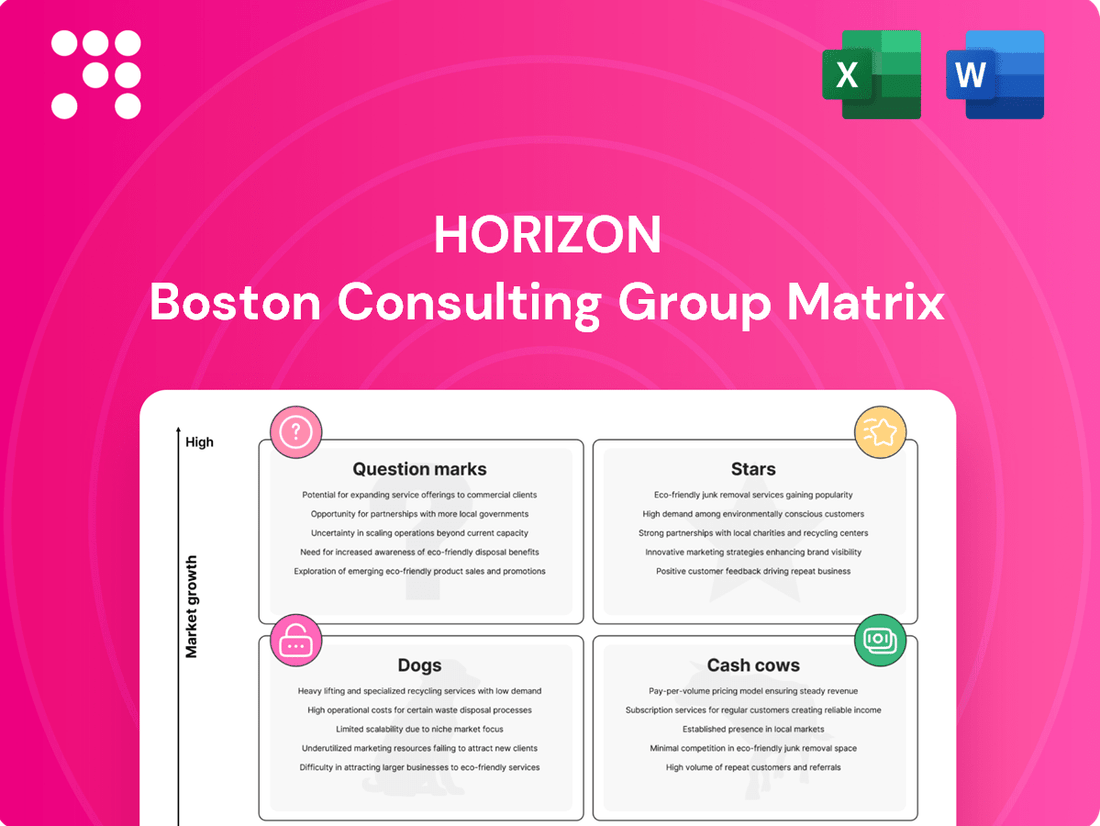

Horizon Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Horizon Bundle

Unlock the secrets of strategic growth with the BCG Matrix, a powerful tool that categorizes products based on market share and growth rate. Understand which of your offerings are Stars, Cash Cows, Dogs, or Question Marks, and make informed decisions about resource allocation. Purchase the full BCG Matrix report for a comprehensive analysis and actionable strategies to optimize your product portfolio and drive business success.

Stars

Horizon Oil's 25% stake in the Mereenie gas field, secured in June 2024, is a prime example of a Star within the BCG matrix. This strategic move significantly boosted the company's reserves and broadened its Australian production portfolio.

The field's development, bolstered by recent successful infill drilling, has solidified its position. Mereenie has secured long-term gas sales agreements with the Northern Territory Government, underscoring its role as a key player in the regional domestic gas market.

This development directly addresses the increasing demand for natural gas across the Asia-Pacific region, highlighting Mereenie's strong growth potential and market leadership.

The WZ12-8M infill well in China is a prime example of a Star in Horizon's BCG Matrix. Its successful drilling and early production in the WZ12-8E field highlight a high-growth product within the company's core operations.

Initial production rates from WZ12-8M have surpassed projections, signaling robust performance and a significant boost in output from this crucial asset. This success is a testament to Horizon's strategic focus on optimizing resource recovery.

This investment in WZ12-8M underscores Horizon's commitment to maintaining its leading edge in the Block 22/12 area. The well's strong early performance positions it as a key contributor to the company's future growth and market dominance.

The Block 22/12 water handling capacity upgrade in China is a key strategic initiative for Horizon, targeting an increase in oil production. This project, slated for completion by late 2025, underscores Horizon's dedication to maximizing efficiency at its cost-effective, high-yield asset.

By investing in improved infrastructure, Horizon is positioned to maintain a strong market presence in this productive area, aligning with the projected growth in global energy demand. This upgrade is anticipated to support higher operational output, contributing to Horizon's overall production targets.

Future Infill Drilling Programs in Block 22/12

Horizon Oil is actively progressing plans for future infill drilling programs within Block 22/12, with a focus on calendar year 2025. This strategic commitment to infill drilling underscores their dedication to maximizing output from their existing Chinese petroleum assets.

These ongoing investments are vital for preserving and potentially expanding Horizon Oil's market position in China, a nation experiencing substantial energy demand and continued economic expansion. For instance, China's crude oil output reached approximately 4.18 million barrels per day in 2023, highlighting the importance of efficient production from established fields.

The company's forward-looking approach to infill drilling in Block 22/12 aligns with a strategy aimed at sustained production and efficient resource utilization. This proactive stance is crucial for navigating the competitive energy landscape and capitalizing on growth opportunities in the region.

- Horizon Oil's 2025 Infill Drilling Focus: Block 22/12 is slated for further infill drilling evaluations and program maturation.

- Strategic Asset Maximization: This initiative directly supports Horizon Oil's objective to sustain and enhance production from its Chinese operations.

- Market Position in China: Continued investment in production is key to maintaining market share in China's significant and growing energy market.

Strategic Position in Asia-Pacific Gas Market Growth

Horizon Oil's strategic emphasis on gas assets, highlighted by the Mereenie acquisition and its secured sales into the Northern Territory domestic market, positions it favorably for the anticipated surge in Asia's natural gas demand starting in 2026.

This proactive stance in a rapidly expanding regional market, capitalizing on both existing and newly acquired infrastructure, suggests a significant opportunity for Horizon Oil to increase its market penetration within the wider Asia-Pacific gas industry.

The company's focus on gas aligns with broader regional trends, where natural gas is increasingly viewed as a crucial transition fuel.

- Asia-Pacific Gas Demand Growth: Projections indicate accelerated demand growth in Asia from 2026 onwards, with natural gas playing a key role in energy transitions.

- Mereenie Acquisition Impact: Horizon Oil's acquisition of Mereenie strengthens its gas portfolio and provides contracted sales into a stable domestic market.

- Strategic Market Positioning: The company is leveraging its assets to tap into the high-growth Asia-Pacific gas market, aiming for expanded market share.

Stars represent Horizon Oil's high-growth, market-leading assets. The Mereenie gas field, with its secured long-term sales agreements, exemplifies this category, directly addressing the robust demand for natural gas in the Asia-Pacific region. Similarly, the WZ12-8M infill well in China has demonstrated strong early production, significantly boosting output and reinforcing Horizon's dominant position in Block 22/12.

| Asset | Market Share | Growth Potential | Key Developments |

| Mereenie Gas Field | Leading domestic supplier | High (Asia-Pacific demand) | 25% stake secured (June 2024), long-term NT Gov sales agreements |

| WZ12-8M (Block 22/12) | Strong in Block 22/12 | High (optimizing recovery) | Exceeded initial production projections, focus for 2025 infill drilling |

What is included in the product

The Horizon BCG Matrix categorizes business units by market growth and share to guide investment and divestment strategies.

Clear visualization of your portfolio's strengths and weaknesses, simplifying strategic decision-making.

Cash Cows

The WZ6-12 and WZ12-8W fields in China's Block 22/12 are Horizon Oil's dependable cash cows, demonstrating consistent revenue generation. In the fiscal year ending June 30, 2024, these fields contributed significantly to the company's production, with WZ6-12 producing an average of approximately 10,000 barrels of oil equivalent per day (boepd) and WZ12-8W around 3,000 boepd.

These mature assets benefit from low cash operating costs, averaging around $15 per boe, which allows them to generate substantial free cash flow for Horizon Oil. This financial strength is crucial for funding other ventures and returning value to shareholders, underscoring their importance in the company's portfolio.

While natural decline is a factor in mature fields, Horizon Oil actively manages this through strategic infill drilling programs. This approach has successfully maintained stable, high-volume output, reinforcing the Block 22/12 assets as high-market-share, reliable contributors to the company's financial performance.

Horizon's investment in the Maari and Manaia oil fields, situated offshore New Zealand, represents a significant source of stable crude oil revenue. These mature fields are characterized by established infrastructure and a developed market, enabling consistent cash flow generation for the company. Their long history of production and contribution to overall sales volumes firmly place them in the cash cow category, despite the necessity of ongoing operational maintenance.

Horizon Oil's consistent dividend payments, such as the AUD 1.5 cents per share declared in October 2024 and anticipated for April 2025, highlight its status as a Cash Cow within the BCG framework.

This sustained return of capital to shareholders is a direct result of the strong, predictable cash flows generated by its mature, high-market-share assets. These dividends are a clear testament to the company's profitability and financial stability, stemming from its core producing operations.

Low Operating Costs in Core Assets

Horizon's core assets, like the China Block 22/12, demonstrate exceptional operational efficiency with operating costs around $20 per barrel. This low cost base is a critical factor in their status as cash cows, enabling substantial profit margins from their mature, high-market-share fields. Such cost control directly translates into robust net cash flow generation for the company.

- Low Operating Costs: Maintaining operating expenses as low as $20/bbl in key areas like China Block 22/12.

- High Profit Margins: This cost efficiency directly fuels strong profit margins on production from mature assets.

- Maximized Net Cash Flow: The company leverages this cost advantage to optimize cash generation from its established fields.

- Financial Health: These favorable economics are a cornerstone of Horizon's overall financial stability and performance.

Strong Cash Reserves and Financial Flexibility

Horizon Oil demonstrates considerable financial strength, underscored by its substantial cash reserves. As of December 2024, the company held US$47.3 million in cash, a testament to its operational efficiency and the consistent cash flow generated by its mature assets.

This robust cash position, augmented by recently secured and amended debt facilities, grants Horizon Oil significant financial flexibility. This allows the company to pursue strategic growth opportunities while also providing for shareholder returns.

- Strong Cash Position: US$47.3 million in cash reserves as of December 2024.

- Financial Flexibility: Enhanced by recently secured and amended debt facilities.

- Indicative of Performance: Reflects strong cash generation from established producing assets.

- Strategic Capability: Enables both shareholder returns and investment in future growth.

Cash Cows, within the BCG Matrix framework, represent established, high-market-share products or business units that generate more cash than they consume. These are typically mature assets with stable demand and low operating costs, providing a reliable source of funding for other strategic initiatives.

Horizon Oil's Chinese fields, like WZ6-12, exemplify this category. In FY2024, WZ6-12 averaged around 10,000 boepd, with operating costs near $15 per boe, showcasing their efficiency and profitability. This consistent performance underpins the company's financial stability.

The consistent dividend payouts, such as the AUD 1.5 cents per share declared in October 2024, directly reflect the strong, predictable cash flows from these mature, high-market-share assets. These payouts underscore the robust financial health derived from their core operations.

| Asset | Production (FY2024 Avg) | Operating Cost (Approx.) | Market Share |

|---|---|---|---|

| WZ6-12 (China Block 22/12) | 10,000 boepd | $15/boe | High |

| WZ12-8W (China Block 22/12) | 3,000 boepd | $15/boe | High |

| Maari & Manaia (New Zealand) | Stable Crude Oil Revenue | Low | High |

What You’re Viewing Is Included

Horizon BCG Matrix

The Horizon BCG Matrix document you are previewing is the identical, fully polished report you will receive upon purchase. This means no watermarks, no placeholder text, and no limitations—just the complete, professionally formatted strategic tool ready for immediate application in your business planning. You can confidently assess your product portfolio's potential and make informed decisions with this comprehensive analysis.

Dogs

Horizon Oil's divestment of its Papua New Guinea interests in February 2020 likely positioned these assets as Dogs within its BCG Matrix. This strategic exit suggests these operations had low market share and uncertain future growth, making them a drain on resources rather than a contributor to overall company performance.

Within the generally robust Maari field, certain older wells, such as those plagued by recurring Electric Submersible Pump (ESP) failures, can be categorized as Dogs on a granular level. These wells demand substantial capital expenditure for repairs and upkeep, as evidenced by increased operational costs in Q4 FY24, without generating commensurate returns or contributing to future expansion.

These high-maintenance wells act as significant cash drains, requiring diligent oversight or even strategic decommissioning to optimize resource allocation. The ongoing costs associated with addressing ESP failures in these specific Maari wells exemplify a classic cash trap scenario, diverting funds that could be better utilized in more promising ventures.

Underperforming exploration permits, while not always explicitly labeled as such in current industry reports, represent a critical drain on resources within a company's portfolio. These are the permits where initial exploration efforts have consistently failed to uncover commercially viable reserves, or where geological assessments have significantly downgraded the prospectivity of the area. For instance, a company might hold several permits in a region known for its potential, but after several years and significant investment, no economically extractable resources have been identified, pushing them into this category.

These permits are essentially capital sinks. They incur ongoing holding costs, such as lease payments and administrative fees, and often require a minimal level of exploration expenditure to maintain their validity, even if the prospectivity is low. This capital could be far more effectively deployed in areas with higher chances of success. In 2024, many junior exploration companies found themselves burdened by such permits, with reports indicating that holding costs alone could represent a substantial percentage of their operating budget, diverting funds from more promising ventures.

Ultimately, underperforming exploration permits are viewed as sunk costs with very limited future potential. Their continued existence ties up valuable capital and management attention that could be directed towards strategic growth areas. Companies are increasingly under pressure to divest or relinquish these permits to streamline their portfolios and focus on opportunities that offer a clearer path to future production and profitability, a trend expected to accelerate in 2025 as capital discipline becomes paramount.

Non-Core, Depleting Small Fields

Horizon Oil might possess smaller, non-core hydrocarbon fields that are naturally declining. These assets typically generate very little cash flow and offer limited prospects for future development, effectively immobilizing capital without contributing significantly to the company's growth or market position.

Such fields often represent a drain on resources, as ongoing operational costs can outweigh the minimal revenue generated. For instance, in 2024, many independent oil producers focused on optimizing production from mature assets, but those with no significant reserve replacement strategies often saw declining netbacks.

- Minimal Net Cash Flow: These fields contribute little to overall profitability.

- Limited Future Potential: Without substantial new investment, their production is expected to continue declining.

- Capital Immobilization: Resources tied up in these assets could be better deployed elsewhere.

- Divestment Candidates: Often considered for sale to streamline the portfolio.

Legacy Infrastructure Requiring High Decommissioning Costs

Legacy infrastructure with high decommissioning costs, even with prepaid abandonment expenses for some fields like WZ6-12 and WZ12-8W in China, can be categorized as 'Dogs' in the Horizon BCG Matrix. These are assets from older, depleted, or uneconomical fields that will necessitate significant future spending for removal without any ongoing revenue generation. For instance, by the end of 2023, Horizon reported contingent liabilities related to decommissioning obligations.

These 'Dog' assets represent a drain on cash flow, creating future liabilities that consume financial resources without contributing to current earnings. Their presence can negatively impact the company's overall financial health and strategic flexibility.

- Prepaid Abandonment Costs: Horizon has addressed some future decommissioning expenses, such as for WZ6-12 and WZ12-8W, mitigating immediate cash outlays for these specific assets.

- Future Liabilities: Remaining legacy infrastructure from fully depleted or uneconomical fields poses a significant future financial burden for decommissioning.

- Cash Consumption Without Revenue: These 'Dog' assets consume cash for maintenance and eventual decommissioning, offering no offsetting production or revenue.

- Strategic Drag: Such assets can tie up capital and management attention that could otherwise be allocated to more profitable or growth-oriented ventures.

Dogs in Horizon Oil's portfolio are assets that exhibit low market share and low growth prospects, often acting as cash drains rather than contributors. These can include underperforming exploration permits, mature fields with declining production, or legacy infrastructure requiring significant decommissioning costs. For example, in 2024, the company continued to manage mature assets where operational costs could outpace revenue generation, especially in the absence of significant reserve replacement strategies.

These assets demand careful management, as they tie up capital and operational resources without offering substantial returns. Horizon's approach often involves optimizing production from mature fields or considering divestment for non-core, low-performing assets to improve overall portfolio efficiency. The ongoing costs associated with maintaining these 'Dogs', such as holding costs for exploration permits or operational expenses for declining fields, highlight the need for strategic evaluation and potential divestment or decommissioning.

The financial impact of these 'Dogs' is characterized by minimal net cash flow and a lack of future growth potential, often leading to capital immobilization. Horizon's focus in 2024 and beyond has been on enhancing capital discipline, which includes scrutinizing and potentially divesting assets that no longer align with strategic growth objectives. This proactive management of 'Dogs' is crucial for freeing up capital for more promising ventures.

Legacy infrastructure, even with some prepaid abandonment costs as seen with WZ6-12 and WZ12-8W, represents a future liability. By the end of 2023, Horizon reported contingent liabilities for decommissioning, underscoring the cash consumption without revenue generation inherent in these 'Dog' assets. These liabilities can negatively impact financial health and strategic flexibility.

| Asset Type | Characteristics | Financial Impact | Strategic Consideration |

|---|---|---|---|

| Underperforming Exploration Permits | Low prospectivity, high holding costs | Capital sink, minimal return | Divestment or relinquishment |

| Mature, Declining Fields | Low production, high operational costs | Minimal net cash flow, capital immobilization | Optimization or divestment |

| Legacy Infrastructure | High decommissioning costs, no revenue | Future liabilities, cash drain | Decommissioning or sale of liabilities |

Question Marks

Horizon Oil's acquisition of stakes in Thailand's Sinphuhorm and Nam Phong gas fields, bolstered by new financing, places these assets squarely in the ‘Question Mark’ quadrant of the BCG matrix. This classification stems from their status as newer additions to Horizon's portfolio, with their ultimate production capacity and market penetration in Thailand's energy sector still under development.

The high growth potential of these gas fields necessitates substantial capital investment to unlock their full value. However, the successful realization of these prospects and their long-term market viability remain uncertain, requiring careful monitoring and strategic execution.

The 2025 infill wells in Block 22/12, specifically those targeting contingent resources, represent a classic question mark in the BCG matrix. While the intention is to tap into potential growth, their classification as contingent means their economic viability is not yet fully proven. This implies that while they hold promise, their immediate contribution to market share is uncertain, much like a new product with unproven market demand.

These wells require significant capital investment for development, yet the returns are not guaranteed. For instance, if the estimated contingent resources are, say, 50 million barrels of oil equivalent, but the cost to extract them exceeds the projected market price, these wells could become cash drains rather than profit generators. This cash consumption without immediate, certain returns is a hallmark of question mark assets.

Horizon Oil, like many exploration and production companies, might be looking at early-stage exploration in frontier basins within the Asia-Pacific. These are areas where exploration hasn't happened much yet, meaning there's a lot of potential if they strike oil or gas, but also a significant chance of finding nothing.

These ventures are essentially question marks in the BCG matrix. They demand considerable initial funding for things like seismic data acquisition and preliminary drilling, with success being far from guaranteed. For instance, in 2024, many junior exploration companies faced challenges securing capital for such high-risk, high-reward projects, with the average cost of an exploration well often running into tens of millions of dollars.

Appraisal of Unbooked Contingent Resources

Unbooked contingent resources, representing potential future hydrocarbon volumes, are crucial for Horizon's long-term growth but fall into the question mark category of the BCG matrix. These resources require substantial investment for appraisal and development, with uncertain outcomes. For instance, in 2024, Horizon might have identified several such prospects, but their conversion to reserves depends on successful exploration drilling and favorable economic conditions.

These unbooked resources present a high-risk, high-reward scenario. While they offer significant upside potential if successfully commercialized, the capital expenditure required for their evaluation and development carries inherent uncertainty. This means Horizon must carefully allocate capital, balancing the need for exploration with the certainty of existing production.

- Uncertainty of Conversion: Unbooked contingent resources have not yet met the criteria for commerciality, meaning their economic viability and eventual production are not assured.

- Capital Intensity: Significant upfront investment is needed for seismic surveys, exploration drilling, and feasibility studies to de-risk these resources.

- Potential for Growth: Successful appraisal and development of these resources could significantly boost Horizon's future production and reserve base.

- Risk Mitigation: Horizon must employ robust technical and economic evaluation processes to prioritize and manage the risks associated with these question mark assets.

Potential Diversification into Adjacent Energy Sectors

Horizon Oil could be eyeing diversification into adjacent energy sectors, aligning with the global energy transition. This would position them in high-growth, low-market-share areas, characteristic of question marks in the BCG matrix.

Such moves might involve investing in technologies that enhance hydrocarbon recovery or exploring nascent renewable energy opportunities. For instance, the global renewable energy market was valued at approximately $1.3 trillion in 2023 and is projected to grow significantly, presenting potential avenues for expansion.

- Exploring Carbon Capture, Utilization, and Storage (CCUS): Horizon Oil might investigate CCUS technologies to mitigate emissions from existing operations and potentially monetize captured CO2. The global CCUS market is expected to reach hundreds of billions of dollars by 2030.

- Investing in Hydrogen Production: Developing capabilities in blue or green hydrogen production could be a strategic diversification, leveraging existing infrastructure and expertise in gas handling. The hydrogen market is anticipated to see substantial growth, with various government incentives supporting its development.

- Digitalization and AI in Energy: Implementing advanced analytics and AI for operational efficiency, predictive maintenance, and optimizing exploration could be a less capital-intensive adjacent play, improving existing hydrocarbon recovery rates. The energy sector's adoption of AI is rapidly increasing, with significant efficiency gains reported.

Question marks in the BCG matrix represent business units or products with low market share but operating in high-growth markets. These are often new ventures or undeveloped assets that require significant investment to realize their potential.

The key characteristic is the uncertainty surrounding their future success; they could become stars if their market share grows, or dogs if they fail to gain traction. For Horizon Oil, this might include new exploration blocks or early-stage development projects.

These assets consume considerable cash due to the need for investment in growth, but they do not yet generate substantial returns. Strategic decisions for question marks involve either investing heavily to increase market share or divesting if the potential is deemed too low or the risk too high.

In 2024, Horizon Oil's exploration activities in frontier basins exemplify question marks, demanding substantial capital for seismic surveys and initial drilling, with success rates typically below 20% for exploration wells in challenging regions.

| Asset Type | Market Growth | Market Share | Strategic Consideration |

| New Exploration Blocks | High | Low | Invest for growth or divest |

| Early-Stage Development Projects | High | Low | Capital intensive, uncertain returns |

| Contingent Resources (Unbooked) | High | Low | Requires appraisal and development |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, market share reports, and industry growth projections, to accurately assess product performance and strategic positioning.