IAC Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IAC Bundle

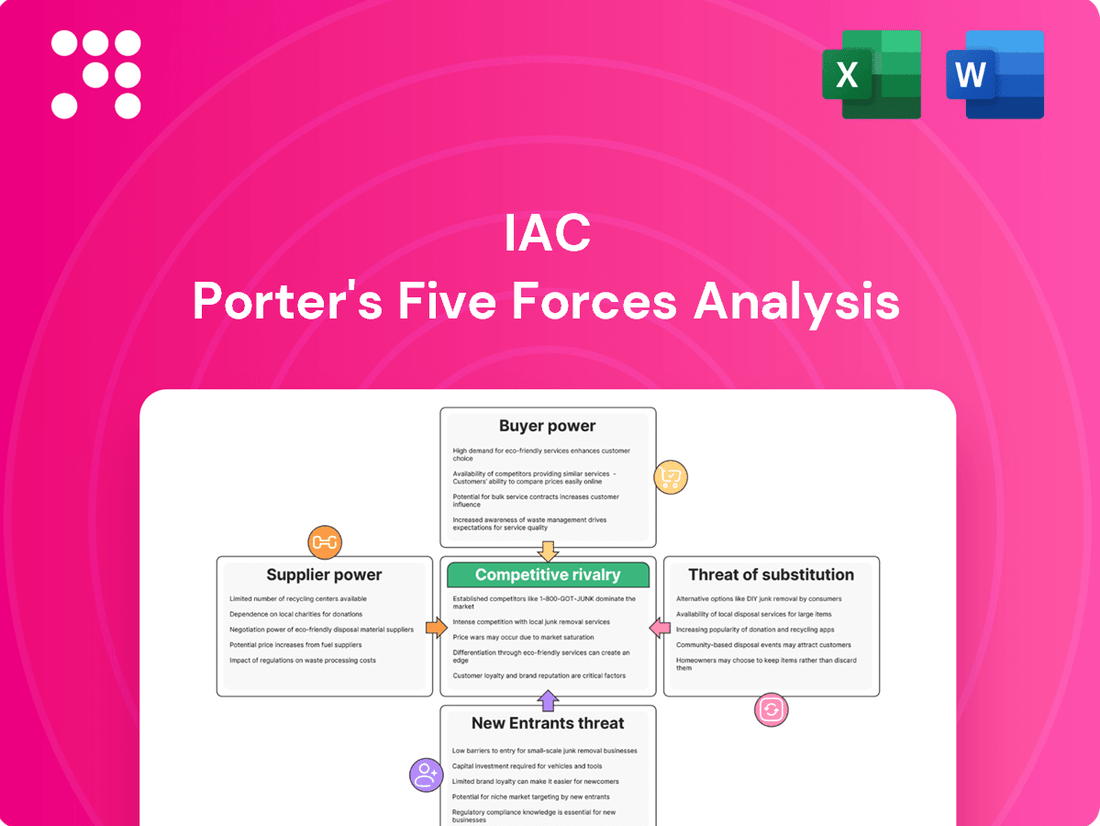

Porter's Five Forces reveals the intense competitive landscape IAC navigates, highlighting the significant bargaining power of buyers and the constant threat of new entrants. Understanding these forces is crucial for any stakeholder interested in IAC's long-term success.

The complete report reveals the real forces shaping IAC’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The concentration of suppliers significantly impacts IAC's bargaining power, especially within its digital publishing arm, Dotdash Meredith. When a few key providers dominate the market for essential technologies or content, they can exert considerable influence.

Major search engines, such as Google, represent a prime example of this concentrated power. They are critical drivers of traffic for online publishers. IAC's Search segment has a crucial agreement with Google that was extended through March 2026, highlighting the dependence on such dominant platforms.

When suppliers offer highly specialized or unique services, their bargaining power increases significantly. For example, companies relying on advanced AI tools for content creation or sophisticated ad targeting might find themselves dependent on a limited number of providers.

Dotdash Meredith's partnership with OpenAI to bolster its D/Cipher ad-targeting tool exemplifies this. This reliance on specific technological advancements grants OpenAI considerable leverage, as Dotdash Meredith needs these cutting-edge capabilities to remain competitive in the digital advertising space.

The bargaining power of suppliers for IAC is significantly influenced by switching costs. When it's costly and complex for IAC to move away from a particular technology platform, content management system, or advertising partner, those suppliers gain leverage. For instance, if IAC has deeply integrated a specific advertising technology, the expense and disruption involved in migrating to a new system could make suppliers of that technology more powerful.

Threat of Forward Integration by Suppliers

Suppliers in the digital realm, particularly those providing essential technology or content, possess the latent threat of forward integration. This means they could develop their own platforms or services, directly entering markets where IAC currently operates. For instance, a technology provider powering a key IAC service might decide to launch a competing offering, leveraging their existing infrastructure and expertise.

This strategic move would significantly amplify their bargaining power by transforming them from a mere supplier into a direct competitor. Such a shift could disrupt IAC's market position and necessitate a strategic response to maintain competitive advantage. The digital ecosystem is particularly susceptible to this, as technological advancements often lower the barriers to entry for new players.

- Forward Integration Risk: Suppliers can leverage their resources and technology to launch competing platforms, directly challenging IAC's business lines.

- Increased Bargaining Power: By becoming direct competitors, suppliers gain leverage, potentially dictating terms or demanding higher prices from IAC.

- Digital Ecosystem Dynamics: Technology providers often have the capability to pivot into content creation or service delivery, a common trend in the online space.

- Competitive Landscape Shift: The potential for suppliers to integrate forward necessitates continuous monitoring and strategic adaptation by IAC to safeguard its market share.

Importance of IAC to Suppliers

The relative importance of InterActiveCorp (IAC) as a client significantly influences supplier bargaining power. If IAC constitutes a substantial portion of a supplier's annual revenue, that supplier's ability to dictate terms is likely diminished. For instance, if a key technology provider generates 30% of its income from IAC, it will be more amenable to IAC's pricing and service demands.

Conversely, when IAC represents only a minor fraction of a supplier's business, the supplier gains considerable leverage. A small software developer, for example, might be less concerned about losing IAC as a client if that account represents less than 1% of their total sales. This asymmetry allows such suppliers to push for more favorable contract terms or higher prices.

- Supplier Dependence: High dependence of a supplier on IAC's business can reduce the supplier's bargaining power.

- Client Size: If IAC is a small client for a supplier, the supplier's bargaining power increases.

- Revenue Concentration: Suppliers with concentrated revenue streams from IAC are less likely to exert significant bargaining power.

- Market Position: A supplier's overall market position also affects its leverage, independent of its relationship with IAC.

The bargaining power of suppliers for InterActiveCorp (IAC) is a key factor in its operational costs and strategic flexibility. When suppliers offer unique or differentiated inputs, or when switching costs are high, their leverage increases. For example, IAC's reliance on major search engines like Google for traffic, as seen in its extended agreement through March 2026, highlights how dominant platforms can exert significant influence. Similarly, partnerships with advanced technology providers, such as Dotdash Meredith's use of OpenAI for its D/Cipher ad-targeting tool, grant these suppliers considerable power due to the specialized nature of their offerings.

The threat of forward integration by suppliers also amplifies their bargaining power. If a technology provider powering an IAC service were to launch a competing offering, it would directly challenge IAC's market position. Furthermore, the proportion of a supplier's revenue derived from IAC plays a crucial role; if IAC is a small client, the supplier has more leverage to dictate terms, whereas if IAC represents a significant revenue stream, the supplier's power is diminished.

| Factor | Impact on IAC | Example |

|---|---|---|

| Supplier Concentration | Increases bargaining power | Dominance of search engines like Google |

| Uniqueness of Offering | Increases bargaining power | Advanced AI tools for content creation |

| Switching Costs | Increases bargaining power | Deep integration of advertising technology |

| Threat of Forward Integration | Increases bargaining power | Tech provider launching competing services |

| Client Dependence (Supplier) | Decreases bargaining power | IAC representing a large portion of supplier revenue |

| Client Size (IAC) | Increases bargaining power | IAC being a small client for a supplier |

What is included in the product

Analyzes the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the availability of substitutes to understand IAC's competitive environment.

Instantly identify and address competitive pressures with a visual breakdown of each of Porter's Five Forces, making strategic planning more intuitive.

Customers Bargaining Power

Customer concentration can significantly impact bargaining power. For IAC's advertising-dependent segments, if a few major advertisers represent a substantial portion of revenue, they gain leverage. This is particularly true if switching costs for advertisers are low.

However, IAC's Dotdash Meredith is demonstrating robust growth in digital advertising, exceeding some competitors. In 2024, Dotdash Meredith's digital advertising revenue saw a notable increase, indicating a strengthening position that could mitigate the impact of customer concentration.

The digital age has dramatically amplified the bargaining power of customers, particularly in the online realm. Advertisers and content consumers alike now have an unprecedented wealth of information at their fingertips, making it incredibly easy to compare offerings across numerous platforms. This easy access to alternatives means customers can quickly identify the best value or most suitable content, forcing companies to compete more fiercely on price, quality, and features.

For many digital content and services, the cost for consumers to switch to a competitor is remarkably low. This ease of transition means users can hop between different news sites, streaming services, or social media platforms with minimal effort or expense. In 2024, this low switching cost is a significant factor shaping consumer behavior and expectations.

This accessibility directly empowers customers. They can readily compare offerings and readily switch if they find a better deal or a more appealing service. For instance, a user might switch from one music streaming service to another based on a promotional offer, demonstrating their ability to demand better value or lower prices without significant friction.

Price Sensitivity of Customers

Customers, particularly advertisers, exhibit significant price sensitivity in the rapidly evolving digital advertising landscape. This sensitivity is amplified by the increasing availability of alternative advertising channels and platforms, forcing publishers to compete aggressively on price to secure ad spend.

Publishers grapple with the complexities of programmatic advertising, where automated bidding processes can lead to downward pressure on ad rates. Furthermore, evolving privacy regulations, such as those impacting cookie usage, create uncertainty and can necessitate adjustments in ad targeting and monetization strategies, potentially affecting revenue yields and, consequently, pricing power.

- Digital ad spending: Global digital ad spending was projected to reach over $600 billion in 2024, indicating a massive market where price competition is fierce.

- Programmatic share: Programmatic advertising accounts for a significant majority of digital ad transactions, often exceeding 80% in developed markets, highlighting its influence on pricing.

- Privacy impact: The deprecation of third-party cookies continues to influence advertiser demand and publisher pricing models, with many publishers exploring first-party data strategies to maintain ad revenue.

Threat of Backward Integration by Customers

The threat of backward integration by customers, particularly large advertisers or media buyers, poses a significant challenge for publishers. These powerful entities could choose to develop their own in-house content creation or advertising technology solutions, thereby diminishing their dependence on external publishers like Dotdash Meredith. This potential shift underscores the critical need for publishers to continually innovate and offer compelling, unique value propositions to retain their client base.

For instance, in 2024, major brands are increasingly exploring direct-to-consumer (DTC) strategies, which often involve building out their own content capabilities. This trend directly translates to a reduced reliance on traditional media partners. To counter this, publishers must focus on cultivating deep audience engagement and providing data-driven insights that advertisers cannot easily replicate internally.

- Customer Threat: Large advertisers may develop in-house content and advertising solutions.

- Publisher Response: Publishers must offer unique value and strong audience engagement.

- Market Trend (2024): Brands are increasingly adopting DTC strategies, potentially reducing ad spend with publishers.

- Strategic Implication: Publishers need to demonstrate irreplaceable value to mitigate this threat.

Customers wield significant bargaining power when they have numerous alternatives and low switching costs, forcing companies like IAC to compete on price and quality. The digital landscape exacerbates this, with consumers easily comparing options and shifting preferences. For 2024, the ease of digital comparison and minimal friction in switching platforms remain key drivers of customer leverage.

Advertisers, a crucial customer segment for IAC's media businesses, are highly price-sensitive due to the vast array of digital advertising channels available. Programmatic advertising's dominance, often exceeding 80% of digital ad transactions, further intensifies price competition. Global digital ad spending projected to surpass $600 billion in 2024 underscores the competitive pricing environment.

The threat of backward integration, where large advertisers develop their own content capabilities, is a growing concern. Major brands increasingly pursuing direct-to-consumer strategies in 2024 reduce their reliance on external publishers. This necessitates publishers like IAC's Dotdash Meredith to offer unique value and deep audience engagement to retain advertiser relationships.

| Factor | Impact on IAC | Supporting Data (2024) |

|---|---|---|

| Availability of Alternatives | Increases customer bargaining power | Digital ad market with numerous platforms |

| Low Switching Costs | Empowers customers to demand better value | Ease of transition between digital services |

| Price Sensitivity (Advertisers) | Pressures ad rates | Global digital ad spend > $600 billion; Programmatic share > 80% |

| Backward Integration Threat | Reduces reliance on publishers | Brands pursuing DTC strategies |

Full Version Awaits

IAC Porter's Five Forces Analysis

This preview showcases the complete IAC Porter's Five Forces Analysis, providing a thorough examination of competitive forces within the industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning.

Rivalry Among Competitors

IAC operates in a digital media landscape teeming with rivals. In 2024, the sheer volume of online publishers, social media behemoths like Meta Platforms and TikTok, and search engine giants such as Google creates an intensely crowded market. This diversity means IAC faces competition not just from direct digital media peers but also from platforms that capture user attention and advertising spend.

The digital advertising market is booming, with forecasts suggesting substantial spending increases through 2029, indicating a strong tailwind for companies in this space. However, this rapid growth also fuels intense competition, which can cap the expansion and profitability of individual players within the broader digital publishing industry.

IAC's competitive rivalry is significantly shaped by its product differentiation strategies across its diverse digital portfolio. For instance, Dotdash Meredith distinguishes itself through a commitment to "no bad ads" and expert-authored content, aiming to build trust and loyalty with consumers in a saturated digital media landscape. This focus on quality and authenticity is a key lever against competitors relying on more intrusive advertising models.

Further enhancing this differentiation, IAC leverages unique content creation and the strength of its established brands. The company's ability to develop compelling and original material across its various platforms, from publishing to dating services, sets it apart. Strong brand recognition reduces customer acquisition costs and fosters repeat engagement, a critical advantage in online markets where brand perception plays a vital role.

Moreover, IAC's proprietary ad-targeting solution, D/Cipher, acts as a significant differentiator. This technology allows for more precise and effective ad delivery, benefiting both advertisers and users by providing relevant content. In 2023, digital advertising spending globally reached approximately $600 billion, highlighting the intense competition for ad revenue, making sophisticated targeting solutions like D/Cipher essential for capturing market share.

High Fixed Costs and Low Marginal Costs

Digital media companies like IAC often face intense competition due to their cost structures. They invest heavily upfront in creating content and building robust platforms, which represents a significant fixed cost. For instance, developing a new streaming service or a sophisticated online marketplace requires millions in initial investment.

However, once this infrastructure is in place, the cost to deliver additional content or serve more users is remarkably low. This is the essence of low marginal costs. Think about streaming a movie – the cost to stream it to one more person is negligible compared to the initial production budget. This cost dynamic incentivizes aggressive pricing strategies as companies aim to attract a large user base and spread their fixed costs over more transactions, thereby gaining market share and optimizing their infrastructure.

This scenario fuels a competitive environment where companies may engage in price wars or offer extensive free content to capture eyeballs. For example, in the competitive online dating sector, where IAC has a strong presence with brands like Tinder and Match.com, user acquisition costs can be high, but the cost to add a new subscriber is minimal, leading to continuous promotional offers and feature enhancements to retain and attract users.

- High initial investment in content and platform development creates substantial fixed costs for digital media firms.

- The cost to distribute content or serve additional users is very low, defining low marginal costs.

- This cost structure encourages aggressive pricing and market share grabs to leverage existing infrastructure.

- Companies may offer promotions or free tiers to increase user volume and offset fixed expenses.

Exit Barriers

High exit barriers can trap less efficient companies in the market, leading to prolonged and intensified competition. For instance, if a competitor has heavily invested in specialized digital advertising technology that has limited resale value, they might continue operating even at a loss to recoup some of their investment, directly impacting IAC's market share.

However, IAC has demonstrated a proactive approach to managing its portfolio, which can mitigate the impact of high exit barriers for its rivals. A prime example is the spin-off of Angi. In 2023, Angi reported revenue of $1.7 billion, showcasing its growth to a point where it could operate independently. This strategic divestment allows IAC to shed businesses that may face significant exit challenges or to focus on core competencies, thereby reducing the pressure from struggling competitors.

This strategic flexibility is crucial in the dynamic digital services landscape. By shedding underperforming or non-core assets, IAC can reallocate capital and management attention to areas with higher growth potential, effectively sidestepping the negative effects of competitors being locked into unprofitable operations due to high exit barriers.

- Specialized Assets: Competitors with significant investments in proprietary technology or unique infrastructure may find it difficult and costly to exit, potentially prolonging their presence in the market.

- Long-Term Contracts: Obligations to customers or suppliers can create financial penalties for early termination, making it unattractive for businesses to cease operations.

- IAC's Divestment Strategy: IAC's practice of spinning off businesses, like Angi, once they achieve a certain scale allows for a controlled exit, preserving value and enabling a sharper focus on core strategic initiatives.

IAC faces intense competition from a vast array of digital players, including social media giants, search engines, and other online publishers. The digital advertising market, projected for significant growth through 2029, attracts numerous competitors, intensifying the battle for ad revenue and user attention. This crowded landscape necessitates strong differentiation strategies for IAC to thrive.

IAC differentiates itself through content quality, as seen with Dotdash Meredith's "no bad ads" policy and expert content, and by leveraging strong brand recognition across its diverse portfolio. Its proprietary ad-targeting solution, D/Cipher, provides a technological edge in the highly competitive global digital advertising market, which saw approximately $600 billion in spending in 2023.

The company's cost structure, characterized by high initial investments and low marginal costs, encourages aggressive market strategies. This dynamic is evident in sectors like online dating, where IAC brands like Tinder and Match.com operate, often leading to promotional offers to acquire and retain users. High exit barriers for some competitors can prolong market competition, though IAC's strategic divestments, such as the 2023 spin-off of Angi (which reported $1.7 billion in revenue), allow it to manage its portfolio effectively.

| Competitive Rivalry Factor | Description | Impact on IAC | Example/Data Point |

|---|---|---|---|

| Market Saturation | Numerous digital media companies compete for user attention and ad spend. | Intensifies competition for market share and revenue. | Google and Meta Platforms are dominant players in digital advertising. |

| Differentiation | Focus on content quality, brand strength, and proprietary technology. | Helps IAC capture and retain users and advertisers. | Dotdash Meredith's "no bad ads" and D/Cipher ad-targeting. |

| Cost Structure | High fixed costs, low marginal costs drive aggressive pricing. | Encourages user acquisition strategies and potential price wars. | Low cost to add new users to dating platforms. |

| Exit Barriers | Specialized assets and contracts can trap competitors. | Can lead to prolonged competition from struggling firms. | IAC's spin-off of Angi mitigates exposure to high exit barrier businesses. |

SSubstitutes Threaten

The threat of substitutes for traditional media companies is significant, stemming from a proliferation of alternative content consumption methods. Consumers are increasingly turning to social media platforms like TikTok and Instagram for entertainment and news, bypassing established channels. In 2024, it's estimated that over 4.9 billion people worldwide use social media, highlighting its pervasive reach.

Video-led content, particularly short-form video, continues to dominate, with platforms like YouTube and TikTok capturing substantial viewer attention. Podcasts have also surged in popularity, offering on-demand audio content that competes directly for listening time. By the end of 2023, there were over 3 million active podcasts globally, demonstrating a robust and growing market.

Emerging immersive digital experiences, such as augmented reality (AR) and virtual reality (VR), also pose a future threat. While still developing, these technologies offer novel ways to consume content that could eventually draw audiences away from existing formats, potentially disrupting how information and entertainment are delivered and accessed.

The increasing prevalence of zero-click search results and AI-powered answer generation directly challenges traditional digital publishers. This trend means users can get answers from search engines like Google, which in 2024 is heavily integrating AI, without ever clicking through to a website. For publishers relying on advertising revenue tied to website visits, this represents a substantial threat as their content becomes a source for AI without direct user engagement.

User-generated content platforms, like TikTok and YouTube, present a significant threat of substitution for traditional media companies. These platforms offer an endless stream of often free content, directly competing for consumer attention and time that might otherwise be spent on professionally produced digital media. This can lead to a fragmentation of audiences, making it harder for established players to capture and retain viewers.

The sheer volume and variety of UGC mean consumers have readily available alternatives to professionally curated content, impacting advertising revenue for traditional media. For instance, in 2024, digital advertising spending on social media platforms continued to surge, diverting significant portions of marketing budgets away from more traditional digital outlets. This shift directly impacts the revenue streams of companies reliant on advertising, as user-generated content offers a lower-cost, often more engaging alternative for advertisers seeking to reach specific demographics.

Direct-to-Consumer Models

The rise of direct-to-consumer (DTC) models presents a significant threat of substitutes for traditional digital publishers. Many brands are now leveraging their own digital channels and retail media networks to connect directly with customers and run advertising campaigns, effectively bypassing third-party publishers.

This shift means that advertising spend, which historically flowed to publishers, is increasingly being retained by brands themselves. For example, in 2024, retail media networks are projected to capture a substantial portion of the digital advertising market, with some estimates suggesting they could reach over $100 billion globally.

- Brands investing in owned digital channels and retail media networks.

- Reduced reliance on traditional digital publishers for advertising.

- Potential for lower ad revenue for publishers as brands control more ad inventory.

- The growing scale of retail media networks is a key factor in this substitution.

Traditional Media Evolution

While print media faces decline, its transformation into digital forms like eBooks and audiobooks offers a substitute for consumers valuing long-form content. This evolution maintains relevance by integrating with digital experiences, providing an alternative to traditional consumption methods.

The threat of substitutes for traditional media is significant as digital platforms offer convenience and accessibility. For instance, the audiobook market experienced robust growth, with Statista projecting global revenue to reach approximately $3.5 billion in 2024. This indicates a clear shift in consumer preference and a strong substitute for physical books.

- Digital Content Dominance: eBooks and audiobooks now compete directly with physical books, offering consumers more portable and searchable options.

- Subscription Models: Services like Kindle Unlimited and Audible's subscription plans provide vast libraries at a fixed cost, acting as a powerful substitute for individual purchases.

- Changing Consumption Habits: Consumers are increasingly opting for on-demand digital content, reducing reliance on traditional media formats.

The threat of substitutes for traditional media is amplified by the rise of user-generated content (UGC) platforms. These platforms offer a vast, often free, and constantly updated stream of entertainment and information, directly competing for consumer attention. In 2024, the sheer volume of content available on platforms like TikTok and YouTube means consumers have readily accessible alternatives to professionally produced media, impacting advertising revenue for established players.

AI-powered content generation and zero-click search results also represent a significant substitution threat. Search engines are increasingly providing direct answers, bypassing the need for users to visit publisher websites. This trend, heavily integrated into search engines like Google in 2024, means content creators may source information for AI without direct user engagement or ad impressions, impacting their revenue models.

The growth of direct-to-consumer (DTC) models and retail media networks further substitutes traditional digital publishers. Brands are now investing in their own channels to reach customers and run advertising, diverting ad spend. Retail media networks, projected to capture over $100 billion globally in 2024, are a prime example of this shift, offering brands alternative advertising inventory.

| Substitute Type | Key Characteristics | Impact on Traditional Media | 2024 Data Point |

| User-Generated Content (UGC) Platforms | Free, abundant, diverse content; high engagement | Audience fragmentation; reduced ad revenue | Billions of active users on platforms like TikTok and YouTube |

| AI-Generated Content & Zero-Click Search | Instant answers; bypasses publisher websites | Reduced website traffic; loss of ad impressions | Increased AI integration in search engines like Google |

| Direct-to-Consumer (DTC) & Retail Media Networks | Brands control customer relationships and ad inventory | Diversion of advertising spend from publishers | Retail media networks projected to exceed $100 billion globally |

Entrants Threaten

While establishing a basic online presence is relatively inexpensive, the capital demands for launching and growing a significant digital media and internet enterprise, akin to those within IAC's diverse portfolio, are substantial. These requirements encompass robust technology infrastructure, securing compelling content, extensive marketing campaigns, and attracting skilled personnel.

For instance, in 2024, the competitive landscape of digital advertising and content creation necessitates significant upfront investment. Companies like IAC, operating in sectors such as online dating (Match Group) or digital publishing, must continually invest in platform development, data analytics, and user acquisition strategies, often running into hundreds of millions of dollars annually to maintain market share and innovate.

Established players in the digital media space, like Dotdash Meredith, possess significant advantages due to economies of scale. They can spread the high costs of content creation, technology infrastructure, and marketing across a vast audience, making their per-unit costs much lower than a new entrant could achieve. For instance, in 2024, major digital publishers continued to invest heavily in AI-driven content optimization and personalized advertising, further entrenching the benefits of scale.

IAC's strategic approach, often involving the acquisition and integration of complementary businesses, directly leverages these economies of scale and scope. By combining operations, they can achieve greater efficiency in areas like data analytics and platform development. This allows them to offer more competitive advertising packages and a richer user experience, posing a substantial barrier for newcomers attempting to replicate their operational breadth and cost efficiencies without a similar established footprint.

Dotdash Meredith, for instance, commands strong brand loyalty with its portfolio of well-known titles like PEOPLE and Allrecipes. This established recognition makes it difficult for newcomers to attract and retain an audience.

Furthermore, the digital media landscape often benefits from network effects; platforms become more valuable as more users engage, creating a self-reinforcing cycle. For example, social media platforms or marketplaces thrive on this, making it challenging for new entrants to gain traction against established networks.

Building comparable trust and audience loyalty requires substantial, long-term investment in content quality and marketing, acting as a significant deterrent to potential competitors looking to enter the market.

Access to Distribution Channels

New entrants in the Internet Advertising and Content (IAC) industry often grapple with securing access to crucial distribution channels. Established players frequently control prime real estate on search engines, prominent positions in app stores, and lucrative advertising networks. For instance, in 2024, Google's Search engine market share remained dominant, making it exceptionally difficult for new search platforms to gain organic visibility without significant investment.

This control creates a substantial barrier, as new companies must find ways to either compete directly for these limited resources or develop entirely novel distribution strategies. The cost of acquiring comparable visibility can be prohibitive, especially for startups. In 2023, the average cost per click (CPC) in competitive online advertising sectors often exceeded $2.00, illustrating the financial hurdle.

Key challenges for new entrants include:

- Limited organic visibility: Gaining prominence on platforms like Google Search or major social media feeds requires extensive SEO and content marketing efforts, which are resource-intensive.

- High advertising costs: Paid advertising on established networks is expensive, with CPCs and CPMs (cost per mille/thousand impressions) often escalating due to competition.

- App store saturation: The sheer volume of applications in major app stores makes discoverability a significant challenge for new mobile-first IAC services.

- Partnership dependencies: New entrants might need to rely on partnerships with existing platforms or content aggregators, which can come with unfavorable terms or revenue-sharing agreements.

Regulatory and Legal Barriers

The digital media sector faces significant regulatory and legal barriers to entry. Evolving data privacy regulations, such as the General Data Protection Regulation (GDPR) in Europe and the California Consumer Privacy Act (CCPA) in the United States, impose strict requirements on how companies collect, process, and store user data. Non-compliance can result in substantial fines; for example, GDPR fines can reach up to 4% of global annual turnover or €20 million, whichever is higher. Similarly, content moderation policies, driven by societal and governmental pressures, add another layer of complexity and cost for new players needing to invest in robust systems and personnel to ensure adherence.

These compliance demands translate into tangible financial burdens. New entrants must allocate significant resources to legal counsel, technology infrastructure for data management, and ongoing training for staff to navigate these intricate legal frameworks. For instance, companies operating in the digital space in 2024 are increasingly investing in privacy-enhancing technologies and compliance officers. A 2024 report indicated that over 60% of companies surveyed had increased their cybersecurity and data privacy budgets, with a significant portion of this increase attributed to regulatory compliance efforts.

- Increased Compliance Costs: New entrants must budget for legal expertise, data protection officers, and technology solutions to meet GDPR, CCPA, and similar regulations.

- Operational Complexity: Implementing and maintaining compliant data handling and content moderation processes requires sophisticated operational frameworks.

- Risk of Penalties: Failure to adhere to these regulations can lead to severe financial penalties, potentially crippling a nascent business.

- Reputational Damage: Violations can also result in significant reputational harm, deterring users and partners.

The threat of new entrants for IAC is moderate, primarily due to the substantial capital requirements and established brand loyalty of existing players. While digital platforms can be launched with relatively low initial investment, scaling to compete with giants like IAC requires significant funding for technology, content, marketing, and talent. For example, in 2024, companies in the online dating and digital publishing sectors, both within IAC's purview, continued to see massive annual investments in platform development and user acquisition, often in the hundreds of millions of dollars, creating a high barrier to entry.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, including publicly available financial statements, industry-specific market research reports, and expert commentary from financial analysts.