IAC Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IAC Bundle

Curious about the engine driving IAC's diverse portfolio? Our full Business Model Canvas unpacks the intricate web of customer relationships, revenue streams, and key resources that fuel their success. Discover the strategic brilliance behind their innovation and market dominance.

Unlock the complete strategic blueprint of IAC's empire. This detailed Business Model Canvas reveals their core competencies, value propositions, and cost structures, offering invaluable insights for anyone looking to understand or replicate their growth. Elevate your business strategy today!

Partnerships

IAC, primarily through its Dotdash Meredith division, actively collaborates with a wide array of digital content creators and smaller publishers. These strategic alliances are fundamental to aggregating a rich tapestry of content, thereby broadening the scope and depth of information accessible to users across a multitude of subjects and passions.

This partnership model is central to Dotdash Meredith's overarching strategy. It focuses on nurturing premium franchise communities and ensuring the delivery of expertly crafted content, a key driver for user engagement and platform growth.

In 2024, Dotdash Meredith continued to leverage these partnerships, with its portfolio of brands reaching over 150 million Americans monthly, showcasing the significant reach and impact of its content aggregation strategy.

IAC collaborates with advertising technology providers, especially for its Dotdash Meredith segment, to sharpen its ad-targeting precision. This partnership is vital for powering Dotdash Meredith's D/Cipher tool, a proprietary system designed for intent-based ad targeting that bypasses traditional cookie reliance.

These technological alliances are essential for creating robust advertising solutions in today's privacy-conscious digital environment. For instance, in 2024, the digital advertising market continued its shift towards privacy-centric approaches, making partnerships with ad tech innovators critical for companies like IAC to maintain competitive ad delivery.

IAC's search engine partners, most notably Google, are critical to its revenue generation. This relationship is so foundational that IAC recently renewed its agreement with Google through March 31, 2026.

This extended partnership highlights the ongoing reliance on search engine visibility and traffic for IAC's online properties. It ensures a steady stream of users to their search-related businesses, which is essential for monetizing that traffic.

Acquisition Targets and Founders

IAC's strategy hinges on acquiring and nurturing businesses, making partnerships with founders and their teams paramount. These collaborations are vital for seamless integration and unlocking the acquired companies' inherent potential, ensuring their continued growth within the IAC ecosystem.

For instance, the acquisition of Care.com in 2017 for $500 million exemplifies this approach, where founder Jerry Levin played a key role in the transition. Similarly, the recent spin-off of Angi in 2023, formerly Angie's List, highlights the dynamic nature of these partnerships and IAC's ability to reshape its portfolio.

- Founder Collaboration: Critical for knowledge transfer and maintaining operational momentum post-acquisition.

- Integration Success: Founders' insights are key to aligning acquired companies with IAC's strategic goals.

- Long-Term Value: Partnerships foster an environment for sustained growth and innovation from acquired assets.

Investment and Financial Institutions

IAC, as a strategic investor and media holding company, relies heavily on its relationships with investment and financial institutions. These partnerships are crucial for managing its diverse portfolio, which includes significant equity stakes in companies like MGM Resorts International and Turo Inc. For instance, in early 2024, IAC continued to navigate its investments, leveraging financial expertise for capital allocation and strategic financial planning.

These collaborations provide IAC with essential capital, advisory services, and market insights, enabling it to effectively manage its equity positions and pursue growth opportunities. The financial institutions involved facilitate everything from debt financing to equity management, underpinning IAC's flexible approach to its business ventures and spin-offs.

Key aspects of these partnerships include:

- Capital Allocation: Financial institutions advise on and facilitate the allocation of capital for new investments, acquisitions, and strategic initiatives.

- Equity Management: Partnerships are vital for managing IAC's substantial equity holdings, including positions in publicly traded companies.

- Advisory Services: Investment banks and financial advisors provide strategic guidance on mergers, acquisitions, divestitures, and overall financial strategy.

- Financing: Access to credit markets and other financing vehicles through these institutions supports IAC's operational needs and expansion plans.

IAC's Key Partnerships are diverse, ranging from content creators and ad tech providers to search engines and financial institutions. These collaborations are essential for content aggregation, precise ad targeting, revenue generation, and strategic financial management.

The company's reliance on search engine partners like Google is critical, as evidenced by the recent renewal of their agreement through March 31, 2026. Furthermore, partnerships with founders of acquired companies are vital for successful integration and unlocking growth potential, as seen with past acquisitions.

In 2024, Dotdash Meredith's brand portfolio reached over 150 million Americans monthly, underscoring the expansive reach facilitated by its content creator partnerships. The company also actively engages with financial institutions for capital allocation and managing its significant equity stakes in companies like MGM Resorts and Turo.

| Partnership Type | Key Collaborators | Strategic Importance | 2024 Impact/Data |

|---|---|---|---|

| Content Aggregation | Digital Content Creators, Smaller Publishers | Broadens content scope and depth for user engagement. | Dotdash Meredith brands reached >150M Americans monthly. |

| Advertising Technology | Ad Tech Providers | Enhances ad targeting precision via tools like D/Cipher. | Crucial for privacy-centric ad delivery in a shifting market. |

| Search Engine | Drives significant revenue and user traffic. | Agreement renewed through March 31, 2026. | |

| Acquisitions | Founders and Acquisition Teams | Facilitates seamless integration and unlocks acquired company potential. | Past acquisitions like Care.com highlight founder involvement. |

| Financial Services | Investment Banks, Financial Institutions | Supports capital allocation, equity management, and financing. | Essential for managing stakes in MGM Resorts, Turo, etc. |

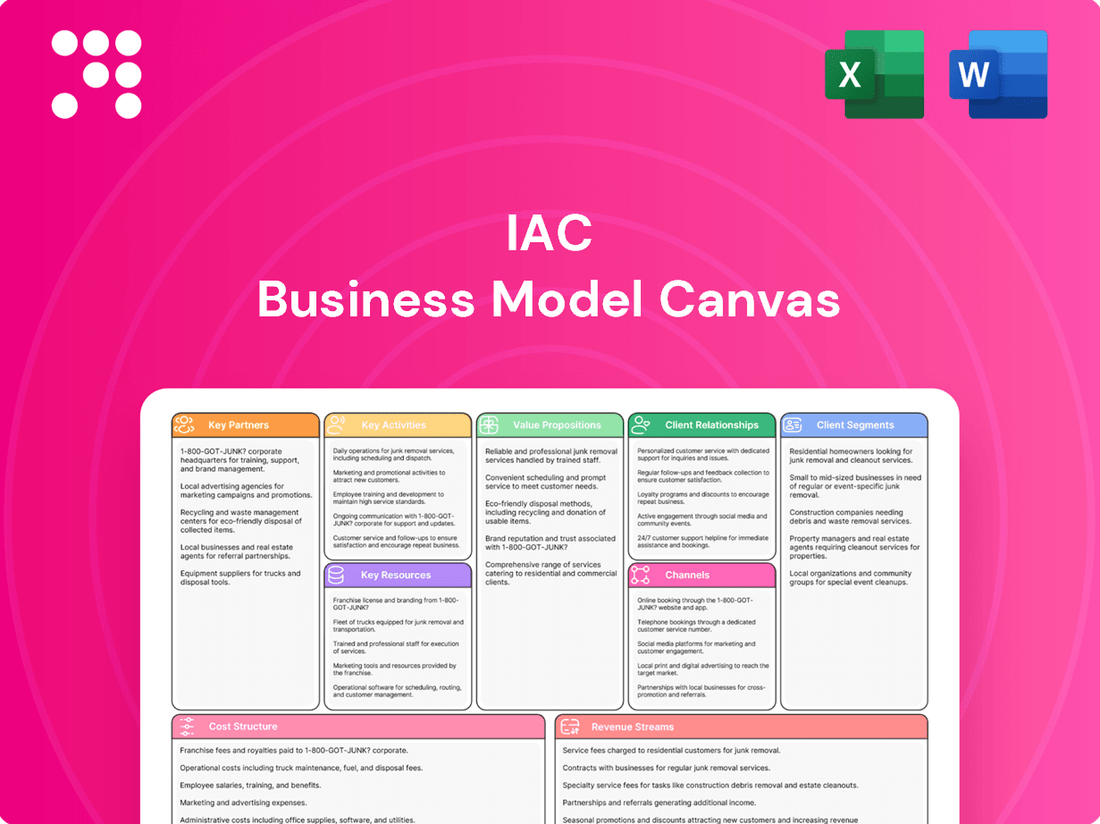

What is included in the product

A structured framework that visually maps out a company's strategy across nine key building blocks, from customer segments to revenue streams.

It provides a holistic view of how a business creates, delivers, and captures value, facilitating strategic analysis and communication.

Provides a structured framework to identify and address critical business model weaknesses.

Helps pinpoint and resolve operational inefficiencies and strategic misalignments.

Activities

IAC's core operational strategy revolves around a dynamic cycle of acquiring, incubating, and divesting businesses. This approach is designed to foster growth and unlock value by identifying promising digital and media ventures, nurturing them to maturity, and then strategically exiting them to realize returns.

A key element of this strategy is the incubation phase, where IAC actively supports and develops acquired companies until they achieve operational independence and significant scale. For instance, the spin-off of Angi in April 2025 exemplifies this divestiture process, marking the culmination of IAC's efforts to build and prepare a business for standalone success.

IAC, through its Dotdash Meredith segment, is deeply engaged in creating and publishing a wide variety of digital content. This includes everything from editorial articles and lifestyle advice to detailed financial information and recipes. The core of this activity is producing high-quality, expert-driven content designed to attract and retain a broad audience.

The strategy centers on delivering premium content to foster engaged communities around its diverse portfolio of brands. For instance, in 2024, Dotdash Meredith continued to leverage its extensive network of writers and editors to produce original content across its numerous digital properties, aiming to solidify its position as a leading digital publisher.

A core activity for IAC involves the sale of digital advertising space across its wide array of websites and platforms. This isn't just about selling ads; it's about making them work effectively for advertisers.

To achieve this, IAC actively develops and refines sophisticated ad-targeting technologies. For instance, Dotdash Meredith leverages its D/Cipher technology to ensure advertisements reach the most relevant audiences, thereby maximizing value for both advertisers and IAC itself.

The ultimate aim here is to boost advertising revenue. By connecting businesses with precisely the right consumers, IAC ensures its advertising solutions are impactful, driving performance and encouraging repeat business.

Search Technology Development and Monetization

IAC's core operational strength lies in the continuous development and refinement of its proprietary search technologies and platforms. This ongoing innovation is crucial for delivering highly relevant and engaging search experiences to a vast user base.

The monetization of this search technology is primarily achieved through strategic partnerships and revenue-sharing agreements with major search engines. These collaborations allow IAC to leverage its user traffic and search capabilities for financial gain.

In 2024, the search market continued to be highly competitive, with significant investment in AI-driven search enhancements. Companies like Google, a key partner for many search entities, reported substantial revenue growth in their search advertising segments, underscoring the value of optimized search traffic.

- Search Technology Enhancement: Ongoing investment in algorithms and user interface improvements to boost search result accuracy and user satisfaction.

- Monetization Agreements: Securing and optimizing revenue streams through partnerships with leading search providers.

- Performance Metrics: Focusing on key performance indicators such as click-through rates, conversion rates, and user engagement to drive monetization.

- Competitive Landscape: Adapting to evolving search trends, including the rise of conversational AI and personalized search experiences.

Strategic Capital Management and Investment

IAC's strategic capital management is a core activity, focusing on astute investments in public equities and diverse assets. This involves actively seeking opportunities to enhance asset value, exemplified by the recent divestment of a property by Industrial Asphalts (Ceylon) PLC, an IAC subsidiary. This strategic move generated capital to fuel future investment initiatives, ensuring efficient resource allocation for sustained growth.

The company's approach prioritizes unlocking intrinsic asset value to reinvest in promising ventures. For instance, in 2024, IAC continued to refine its portfolio by divesting non-core assets, thereby strengthening its financial position. This strategic capital deployment is crucial for pursuing new growth avenues and optimizing returns.

- Strategic Capital Allocation: IAC actively manages its financial capital through strategic investments in public equities and other financial assets.

- Asset Value Enhancement: A key activity involves evaluating and executing opportunities to unlock asset value, such as property divestments.

- Funding Future Investments: Proceeds from asset divestments, like the Industrial Asphalts (Ceylon) PLC property sale, are reinvested to support ongoing and future investment strategies.

- Efficient Resource Deployment: This ensures capital is efficiently allocated to drive growth and maximize shareholder value.

IAC's key activities encompass the strategic acquisition, incubation, and subsequent divestiture of digital and media businesses, aiming to cultivate growth and realize value. This cycle is exemplified by the spin-off of Angi in April 2025, showcasing the company's ability to mature and prepare businesses for independent success.

Content creation and publishing through its Dotdash Meredith segment form another vital activity. This involves producing a wide array of high-quality, expert-driven digital content across numerous brands to foster engaged communities. In 2024, Dotdash Meredith continued to enhance its content offerings, solidifying its position as a leading digital publisher.

Selling digital advertising space, supported by sophisticated ad-targeting technologies like D/Cipher, is a core revenue-generating activity. This focus on precise audience targeting maximizes value for advertisers and IAC, driving advertising revenue and repeat business.

Continuous enhancement of proprietary search technologies and platforms is crucial for IAC. Monetization of this technology is achieved through strategic partnerships and revenue-sharing with major search engines, leveraging user traffic and search capabilities. The competitive search market in 2024 saw significant AI integration, with companies like Google reporting strong search advertising revenue growth.

Strategic capital management, including investments in public equities and asset divestments, is a fundamental activity. The sale of a property by Industrial Asphalts (Ceylon) PLC in 2024 generated capital for reinvestment, demonstrating IAC's commitment to unlocking asset value and efficiently deploying resources for growth.

Full Version Awaits

Business Model Canvas

The IAC Business Model Canvas preview you're viewing is an exact representation of the final document you will receive upon purchase. This means the structure, content, and formatting are identical to the complete file, ensuring no surprises and immediate usability. You'll gain full access to this professionally designed and ready-to-use tool, allowing you to immediately begin strategizing and refining your business model.

Resources

IAC's core strength lies in its expansive collection of digital brands and the associated intellectual property. This portfolio, notably featuring Dotdash Meredith, includes a multitude of well-recognized consumer titles and online platforms, attracting substantial user engagement.

These digital assets are more than just websites; they represent valuable intellectual property, encompassing extensive content archives, registered trademarks, and unique data sets. This diverse brand ecosystem is a key driver for audience acquisition and advertiser appeal.

For instance, Dotdash Meredith, a significant part of IAC's portfolio, reached over 195 million consumers in the US in early 2024, showcasing the immense reach and audience engagement these brands command.

IAC's proprietary technology platforms, like Dotdash Meredith's D/Cipher, are central to its business model, enabling precise ad targeting and efficient content distribution across its diverse portfolio. These advanced algorithms are key to optimizing user engagement and driving revenue.

In 2024, continued investment in these technological assets is paramount for maintaining a competitive edge in the digital media landscape. This focus on innovation allows IAC to adapt to evolving market demands and enhance the value proposition for both advertisers and consumers.

IAC's skilled workforce, especially those adept at mergers and acquisitions, digital publishing, and technology, is a cornerstone of its business model. This human capital is crucial for identifying, integrating, and scaling acquired businesses.

In 2024, IAC's strategic acquisitions, such as its investment in Dotdash Meredith, highlight the importance of this expertise. The company's ability to leverage its teams' deep understanding of digital operations and content creation directly fuels its growth strategy.

The collective knowledge and strategic foresight of IAC's management and employees are not just operational assets but are fundamental to its value creation. This expertise allows IAC to navigate complex market dynamics and capitalize on emerging opportunities in the digital landscape.

Financial Capital and Strategic Investments

IAC's financial capital, encompassing substantial cash reserves and strategic equity stakes in entities such as MGM Resorts International and Turo Inc., is a pivotal resource. This financial strength allows for agile funding of new acquisitions, investment in burgeoning businesses, and the execution of strategic spin-offs, underscoring a robust balance sheet that underpins its long-term value creation objectives.

As of the first quarter of 2024, IAC reported cash and cash equivalents of approximately $1.3 billion. This liquidity is crucial for pursuing strategic opportunities and maintaining operational flexibility.

- Cash Reserves: Significant cash on hand provides immediate access to capital for opportunistic investments and operational needs.

- Strategic Equity Holdings: Investments in companies like MGM Resorts International and Turo Inc. offer potential for capital appreciation and diversification.

- Funding Flexibility: The financial capital enables IAC to fund growth initiatives, acquisitions, and potential divestitures without immediate reliance on external financing.

- Balance Sheet Strength: A healthy balance sheet supports the company's overall financial stability and its capacity to execute long-term strategic plans.

Extensive User Data and Audience Insights

IAC leverages its extensive user data to understand audience behavior and preferences across its diverse digital properties. This allows for highly targeted advertising, a key revenue stream. For example, in 2024, IAC reported that its digital advertising segment generated a significant portion of its revenue, driven by the ability to reach specific consumer demographics.

The insights gleaned from this user data are crucial for optimizing content and improving user engagement. By analyzing what users interact with, IAC can refine its offerings to keep audiences coming back. This data-driven approach to content development and platform enhancement is a core component of their strategy to maintain a competitive edge.

This deep understanding of user intent translates into more effective advertising solutions for partners. IAC can offer advertisers precise targeting capabilities, leading to higher conversion rates and a better return on investment. This makes their platforms attractive to a wide range of businesses seeking to connect with relevant audiences.

Key benefits of IAC's extensive user data include:

- Enhanced Ad Targeting: Precision in reaching desired consumer segments.

- Improved User Engagement: Data-driven content optimization keeps users invested.

- Personalized Experiences: Tailoring platform interactions to individual preferences.

- Increased Advertising Effectiveness: Delivering measurable results for advertisers.

IAC's key resources encompass its vast digital brand portfolio, including Dotdash Meredith, which boasts significant intellectual property and extensive content. Proprietary technology platforms like Dotdash Meredith's D/Cipher are vital for precise ad targeting and content distribution. The company's skilled workforce, particularly in digital publishing and M&A, drives strategic growth. Furthermore, substantial financial capital, including cash reserves and strategic equity holdings, provides flexibility for investments and acquisitions.

IAC's user data is a critical resource, enabling highly targeted advertising and personalized user experiences across its platforms. This data-driven approach optimizes content and enhances advertising effectiveness, a key revenue driver. In 2024, IAC's digital advertising segment demonstrated the value of this data by reaching specific consumer demographics effectively.

| Key Resource | Description | 2024 Relevance/Data Point |

|---|---|---|

| Digital Brand Portfolio | Extensive collection of digital brands and intellectual property. | Dotdash Meredith reached over 195 million US consumers in early 2024. |

| Proprietary Technology | Platforms for ad targeting and content distribution. | D/Cipher enables precise ad targeting across IAC's portfolio. |

| Human Capital | Skilled workforce in digital publishing, tech, and M&A. | Expertise crucial for integrating and scaling acquired businesses. |

| Financial Capital | Cash reserves and strategic equity holdings. | Q1 2024 cash and equivalents ~$1.3 billion; strategic stakes in MGM, Turo. |

| User Data | Insights into audience behavior and preferences. | Drives targeted advertising, a significant revenue stream. |

Value Propositions

IAC, through its Dotdash Meredith brands, delivers consumers a wealth of high-quality, expert-vetted digital content. This spans critical areas like personal finance, health and wellness, and lifestyle, aiming to inform and engage a broad audience.

The focus on trusted information builds authority, a key factor for users navigating complex topics. In 2024, Dotdash Meredith's portfolio, including Investopedia and Healthline, continued to be a go-to resource for millions seeking reliable advice and insights.

IAC offers advertisers highly efficient and targeted advertising solutions across its diverse digital properties, allowing them to connect with specific consumer segments. For instance, innovations like Dotdash Meredith's D/Cipher are designed for intent-based ad targeting, aiming to deliver superior performance compared to conventional approaches.

This focus on precision helps advertisers achieve a better return on their investment by ensuring their messages reach the most relevant audiences. In 2023, digital advertising spending continued its upward trend, with a significant portion allocated to platforms demonstrating strong audience engagement and targeting capabilities, a space where IAC actively competes.

IAC provides acquired companies with crucial growth capital and operational expertise, enabling them to scale effectively. This financial backing and strategic guidance are key components of their 'acquire, build, and grow' strategy, fostering accelerated development within IAC's established internet and media network.

By leveraging IAC's resources, businesses can achieve their full potential, with the ultimate goal of becoming independent public entities. For instance, in 2023, IAC completed the acquisition of Angi Inc., integrating its operations to drive synergistic growth and enhance market position.

For Shareholders: Long-Term Value Creation and Capital Appreciation

IAC's strategy focuses on building and divesting businesses to drive long-term shareholder value and capital appreciation. This approach involves acquiring promising companies, fostering their growth, and then spinning them off when they reach maturity, unlocking their potential value for shareholders.

The company's disciplined portfolio management, including strategic divestitures like the Angi spin-off, underscores its commitment to maximizing shareholder returns. This proactive management ensures resources are allocated to high-growth opportunities and underperforming assets are addressed.

- Value Creation: IAC's model aims to generate sustained value through strategic acquisitions and organic growth, leading to capital appreciation for shareholders.

- Portfolio Optimization: The company actively manages its business portfolio, divesting non-core or mature assets to focus on high-potential ventures.

- Transparency: IAC prioritizes open communication with investors through regular financial reporting and engagement, fostering trust and informed decision-making.

For Business Partners: Monetization and Audience Reach

For strategic partners like Google and OpenAI, IAC presents compelling monetization avenues and access to a vast, engaged user base. IAC's rich content repository and established audience make it a highly desirable collaborator for platforms aiming to enhance their offerings with premium content and extensive reach.

These symbiotic relationships effectively broaden the value chain, benefiting both IAC and its technology partners. For instance, in 2023, search advertising revenue, a key monetization stream for partners like Google, continued to be a significant contributor to digital media companies' overall income, underscoring the value of such collaborations.

- Monetization Opportunities: IAC's platforms offer partners direct revenue generation through advertising, data insights, and integrated services.

- Audience Reach: Partners gain access to IAC's millions of active users across its diverse digital properties.

- Content Licensing: IAC's extensive library of original and curated content provides valuable assets for partners seeking to enrich their own services.

- Value Chain Extension: Collaborations create new revenue streams and enhance user engagement for all parties involved.

IAC's value proposition centers on delivering high-quality, expert-driven digital content to consumers, fostering trust and authority across its brands like Investopedia and Healthline. This commitment to reliable information attracts and retains a broad audience. Furthermore, IAC provides advertisers with highly targeted and efficient advertising solutions, leveraging intent-based targeting technologies to maximize return on investment for their campaigns.

The company also creates value by providing acquired businesses with growth capital and operational expertise, facilitating their expansion within IAC's network. Finally, IAC optimizes its portfolio by nurturing and strategically divesting businesses, aiming to unlock shareholder value and achieve capital appreciation through disciplined management.

| Value Proposition Element | Description | 2024/2023 Relevance |

|---|---|---|

| High-Quality Content | Expert-vetted digital content in finance, health, lifestyle. | Dotdash Meredith brands are go-to resources for millions. |

| Targeted Advertising | Efficient, precise ad solutions for specific consumer segments. | Innovations like D/Cipher enhance ad performance; digital ad spend growth. |

| Business Growth Support | Capital and expertise for acquired companies to scale. | IAC's strategy includes integrating and growing acquired entities. |

| Portfolio Management | Strategic acquisitions and divestitures to maximize shareholder value. | Focus on high-potential ventures and optimizing asset allocation. |

Customer Relationships

IAC cultivates strong customer relationships by offering free, engaging digital content across its diverse portfolio, including popular brands like Dotdash Meredith. This approach encourages users to return frequently, fostering loyalty and a sense of connection.

The company prioritizes a seamless and informative user experience, constantly refining its platforms. For instance, in 2024, Dotdash Meredith brands saw significant growth in digital traffic, with many sites consistently ranking among the top performers in their respective categories, demonstrating the effectiveness of their content strategy in retaining and attracting users.

IAC cultivates advertiser relationships through dedicated direct sales teams and account managers. These professionals focus on understanding advertiser goals and delivering customized ad solutions, such as those leveraging advanced targeting capabilities like D/Cipher. This direct engagement aims to foster enduring partnerships by providing performance insights and tailored strategies.

When IAC acquires new companies, it forms strategic partnerships, offering resources and expertise to help them integrate smoothly and grow faster. This partnership involves working together on goals, sharing successful methods, and providing help with daily operations.

For instance, in 2024, IAC continued its strategy of acquiring and integrating digital businesses. While specific integration support details for individual acquisitions aren't publicly detailed, the company's historical approach emphasizes providing operational guidance and capital to foster growth within its diverse portfolio.

The goal is to support these businesses so they can thrive independently or continue to grow as part of IAC's larger structure, ensuring long-term value creation.

Investor Relations and Transparency

IAC prioritizes a transparent relationship with its investors, fostering trust through consistent and clear communication. This is achieved via regular earnings calls, detailed financial reports, and comprehensive investor presentations, ensuring stakeholders are well-informed about the company's trajectory.

These efforts keep shareholders and financial professionals updated on IAC's performance, strategic direction, and future outlook. For instance, in Q1 2024, IAC reported revenue of $1.1 billion, demonstrating steady operational performance that was communicated to investors.

To further enhance this connection, IAC maintains open communication channels specifically designed to address investor inquiries and concerns promptly. This proactive approach is crucial for managing expectations and building long-term investor confidence.

- Regular Earnings Calls: Providing real-time updates on financial results and operational highlights.

- Detailed Financial Reports: Offering in-depth analysis of performance, including 2024 year-to-date figures.

- Investor Presentations: Showcasing strategic initiatives and future growth plans.

- Direct Communication Channels: Facilitating prompt responses to investor questions and feedback.

Automated and Self-Service Interactions for General Users

For a vast audience of general internet users, customer relationships are primarily automated and self-service. This approach is powered by sophisticated website architecture and user-friendly navigation, ensuring effortless access to information and services.

The emphasis is on delivering a smooth and efficient digital journey, minimizing the need for direct human interaction. For instance, by mid-2024, many leading tech companies reported that over 80% of customer queries were resolved through automated systems or self-help portals, a testament to the effectiveness of this model.

- Automated Support: AI-powered chatbots and extensive FAQ sections handle common inquiries, providing instant responses 24/7.

- Self-Service Portals: Users can manage accounts, access data, and troubleshoot issues independently through intuitive online platforms.

- Personalized Content Delivery: Algorithms tailor content and recommendations, enhancing user experience and engagement without direct contact.

- Feedback Mechanisms: Automated surveys and rating systems collect user input, allowing for continuous improvement of self-service tools.

IAC fosters strong customer relationships through engaging free content across its brands, encouraging repeat visits and loyalty. In 2024, Dotdash Meredith brands saw significant digital traffic growth, highlighting effective user retention strategies.

Channels

IAC's primary engagement with its audience occurs through a robust ecosystem of owned and operated websites and mobile applications. This direct control over distribution channels is fundamental to its business model, allowing for seamless content delivery and monetization strategies.

Properties like those under the Dotdash Meredith umbrella are key examples, serving as the primary conduits for user interaction and advertising revenue. In 2024, these digital assets continued to be the bedrock of IAC's strategy for building brand loyalty and expanding its reach across diverse consumer interests.

Search Engine Optimization (SEO) is a vital channel for IAC, focusing on making its digital content easily discoverable by users actively searching online. By improving its search engine rankings, IAC drives significant organic traffic to its various platforms, a key component of its customer acquisition strategy.

In 2023, IAC's portfolio of brands, including Dotdash Meredith, saw substantial growth in organic search traffic, contributing to a significant portion of their overall user engagement. This focus on SEO is crucial for increasing audience reach and content consumption across their diverse digital properties.

IAC leverages programmatic advertising platforms and ad networks to efficiently monetize its vast content library, selling ad space to a broad spectrum of advertisers. These automated systems facilitate real-time bidding and placement, maximizing reach and revenue. For instance, in 2024, the digital advertising market continued its robust growth, with programmatic advertising accounting for a significant portion of ad spend, underscoring the importance of these channels for IAC's business model.

Dotdash Meredith's proprietary data and technology solution, D/Cipher, plays a crucial role in optimizing these programmatic channels. By enhancing data utilization and audience targeting, D/Cipher helps IAC deliver more effective advertising campaigns, leading to better performance for advertisers and increased revenue for IAC. This focus on data-driven optimization is key in the competitive digital advertising landscape of 2024.

Social Media Platforms

Social media platforms are vital channels for IAC, acting as conduits for content distribution, audience interaction, and brand elevation. Brands within the IAC portfolio actively utilize platforms such as YouTube, Instagram, and TikTok to foster connections with their user base, disseminate engaging content, and direct traffic towards their proprietary digital assets.

This strategic use of social media is instrumental in bolstering brand visibility and expanding customer reach. For instance, in 2024, platforms like TikTok saw significant growth in user engagement across various demographics, presenting a prime opportunity for IAC brands to capture attention. The effectiveness of social media marketing is directly tied to its ability to generate awareness and attract new clientele.

- Content Distribution: Social media facilitates the broad dissemination of content from IAC's diverse brands.

- Audience Engagement: Platforms enable direct interaction and community building with users.

- Brand Promotion: Social media is a key tool for increasing brand recognition and affinity.

- Traffic Generation: Campaigns are designed to drive users back to IAC's owned websites and applications.

Direct Sales Force and Business Development Teams

IAC leverages specialized direct sales forces and business development teams to cultivate relationships with advertising clients and identify promising acquisition targets. These teams are instrumental in direct outreach, negotiating advertising contracts, and pinpointing strategic investment opportunities, particularly for high-value B2B engagements.

For instance, in 2024, IAC's focus on direct client relationships likely contributed to its ongoing revenue streams. Business development teams actively scouted for synergistic acquisitions, a strategy that has historically fueled IAC's growth, as seen in past acquisitions that expanded its portfolio of digital brands.

- Direct Sales Force: Focuses on securing advertising revenue from businesses, requiring skilled negotiation and account management.

- Business Development: Identifies and pursues strategic partnerships and potential acquisitions to expand IAC's market presence and offerings.

- B2B Focus: These channels are critical for high-value transactions and long-term partnerships within the business ecosystem.

IAC's channels are a multi-faceted approach to reaching and engaging users, primarily through its owned digital properties like Dotdash Meredith. These platforms are crucial for content delivery and monetization.

SEO is a significant driver of organic traffic, ensuring IAC's content is discoverable. In 2023, organic search traffic saw substantial growth across its brands, highlighting its importance.

Programmatic advertising, enhanced by proprietary tech like D/Cipher, efficiently monetizes content. The digital advertising market in 2024 continued its strong growth, making these automated channels vital.

Social media platforms are actively used for content distribution, audience interaction, and driving traffic back to IAC's owned assets. Platforms like TikTok saw increased engagement in 2024, offering new avenues for reach.

Direct sales and business development teams build client relationships and identify strategic growth opportunities, including acquisitions. This direct engagement is key for high-value B2B transactions and sustained revenue.

Customer Segments

General internet users represent a vast customer base for IAC, actively searching for information and services across diverse categories like finance, health, and lifestyle. These users engage with IAC's search and content platforms for their everyday needs and curiosities, demonstrating a broad demand for accessible and informative online resources.

Advertisers and brands are a core customer segment for IAC, seeking to connect with targeted demographics across its diverse digital properties. These businesses invest in advertising to promote their products and services, valuing platforms that offer measurable reach and engagement.

In 2024, the digital advertising market continued its robust growth, with brands increasingly allocating budgets to platforms like those offered by IAC. For instance, programmatic advertising, a significant channel for IAC, was projected to account for over 80% of all digital ad spending in the US by the end of 2024, highlighting the efficiency and targeting capabilities brands demand.

IAC's extensive portfolio, encompassing search, media, and e-commerce, provides advertisers with a wide array of opportunities to reach consumers at various touchpoints. This breadth allows brands to execute sophisticated, multi-channel campaigns, driving both brand awareness and direct response, a key objective for most advertising endeavors.

These are typically digital and internet-focused small to medium-sized enterprises (SMEs) actively pursuing capital infusions and operational enhancements to fuel their expansion. For instance, in 2024, the digital advertising market alone was projected to reach over $600 billion globally, highlighting the significant growth potential within this sector.

IAC views these companies as prime acquisition candidates, directly supporting its overarching strategy of consolidating and scaling its diverse business portfolio. This segment benefits immensely from IAC's established industry expertise, access to capital, and its proven track record in nurturing digital ventures.

Shareholders and Financial Investors

Shareholders and financial investors are a critical customer segment for IAC, comprising both individual and institutional entities. These stakeholders are primarily driven by the pursuit of long-term capital appreciation and closely scrutinize IAC's financial health, market standing, and strategic portfolio decisions. For instance, as of the first quarter of 2024, IAC reported revenue of $550 million, demonstrating its operational scale and market presence.

IAC’s objective is to deliver consistent value and maintain a high degree of transparency with these investors. They actively monitor key performance indicators such as earnings per share and return on equity, which directly influence their investment decisions.

- Capital Appreciation: Investors seek growth in the value of their IAC holdings over time.

- Financial Performance Monitoring: This includes tracking revenue, profitability, and cash flow.

- Strategic Direction Oversight: Investors are keen on IAC's acquisition strategies and portfolio management.

- Transparency and Communication: IAC prioritizes clear and timely reporting to its investor base.

Content Creators and Publishers (Partners)

Content creators and smaller publishers are crucial partners within IAC's ecosystem, benefiting from its platforms for enhanced distribution and monetization. In 2024, platforms like these are vital for creators seeking to expand their reach, with many leveraging digital channels to connect with audiences. This symbiotic relationship allows creators to access IAC's user base, potentially increasing ad revenue and subscription numbers.

These partners gain significant advantages by collaborating with IAC. They can tap into IAC's established infrastructure for content delivery and audience engagement, which is particularly valuable for independent creators or smaller media companies. For instance, a creator might use IAC's video platform to host their content, benefiting from the platform's built-in advertising tools and analytics to understand audience behavior.

- Distribution Reach: IAC's platforms offer creators access to millions of users, significantly amplifying their content's visibility.

- Monetization Opportunities: Creators can generate revenue through advertising, subscriptions, or direct sales facilitated by IAC's services.

- Content Enrichment: The diverse content produced by these partners adds significant value and variety to IAC's overall offerings.

- Audience Engagement Tools: IAC provides tools that help creators better understand and interact with their audience, fostering community growth.

Businesses seeking to acquire or partner with IAC's portfolio companies represent a distinct customer segment. These entities are often larger corporations or private equity firms looking to integrate IAC's assets into their own operations or investment portfolios. For example, in 2024, the trend of consolidation within the digital media and technology sectors continued, with significant M&A activity driving such strategic partnerships.

IAC's strategy involves identifying and engaging with these potential acquirers or partners to facilitate strategic exits or synergistic integrations. This segment values IAC's established market positions, revenue streams, and growth potential within its various business units. Understanding their strategic objectives is key to successful transactions.

| Customer Segment | Value Proposition | Key Activities |

| Acquiring Businesses/Private Equity | Access to established IAC portfolio companies with proven revenue streams and market presence. | Identifying strategic fit, due diligence, negotiation of acquisition terms. |

| Strategic Partners | Opportunities for synergistic collaborations, joint ventures, or technology integration. | Partnership development, co-marketing initiatives, shared resource utilization. |

Cost Structure

A substantial part of IAC's expenses goes into creating and managing the digital content that populates its various brands, like Dotdash Meredith. This involves paying writers, editors, and those who produce multimedia content. For instance, in 2024, companies heavily invested in content creation saw significant operational costs related to talent and production.

Significant expenditures are tied to building, maintaining, and enhancing proprietary technology, including algorithms and IT systems. For instance, in 2024, many tech companies allocated over 20% of their revenue to R&D, a substantial portion of which goes into technology development.

These costs encompass salaries for software engineers and data scientists, as well as expenses for cloud services and robust cybersecurity. Global spending on cloud computing services was projected to reach over $600 billion in 2024, reflecting the critical role of scalable infrastructure.

These investments are fundamental for ensuring smooth operations and securing a competitive edge in the market. Companies like Amazon, for example, invested billions in AWS infrastructure in 2024 to support their vast technological operations and offer cutting-edge services.

IAC invests heavily in sales and marketing to draw in and keep users and advertisers for its various ventures. This encompasses advertising campaigns, sales team commissions, and various promotional activities designed to boost engagement and revenue.

Customer acquisition costs (CAC) are a critical performance indicator for IAC, especially for its consumer-focused services like Match Group. In 2024, many digital businesses continue to see rising CAC due to increased competition for online attention and advertising inventory.

General, Administrative, and Corporate Overhead

General, Administrative, and Corporate Overhead encompasses the essential costs of running a diversified business portfolio, including executive and administrative staff compensation, legal counsel, and accounting services. These expenses are crucial for the overarching management and strategic direction of the entire organization.

For instance, in 2024, many large corporations reported that their G&A expenses represented a significant portion of their operating costs. Companies like Amazon, for example, often see their corporate overhead, while a necessary investment in infrastructure and talent, carefully managed to ensure it doesn't disproportionately impact the profitability of individual business units.

- Executive Salaries: Compensation for top leadership driving the overall business strategy.

- Administrative Staff: Support personnel handling HR, finance, and general operations.

- Professional Fees: Costs for external legal, accounting, and consulting services.

- Severance Costs: Expenses related to employee terminations, impacting overall overhead.

Acquisition-Related and Investment Costs

The company faces substantial acquisition-related and investment costs, a direct consequence of its strategy to buy and sell businesses. These expenses encompass rigorous due diligence, legal consultations, and the often-complex process of integrating new entities. For example, in 2024, mergers and acquisitions (M&A) activity saw significant investment, with global M&A volume reaching approximately $3.2 trillion, reflecting substantial spending on deal-making.

These costs also include expenses associated with restructuring, such as severance packages for employees affected by these strategic shifts. Such investments, while immediately impactful on the cost structure, are fundamentally geared towards building long-term value and enhancing the company's overall market position.

- Due Diligence Expenses: Costs incurred for thorough investigation of potential acquisitions.

- Legal and Advisory Fees: Payments to legal counsel and financial advisors for transaction support.

- Integration Costs: Expenses related to merging acquired businesses, including IT systems and operational alignment.

- Restructuring and Severance: Costs associated with workforce adjustments following acquisitions.

IAC's cost structure is largely defined by its digital-first approach, encompassing significant investments in content creation, technology development, and marketing to acquire and retain users. These operational expenses are crucial for maintaining and growing its diverse portfolio of online businesses.

The company also incurs substantial costs related to mergers and acquisitions, reflecting its strategic growth through acquiring and integrating new ventures. These expenses, alongside general administrative overhead, are vital for managing its complex business model and ensuring long-term market competitiveness.

| Cost Category | Description | 2024 Relevance/Data Point |

|---|---|---|

| Content Creation | Paying creators, editors, and production teams for digital content. | Significant portion of operational costs for brands like Dotdash Meredith. |

| Technology Development | Building and maintaining proprietary algorithms, IT systems, and cloud infrastructure. | Global cloud spending projected over $600 billion in 2024; many tech firms allocate over 20% of revenue to R&D. |

| Sales & Marketing | Advertising campaigns, sales commissions, and promotional activities to drive user and advertiser engagement. | Customer Acquisition Costs (CAC) continue to rise due to increased competition. |

| General & Administrative | Executive compensation, legal, accounting, and HR support for overall business management. | A necessary investment for strategic direction and operational oversight. |

| Acquisitions & Integration | Due diligence, legal fees, and integration costs for acquiring new businesses. | Global M&A volume reached approximately $3.2 trillion in 2024, indicating substantial deal-making expenses. |

Revenue Streams

Advertising revenue is a cornerstone for IAC, with digital formats like display, native, and programmatic advertising forming a primary income source. This is particularly evident through its Dotdash Meredith segment.

Advertisers invest in placing their content across IAC's digital platforms, capitalizing on the company's substantial audience reach and sophisticated targeting options. In 2023, IAC reported that digital advertising, including these formats, was a significant contributor to its financial performance.

Performance marketing and affiliate commerce commissions form a significant revenue stream. This involves earning money by referring users to partner websites where they complete a purchase or take a specific action, often through affiliate links embedded within content. For instance, in 2024, the global affiliate marketing market was projected to reach over $17 billion, highlighting the substantial opportunity.

Affinity marketing programs also contribute, where partnerships are built around shared audiences. Revenue is generated via cost-per-click or cost-per-action models, directly linking user engagement to income. This approach effectively monetizes content by driving valuable user actions for advertisers.

IAC generates revenue through content and brand licensing, allowing third parties to use its intellectual property. This includes royalties from long-term agreements with retailers, manufacturers, and publishers for its brand trademarks.

Furthermore, IAC earns content licensing royalties from platforms like Apple News+ and through the utilization of its content in large-language models. A significant example of this is their partnership with OpenAI, which contributes to this revenue stream.

Search-Related Revenue

IAC's search-related revenue primarily stems from a significant services agreement with Google. This income is directly tied to the volume of search queries processed and the associated advertising displayed on IAC's search properties, like Ask.com. The company's ability to drive high-quality traffic is crucial for maximizing this revenue stream.

The continuation of this lucrative partnership was solidified with a renewed agreement with Google, ensuring a predictable income for IAC's search segment. This ongoing relationship underpins a substantial portion of the company's earnings. For instance, in 2023, search and related services represented a significant component of IAC's overall revenue generation.

- Primary Revenue Source: Services agreement with Google for search queries and related advertising.

- Key Driver: Volume and quality of traffic directed to IAC's search properties.

- Partnership Stability: Renewed agreement with Google provides continued income.

Subscription and Transaction Fees (from specific portfolio companies)

While Dotdash Meredith primarily monetizes through advertising on its free content platforms, other IAC portfolio companies leverage subscription and transaction fees. For example, services like Care.com historically generated revenue from user subscriptions for premium features or per-transaction fees for connecting users with care providers.

This dual approach diversifies IAC's revenue streams, reducing reliance solely on advertising income. Such models are common in digital service platforms where value is provided through access or facilitated transactions.

- Subscription Revenue: Recurring fees from users accessing premium content, services, or features.

- Transaction Fees: A percentage or fixed fee charged on each transaction facilitated through a platform.

- Diversification: These models complement advertising, creating a more resilient revenue base.

IAC's revenue is a blend of advertising, affiliate marketing, and transactional models. A significant portion comes from its search partnership with Google, driven by traffic volume and ad revenue. Dotdash Meredith heavily relies on digital advertising, including display and programmatic formats, to monetize its broad audience reach.

Affiliate commerce and performance marketing generate income by facilitating user transactions on partner sites, a market projected to exceed $17 billion globally in 2024. Subscription and transaction fees from platforms like Care.com further diversify IAC's income, offering recurring revenue and per-transaction earnings.

Content and brand licensing, including royalties from agreements with retailers and publishers, add another layer to IAC's revenue generation. Partnerships with entities like OpenAI for large-language model content utilization also contribute to this stream.

| Revenue Stream | Primary Monetization Method | Key Drivers | Example (2024 Data/Projections) |

|---|---|---|---|

| Digital Advertising | Display, native, programmatic ads | Audience reach, targeting capabilities | Dotdash Meredith's core income |

| Affiliate Marketing | Commissions on referred purchases | User engagement, conversion rates | Global market projected over $17 billion |

| Search Services | Google partnership for search queries/ads | Traffic volume and quality | Significant contributor to overall revenue |

| Subscriptions & Transactions | Premium features, per-transaction fees | Platform value, user demand | Care.com's historical model |

| Content & Brand Licensing | Royalties from IP usage | Brand recognition, licensing agreements | Partnerships with retailers, OpenAI |

Business Model Canvas Data Sources

The IAC Business Model Canvas is informed by a blend of internal operational data, customer feedback mechanisms, and external market intelligence. This multi-faceted approach ensures a comprehensive understanding of our business ecosystem.