necessitate substantial investment in compliance measures.

Antitrust investigations and potential new legislation, such as ongoing scrutiny of major tech players in the US and Europe, could directly affect IAC's business models, particularly those reliant on platform dynamics or data aggregation. Such regulatory shifts, exemplified by potential changes to app store policies or search engine algorithms, could reshape market access and revenue streams, adding uncertainty to future strategic planning.

The digital advertising landscape is in flux, with the phasing out of third-party cookies and the growing trend of 'zero-click' searches powered by AI posing significant challenges. This could directly impact IAC's revenue streams from its publishing and search operations by potentially lowering programmatic ad monetization and decreasing website traffic.

As advertisers adapt their strategies to these evolving consumer behaviors, IAC faces the threat of reduced ad effectiveness and engagement across its platforms. For instance, the increasing prevalence of AI-driven answers in search results means users may not even click through to websites, directly impacting publisher ad views and revenue.

Antitrust Scrutiny on Online Search Dominance

Antitrust scrutiny targeting dominant online search engines presents a significant threat. Major search providers, including Google, are facing ongoing lawsuits and regulatory actions concerning allegations of monopolistic practices. For instance, the U.S. Department of Justice's lawsuit against Google, filed in 2020 and ongoing into 2024, centers on its alleged illegal monopolization of the search engine and search advertising markets. Such actions could lead to mandated changes in how search results are presented or how revenue is shared.

These regulatory interventions could indirectly impact IAC's search-related ventures and existing partnerships. Changes to search algorithms or enforced remedies by regulators might shift the competitive landscape, potentially affecting the volume and value of search traffic that IAC businesses rely on. For example, if search engines are compelled to de-prioritize certain types of content or partnerships, it could reduce referral traffic and associated revenue streams for IAC's search-dependent services.

- Regulatory Actions: Ongoing antitrust cases against search engine giants could lead to forced changes in search algorithms and business practices.

- Impact on Traffic: Potential shifts in search result rankings or de-prioritization of specific content types may reduce organic search traffic for IAC's platforms.

- Revenue Streams: Altered search dynamics could affect revenue generated from search advertising and affiliate marketing partnerships.

- Competitive Landscape: Regulatory interventions might create new opportunities or challenges for IAC by reshaping the competitive environment in online search.

Economic Downturns and Advertising Budget Cuts

Broader economic headwinds, including persistent inflation and the increasing likelihood of recessionary pressures in major markets, pose a significant threat to IAC. These conditions typically lead to reduced consumer spending power, prompting businesses to scrutinize and often slash their advertising expenditures.

Given IAC's substantial reliance on advertising revenue across its diverse digital media and online service portfolio, an economic downturn directly impacts its top-line performance. For instance, in the first quarter of 2024, many digital advertising platforms experienced slower growth rates compared to previous periods due to this economic uncertainty, a trend that could disproportionately affect IAC's revenue streams.

This anticipated reduction in advertising spend directly challenges IAC's profitability and its ability to fund ongoing growth initiatives and strategic investments. The company's exposure to sectors sensitive to economic cycles means that a contraction in ad budgets could significantly hinder its financial results.

Key considerations include:

- Reduced Ad Spend: Economic slowdowns historically correlate with decreased advertising budgets across industries, impacting IAC's core revenue.

- Consumer Behavior Shifts: Inflationary pressures can alter consumer spending habits, potentially reducing engagement with IAC's platforms.

- Profitability Squeeze: Lower advertising revenue, coupled with potentially stable or increasing operating costs, could compress profit margins.

- Growth Capital Constraints: A downturn might limit the capital available for new ventures or acquisitions, slowing overall company expansion.

Intense competition from both established players and emerging startups across its diverse digital segments remains a significant threat to IAC. Companies like Bumble and Hinge continue to challenge Match Group's dominance in online dating, while digital media properties face constant pressure from a crowded content landscape. This necessitates ongoing, substantial investments in innovation and marketing to maintain market share and user engagement.

SWOT Analysis Data Sources

This IAC SWOT analysis is built upon a robust foundation of data, drawing from internal financial reports, comprehensive market research, and expert industry analysis to provide a well-rounded strategic perspective.