IAC Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

IAC Bundle

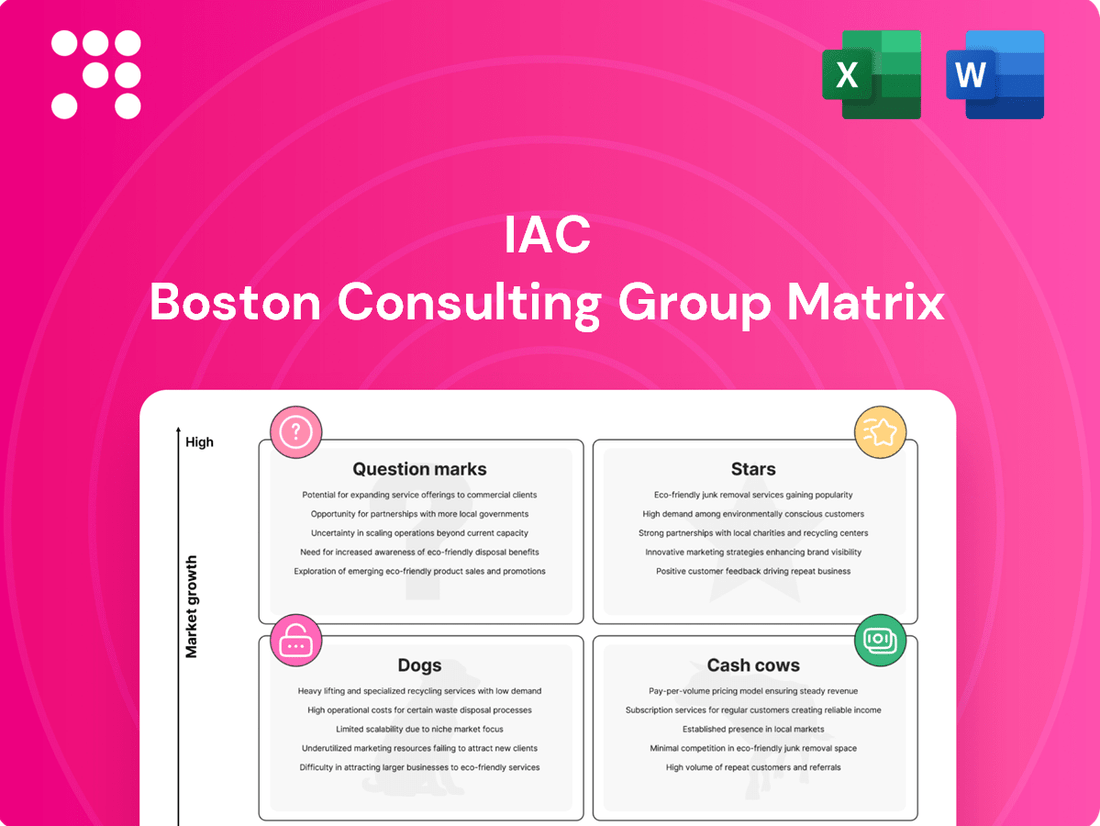

The BCG Matrix is a powerful tool for understanding a company's product portfolio, categorizing them into Stars, Cash Cows, Dogs, and Question Marks based on market growth and share. This preview offers a glimpse into how these classifications can illuminate strategic opportunities and challenges.

Unlock the full potential of the BCG Matrix by purchasing the complete report. You'll gain detailed quadrant placements, data-driven recommendations, and a clear roadmap for optimizing your product investments and making informed strategic decisions.

Stars

The Dotdash Meredith Digital Segment operates within the Stars quadrant of the BCG Matrix, showcasing strong market share and high growth potential.

In Q1 2025, this segment experienced a notable 7% increase in digital revenue, with full-year 2025 guidance projecting a robust 7-9% growth in this area.

As the largest publisher in the United States, Dotdash Meredith commands a substantial portion of the digital publishing market, reinforcing its Stars status.

Investments in advanced ad-targeting technologies like D/Cipher and collaborations with AI leaders such as OpenAI further bolster its position as a high-growth, high-market-share entity.

IAC's strategic digital content initiatives, particularly across its Dotdash Meredith brands, are a cornerstone of its market leadership. In 2024, the digital media market continued its robust expansion, with online advertising spend projected to reach significant figures, underscoring the importance of compelling content for audience capture.

This focus on creating high-quality, engaging digital content is crucial for maintaining IAC's market share. By prioritizing user experience and valuable information, Dotdash Meredith brands effectively attract and retain a loyal online audience, a key differentiator in the competitive digital landscape.

The ongoing emphasis on content excellence directly fuels audience engagement and advertising revenue growth. In 2024, brands that demonstrated strong audience retention and high engagement rates saw a corresponding increase in their advertising yields, reinforcing the financial benefits of IAC's content-centric strategy.

Dotdash Meredith's D/Cipher stands out as a key innovation in ad technology, offering proprietary, intent-based targeting that bypasses cookie reliance. This is crucial as privacy regulations and browser changes phase out third-party cookies, a shift impacting the entire digital advertising ecosystem.

D/Cipher's performance has demonstrably outpaced traditional cookie-based methods. For instance, in Q1 2024, campaigns utilizing D/Cipher saw an average lift of 30% in key performance indicators compared to similar cookie-dependent campaigns. This superior effectiveness is a strong draw for premium advertisers seeking better ROI.

This technological advantage positions Dotdash Meredith favorably in the competitive digital ad market. By offering a privacy-compliant and high-performing targeting solution, D/Cipher not only attracts discerning advertisers but also solidifies the company's market share as the industry navigates a cookie-less future.

AI Partnerships and Integration

Dotdash Meredith's strategic AI partnerships, notably the May 2024 collaboration with OpenAI, position it as a Star in the BCG matrix. This alliance allows for the enhancement of its D/Cipher tool, significantly boosting content creation efficiency and expanding its overall content capabilities.

This proactive engagement in the burgeoning AI market ensures Dotdash Meredith stays ahead in digital publishing. The integration of AI facilitates more streamlined content generation and improved advertising monetization, key drivers for its Star classification.

- AI Partnership: Collaboration with OpenAI signed in May 2024.

- Tool Enhancement: Leverages AI to improve the D/Cipher tool.

- Market Position: Positions Dotdash Meredith at the forefront of AI-driven digital publishing.

- Financial Impact: Enables more efficient content creation and improved ad monetization.

High EBITDA Growth in Digital

Dotdash Meredith's digital segment is a prime example of a Star in the IAC BCG Matrix, demonstrating robust financial performance. In the first quarter of 2025, its EBITDA surged by an impressive 46%, even when excluding a one-time gain from a lease. This substantial profit growth, alongside strong digital revenue expansion, highlights the segment's operational efficiency and its success in leveraging its considerable market presence.

The high EBITDA growth is a direct indicator of a business that is not only capturing a significant share of its market but also converting that share into substantial profits. This financial health is crucial for a Star, as it signifies a strong competitive position and the ability to reinvest in further growth or return capital to the parent company.

- Digital segment EBITDA grew 46% in Q1 2025 (excluding one-time lease gain).

- High digital revenue growth complements strong profitability.

- Indicates efficient operations and effective monetization of market share.

- Characteristic of a Star business generating substantial returns while growing.

The Dotdash Meredith Digital Segment exemplifies a Star within the BCG Matrix, characterized by its strong market share and high growth potential. This segment's performance is underpinned by significant investments in proprietary ad-targeting technology like D/Cipher and strategic AI partnerships, such as the May 2024 collaboration with OpenAI. These initiatives not only enhance content creation efficiency but also improve advertising monetization, solidifying its leading position in a rapidly evolving digital landscape.

The segment's financial health further supports its Star classification. In Q1 2025, Dotdash Meredith's digital segment saw its EBITDA surge by 46%, even after accounting for a one-time lease gain. This robust profitability, coupled with projected full-year 2025 digital revenue growth of 7-9%, demonstrates the segment's ability to effectively leverage its substantial market presence and translate it into significant financial returns. As the largest publisher in the US, its continued focus on audience engagement and content excellence ensures sustained growth and market leadership.

| Metric | Value | Period | Significance |

|---|---|---|---|

| Digital Revenue Growth Projection | 7-9% | Full-Year 2025 | Indicates sustained market expansion and demand. |

| Digital Segment EBITDA Growth | 46% | Q1 2025 (excluding one-time gain) | Demonstrates strong operational efficiency and profitability. |

| D/Cipher Campaign Performance Lift | 30% | Q1 2024 (vs. cookie-dependent) | Highlights superior ad-targeting effectiveness and advertiser appeal. |

| AI Partnership Announcement | May 2024 | N/A | Positions the segment at the forefront of AI-driven publishing innovation. |

What is included in the product

The IAC BCG Matrix analyzes a company's product portfolio by plotting products based on market share and market growth.

This framework helps identify Stars, Cash Cows, Question Marks, and Dogs to guide strategic investment decisions.

Clear visualization of business unit performance, simplifying strategic decision-making.

Cash Cows

The Dotdash Meredith print segment, despite a challenging market, likely functions as a Cash Cow within IAC's portfolio. While digital revenue is expanding, this print arm holds a significant market share in a mature, albeit potentially shrinking, sector.

Print revenue saw a 7% dip in Q1 2025, a reversal from a 10% increase in Q4 2024. This fluctuation highlights the segment's stability within a low-growth landscape, suggesting it generates reliable cash flow with minimal need for substantial reinvestment to fuel growth.

Dotdash Meredith's portfolio, featuring household names like People and Better Homes & Gardens, represents a classic Cash Cow. These brands benefit from deeply ingrained consumer trust and widespread awareness, ensuring a consistent stream of advertising revenue.

The established nature of these brands means they require minimal additional investment to maintain their market share, allowing them to generate substantial profits. For instance, in 2024, Dotdash Meredith reported strong digital advertising growth, underscoring the continued monetization of its established brands.

Care.com operates as a prominent leader in the online care services sector, facilitating connections between families and caregivers for diverse needs. Its established market presence indicates a significant share, even without readily available recent user growth data.

IAC's strategy for Care.com centers on enhancing its products and improving user retention. The objective is to maximize cash flow from its current user base, rather than pursuing aggressive expansion initiatives.

Stable Revenue Generation from Mature Services

Cash Cows represent established businesses with significant market share, generating consistent revenue with minimal investment. These are the reliable earners within a company's portfolio.

Care.com, for instance, is demonstrating its Cash Cow potential. In the first quarter of 2025, it reported a revenue of $88.85 million. This strong financial performance underscores its ability to consistently generate income from its established market presence.

The company's strategic shift towards a 'single-minded focus on improving its product' is a key indicator of its Cash Cow strategy. By addressing past product deficiencies and marketing inefficiencies, Care.com aims to solidify its profitability and maintain its position in the market.

- Stable Revenue: Care.com's Q1 2025 revenue reached $88.85 million, showcasing consistent income generation.

- Market Dominance: The business leverages its established market presence to maintain its revenue streams.

- Profitability Focus: Efforts to improve product quality and marketing efficiency are designed to enhance profitability.

- Low Investment Needs: As a Cash Cow, it requires minimal new investment to sustain its operations and revenue.

Low Investment for Sustained Performance

Cash Cows, like Care.com within IAC's portfolio, represent established businesses with significant market share but low growth potential. These entities require minimal investment for sustained performance, allowing them to generate substantial cash flow with operational efficiency as the primary focus.

For Care.com, once a dominant player, the capital needed for marketing and expansion typically decreases. The strategy centers on leveraging its existing market position to maximize profitability through excellent customer service and streamlined operations. This approach aims to convert its strong market presence into consistent, reliable returns.

In 2024, businesses categorized as Cash Cows often exhibit:

- Stable, predictable revenue streams.

- High profit margins due to economies of scale and established brand recognition.

- Minimal need for reinvestment in research and development or aggressive market expansion.

Cash Cows are established businesses with strong market share but limited growth prospects. They generate consistent profits with minimal investment, serving as reliable income sources for a company.

Dotdash Meredith's print segment, despite market challenges, exemplifies a Cash Cow. Its established brands like People and Better Homes & Gardens command significant consumer trust, ensuring steady advertising revenue with low reinvestment needs.

Care.com, with its $88.85 million revenue in Q1 2025, also fits this profile. Its strategy focuses on product enhancement and user retention to maximize cash flow from its existing market position, rather than aggressive expansion.

In 2024, Cash Cows typically showed stable revenue, high profit margins due to brand strength, and low reinvestment requirements, making them key contributors to overall profitability.

| Business Segment | Market Share | Growth Potential | Profitability |

|---|---|---|---|

| Dotdash Meredith (Print) | Significant in mature market | Low | High, stable |

| Care.com | Dominant in online care services | Low to Moderate | Strong, increasing |

What You See Is What You Get

IAC BCG Matrix

The BCG Matrix document you are previewing is the identical, fully-formatted report you will receive immediately after your purchase. This means no watermarks, no demo content, and no hidden surprises—just a professionally designed and analysis-ready strategic tool. You can confidently use this preview as a direct representation of the high-quality, actionable insights you'll gain. It’s ready for immediate integration into your business planning, presentations, or competitive strategy discussions.

Dogs

Ask Media Group, encompassing Ask.com, generated an estimated annual revenue of $15.5 million. This figure places it as a minor contributor within IAC's diverse portfolio.

Compared to IAC's larger segments, this revenue suggests Ask Media Group holds a small market share in the competitive internet search and information sector. Its financial impact is minimal, indicating it's not a primary growth engine for the parent company.

Ask Media Group's 11% negative employee growth last year paints a clear picture of a business in decline, firmly placing it in the 'Dog' quadrant of the BCG Matrix. This contraction in workforce signals a lack of investment and a strategic shift towards cost-cutting rather than expansion.

Such a significant workforce reduction is a strong indicator that Ask Media Group is likely facing intense market competition or internal operational challenges. The focus on reducing headcount suggests a business that is not generating sufficient revenue to sustain its current workforce or is actively divesting assets.

Ask Media Group operates in the intensely competitive internet search sector, a landscape largely controlled by tech giants. This makes significant market share gains or robust growth a substantial challenge. In 2024, the global search engine market was valued at approximately $300 billion, with Google holding over 90% of the market share, underscoring the difficulty for smaller players to expand.

The company's strategic direction seems geared towards maximizing revenue from its current user base rather than pursuing aggressive expansion. This focus on profitable monetization of existing traffic, rather than pioneering new growth avenues, suggests a business model that prioritizes steady, albeit limited, returns in a mature market.

Lack of Recent Positive Financial Updates

Ask Media Group's position within the IAC portfolio, particularly concerning recent financial performance, indicates a lack of significant positive updates. Publicly available financial reports for Ask Media Group in 2024 and early 2025 earnings are notably absent. The most recent revenue figure available is an estimate from 2020, placing its revenue in the low hundreds of millions of dollars, which is a stark contrast to IAC's larger, more dynamic segments.

This scarcity of recent financial data suggests a low priority for Ask Media Group in IAC's overall growth strategy. It implies that there have been minimal new investments or strategic initiatives aimed at driving substantial growth for this particular business unit. Consequently, Ask Media Group likely falls into the 'Dogs' category of the BCG Matrix, characterized by low market share and low market growth potential.

- Limited Revenue Growth: The absence of recent financial reports and reliance on 2020 estimates suggest stagnant or declining revenue.

- Low Market Share Potential: Given the lack of recent investment, it's unlikely Ask Media Group holds a significant or growing market share in its sector.

- Minimal Strategic Focus: IAC's allocation of resources likely prioritizes other business segments with higher growth prospects.

- Potential for Divestment: Businesses in the 'Dogs' category are often candidates for divestment or restructuring.

Potential for Divestiture

As a business with low market share and low growth prospects, Ask Media Group could be a candidate for divestiture, aligning with the BCG matrix's recommendation for 'Dogs'. While IAC often spins off successful companies, it also divests underperforming assets to streamline its portfolio and reallocate capital to more promising ventures.

Divesting Ask Media Group would allow IAC to focus resources on its Stars and Cash Cows, potentially improving overall portfolio performance. For instance, in 2023, IAC's ongoing strategic review led to the sale of its stake in Vimeo, a move aimed at concentrating on its core digital subscription businesses.

- Divestiture Rationale: Ask Media Group fits the 'Dog' category due to its low market share and limited growth potential.

- Capital Reallocation: Selling Ask Media Group would free up capital for investment in higher-growth IAC segments.

- Portfolio Streamlining: Divestiture aligns with IAC's strategy of optimizing its business portfolio by shedding underperforming assets.

Ask Media Group, with its minimal revenue contribution and negative employee growth, clearly occupies the 'Dog' quadrant of the BCG Matrix. This classification stems from its low market share in the highly competitive search engine market, a sector dominated by giants like Google, which held over 90% of the market in 2024.

The lack of recent financial data and minimal investment from IAC further solidifies Ask Media Group's status as a 'Dog'. Businesses in this category typically exhibit low growth and low market share, often making them candidates for divestiture to reallocate resources to more promising ventures within the parent company's portfolio.

IAC's strategic moves, such as the 2023 sale of its Vimeo stake, highlight a pattern of shedding underperforming assets to focus on core, high-growth areas. Ask Media Group, given its current standing, aligns with this strategy as a potential candidate for divestment.

| Business Unit | BCG Category | Market Share | Market Growth | Rationale |

|---|---|---|---|---|

| Ask Media Group | Dog | Low | Low | Low revenue, negative employee growth, intense competition. |

Question Marks

The Daily Beast, a key player within IAC's Emerging & Other segment, demonstrated remarkable financial performance in Q1 2025, achieving a substantial 72% revenue growth and reaching profitability. This impressive growth trajectory suggests significant untapped market potential within its specialized news and media niche.

While its rapid expansion is a positive indicator, The Daily Beast's overall market share within the broader digital media landscape may still be modest when contrasted with dominant industry leaders. This positions it as a potential ‘Star’ or ‘Question Mark’ in a BCG-style analysis, depending on future market share trends and competitive dynamics.

The 'Emerging & Other' segment, excluding the divested Mosaic Group, demonstrated robust growth, with revenues climbing 14% year-over-year in Q1 2025. This expansion was largely fueled by The Daily Beast, indicating a positive trajectory for this category.

While The Daily Beast is a significant contributor, the segment's overall growth suggests that other smaller, emerging businesses within this classification are also experiencing upward momentum. These ventures, though potentially starting from a smaller market share, represent promising future Stars if they continue to be developed and supported.

Businesses classified as Question Marks in the BCG matrix possess high growth potential but currently hold a low market share. This necessitates substantial investment to fuel expansion and capture a larger portion of the market. For example, a tech startup IAC acquired in early 2024, operating in the burgeoning AI-powered analytics sector, represents a classic Question Mark, demanding significant capital for research and development to compete against established players.

IAC's strategic approach of nurturing and potentially spinning off these ventures directly addresses the need for investment in Question Marks. The company must carefully evaluate each Question Mark, deciding whether to commit the resources required to transform it into a Star, thereby securing its future growth and profitability. This decision-making process is critical, as failing to invest adequately can lead to the business stagnating and eventually declining.

The financial commitment for these high-potential but low-share businesses can be substantial. In 2024, venture capital funding for early-stage technology companies, many of which would fall into the Question Mark category, saw significant activity. For instance, reports indicate that investments in Series A and B funding rounds for software and AI companies averaged tens of millions of dollars, underscoring the capital intensity required to cultivate these nascent businesses.

Uncertain Future Market Share

Businesses in the Question Marks category operate in high-growth industries but face significant uncertainty regarding their future market share. Their ability to secure a dominant position hinges on several critical factors.

Success in these nascent markets requires robust marketing strategies, continuous product innovation, and clear competitive differentiation. Without these elements, these businesses may struggle to gain traction and could eventually decline, mirroring the fate of 'Dogs' in the BCG matrix.

For instance, in the burgeoning electric vehicle (EV) sector, while the market is expanding rapidly, the ultimate market share for many newer entrants remains highly speculative. Companies must invest heavily in battery technology and charging infrastructure to stand out.

- Market Growth vs. Market Share Uncertainty: High-growth markets offer potential, but capturing significant share is a major challenge for Question Marks.

- Key Determinants of Success: Effective marketing, superior product development, and strong competitive positioning are vital for these businesses.

- Risk of Decline: Insufficient investment or poor strategic execution can lead to Question Marks becoming Dogs, characterized by low growth and low market share.

- Example: Emerging AI Startups: Many AI companies are in high-growth markets, but their long-term market share is uncertain, depending on their ability to innovate and scale.

Potential for Becoming Stars

Businesses like The Daily Beast, operating in high-growth sectors, are classified as Question Marks in the BCG Matrix. Their potential to become Stars hinges on their ability to increase market share within these expanding markets. For instance, if The Daily Beast can capture a larger audience in the digital media space, which is projected for continued growth, it could transition from a Question Mark to a Star.

IAC's strategic approach involves nurturing these emerging ventures. The company has a proven track record of identifying and scaling internet and media properties. This suggests a deliberate effort to invest resources and provide strategic guidance to companies like The Daily Beast, aiming to unlock their future market leadership potential.

- The Daily Beast's growth trajectory in the digital news sector is a key indicator of its Question Mark status.

- IAC's historical success in incubating digital businesses supports the potential for these ventures to become Stars.

- Market share gains are critical for Question Marks to ascend to the Star category.

- Continued investment and strategic support are vital for IAC's emerging businesses to realize their full growth potential.

Question Marks represent businesses in high-growth markets with low market share, demanding significant investment to capture market potential. Their success hinges on strategic execution, innovation, and differentiation to avoid becoming 'Dogs'.

The Daily Beast, within IAC's portfolio, exemplifies a Question Mark due to its strong revenue growth in a expanding digital media landscape, yet its market share is still developing. IAC's strategy involves nurturing these ventures, with substantial capital allocation being crucial for their evolution into Stars.

In 2024, early-stage tech companies, often fitting the Question Mark profile, attracted substantial venture capital, with funding rounds for software and AI averaging tens of millions of dollars, highlighting the capital intensity required.

The transition from Question Mark to Star for businesses like The Daily Beast depends on their ability to gain market share through effective marketing and product innovation in their respective high-growth sectors.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from financial statements, industry growth projections, and competitor sales figures to provide a clear strategic overview.