Hyundai Steel Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hyundai Steel Bundle

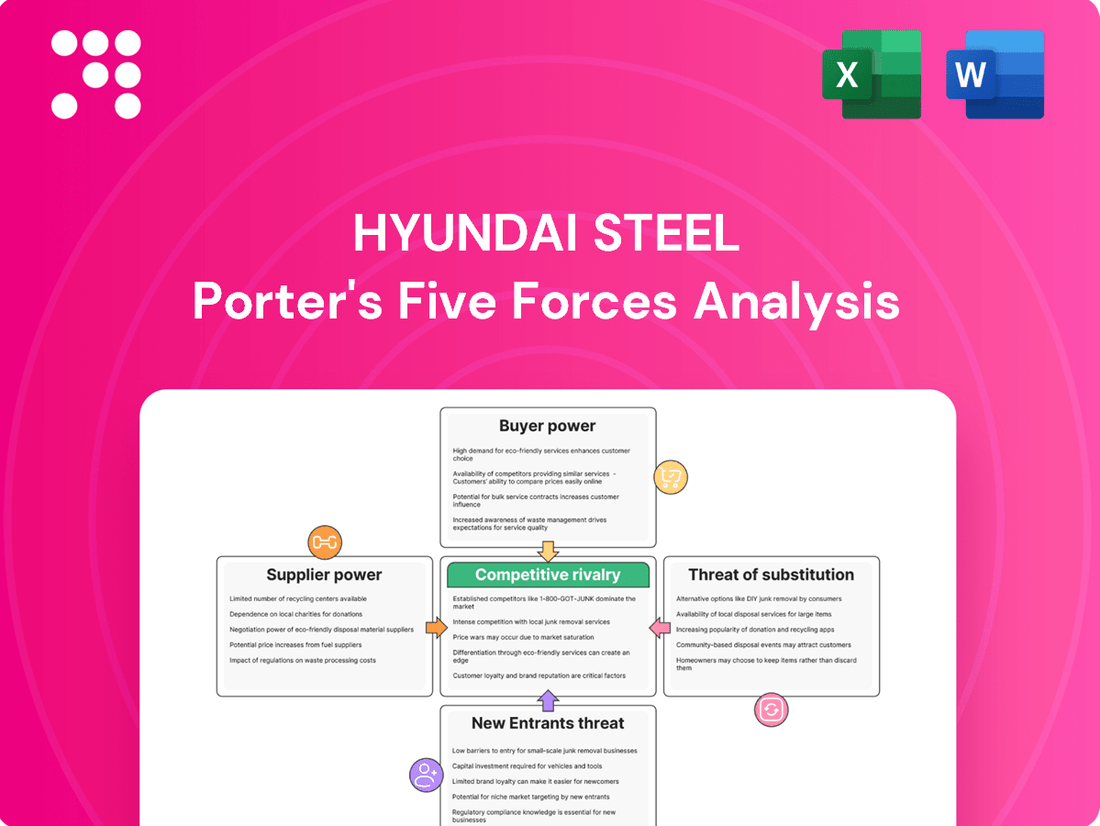

Hyundai Steel operates within a complex industry shaped by intense rivalry, significant buyer power, and the constant threat of substitutes. Understanding these forces is crucial for navigating its market landscape.

The complete report reveals the real forces shaping Hyundai Steel’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The global steel industry's dependence on essential raw materials like iron ore and coking coal means that a concentrated supplier base can wield considerable influence. If a small number of companies control these vital inputs, they have the leverage to dictate terms, impacting prices and the consistent flow of materials to steel producers such as Hyundai Steel.

In 2024, the price of iron ore experienced significant volatility, with benchmarks like the Platts IO62 index fluctuating throughout the year, directly impacting the cost structure for steelmakers. Similarly, coking coal prices remained a key determinant of production expenses, with supply disruptions in major exporting regions, such as Australia, continuing to create upward pressure on costs for companies like Hyundai Steel.

The bargaining power of suppliers for Hyundai Steel is significantly influenced by the availability of substitute inputs. If Hyundai Steel can readily source alternative materials or grades for its production processes, the leverage held by any single supplier diminishes.

For instance, while iron ore is a core component, Hyundai Steel can explore different iron ore grades or diversify its sourcing locations. Furthermore, an increased reliance on recycled steel, or scrap metal, presents a viable alternative to virgin materials. This flexibility in sourcing metallic inputs directly impacts the negotiating strength of iron ore suppliers.

The market dynamics for metallic inputs are constantly evolving. In 2024, the price of steel scrap in regions like India saw fluctuations, with cheaper direct-reduced iron (DRI) emerging as a competitive alternative, thereby altering sourcing strategies for steelmakers. This trend underscores how the availability of substitutes can reshape supplier power.

Hyundai Steel faces significant supplier bargaining power when switching costs are high. If specialized alloys or components require extensive retooling or integration with new suppliers, the cost and complexity for Hyundai Steel to change providers increase substantially. This dependency grants existing suppliers leverage, particularly if they offer unique materials or integrated solutions crucial for Hyundai's manufacturing processes.

Threat of Forward Integration by Suppliers

If a key raw material supplier were to integrate forward into steel production, it would directly challenge Hyundai Steel by introducing a new competitor. This could lead to increased market competition and potentially restrict Hyundai Steel's access to essential raw materials, impacting its production capabilities and cost structure.

While not a frequent occurrence, the threat of forward integration by suppliers becomes more plausible when those suppliers identify opportunities to capture greater value further down the supply chain. For instance, a supplier of specialized alloys or high-grade iron ore might consider such a move if they believe they can efficiently produce steel and achieve higher profit margins than their current role allows.

Consider the global steel industry's reliance on specific raw materials like coking coal and iron ore. In 2023, the average price of high-grade iron ore hovered around $110-$130 per tonne, and coking coal prices fluctuated significantly, impacting steel production costs. If a major supplier of these inputs were to integrate forward, they could leverage their existing supply chain and cost advantages to compete directly with established steel manufacturers like Hyundai Steel.

- Potential for Increased Competition: A supplier entering steel production would add another player to the market, intensifying competition for Hyundai Steel.

- Supply Chain Disruption: Forward integration by a key supplier could disrupt Hyundai Steel's raw material sourcing, potentially leading to shortages or price increases.

- Value Chain Capture: Suppliers may integrate forward to capture a larger portion of the value created in the steel production process.

- Strategic Implications: This scenario would necessitate Hyundai Steel to re-evaluate its supplier relationships and potentially seek alternative sourcing strategies.

Uniqueness of Inputs

The uniqueness of inputs significantly impacts supplier bargaining power for Hyundai Steel. When suppliers offer highly specialized or proprietary materials and technologies essential for Hyundai Steel's advanced production or product differentiation, their leverage grows. This is particularly true for high-performance steel grades needed in demanding sectors like automotive manufacturing, where specific material properties are critical for safety and efficiency.

For instance, the demand for advanced high-strength steel (AHSS) in the automotive industry, driven by lightweighting initiatives for fuel efficiency and electric vehicle battery casing requirements, means suppliers of these specialized alloys and production technologies hold considerable sway. Hyundai Steel's reliance on these unique inputs for its premium product lines directly translates to increased bargaining power for the suppliers of these critical components.

- Specialized Alloys: Suppliers of unique steel alloys with specific tensile strength, ductility, or corrosion resistance properties for automotive or aerospace applications command higher prices.

- Proprietary Technologies: Companies providing exclusive manufacturing processes or coatings that enhance steel performance or reduce production costs for Hyundai Steel gain significant leverage.

- Critical Raw Materials: In cases where certain rare earth elements or specific chemical compounds are vital for producing advanced steel grades, suppliers of these unique raw materials can exert substantial influence.

- Limited Alternatives: If there are few or no viable alternative suppliers for these specialized inputs, Hyundai Steel's dependence on a particular supplier amplifies that supplier's bargaining power.

Hyundai Steel's suppliers, particularly those providing essential raw materials like iron ore and coking coal, hold significant bargaining power due to market concentration and the critical nature of these inputs. In 2024, iron ore prices remained volatile, with the Platts IO62 index fluctuating, directly impacting Hyundai Steel's cost structure. Similarly, coking coal prices, influenced by supply chain issues in regions like Australia, continued to put upward pressure on production expenses.

The bargaining power of suppliers is also amplified when switching costs for Hyundai Steel are high, such as when specialized alloys or components require extensive retooling. Furthermore, the uniqueness of inputs, like advanced high-strength steel alloys for the automotive sector, gives suppliers considerable leverage, as alternatives are limited. This reliance on proprietary technologies or critical raw materials means suppliers can command higher prices and dictate terms.

| Input Type | Supplier Bargaining Power Factor | 2024 Impact Example |

|---|---|---|

| Iron Ore | Market Concentration, Criticality | Volatile prices impacting production costs (Platts IO62 index fluctuations) |

| Coking Coal | Supply Chain Disruptions, Criticality | Upward cost pressure due to limited supply from key exporting regions (e.g., Australia) |

| Specialized Alloys (e.g., AHSS) | Uniqueness, High Switching Costs | Suppliers of advanced alloys for automotive sector command higher prices due to specific performance requirements |

| Recycled Steel (Scrap) | Availability of Substitutes | Price fluctuations in regions like India, with DRI emerging as a competitive alternative, can shift power dynamics |

What is included in the product

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Hyundai Steel's position in the global steel industry.

Quickly assess competitive pressures with a visual, interactive five forces model, eliminating the need for complex data manipulation and enabling rapid strategic adjustments for Hyundai Steel.

Customers Bargaining Power

Hyundai Steel serves vital industries like automotive, construction, and shipbuilding. If a few major clients represent a large chunk of Hyundai Steel's revenue, they gain significant leverage to push for lower prices or better contract conditions. For example, the automotive sector in South Korea, buoyed by domestic demand and eco-friendly vehicle incentives in 2024, continues to rely heavily on advanced high-strength steel, making these large automotive manufacturers powerful customers.

Customers in sectors like automotive and construction have a growing array of alternative materials to steel, including aluminum, carbon composites, and advanced polymers. For instance, the automotive industry's push for lighter vehicles saw aluminum content in cars increase significantly, with some estimates suggesting a 20% rise in aluminum usage per vehicle between 2015 and 2025, impacting steel demand.

This availability of substitutes directly enhances buyer power. If Hyundai Steel's pricing becomes uncompetitive or its supply chain faces disruptions, customers can more readily shift their material sourcing to these alternatives, putting pressure on Hyundai Steel to maintain favorable terms.

The ease and cost for Hyundai Steel's customers to switch suppliers significantly influence their bargaining power. For commodity steel products, where differentiation is minimal, customers can more readily shift to competitors, increasing their leverage. For instance, in 2023, the global steel market saw a slight decrease in average selling prices, making price a more critical factor for buyers of standard steel grades.

Threat of Backward Integration by Customers

The threat of backward integration by customers, particularly major automotive manufacturers, poses a significant challenge to Hyundai Steel. If these large buyers possess the financial and technical capacity to produce steel themselves, their leverage in price negotiations increases substantially, potentially eroding Hyundai Steel's market share and profitability. This is a critical consideration for Hyundai Steel, as it directly impacts its pricing power and customer retention strategies.

While the capital expenditure required for steel production is immense, the mere possibility of major clients like Hyundai Motor Group or Kia exploring such a move can influence ongoing contract discussions. For instance, in 2024, the automotive industry continued to face supply chain pressures, making vertical integration a recurring strategic consideration for large OEMs seeking greater control over critical raw material inputs.

- Customer Capability: Large automotive manufacturers often have substantial capital reserves and engineering expertise, making backward integration a technically feasible, albeit costly, option.

- Strategic Incentive: Securing a stable and cost-effective supply of steel is paramount for automakers, driving interest in controlling production through integration.

- Market Influence: The potential for a major customer to integrate backward can weaken Hyundai Steel's bargaining position, impacting pricing and contract terms.

- Industry Trends: Supply chain resilience and cost management remain key priorities for the automotive sector in 2024, potentially increasing the attractiveness of backward integration.

Price Sensitivity of Customers

Customers in sectors with high competition or where steel is a major cost component exhibit significant price sensitivity. For instance, the automotive industry, a key buyer for Hyundai Steel, often operates on thin margins, making them acutely aware of steel prices. In 2023, the average profit margin for major global automakers hovered around 5-8%, underscoring the pressure to control input costs.

This heightened price sensitivity compels steel producers like Hyundai Steel to engage in competitive pricing strategies to secure and retain business. Consequently, this can directly affect Hyundai Steel's profitability, as they must balance market share with maintaining healthy margins. For example, fluctuations in raw material costs, such as iron ore, must be absorbed or passed on carefully, given customer price resistance.

- Automotive Sector Price Sensitivity: Automakers, facing intense global competition, are highly sensitive to steel price increases, as steel can represent 10-20% of a vehicle's manufacturing cost.

- Construction Industry Demands: The construction sector, another significant steel consumer, also demonstrates price sensitivity, particularly in large-scale projects where cost overruns can derail profitability.

- Impact on Margins: High customer price sensitivity forces Hyundai Steel to maintain competitive pricing, potentially squeezing profit margins, especially during periods of rising production costs.

Hyundai Steel's customers, particularly in the automotive sector, wield considerable bargaining power. This is driven by their significant purchasing volume and the availability of substitute materials like aluminum and advanced composites, which saw increased adoption in 2024 as automakers pursued lighter, more fuel-efficient vehicles. For example, the automotive industry's push for sustainability and reduced emissions in 2023-2024 has intensified the search for alternative materials, directly impacting steel demand and customer leverage.

The ease with which these customers can switch suppliers, especially for commodity steel grades where differentiation is minimal, further amplifies their power. In 2023, global steel markets experienced slight price declines, making price a more critical factor for buyers. Furthermore, the potential for major automotive clients to consider backward integration, a strategy explored by some OEMs in 2024 to secure supply chains, adds another layer of pressure on Hyundai Steel to offer competitive terms.

Customers' price sensitivity, especially in the automotive industry where steel can represent a substantial portion of manufacturing costs (estimated at 10-20%), means Hyundai Steel must carefully manage pricing to retain business, impacting its own profit margins.

| Factor | Impact on Hyundai Steel | Supporting Data/Trend (2023-2024) |

|---|---|---|

| Customer Concentration | High leverage for large buyers | Automotive sector remains a key, concentrated market for steel. |

| Availability of Substitutes | Pressure to offer competitive pricing | Increased aluminum and composite use in vehicles for weight reduction. |

| Switching Costs | Low for commodity grades, high for specialized steels | Global steel price fluctuations in 2023 made price a key switching driver for standard grades. |

| Backward Integration Threat | Potential loss of market share and pricing power | Automotive industry's focus on supply chain resilience in 2024 makes integration a strategic consideration. |

| Price Sensitivity | Limits Hyundai Steel's pricing flexibility | Automotive profit margins (5-8% in 2023) necessitate strict cost control on inputs like steel. |

What You See Is What You Get

Hyundai Steel Porter's Five Forces Analysis

This preview showcases the complete Hyundai Steel Porter's Five Forces Analysis, detailing the competitive landscape including threat of new entrants, bargaining power of buyers and suppliers, threat of substitute products, and intensity of rivalry. The document displayed here is the part of the full version you’ll get—ready for download and use the moment you buy. You'll receive this exact, professionally formatted analysis immediately after purchase, offering actionable insights into Hyundai Steel's strategic positioning.

Rivalry Among Competitors

The global steel sector is crowded with numerous significant entities. Giants such as China Baowu Group, ArcelorMittal, Nippon Steel Corporation, and POSCO Holdings represent formidable competition, each boasting substantial production capacities and market reach.

Hyundai Steel, despite its prominent position as a major South Korean steel producer, navigates a landscape teeming with both global behemoths and strong regional players. This intense competition means that market share gains are hard-won, and maintaining profitability requires constant innovation and efficiency.

For instance, in 2023, ArcelorMittal reported crude steel production of approximately 58.8 million metric tons, highlighting the sheer scale of operations that Hyundai Steel must contend with. Similarly, China Baowu Group's production volume in the same year was significantly higher, underscoring the dominance of a few extremely large competitors.

The global steel market experienced a challenging environment in 2024, with a modest recovery projected for 2025. This slower growth trajectory amplifies competitive pressures among established steel manufacturers as they contend for a greater slice of a market with limited expansion.

Global steel demand is anticipated to see a rebound of 1.7% in 2024, followed by a 1.2% growth in 2025. Such subdued growth rates mean that companies like Hyundai Steel must intensely compete for market share, potentially leading to price wars or increased efforts in product differentiation and efficiency improvements to maintain profitability.

While steel is often seen as a basic commodity, Hyundai Steel actively differentiates itself. They focus on specialized products like advanced high-strength steels crucial for the automotive sector, enhancing vehicle safety and fuel efficiency. This product specialization, coupled with a commitment to quality and customer service, allows them to move beyond pure price competition.

Exit Barriers

Hyundai Steel, like many in the steel industry, faces substantial exit barriers. These include the massive investment in specialized, fixed assets like blast furnaces and rolling mills, which are difficult to redeploy or sell. The need for highly skilled labor, from engineers to plant operators, also ties companies to the sector, as retraining or finding alternative employment for such specialized workforces can be challenging.

Environmental regulations, particularly concerning emissions and waste disposal, add another layer of complexity and cost to exiting the steel business. Decommissioning plants in compliance with these rules requires significant financial outlay and time. This situation can trap companies in the market even when profitability is low, contributing to industry-wide overcapacity.

The persistence of overcapacity is a major concern. For instance, global steel overcapacity stood at approximately 600 million metric tons in 2023. Projections indicate that new capacity additions, particularly in Asia, could add another 50 million metric tons by 2027, potentially exacerbating this issue and intensifying price competition among existing players like Hyundai Steel.

- High Capital Investment: Steel production requires immense, specialized fixed assets, making divestment extremely costly.

- Specialized Workforce: The industry relies on a skilled labor pool that is difficult to transition to other sectors.

- Environmental Compliance: Strict regulations for plant closure and waste management add significant exit costs.

- Industry Overcapacity: With global overcapacity around 600 million metric tons in 2023 and new capacity expected, companies may be forced to operate even at low profitability to avoid complete asset write-offs.

Strategic Objectives of Competitors

Competitors in the steel industry often pursue aggressive strategic objectives that directly fuel competitive rivalry. For instance, a primary goal for many is achieving market share dominance, which can lead to price wars or increased marketing efforts. Companies are also heavily invested in technological leadership, particularly in areas like advanced high-strength steel and automation.

Sustainability is another major driver. Many steel manufacturers are setting ambitious decarbonization targets, pushing for green steel production. This focus translates into substantial investments in new technologies and processes, potentially altering the competitive landscape and introducing new forms of competition based on environmental credentials. For example, by 2024, several major players have announced significant capital expenditures aimed at reducing their carbon footprint, such as investing in hydrogen-based steelmaking technologies.

- Market Share Expansion: Competitors actively seek to grow their share by offering competitive pricing and expanding product portfolios.

- Technological Advancement: A key objective is to lead in developing and implementing innovative steelmaking processes and materials.

- Sustainability Leadership: Many companies are prioritizing green steel production and carbon emission reduction to meet regulatory demands and market expectations.

Competitive rivalry within the steel industry is fierce, driven by a large number of significant global and regional players vying for market share. Hyundai Steel faces intense competition from giants like ArcelorMittal and China Baowu Group, whose massive production scales, exemplified by ArcelorMittal's 58.8 million metric tons of crude steel production in 2023, create a challenging environment.

The market's projected modest growth of 1.7% in 2024 and 1.2% in 2025 intensifies this rivalry, pushing companies to focus on product differentiation, such as Hyundai Steel's specialization in advanced high-strength steels for the automotive sector, and operational efficiency to maintain profitability amidst potential price wars.

High exit barriers, including substantial capital investments in fixed assets and specialized labor, alongside stringent environmental regulations for plant closures, trap companies in the market, contributing to persistent overcapacity. Global steel overcapacity stood at approximately 600 million metric tons in 2023, with further capacity additions expected, intensifying competitive pressures.

Competitors are actively pursuing market share dominance, technological leadership in areas like green steel, and sustainability goals, such as decarbonization targets and investments in hydrogen-based steelmaking, which are reshaping the competitive landscape and driving innovation.

| Competitor | 2023 Crude Steel Production (Million Metric Tons) | Key Focus Areas |

|---|---|---|

| ArcelorMittal | 58.8 | Market share, technological advancement, sustainability |

| China Baowu Group | (Significantly higher than ArcelorMittal) | Market share dominance, scale, technological leadership |

| POSCO Holdings | (Major global player) | Innovation, sustainability, high-value products |

| Nippon Steel Corporation | (Major global player) | Technological leadership, advanced materials, global expansion |

SSubstitutes Threaten

The threat of substitutes for steel is significant, primarily from materials like aluminum, composites, and advanced plastics. These alternatives are gaining traction, especially in industries focused on lightweighting and fuel efficiency, such as the automotive sector. For example, while electric vehicles often utilize advanced high-strength steels, they also create a market for lighter materials that can improve battery range.

The attractiveness of substitutes for steel hinges on their price-performance ratio. If materials like advanced composites or high-strength plastics offer similar or better durability and functionality at a lower cost, they become a more compelling alternative for buyers. For instance, while the automotive sector continues to use steel, there's a growing trend towards lighter materials to improve fuel efficiency, with some estimates suggesting the use of aluminum in vehicles could increase by 15-20% in the coming years, directly impacting steel demand.

Hyundai Steel faces a moderate threat from substitutes, as industries like automotive actively explore lighter materials for improved fuel efficiency and reduced emissions. For instance, advancements in aluminum and advanced composites offer alternatives that can decrease vehicle weight. In 2024, the automotive industry's drive for sustainability continues to push material innovation, making the cost and performance of steel versus these substitutes a crucial consideration for buyers.

Technological Advancements in Substitutes

Technological advancements are significantly reshaping the threat of substitutes for steel. Ongoing research and development in alternative materials, such as advanced composites and high-strength plastics, are rapidly enhancing their properties and reducing their costs. This makes them increasingly competitive against steel in various applications, from automotive to construction. For instance, the automotive industry is actively exploring lighter, more fuel-efficient materials, with some projections indicating a continued shift away from traditional steel components in certain vehicle segments by 2025-2026.

Innovations in materials science could lead to entirely new materials that directly challenge steel's long-standing dominance in critical sectors. The development of novel alloys and engineered materials with superior strength-to-weight ratios or enhanced corrosion resistance poses a direct threat. By 2024, the global market for advanced composites, a key substitute, was already valued in the tens of billions of dollars, with consistent growth driven by these technological leaps.

- Advancements in Composites: Enhanced strength and reduced weight make composites viable alternatives in aerospace and automotive manufacturing.

- High-Performance Plastics: Innovations in polymer science are creating plastics capable of withstanding greater stress and temperature, encroaching on steel's territory.

- Aluminum and Magnesium Alloys: Continued improvements in these lightweight metals offer compelling substitution opportunities, particularly in vehicle body panels and structural components.

- 3D Printing Materials: Emerging additive manufacturing technologies are enabling the creation of complex parts from novel materials that can outperform traditional steel in specific engineering contexts.

Environmental and Sustainability Considerations

The growing emphasis on environmental responsibility presents a significant threat of substitutes for traditional steel products. As industries worldwide strive to reduce their carbon footprint, materials offering superior sustainability credentials, such as advanced composites or bio-based materials, could become more attractive alternatives. For instance, by 2024, the global market for sustainable building materials was projected to reach hundreds of billions of dollars, indicating a strong consumer and regulatory push towards greener options.

While Hyundai Steel is actively investing in eco-friendly production methods and circular economy initiatives, the pace of innovation in alternative materials could outstrip these efforts. If substitute materials can demonstrably offer lower lifecycle emissions or enhanced recyclability, they could erode demand for steel in key sectors like automotive and construction. For example, the automotive industry is increasingly exploring lightweight composite materials to improve fuel efficiency, a trend that directly impacts steel demand.

- Growing demand for sustainable materials: Global markets for green building materials and lightweight automotive components are expanding rapidly.

- Technological advancements in alternatives: Innovations in composites, advanced plastics, and bio-materials offer potential replacements for steel in various applications.

- Regulatory pressures: Stricter environmental regulations and carbon pricing mechanisms may favor materials with lower embodied carbon.

- Consumer preference shifts: Increasing consumer awareness and demand for environmentally responsible products can influence material choices across industries.

The threat of substitutes for steel, while present, is often mitigated by steel's inherent cost-effectiveness and widespread availability. However, industries like automotive are increasingly adopting lighter materials such as aluminum and advanced composites to meet fuel efficiency and emissions standards. For instance, by 2024, the automotive industry's focus on lightweighting continued to drive demand for alternative materials, with some vehicle manufacturers aiming to increase the proportion of aluminum in their chassis by up to 15% compared to previous years.

Hyundai Steel faces a moderate threat from substitutes, particularly in the automotive sector where lightweighting is paramount. Advanced composites and high-strength plastics are becoming more competitive due to ongoing technological advancements and a growing emphasis on sustainability. For example, the global market for advanced composites was projected to reach over $15 billion in 2024, indicating a significant and growing challenge to traditional materials like steel.

| Substitute Material | Key Advantages | Applications Impacted | 2024 Market Trend (Illustrative) |

|---|---|---|---|

| Aluminum Alloys | Lightweight, Corrosion Resistance | Automotive body panels, structural components | Continued growth in automotive, driven by EV lightweighting |

| Advanced Composites | High Strength-to-Weight Ratio, Design Flexibility | Aerospace, Automotive, Wind Turbine Blades | Strong growth, with increasing adoption in mass-market vehicles |

| High-Performance Plastics | Lightweight, Cost-Effective (in some applications), Corrosion Resistance | Automotive interior/exterior parts, consumer goods | Steady expansion, particularly in specialized engineering plastics |

Entrants Threaten

The steel industry demands colossal upfront investments, creating a formidable barrier for potential new entrants. Establishing a modern, integrated steel mill, complete with blast furnaces, rolling mills, and extensive logistics, can easily run into billions of dollars. For instance, building a new greenfield steel plant in 2024 often requires upwards of $5 billion, a figure that deters many smaller or less-funded companies.

This high capital intensity extends to modernizing existing facilities or venturing into newer, more sustainable steelmaking processes. The significant financial commitment needed for advanced electric arc furnaces or hydrogen-based direct reduction technologies further solidifies the entry barrier, particularly for small and medium-sized enterprises (SMEs) looking to compete.

Existing players like Hyundai Steel leverage significant economies of scale in production, procurement, and distribution. This allows them to achieve lower per-unit costs, making it difficult for new entrants to compete on price from the outset. For instance, Hyundai Steel's massive production capacity, reaching millions of tons annually, enables bulk purchasing discounts and optimized logistics.

Established steel manufacturers like Hyundai Steel boast deeply ingrained customer relationships and robust distribution networks, making it difficult for newcomers to penetrate the market. These existing channels are crucial for timely delivery and customer service, areas where new entrants would struggle to compete. For instance, in 2024, the global steel distribution market is characterized by long-term contracts and established logistics, representing a significant barrier to entry.

Government Policy and Regulations

Government policies significantly shape the threat of new entrants in the steel industry. Regulations concerning environmental impact, such as emissions standards, can require substantial upfront investment in technology, acting as a deterrent for newcomers. For instance, stricter emissions controls implemented in various regions necessitate advanced pollution abatement systems, adding to the capital expenditure required to establish operations.

Trade policies, including tariffs and quotas, directly influence market accessibility. The U.S. imposed tariffs on steel imports in 2018, a move that aimed to protect domestic producers but also raised the cost for new international competitors looking to enter the American market. Such measures can prompt companies like Hyundai Steel to evaluate localized production strategies to circumvent these trade barriers.

- Environmental Regulations: Stringent emissions standards require significant capital investment in pollution control technology, raising entry costs.

- Trade Tariffs: Tariffs on imported steel, like those historically seen in the U.S., increase the cost for foreign entrants and can incentivize localized production.

- Industrial Licensing: Obtaining necessary permits and licenses for steel production can be a complex and time-consuming process, adding another layer of difficulty for new players.

Brand Loyalty and Switching Costs for Buyers

While steel is often viewed as a commodity, Hyundai Steel benefits from established relationships and a reputation for reliability, fostering a degree of buyer loyalty. This loyalty can make it challenging for new entrants to capture market share, especially when buyers prioritize consistent quality and dependable supply chains.

Switching steel suppliers can involve significant costs and risks for buyers. These can include expenses related to re-tooling manufacturing equipment, implementing new quality assurance protocols, and potential disruptions to production if the new supplier's product doesn't meet exact specifications. For instance, a major automotive manufacturer might face millions in costs to recalibrate stamping presses for a different steel grade, making them hesitant to switch from a trusted supplier like Hyundai Steel.

- Brand Loyalty: Established relationships and consistent quality from suppliers like Hyundai Steel can lead to strong buyer loyalty, making it harder for new entrants to gain traction.

- Switching Costs: Buyers incur significant costs and potential risks when changing steel suppliers, including re-tooling, quality assurance validation, and production continuity concerns.

- Supplier Reliability: In industries where production uptime is critical, the perceived reliability and proven track record of existing suppliers act as a barrier to new entrants.

The threat of new entrants in the steel industry, including for players like Hyundai Steel, remains moderate due to substantial capital requirements and established market dynamics. Building a new, fully integrated steel mill in 2024 can cost upwards of $5 billion, a significant hurdle. Furthermore, existing players benefit from economies of scale, strong customer relationships, and complex distribution networks, making it challenging for newcomers to compete effectively on price and service.

Government regulations, such as environmental standards and trade tariffs, also influence market entry. For instance, the U.S. tariffs on steel imports, first implemented in 2018 and subject to ongoing review, increase the cost for foreign competitors. These factors combine to create a relatively high barrier, limiting the influx of new companies into the global steel market.

| Factor | Impact on New Entrants | Example/Data Point (2024) |

|---|---|---|

| Capital Intensity | High Barrier | New greenfield steel plant cost: ~$5+ billion |

| Economies of Scale | Competitive Disadvantage for Newcomers | Hyundai Steel's annual production capacity in millions of tons |

| Customer Relationships & Distribution | Difficult to Replicate | Established logistics and long-term contracts in global steel distribution |

| Government Regulations (Environmental) | Increased Upfront Investment | Costs for advanced pollution abatement systems |

| Trade Policies (Tariffs) | Increased Cost of Entry | Impact of tariffs on imported steel in major markets |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Hyundai Steel is built upon a foundation of diverse data sources, including Hyundai Steel's annual reports and investor presentations, alongside industry-specific market research from firms like IHS Markit and CRU Group. We also incorporate macroeconomic data from sources such as the World Steel Association and government economic indicators to provide a comprehensive view of the competitive landscape.