IAC PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IAC Bundle

Uncover the external forces shaping IAC's future with our comprehensive PESTLE analysis. Understand how political, economic, social, technological, legal, and environmental factors are influencing the company's strategic landscape. Gain critical insights to inform your own business decisions and investment strategies. Download the full analysis now for actionable intelligence.

Political factors

Governments globally are tightening their grip on digital content, a trend directly impacting IAC's diverse portfolio. For instance, the European Union's Digital Services Act (DSA), fully in effect since February 2024, imposes strict rules on online platforms regarding content moderation, illegal content, and disinformation, potentially affecting companies like Dotdash Meredith if their platforms fall under its scope. This heightened scrutiny translates into increased compliance burdens and potential penalties for content providers.

These evolving regulations directly influence revenue streams and operational strategies. For example, stricter rules on data privacy and targeted advertising, such as those being considered or implemented in various US states throughout 2024 and 2025, could limit the effectiveness and profitability of advertising models used by IAC's digital publishers. Companies must adapt their content strategies and invest in robust moderation systems to navigate these complex legal landscapes.

Increased regulatory scrutiny on large tech and media companies, including those in IAC's sphere, regarding market dominance and potential anti-competitive practices is a significant political factor. For instance, ongoing investigations into major platforms by the FTC and DOJ in 2024 highlight a trend towards tighter oversight.

Any new antitrust investigations or stricter merger guidelines could complicate IAC's strategy of acquiring and integrating businesses, potentially impacting future acquisition targets or even forcing divestitures. For example, the proposed merger guidelines released in mid-2024 by the US government aim to scrutinize deals more thoroughly.

This evolving regulatory landscape demands careful consideration of market share and the competitive landscape in IAC's new ventures and potential acquisitions to navigate potential challenges and ensure compliance.

Data privacy legislation is constantly evolving worldwide, with new versions of regulations like GDPR and CCPA-style laws emerging in various regions. This directly affects how companies like IAC gather, utilize, and safeguard user information.

Compliance with these stringent rules necessitates substantial investment in infrastructure and can impact the effectiveness of targeted advertising, a crucial revenue source for digital businesses. For instance, the EU's General Data Protection Regulation (GDPR), implemented in 2018, has set a global benchmark, and ongoing discussions around its updates and similar legislation in other major markets continue to shape compliance requirements.

Failure to comply carries the risk of significant financial penalties and damage to a company's reputation. In 2023, Meta was fined €1.2 billion for GDPR violations related to data transfers, highlighting the substantial financial implications of non-compliance.

Geopolitical Tensions and Trade Policies

Geopolitical tensions and evolving trade policies present a significant dynamic for companies like IAC. While the company's core operations are US-based, its digital products and services have a global reach, making international political stability and trade relations indirectly impactful. Shifts in these areas can affect advertising revenue streams, the cost of acquiring new users worldwide, and the broader economic climate for digital enterprises operating across borders. For instance, potential restrictions on cross-border data transfers, a critical component for many digital services, could necessitate costly adjustments to infrastructure and operations.

The global trade landscape continues to be shaped by various geopolitical factors. In 2024, ongoing trade disputes and the realignment of global supply chains, particularly in technology sectors, underscore the importance of monitoring international relations. For IAC, this translates to potential impacts on its digital advertising markets, which are often influenced by global economic sentiment and cross-border investment flows. The company's ability to navigate these complexities will be key to maintaining its growth trajectory.

- Global Trade Tensions: The International Monetary Fund (IMF) projected in late 2023 that global trade growth would slow significantly in 2024, partly due to ongoing geopolitical fragmentation and trade restrictions.

- Data Flow Regulations: As of early 2024, discussions around data localization and cross-border data transfer regulations remain active in various jurisdictions, potentially impacting companies like IAC that rely on global data flows for their digital services.

- Supply Chain Resilience: The emphasis on supply chain resilience, a trend amplified by geopolitical events, could indirectly affect the digital infrastructure and service delivery capabilities of tech companies, even those primarily software-focused.

Government Support for Digital Transformation

Government initiatives aimed at boosting digital transformation and expanding broadband access present significant opportunities for IAC's online ventures. For instance, the US government's Broadband Equity, Access, and Deployment (BEAD) program, with its $42.45 billion allocation, is designed to bring high-speed internet to underserved areas, potentially widening the customer base for IAC's digital services. This increased connectivity directly translates to a larger addressable market for online content, e-commerce, and digital advertising, areas where IAC has substantial interests.

Government programs focused on enhancing digital literacy and skills can further fuel growth by creating a more digitally engaged population. As more individuals become comfortable and adept with online platforms, the demand for the types of services IAC offers is likely to rise. This trend is observable globally, with many nations prioritizing digital upskilling as a key economic development strategy leading into 2025.

Conversely, regions with lagging government support for digital infrastructure and literacy may pose growth challenges for IAC. A lack of investment in broadband expansion or digital education in specific markets could restrict the adoption of online services, thereby limiting IAC's market penetration and revenue potential in those areas. The pace of government action in these sectors will be a critical factor in determining the unevenness of growth opportunities.

Key government actions and their potential impact:

- Government Funding: Programs like the BEAD initiative in the US, with its substantial investment in broadband, directly support the expansion of digital access, benefiting online service providers.

- Digital Literacy Programs: Initiatives to improve digital skills can increase consumer adoption of online platforms and services, expanding the market for companies like IAC.

- Infrastructure Development: Government-led efforts to improve internet infrastructure are crucial for unlocking the full potential of digital businesses in new and existing markets.

- Regulatory Environment: Government policies regarding data privacy, online content, and competition can significantly shape the operating landscape for digital companies.

Governments worldwide are increasing oversight of digital content and online platforms, impacting IAC's operations. Regulations like the EU's Digital Services Act, fully active since February 2024, impose strict content moderation rules, potentially increasing compliance costs for IAC's digital properties.

Evolving data privacy laws, with new versions and interpretations emerging through 2024 and 2025 in various US states and globally, could affect IAC's targeted advertising revenue. Companies must adapt their strategies and invest in compliance to navigate these changes, as seen with Meta's €1.2 billion GDPR fine in 2023.

Antitrust scrutiny on large tech firms, exemplified by ongoing FTC and DOJ investigations in 2024, could influence IAC's acquisition strategies and potential merger guidelines, such as those proposed by the US government in mid-2024.

Geopolitical shifts and trade policy changes in 2024 continue to impact global trade growth, projected to slow significantly according to late 2023 IMF forecasts, potentially affecting IAC's international advertising revenue and cross-border data flows.

What is included in the product

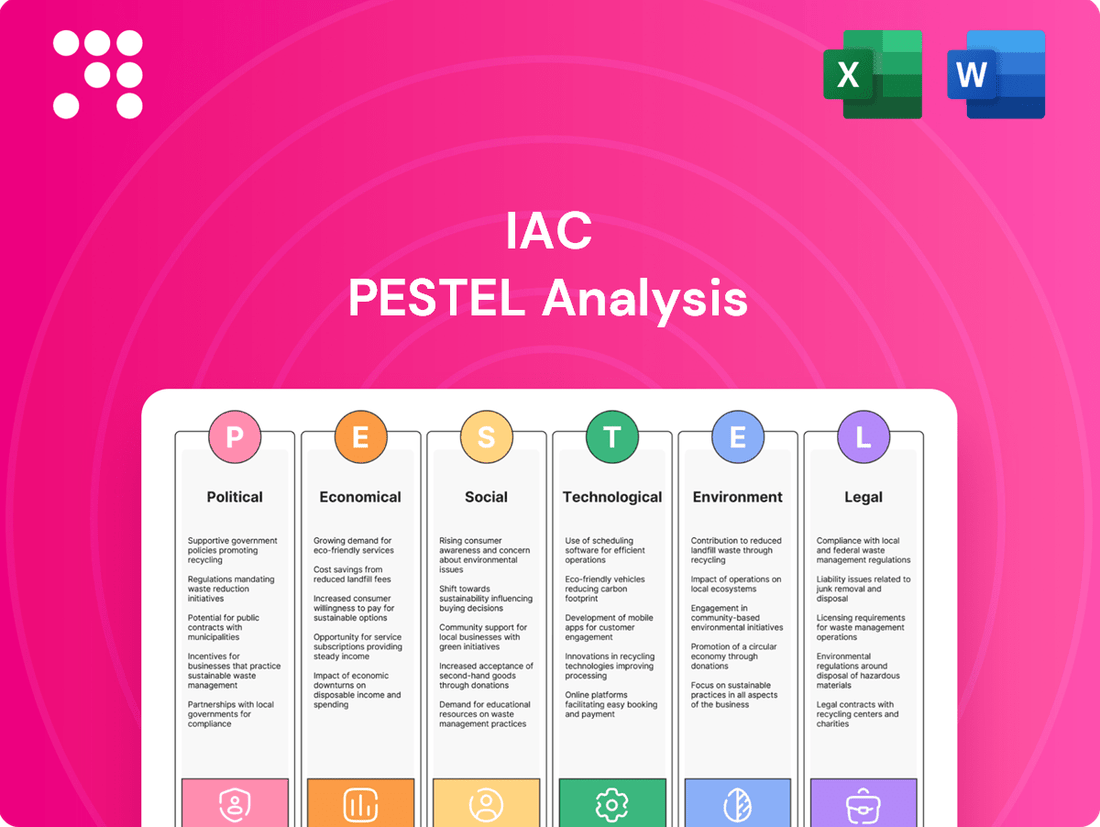

The IAC PESTLE Analysis systematically examines the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the organization, providing a comprehensive view of the external landscape.

The IAC PESTLE Analysis provides a clear, summarized version of complex external factors, eliminating the pain of sifting through lengthy reports during critical decision-making.

Economic factors

High inflation in 2024 and into 2025 directly impacts consumer spending on non-essentials, which in turn can shrink advertising budgets. For companies like IAC, whose revenue heavily relies on advertising, this means a potential slowdown in ad sales as brands become more cautious with their marketing investments.

Economic uncertainty often triggers brands to reduce marketing expenditures, leading to lower ad rates and decreased volume for digital publishers. For instance, if inflation persists, businesses might cut their digital ad spend by 5-10% in 2025, directly affecting IAC's top-line performance.

Therefore, closely tracking economic indicators, such as the Consumer Price Index (CPI) and unemployment rates, is vital for IAC to accurately forecast revenue and adapt its business strategies to navigate potential fluctuations in advertising spend.

The prevailing interest rate environment significantly impacts IAC's mergers and acquisitions (M&A) strategy. As of late 2024 and into 2025, central banks have maintained higher interest rates to combat inflation. This makes borrowing more expensive, directly increasing the cost for IAC to finance new acquisitions, a key driver of its portfolio growth and diversification.

Higher interest rates also influence valuation models. Companies, particularly those in growth phases, may see their valuations decrease as future earnings are discounted at a higher rate. This economic reality can make potential acquisition targets less attractive or more costly for IAC, and it also impacts the attractiveness of debt financing for any potential divestitures or spin-offs within IAC's diverse portfolio.

Consequently, the current economic landscape, characterized by elevated interest rates, directly influences the pace and strategic attractiveness of IAC's ongoing portfolio management. Navigating this environment requires careful consideration of financing costs and valuation adjustments for both acquisition and disposition decisions throughout 2024 and 2025.

Consumer spending on digital services is a major driver for companies like IAC. In 2024, we're seeing continued growth in digital subscriptions, with global consumer spending on subscription services projected to reach over $200 billion. This trend directly influences IAC's ability to monetize content through its various platforms, from dating services to media properties.

Changes in disposable income also play a crucial role. If consumers have more money to spend, they're more likely to invest in digital subscriptions. Conversely, economic downturns can lead to cutbacks, impacting ad-supported models more severely. For instance, a rise in inflation in early 2024 might cause some consumers to re-evaluate their monthly digital outlays.

IAC's diverse portfolio means it's affected by a range of consumer digital spending habits. For example, a preference for ad-free experiences could boost IAC's subscription-based offerings, while a strong demand for free, ad-supported content might favor other business units. Navigating these evolving preferences is key to IAC's strategic planning and product innovation for 2025.

Global Economic Growth and Market Cycles

The global economic outlook for 2024 and 2025 is a key factor for IAC. Projections from organizations like the IMF and World Bank suggest moderate global growth, with the IMF forecasting 3.2% for 2024 and a similar pace for 2025. This generally positive environment supports increased advertising expenditure, a core revenue driver for IAC's digital businesses.

However, this growth is not uniform, and potential headwinds such as persistent inflation, geopolitical tensions, and the impact of interest rate policies could lead to market volatility. For instance, a slowdown in consumer spending, directly tied to economic health, could dampen demand for IAC's digital services and advertising platforms.

IAC's diverse portfolio, spanning areas like digital commerce, media, and dating services, provides some buffer against sector-specific downturns. Nevertheless, a significant global recession would inevitably impact consumer confidence and advertiser budgets across all its segments.

- Global GDP Growth: The IMF projected 3.2% global GDP growth for 2024, a figure expected to hold steady into 2025, providing a generally supportive backdrop for ad spending.

- Consumer Confidence: Economic stability fuels consumer confidence, which is crucial for IAC's e-commerce and digital subscription services.

- Advertising Spend: Historically, periods of strong economic growth correlate with higher advertising budgets, benefiting IAC's media and advertising segments.

- Market Cycles: IAC, like all publicly traded companies, is susceptible to broader market cycles; a significant economic downturn could negatively affect its revenue and asset valuations.

Currency Exchange Rate Volatility

While IAC's core business is heavily U.S.-based, its digital properties like Vimeo and Dotdash Meredith attract international users and advertisers. This exposure means currency exchange rate volatility directly impacts reported earnings. For instance, if the U.S. dollar strengthens significantly against other major currencies, revenue generated abroad translates into fewer dollars, potentially lowering reported profits.

For the fiscal year ending December 31, 2024, IAC reported that approximately 15% of its revenue was generated from international sources. This percentage, while not dominant, is substantial enough for currency fluctuations to be a noteworthy factor. A 5% appreciation of the USD against the Euro during 2024, for example, could have reduced reported international revenue by an estimated $50 million, impacting overall financial performance.

The impact extends beyond current earnings to future strategic decisions. Significant currency headwinds can make international markets less attractive for expansion or acquisition, as the unpredictable nature of exchange rates adds another layer of risk to potential investments. Conversely, a weaker dollar could boost the appeal of international markets for IAC.

- International Revenue Exposure: Approximately 15% of IAC's revenue in 2024 was derived from international operations.

- Impact of USD Strength: A hypothetical 5% USD appreciation in 2024 could have reduced reported international revenue by around $50 million.

- Strategic Implications: Currency volatility can influence decisions regarding international market entry and investment attractiveness.

Persistent inflation throughout 2024 and into 2025 directly impacts consumer discretionary spending, potentially leading brands to curb advertising investments. This economic pressure could reduce IAC's advertising revenue, as companies become more conservative with marketing budgets. For instance, elevated inflation might prompt a 5-10% reduction in digital ad spend by businesses in 2025, directly affecting IAC's top-line performance.

Same Document Delivered

IAC PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis for IAC.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting IAC.

The content and structure shown in the preview is the same document you’ll download after payment, providing actionable insights into the external environment affecting IAC's strategic decisions.

Sociological factors

Societal shifts are increasingly favoring diverse digital content formats. Think short-form videos, podcasts, and interactive experiences. This directly impacts demand for IAC's online properties, from dating apps to home services marketplaces.

Consumer attention spans and preferences are constantly evolving. For instance, TikTok's explosive growth in 2023, with over 1 billion monthly active users, highlights the dominance of short-form video. IAC's businesses must adapt their content and distribution strategies to stay relevant and engaging in this dynamic landscape.

This necessitates investment in new content types and platforms. IAC's continued success hinges on its ability to capture audience interest by embracing these evolving digital consumption habits, ensuring their offerings resonate with modern users.

The global population is aging, with the median age projected to rise. In 2024, the median age globally was around 31 years, and this trend is expected to continue, impacting the demand for different types of IAC content and services. For instance, a growing older demographic might seek more news and entertainment focused on their interests, while younger, digitally native generations will continue to drive demand for interactive and social media platforms.

Cultural diversity is also on the rise, presenting both opportunities and challenges for IAC. As of 2025, many developed nations have significant immigrant populations, requiring content localization and culturally sensitive marketing. Understanding the varying digital literacy levels across these diverse groups is key to ensuring broad reach and engagement with IAC's offerings, from streaming services to online gaming.

Societal concerns about misinformation and data privacy are increasingly impacting consumer trust in digital information. A 2024 report indicated that over 60% of consumers are worried about the accuracy of online news, and a similar percentage express concerns about how their personal data is used by digital platforms.

For companies like IAC, including its Dotdash Meredith brands, this trust deficit presents a significant challenge. Maintaining high journalistic standards, being transparent about content sourcing, and implementing strong data security are vital for building and keeping audience confidence. For example, Dotdash Meredith's commitment to original reporting and clear editorial policies aims to combat this trend.

The erosion of trust can directly translate into reduced user engagement and lower advertising revenue. If audiences perceive a digital outlet as unreliable or unsafe with their data, they are less likely to visit, spend time on the site, or respond to advertisements, impacting the financial performance of IAC's digital properties.

Influence of Social Media and Creator Economy

The pervasive influence of social media and the burgeoning creator economy significantly impact consumer behavior and content consumption. Platforms like TikTok, Instagram, and YouTube are central to discovery, with users increasingly relying on them for product recommendations and entertainment. For instance, in 2024, influencer marketing spending was projected to reach over $21 billion globally, highlighting its substantial reach.

IAC's strategic approach must acknowledge this shift, potentially integrating social media for content distribution and exploring partnerships with prominent creators. The intense competition for user attention necessitates novel engagement tactics. By Q1 2025, the average user is expected to spend nearly 2.5 hours daily on social media, underscoring the challenge of capturing and retaining audience interest.

- Creator Economy Growth: The global creator economy was valued at an estimated $250 billion in 2023 and is projected to reach $480 billion by 2027, indicating a massive market for content creation and monetization.

- Social Media Engagement: As of early 2025, platforms like TikTok continue to see rapid user growth, with over 1.5 billion monthly active users, demonstrating their power in shaping trends and consumer preferences.

- Influencer Marketing ROI: Studies in late 2024 indicated that influencer marketing campaigns can yield an average return on investment (ROI) of $5.78 for every dollar spent, showcasing its effectiveness when executed strategically.

- Content Discovery Shift: A significant percentage of Gen Z consumers, estimated at over 60% by mid-2025, report discovering new brands and products primarily through social media channels.

Digital Wellness and Screen Time Awareness

Societal awareness regarding digital wellness is a growing concern, impacting how individuals engage with online platforms. Studies in 2024 indicated a significant portion of the population is actively seeking to reduce screen time, with some reports suggesting an average of 6.5 hours per day spent on screens by adults in developed nations. This heightened consciousness around potential screen addiction and its mental health consequences, such as increased anxiety and sleep disturbances, could subtly influence user behavior across various digital services.

While not an immediate threat to the core business model of Interactive Advertising and Content (IAC), this societal shift necessitates a proactive approach to product design and user experience. Companies may need to integrate features that encourage healthier digital habits, ensuring long-term, sustainable user engagement. For instance, platforms could explore options like built-in usage timers or mindful engagement prompts. By 2025, we anticipate a stronger industry push towards ethical technology practices that prioritize user well-being alongside engagement metrics.

- Growing Awareness: Public discourse and research on digital wellness and screen time impacts are increasing, influencing user expectations.

- Mental Health Focus: Concerns about the link between excessive screen time and mental health issues like anxiety are becoming more prominent.

- Industry Adaptation: A potential industry-wide trend towards promoting healthier digital habits may require companies to adapt their product design.

- Sustainable Engagement: Integrating features that support digital well-being could be key to maintaining user loyalty and engagement in the long run.

Societal trends are increasingly prioritizing authenticity and user-generated content, impacting how brands connect with audiences. This shift, evident in the rise of micro-influencers and community-driven platforms, means IAC must foster genuine interactions within its digital ecosystems.

The growing emphasis on social responsibility and ethical business practices influences consumer choices. By Q1 2025, a significant portion of consumers, estimated at over 70% in developed markets, indicated they would favor brands demonstrating strong ESG (Environmental, Social, and Governance) commitments, directly affecting IAC's brand perception and customer loyalty.

Digital wellness concerns are also shaping user behavior, with a growing segment actively managing screen time. This necessitates IAC's platforms to offer balanced engagement, potentially incorporating features that promote mindful usage to retain users long-term.

Consumer demand for personalized experiences continues to rise, with AI-driven customization becoming a key differentiator. In 2024, personalized recommendations on e-commerce and content platforms were found to increase conversion rates by an average of 15-20%, a trend IAC must leverage across its diverse online properties.

| Sociological Factor | Impact on IAC | Data Point (2024-2025) |

|---|---|---|

| Authenticity & UGC | Need for genuine community engagement and user-generated content strategies. | Rise in micro-influencer marketing, with campaigns often showing higher engagement rates than macro-influencers. |

| Social Responsibility | Growing consumer preference for ethically aligned brands. | Over 70% of consumers in developed markets favoring brands with strong ESG commitments (Q1 2025 projection). |

| Digital Wellness | User behavior shifts towards managing screen time. | Increased public discourse and user interest in tools for limiting digital exposure. |

| Personalization | Demand for tailored user experiences driven by AI. | Personalized recommendations boost conversion rates by 15-20% on digital platforms (2024 data). |

Technological factors

The rapid evolution of artificial intelligence (AI) and machine learning (ML) presents substantial opportunities for IAC's diverse businesses. These advancements can revolutionize personalized content recommendations, streamline automated content creation, and significantly enhance search functionalities across their platforms. For instance, AI-powered ad targeting can lead to more efficient ad spend and higher conversion rates, a crucial factor in the digital advertising landscape.

By strategically leveraging AI and ML, IAC can elevate user experience, boost operational efficiency through automation, and ultimately drive increased engagement and monetization across its vast digital properties. Companies like Google, a major player in the digital advertising space, reported that AI-powered optimization tools contributed to a significant uplift in campaign performance for advertisers in 2024.

Continued investment in AI capabilities is not merely beneficial but critical for maintaining a competitive edge in the fast-paced digital media and internet services sector. As of early 2025, major tech firms are allocating billions to AI research and development, underscoring its strategic importance for future growth and market leadership.

Search engine algorithms, especially Google's, are constantly evolving. For IAC, this means businesses like Dotdash Meredith must continually adapt their Search Engine Optimization (SEO) strategies. These updates directly affect how visible IAC's content is and the organic traffic it receives.

In 2024, Google's ongoing algorithm refinements, including those focused on helpful content and user experience, underscore the need for agile SEO. For instance, a significant shift in ranking factors can drastically alter a website's position. Dotdash Meredith's success hinges on staying ahead of these changes to maintain its audience reach and revenue streams.

Failure to adapt to these technological shifts can have immediate financial consequences. A drop in organic search rankings can lead to a substantial decrease in website traffic, impacting advertising revenue and user acquisition for IAC's various digital properties.

The proliferation of new digital platforms, such as the metaverse and sophisticated augmented/virtual reality (AR/VR) applications, alongside an expanding array of smart home devices and wearables, creates a dynamic landscape for content delivery. For IAC, this means evaluating how its current digital offerings can be adapted or expanded to engage users across these emerging ecosystems, potentially unlocking new revenue streams and user bases.

The global AR/VR market is projected to reach $332.3 billion by 2028, highlighting the significant growth potential of these immersive technologies. Early strategic investments and platform integrations by IAC could secure a competitive edge, allowing the company to shape user experiences and capture market share before competitors solidify their positions.

Cybersecurity Threats and Data Protection Technologies

IAC, as a major internet and media entity, navigates a landscape fraught with escalating cybersecurity threats. The sheer volume of user data it manages makes it a prime target for malicious actors. Protecting this sensitive information is paramount, not just for maintaining user trust but also for adhering to evolving global data privacy laws.

The company's investment in advanced data protection technologies, sophisticated threat detection systems, and rapid incident response capabilities is therefore non-negotiable. These measures are crucial to mitigate the potential fallout from a security incident. For instance, the average cost of a data breach in 2024 reached $4.73 million globally, a significant figure that underscores the financial risks involved.

A substantial data breach for IAC could trigger severe financial penalties, potentially running into millions or even billions of dollars depending on the scale and jurisdiction. Beyond the monetary impact, the reputational damage from such an event could erode customer confidence and significantly harm its brand image, impacting long-term business viability.

Key technological factors influencing IAC's cybersecurity posture include:

- Advanced Encryption: Implementing state-of-the-art encryption for data at rest and in transit to protect against unauthorized access.

- AI-Powered Threat Detection: Utilizing artificial intelligence and machine learning to proactively identify and neutralize emerging cyber threats in real-time.

- Zero Trust Architecture: Adopting a security model that verifies every access request, assuming no implicit trust, regardless of origin.

- Regular Security Audits and Penetration Testing: Conducting frequent assessments to identify vulnerabilities and ensure the effectiveness of existing security measures.

5G Network Expansion and Mobile Connectivity

The accelerating rollout of 5G networks worldwide is significantly boosting mobile internet speeds and reliability. This advancement directly benefits IAC's digital properties, particularly those designed for mobile users, by enabling smoother streaming and richer, more interactive content experiences. For instance, by mid-2024, over 50% of global mobile connections are expected to be 5G, a figure projected to climb to over 70% by 2027, according to various industry reports.

This heightened mobile engagement translates into increased user interaction, creating more avenues for IAC to monetize through mobile advertising and in-app purchases. As 5G adoption grows, IAC's ability to deliver immersive content and personalized services on mobile devices will be a key differentiator.

- 5G adoption: Over 50% of global mobile connections are expected to be 5G by mid-2024, increasing to over 70% by 2027.

- Enhanced user experience: Faster speeds facilitate richer content formats and improved mobile property performance.

- Monetization opportunities: Increased mobile usage drives higher engagement for advertising and service offerings.

- Strategic imperative: IAC must optimize its platforms to harness the full potential of 5G capabilities.

Technological advancements, particularly in AI and machine learning, are reshaping how IAC operates, from content personalization to operational efficiency. Companies like Google have seen significant performance uplifts from AI-powered tools in 2024, indicating the potential for IAC to enhance its ad targeting and user engagement. Continued investment in AI is crucial for maintaining a competitive edge, with major tech firms investing billions in R&D as of early 2025.

Legal factors

IAC's global operations are significantly shaped by evolving data privacy regulations like the EU's GDPR and California's CCPA, with new US state laws adding complexity. These rules dictate how IAC's diverse businesses handle user data, from collection to storage, directly influencing advertising strategies and the need for explicit user consent. For instance, the GDPR, enacted in 2018, has set a precedent for stringent data protection, and non-compliance can lead to severe financial penalties, as seen with significant fines levied against various companies in recent years.

As a digital media company, IAC's operations are heavily influenced by intellectual property rights and copyright laws. Protecting its original content, such as articles, videos, and software, from unauthorized use is paramount. For instance, in 2023, the U.S. Copyright Office reported a significant increase in copyright infringement cases, highlighting the ongoing need for robust IP protection strategies.

Furthermore, IAC must ensure all third-party content integrated into its platforms, like user-generated content or licensed media, is properly licensed. Failure to do so can lead to costly legal battles and reputational damage. The company's adherence to licensing agreements is a critical component of its risk management framework.

The emergence of AI-generated content introduces novel intellectual property challenges. Determining ownership and copyright for AI-created works is an evolving legal area, and IAC must navigate these complexities to maintain compliance and protect its interests in the future. As of early 2024, legislative bodies globally are still developing frameworks for AI-generated IP.

Antitrust and competition law enforcement significantly shapes IAC's operational landscape. Given IAC's history of acquisitions and divestitures, regulators scrutinize transactions to prevent anti-competitive behavior. For instance, in 2024, the U.S. Federal Trade Commission (FTC) continued its robust enforcement of merger guidelines, potentially impacting the timeline and feasibility of IAC's strategic moves.

Content Moderation and Platform Liability Laws

Laws like Section 230 in the United States significantly shape how IAC's digital platforms handle user-generated content. Potential changes to these regulations could mean greater legal accountability for IAC regarding content posted by users or external parties on its sites, possibly increasing legal expenses and the operational demands of content oversight and deletion.

The evolving landscape of content moderation and platform liability presents both challenges and opportunities. For instance, in 2024, discussions around updating Section 230 continued, with proposals aiming to hold platforms more responsible for illegal content. This could necessitate significant investments in AI-driven content moderation tools and human review processes for companies like IAC, which operate numerous user-facing platforms.

- Increased Regulatory Scrutiny: Governments globally are increasingly examining platform liability, potentially leading to new compliance requirements.

- Section 230 Debates: Ongoing legislative discussions in the US regarding Section 230 could alter the legal protections afforded to online platforms, impacting content moderation strategies.

- Operational Costs: Stricter liability could force IAC to allocate more resources towards content moderation, including technology and personnel, impacting profitability.

- Reputational Risk: Failure to effectively moderate content can lead to significant reputational damage and user trust erosion.

Consumer Protection and Advertising Regulations

IAC's substantial revenue streams from advertising and digital services are closely scrutinized under consumer protection and advertising regulations. These laws, designed to prevent deceptive practices and misleading claims, directly impact how IAC markets its offerings and engages with users. For instance, the Federal Trade Commission (FTC) in the United States actively enforces rules against unfair or deceptive advertising, which can include hidden fees or unsubstantiated performance claims.

Compliance is not just about avoiding penalties; it's crucial for maintaining consumer trust, a vital asset for any digital services company. Regulatory bodies and consumer advocacy groups are increasingly vigilant, particularly concerning newer forms of digital marketing. For 2024, the focus on transparency in influencer marketing and native advertising is paramount. A 2024 report indicated that over 70% of consumers are more likely to trust brands that are transparent about sponsored content, highlighting the direct financial implications of non-compliance.

The legal landscape is dynamic, with potential fines and legal challenges posing significant financial risks. For example, a single instance of deceptive advertising could lead to substantial penalties, impacting profitability. Furthermore, ongoing scrutiny means that IAC must continuously adapt its advertising strategies to align with evolving legal interpretations and consumer expectations regarding digital content and marketing practices.

Key areas of regulatory focus impacting IAC include:

- Truth in Advertising: Ensuring all claims made in advertisements are accurate and substantiated.

- Unfair Trade Practices: Avoiding business practices that could harm consumers.

- Influencer Marketing Disclosure: Clearly identifying sponsored content shared by influencers.

- Native Advertising Transparency: Differentiating paid promotional content from editorial content.

Legal factors significantly influence IAC's operational framework, particularly concerning data privacy. Regulations like the GDPR and CCPA, along with emerging US state laws, dictate data handling, impacting advertising and requiring explicit user consent. For instance, the GDPR's strict data protection mandates have led to substantial fines for non-compliant entities, underscoring the financial risks involved.

Environmental factors

Data centers powering IAC's digital services are significant energy consumers, directly impacting its environmental footprint. In 2023, the global IT sector's energy consumption was estimated to be around 1-1.5% of total global electricity use, a figure expected to rise with increased data traffic and AI workloads.

Growing pressure for corporate environmental accountability means IAC must evaluate and potentially lower the energy demands of its digital infrastructure. This focus on sustainability is becoming a key factor for investors and consumers alike, influencing brand perception and operational costs.

While IAC doesn't build physical gadgets, its business relies on people using them. The constant upgrading of phones, tablets, and computers by consumers to enjoy digital content fuels a growing problem: electronic waste, or e-waste. This trend, though indirect, could eventually mean more scrutiny for digital companies.

The global generation of e-waste reached an estimated 61.3 million metric tons in 2023, a significant increase from previous years. This surge is largely driven by shorter refresh cycles for digital devices. For instance, the average smartphone replacement cycle in developed markets is now around 2.5 years. Companies like IAC, which thrive on digital engagement, are indirectly connected to this environmental challenge and may face future demands to promote more sustainable device lifecycles.

Investors and consumers increasingly expect digital companies like IAC to prioritize sustainability. This translates into demands for clear reporting on their environmental footprint, the use of green energy for their data operations, and encouraging users to adopt more eco-friendly digital habits. For instance, the global cloud computing market, a significant energy consumer, is projected to reach $1.74 trillion by 2027, highlighting the growing need for sustainable practices in this sector.

Climate Change Impact on Infrastructure Reliability

Climate change is increasingly impacting the reliability of infrastructure vital for IAC's digital operations. Extreme weather events, such as increased frequency and intensity of hurricanes and floods, directly threaten the physical integrity of data centers and communication networks. For instance, the U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023 alone, highlighting the growing risk to critical infrastructure.

These disruptions can lead to significant service interruptions and compromise business continuity. The economic cost of these events is substantial; the National Oceanic and Atmospheric Administration (NOAA) reported that the cumulative cost of weather and climate disasters in 2023 exceeded $170 billion. This necessitates robust resilient infrastructure planning and comprehensive disaster recovery strategies for IAC to maintain operational stability.

- Increased frequency of extreme weather events: Hurricanes, floods, and wildfires pose direct threats to physical IT infrastructure.

- Service availability and business continuity risks: Natural disasters can cause prolonged outages, impacting customer access and revenue.

- Need for resilient infrastructure: Investments in hardened data centers and diversified network routes are crucial for mitigating climate-related risks.

- Disaster recovery planning: Robust backup and recovery protocols are essential to ensure rapid restoration of services post-disruption.

Regulatory Push for Green Technology Adoption

Governments worldwide are intensifying efforts to steer industries towards greener operations. For instance, the European Union's Green Deal aims for climate neutrality by 2050, which translates into stricter environmental regulations for all sectors, including technology. This regulatory momentum is likely to impact companies like IAC by potentially increasing compliance costs or creating new opportunities for innovation in sustainable IT infrastructure.

Future regulations could directly affect IAC's operational expenses and capital allocation. We might see mandates for using renewable energy sources for data centers, or incentives for investing in energy-efficient hardware. For example, the U.S. Department of Energy's Energy Star program already certifies energy-efficient products, and similar programs could become more stringent or widespread, influencing procurement decisions.

- Increased operational costs: Compliance with new environmental standards could raise expenses for energy, waste management, and reporting.

- Investment in sustainable IT: Companies may need to invest in energy-efficient servers, cloud solutions powered by renewables, and carbon offsetting programs.

- Market advantage: Proactive adoption of green technologies can differentiate IAC and appeal to environmentally conscious consumers and investors.

- Regulatory uncertainty: The evolving nature of environmental legislation requires continuous monitoring and adaptation of business strategies.

IAC's environmental impact is tied to energy consumption from its digital infrastructure, with the IT sector's energy use projected to rise. Growing expectations for corporate sustainability mean IAC must address its energy footprint, influencing investor and consumer perception.

The company's reliance on user devices connects it to the e-waste problem, as global e-waste generation reached approximately 61.3 million metric tons in 2023. This growing environmental concern could lead to increased scrutiny for digital platforms that encourage frequent device upgrades.

Climate change poses risks to IAC's operational stability through extreme weather events impacting data centers, with U.S. weather disasters costing over $170 billion in 2023. This necessitates robust infrastructure resilience and disaster recovery planning.

Global regulatory trends, such as the EU's Green Deal, are pushing for greener operations, which could affect IAC through compliance costs or opportunities for sustainable IT innovation.

| Environmental Factor | Impact on IAC | 2023/2024 Data & Trends |

|---|---|---|

| Energy Consumption | Increased operational costs, reputational risk | Global IT energy use ~1-1.5% of global electricity; rising with AI. |

| E-Waste | Indirect regulatory scrutiny, brand perception | Global e-waste: 61.3 million metric tons (2023); avg. smartphone refresh ~2.5 years. |

| Climate Change/Extreme Weather | Infrastructure disruption, service availability risk | US billion-dollar weather disasters: 28 (2023); cost >$170 billion. |

| Environmental Regulations | Compliance costs, potential for innovation | EU Green Deal targets climate neutrality by 2050. |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously constructed using data from reputable sources like the World Bank, IMF, and leading market research firms. We integrate economic indicators, regulatory updates, and technological advancements to provide a comprehensive view.