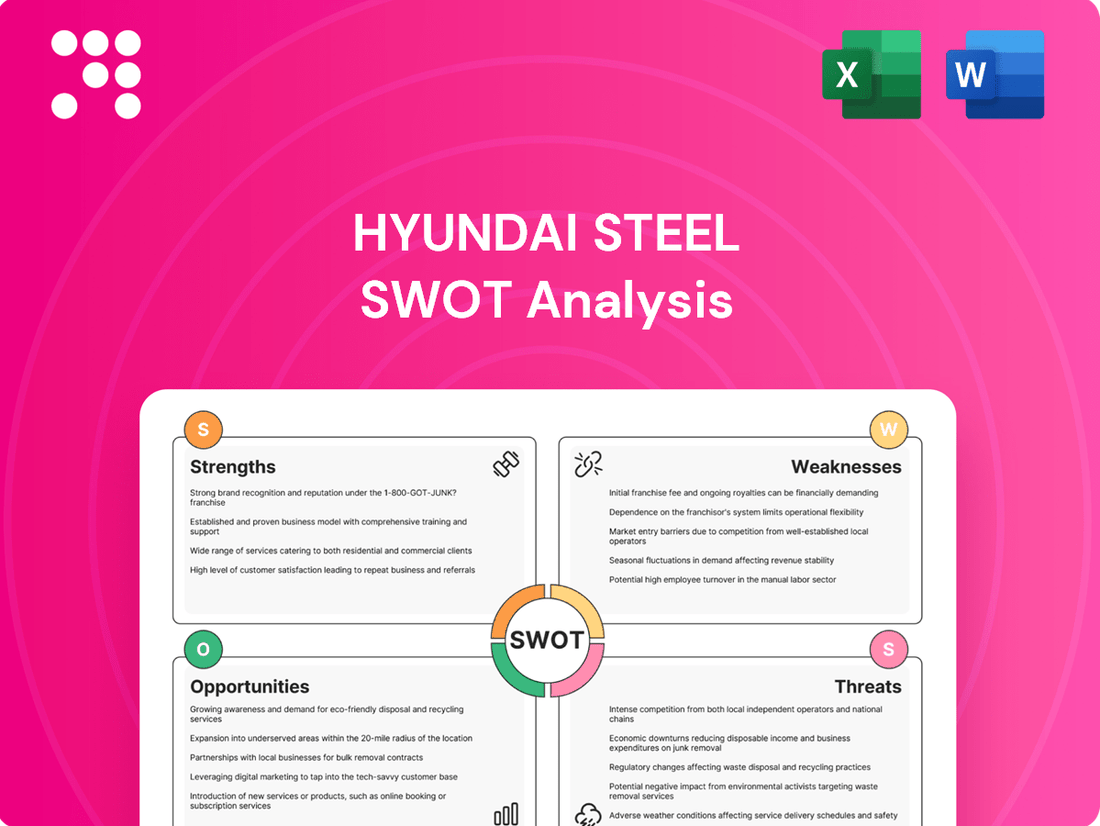

Hyundai Steel SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hyundai Steel Bundle

Hyundai Steel leverages strong brand recognition and advanced manufacturing capabilities, but faces intense competition and fluctuating raw material costs. Understanding these dynamics is crucial for navigating the steel market.

Want the full story behind Hyundai Steel's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Hyundai Steel boasts a comprehensive product range, encompassing hot-rolled and cold-rolled steel, steel plates, and H-beams. This broad offering serves vital industries like automotive, construction, shipbuilding, and heavy machinery. For instance, in 2023, the automotive sector remained a significant consumer, with global vehicle production showing signs of recovery, driving demand for specialized steel grades.

Hyundai Steel's position as a key affiliate of the Hyundai Motor Group provides a significant advantage, ensuring robust internal demand for its automotive steel. This captive market is essential for the consistent production of Hyundai and Kia vehicles.

The company is strategically growing its presence in non-captive markets, demonstrating a commitment to diversification. In 2024, Hyundai Steel successfully supplied over 1 million tons of automotive steel sheets to automakers outside of its group, a testament to its expanding global reach and competitive offering.

This dual approach of leveraging captive demand while actively pursuing external sales helps mitigate risk by reducing dependence on a single customer. It also positions Hyundai Steel for greater global market penetration and a stronger competitive standing in the automotive steel sector.

Hyundai Steel is demonstrating a strong commitment to sustainable production, actively engaging in resource recycling and energy-related ventures. Their mid- to long-term strategy targets carbon neutrality by 2050, reflecting a forward-thinking approach to environmental responsibility.

Significant investments have been made in environmental improvements and greenhouse gas reduction. These include planned installations of Coke Dry Quenching and coke desulfurization and denitrification facilities, underscoring their dedication to cleaner operations.

This dedication has been formally recognized, with Hyundai Steel being named a '2025 Sustainability Champion' by the World Steel Association, highlighting their leadership in environmental stewardship within the industry.

Advanced Technological Adoption and Innovation

Hyundai Steel is heavily investing in advanced technology, aiming to complete its 'Smart Enterprise system' by 2025. This system leverages AI and big data to streamline operations from production to sales, boosting efficiency and cutting costs. For example, AI is being used to optimize furnace operations, leading to an estimated 5% reduction in energy consumption in pilot programs.

The company is also a leader in developing next-generation steel products. This includes third-generation steel sheets, which offer superior strength and lighter weight for the automotive sector. Hyundai Steel's commitment to innovation is further demonstrated by their focus on low-carbon automotive steel, a critical material for electric vehicles and meeting environmental regulations.

- Smart Enterprise System: Targeted completion by 2025, integrating AI and big data for end-to-end process optimization.

- AI-Driven Efficiency: Pilot programs show potential for up to 5% energy savings through AI in manufacturing processes.

- Advanced Materials Development: Focus on third-generation steel sheets and low-carbon automotive steel, anticipating future market demands.

Strategic Global Expansion to Mitigate Trade Risks

Hyundai Steel is actively pursuing global expansion to buffer against trade risks, evidenced by its substantial investment in overseas production facilities. A prime example is the planned $5.8 billion Electric Arc Furnace (EAF) mill in Louisiana, USA, slated for commercial operation in 2029. This initiative is designed to directly serve major automotive clients, like Hyundai Motor and Kia, thereby insulating supply chains from potential trade tariffs and ensuring consistent access to critical markets.

This strategic diversification into new geographic regions, particularly the United States, unlocks significant growth opportunities by capitalizing on strong regional demand for steel products. By establishing a local manufacturing presence, Hyundai Steel can more effectively compete and meet the needs of its key automotive partners.

- Global Production Footprint: Investments in overseas facilities like the Louisiana EAF mill aim to diversify production and reduce reliance on single markets.

- Mitigating Trade Barriers: Establishing local production bases helps circumvent tariffs and other trade-related disruptions.

- Securing Key Markets: The expansion targets robust demand in regions such as the US, ensuring stable supply for major clients.

- New Growth Avenues: Overseas investments represent a strategic move to tap into new growth engines and expand market reach.

Hyundai Steel's comprehensive product portfolio, including hot-rolled and cold-rolled steel, steel plates, and H-beams, caters to crucial sectors like automotive and construction, with automotive steel demand showing recovery in 2023.

Its integration with Hyundai Motor Group provides substantial captive demand, ensuring consistent sales for its automotive steel products.

The company is actively expanding into non-captive markets, successfully supplying over 1 million tons of automotive steel sheets to external automakers in 2024, demonstrating growing global competitiveness.

Hyundai Steel's commitment to sustainability, with a 2050 carbon neutrality target and investments in cleaner production facilities, has earned it recognition as a '2025 Sustainability Champion' by the World Steel Association.

What is included in the product

Analyzes Hyundai Steel’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Streamlines Hyundai Steel's strategic planning by offering a clear, actionable framework to identify and leverage strengths, mitigate weaknesses, capitalize on opportunities, and address threats.

Weaknesses

Hyundai Steel's performance in 2024 highlighted a significant vulnerability to construction market slowdowns. The company reported a notable decrease in net profit and sales revenue, directly linked to this sector's sluggishness.

This dependence is further underscored by a substantial 14.6% year-on-year decline in long steel sales during 2024, a key product for the construction industry. Such a sharp drop clearly illustrates Hyundai Steel's susceptibility to economic downturns affecting construction activity.

Hyundai Steel's profitability in 2024 faced headwinds due to a surge in low-priced steel imports, a direct consequence of global steel market overcapacity. This oversupply, heavily influenced by aggressive export strategies from Chinese steel producers, intensified competition.

The influx of cheaper imported steel directly pressured domestic prices, leading to a significant erosion of profit margins for South Korean manufacturers like Hyundai Steel. This competitive disadvantage highlights a critical vulnerability in the company's market position.

Hyundai Steel, as a traditional steel manufacturer, faces a significant challenge with its substantial carbon footprint. In 2023, the company reported total carbon emissions of roughly 29.27 billion kg CO2e, highlighting its role as a major contributor to greenhouse gases.

Despite a commitment to achieve carbon neutrality by 2050, the path forward is fraught with difficulty. Transitioning to low-carbon production methods demands massive capital outlays and presents considerable technological and operational hurdles. The financial burden of producing green steel, coupled with the scarcity of green hydrogen, could impede the pace of decarbonization efforts.

Volatility in Financial Performance

Hyundai Steel's financial performance has shown significant volatility, a key weakness. In 2024, the company saw its net profit plummet from KRW 443 billion in 2023 to KRW 123 billion. This sharp decline, coupled with a 10.3% year-on-year decrease in sales revenue, highlights the unpredictable nature of its earnings.

This instability in financial results can create investor apprehension and potentially hinder Hyundai Steel's ability to fund future growth initiatives or manage its existing debt effectively.

- 2024 Net Profit: KRW 123 billion (down from KRW 443 billion in 2023)

- 2024 Sales Revenue: Decreased by 10.3% year-on-year

- Impact: Investor concern and potential limitations on strategic investments and debt management

Execution Risks in Large-Scale Overseas Projects

Hyundai Steel's ambitious $5.8 billion investment in a new electric arc furnace (EAF) steel plant in Louisiana presents significant execution risks. Concerns have been raised by analysts regarding the financing of this massive undertaking, especially considering the company's existing debt levels. Successfully implementing advanced EAF technology for high-quality automotive steel production will be a complex challenge.

These execution hurdles could potentially delay the project's completion and affect its anticipated financial returns. The sheer scale of the investment, coupled with the technological learning curve for specialized automotive steel, amplifies these potential downsides.

- Financing Concerns: The $5.8 billion investment in the Louisiana EAF plant raises questions about Hyundai Steel's debt capacity and the project's funding structure.

- Technological Implementation: Integrating and optimizing new EAF technology specifically for automotive-grade steel production presents a significant operational challenge.

- Project Timeline and Returns: Execution risks could lead to project delays and impact the realization of expected profitability and return on investment.

Hyundai Steel's reliance on the construction sector proved to be a significant weakness in 2024, with a 14.6% year-on-year drop in long steel sales directly impacting performance. The company's net profit saw a sharp decline to KRW 123 billion in 2024 from KRW 443 billion in 2023, reflecting this vulnerability and broader market overcapacity leading to price pressures from low-cost imports.

The company's substantial carbon footprint, estimated at 29.27 billion kg CO2e in 2023, presents a major hurdle for decarbonization efforts. Despite a 2050 net-zero target, the massive capital investment required for green steel production and the limited availability of green hydrogen pose significant challenges to achieving this goal.

Furthermore, the ambitious $5.8 billion investment in a new Louisiana EAF plant introduces considerable execution risks, including financing concerns given existing debt levels and the complex technological implementation for automotive-grade steel. These factors could delay the project and impact its financial viability.

| Metric | 2023 Value | 2024 Value | Change | Impact |

|---|---|---|---|---|

| Net Profit | KRW 443 billion | KRW 123 billion | -72.2% | Reduced financial flexibility |

| Long Steel Sales | N/A | -14.6% YoY | Significant decline | Construction market sensitivity |

| Carbon Emissions | 29.27 billion kg CO2e (2023) | N/A | High | Decarbonization cost & complexity |

Preview the Actual Deliverable

Hyundai Steel SWOT Analysis

This is the actual Hyundai Steel SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the company's strategic position.

The preview below is taken directly from the full Hyundai Steel SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing key internal and external factors influencing the business.

This is a real excerpt from the complete Hyundai Steel SWOT analysis. Once purchased, you’ll receive the full, editable version, ready for your strategic planning needs.

Opportunities

The global market for green steel is experiencing a significant upswing, valued at approximately USD 7.4 billion in 2024 and forecast to surge to USD 19.4 billion by 2029. This growth is fueled by advancements in production technologies and strong backing from governments worldwide.

Industries such as construction and automotive are actively seeking greener materials, creating a substantial opportunity for companies like Hyundai Steel that are committed to sustainable steelmaking. With 70% of steel manufacturers targeting reduced carbon footprints by 2025, Hyundai Steel's strategic investments in eco-friendly processes align perfectly with these evolving market demands.

Hyundai Steel is strategically targeting an expansion within the high-value automotive steel segment, aiming to boost non-captive sales and solidify its position as a global leader. This focus is crucial as the automotive industry increasingly demands advanced materials for lighter, more fuel-efficient vehicles.

The company's planned Electric Arc Furnace (EAF) facility in the U.S. is specifically designed to produce high-grade automotive steel. This investment directly addresses the growing market need for lightweight and high-strength steel solutions, positioning Hyundai Steel to capitalize on this specialized sector.

By concentrating on these premium offerings, Hyundai Steel is poised to capture a greater share of a lucrative market, enhancing its overall profitability and competitive edge in the automotive supply chain. This move aligns with industry trends and positions them for sustained growth in a critical segment.

Hyundai Steel's commitment to its 'Smart Enterprise system,' integrating AI and big data, offers a prime opportunity to streamline operations. This investment is geared towards achieving significant cost reductions and boosting product quality by enabling finer control over raw material usage and optimizing intricate production sequences. The company anticipates this system to be fully operational by 2025, promising tangible efficiency gains.

By leveraging AI and big data, Hyundai Steel can achieve more accurate production forecasting and dynamic adjustments to manufacturing processes. This advanced analytics capability allows for proactive identification and mitigation of potential quality issues, directly impacting overall operational efficiency and reinforcing its market competitiveness. Such technological adoption is crucial for maintaining an edge in the evolving steel industry.

Strategic Diversification of Manufacturing Bases

Establishing new production facilities in key international markets, like the planned plant in Louisiana, USA, offers a significant opportunity to buffer against trade protectionism and tariffs. This strategic move allows Hyundai Steel to produce steel closer to major demand centers, ensuring a consistent supply for its automotive clients, including Hyundai Motor and Kia. By localizing production, the company can also potentially bypass import duties, enhancing its competitive edge and diversifying its operational footprint beyond South Korea.

This geographical expansion directly addresses the increasing global trade complexities. For instance, the U.S. Inflation Reduction Act (IRA) and similar regional policies can create significant hurdles for imported goods. By having a manufacturing presence within these key markets, Hyundai Steel can better navigate these policy landscapes and secure its market access.

- Mitigating Trade Risks: Localized production in the U.S. reduces exposure to potential tariffs and trade disputes impacting exports from South Korea.

- Securing Key Customer Supply: The Louisiana plant will ensure a stable, domestic supply chain for major clients like Hyundai Motor and Kia in North America.

- Market Access and Competitiveness: Producing within the U.S. can provide a cost advantage by avoiding import duties and improving responsiveness to local market demands.

- Geographic Diversification: Expanding manufacturing bases internationally reduces reliance on any single region, bolstering overall business resilience.

Development of Byproduct Utilization and Circular Economy Initiatives

Hyundai Steel's commitment to resource recycling and the innovative utilization of steel byproducts, like slag from its carbon reduction initiatives, represents a substantial growth avenue. This strategic focus on circular economy principles not only minimizes waste but also opens up new revenue streams, transforming potential liabilities into assets. For instance, in 2024, the company continued to explore applications for blast furnace slag in cement production and road construction, aiming to divert millions of tons from landfills annually.

Further developing these byproduct utilization and circular economy efforts offers a clear path to enhanced sustainability and cost efficiency. By leveraging technologies that convert steelmaking residues into valuable construction materials, Hyundai Steel can reduce its environmental footprint and improve its bottom line. Collaborative research with universities and industry partners is crucial for accelerating the commercialization of these advanced recycling processes, ensuring long-term competitive advantage.

- Resource Recycling: Hyundai Steel actively seeks to recycle byproducts, such as slag, from its manufacturing processes.

- Circular Economy Alignment: These initiatives align with circular economy principles, promoting sustainability and waste reduction.

- New Revenue Streams: Utilizing byproducts as construction materials creates new commercial opportunities and revenue generation.

- Collaborative Innovation: Partnerships with academia and industry are key to commercializing advanced recycling technologies for greater efficiency.

Hyundai Steel is well-positioned to capitalize on the burgeoning green steel market, projected to reach USD 19.4 billion by 2029, by aligning with industry-wide sustainability goals. The company's strategic focus on high-value automotive steel, particularly through its new U.S. Electric Arc Furnace facility, targets a growing demand for advanced, lightweight materials, aiming to increase non-captive sales. Furthermore, investments in AI and big data through its 'Smart Enterprise system' are expected to drive efficiency and quality improvements by 2025, enhancing operational competitiveness.

| Opportunity Area | Key Driver | Projected Impact |

|---|---|---|

| Green Steel Market Growth | Increased demand for sustainable materials, government support | Access to a rapidly expanding market segment (USD 19.4B by 2029) |

| Automotive Steel Expansion | Demand for lightweight, high-strength vehicle components | Increased non-captive sales, leadership in premium steel |

| AI & Big Data Integration | Need for operational efficiency and quality control | Cost reductions, improved product quality (operational by 2025) |

Threats

Hyundai Steel operates in a global market grappling with significant overcapacity. Countries like China continue to be major exporters, flooding the market with steel. This oversupply puts downward pressure on prices worldwide.

This intense competition from low-priced imports directly impacts Hyundai Steel's sales revenue and profitability. For instance, in the first half of 2024, the company faced margin pressures exacerbated by these import dynamics, impacting its overall financial performance.

Rising trade protectionism, exemplified by potential tariffs such as a hypothetical 50% levy on steel imports by the U.S. starting in June 2025, directly threatens Hyundai Steel's export business. This could significantly shrink its sales in crucial markets.

Such protectionist measures reduce the cost-competitiveness of South Korean steel, forcing Hyundai Steel to consider expensive strategic shifts, like building new factories abroad to circumvent these trade barriers.

Steel production relies heavily on raw materials such as iron ore, nickel, and chromium, alongside substantial energy consumption. Global inflation and unpredictable energy price swings directly increase production costs for companies like Hyundai Steel, squeezing profit margins.

For instance, the average price of iron ore, a key component, saw significant volatility in late 2023 and early 2024, influenced by global demand and supply chain disruptions. Similarly, energy costs, particularly natural gas and electricity, have experienced sharp increases, impacting the energy-intensive steelmaking process.

This cost volatility makes it difficult for Hyundai Steel to accurately forecast expenses and manage its budget effectively, posing a significant challenge to maintaining stable profitability.

Strict Environmental Regulations and Carbon Border Adjustments

The global steel industry faces mounting pressure to decarbonize, with stringent environmental regulations and evolving carbon pricing mechanisms like the EU's Carbon Border Adjustment Mechanism (CBAM) posing significant challenges. As CBAM phases in, it will directly impact steel imports, potentially increasing costs for producers like Hyundai Steel if their carbon footprint remains high. This necessitates substantial capital expenditure for green technology adoption to maintain market access and competitiveness.

These regulatory shifts translate into tangible financial implications. For instance, the EU aims to reduce greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, a target that will increasingly influence trade policies. Failure to adapt could lead to:

- Increased operational costs: Compliance with stricter emissions standards and potential carbon taxes will raise production expenses.

- Reduced export competitiveness: Products from regions with less stringent environmental policies may face tariffs or penalties in markets with carbon border adjustments.

- Need for significant investment: Transitioning to greener steelmaking processes, such as using hydrogen or carbon capture technologies, requires billions in upfront investment.

Slowdown in Key End-User Industries

Beyond construction, Hyundai Steel faces demand risks from a broader economic slowdown impacting sectors like automotive and heavy machinery. These industries are significant consumers of steel, and a downturn directly affects Hyundai Steel's sales volumes. For instance, a projected 0.5% contraction in global automotive production in 2024, as estimated by IHS Markit, would translate to reduced orders for steel components.

Persistent economic headwinds continue to constrain demand in major economies. Declining household purchasing power and elevated construction costs are dampening activity, leading to lower steel consumption. While a modest rebound in global steel demand is anticipated for 2024 and 2025, these underlying economic pressures could limit the extent of this recovery, impacting Hyundai Steel's revenue streams.

Key end-user industries for steel are experiencing significant slowdowns, posing a direct threat to Hyundai Steel's market position. These include:

- Automotive Sector: Facing production challenges and reduced consumer spending, leading to fewer vehicle manufacturing orders.

- Heavy Machinery: Economic uncertainty often results in postponed capital expenditures, decreasing demand for large-scale machinery and its steel components.

- Consumer Durables: A slowdown in household spending can also impact demand for appliances and other steel-intensive consumer goods.

Hyundai Steel faces significant threats from global steel overcapacity, particularly from countries like China, which drives down prices and squeezes profit margins. For example, in the first half of 2024, the company experienced margin pressures due to intense competition from low-priced imports.

Rising trade protectionism, such as potential tariffs, directly endangers Hyundai Steel's export markets, potentially forcing costly strategic adjustments like establishing overseas production facilities. Furthermore, increasing environmental regulations and carbon pricing mechanisms, like the EU's CBAM, are set to raise operational costs and reduce export competitiveness if decarbonization efforts lag.

Economic slowdowns impacting key sectors like automotive and heavy machinery also pose a substantial threat, reducing demand for steel products. For instance, a projected contraction in global automotive production for 2024 directly translates to fewer orders for steel components.

| Threat Category | Specific Threat | Impact on Hyundai Steel | Example Data/Statistic |

|---|---|---|---|

| Market Competition | Global Steel Overcapacity | Downward pressure on prices, reduced sales revenue | China's steel output accounted for over 50% of global production in 2023. |

| Trade Policy | Trade Protectionism (Tariffs) | Reduced export market access, increased operational costs | Hypothetical 50% U.S. steel import tariff from June 2025 could significantly impact sales. |

| Environmental Regulations | Decarbonization Mandates (e.g., CBAM) | Increased production costs, need for significant capital investment in green tech | EU aims for 55% GHG reduction by 2030, impacting steel imports. |

| Economic Conditions | Economic Slowdown in Key Sectors | Decreased demand from automotive, heavy machinery, and consumer durables | Projected 0.5% contraction in global automotive production for 2024. |

SWOT Analysis Data Sources

This Hyundai Steel SWOT analysis is built upon a foundation of robust data, including the company's official financial statements, comprehensive market research reports, and expert industry forecasts to provide a well-rounded strategic perspective.