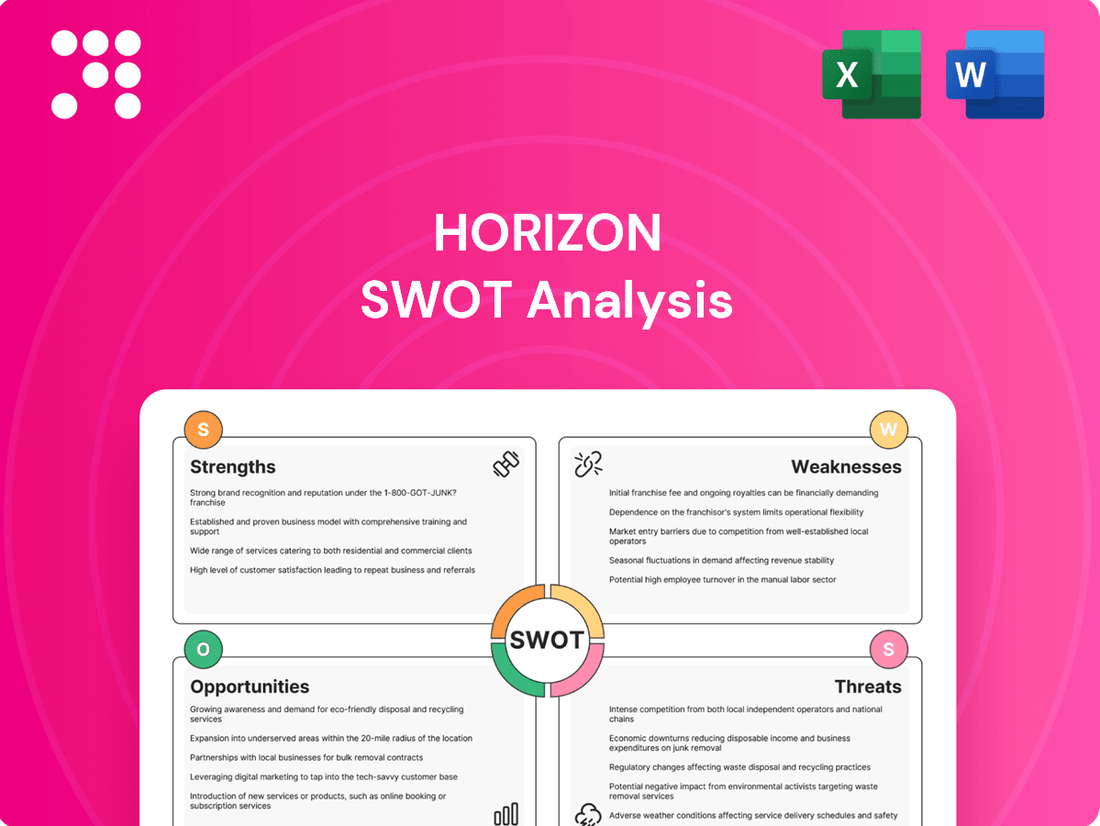

Horizon SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Horizon Bundle

Horizon's current market position is defined by its innovative technology and strong brand recognition, but it faces challenges from emerging competitors and evolving consumer preferences. Understanding these dynamics is crucial for any strategic move.

Want the full story behind Horizon's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Horizon Oil Limited boasts a formidable and enduring presence across the Asia-Pacific, with over two decades of operational history in China and seventeen years in New Zealand. This deep-rooted experience translates into a profound understanding of regional operating conditions and regulatory frameworks, cultivating valuable stability and robust partnerships, such as that with CNOOC.

The company's strategic concentration on these specific Asia-Pacific territories enables the development of specialized expertise in hydrocarbon appraisal, development, and production, tailored to the unique geological and economic characteristics prevalent in the area.

Horizon's asset portfolio is notably diverse, spanning various stages of the exploration and production (E&P) lifecycle. This includes interests in the Block 22/12 in China, the Maari/Manaia fields in New Zealand, and the recently integrated Mereenie fields in Australia. This spread across different geographies and operational phases mitigates risk and provides multiple avenues for growth.

The strategic acquisition of a 25% stake in the Mereenie oil and gas field in 2024 was a pivotal move. This transaction effectively doubled Horizon's net 2P reserves, increasing them from 4.9 million barrels of oil equivalent (MMboe) to 9.9 MMboe. This significant reserve enhancement solidifies the company's production capacity and extends its operational runway well beyond the expiration of current licenses.

Horizon Oil's strength lies in its full value chain involvement, managing everything from finding oil to getting it out of the ground. This integrated approach gives them better command over project schedules and expenses, ensuring they can extract the most value from their finds.

For example, their consistent infill drilling at the Wenchang field in China's Block 22/12 highlights their dedication to boosting output from established assets. In 2024, this strategy contributed to a significant portion of their production, with the company reporting approximately 60% of its total output coming from its mature fields.

Strong Cash Generation and Shareholder Returns

Horizon Oil consistently generates robust cash flow, a key strength supporting its financial stability. For instance, the company reported significant operating cash flow in its recent financial periods, underscoring its efficient operations.

Shareholder returns remain a priority, with Horizon Oil maintaining a strong track record. The company has delivered at least AUD 3.0 cents per share for four consecutive years, demonstrating a commitment to rewarding its investors.

This dedication to shareholder value is further evidenced by the interim dividend paid in April 2025 and the final dividend announced for FY24. These consistent payouts reflect effective capital management and a focus on delivering tangible returns.

Key financial highlights supporting this strength include:

- Consistent Operating Cash Flow: Recent financial reports show substantial operating cash flow generation.

- Sustained Shareholder Dividends: A minimum of AUD 3.0 cents per share returned annually for the past four years.

- Interim Dividend (April 2025): Further evidence of ongoing commitment to shareholder returns.

- FY24 Final Dividend Announcement: Reinforces the company's policy of distributing profits.

Strategic Gas Sales Agreements

Horizon Oil's strategic gas sales agreements are a significant strength, offering a predictable revenue stream. For instance, the agreement with the Northern Territory Government, running from January 2025 to December 2030, guarantees sales for its gas production. This forward-looking approach effectively de-risks market fluctuations and provides a solid foundation for the company's gas output throughout the next decade.

These agreements, exemplified by the Mereenie joint venture, are crucial for financial stability. They not only secure sales but also enable Horizon Oil to confidently plan and fund its development and drilling initiatives. This creates a virtuous cycle, where secured revenue supports operational expansion, further solidifying the company's market position.

- Secured Revenue: Agreements like the one with the Northern Territory Government (Jan 2025 - Dec 2030) provide a stable income base.

- Market Risk Mitigation: Long-term contracts reduce exposure to volatile gas prices and demand shifts.

- Development Support: Guaranteed sales facilitate investment in exploration and production infrastructure.

Horizon Oil's deep operational history in the Asia-Pacific, particularly in China and New Zealand, provides a significant competitive advantage. This extensive experience, spanning over two decades in China and seventeen years in New Zealand, fosters a profound understanding of regional operating environments and regulatory landscapes. This stability and established relationships, such as with CNOOC, are invaluable assets.

The company's strategic focus on specific Asia-Pacific territories allows for the development of specialized expertise in hydrocarbon appraisal, development, and production, tailored to the unique geological and economic conditions of the region. This focused approach enhances efficiency and success rates.

Horizon's diverse asset portfolio, encompassing exploration, development, and production phases across China (Block 22/12), New Zealand (Maari/Manaia fields), and Australia (Mereenie fields), effectively mitigates risk and creates multiple avenues for future growth. The 2024 acquisition of a 25% stake in the Mereenie field notably doubled Horizon's net 2P reserves to 9.9 MMboe, significantly extending its production runway.

The company's integrated approach, managing the full value chain from exploration to production, provides enhanced control over project timelines and costs, maximizing value extraction. This is exemplified by their consistent infill drilling strategy at the Wenchang field, which contributed approximately 60% of their total production in 2024 from mature fields.

| Strength Category | Specific Strength | Supporting Fact/Data |

|---|---|---|

| Operational Expertise | Asia-Pacific Market Experience | 20+ years in China, 17 years in New Zealand |

| Asset Portfolio | Geographic & Lifecycle Diversification | Interests in China, New Zealand, Australia; Mereenie acquisition doubled 2P reserves to 9.9 MMboe in 2024 |

| Operational Strategy | Full Value Chain Integration | Infill drilling at Wenchang field contributed ~60% of 2024 production from mature fields |

| Financial Performance | Consistent Operating Cash Flow & Shareholder Returns | Minimum AUD 3.0 cents/share dividend for 4 consecutive years; interim dividend April 2025 |

| Revenue Streams | Strategic Gas Sales Agreements | Northern Territory Government agreement (Jan 2025 - Dec 2030) secures gas sales |

What is included in the product

Analyzes Horizon’s competitive position through key internal and external factors.

Offers a clear, actionable SWOT framework to quickly identify and address strategic weaknesses and threats.

Weaknesses

Horizon Oil’s reliance on the volatile global oil and gas markets presents a significant weakness. As an independent exploration and production company, its earnings are directly tied to the fluctuating prices of these commodities. For instance, during the first half of fiscal year 2024, Brent crude oil prices averaged around $80 per barrel, a figure subject to considerable swings that can impact Horizon's revenue streams.

While Horizon employs hedging strategies to cushion the blow from price downturns, these measures cannot eliminate all risks. A substantial and prolonged drop in oil and gas prices, even with hedges in place, can still severely affect the company's profitability and cash flow, introducing uncertainty into its financial outlook and operational planning.

Horizon Oil's operations are inherently capital intensive. The exploration, development, and production phases of oil and gas projects necessitate significant upfront investment in drilling, pipelines, and ongoing field maintenance. This can tie up substantial financial resources.

While Horizon Oil has secured financing for its current projects, the sheer scale of capital expenditure required can strain its financial flexibility. This high demand for capital might limit the company's ability to pursue other strategic opportunities or adapt quickly during periods of fluctuating revenue, as seen in the volatile energy markets of 2024.

Horizon's operations across the Asia-Pacific, particularly in China and New Zealand, present significant geopolitical and regulatory vulnerabilities. Shifts in government policies or evolving regulatory landscapes in these diverse markets could directly affect operational costs and project timelines. For instance, changes in environmental regulations, a growing concern globally, could necessitate costly upgrades or impact the approval processes for new projects.

The company's reliance on long-term partnerships in these regions, while beneficial, also means exposure to unforeseen policy changes. A sudden alteration in trade agreements or local business regulations could disrupt supply chains or increase the cost of doing business. In 2024, several Asia-Pacific nations saw increased regulatory scrutiny on foreign investments and environmental compliance, a trend that could continue and impact Horizon's asset viability.

Historical Divestment from Key Regions

Horizon Oil's historical divestment from key regions, such as its complete exit from Papua New Guinea in 2020, presents a notable weakness. This move, while potentially strategic, underscores a susceptibility to market shifts or regional instability that could necessitate further asset sales, thereby diminishing geographic diversification and its long-term reserve base.

This past divestment can be seen as a signal of potential vulnerability:

- Reduced Geographic Footprint: The 2020 sale of its Papua New Guinea assets meant Horizon Oil lost a significant operational area, impacting its ability to spread risk across different markets.

- Concentration Risk: A smaller geographic spread can lead to a greater reliance on the performance of its remaining assets, making the company more susceptible to downturns in specific regions.

- Impact on Reserve Base: Divesting from established regions can shrink the company's proven reserve base, potentially affecting future production and cash flow generation.

Dependence on Joint Venture Partners for Operations

Horizon Oil's reliance on joint venture partners for crucial operations, as seen in its non-operated stakes in China's Block 22/12 and Australia's Mereenie field, presents a significant weakness. This structure, while beneficial for risk and capital sharing, places operational control and execution in the hands of partners like CNOOC. For instance, in 2023, Horizon's share of production from its non-operated assets contributed a substantial portion of its overall output, highlighting the scale of this dependence.

This operational dependence can lead to potential project delays and strategic misalignments if partner objectives diverge from Horizon's. Such scenarios could impact the timely development and profitability of key assets, directly affecting Horizon's financial performance and growth trajectory. The company's 2024 forward plan is intricately tied to the successful execution of these joint ventures.

Key operational dependencies include:

- Reliance on partner expertise and efficiency for exploration and production activities.

- Vulnerability to partner-driven schedule changes or operational disruptions.

- Potential for differing strategic priorities impacting project timelines and resource allocation.

Horizon Oil's dependence on joint venture partners for critical operations, such as its stakes in China's Block 22/12 and Australia's Mereenie field, represents a significant weakness. This reliance means Horizon has less direct control over project execution and timelines. For example, in the first half of fiscal year 2024, a substantial portion of Horizon's production came from these non-operated assets, underscoring the depth of this dependency.

Divergent strategic goals or operational inefficiencies from partners can lead to project delays and reduced profitability for Horizon. This lack of direct control can hinder the company's ability to respond swiftly to market changes or pursue its own strategic initiatives effectively, impacting its overall financial performance and growth plans for 2024 and beyond.

This dependence creates several key vulnerabilities:

- Operational Control: Horizon is subject to the operational capabilities and decisions of its partners, potentially impacting production efficiency and cost management.

- Strategic Alignment: Differences in strategic priorities between Horizon and its joint venture partners could lead to conflicts or delays in project development and resource allocation.

- Risk Concentration: The success of key assets is tied to partner performance, concentrating risk rather than diversifying it.

Horizon Oil's financial health is intrinsically linked to the volatile global oil and gas markets, a significant weakness for an independent exploration and production company. Its revenue streams are directly exposed to commodity price fluctuations, which can be substantial. For instance, Brent crude oil prices experienced considerable volatility throughout 2024, averaging around $80 per barrel but subject to sharp swings.

While Horizon utilizes hedging strategies to mitigate price risk, these measures cannot entirely eliminate the impact of prolonged downturns. A significant and sustained drop in oil and gas prices, even with hedges in place, can still severely affect the company's profitability and cash flow, creating uncertainty for its financial planning and operational capacity. This sensitivity to market prices remains a core vulnerability.

Key financial vulnerabilities include:

- Revenue Volatility: Direct correlation between oil and gas prices and company revenue.

- Hedging Limitations: Hedges provide partial protection but do not eliminate all downside price risk.

- Cash Flow Sensitivity: Profitability and cash flow are highly susceptible to commodity price movements, impacting financial flexibility.

Full Version Awaits

Horizon SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality and comprehensive insights.

This is a real excerpt from the complete document, showcasing the depth and structure you can expect. Once purchased, you’ll receive the full, editable version ready for your strategic planning.

You’re viewing a live preview of the actual Horizon SWOT analysis file. The complete, detailed version becomes available immediately after checkout, ensuring you have all the necessary information.

Opportunities

The Asia-Pacific region's economic expansion and industrialization are fueling a consistent rise in energy consumption, with natural gas being a key component. This growing demand creates a substantial market opportunity for Horizon Oil to increase its production and sales, capitalizing on its current assets and existing gas supply contracts to satisfy regional energy requirements.

Horizon Oil has considerable contingent resources within its current permit zones, notably in the Stairway and Pacoota reservoirs at its Mereenie asset. This presents a significant opportunity for uncovering new discoveries and boosting its proven reserves, potentially adding millions of barrels of oil equivalent.

The company's planned infill drilling and evaluation of new targets, such as those in Block 22/12 for 2025, are designed to convert these contingent resources into proved reserves. This strategic move aims to bolster future production and unlock substantial value from its existing acreage.

Horizon's history shows a proactive approach to growth via acquisitions, notably securing the Mereenie asset in Australia and acquiring stakes in Thai gas fields from ExxonMobil. This pattern suggests continued opportunities to bolster its asset base and expand its geographic reach.

The company can further leverage this strategy by identifying and acquiring undervalued or high-potential energy assets, which would not only diversify its portfolio but also enhance its reserve base. For instance, in 2023, Horizon reported a significant increase in its proved reserves, underscoring the success of its acquisition-led growth strategy.

Forming strategic partnerships and joint ventures presents another avenue for expansion, allowing Horizon to share the substantial capital expenditure and development risks associated with large-scale projects. Such collaborations can unlock access to new technologies and markets, further accelerating its growth trajectory in the evolving energy landscape.

Leveraging Technological Advancements in E&P

The oil and gas sector is seeing rapid technological progress in areas like drilling efficiency, advanced seismic imaging for better reservoir understanding, and sophisticated production optimization techniques. Embracing these innovations allows companies to significantly boost recovery from current fields, lower operational expenses, and tap into reserves that were previously considered too costly to exploit. For instance, the adoption of AI-driven analytics in seismic interpretation can reduce processing time by up to 50%, leading to faster exploration decisions.

Horizon Oil's stated intention to invest in expanding production from its core assets suggests a strategic alignment with incorporating these technological advancements. This could translate into improved operational performance and a more competitive cost structure. A recent industry report from 2024 highlighted that companies integrating digital twin technology in their production facilities saw an average reduction in downtime by 15% and a 5% increase in output.

- Enhanced Recovery: Implementing advanced hydraulic fracturing techniques and enhanced oil recovery (EOR) methods, such as CO2 injection, can increase recovery factors by an additional 5-15% in mature fields.

- Cost Reduction: Automation and remote monitoring technologies in drilling operations have demonstrated a potential to cut operational costs by 10-20% through reduced personnel and improved efficiency.

- Reserve Unlocking: New seismic imaging technologies, like full-waveform inversion (FWI), can provide higher resolution subsurface data, potentially identifying previously missed bypassed pay zones in existing fields.

- Production Optimization: Real-time data analytics and machine learning algorithms can predict equipment failures and optimize flow rates, leading to a more consistent and efficient production profile.

Potential for Low-Carbon Initiatives and Energy Transition Adaptation

The global shift towards sustainability offers oil and gas companies a chance to pivot. This includes developing carbon capture, utilization, and storage (CCUS) technologies, which are gaining traction. For instance, projects like the Northern Lights in Norway are advancing CCUS infrastructure, aiming to store CO2 from industrial sources.

Investing in operations with a lower carbon footprint can also attract capital from environmentally conscious investors. The broader energy sector saw significant growth in low-carbon investments, with global clean energy spending projected to reach over $2 trillion in 2024, according to some industry forecasts, highlighting the market's direction.

- Explore CCUS: Companies can invest in or partner on carbon capture projects, mirroring initiatives like ExxonMobil's planned CCUS hub in Houston.

- Lower Carbon Intensity: Focus on reducing methane emissions and improving operational efficiency to decrease the carbon intensity of existing production.

- Diversify into Renewables: Strategic investments in renewable energy sources, such as offshore wind or solar, can create new revenue streams.

- ESG Alignment: Companies that proactively adapt to the energy transition are better positioned to attract Environmental, Social, and Governance (ESG) focused investment capital.

Horizon Oil can capitalize on the growing Asia-Pacific energy demand by expanding its production and sales, leveraging its existing assets and contracts. The company also has significant contingent resources at its Mereenie asset, presenting an opportunity to convert these into proven reserves through infill drilling and exploration, potentially adding millions of barrels of oil equivalent. Strategic acquisitions and partnerships offer further avenues for growth, allowing Horizon to diversify its portfolio and access new technologies and markets, as demonstrated by its past successful acquisitions.

Threats

The relentless global push for decarbonization, driven by climate change concerns and net-zero commitments, presents a significant long-term threat to fossil fuel industries. Many nations, including those in the Asia-Pacific, are increasing investments in renewables, with global renewable energy capacity additions projected to rise by 10% in 2024 compared to 2023, reaching over 500 GW. This shift directly impacts the demand for oil and gas, potentially rendering existing hydrocarbon assets uneconomical and creating the risk of stranded assets for heavily invested companies.

Governments globally are intensifying environmental oversight, with new policies impacting the oil and gas sector. These include carbon pricing, which adds direct costs to emissions, and tougher operational standards. For Horizon Oil, this translates to potentially higher operating expenses and more complex project permitting processes.

The financial implications are substantial. Increased compliance costs can directly erode profit margins, while stricter regulations might necessitate significant capital investment in cleaner technologies. In 2024, for instance, many oil and gas companies faced rising costs associated with meeting evolving emissions standards, a trend expected to continue into 2025.

A prolonged slump in global oil and gas prices poses a significant risk to Horizon Oil, even with hedging strategies in place. For instance, if Brent crude prices were to average $50 per barrel in 2025, down from an estimated $80 in 2024, this could slash Horizon's revenue by billions.

Such price drops, potentially triggered by geopolitical instability or a sudden global demand contraction, would directly squeeze Horizon's cash flow. This would make it harder to cover operational costs and finance critical new exploration and production ventures.

Operational and Geohazard Risks

Oil and gas operations are inherently risky, with potential threats like well blowouts, spills, and equipment failures. These can result in significant financial burdens from cleanup costs, fines, and damage to assets. For instance, the 2010 Deepwater Horizon spill cost BP over $65 billion in cleanup, fines, and compensation, highlighting the severe financial and operational impact of such events.

Natural disasters, such as hurricanes or earthquakes, pose another substantial threat, capable of crippling infrastructure and halting production for extended periods. The impact of Hurricane Ida in 2021 on the Gulf of Mexico oil and gas production serves as a stark reminder, with output significantly reduced for weeks, leading to substantial revenue loss and market price volatility.

- Operational Failures: Incidents like well blowouts or pipeline ruptures can lead to immediate production halts and costly remediation efforts.

- Environmental Spills: Accidental releases of oil or gas can result in massive cleanup expenses, regulatory penalties, and long-term damage to ecosystems.

- Geohazard Impacts: Extreme weather events, seismic activity, or landslides can damage critical infrastructure, causing prolonged operational disruptions and significant repair costs.

- Reputational Damage: Major incidents can severely harm a company's public image, impacting its social license to operate and investor confidence.

Competition from Larger and More Diversified Energy Companies

Horizon Oil faces significant competition from larger, more diversified energy firms. These competitors, often national oil companies or major international players, benefit from substantial financial backing, allowing them to invest heavily in exploration and development. For instance, as of early 2024, major oil companies like ExxonMobil and Shell reported multi-billion dollar capital expenditures for their upstream operations, dwarfing Horizon's capacity.

These larger entities also leverage advanced technological capabilities and established global networks. This enables them to more effectively bid for prime exploration acreage, undertake complex, large-scale projects, and maintain operations through volatile market conditions. Their diversified portfolios across different geographies and energy sources also provide a buffer against regional downturns, a resilience that smaller, more focused companies like Horizon may find challenging to match.

- Financial Disparity: Major energy companies often have market capitalizations in the hundreds of billions, providing access to capital far exceeding Horizon's.

- Technological Edge: Larger firms can invest more in cutting-edge exploration and production technologies, improving efficiency and success rates.

- Diversification Advantage: Broader geographic and product portfolios allow larger competitors to absorb shocks more effectively than a company focused on specific regions or assets.

The global shift towards decarbonization is a major threat, with renewable energy capacity expected to exceed 500 GW in 2024, a 10% increase. This trend diminishes demand for fossil fuels, risking stranded assets for companies like Horizon Oil. Increased government regulations, including carbon pricing, are also raising operational costs and complicating project approvals, with compliance expenses climbing for the sector in 2024 and projected into 2025.

SWOT Analysis Data Sources

This Horizon SWOT analysis is built upon a robust foundation of data, incorporating financial statements, comprehensive market intelligence, and expert industry forecasts to provide a clear and actionable strategic overview.