Hyundai Steel PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hyundai Steel Bundle

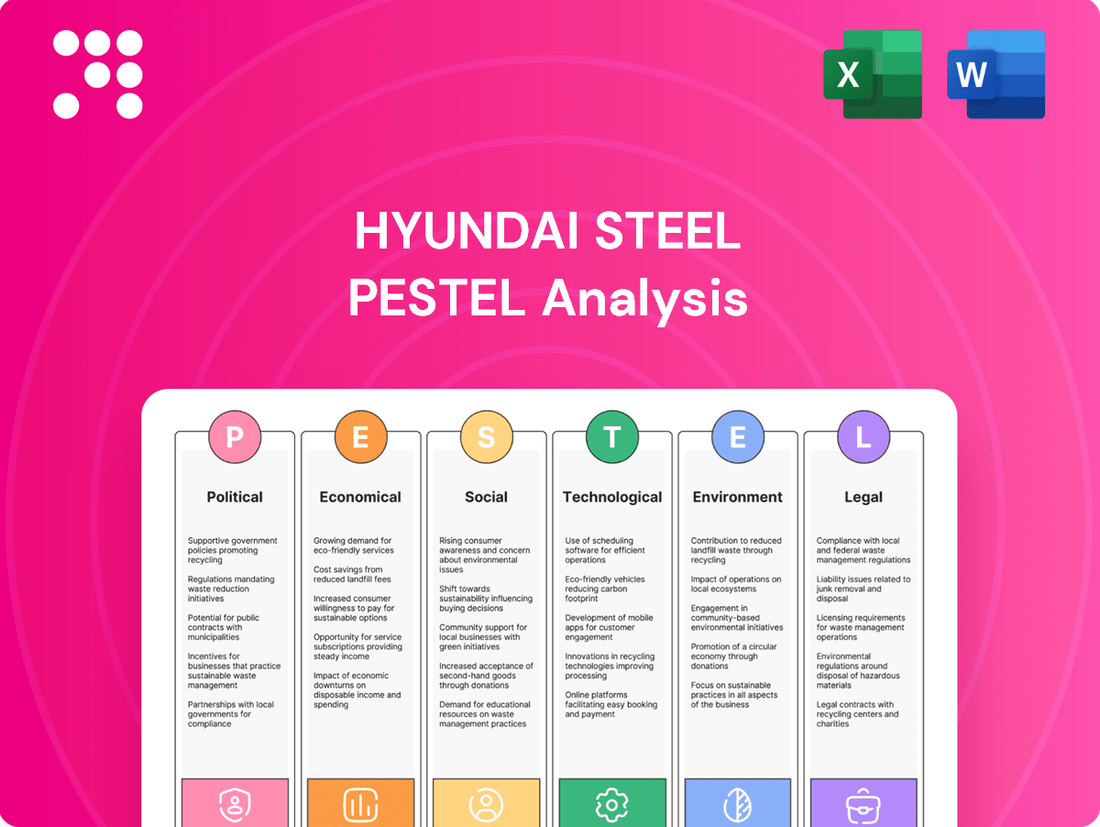

Unlock the critical external factors influencing Hyundai Steel's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces shaping its operations and future growth. Equip yourself with the strategic foresight needed to navigate this dynamic landscape. Download the full PESTLE analysis now for actionable insights and a competitive edge.

Political factors

Trade protectionism, particularly through tariffs, presents a significant challenge for Hyundai Steel. For instance, the United States' imposition of a 25% tariff on all steel imports, which removed South Korea's prior duty-free quota, directly impacts Hyundai Steel's ability to compete in this crucial market by increasing its export costs. This situation necessitates a strategic adaptation to these higher cost structures in key international markets.

The ongoing possibility of further tariff increases, such as a potential hike to 50% by the US, introduces considerable uncertainty for Hyundai Steel. This evolving trade landscape compels the company to explore strategic responses, including the possibility of investing in production facilities located in overseas markets to mitigate the impact of tariffs and maintain market access.

The South Korean government is actively promoting the steel industry's shift to carbon neutrality and improved competitiveness. This involves providing financial backing and simplifying administrative processes for the development of green technologies, such as hydrogen reduction steelmaking. These initiatives are designed to maintain the domestic steel sector's edge as the world moves towards low-carbon manufacturing.

South Korea has actively implemented anti-dumping duties on steel imports, notably from China and Japan. This action stems from complaints lodged by domestic producers, with Hyundai Steel being a key beneficiary. These provisional tariffs, which can be substantial, are designed to shield the local steel sector from the detrimental effects of unfairly priced foreign competition.

The imposition of these duties is a critical strategy to preserve the health of South Korea's domestic steel market. By curbing the influx of oversupplied and underpriced foreign steel, these measures help mitigate price volatility and support the viability of local manufacturers like Hyundai Steel. For instance, in early 2024, South Korea finalized definitive anti-dumping duties on certain steel products from Japan, with rates reaching up to 15.13% for specific companies, demonstrating the government's commitment to protecting its industry.

Geopolitical Stability and Regional Trade

Geopolitical uncertainties, especially concerning the Korean peninsula and evolving global trade relationships, directly impact steel trade dynamics and market fluctuations. For instance, shifts in trade policies, such as those potentially enacted by a new US administration, could negatively affect South Korea's export-reliant economy. Hyundai Steel, like other major players, must stay vigilant in tracking these geopolitical developments to understand their ripple effects on international supply chains and demand for its products.

The global steel market in 2024 and heading into 2025 is highly sensitive to geopolitical shifts. Trade disputes and protectionist measures can significantly alter market access and pricing. For example, the ongoing trade tensions between major economies continue to create an unpredictable environment for steel exports, impacting companies like Hyundai Steel that rely on international markets.

- Trade Policy Impact: Changes in tariffs or import quotas by key trading partners can directly reduce export volumes and profitability for South Korean steel producers.

- Supply Chain Disruptions: Geopolitical conflicts or instability in resource-rich regions can disrupt the supply of raw materials like iron ore and coal, leading to increased input costs for steel manufacturing.

- Market Volatility: Uncertainty surrounding international relations and trade agreements contributes to price volatility in the global steel market, making long-term planning more challenging.

Industrial Policy and Economic Growth Initiatives

The South Korean government's industrial policies, such as the New Industrial Policy 2.0, are designed to bolster the competitiveness of vital sectors, including steel, by encouraging private-sector driven expansion. These efforts are geared towards cultivating a dynamic, market-oriented economy and backing strategic capital expenditures.

Hyundai Steel is positioned to gain from a policy landscape that champions industrial advancement and market dynamism. For instance, the government's commitment to fostering future growth engines, as outlined in strategies aiming for a 2.5% GDP growth in 2024, indirectly supports heavy industries like steel by stimulating overall economic activity and demand.

- Government Support: South Korea's New Industrial Policy 2.0 prioritizes private-led growth in key sectors like steel.

- Economic Focus: Initiatives aim to strengthen market-based economies and encourage strategic investments.

- Growth Projections: Government targets for economic growth, such as the 2.5% GDP forecast for 2024, signal a supportive environment for industrial development.

Government support for green steel initiatives, like hydrogen reduction steelmaking, is crucial for Hyundai Steel's future competitiveness. South Korea's commitment to carbon neutrality and its financial backing for these technologies, as seen in 2024, helps maintain the industry's edge. This policy environment, coupled with anti-dumping duties protecting the domestic market from unfair competition, creates a more stable operating landscape.

Trade policies, including tariffs and anti-dumping measures, significantly influence Hyundai Steel's export costs and market access. For example, provisional anti-dumping duties on certain steel products from Japan, finalized in early 2024 with rates up to 15.13%, illustrate the government's protective stance. These actions aim to shield local producers from price volatility and foreign competition.

Geopolitical shifts and trade disputes remain key political factors impacting the global steel market in 2024-2025. Potential changes in trade policies by major economies create uncertainty for export-reliant companies like Hyundai Steel. Staying attuned to these developments is vital for navigating international supply chains and demand fluctuations.

| Political Factor | Description | Impact on Hyundai Steel |

| Trade Protectionism | Tariffs and import quotas imposed by trading partners. | Increases export costs and reduces market access. US tariffs on steel imports, for instance, have directly affected South Korean producers. |

| Government Industrial Policy | Policies promoting domestic industry growth and competitiveness. | South Korea's New Industrial Policy 2.0 supports private-led expansion and strategic investments, benefiting sectors like steel. Government forecasts for 2.5% GDP growth in 2024 also signal a supportive economic climate. |

| Anti-Dumping Measures | Duties imposed on unfairly priced imports. | Protects the domestic market from detrimental foreign competition, ensuring price stability and supporting local manufacturers. South Korea's finalized anti-dumping duties on Japanese steel products in early 2024 are a prime example. |

| Geopolitical Stability | International relations and potential conflicts. | Can disrupt raw material supply chains and create market volatility, impacting demand and pricing for steel products. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Hyundai Steel, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities arising from these critical external forces.

A concise Hyundai Steel PESTLE analysis provides a clear, actionable roadmap for navigating complex external factors, alleviating the pain of uncertainty and enabling more confident strategic decision-making.

Economic factors

Global steel demand is projected for a modest uptick, largely fueled by robust economic activity and significant infrastructure projects underway in developing nations, such as India, which is a key growth driver.

Despite this growth, the international steel market is still grappling with persistent oversupply issues. This imbalance often results in considerable price fluctuations, creating a challenging environment for producers.

Hyundai Steel needs to carefully manage its production levels in response to these shifting demand patterns and intense competition. For instance, in 2023, global crude steel production reached 1.88 billion tonnes, a slight increase from 2022, indicating continued output despite oversupply concerns.

Prices for essential steelmaking inputs like iron ore and coking coal are inherently volatile. These fluctuations are driven by a mix of supply disruptions, international political situations, and changing global demand patterns. For instance, iron ore prices experienced significant swings in 2023, with benchmarks like the Singapore FOB 62% Fe index trading between $100-$130 per tonne for much of the year, reflecting these dynamic forces.

Looking ahead to 2024 and 2025, while some analysts anticipate a degree of stabilization or even marginal price declines for these commodities, the challenge for steel producers like Hyundai Steel in maintaining consistent profitability persists. This ongoing price uncertainty necessitates robust procurement strategies to effectively buffer the impact of these input cost variations.

South Korea's economic growth is projected to be modest for 2025, with a Q2 rebound fueled by exports and private consumption. This recovery, however, is tempered by ongoing challenges.

Hyundai Steel experienced a downturn in 2024, with lower net profit and sales revenue directly linked to a sluggish domestic construction market. This sector's weakness has a tangible impact on the company's financial results.

The company's fortunes are intrinsically linked to the vitality of crucial domestic industries, particularly construction and the automotive sector, which are key consumers of steel products.

Exchange Rate Fluctuations (Korean Won)

The Korean Won (KRW) has shown considerable volatility against the US dollar (USD). Analysts predict this weakness, or a sustained higher range for the KRW, could persist through 2025, influenced by global political shifts and South Korea's internal economic conditions. For Hyundai Steel, this economic factor presents a dual challenge and opportunity.

A weaker Won directly impacts Hyundai Steel's cost of imported raw materials, such as iron ore and coal, making these essential inputs more expensive. Conversely, this currency depreciation can boost the competitiveness of its steel products in international markets, potentially increasing export volumes and revenue.

- 2024 Forecasts: Many economists projected the KRW to trade in the 1,300-1,400 range against the USD for much of 2024, reflecting ongoing global economic uncertainties.

- Impact on Imports: For every 1% depreciation of the KRW, the cost of imported raw materials for steel production increases by a corresponding percentage.

- Export Competitiveness: A weaker Won can make South Korean steel exports, including those from Hyundai Steel, more attractive to buyers in countries with stronger currencies.

- Risk Management: Effectively managing this currency risk through hedging strategies is paramount for Hyundai Steel to stabilize its financial performance and protect profit margins.

Inflation and Interest Rate Environment

While South Korea's inflation is anticipated to stay within manageable levels, the Bank of Korea's monetary policy remains cautious due to significant household debt. This delicate balance means the central bank might explore interest rate adjustments to stimulate economic activity, directly impacting Hyundai Steel's borrowing expenses and the broader investment landscape.

For instance, as of early 2024, South Korea's consumer price index (CPI) saw moderate increases, but the persistent high levels of household debt, exceeding 100% of GDP, present a key constraint on aggressive rate cuts.

- Inflationary Pressures: South Korea's CPI has shown resilience, with projections for 2024 generally aligning with the Bank of Korea's target range, although global commodity price volatility remains a watchpoint.

- Monetary Policy Stance: The Bank of Korea's policy rate has been held steady through much of 2023 and early 2024, reflecting concerns over household debt alongside inflation management.

- Household Debt Impact: High household debt levels (over 100% of GDP) limit the central bank's flexibility for significant interest rate reductions, potentially keeping borrowing costs elevated for corporations like Hyundai Steel.

- Investment Climate: Fluctuations in interest rates directly influence capital expenditure decisions and the overall cost of financing for industrial companies, affecting Hyundai Steel's strategic planning and operational costs.

Global economic growth forecasts for 2024 and 2025 indicate a period of modest expansion, with developing nations, particularly India, expected to drive demand for steel through infrastructure development. However, the persistent oversupply in the global steel market continues to create price volatility, impacting profitability for companies like Hyundai Steel.

Hyundai Steel's financial performance in 2024 was notably affected by a sluggish domestic construction market, a key sector for steel consumption. The company's overall results are closely tied to the health of South Korea's automotive and construction industries.

The volatility of the Korean Won (KRW) against the US Dollar (USD) presents a dual challenge: increased costs for imported raw materials like iron ore and coal, but also enhanced competitiveness for its exports. This currency fluctuation necessitates careful risk management strategies.

South Korea's monetary policy, guided by the Bank of Korea, remains cautious due to high household debt levels, potentially limiting interest rate cuts. This could keep borrowing costs elevated for Hyundai Steel, influencing its investment and operational expenditures.

| Economic Factor | 2024 Data/Projection | 2025 Projection | Impact on Hyundai Steel |

|---|---|---|---|

| Global Steel Demand | Modest uptick, driven by developing nations | Continued modest growth | Potential for increased sales volume |

| Global Steel Oversupply | Persistent issue | Likely to continue | Price volatility, pressure on margins |

| Iron Ore/Coking Coal Prices | Volatile, trading between $100-$130/tonne (62% Fe) in 2023 | Anticipated stabilization or marginal decline | Input cost fluctuations affect profitability |

| South Korea GDP Growth | Modest recovery expected | Modest growth | Influences domestic demand for steel |

| KRW/USD Exchange Rate | Weakness predicted (1,300-1,400 range) | Sustained higher range possible | Increased import costs, enhanced export competitiveness |

| South Korea Inflation (CPI) | Within manageable levels, target range | Expected to remain stable | Influences consumer spending and investment |

| Bank of Korea Policy Rate | Held steady (early 2024) | Cautious adjustments possible | Impacts borrowing costs and investment climate |

| South Korea Household Debt | Over 100% of GDP | Remains a significant factor | Limits monetary policy flexibility, may keep borrowing costs higher |

Same Document Delivered

Hyundai Steel PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of Hyundai Steel provides a detailed examination of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It’s designed for immediate application in strategic planning and market analysis.

Sociological factors

South Korea's labor force participation rate saw a modest increase, reaching approximately 62.5% in early 2024, with the total labor force remaining robust. However, unemployment rates have seen some volatility, with youth unemployment, in particular, fluctuating around 7-8% in recent periods, highlighting ongoing adjustments within the market. The number of temporary and non-regular workers also continues to be a significant factor, representing a substantial portion of the workforce.

For Hyundai Steel, a key player in South Korea's heavy industry, these labor dynamics necessitate a strategic approach to talent management. Ensuring stable employment opportunities and implementing effective talent retention programs are crucial for maintaining operational efficiency and competitiveness. The company's ability to attract and keep skilled labor amidst these trends will be a key determinant of its long-term success.

Consumers and industries are increasingly prioritizing eco-friendly products, with a notable surge in demand for 'green steel' that boasts a reduced carbon footprint. This growing environmental consciousness is prompting steel manufacturers, including Hyundai Steel, to channel investments into more sustainable production processes.

For instance, by 2025, the global green steel market is projected to reach a significant valuation, reflecting this robust demand. Hyundai Steel's commitment to developing low-carbon steelmaking technologies, such as hydrogen-based direct reduced iron (DRI), directly addresses this societal shift. Successfully meeting this demand not only bolsters a company's market standing but also unlocks avenues for new business ventures and competitive advantages.

Hyundai Steel is deeply committed to social leadership, fostering a win-win culture by prioritizing a safe, healthy, and rights-respecting workplace. This focus extends to actively engaging with stakeholders to foster local community development and create broader social value.

The company's dedication to transparency and sustainability is evident in its consistent publication of annual Integrated Reports, a practice initiated in 2016. In its 2023 Integrated Report, Hyundai Steel highlighted a 98.9% safety management system compliance rate and invested KRW 53.1 billion in social contribution activities, underscoring its tangible commitment to societal well-being.

Safety and Health in Heavy Industry

Workplace safety and health are paramount in heavy industries like steel manufacturing, directly impacting employee well-being and operational efficiency. Hyundai Steel places a strong emphasis on these aspects, striving to create a secure and healthy environment for all its employees, which also extends to upholding human rights.

Adherence to rigorous safety protocols is not just a legal requirement but a fundamental sociological commitment. For instance, in 2023, the global manufacturing sector reported an average of 2.7 workplace injuries per 100 workers, highlighting the persistent need for robust safety measures. Hyundai Steel's proactive approach aims to significantly reduce this figure within its operations.

- Commitment to Safety: Hyundai Steel actively promotes safety, health, and human rights, fostering a positive work culture.

- Operational Continuity: Strict adherence to safety standards is vital for preventing disruptions and ensuring consistent production.

- Employee Well-being: A safe and healthy workplace is directly linked to employee morale, productivity, and retention.

- Industry Benchmarks: The company aims to meet and exceed industry safety benchmarks, recognizing the inherent risks in steel production.

Urbanization and Infrastructure Development Impact

South Korea's ongoing urbanization and infrastructure development significantly shape the demand for steel. As cities expand and public works projects progress, the need for steel plates and H-beams for construction remains a key driver for Hyundai Steel. While construction investment saw a dip, the fundamental trend of urban growth continues to underpin this demand.

In 2023, South Korea's construction investment experienced a contraction, but the long-term demographic shifts toward urban centers continue to generate a baseline demand for steel. For instance, the government's focus on smart city initiatives and housing supply projects, even with fluctuating investment levels, directly translates into opportunities for steel suppliers like Hyundai Steel.

- Urban Population Growth: South Korea's urban population continues to grow, driving demand for residential and commercial construction.

- Infrastructure Spending: Government plans for infrastructure upgrades, including transportation networks and public facilities, require substantial steel.

- Construction Sector Trends: Despite short-term fluctuations, the underlying need for building materials remains robust due to urbanization.

Societal values are increasingly emphasizing sustainability and corporate responsibility, influencing consumer choices and investor sentiment. Hyundai Steel's commitment to eco-friendly practices, such as developing low-carbon steelmaking technologies, directly addresses this shift, aligning with growing consumer demand for green products. The company's significant investment in social contribution activities, KRW 53.1 billion in 2023, further demonstrates its dedication to societal well-being and community development.

Technological factors

Hyundai Steel is heavily invested in hydrogen reduction steelmaking, a groundbreaking method that swaps coal for hydrogen to slash carbon emissions. This shift is crucial for their sustainability goals and aligns with global efforts to decarbonize heavy industry.

The South Korean government is backing this green initiative, aiming for a demonstration plant by 2030. This governmental support is vital for accelerating the technology's development and making it commercially viable, potentially transforming steel production.

This technological advancement positions Hyundai Steel at the forefront of low-carbon steel manufacturing. By 2025, the company plans to have its hydrogen-based pilot plant operational, showcasing its commitment to innovation and environmental responsibility.

The automotive sector, a cornerstone for Hyundai Steel, is experiencing a significant shift towards Advanced High-Strength Steel (AHSS). This trend is driven by the industry's pursuit of lighter, safer, and more fuel-efficient vehicles. For instance, by 2025, the average vehicle weight is projected to continue its downward trajectory, with AHSS playing a crucial role in achieving these targets.

Hyundai Steel's strategic emphasis on AHSS production is therefore paramount to satisfying the evolving demands of its automotive clientele. The company's investment in developing these specialized steel grades directly impacts its ability to secure and maintain partnerships with major automakers who are increasingly specifying AHSS content in their new models.

Ongoing research and development in AHSS technology are indispensable for Hyundai Steel to remain competitive. Innovations in areas like hot stamping and dual-phase steels, which offer superior strength-to-weight ratios, are key to differentiating its product offerings and capturing market share in this critical segment.

Hyundai Steel is known for its advanced production technologies, even if specific smart factory project details aren't widely publicized. The steel industry globally is pushing towards smart factory integration and automation. This move is driven by the need to boost efficiency, cut operational expenses, and ensure higher product consistency.

Resource Recycling and Circular Economy Technologies

Hyundai Steel is actively pursuing resource recycling and circular economy technologies to foster sustainable steel production and build a comprehensive circular ecosystem. This strategic focus involves integrating advanced technologies designed to maximize material reuse and significantly reduce waste generation throughout its operations.

The company's commitment to innovation in steel recycling is paramount for mitigating environmental consequences and enhancing overall resource efficiency. For instance, in 2023, Hyundai Steel reported a 95% recycling rate for its blast furnace slag, a key byproduct, which is then repurposed into cement and other construction materials, demonstrating a tangible application of circular economy principles.

Key technological advancements enabling this transition include:

- Advanced Scrap Pre-treatment: Technologies that improve the quality and usability of recycled steel scrap, reducing the need for virgin materials.

- Waste Heat Recovery Systems: Implementing systems that capture and reuse waste heat generated during steelmaking processes, improving energy efficiency and lowering carbon emissions.

- Byproduct Valorization: Developing innovative methods to convert steelmaking byproducts, such as dust and sludge, into valuable resources or raw materials for other industries.

- Digitalization for Resource Tracking: Utilizing digital platforms to monitor and manage material flows, identifying opportunities for increased recycling and waste reduction across the value chain.

Energy Efficiency in Production Processes

Hyundai Steel is actively pursuing technological advancements to enhance energy efficiency in its production processes. This focus is critical for both reducing operational costs and meeting increasingly stringent environmental regulations. For instance, by 2023, the company had invested significantly in upgrading its electric arc furnaces to more energy-efficient models, aiming to lower electricity consumption per ton of steel produced.

Further technological development includes exploring and implementing fuel substitution strategies, such as increasing the use of natural gas and potentially hydrogen in its blast furnaces. This transition is a key component of Hyundai Steel's broader decarbonization strategy, with ongoing research into hydrogen reduction technology expected to yield substantial emissions reductions in the coming years.

These initiatives are not just about sustainability; they directly impact the bottom line.

- Investments in high-efficiency electric arc furnaces are ongoing, targeting a reduction in energy consumption.

- Fuel substitution, including the integration of natural gas and research into hydrogen, is a core strategy.

- Development of hydrogen reduction technology aims to significantly lower carbon emissions in steelmaking.

- These technological improvements are designed to achieve both operational cost savings and enhanced environmental performance.

Hyundai Steel is pioneering hydrogen reduction steelmaking, aiming to replace coal with hydrogen for reduced carbon emissions, a critical step for sustainability and global decarbonization efforts in heavy industry.

The company is also focusing on Advanced High-Strength Steel (AHSS) to meet the automotive sector's demand for lighter, safer, and more fuel-efficient vehicles, with ongoing R&D in areas like hot stamping crucial for competitiveness.

Hyundai Steel is actively integrating smart factory technologies to boost efficiency and product consistency, alongside pursuing resource recycling and circular economy principles, evidenced by a 95% recycling rate for blast furnace slag in 2023.

Investments in high-efficiency electric arc furnaces and fuel substitution, including natural gas and hydrogen research, are key to reducing energy consumption and carbon emissions, directly impacting operational costs and environmental performance.

| Technology Area | Key Initiatives | Projected Impact/Status |

|---|---|---|

| Hydrogen Reduction Steelmaking | Pilot plant development, government support | Demonstration plant by 2030; Hydrogen-based pilot plant operational by 2025 |

| Advanced High-Strength Steel (AHSS) | R&D in hot stamping, dual-phase steels | Meeting automotive demand for lighter vehicles; enhancing competitiveness |

| Smart Factory & Automation | Global industry trend, focus on efficiency | Boosting efficiency, cutting operational expenses, ensuring product consistency |

| Resource Recycling & Circular Economy | Scrap pre-treatment, waste heat recovery, byproduct valorization | 95% slag recycling rate (2023); reducing waste, enhancing resource efficiency |

| Energy Efficiency | Upgrading electric arc furnaces, fuel substitution | Lowering electricity consumption per ton; exploring natural gas and hydrogen integration |

Legal factors

South Korea has implemented provisional anti-dumping duties on hot-rolled steel plates originating from China and Japan, with duty rates varying considerably. These measures are a direct response to unfair trade practices that could harm domestic industries.

Hyundai Steel played a pivotal role in this development, lodging a formal complaint in July 2024, which initiated the investigations leading to these duties. The company's action underscores the importance of safeguarding its market position.

These legal frameworks are essential for maintaining fair competition within the steel sector. By imposing these duties, South Korea aims to prevent the influx of unfairly priced imported steel, thereby protecting its own manufacturers and ensuring a more equitable market environment.

The United States' re-imposition of a 25% tariff on South Korean steel imports significantly affects Hyundai Steel's export plans. This trade barrier directly impacts the competitiveness of its products in the crucial US market, forcing a strategic re-evaluation.

South Korea's government is actively engaged in diplomatic discussions to secure exemptions or more favorable trade terms for its steel industry. These negotiations are vital for mitigating the financial impact of tariffs on companies like Hyundai Steel.

To circumvent these trade obstacles, Hyundai Steel is exploring options such as establishing production facilities within the United States. This strategy aims to localize production and reduce exposure to international trade disputes and tariffs, a move that could involve substantial capital investment in the coming years.

Stricter environmental laws, particularly those concerning carbon emissions, are reshaping the steel industry. For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), fully implemented in 2026, will levy charges on carbon-intensive imports, directly impacting steel producers like Hyundai Steel. This mechanism, alongside national targets for emissions reduction, is pushing for greener steelmaking processes.

These evolving legal frameworks necessitate significant investment in low-carbon technologies. Failure to adapt could lead to penalties and reduced access to key export markets, especially in regions with stringent environmental policies. Hyundai Steel's strategic response to these regulations, including its investments in hydrogen-based steelmaking technologies, will be crucial for its future competitiveness and market positioning.

Labor Laws and Workplace Safety Standards

Hyundai Steel operates under South Korea's comprehensive labor laws, which dictate terms of employment, minimum wages, working hours, and crucial workplace safety standards. Adhering to these legal mandates is fundamental for ethical operations and fostering a stable workforce. For instance, South Korea's Occupational Safety and Health Act requires employers to implement measures to prevent industrial accidents and protect worker health, a framework Hyundai Steel actively navigates.

Compliance ensures Hyundai Steel maintains a positive relationship with its employees and avoids penalties. The company's stated commitment to safety, health, and human rights directly reflects its legal obligations. In 2023, South Korea saw a continued focus on improving industrial safety, with government initiatives aimed at reducing workplace fatalities in heavy industries, a sector where Hyundai Steel is a major player.

- Labor Law Compliance: Hyundai Steel must adhere to South Korea's Labor Standards Act, covering wages, working hours, and dismissal regulations.

- Workplace Safety: The company is obligated by the Occupational Safety and Health Act to provide a safe working environment, including hazard prevention and safety training.

- Human Rights Integration: Legal frameworks increasingly require businesses to uphold human rights throughout their operations, impacting supply chain and employment practices.

- Recent Regulatory Focus: In 2024, there's an ongoing emphasis on strengthening safety regulations in manufacturing and heavy industries, potentially impacting operational costs and procedures for companies like Hyundai Steel.

Product Liability and Quality Standards

Hyundai Steel, as a key supplier to the automotive and construction industries, faces significant legal obligations regarding product liability and quality. Adherence to these standards is paramount, especially given the increasing demand for advanced high-strength steels that enhance vehicle safety and durability. For example, the automotive sector's focus on meeting stringent crashworthiness standards directly impacts the specifications Hyundai Steel must achieve.

Failure to meet these quality benchmarks can result in substantial legal repercussions, including costly lawsuits and damage to the company's reputation. In 2024, the global automotive industry continued to emphasize safety features, with regulatory bodies worldwide reinforcing standards for vehicle components. This trend necessitates that steel manufacturers like Hyundai Steel maintain rigorous quality control and robust product liability frameworks to ensure compliance and mitigate risks.

- Product Integrity is Non-Negotiable: Hyundai Steel's commitment to quality directly affects its legal standing, particularly in sectors with high safety expectations.

- Automotive Safety Demands: The push for advanced high-strength steels in vehicles, driven by safety regulations, requires strict adherence to quality and liability standards.

- Reputational and Financial Risks: Non-compliance can lead to severe legal disputes and damage Hyundai Steel's market credibility.

- Global Regulatory Landscape: Evolving international safety and quality regulations, particularly in the automotive sector, demand continuous adaptation and stringent oversight.

South Korea's trade protection measures, like the anti-dumping duties on Chinese and Japanese hot-rolled steel plates initiated by Hyundai Steel's complaint in July 2024, highlight the legal battles shaping the industry. Conversely, the US re-imposition of a 25% tariff on South Korean steel in 2024 directly challenges Hyundai Steel's export strategies, prompting diplomatic efforts for exemptions.

Stricter environmental regulations, such as the EU's CBAM fully implemented in 2026, will impose carbon charges on imports, compelling Hyundai Steel to invest in greener technologies to avoid penalties and market exclusion.

Hyundai Steel must navigate South Korea's labor laws, including the Occupational Safety and Health Act, to ensure worker safety and compliance, especially with the 2024 focus on reducing industrial accidents in heavy industries.

Product liability and quality standards are critical, particularly in the automotive sector, where evolving safety regulations in 2024 demand adherence to advanced high-strength steel specifications, with non-compliance risking legal action and reputational damage.

Environmental factors

Hyundai Steel is making significant strides towards carbon neutrality, investing heavily in hydrogen reduction steelmaking technology to slash CO2 emissions. This commitment is clearly outlined in their sustainability reports, showcasing a strategic shift towards a low-carbon production model.

The global demand for 'green steel' is accelerating, pushing industries like Hyundai Steel to move beyond traditional coal-reliant production. This transition involves adopting new technologies, such as hydrogen direct reduction, a process that significantly lowers carbon emissions.

Hyundai Steel is actively investing in these greener technologies, recognizing the long-term imperative. However, the path forward isn't without hurdles, including the substantial upfront costs associated with these advanced methods and the critical need for a reliable and abundant supply of renewable energy to power them.

Government policies and financial incentives are proving vital in making this shift economically viable. For instance, in 2024, several nations announced substantial funding packages and tax credits aimed at decarbonizing heavy industries, directly impacting the feasibility of green steel initiatives for companies like Hyundai Steel.

Hyundai Steel is actively working to build a circular economy by prioritizing resource recycling and sustainable steelmaking. This means they're focused on cutting down waste and making sure materials are reused as much as possible within their own processes.

These efforts directly support environmental sustainability and make their use of resources more efficient, fitting perfectly with the larger ideas behind a circular economy. For instance, in 2023, Hyundai Steel reported a significant increase in the utilization rate of its by-products, reaching 95% in certain production lines, demonstrating a tangible commitment to resource reuse.

Water Usage and Pollution Control

Hyundai Steel, as a major industrial entity, faces significant scrutiny regarding its water usage and potential for pollution. For instance, in 2023, the company reported its total water withdrawal across its facilities, with a focus on optimizing consumption in its production processes. Strict adherence to environmental regulations, such as those governing wastewater discharge quality and treatment standards, is paramount to its operational license and public image.

The company's environmental management approach typically incorporates strategies to mitigate its water footprint. This includes investments in advanced water treatment technologies and closed-loop systems to recycle and reuse water, thereby minimizing both consumption and effluent discharge. Hyundai Steel's commitment to sustainability in 2024 is reflected in its ongoing efforts to reduce the environmental impact of its water management practices.

- Water Withdrawal Optimization: Hyundai Steel is actively working to reduce its overall water withdrawal by implementing efficiency measures in cooling and processing operations.

- Wastewater Treatment Standards: The company must meet stringent national and international standards for pollutants in its discharged water, requiring robust treatment infrastructure.

- Pollution Prevention Investments: Ongoing investments in advanced wastewater treatment plants and spill prevention protocols are crucial for environmental compliance and risk management.

Climate Change Adaptation and Resilience

Hyundai Steel, like all major steel producers, must contend with the evolving realities of climate change. This includes potential disruptions to raw material sourcing, such as iron ore and coking coal, due to altered weather patterns and resource availability. Extreme weather events, like intensified storms or prolonged droughts, can directly impact manufacturing facilities and logistics, leading to operational delays and increased costs. For instance, the World Meteorological Organization reported that the economic losses from weather and climate-related disasters in 2023 alone were estimated to be in the tens of billions of dollars, highlighting the tangible risks.

In response, Hyundai Steel's long-term sustainability initiatives focus on building resilience. This involves fortifying its production processes and supply chains against climate-related shocks. The company is actively exploring and investing in technologies that not only reduce its environmental footprint but also enhance its ability to withstand climate impacts. This proactive approach is crucial for maintaining operational continuity and market competitiveness in an increasingly climate-conscious global economy.

Investing in eco-friendly technologies serves a dual purpose: it's a key climate change mitigation strategy and a driver of operational resilience. For example, advancements in green hydrogen production for steelmaking, a sector Hyundai Steel is exploring, promise to significantly cut emissions while potentially diversifying energy sources away from fossil fuels vulnerable to climate-related supply disruptions. The International Energy Agency noted in its 2024 outlook that investments in clean energy technologies are accelerating globally, a trend Hyundai Steel is aligning with to secure its future operations.

- Raw Material Volatility: Climate change can impact the extraction and transportation of key steelmaking inputs like iron ore and coal.

- Operational Disruptions: Extreme weather events pose a direct threat to manufacturing plants and logistics networks.

- Supply Chain Resilience: Hyundai Steel is investing in strategies to ensure its supply chains can withstand climate-related disruptions.

- Green Technology Investment: Adoption of eco-friendly technologies aids both emissions reduction and adaptation to changing environmental conditions.

Hyundai Steel is prioritizing sustainability, investing in green steel technologies like hydrogen reduction to cut emissions, aligning with global demand for environmentally friendly products. The company's commitment is evident in its 2023 report of a 95% by-product utilization rate in some lines, showcasing a strong focus on resource efficiency and circular economy principles.

PESTLE Analysis Data Sources

Our Hyundai Steel PESTLE Analysis is built on a comprehensive review of data from reputable sources including government economic reports, international trade organizations, and leading industry publications. We integrate insights from regulatory updates, market research firms, and technological trend analyses to provide a robust understanding of the macro-environment.