Hyundai Steel Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hyundai Steel Bundle

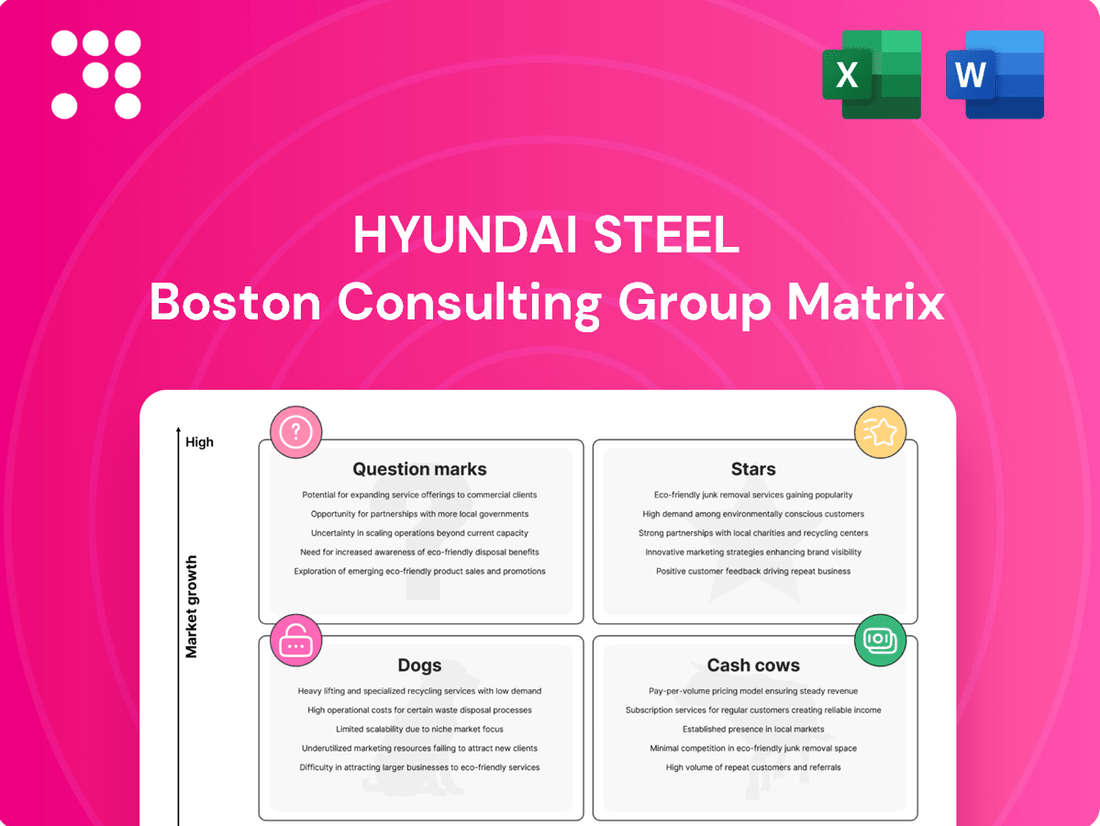

Uncover the strategic positioning of Hyundai Steel's product portfolio with our comprehensive BCG Matrix analysis. Understand which segments are driving growth and which require careful management to maximize profitability.

This preview offers a glimpse into Hyundai Steel's market dynamics. Purchase the full BCG Matrix report for detailed quadrant placements, actionable insights, and a clear roadmap for optimized resource allocation and future investment decisions.

Stars

Hyundai Steel's high-strength automotive steel is a clear star in its product portfolio. This is largely fueled by the worldwide push for lighter, more fuel-efficient cars. The company has set an ambitious goal to be among the top three global automotive steel suppliers.

In 2024, Hyundai Steel achieved a significant milestone, selling more than 1 million tons of automotive steel sheets to automakers outside of its own group. This substantial figure underscores its strong presence and competitiveness in the broader automotive steel market.

Eco-friendly/Low-Carbon Automotive Steel is a star in Hyundai Steel's BCG matrix. The global push for carbon neutrality, exemplified by regulations like the EU's Carbon Border Adjustment Mechanism (CBAM), is fueling a surge in demand for sustainable automotive materials.

Hyundai Steel is strategically positioning itself to capitalize on this trend. They are actively investing in facilities dedicated to producing low-carbon steel and have secured partnerships with European auto parts manufacturers for carbon-reduced steel sheet supply. This proactive approach aligns with their commitment to achieving carbon neutrality by 2050.

The company's recognition for its climate change response further solidifies its strong standing in this rapidly expanding, high-growth market segment. Hyundai Steel's focus on sustainability is not just an environmental initiative but a clear business strategy to capture future market share.

Hyundai Steel's investment in its first US automotive steel mill is a clear star in its BCG Matrix. This venture directly supports Hyundai and Kia's expanding US operations, which benefited from a strong automotive market in 2024, with sales figures showing robust demand.

The new facility, located in Georgia, represents a significant capital expenditure aimed at bolstering the localized supply chain and mitigating geopolitical risks. This strategic positioning ensures a stable supply of high-quality steel for electric vehicle production and other automotive needs.

Advanced High-Strength Steel (AHSS)

Advanced High-Strength Steel (AHSS) is a shining star for Hyundai Steel, especially within the automotive industry. This segment is booming because AHSS offers a fantastic strength-to-weight ratio, which is a big deal for making cars safer and more fuel-efficient. Hyundai Steel is a major player, supplying these cutting-edge steel types to meet the changing needs of car manufacturers worldwide.

The demand for AHSS is really taking off. For example, the global AHSS market was valued at approximately USD 28.5 billion in 2023 and is projected to grow significantly, with a compound annual growth rate (CAGR) of around 6.5% expected through 2030. This growth is directly linked to stricter automotive safety regulations and the ongoing push for lighter, more fuel-efficient vehicles.

- Market Growth Driver: AHSS adoption is driven by the automotive industry's focus on lightweighting and enhanced crashworthiness.

- Hyundai Steel's Position: The company is a leading producer, investing heavily in R&D to develop next-generation AHSS grades.

- Key AHSS Applications: Used in vehicle body structures, including pillars, bumpers, and door beams, to improve safety performance.

- Projected Market Size: The AHSS market is anticipated to reach over USD 45 billion by 2030, reflecting strong industry demand.

Specialized Steel for Heavy Machinery

Hyundai Steel's specialized steel for heavy machinery is a strong contender in the market, likely a Star in the BCG Matrix. This segment benefits from ongoing global infrastructure projects and industrial expansion, which directly fuels demand for high-strength, durable steel. For instance, the global construction equipment market was valued at approximately USD 200 billion in 2023 and is projected to grow significantly, indicating robust demand for specialized steel components.

The company's focus on developing advanced steel grades tailored for the rigorous demands of heavy machinery, such as high tensile strength and wear resistance, positions it favorably. This specialization often leads to a commanding market share within this niche. Hyundai Steel's commitment to research and development in this area ensures they remain at the forefront of material innovation for this critical sector.

- High Market Share: Hyundai Steel likely holds a significant portion of the specialized steel market for heavy machinery due to its advanced product offerings.

- Growing Demand: Global infrastructure investment and industrialization, projected to continue its upward trend through 2024 and beyond, directly supports demand for these steel products.

- Technological Expertise: The company's investment in R&D for high-performance steel grades for applications like excavators, bulldozers, and cranes is a key competitive advantage.

- Industry Growth: The heavy machinery sector itself is experiencing steady growth, creating a favorable environment for steel suppliers like Hyundai Steel.

Hyundai Steel's high-strength automotive steel, particularly Advanced High-Strength Steel (AHSS), is a clear Star. This is driven by the automotive industry's relentless pursuit of lighter, safer, and more fuel-efficient vehicles. The global AHSS market, valued at approximately USD 28.5 billion in 2023, is projected to grow at a CAGR of around 6.5% through 2030, reaching over USD 45 billion. Hyundai Steel's significant sales of automotive steel sheets to external automakers, exceeding 1 million tons in 2024, highlight its strong market position.

Eco-friendly and low-carbon automotive steel is another significant Star. The global push for carbon neutrality, reinforced by policies like the EU's CBAM, is creating substantial demand for sustainable materials. Hyundai Steel's investments in dedicated low-carbon steel facilities and its partnerships for carbon-reduced steel sheet supply, alongside its 2050 carbon neutrality goal, position it for continued growth in this environmentally driven market.

The company's strategic investment in its first US automotive steel mill solidifies its Star status. This move directly supports Hyundai and Kia's expanding North American operations, which experienced robust demand in 2024. The Georgia facility is key to localizing supply chains and mitigating geopolitical risks, ensuring a stable supply for EV production and other automotive needs.

| Product Category | BCG Status | Key Growth Drivers | Hyundai Steel's Position | 2024 Data/Projections |

|---|---|---|---|---|

| High-Strength Automotive Steel (AHSS) | Star | Lightweighting, Fuel Efficiency, Safety Regulations | Leading Producer, R&D Investment | Sold >1M tons of automotive steel sheets externally in 2024. Global AHSS market projected >$45B by 2030. |

| Eco-friendly/Low-Carbon Automotive Steel | Star | Carbon Neutrality Push, ESG Regulations | Investment in dedicated facilities, Partnerships | Commitment to carbon neutrality by 2050. Securing European partnerships. |

| US Automotive Steel Mill Investment | Star | Expansion of Hyundai/Kia US Ops, Supply Chain Localization | Strategic Capital Expenditure | New facility in Georgia to support expanding US market demand. |

What is included in the product

This Hyundai Steel BCG Matrix analysis identifies strategic opportunities, detailing which business units to invest in, hold, or divest based on market share and growth.

A clear visual of Hyundai Steel's BCG Matrix, showcasing each business unit's position, alleviates the pain of strategic uncertainty.

Cash Cows

Hot-rolled steel represents a core offering for Hyundai Steel, underpinning sectors like construction, shipbuilding, and general manufacturing. While the growth trajectory for basic hot-rolled steel might be less dynamic than for advanced materials, Hyundai Steel's significant production capabilities and established client base are key to maintaining a strong market position.

This segment likely functions as a cash cow due to its consistent demand and Hyundai Steel's competitive advantage. For instance, in 2024, the global steel market, while facing some headwinds, continued to see robust demand from infrastructure projects, with hot-rolled coil prices generally stabilizing after earlier volatility, indicating a predictable revenue stream for established players like Hyundai Steel.

Hyundai Steel's cold-rolled steel coils represent a classic Cash Cow within its product portfolio. This segment operates in a mature market with steady, predictable demand, projected to grow at a modest 3% compound annual growth rate from 2025 through 2033.

The widespread application of cold-rolled steel coils in construction and numerous industrial sectors signifies Hyundai Steel's substantial market share. This strong position in a stable, albeit slow-growing, market ensures consistent and reliable cash generation, funding other ventures and operations.

Hyundai Steel's steel plates for shipbuilding are a prime example of a cash cow within their BCG matrix. South Korea's dominance in global shipbuilding, accounting for a significant portion of new vessel orders, creates a consistent and substantial demand for high-quality steel plates.

In 2024, the shipbuilding sector continued its robust performance, with South Korean shipbuilders securing a substantial share of global orders, particularly for high-value vessels like LNG carriers. Hyundai Steel, as a leading domestic supplier, benefits from this sustained demand, maintaining a strong market share in this mature but vital segment. This consistent demand translates into reliable revenue streams, allowing Hyundai Steel to generate significant cash flow from this business unit.

General H-Beams for Domestic Construction

General H-beams for domestic construction represent a mature product line for Hyundai Steel within the BCG matrix, often categorized as a Cash Cow. These beams are fundamental to building infrastructure, and despite a general slowdown in the domestic construction market, Hyundai Steel has a strong foothold. For instance, in 2024, the domestic construction sector faced headwinds, with some reports indicating a contraction in new housing starts compared to previous years.

However, Hyundai Steel's established supply chain and significant market share for standard H-beams ensure consistent, albeit modest, cash flow. This stability is maintained even amidst what some analysts term 'poor sentiments' in the broader building sector. The company's long-standing relationships and efficient production processes allow it to generate reliable revenue from these essential construction materials.

- Market Position: Dominant player in the mature domestic H-beam construction market.

- Cash Generation: Provides stable, consistent cash flow despite market maturity.

- Growth Potential: Limited due to the mature nature of the domestic construction sector.

- Strategic Importance: Funds investment in higher-growth potential business units.

Track Chain for Heavy-Duty Machinery

Hyundai Steel's track chains for heavy-duty machinery represent a strong contender in their BCG matrix, likely positioned as a Cash Cow. This classification stems from the product's role as a critical component within a mature, established market. The heavy machinery sector, encompassing construction, mining, and agriculture, relies heavily on durable components like track chains, ensuring consistent demand.

As a key supplier, Hyundai Steel likely holds a significant market share in this specialized niche. This dominance allows them to generate substantial and stable cash flow, a hallmark of Cash Cow products. For instance, the global construction equipment market, where track chains are essential, was valued at approximately USD 200 billion in 2023 and is projected to grow at a CAGR of around 4% through 2030, indicating a stable yet growing demand base for such components.

- Product: Track chains for heavy-duty machinery.

- Market Position: High market share in a mature, stable segment.

- Cash Flow Generation: Significant and consistent contributor to Hyundai Steel's revenue.

- Strategic Implication: Funds investment in other business units within the company.

Hyundai Steel's cold-rolled steel coils are a prime example of a Cash Cow. This segment operates in a mature market with steady, predictable demand, projected to grow at a modest 3% compound annual growth rate from 2025 through 2033. The widespread application of cold-rolled steel coils in construction and numerous industrial sectors signifies Hyundai Steel's substantial market share, ensuring consistent and reliable cash generation to fund other ventures.

Steel plates for shipbuilding also function as a Cash Cow, capitalizing on South Korea's dominance in global shipbuilding. In 2024, South Korean shipbuilders secured a substantial share of global orders, particularly for high-value vessels, creating sustained demand for Hyundai Steel's high-quality plates and translating into reliable revenue streams.

General H-beams for domestic construction represent another Cash Cow. Despite headwinds in the domestic construction sector in 2024, Hyundai Steel's established supply chain and significant market share ensure consistent, albeit modest, cash flow from these essential materials, supporting other business units.

Hyundai Steel's track chains for heavy-duty machinery are also likely Cash Cows. The global construction equipment market, where track chains are essential, was valued at approximately USD 200 billion in 2023 and is projected to grow at a CAGR of around 4% through 2030, indicating a stable demand base for these critical components supplied by Hyundai Steel.

| Product Segment | BCG Category | Market Growth | Hyundai Steel's Position | Cash Flow Contribution |

| Cold-Rolled Steel Coils | Cash Cow | ~3% (2025-2033) | Substantial Market Share | Consistent & Reliable |

| Steel Plates for Shipbuilding | Cash Cow | Mature, Stable Demand | Leading Domestic Supplier | Significant & Stable |

| General H-beams (Construction) | Cash Cow | Mature, Modest Growth | Strong Domestic Foothold | Consistent, Modest |

| Track Chains (Heavy Machinery) | Cash Cow | ~4% (Global Market) | Key Supplier, High Share | Substantial & Stable |

What You’re Viewing Is Included

Hyundai Steel BCG Matrix

The Hyundai Steel BCG Matrix preview you are viewing is the identical, fully formatted document you will receive upon purchase, ensuring complete transparency and immediate utility for your strategic planning. This comprehensive report contains no watermarks or demo content, offering you a polished and professional analysis ready for immediate integration into your business operations. You can confidently expect to download the exact same BCG Matrix, meticulously crafted to provide actionable insights into Hyundai Steel's product portfolio. This preview guarantees that the final file is precisely what you need for informed decision-making and competitive strategy development.

Dogs

Certain long steel products for domestic construction are currently positioned as dogs in Hyundai Steel's BCG Matrix. This is due to a substantial 14.6% year-on-year decline in sales for these products during 2024.

The primary drivers behind this downturn are a weakened domestic construction sector and increased competition from more affordable imported steel. This combination of factors points to a low market share within a segment that is experiencing either minimal growth or outright contraction, making these products unprofitable and potentially inefficient capital users.

Hyundai Steel's net profit and sales revenue saw a dip in 2024, largely impacted by a surge in affordable steel imports from nations like China and Japan. This influx eroded the company's standing in the domestic market.

This situation highlights how commodity-grade steel products, lacking significant differentiation and facing intense price wars, are increasingly behaving like 'dogs' in the BCG Matrix. Their low market share within a demanding market environment underscores this challenge.

Older, less efficient blast furnace operations at Hyundai Steel, particularly those without significant carbon reduction investments, would likely be categorized as 'dogs' in a BCG matrix. These facilities may struggle with escalating environmental regulations and a declining market preference for conventionally produced steel.

In 2024, the global steel industry is under immense pressure to decarbonize. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM) is already impacting steel imports, penalizing high-carbon products. Older blast furnaces not equipped with advanced carbon capture or hydrogen-based technologies would face higher operational costs and reduced competitiveness compared to newer, greener facilities.

These legacy operations could see diminishing profitability and market share as demand shifts towards low-carbon steel. Their contribution to Hyundai Steel's overall portfolio might become negligible, posing a drag on financial performance unless substantial modernization or phased retirement is undertaken.

Non-core, Low-Value Added General Steel Offerings

Hyundai Steel's general steel offerings, those that are undifferentiated and face stiff competition, likely fall into the 'dogs' category of the BCG matrix. These products, such as basic rebar or standard structural steel, often operate in mature markets with limited growth potential. Their contribution to Hyundai Steel's overall revenue and profit margins is typically marginal, reflecting their low market share in these highly competitive segments.

For instance, while specific figures for Hyundai Steel's 'dog' products aren't publicly detailed, the broader South Korean construction steel market, where many of these general offerings compete, saw a modest demand increase in 2024, around 2-3%. However, the intense competition from both domestic and international players keeps price premiums low, impacting profitability for these less specialized products.

- Low Market Share: General steel products often struggle to capture significant market share in a crowded landscape.

- Stagnant Market Growth: Many segments for basic steel products have reached maturity, offering minimal expansion opportunities.

- Intense Competition: The commoditized nature of these offerings leads to price wars and reduced profitability.

- Marginal Profitability: These products typically generate low returns, requiring careful management to avoid becoming a drain on resources.

Segments Heavily Reliant on a Stagnant Domestic Construction Market

Hyundai Steel's exposure to the South Korean domestic construction market presents a challenge, as this sector has experienced a significant slowdown. This directly affects sales and profitability for products deeply tied to construction activity.

Segments within Hyundai Steel that are heavily reliant on this stagnant domestic construction market would likely be classified as 'dogs' in the BCG matrix. These are areas with low growth and potentially low market share, especially as overall demand shrinks.

- South Korea's construction sector faced a contraction in 2023, with a notable slowdown in new housing starts and infrastructure projects.

- Hyundai Steel's reliance on rebar and structural steel for domestic building projects makes these product lines vulnerable to the current market conditions.

- Increased competition for a smaller pie in the domestic market could further erode margins for these specific steel products.

Hyundai Steel's less competitive, commodity steel products, particularly those for domestic construction, are firmly in the 'dog' category of the BCG matrix. These items are characterized by low market share in a slow-growth or declining market, often due to intense price competition from imports and a lack of product differentiation.

The company's 2024 performance was notably affected by a 14.6% year-on-year sales decline in certain long steel products, directly linked to the weakened domestic construction sector and aggressive pricing by international competitors. This situation exemplifies how undifferentiated steel offerings, facing significant price pressure, struggle to maintain profitability.

Legacy blast furnace operations, especially those not investing in decarbonization, also represent 'dogs'. These facilities face rising compliance costs due to environmental regulations, like the EU's CBAM, and a shrinking market preference for conventionally produced steel, impacting their long-term viability.

| Product Category | BCG Classification | Key Challenges | 2024 Market Trend Impact |

|---|---|---|---|

| Domestic Construction Long Steel | Dog | Weakened domestic demand, high import competition | 14.6% year-on-year sales decline |

| General Steel Offerings (e.g., rebar) | Dog | Commoditization, intense price wars, low market share | Marginal profitability in mature markets |

| Older Blast Furnace Operations | Dog | Environmental regulations, declining demand for conventional steel | Increased operational costs, reduced competitiveness |

Question Marks

Hyundai Steel's Hy-Cube project is a significant move into the burgeoning green steel market, targeting a substantial reduction in carbon emissions through hydrogen-based ironmaking, with a goal set for 2030. This positions the company for high future growth in an environmentally conscious sector.

Despite the promising outlook, Hyundai Steel's current market share in fully commercialized hydrogen steel is likely minimal. This places the Hy-Cube project squarely in the question mark category of the BCG matrix, necessitating considerable investment to capture future market potential.

Hyundai Steel's ventures into resource recycling and energy businesses, like utilizing steel byproducts for construction materials and developing rapid-setting cement from slag, position them as question marks in the BCG matrix. These areas operate within a rapidly expanding market fueled by the circular economy and sustainability trends.

While the market for these eco-friendly solutions is growing, Hyundai Steel's current market share and revenue generation from these specific initiatives are likely still in their early stages. This necessitates significant investment to achieve economies of scale and establish a stronger market presence, characteristic of question mark strategic business units.

HD Hyundai, Hyundai Steel's parent, is heavily investing in smart construction and AI, showcasing unmanned excavators and digital twins. This positions them at the forefront of a high-growth market, aiming to revolutionize construction efficiency and safety.

Hyundai Steel's direct participation in providing these advanced smart construction solutions is likely in its nascent stages. While the broader group's investment signals future potential, Hyundai Steel's current market share and revenue contribution from these specific offerings would be minimal, classifying it as a question mark in the BCG matrix.

Expansion of Eco-friendly Steel into New European Markets

Hyundai Steel's move into new European markets with eco-friendly steel positions it as a potential 'question mark' in the BCG matrix. Recent MOUs with European auto parts manufacturers to supply carbon-reduced steel sheets highlight this strategic expansion. These markets are characterized by the development of new sales networks and product testing, aiming to capture significant market share.

The success of this expansion hinges on Hyundai Steel's ability to compete with established players in the European automotive supply chain. While the demand for sustainable materials is growing, the initial investment and market penetration phase for these specialized products place them in a 'question mark' category. The company is actively building its presence, with early indications suggesting a promising, yet unproven, trajectory.

- Market Entry Strategy: Hyundai Steel is establishing sales networks and conducting product tests in these new European markets, signifying a deliberate approach to market penetration.

- Competitive Landscape: The expansion faces competition from established steel suppliers already serving the European automotive sector, making market share acquisition a key challenge.

- Product Differentiation: The focus on carbon-reduced steel sheets leverages the increasing demand for eco-friendly materials, a critical factor for success in this segment.

- Investment and Growth Potential: While currently a 'question mark', successful market penetration could elevate this segment to a 'star' status, driven by the growing sustainability trend in the automotive industry.

Next-Generation Steel for Electric Vehicles (EVs)

Hyundai Steel's investment in next-generation steel for electric vehicles (EVs) represents a significant growth opportunity, driven by the accelerating EV market. The company's strategic alignment with Hyundai Motor Group's EV production, including the new Georgia plant, underscores this focus.

While the demand for specialized EV steel is soaring, Hyundai Steel's market position outside its captive network and the substantial R&D and scaling efforts required place this segment in the question mark category. For instance, the global EV market is projected to reach over 25 million units by 2025, creating a substantial demand for advanced materials.

- Growing EV Demand: The global EV market is expanding rapidly, with projections indicating significant growth through 2030, necessitating advanced steel solutions.

- Captive Market Strength: Hyundai Steel benefits from a strong relationship with Hyundai Motor Group, securing a foundational customer base for its EV steel.

- External Market Uncertainty: The extent of Hyundai Steel's success in capturing market share for its next-generation EV steel beyond its affiliated companies remains a key question.

- R&D and Scaling Investment: Continuous innovation and the ability to scale production efficiently are critical for competing in this evolving sector.

Hyundai Steel's initiatives in green steel, resource recycling, and specialized EV steel all fall into the question mark category of the BCG matrix. These ventures are characterized by high growth potential in emerging markets but currently have a low market share, requiring substantial investment to achieve scale and competitive positioning.

The company's Hy-Cube project, aiming for reduced carbon emissions by 2030, and its ventures into construction materials from steel byproducts are prime examples. Similarly, its efforts to supply next-generation steel for the rapidly expanding electric vehicle market, despite a strong captive customer base, represent significant investment opportunities with uncertain market capture outside affiliated entities.

These question mark segments demand strategic investment to develop market presence and achieve economies of scale. Success in these areas could see them transition into stars, capitalizing on global trends toward sustainability and electrification, but the initial phase requires careful resource allocation and market development.

Hyundai Steel's European market entry for eco-friendly steel also fits this profile. While MOUs with auto parts manufacturers indicate a strategic push, establishing new sales networks and product testing in a competitive landscape places this segment as a question mark, dependent on successful market penetration.

BCG Matrix Data Sources

Our Hyundai Steel BCG Matrix leverages a robust foundation of data, including Hyundai Steel's official financial reports, industry-specific market research, and competitor performance benchmarks to provide accurate strategic insights.