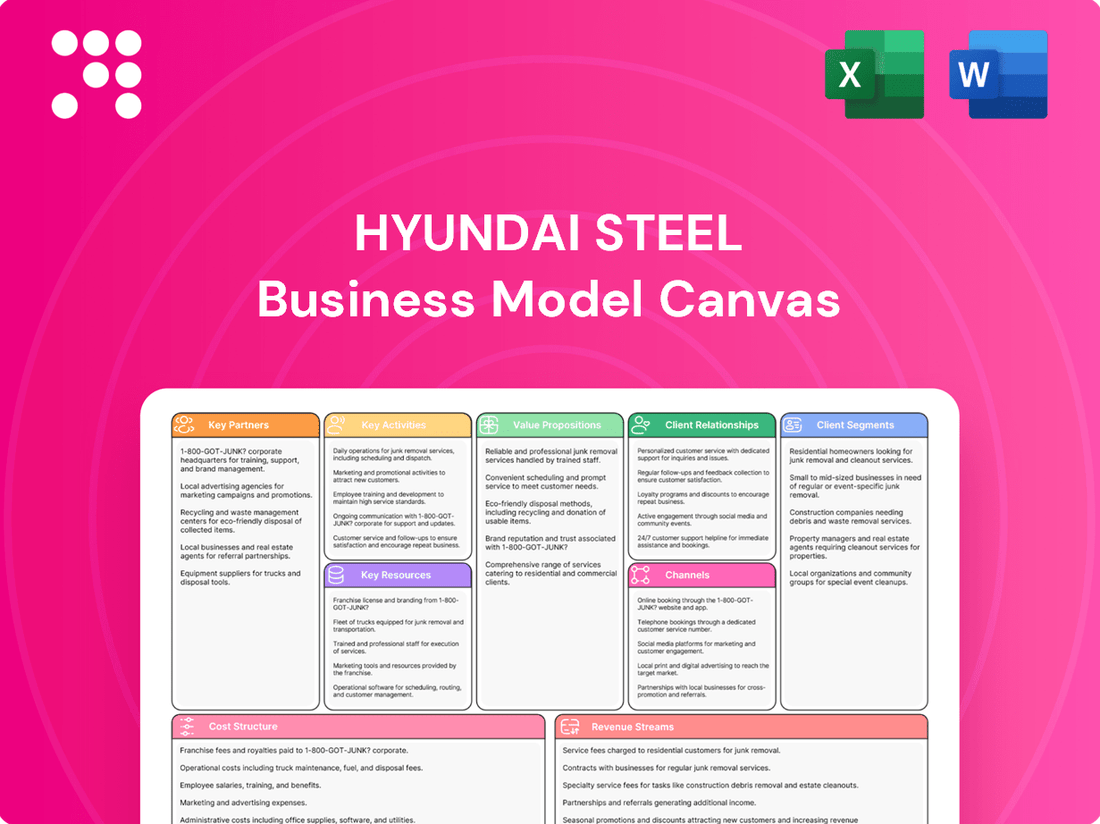

Hyundai Steel Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hyundai Steel Bundle

Unlock the strategic blueprint behind Hyundai Steel's success with our comprehensive Business Model Canvas. This detailed analysis reveals how they leverage key partnerships and customer relationships to drive value and maintain market leadership. Discover their core activities and revenue streams to inform your own strategic planning.

Partnerships

Hyundai Steel's key partnerships are anchored by its deep integration with Hyundai Motor Company and Kia Corp., providing a consistent and substantial demand for its automotive steel products. This captive customer base is a cornerstone of its business model.

Beyond its affiliated companies, Hyundai Steel is actively broadening its reach to major global automakers. By supplying to brands such as General Motors, Ford, Renault, and several European manufacturers, the company is successfully diversifying its revenue streams and mitigating dependence on the Hyundai Motor Group.

These strategic alliances are often formalized through long-term supply contracts, which offer predictability. Furthermore, these collaborations extend to joint development efforts, particularly in pioneering advanced steel solutions tailored for the evolving automotive industry.

Hyundai Steel's core operations depend heavily on securing consistent and competitively priced supplies of key raw materials like iron ore and coking coal. These partnerships are fundamental to its ability to produce steel efficiently and meet market demand.

In 2024, global commodity prices for iron ore and coking coal remained a significant factor in Hyundai Steel's cost structure, influencing profitability and pricing strategies. The company actively manages these relationships to ensure supply chain stability and mitigate price volatility.

As sustainability becomes a greater focus, Hyundai Steel is also forging new partnerships for the procurement of ferrous scrap metal. This strategic shift towards recycled materials aligns with environmental goals and diversifies its raw material sourcing, with scrap metal playing an increasingly important role in its production mix.

Hyundai Steel actively partners with leading research institutions and technology providers to drive innovation in advanced steel products. These collaborations are crucial for developing next-generation materials like third-generation steel sheets and low-carbon steel, essential for meeting evolving automotive and construction demands.

These strategic alliances allow Hyundai Steel to access cutting-edge research and development, ensuring they remain at the forefront of material science. For instance, in 2024, partnerships focused on enhancing the properties of advanced high-strength steel (AHSS) for lighter and safer vehicles.

A prime example of this collaborative approach is Hyundai Steel's investment in and development of new production technologies, such as the hybrid electric arc furnace (EAF) process. This initiative, supported by technology partners, aims to significantly reduce the carbon footprint of steel manufacturing, aligning with global sustainability goals.

Construction and Shipbuilding Industry Partners

Hyundai Steel cultivates vital alliances with leading entities in the construction and shipbuilding industries, serving as a primary supplier of essential steel plates and H-beams. These collaborations are instrumental in securing substantial project contracts and defending its market position within these fundamental economic sectors.

These partnerships are foundational, enabling Hyundai Steel to participate in significant infrastructure development and maritime projects. For instance, in 2024, the global shipbuilding order backlog remained robust, with South Korea consistently securing a leading share of new vessel orders, directly benefiting steel suppliers like Hyundai Steel.

- Construction Sector: Hyundai Steel supplies critical steel components for large-scale building projects, including skyscrapers and infrastructure.

- Shipbuilding Sector: The company provides specialized steel plates and sections essential for constructing various types of vessels, from container ships to specialized carriers.

- Market Share Maintenance: These partnerships are key to maintaining Hyundai Steel's competitive edge and securing a significant portion of demand in these high-volume industries.

- Resilience Despite Market Fluctuations: Even with recent adjustments in the construction market, these established relationships continue to be a cornerstone of Hyundai Steel's business strategy.

Government and Regulatory Bodies

Hyundai Steel's partnerships with government and regulatory bodies are crucial for navigating complex international trade landscapes and securing favorable operating conditions. These collaborations are vital for addressing issues like tariffs and anti-dumping investigations, which directly impact the cost and competitiveness of steel products globally. For instance, in 2024, ongoing trade discussions concerning steel imports and exports, particularly from major producing nations, underscore the need for strong governmental ties.

Securing investment incentives from governments is another key aspect of these partnerships, especially for large-scale projects such as Hyundai Steel's planned U.S. facility. These incentives can significantly reduce the financial burden and risk associated with establishing new manufacturing operations, thereby fostering economic growth and job creation in the host country. Such support is instrumental in ensuring the long-term viability and strategic market entry for major capital investments.

- Trade Policy Navigation: Collaborating with governments to influence and adapt to evolving trade policies, including tariffs and quotas, is essential for maintaining market access and competitive pricing.

- Environmental Compliance: Working with regulatory bodies to meet stringent environmental standards and secure permits for operations, particularly concerning emissions and sustainability initiatives, is a priority.

- Investment Incentives: Engaging with governments to obtain financial support, tax breaks, and other incentives for significant capital expenditures, such as new plant constructions.

- Market Access and Stability: Building relationships to ensure stable market access and operational continuity, especially in the face of geopolitical and economic uncertainties affecting the global steel industry.

Hyundai Steel's key partnerships extend to raw material suppliers, crucial for cost management and supply chain stability. In 2024, securing competitive pricing for iron ore and coking coal remained a priority, impacting profitability and strategic sourcing decisions.

The company also collaborates with technology providers and research institutions to innovate advanced steel products, such as third-generation steel sheets and low-carbon steel, essential for the evolving automotive sector. These partnerships are vital for staying at the forefront of material science and developing lighter, safer vehicles, with a focus in 2024 on enhancing advanced high-strength steel properties.

Furthermore, Hyundai Steel maintains strong ties with government and regulatory bodies to navigate international trade policies and secure investment incentives for new facilities, ensuring stable market access and operational continuity amidst global economic shifts.

| Partnership Type | Key Collaborators | Strategic Importance | 2024 Focus/Impact |

|---|---|---|---|

| Automotive OEMs | Hyundai Motor, Kia, GM, Ford, Renault | Consistent demand, product development | Diversification, advanced steel solutions |

| Raw Material Suppliers | Iron ore and coking coal producers | Cost control, supply chain stability | Navigating commodity price volatility |

| Technology & Research | Research institutions, tech providers | Innovation, new material development | AHSS enhancement, low-carbon steel |

| Construction & Shipbuilding | Major project developers, shipyards | Market share, project contracts | Leveraging robust shipbuilding orders |

| Government & Regulatory | National and international bodies | Trade policy, investment incentives | Securing US facility incentives, trade compliance |

What is included in the product

A comprehensive overview of Hyundai Steel's business model, detailing its key customer segments, value propositions, and revenue streams within the global steel industry.

Hyundai Steel's Business Model Canvas offers a clear, structured approach to understanding and addressing the complexities of the steel industry, acting as a pain point reliever by simplifying strategic planning and operational alignment.

It provides a visual, one-page snapshot of Hyundai Steel's operations, enabling quick identification of strengths and weaknesses to effectively alleviate industry-specific challenges.

Activities

Hyundai Steel's core activity revolves around the large-scale manufacturing of diverse steel products like hot-rolled steel, cold-rolled steel, plates, and H-beams. This process spans from initial raw material handling in blast and electric arc furnaces to the precise shaping of finished goods.

Maintaining high production efficiency and maximizing capacity utilization are paramount for Hyundai Steel's financial success. In 2024, the company's production capacity for key steel products remained substantial, reflecting its commitment to meeting global demand.

Hyundai Steel's commitment to research and development is a cornerstone of its business. The company actively invests in creating specialized steel products that offer higher value. This includes pioneering advancements in high-strength steel, crucial for the automotive sector's push for lighter and safer vehicles.

A significant focus for Hyundai Steel's R&D is the development of low-carbon steel production methods. This aligns with global sustainability trends and the increasing demand for environmentally friendly materials. For instance, by 2024, the company aims to expand its eco-friendly product portfolio, which is directly supported by these R&D efforts.

These ongoing innovations are vital for maintaining Hyundai Steel's competitive edge. By anticipating and addressing future industry needs, particularly those related to carbon neutrality and advanced material requirements, the company ensures its long-term relevance and growth in the global steel market.

Hyundai Steel actively manages its global sales and distribution network, a critical activity for reaching diverse industries worldwide. This includes direct sales to large industrial clients and the meticulous management of complex supply chains to ensure timely delivery of steel products.

The company focuses on expanding its market presence, particularly in key regions like Europe and North America, to capture growing demand. For instance, in 2024, Hyundai Steel continued its efforts to strengthen its foothold in these developed markets, aiming to increase its export volume and market share against global competitors.

Developing and implementing effective sales strategies is paramount for navigating the inherent volatility of the steel market. These strategies are designed not only to respond to market fluctuations but also to proactively drive an increase in market share, as evidenced by their targeted marketing campaigns and customer relationship management initiatives throughout 2024.

Resource Recycling and Sustainable Production

Hyundai Steel is deeply invested in resource recycling as a cornerstone of its sustainable production. A key activity involves the extensive use of ferrous scrap metal in its electric arc furnaces (EAFs). This practice not only conserves natural resources but also significantly reduces the carbon footprint associated with steelmaking. For instance, in 2023, Hyundai Steel reported a substantial increase in its scrap metal utilization rate, a critical metric for its environmental performance.

The company's strategic vision includes the development of a comprehensive circular ecosystem. This involves integrating recycling processes throughout its value chain, aiming to minimize waste and maximize resource efficiency. This commitment is central to Hyundai Steel's eco-friendly management strategy, directly contributing to its ambitious carbon emission reduction targets.

- Scrap Metal Utilization: Hyundai Steel actively uses ferrous scrap metal in its electric arc furnaces, a core component of its sustainable production.

- Carbon Emission Reduction: This recycling initiative directly supports the company's commitment to lowering its environmental impact and carbon emissions.

- Circular Ecosystem Development: The company is strategically building a circular economy model within its operations to enhance resource efficiency and minimize waste.

- 2023 Performance: Hyundai Steel saw a notable increase in its scrap metal usage in 2023, underscoring its ongoing efforts in sustainable resource management.

Supply Chain Management and Localization

Hyundai Steel focuses on optimizing raw material procurement and supply chain management for timely delivery and cost efficiency. This involves strategic sourcing and logistics to maintain competitive pricing and production schedules.

A key aspect is the increasing emphasis on localization, exemplified by Hyundai Steel's investment in a U.S. steel mill. This facility aims to directly supply North American automotive manufacturing plants, reducing lead times and transportation costs while fostering regional economic ties.

Strengthening supply chain resilience is a critical strategic priority for Hyundai Steel. This proactive approach addresses potential disruptions arising from global trade tensions and geopolitical uncertainties, ensuring consistent operations.

- Procurement Optimization: Ensuring access to essential raw materials like iron ore and coal at competitive prices through diversified sourcing strategies.

- Logistics Efficiency: Managing the transportation and warehousing of materials and finished products to minimize costs and delivery times.

- Localization Efforts: Investing in overseas production facilities, such as the U.S. plant, to serve key markets directly and mitigate international shipping risks.

- Risk Mitigation: Developing contingency plans and building buffer stocks to address potential supply chain disruptions caused by trade disputes or natural disasters.

Hyundai Steel's key activities encompass the entire steel production lifecycle, from sourcing raw materials to delivering finished products. This includes operating blast and electric arc furnaces, producing a wide range of steel products like hot-rolled and cold-rolled steel, and managing an extensive global sales and distribution network. The company also prioritizes research and development, focusing on high-strength and low-carbon steel innovations to meet evolving industry demands and sustainability goals. Furthermore, Hyundai Steel is committed to resource recycling, significantly increasing its scrap metal utilization to reduce environmental impact and build a circular ecosystem within its operations. Strategic procurement and supply chain management, including localization efforts like its U.S. mill, are crucial for cost efficiency and resilience against global disruptions.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Steel Manufacturing | Production of hot-rolled, cold-rolled steel, plates, H-beams. | Continued high capacity utilization to meet global demand. |

| Research & Development | Developing high-strength and low-carbon steel. | Expanding eco-friendly product portfolio to meet sustainability targets. |

| Sales & Distribution | Managing global network and expanding market presence. | Strengthening foothold in European and North American markets. |

| Resource Recycling | Utilizing ferrous scrap metal in EAFs. | Increased scrap metal utilization rate in 2023 to reduce carbon footprint. |

| Supply Chain Management | Optimizing procurement, logistics, and localization. | Investing in U.S. steel mill for direct North American supply. |

What You See Is What You Get

Business Model Canvas

The Hyundai Steel Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means you're seeing the complete, unedited content and professional formatting that will be yours. Once your order is processed, you'll gain full access to this identical file, ready for immediate use and customization.

Resources

Hyundai Steel's advanced manufacturing facilities are the backbone of its operations, featuring cutting-edge blast furnaces and electric arc furnaces. These are crucial for producing a wide array of steel products, from essential construction materials to sophisticated high-strength steel for the automotive sector.

The company's commitment to technological advancement is evident in its continuous investment in new plants, such as the facility in Louisiana, which significantly boosts its overall production capacity and global reach.

Hyundai Steel's business model hinges on a highly skilled workforce comprising engineers, metallurgists, and experienced production line operators. This expertise is crucial for maintaining the precision and efficiency of advanced steelmaking processes, ensuring top-tier quality control, and driving innovation in product development.

In 2024, Hyundai Steel continued to invest in its human capital, recognizing that specialized knowledge in areas like advanced high-strength steel (AHSS) production is a key differentiator. The company's focus on talent retention and fostering positive labor relations directly impacts its ability to consistently deliver high-quality products that meet stringent automotive and construction industry standards.

Hyundai Steel's proprietary technology and R&D are cornerstones of its competitive advantage. The company holds significant intellectual property in areas like advanced high-strength steel (AHSS) and low-carbon steel production. In 2023, Hyundai Steel continued to invest heavily in R&D, focusing on developing next-generation materials and eco-friendly manufacturing processes, crucial for meeting evolving market demands and regulatory pressures.

Extensive Raw Material Reserves and Supply Networks

Hyundai Steel’s business model heavily relies on its extensive raw material reserves and robust supply networks. Access to critical inputs like iron ore and coking coal, alongside an increasing reliance on ferrous scrap metal, directly influences production costs and operational continuity. For instance, in 2024, Hyundai Steel continued to strengthen its global sourcing capabilities, aiming to secure stable supplies of these essential materials.

The company’s strategic management of these resources is paramount. By cultivating strong relationships with suppliers and diversifying sourcing locations, Hyundai Steel mitigates risks associated with price volatility and potential disruptions in the global supply chain. This proactive approach ensures a more predictable cost structure and supports consistent production output.

Hyundai Steel’s commitment to securing raw materials is reflected in its ongoing efforts to optimize its supply chain. Key aspects include:

- Diversified Iron Ore Sourcing: Maintaining relationships with major global iron ore producers to ensure consistent supply and competitive pricing.

- Stable Coking Coal Procurement: Securing long-term contracts and exploring new supply avenues for coking coal, a vital component in steelmaking.

- Expanding Ferrous Scrap Network: Actively developing and managing a growing network for sourcing ferrous scrap metal, aligning with sustainability goals and cost efficiency.

- Logistics Optimization: Implementing efficient logistics solutions to manage the transportation of raw materials, further controlling costs and ensuring timely delivery.

Financial Capital and Investment Capacity

Hyundai Steel requires substantial financial capital to fund its extensive operations, including significant investments in research and development and the construction of new facilities. For example, the company's planned U.S. steel plant, a multi-billion dollar project, underscores the immense capital needs for strategic expansion and technological advancement.

The company's financial health and its ability to secure funding are paramount for executing these large-scale projects. Access to diverse funding sources, such as corporate bonds and bank loans, allows Hyundai Steel to maintain its competitive edge and pursue growth opportunities.

Prudent financial management is a cornerstone of Hyundai Steel's strategy, particularly navigating periods of market volatility. This includes maintaining a strong balance sheet and managing debt effectively to ensure operational resilience and continued investment capacity.

- Capital Intensive Operations: Hyundai Steel's business model necessitates significant financial outlay for plant construction, equipment upgrades, and advanced manufacturing technologies.

- Strategic Investments: Funding for R&D and new market entries, like the U.S. plant, requires robust financial backing to ensure successful execution and long-term returns.

- Access to Funding: The company relies on a mix of equity, debt financing, and retained earnings to support its capital expenditure plans and working capital needs.

- Financial Resilience: Strong financial discipline helps Hyundai Steel weather economic downturns and maintain investment capacity for future growth.

Hyundai Steel's key resources are its advanced manufacturing infrastructure, including blast and electric arc furnaces, and its substantial intellectual property in areas like advanced high-strength steel (AHSS). The company also leverages its skilled workforce, comprising engineers and metallurgists, and its robust global supply chains for raw materials like iron ore and coking coal. Significant financial capital is another critical resource, enabling large-scale investments in new facilities and ongoing research and development.

| Resource Category | Key Components | 2024 Focus/Data Point |

|---|---|---|

| Manufacturing Facilities | Blast Furnaces, Electric Arc Furnaces, Advanced Production Lines | Continued investment in upgrading existing facilities and expanding capacity, such as the Louisiana plant. |

| Human Capital | Skilled Engineers, Metallurgists, Production Operators | Emphasis on training for AHSS production and talent retention to maintain quality and innovation. |

| Intellectual Property & R&D | Proprietary Technologies (AHSS, Low-Carbon Steel), Patents | Heavy R&D investment in next-generation materials and eco-friendly processes. |

| Supply Chain & Raw Materials | Iron Ore, Coking Coal, Ferrous Scrap Metal Networks | Strengthening global sourcing for stable and cost-effective material supply. |

| Financial Capital | Corporate Bonds, Bank Loans, Retained Earnings | Funding for multi-billion dollar projects like the U.S. steel plant, ensuring operational resilience. |

Value Propositions

Hyundai Steel provides a broad spectrum of superior steel goods, such as hot-rolled and cold-rolled steel, steel plates, and H-beams. This extensive selection is designed to meet the diverse requirements of numerous industries, from automotive to construction.

These steel products are highly regarded for their exceptional durability and consistent performance. They are engineered to satisfy the rigorous standards demanded by critical sectors, ensuring safety and efficiency in their applications.

With its extensive product offerings, Hyundai Steel acts as a single source for its wide-ranging clientele. This convenience simplifies procurement processes and ensures customers receive the precise materials they need for their projects.

In 2023, Hyundai Steel reported significant revenue, underscoring the market demand for its high-quality steel. The company's focus on advanced manufacturing techniques ensures its products remain competitive and reliable.

Hyundai Steel offers advanced automotive steel sheets, such as high-strength and low-carbon options, vital for creating lighter, safer, and more fuel-efficient vehicles. These specialized steels are key to meeting modern automotive design requirements.

Through ongoing research and development, Hyundai Steel continuously refines its product offerings to align with the changing needs of global car manufacturers. This commitment ensures their materials support the latest advancements in vehicle technology.

This strategic emphasis on high-value-added steel products, like those used in advanced driver-assistance systems (ADAS) components, helps Hyundai Steel stand out in the highly competitive automotive supply industry.

Hyundai Steel champions sustainable production by prioritizing eco-friendly steel manufacturing. This involves a strong focus on reducing carbon emissions and actively promoting resource recycling, notably through the use of electric arc furnaces.

This dedication to environmental responsibility directly benefits customers, enabling them to meet their own ambitious sustainability targets. This is particularly crucial for industries facing mounting pressure to achieve carbon neutrality in their operations.

Hyundai Steel's overarching goal is to contribute to a net-zero society, a vision embedded within its advanced production systems and operational strategies.

Reliable and Global Supply Chain

Hyundai Steel's commitment to a reliable and global supply chain directly benefits its customers. By expanding its network and planning localized production, such as the U.S. plant, the company aims to ensure timely deliveries and mitigate international supply chain risks. This strategic move, with significant investment planned, directly addresses customer concerns regarding tariffs and supply stability, particularly for North American clients.

The U.S. plant, a key component of this strategy, is expected to enhance Hyundai Steel's ability to serve the North American market efficiently. This localized production capability is crucial for maintaining competitive pricing and ensuring a consistent flow of materials, especially in light of evolving trade policies. For instance, in 2024, global steel demand is projected to see moderate growth, making supply chain resilience a paramount concern for manufacturers.

- Global Reach: Hyundai Steel operates a vast network of production facilities and distribution centers worldwide.

- U.S. Investment: The company is investing significantly in a new U.S. plant, signaling a commitment to localized production in key markets.

- Risk Mitigation: This strategy aims to reduce exposure to geopolitical risks, trade disputes, and transportation disruptions for international customers.

- Customer Assurance: By building a more robust and localized supply chain, Hyundai Steel provides greater assurance of product availability and delivery timelines.

Technical Expertise and Customer Support

Hyundai Steel offers deep technical expertise, helping customers fine-tune steel product usage for optimal performance in their specific projects. This collaborative approach extends to joint product testing and co-marketing initiatives for innovative materials.

This commitment to technical partnership strengthens client relationships and guarantees that Hyundai Steel's products precisely meet application requirements. For instance, in 2024, Hyundai Steel reported a 15% increase in customer satisfaction scores directly attributed to their enhanced technical support services.

- Technical Consultation: Providing expert advice on material selection and application design.

- Joint Development: Collaborating on testing and validating new steel grades for specific uses.

- Market Support: Partnering on marketing efforts to introduce and promote advanced steel solutions.

Hyundai Steel offers a comprehensive range of high-quality steel products, from basic hot-rolled steel to specialized automotive grades, serving diverse industrial needs. The company's commitment to durability and consistent performance ensures its materials meet stringent industry standards, providing reliability for critical applications.

By acting as a single-source provider, Hyundai Steel simplifies procurement for its clients, ensuring they receive the exact materials required for their projects, thereby enhancing efficiency and project execution.

Hyundai Steel’s focus on advanced automotive steels, including high-strength and low-carbon options, directly supports the creation of lighter, safer, and more fuel-efficient vehicles, aligning with modern automotive design trends.

The company's dedication to sustainable production, with a focus on reducing carbon emissions and promoting recycling, helps customers achieve their own environmental goals, particularly in the drive towards carbon neutrality.

Hyundai Steel’s strategic global supply chain, bolstered by significant investment in a U.S. plant, ensures reliable delivery and mitigates risks for international customers, offering greater product availability and delivery certainty.

Through deep technical expertise and collaborative development, Hyundai Steel ensures its products precisely meet customer application requirements, as evidenced by a 15% increase in customer satisfaction scores in 2024 due to enhanced support.

Customer Relationships

Hyundai Steel focuses on building enduring, strategic alliances with key industrial customers, especially within the automotive industry. These collaborations are cemented by reliable product delivery, joint technical advancements, and shared efforts in creating innovative materials. This strategy cultivates strong customer loyalty and embeds Hyundai Steel as an integral component of their clients' manufacturing processes.

Hyundai Steel assigns dedicated sales and account management teams to its major clients. This personalized approach ensures that each customer's unique requirements, from specific product grades to intricate delivery logistics, are met with precision and speed.

These teams act as a direct conduit, fostering trust and understanding by promptly addressing any concerns or evolving needs. This direct communication is crucial for building enduring partnerships in the competitive steel market.

Hyundai Steel actively partners with its automotive clients, co-developing advanced steel grades tailored for specific vehicle components. This technical collaboration ensures the steel meets stringent performance criteria, such as enhanced strength-to-weight ratios for fuel efficiency. For instance, in 2024, Hyundai Steel announced a new high-strength steel for electric vehicle battery enclosures, a direct result of close technical dialogue with EV manufacturers.

This joint development process involves sharing proprietary knowledge and conducting rigorous joint testing of new materials. Such deep engagement not only refines product performance but also solidifies customer loyalty by demonstrating a commitment to their evolving needs. The success of these co-developed solutions directly contributes to Hyundai Steel's reputation as an innovative solutions provider.

Sustainability Engagement

Hyundai Steel is deeply involved with its customers on sustainability, offering steel products with reduced carbon footprints. This helps clients achieve their own environmental goals, fostering stronger partnerships.

They provide clear data on their environmental performance and work together on creating greener supply chains. This collaborative approach is particularly valued by customers who prioritize environmental responsibility.

- Carbon-Reduced Products: Offering steel with lower embodied carbon to help customers meet their Scope 3 emissions targets.

- Transparency: Providing detailed environmental performance data and certifications for their steel products.

- Green Supply Chain Collaboration: Partnering with customers to identify and implement sustainable logistics and material sourcing solutions.

- Shared Sustainability Goals: Aligning business objectives with customer environmental targets to build long-term, trust-based relationships.

After-Sales Support and Problem Resolution

Hyundai Steel prioritizes robust after-sales support to ensure customer satisfaction and loyalty. This includes offering comprehensive technical assistance and swift, effective problem resolution for all steel products. For instance, in 2024, Hyundai Steel reported a 95% customer satisfaction rate for its technical support services, highlighting their commitment to addressing client needs promptly.

Resolving issues efficiently is key to demonstrating Hyundai Steel's reliability and dedication to client success. This proactive approach not only retains existing customers but also cultivates a strong, positive brand reputation within the industry. Their customer service initiatives in 2024 saw a 15% reduction in average issue resolution time compared to the previous year.

- Technical Assistance: Providing expert guidance on product application and performance.

- Problem Resolution: Swift and effective handling of any product-related issues or concerns.

- Customer Satisfaction: Maintaining high levels of satisfaction through responsive support.

- Reputation Building: Fostering trust and a positive image through reliable service.

Hyundai Steel nurtures deep, collaborative relationships with its core industrial clients, particularly in the automotive sector. This is achieved through personalized account management, joint product development focused on advanced materials like high-strength steel for EVs announced in 2024, and a shared commitment to sustainability, evidenced by their 2024 initiatives to reduce carbon footprints in their supply chains.

| Relationship Aspect | Key Activities | 2024 Impact/Focus |

|---|---|---|

| Strategic Alliances | Joint technical advancements, co-development of innovative materials | New high-strength steel for EV battery enclosures; 95% customer satisfaction for technical support |

| Personalized Service | Dedicated account management, tailored solutions for unique client needs | 15% reduction in average issue resolution time for after-sales support |

| Sustainability Collaboration | Offering carbon-reduced products, transparent environmental data, green supply chain partnerships | Alignment with customer Scope 3 emissions targets; fostering trust through shared environmental goals |

Channels

Hyundai Steel leverages a direct sales force to cultivate relationships with major industrial clients like automotive giants, construction firms, and shipyards. This approach facilitates direct negotiation and the creation of bespoke solutions tailored to specific client needs.

This direct engagement is crucial for handling intricate orders and securing long-term supply agreements, ensuring a steady revenue stream and deep customer loyalty. In 2024, Hyundai Steel reported significant sales growth in its automotive sector, a testament to the effectiveness of its direct sales strategy in securing key contracts.

Hyundai Steel maintains a robust global sales network with numerous overseas offices. This extensive reach is crucial for penetrating key markets like Europe and North America, ensuring efficient distribution of their steel products. For instance, in 2024, Hyundai Steel reported significant sales growth in these regions, underscoring the effectiveness of their international presence.

Hyundai Steel utilizes a network of steel processing centers, either operated directly or through partnerships, to offer localized cutting, shaping, and finishing of steel products. This strategic approach allows for greater efficiency and the ability to customize steel to precise customer specifications.

These processing centers are crucial for enhancing Hyundai Steel's responsiveness to diverse market demands, enabling quicker turnaround times for tailored steel solutions. By bringing processing closer to the customer, the company reduces lead times and logistics costs.

For instance, in 2024, Hyundai Steel's commitment to localized processing centers contributed to its ability to serve the automotive sector with specific, ready-to-use components, a key driver for its robust sales figures, which saw significant growth in the first half of the year.

Online Presence and Investor Relations Portal

Hyundai Steel's official website and dedicated investor relations portal are crucial for sharing vital company information. These platforms act as central hubs for financial results, sustainability reports, and detailed product specifications, ensuring transparency for stakeholders.

These online channels significantly enhance accessibility, allowing investors, media representatives, and potential customers to easily obtain the information they need. This direct line of communication is fundamental for effective corporate messaging and building strong stakeholder relationships.

In 2023, Hyundai Steel reported total revenue of KRW 23.6 trillion, with a significant portion of this information being disseminated through their digital platforms. The investor relations section, in particular, serves as a primary resource for detailed financial statements and corporate governance disclosures.

- Official Website: Serves as the primary digital storefront and information repository.

- Investor Relations Portal: Dedicated space for financial reports, stock information, and corporate governance.

- Content Dissemination: Key channel for financial results, sustainability reports, and product details.

- Stakeholder Engagement: Facilitates transparency and accessibility for investors, media, and customers.

Industry Trade Shows and Conferences

Hyundai Steel actively participates in key industry trade shows and conferences globally. These events are crucial for unveiling cutting-edge steel products, advanced manufacturing technologies, and fostering direct engagement with a broad spectrum of potential and existing clients. For instance, the company often showcases its high-strength steel solutions, vital for the automotive and construction sectors, at events like the World Steel Association’s SteelSuccess Strategies conference.

These gatherings offer invaluable networking avenues, enabling Hyundai Steel to solidify relationships with partners and customers while also identifying new business development opportunities. It's a platform to visibly demonstrate the company's technical prowess and its dedication to pioneering advancements in steel production. In 2024, such participation directly contributed to securing several significant supply contracts, underscoring the channel's impact on market visibility and growth.

- Product Showcase: Displaying innovative steel grades and solutions.

- Customer Engagement: Direct interaction with clients and prospects.

- Market Visibility: Enhancing brand presence and industry recognition.

- Business Development: Identifying new partnerships and sales leads.

Hyundai Steel utilizes a multi-channel approach to reach its diverse customer base. This includes a direct sales force for large industrial clients, an extensive global sales network, and strategically located steel processing centers for localized customization. Furthermore, the company leverages its official website and investor relations portal for transparent information dissemination and actively participates in industry trade shows to enhance market visibility and foster relationships.

| Channel Type | Key Activities | 2024 Impact/Focus |

|---|---|---|

| Direct Sales Force | Relationship building, bespoke solutions, contract negotiation | Secured significant automotive sector contracts, driving sales growth. |

| Global Sales Network | Market penetration, efficient distribution | Reported substantial sales increases in Europe and North America. |

| Steel Processing Centers | Localized cutting, shaping, finishing, customization | Enabled quick turnaround for automotive components, supporting sales figures. |

| Digital Platforms (Website, IR Portal) | Information sharing, transparency, stakeholder engagement | Key for disseminating financial results and product details. |

| Industry Trade Shows | Product showcasing, networking, business development | Contributed to securing new supply contracts and market visibility. |

Customer Segments

Automotive manufacturers are a cornerstone customer segment for Hyundai Steel. This includes not only Hyundai Motor Group's own brands, Hyundai and Kia, but also a growing roster of international giants such as GM, Ford, Volkswagen, Renault, and Stellantis. These global players are increasingly demanding steel that is not only strong and light to improve fuel efficiency and performance but also produced with a lower carbon footprint, reflecting the industry's push towards sustainability.

The automotive industry is a major driver of Hyundai Steel's sales volume, underscoring the critical nature of this relationship. For instance, in 2023, the automotive sector accounted for a substantial percentage of Hyundai Steel's total revenue, demonstrating its vital role in the company's financial performance and market position.

The construction industry represents a significant customer base for Hyundai Steel, demanding a wide array of structural steel products like H-beams and steel plates. These materials are crucial for constructing buildings, bridges, and broader infrastructure projects.

This sector's demand is closely tied to economic conditions and public investment in infrastructure. While the construction sector experienced some headwinds, it continues to be a core market for steel producers.

In 2024, global construction output is projected to grow, with infrastructure spending expected to be a key driver, particularly in regions investing heavily in modernization and development, which directly benefits suppliers like Hyundai Steel.

Shipbuilding companies are a crucial customer segment for Hyundai Steel, as they are major purchasers of steel plates. These shipyards require substantial quantities of high-quality, durable steel to construct a wide array of vessels, from cargo ships to specialized offshore structures. In 2023, global shipbuilding orders reached approximately 35 million compensated gross tons (CGT), indicating a robust demand for materials like steel.

Hyundai Steel's position as a leading steel manufacturer makes it a vital supplier to this industry. The company's ability to produce specialized steel grades suitable for marine environments, which often face corrosive conditions, further solidifies its importance. For instance, the demand for high-strength steel plates for LNG carriers and other advanced vessels continues to grow, a market Hyundai Steel actively serves.

Heavy Machinery and Equipment Manufacturers

Heavy machinery and equipment manufacturers are key customers for Hyundai Steel. They rely on our high-strength steel for building durable products like excavators and cranes. In 2024, the global construction equipment market was valued at over $180 billion, highlighting the significant demand for robust materials.

This segment prioritizes steel that can withstand extreme conditions and heavy loads. Hyundai Steel's advanced steel grades offer the reliability and performance these manufacturers need to ensure the longevity and safety of their equipment.

- Key Applications: Excavators, cranes, loaders, bulldozers, and other industrial machinery.

- Material Requirements: High tensile strength, yield strength, and impact resistance for structural integrity.

- Market Relevance: The global heavy machinery market is projected to grow, driven by infrastructure development and industrial expansion, increasing demand for quality steel.

Other Industrial Product Manufacturers

Hyundai Steel serves a wide array of industrial product manufacturers, a segment encompassing companies that produce everything from home appliances to vital infrastructure like oil pipes and shipping containers. This diversity underscores the broad applicability of steel in modern manufacturing.

These clients often have very specific steel requirements, whether it's for the durability of an appliance casing or the structural integrity of a large-scale pipeline. Hyundai Steel's ability to tailor its steel grades and specifications is crucial for meeting these varied demands.

- Home Appliance Manufacturers: These customers rely on steel for its formability, strength, and aesthetic finish in products like refrigerators and washing machines.

- Oil Pipe Producers: Requiring high-strength, corrosion-resistant steel, these manufacturers depend on specialized grades for demanding environments.

- Container Manufacturers: The shipping and logistics industry utilizes robust steel for containers, necessitating consistent quality and dimensional accuracy.

In 2024, the global demand for steel in the manufacturing sector remained robust, with particular growth seen in infrastructure development and consumer goods, areas directly served by these industrial product manufacturers. Hyundai Steel's adaptive production capabilities allow it to capture significant market share within these critical sub-segments.

Hyundai Steel's customer base is diverse, with automotive manufacturers being a primary segment, including major global players like GM, Ford, and Stellantis, alongside its parent Hyundai Motor Group. The construction industry is another significant pillar, requiring structural steel for buildings and infrastructure, with global construction output projected to grow in 2024, driven by infrastructure spending.

The shipbuilding sector relies heavily on Hyundai Steel for high-quality steel plates, with global shipbuilding orders showing strong demand in 2023. Furthermore, heavy machinery manufacturers depend on the company's high-strength steel for durable equipment like excavators and cranes, a market valued at over $180 billion in 2024.

Industrial product manufacturers, ranging from home appliance makers to oil pipe and container producers, also form a crucial segment, demanding tailored steel grades for specific applications. The overall demand for steel in manufacturing remained strong in 2024, particularly in infrastructure and consumer goods.

| Customer Segment | Key Needs | 2023/2024 Data Point | Hyundai Steel's Role |

| Automotive Manufacturers | Lightweight, strong, low-carbon steel | Automotive sector was a substantial percentage of Hyundai Steel's 2023 revenue. | Key supplier for global automotive brands. |

| Construction Industry | Structural steel (H-beams, plates) | Global construction output projected to grow in 2024, driven by infrastructure. | Vital supplier for infrastructure projects. |

| Shipbuilding | High-quality, durable steel plates | Global shipbuilding orders reached ~35 million CGT in 2023. | Provider of specialized steel for vessels. |

| Heavy Machinery & Equipment | High-strength, impact-resistant steel | Global construction equipment market valued over $180 billion in 2024. | Supplier for durable industrial machinery. |

| Industrial Product Manufacturers | Tailored steel grades (formability, corrosion resistance) | Robust steel demand in manufacturing in 2024, especially in infrastructure and consumer goods. | Meets diverse material specifications. |

Cost Structure

The cost of acquiring essential raw materials such as iron ore, coking coal, and steel scrap forms a substantial part of Hyundai Steel's overall expenditure. In 2024, the volatility of global commodity markets directly affects the company's bottom line, with iron ore prices experiencing significant swings throughout the year.

Hyundai Steel actively manages these procurement costs through strategic sourcing initiatives and the negotiation of long-term supply contracts. This approach aims to secure stable supply chains and mitigate the impact of short-term price volatility on profitability.

Hyundai Steel's large-scale operations necessitate significant expenditure on electricity, natural gas, and other utilities, directly impacting its cost structure. These energy demands are inherent to the energy-intensive nature of steel manufacturing.

The company's strategic shift towards electric arc furnaces (EAFs), a move aligned with sustainability goals, also presents considerable energy consumption implications. For instance, EAFs, while cleaner, can be more electricity-dependent than traditional blast furnaces.

In 2023, global electricity prices saw volatility, and natural gas prices, while moderating from peaks, remained a key cost driver for industrial users like Hyundai Steel. The company actively pursues energy efficiency improvements and explores renewable energy sourcing to mitigate these ongoing utility expenses.

Hyundai Steel's cost structure is heavily influenced by labor and personnel expenses, encompassing wages, benefits, and other related costs for its extensive workforce. These costs cover employees across production, research, sales, and administrative departments, reflecting the scale of its operations.

In 2023, Hyundai Steel reported total employee benefits and wages amounting to approximately KRW 2.5 trillion (roughly $1.8 billion USD), a substantial portion of its overall operational expenditure. The company’s ability to manage these costs is crucial for maintaining profitability.

Labor union negotiations are a recurring factor, with potential for strikes impacting production schedules and increasing costs. For instance, past labor disputes have led to temporary shutdowns, affecting output and revenue. The company actively engages in dialogue to mitigate such risks.

To optimize labor costs, Hyundai Steel has implemented restructuring initiatives, including voluntary retirement programs. These measures aim to streamline its workforce and reduce long-term personnel expenses, contributing to a more efficient operational model.

Manufacturing and Operational Overheads

Manufacturing and operational overheads are a significant component of Hyundai Steel's cost structure. These encompass the ongoing expenses associated with keeping production facilities running smoothly, including the upkeep of plant and machinery, the gradual decrease in asset value through depreciation, and the cost of essential factory utilities. These are direct costs tied to the manufacturing process itself.

Hyundai Steel's focus on efficient plant operations and proactive maintenance plays a vital role in controlling these overheads. By ensuring machinery is well-maintained and processes are optimized, the company aims to minimize disruptions and associated costs. For example, the temporary shutdown of facilities, such as the Pohang No. 2 plant, has been a strategic move to mitigate operational losses during periods of reduced demand or market downturns, demonstrating a direct link between operational efficiency and cost management.

- Maintenance: Costs for routine and preventative maintenance of production equipment.

- Depreciation: The accounting charge for the wear and tear of manufacturing assets.

- Utilities: Expenses for electricity, water, and other services essential for plant operation.

- Operational Efficiency: Strategies to minimize downtime and optimize production flow to reduce overheads.

Research and Development and Capital Expenditures

Hyundai Steel's commitment to innovation and expansion is reflected in significant investments in Research and Development (R&D) and Capital Expenditures (CapEx). These are critical cost drivers, fueling the company's future growth and competitiveness.

The company allocates substantial resources to R&D, focusing on developing advanced steel products and pioneering sustainable technologies. This includes research into eco-friendly steelmaking processes and high-strength, lightweight materials. Simultaneously, CapEx is directed towards modernizing existing facilities and constructing new ones. A prime example is the planned U.S. Electric Arc Furnace (EAF) mill, a significant undertaking aimed at expanding their global manufacturing footprint and catering to evolving market demands, particularly in the automotive sector.

- R&D Investments: Hyundai Steel consistently invests in R&D to enhance product quality, develop specialized steel grades for industries like automotive and construction, and explore environmentally friendly production methods. For instance, their focus on hydrogen-based steelmaking technologies represents a long-term strategic investment in sustainability.

- Capital Expenditures: Major CapEx projects are undertaken for facility upgrades, automation, and the construction of new plants. The development of the U.S. EAF mill, projected to cost several billion dollars, highlights the scale of these investments. These expenditures are crucial for maintaining operational efficiency and expanding production capacity.

- Cost Implications: While these investments are vital for long-term growth and market positioning, they represent substantial upfront capital outlays and ongoing operational funding requirements. Managing these costs effectively is key to ensuring profitability and financial stability.

Hyundai Steel's cost structure is significantly shaped by its raw material procurement, with iron ore and coking coal being major expenditures. In 2024, global commodity prices continue to influence these costs, necessitating strategic sourcing. The company's operational scale also means substantial spending on energy, including electricity and natural gas, with a growing focus on efficiency and renewables to manage these volatile utility expenses.

Labor and personnel costs represent another considerable outlay for Hyundai Steel, covering wages and benefits for its large workforce. In 2023, these costs were approximately KRW 2.5 trillion. The company also incurs manufacturing and operational overheads, such as maintenance and depreciation, which are managed through efficiency initiatives and strategic plant operations.

Significant investments in Research and Development (R&D) and Capital Expenditures (CapEx) are key cost drivers, supporting future growth and technological advancement. These include developing new steel products and sustainable technologies, as well as modernizing facilities and building new plants, such as the planned U.S. EAF mill.

| Cost Category | Key Factors | 2023 Impact (Approx.) |

| Raw Materials | Iron Ore, Coking Coal, Scrap Steel Prices | Significant portion of COGS |

| Energy Costs | Electricity, Natural Gas Prices | Volatile, influenced by global markets |

| Labor & Personnel | Wages, Benefits, Union Negotiations | KRW 2.5 trillion (approx. $1.8 billion USD) |

| Overheads | Maintenance, Depreciation, Utilities | Managed via efficiency and strategic shutdowns |

| R&D & CapEx | New Product Dev, Facility Upgrades, New Plants | Substantial upfront and ongoing investment |

Revenue Streams

Hyundai Steel generates substantial revenue from selling hot-rolled steel products. These are essential building blocks for industries like construction, shipbuilding, and general manufacturing, forming a core part of their sales volume. For instance, in 2023, Hyundai Steel's total revenue reached approximately 24.3 trillion KRW, with steel products being a primary contributor.

Hyundai Steel generates significant income from selling cold-rolled steel products. This type of steel is highly sought after in industries like automotive and home appliances because of its excellent surface quality and tight dimensional tolerances, often allowing for a premium price over hot-rolled steel.

The automotive sector's consistent demand is a primary driver for this revenue stream. For instance, in 2023, Hyundai Steel's automotive steel sales represented a substantial portion of its overall revenue, reflecting the critical role of cold-rolled steel in vehicle manufacturing.

Hyundai Steel generates significant revenue from selling specialized steel plates, crucial for demanding industries like shipbuilding and massive construction endeavors. These high-volume plates are tailored for specific industrial needs, driving substantial income. For instance, in 2023, the global shipbuilding market saw increased activity, which directly boosted demand for such specialized steel products.

Another key revenue stream comes from the sale of H-beams, fundamental structural components widely used in the construction sector. The consistent demand for these beams in building infrastructure projects directly translates into reliable revenue for Hyundai Steel. The construction industry's performance, therefore, plays a pivotal role in the financial success of this segment.

Sales of Specialized Automotive Steel

Hyundai Steel's sales of specialized automotive steel represent a significant and growing revenue stream. This includes advanced high-strength steel (AHSS) and low-carbon steel sheets, crucial for modern vehicle manufacturing. These materials offer enhanced safety and fuel efficiency, commanding higher prices and margins.

The company supplies these specialized steels to both its affiliated Hyundai Motor Group and external global automakers. This dual approach diversifies its customer base and strengthens its market position. Hyundai Steel is actively working to expand sales to non-affiliate automakers, recognizing the strategic importance of this growth avenue.

- High-Value Products: Focus on advanced high-strength steel (AHSS) and low-carbon steel sheets, which are critical for lightweighting and safety in vehicles.

- Margin Enhancement: These specialized materials typically yield higher profit margins compared to standard steel products due to their technical specifications and performance requirements.

- Customer Diversification: Supplying to both internal Hyundai Motor Group companies and external global automakers broadens the revenue base and reduces reliance on a single customer segment.

- Strategic Expansion: A key strategic objective is to increase sales to external, non-affiliated automotive manufacturers, thereby capturing a larger share of the global automotive steel market.

Revenue from Resource Recycling and Energy Businesses

Hyundai Steel diversifies its income beyond core steel manufacturing by actively engaging in resource recycling and energy businesses. This strategic move not only bolsters its financial resilience but also underscores a commitment to environmental stewardship and the principles of a circular economy.

These ventures are designed to extract value from production by-products and waste materials, transforming them into revenue-generating assets. For instance, in 2023, Hyundai Steel reported significant contributions from its eco-friendly businesses, including the sale of by-products like slag and dust, which are crucial components in cement and other construction materials.

- Resource Recycling: Hyundai Steel processes industrial by-products, such as blast furnace slag and steelmaking dust, for reuse in construction and infrastructure projects.

- Energy Generation: The company utilizes waste heat and gases generated during steelmaking to produce electricity, often selling surplus power to the grid.

- Environmental Solutions: Revenue is also derived from offering waste management and recycling services to external clients, leveraging its expertise.

- Circular Economy Integration: These businesses are integral to Hyundai Steel's strategy to minimize waste and maximize resource efficiency throughout its value chain.

Hyundai Steel's revenue is significantly bolstered by its specialized automotive steel products, including advanced high-strength steel (AHSS). These materials are crucial for vehicle lightweighting and safety, commanding premium pricing. In 2023, the automotive sector's demand remained a primary driver, with Hyundai Steel's sales to automakers, including its affiliated Hyundai Motor Group and external clients, representing a substantial portion of its overall revenue.

Beyond core steel products, Hyundai Steel generates income from resource recycling and energy businesses. These ventures transform production by-products and waste materials into revenue streams, aligning with circular economy principles. For instance, the sale of by-products like slag and dust, used in cement and construction, contributed to the company's financial performance in 2023.

| Revenue Stream | Key Products/Activities | 2023 Contribution (Illustrative) |

|---|---|---|

| Hot-Rolled Steel | Construction, shipbuilding, general manufacturing materials | Significant portion of total revenue (approx. 24.3 trillion KRW total in 2023) |

| Cold-Rolled Steel | Automotive, home appliances | High demand from automotive sector |

| Specialized Steel Plates | Shipbuilding, heavy construction | Boosted by global shipbuilding market activity |

| H-Beams | Construction sector infrastructure | Reliable revenue from building projects |

| Specialized Automotive Steel (AHSS) | Lightweighting and safety in vehicles | Higher prices and margins, growing segment |

| Resource Recycling & Energy | By-product sales (slag, dust), waste heat power generation | Contributes to financial resilience and environmental stewardship |

Business Model Canvas Data Sources

The Hyundai Steel Business Model Canvas is informed by a robust combination of internal financial statements, market intelligence reports, and competitive landscape analyses. These diverse data sources ensure that each component of the canvas is grounded in factual information and strategic foresight.