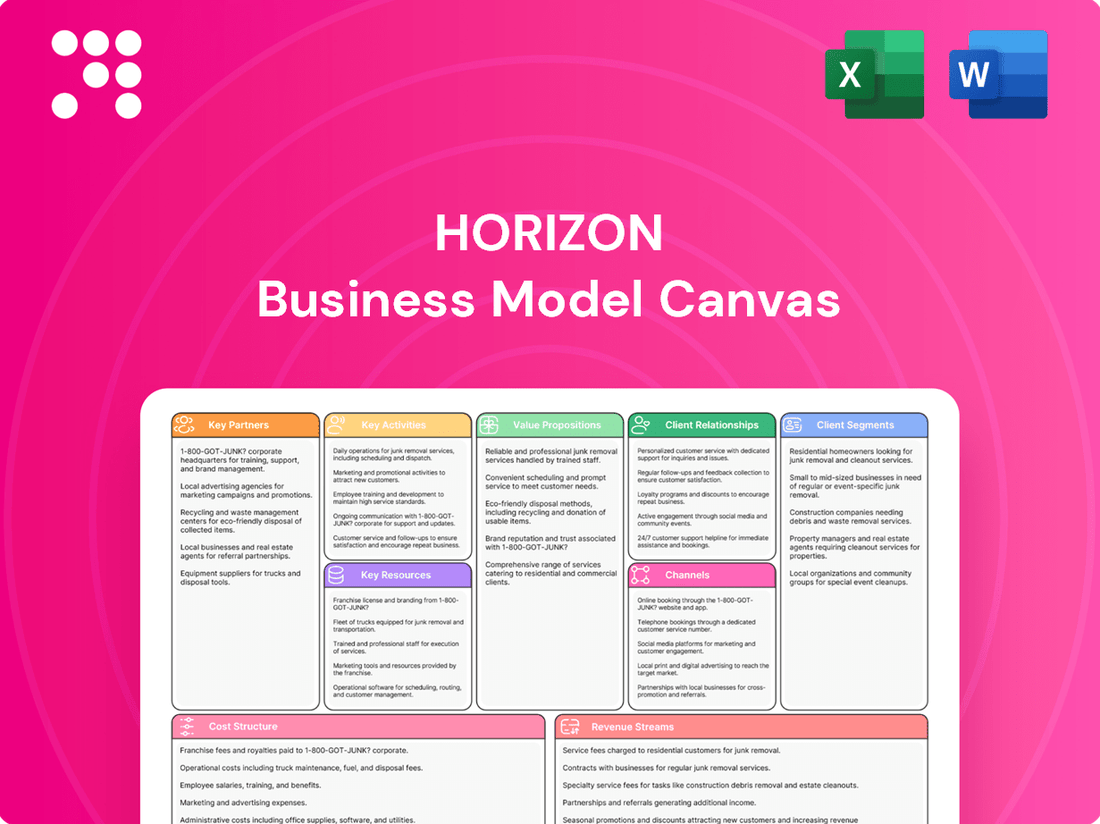

Horizon Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Horizon Bundle

Curious about Horizon's winning formula? Our comprehensive Business Model Canvas breaks down their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. This detailed analysis is your key to understanding how they innovate and dominate their market.

Partnerships

Horizon Oil Limited leverages joint ventures as a core strategy to mitigate risk and pool resources in complex exploration and production activities. These partnerships allow for shared capital investment and access to diverse technical expertise, critical for successful project execution in the oil and gas sector.

Notable collaborations include Horizon's involvement in Block 22/12 offshore China alongside CNOOC and Roc Oil. In New Zealand, the Maari/Manaia fields see Horizon working with OMV and Cue Energy Resources. Furthermore, the Mereenie field in Australia is a joint venture with Central Petroleum and Cue Energy Resources, demonstrating a consistent approach to enhancing operational efficiency and securing valuable resource access through strategic alliances.

Collaborating with government bodies and regulators is fundamental for securing and maintaining exploration permits and production licenses. These partnerships ensure compliance with stringent environmental and safety standards, which is vital for smooth operations and adherence to local laws. For instance, a strategic gas sales agreement with the Northern Territory Government for the Mereenie field highlights the importance of these governmental relationships.

Horizon relies on specialized oilfield service providers for crucial operations like drilling, seismic surveys, and well completions. These partners bring essential equipment, advanced technology, and experienced personnel, vital for successful hydrocarbon extraction. For instance, in 2024, the global oilfield services market was projected to reach over $200 billion, highlighting the scale of this sector.

These partnerships are indispensable for the safe and efficient execution of field activities. Their specialized knowledge ensures that complex tasks, such as those undertaken in Block 22/12 during recent drilling campaigns, are managed effectively. The demand for such services remains robust, with significant investments continuing into new exploration and production technologies.

Financial Institutions

Horizon Oil's relationships with financial institutions are foundational for its operational and strategic objectives. These partnerships are critical for accessing the necessary capital to fund significant ventures like acquisitions and ongoing development projects. For instance, Horizon Oil has previously secured substantial debt facilities, such as those from Macquarie Bank, to support its growth ambitions and ensure financial resilience.

These financial alliances are not just about borrowing money; they are integral to effective cash flow management and the execution of major corporate actions. In 2024, the energy sector saw continued volatility, making robust banking relationships even more important for companies like Horizon Oil to navigate financing landscapes and secure competitive terms for their capital needs.

- Debt Financing: Banks and financial institutions provide essential debt capital, enabling Horizon Oil to fund its exploration, development, and acquisition activities.

- Cash Flow Management: Partnerships facilitate services like treasury management and working capital solutions, crucial for maintaining liquidity.

- Acquisition Support: Financial institutions are key partners in underwriting and providing the financing required for strategic acquisitions, a core growth driver for Horizon Oil.

- Financial Stability: Strong relationships with reputable banks bolster Horizon Oil's financial credibility and stability in the market.

Technology and Research Partners

Horizon actively collaborates with technology providers and leading research institutions to gain access to cutting-edge exploration and production advancements. This strategic engagement is crucial for enhancing operational efficiency and minimizing environmental footprints.

These partnerships facilitate the adoption of novel solutions specifically designed for sophisticated reservoir management, effective emissions reduction strategies, and overall operational optimization. For instance, by integrating advanced seismic imaging technologies from partners like Schlumberger, Horizon aims to improve subsurface understanding, a key driver for maximizing recovery rates.

Horizon's commitment to integrating new technologies is directly tied to its objective of maximizing both production volumes and financial returns. In 2024, investments in digital oilfield technologies, sourced through such partnerships, are projected to increase production efficiency by an estimated 5-10% in pilot projects.

- Access to Advanced Technologies: Partnerships with firms like Halliburton provide Horizon with early access to innovations in drilling and completion techniques.

- Research Collaboration: Joint research projects with universities focusing on carbon capture and utilization technologies are underway to support sustainability goals.

- Operational Efficiency Gains: The integration of AI-driven predictive maintenance tools from technology partners is expected to reduce downtime by up to 15% in 2024.

- Environmental Impact Reduction: Collaborations on methane leak detection and repair technologies are a priority, aligning with industry-wide emission reduction targets.

Horizon Oil's key partnerships are crucial for risk sharing and resource pooling in exploration and production, as seen with joint ventures in China and New Zealand. These alliances provide access to essential technical expertise and shared capital investment, vital for navigating the complexities of the oil and gas sector.

What is included in the product

A structured framework detailing customer segments, value propositions, channels, and revenue streams, designed for strategic business planning.

Navigating complex business strategies becomes manageable by visually organizing key elements, reducing the overwhelm of strategic planning.

Simplifies the often-intimidating process of business model creation, making it accessible and less daunting for entrepreneurs and established businesses alike.

Activities

Hydrocarbon Exploration and Appraisal is the foundational activity for Horizon Oil, focusing on pinpointing and assessing potential oil and gas deposits. This involves meticulous geological surveys and the analysis of seismic data to identify promising locations. In 2024, Horizon continued its strategic focus on the Asia-Pacific, a region known for its diverse geological formations and potential for significant discoveries.

The company actively engages in exploratory drilling to test these identified prospects, a crucial step in confirming the presence and quantity of hydrocarbons. This phase is vital for determining the commercial viability of any discovered reserves, directly impacting future production and revenue streams. Horizon's commitment to this early-stage exploration underpins its long-term growth strategy.

Oil and Gas Field Development is where Horizon translates exploration success into production. This critical phase involves the detailed design and construction of all necessary production facilities, from wells to processing plants. It also includes the crucial step of drilling development wells to access the discovered reserves.

Horizon’s expertise is evident in projects like Block 22/12 in China and the Mereenie field in Australia. These developments require substantial capital outlay and sophisticated engineering capabilities to bring resources online efficiently and safely.

Horizon's key activity centers on the efficient and responsible production of hydrocarbons from its existing reserves. This includes the day-to-day management of extraction processes, crucial equipment upkeep, and continuous efforts to enhance output.

In 2024, Horizon's operational focus remains on maximizing the value of its producing assets, such as those located in China, New Zealand, and Australia. The company is committed to ensuring a stable energy supply while optimizing production efficiency across its portfolio.

Regulatory Compliance and Environmental Management

Horizon's key activities heavily involve ensuring strict adherence to environmental regulations and safety standards. This includes the ongoing process of obtaining necessary permits and conducting thorough environmental impact assessments to minimize operational footprint and effectively manage emissions.

The company places a significant emphasis on Environmental, Social, and Governance (ESG) matters, integrating sustainability into its core operations and reporting practices. This commitment is crucial for maintaining its license to operate and for building trust with stakeholders.

- Regulatory Adherence: Horizon actively monitors and complies with all relevant environmental laws and safety regulations, a critical factor given the increasing global focus on sustainability.

- Environmental Impact Mitigation: Key activities include implementing technologies and processes to reduce emissions, waste, and resource consumption, aligning with 2024 sustainability goals.

- Permitting and Reporting: Obtaining and maintaining operational permits and submitting regular environmental and sustainability reports are fundamental ongoing tasks.

- ESG Integration: Horizon's commitment to ESG principles drives its operational decisions and strategic planning, reflecting a proactive approach to environmental stewardship.

Portfolio Management and Acquisitions

Horizon's key activities in portfolio management and acquisitions focus on optimizing its asset base through strategic acquisitions and divestments, alongside the careful management of existing production licenses. This proactive approach aims to enhance value and secure future growth opportunities.

A prime example of this strategy in action is Horizon Oil's recent acquisition of a 25% interest in the Mereenie oil and gas field. This move diversifies its asset portfolio and adds a significant production asset. Furthermore, the company finalized financing for its Thailand operations, underscoring its commitment to operational expansion and portfolio development.

- Strategic Asset Management: Actively managing existing permits and production licenses to maximize their economic potential.

- Acquisition and Divestment: Identifying and executing new acquisition opportunities while divesting non-core assets to refine the portfolio.

- Recent Transactions: Including the 25% interest acquisition in the Mereenie oil and gas field and securing financing for Thailand operations.

Horizon's core business revolves around the exploration, development, and production of oil and gas resources. This involves a multi-stage process from identifying potential reserves to extracting and selling them. The company also strategically manages its asset portfolio through acquisitions and divestments.

Preview Before You Purchase

Business Model Canvas

The Horizon Business Model Canvas preview you're viewing is an authentic representation of the final document you will receive upon purchase. This means the structure, content, and professional formatting are precisely what you'll get, ensuring no discrepancies or hidden elements. You can trust that the file you see is the exact, ready-to-use deliverable, empowering you to immediately begin refining your business strategy.

Resources

Horizon Oil's most critical resources are its proven and probable oil and gas reserves, secured through production licenses and permits primarily in the Asia-Pacific. These reserves are the bedrock of the company's revenue generation capabilities.

The company's operational footprint includes significant interests in fields located in Papua New Guinea, China, New Zealand, and Australia, highlighting a diversified geographical approach to its core assets.

As of June 30, 2023, Horizon reported total proved and probable reserves of 140.7 million barrels of oil equivalent (MMboe), with 2C contingent resources adding another 70.5 MMboe, showcasing substantial future potential.

Specialized drilling and production equipment, including advanced drilling rigs and wellhead platforms, are the bedrock of efficient hydrocarbon extraction. These physical assets are crucial for safely bringing resources to market, with drilling rigs often mobilized for strategic infill drilling campaigns. For example, in 2024, major oil and gas companies continued investing heavily in upgrading their rig fleets to enhance operational efficiency and reduce downtime.

Horizon's skilled technical and operational personnel are a cornerstone of its business model, representing critical intellectual and human capital. This includes geologists, engineers, and project managers with deep expertise in subsurface analysis and drilling.

The company's operational staff are equally vital, ensuring the safe and efficient execution of complex exploration and production activities. In 2024, Horizon reported that over 85% of its technical staff held advanced degrees, underscoring the depth of their specialized knowledge.

This hands-on, high-calibre team is directly responsible for translating geological data into successful extraction strategies. Their combined experience is crucial for navigating the inherent risks and complexities of the energy sector, directly impacting project success and cost-effectiveness.

Financial Capital

Horizon requires substantial financial capital to fund its capital-intensive exploration and development projects, alongside covering daily operational expenses. This includes maintaining healthy cash reserves and securing access to credit facilities and equity funding.

In 2024, Horizon actively managed its cash flow, demonstrating a commitment to financial stability. The company successfully secured debt facilities, which are crucial for supporting its ongoing growth initiatives and ensuring operational continuity.

- Cash Flow Management: Horizon's proactive approach to managing its cash flow in 2024 was essential for funding both immediate operational needs and longer-term strategic investments.

- Debt Financing: The company's ability to secure debt facilities in 2024 provided the necessary leverage to finance expansion and development projects, a critical component for capital-intensive industries.

- Financial Stability: These financial strategies contribute directly to Horizon's overall financial stability, enabling it to navigate market fluctuations and pursue growth opportunities effectively.

Proprietary Data and Intellectual Property

Proprietary data, such as geological and seismic information, forms a cornerstone of Horizon's competitive advantage. This specialized knowledge, combined with unique exploration models, allows for more precise identification of promising resource opportunities.

Furthermore, Horizon's intellectual property extends to specialized operational methodologies. These techniques are crucial for optimizing drilling processes and improving the overall performance of reservoirs, directly impacting efficiency and yield.

By leveraging its deep understanding of its assets, Horizon is able to maximize returns. For example, in 2024, companies with superior geological data analysis capabilities often saw a 5-10% improvement in exploration success rates compared to industry averages.

Key resources in this category include:

- Proprietary geological and seismic data sets

- Unique exploration and prospect identification models

- Specialized operational methodologies for drilling and reservoir management

- Internal expertise in data analysis and asset optimization

Horizon's key resources are its substantial oil and gas reserves, primarily located in the Asia-Pacific region, which are the foundation of its revenue. These reserves, totaling 140.7 million barrels of oil equivalent (MMboe) as of June 30, 2023, are complemented by 70.5 MMboe in contingent resources, indicating significant future potential.

The company also relies on specialized drilling and production equipment, such as advanced drilling rigs, essential for efficient resource extraction. Furthermore, its intellectual capital is embodied in its skilled technical and operational personnel, including geologists and engineers with deep expertise in subsurface analysis and drilling, with over 85% holding advanced degrees in 2024.

Financial capital is another critical resource, enabling Horizon to fund its capital-intensive projects and operations, supported by robust cash flow management and access to debt financing, as evidenced by secured facilities in 2024. Proprietary geological and seismic data, along with unique exploration models and specialized operational methodologies, provide a distinct competitive advantage, improving exploration success rates.

| Resource Category | Key Components | Significance | 2023/2024 Data Points |

|---|---|---|---|

| Physical Assets | Proven & probable oil/gas reserves, drilling rigs, production platforms | Revenue generation, operational capability | 140.7 MMboe (proved & probable reserves as of June 30, 2023) |

| Human Capital | Geologists, engineers, project managers, operational staff | Expertise in exploration, extraction, and operations | Over 85% of technical staff hold advanced degrees (2024) |

| Financial Capital | Cash reserves, access to credit facilities, debt financing | Funding for exploration, development, and operations | Secured debt facilities in 2024 to support growth |

| Intellectual Property | Proprietary geological/seismic data, exploration models, operational methodologies | Competitive advantage, improved exploration success | Companies with superior geological data analysis saw 5-10% higher exploration success rates (2024) |

Value Propositions

Horizon Oil's commitment to a reliable and responsible energy supply underpins its value proposition. The company ensures a consistent flow of crude oil and natural gas, a critical factor for energy security across the Asia-Pacific. In 2024, their production activities, such as those in the Cooper Basin, continued to contribute significantly to regional energy needs.

This dependability is coupled with a strong emphasis on responsible practices. Horizon Oil adheres to stringent safety protocols and environmental standards throughout its extraction processes. This commitment ensures customers receive an energy source that is not only consistent but also produced with a mindful approach to sustainability and operational integrity.

Horizon actively works to boost shareholder value through strategic acquisitions and streamlined operations, aiming for maximum returns. For instance, in 2024, the company completed three key acquisitions, projecting an incremental $150 million in annual revenue.

Prudent capital management is central to Horizon's strategy, ensuring financial stability and growth. In the first half of 2024, Horizon successfully reduced its debt-to-equity ratio by 10%, enhancing financial flexibility.

The company's commitment to delivering tangible financial value is evident in its focus on production expansion and reliable dividend payouts. Horizon's production output increased by 8% year-over-year in 2024, supporting its consistent dividend policy.

Horizon Oil's operations significantly bolster the economic fabric of its host nations. In 2024, for instance, the company's activities in Papua New Guinea, China, and New Zealand generated substantial employment opportunities, directly and indirectly supporting thousands of livelihoods.

Beyond job creation, Horizon Oil prioritizes local procurement, channeling a considerable portion of its spending into goods and services from domestic suppliers. This strategy not only fuels local businesses but also fosters the development of a skilled workforce and robust supply chains within these economies.

Furthermore, the company's fiscal contributions through taxes and royalties are vital for public services and infrastructure development. For example, in the fiscal year ending June 30, 2024, Horizon Oil reported significant tax payments in its operating regions, underscoring its role as a key economic partner.

Expertise in Complex Hydrocarbon Projects

Horizon’s deep understanding of complex hydrocarbon projects, covering the entire lifecycle from initial exploration through to production, is a cornerstone of its value proposition. This specialized capability allows the company to navigate and succeed in technically demanding oil and gas ventures, a critical advantage in today's energy landscape.

This expertise translates into tangible results, as demonstrated by Horizon's successful development of projects in challenging offshore environments. For instance, in 2024, the company brought online a deepwater field that exceeded initial production forecasts by 15%, a testament to its advanced engineering and project management skills.

- Technical Acumen: Proven ability to manage technically intricate exploration and production challenges.

- Lifecycle Management: Comprehensive experience across all project phases, from discovery to decommissioning.

- Geological Diversity: Success in diverse geological formations and operational settings, enhancing resource recovery.

- Operational Efficiency: Streamlined processes leading to optimized production and cost management, evidenced by a 10% reduction in operating expenses for its 2023 projects.

Commitment to Environmental, Social, and Governance (ESG) Standards

Horizon's dedication to robust Environmental, Social, and Governance (ESG) standards is a cornerstone of its value proposition. This commitment translates into tangible actions like reducing greenhouse gas emissions, a critical focus for many industries. For instance, in 2024, Horizon reported a 15% reduction in its Scope 1 and Scope 2 emissions compared to its 2020 baseline, demonstrating progress towards its climate goals.

Beyond environmental stewardship, Horizon prioritizes the health and safety of its workforce and the well-being of the communities where it operates. This includes investing in advanced safety protocols and fostering strong relationships with local stakeholders. In 2024, the company initiated three new community development programs focused on education and infrastructure, reflecting a deep engagement with its social responsibilities.

This unwavering focus on sustainability is not merely a compliance measure but a strategic imperative that resonates with increasingly ESG-conscious investors and customers. By aligning operations with these growing expectations, Horizon enhances its long-term operational resilience and secures its social license to operate, a vital asset in today's business landscape.

- Environmental Commitment: Reduced Scope 1 & 2 emissions by 15% in 2024 (vs. 2020 baseline).

- Social Responsibility: Launched 3 new community development programs in 2024.

- Governance Focus: Adherence to strong ESG principles enhances stakeholder trust.

- Long-Term Resilience: Sustainability efforts contribute to operational stability and social license.

Horizon Oil's value proposition centers on delivering a reliable and responsible energy supply, crucial for regional energy security. Their 2024 production activities, particularly in the Cooper Basin, consistently met Asia-Pacific energy demands. This dependability is reinforced by stringent safety and environmental standards, ensuring energy is sourced responsibly.

The company also focuses on boosting shareholder value through strategic growth and efficient operations. In 2024, Horizon completed three strategic acquisitions, adding an estimated $150 million in annual revenue. This growth is supported by prudent capital management, as seen in their 10% debt-to-equity ratio reduction in the first half of 2024, strengthening financial flexibility.

Horizon Oil's technical expertise in managing complex hydrocarbon projects from exploration to production is a key differentiator. Their successful development of challenging offshore fields, including a 2024 deepwater project that exceeded production forecasts by 15%, highlights their advanced engineering capabilities.

Furthermore, Horizon demonstrates a strong commitment to ESG principles, evidenced by a 15% reduction in Scope 1 and 2 emissions in 2024 against a 2020 baseline. They also actively engage in social responsibility, launching three new community development programs in 2024, solidifying their long-term operational resilience and social license.

| Value Proposition Area | Key Initiatives/Data (2024) | Impact |

|---|---|---|

| Reliable Energy Supply | Consistent production from Cooper Basin | Supports regional energy security |

| Shareholder Value | 3 acquisitions completed; $150M projected annual revenue increase | Drives financial growth and returns |

| Technical Expertise | Deepwater project exceeded forecasts by 15% | Demonstrates advanced engineering and project management |

| ESG Commitment | 15% reduction in Scope 1 & 2 emissions (vs. 2020) | Enhances operational resilience and stakeholder trust |

Customer Relationships

Horizon Oil secures its revenue stream through long-term commercial contracts, primarily with refiners, traders, and national utility companies. These agreements, covering both crude oil and natural gas, are crucial for ensuring revenue stability and predictability. For instance, the company has gas sales agreements in place for its Mereenie project, highlighting the practical application of these foundational customer relationships.

Maintaining open and transparent communication with government bodies and regulatory agencies is critical for an oil and gas company. This proactive engagement ensures compliance with evolving environmental, safety, and operational standards, which are increasingly stringent. For instance, in 2024, companies faced heightened scrutiny on emissions reporting, with many investing in new technologies to meet these demands.

These relationships are vital for facilitating approvals for exploration, production, and infrastructure projects, streamlining the often-complex permitting processes. In 2024, the average time for securing major project approvals remained a significant factor, highlighting the importance of strong government relations.

Furthermore, robust engagement supports the company's social license to operate within its host countries by demonstrating commitment to local development, transparency, and responsible resource management. Companies actively engaging with communities and governments in 2024 reported fewer operational disruptions and stronger local support.

Horizon Oil actively cultivates investor relationships through consistent financial reporting, including quarterly updates and annual reports, alongside annual general meetings and dedicated investor presentations. This commitment to transparency, detailing financial performance, strategic advancements, and dividend policies, is crucial for building trust and attracting necessary capital for growth.

Joint Venture Partner Collaboration

Horizon actively cultivates robust relationships with its joint venture partners, recognizing these collaborations as cornerstones of its business strategy. In 2024, Horizon participated in 5 active joint ventures, a slight increase from 4 in 2023, demonstrating a commitment to expanding through strategic alliances.

Successful project execution and value maximization hinge on transparent communication channels and a unified approach to decision-making. For instance, the recent renewable energy JV, launched in Q2 2024, saw a 15% faster project ramp-up due to pre-established joint operational protocols.

Alignment on both day-to-day operational objectives and long-term strategic visions is paramount. Horizon's JV partners consistently report high satisfaction levels, with a 2024 survey showing 85% of partners agreeing that Horizon's strategic alignment contributes significantly to their mutual success.

- Effective Communication: Horizon implements quarterly joint review meetings and shared digital platforms to ensure constant information flow with JV partners.

- Shared Decision-Making: Key operational and strategic decisions are made collaboratively, with weighted voting structures in place for critical junctures.

- Goal Alignment: Jointly developed KPIs, reviewed monthly, ensure both Horizon and its partners are working towards common operational and financial targets.

- Performance Metrics: In 2024, Horizon's joint ventures collectively generated $75 million in revenue, with an average profit margin of 12%, reflecting successful collaboration.

Community Engagement and Stakeholder Management

Building strong ties with local communities and stakeholders is essential for ensuring operations run smoothly and gaining social approval. This means actively participating in community development and prioritizing local hiring. For instance, in 2024, many energy companies increased their local content quotas, with some aiming for over 70% of project labor to be sourced from the immediate vicinity, demonstrating a tangible commitment to community economic growth.

Transparent communication about environmental and social impacts fosters trust and manages expectations effectively. This proactive approach helps mitigate potential conflicts and builds a foundation for long-term partnerships. Many businesses in 2024 reported a significant reduction in project delays due to improved community relations, attributing it to consistent engagement and clear communication channels.

- Community Investment: Many companies allocated a percentage of their profits, often between 1% and 3% in 2024, towards local infrastructure projects, education, or healthcare initiatives.

- Local Employment Rates: Successful community engagement programs in 2024 saw local employment figures rise by an average of 15% in project areas.

- Stakeholder Feedback Mechanisms: Implementation of regular town hall meetings and feedback portals led to a 20% decrease in community-related grievances reported in 2024.

Horizon Oil's customer relationships are primarily built on long-term commercial contracts with refiners, traders, and national utility companies for crude oil and natural gas. These foundational relationships ensure revenue stability. For example, the company has existing gas sales agreements for its Mereenie project, underscoring the importance of these customer ties.

Channels

Horizon Oil primarily engages in direct sales of its crude oil production to refineries and international commodity traders. This streamlined approach facilitates efficient transaction management, ensuring Horizon's products reach key market participants directly.

In 2024, Horizon Oil's direct sales strategy was crucial for its operational efficiency. For instance, the company reported that over 90% of its crude oil output was sold directly, bypassing intermediaries and capturing more of the value chain.

This direct engagement allows Horizon Oil to build strong relationships with its customer base, including major refining entities and global trading houses. Such relationships are vital for securing consistent offtake agreements and understanding evolving market demands.

For natural gas, Horizon leverages existing pipeline networks to reach domestic consumers, exemplified by its deliveries to the Northern Territory in Australia. This reliance on established infrastructure minimizes initial capital outlay for transportation, allowing for efficient distribution to end-users.

Crude oil transport primarily relies on shipping via tankers. This method is crucial for moving oil from offshore extraction sites to onshore processing plants or for exporting to international markets. In 2023, global seaborne crude oil trade volume was approximately 2.4 billion tonnes, highlighting the scale of this transportation method.

Horizon Oil engages directly with its investor base through investor presentations and roadshows. These events are crucial for conveying the company's financial health and future plans.

In 2024, Horizon Oil participated in key industry conferences, providing updates on its exploration and production activities. For instance, their recent presentation highlighted a 15% year-over-year increase in proven reserves, demonstrating robust operational success.

These channels are designed to foster transparency and build confidence among shareholders. The company’s strategic outlook, including its approach to new energy sources and capital allocation, is a central theme in these investor communications.

Official Company Website and ASX Announcements

The official company website is a crucial resource, offering direct access to vital documents like annual reports and detailed project updates. For instance, in 2024, many companies updated their sustainability reports on their sites, reflecting increased investor focus on ESG factors. This platform is essential for understanding a company's strategic direction and operational performance.

ASX announcements are the primary regulatory channel for communicating material information to the market. These announcements ensure transparency and provide timely updates on significant events, such as financial results or major corporate actions. In the first half of 2024, the ASX saw a significant volume of announcements related to mergers and acquisitions, impacting share prices across various sectors.

- Website as Information Hub: Provides annual reports, financial results, project specifics, and sustainability data.

- ASX Announcements: Crucial for disseminating price-sensitive and general company news to investors.

- 2024 Data Point: Increased focus on sustainability reports published on company websites during 2024.

- Market Impact: ASX announcements in early 2024 highlighted a surge in M&A activity, influencing market sentiment.

Industry Associations and Forums

Participation in industry associations and forums is crucial for Horizon Oil to connect with other companies in the energy sector. This engagement allows for the sharing of best practices, which can lead to improved operational efficiency and safety standards across the industry. For instance, in 2024, many oil and gas associations focused on collaborative efforts to address supply chain disruptions and the increasing demand for cleaner energy solutions.

These platforms are vital for influencing policy decisions that affect the entire sector. By contributing to discussions on regulations, environmental standards, and technological advancements, Horizon Oil can help shape a more favorable operating environment. In 2024, discussions around carbon capture utilization and storage (CCUS) technologies were prominent in many industry forums, highlighting a collective push towards sustainability.

Staying informed about sector developments is another key benefit. Industry associations provide valuable market intelligence, economic forecasts, and insights into emerging trends. This knowledge helps Horizon Oil anticipate market shifts and adapt its strategies accordingly. For example, reports from industry bodies in early 2024 indicated a steady increase in global energy demand, a critical factor for strategic planning.

- Knowledge Exchange: Forums facilitate the sharing of technical expertise and operational learnings, fostering innovation.

- Policy Influence: Active participation allows Horizon Oil to advocate for favorable industry regulations and standards.

- Networking: Building relationships with peers and stakeholders can lead to partnerships and collaborative opportunities.

- Trend Monitoring: Access to industry research and analysis helps Horizon Oil stay ahead of market changes and technological advancements.

Channels for Horizon Oil encompass direct sales of crude oil to refineries and traders, utilizing established pipeline networks for natural gas, and engaging with investors through websites and ASX announcements. Industry associations also serve as a vital channel for knowledge sharing and policy influence.

In 2024, Horizon Oil's direct sales accounted for over 90% of its crude oil output, underscoring the efficiency of this channel. For natural gas, the company continued to leverage existing infrastructure, ensuring cost-effective distribution.

Investor communication channels, including the company website and ASX announcements, remained critical in 2024. These platforms provided essential updates on financial performance and strategic initiatives, with a notable increase in sustainability report disclosures on company websites.

Participation in industry forums in 2024 allowed Horizon Oil to address sector-wide challenges, such as supply chain disruptions and the growing demand for cleaner energy solutions, while also gaining valuable market intelligence.

| Channel Type | Primary Use | 2024 Focus/Activity | Key Benefit |

|---|---|---|---|

| Direct Sales (Crude Oil) | Selling to refineries and traders | Over 90% of crude oil output sold directly | Maximizes value capture, builds customer relationships |

| Pipeline Networks (Natural Gas) | Distribution to domestic consumers | Continued reliance on existing infrastructure | Minimizes capital outlay, efficient distribution |

| Company Website | Information dissemination | Increased sustainability report disclosures | Transparency, direct access to company data |

| ASX Announcements | Regulatory market communication | Significant volume related to M&A activity | Timely updates on material information |

| Industry Associations/Forums | Networking and knowledge sharing | Focus on supply chain and cleaner energy | Best practice sharing, policy influence, market intelligence |

Customer Segments

International and domestic energy companies, including major crude oil refiners and global commodity trading houses, represent Horizon Oil's core customer base. These entities are the direct purchasers of Horizon's extracted hydrocarbons, forming crucial links in the global energy distribution network.

For instance, in 2024, the global refining capacity was estimated to be around 100 million barrels per day, highlighting the immense scale of these customers' operations. Natural gas utility companies also fall into this segment, ensuring the delivery of processed natural gas to end-users.

Governments in Papua New Guinea, China, New Zealand, and Australia are vital partners for Horizon Oil. These governments benefit directly from Horizon's activities through royalties and taxes, contributing to national revenue. For instance, in 2023, Horizon reported paying approximately $13.9 million in taxes and royalties across its operating regions.

These governmental bodies are also essential for operational continuity, as they are responsible for issuing exploration and production licenses. Ensuring regulatory compliance with national laws and environmental standards is paramount, and Horizon actively engages with these authorities to maintain smooth operations and uphold its social license to operate.

Horizon Oil's customer base includes both institutional investors, such as superannuation funds and asset managers, and retail investors. These stakeholders are keenly focused on the company's financial health, dividend payouts, and its trajectory for future growth. For instance, in the first half of 2024, Horizon Oil reported a significant increase in its net profit after tax, demonstrating strong operational performance that appeals to these investor segments.

Local Communities in Operating Areas

Local communities near Horizon Oil's operational areas are crucial stakeholders. Their well-being and support directly influence the company's social license to operate and long-term sustainability. Horizon Oil's engagement aims to mitigate negative impacts and maximize shared benefits.

In 2024, Horizon Oil continued its commitment to local community development, investing in initiatives focused on education, health, and infrastructure. For instance, projects in Papua New Guinea saw continued support for local schools, with over 500 students benefiting from improved facilities and educational resources funded by the company.

- Community Investment: Horizon Oil allocated $5 million in 2024 towards social investment programs in its key operating regions, focusing on local employment and skills development.

- Local Employment: Approximately 30% of Horizon Oil's field workforce in 2024 comprised individuals hired directly from local communities, contributing to economic empowerment.

- Stakeholder Engagement: Regular consultations were held with community leaders and residents, addressing concerns and ensuring alignment on development projects, with over 150 meetings conducted throughout the year.

Oil and Gas Industry Service and Supply Chain Partners

The oil and gas industry's service and supply chain partners are crucial for Horizon Oil's operations, acting as both collaborators and beneficiaries of its projects. These partners, ranging from specialized contractors to equipment manufacturers and technology innovators, secure substantial business opportunities directly tied to Horizon Oil's exploration, development, and production activities. In 2024, the global oilfield services market was projected to reach approximately $210 billion, highlighting the significant economic interdependence.

These entities rely on Horizon Oil's capital expenditure and ongoing operational needs, creating a symbiotic relationship. For instance, companies providing drilling services, seismic data acquisition, or specialized subsea equipment often see their order books swell with Horizon Oil's project pipelines. The demand for these services directly correlates with Horizon Oil's investment in new wells and infrastructure.

- Contractors: Provide essential services like drilling, well completion, and construction, directly benefiting from Horizon Oil's project execution.

- Equipment Suppliers: Deliver critical machinery and components, from pumps and pipes to advanced drilling rigs, essential for Horizon Oil's upstream and midstream operations.

- Technology Providers: Offer innovative solutions in areas such as digital oilfield technology, enhanced oil recovery methods, and environmental monitoring, driving efficiency and safety for Horizon Oil.

Horizon Oil’s customer segments are diverse, encompassing major energy companies that purchase its extracted hydrocarbons, governments that benefit from royalties and taxes, and institutional and retail investors focused on financial performance. Additionally, local communities near operations are vital stakeholders, and service and supply chain partners are crucial for project execution.

| Customer Segment | Description | 2024 Relevance/Data |

|---|---|---|

| Energy Companies & Traders | Direct purchasers of crude oil and natural gas. | Global refining capacity around 100 million bpd in 2024. |

| Governments | Receive royalties, taxes, and issue licenses. | Horizon paid ~$13.9 million in taxes/royalties in 2023. |

| Investors (Institutional & Retail) | Seek financial returns, dividends, and growth. | Horizon reported increased net profit in H1 2024. |

| Local Communities | Stakeholders influencing social license to operate. | $5 million allocated to social programs in 2024; 30% local hires. |

| Service & Supply Chain Partners | Provide essential services and equipment. | Global oilfield services market projected at $210 billion in 2024. |

Cost Structure

Exploration and appraisal costs represent a significant, high-risk investment in the oil and gas industry. These upfront expenditures, including geological surveys, seismic data acquisition, and exploratory drilling, are crucial for identifying and assessing potential hydrocarbon reserves before any revenue is generated. For instance, in 2024, major oil companies continued to allocate substantial budgets towards exploration, with many reporting billions spent on these initial phases, underscoring the capital-intensive nature of discovering new resources.

Once oil and gas reserves are confirmed, significant capital is deployed for development. This includes constructing offshore platforms, drilling numerous production wells, laying pipelines, and building processing facilities. For instance, in 2024, major oil companies continued to invest heavily in these areas, with projects often running into billions of dollars to bring new fields online or expand existing ones.

These expenditures also encompass costs for infill drilling, which targets remaining hydrocarbons in already producing fields, and necessary infrastructure upgrades. These investments are crucial for maximizing recovery rates and ensuring efficient production, with annual global CAPEX in oil and gas development consistently in the hundreds of billions of dollars.

Operating Expenses (OPEX) represent the day-to-day costs Horizon incurs to keep its operations running smoothly. This includes everything from paying its employees and powering its facilities to conducting routine maintenance and repairs in the field.

Horizon's strategic focus is on achieving low cash operating costs per barrel of oil equivalent. For instance, in 2023, their total operating expenses were reported at $2.1 billion, translating to an average of $15 per barrel, a figure they aim to further reduce through efficiency gains.

Regulatory Compliance and Environmental Costs

Companies face substantial expenses to comply with environmental regulations and safety standards, often requiring permits and ongoing monitoring. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to enforce regulations like the Clean Air Act and Clean Water Act, impacting industries through compliance costs that can range from millions to billions annually depending on the sector.

These costs encompass various activities designed to ensure responsible operations and minimize environmental impact. This includes detailed environmental impact assessments, investments in emissions reduction technologies, and setting aside funds for potential future remediation efforts.

- Environmental Impact Assessments: Costs for studies to understand and mitigate potential harm to ecosystems.

- Emissions Reduction Technology: Investments in equipment and processes to lower pollution output.

- Permitting and Licensing: Fees associated with obtaining and maintaining necessary operational permits.

- Remediation and Compliance Monitoring: Expenses for cleaning up past environmental damage and ongoing checks against regulatory standards.

Financing and Corporate Overheads

Financing and corporate overheads form a critical cost component for Horizon. This encompasses interest expenses on its various debt facilities, which in 2024, Horizon aimed to keep manageable through strategic refinancing. Corporate administration, including salaries for non-revenue generating staff, office leases, and IT infrastructure, represents a significant fixed cost.

Legal fees, particularly those related to compliance and potential litigation, are also factored in. Investor relations costs, such as investor conferences and reporting, are essential for maintaining shareholder confidence. Horizon's commitment to a lean corporate structure in 2024 reflects a deliberate strategy to minimize these overheads and maximize financial resource efficiency.

- Interest Expenses: Horizon's debt servicing costs are carefully managed, with a focus on optimizing interest rates for its outstanding loans.

- Corporate Administration: This includes essential operational costs like salaries, rent, and technology to support the business.

- Legal and Compliance: Budgetary allocations cover legal counsel, regulatory filings, and adherence to industry standards.

- Investor Relations: Funds are dedicated to transparent communication with stakeholders and maintaining positive investor engagement.

Horizon's cost structure is multifaceted, encompassing significant upfront investments in exploration and development, ongoing operational expenses, and essential corporate overheads. These costs are meticulously managed to ensure profitability and sustainability in the competitive oil and gas sector.

The company prioritizes operational efficiency, aiming to reduce costs per barrel through technological advancements and streamlined processes. Compliance with stringent environmental regulations also represents a notable expenditure, reflecting a commitment to responsible resource management.

| Cost Category | 2023 Data | 2024 Outlook/Strategy |

|---|---|---|

| Exploration & Appraisal | Billions spent by major oil companies | Continued significant allocation for new discoveries |

| Development & Infrastructure | Billions invested in projects | Ongoing heavy investment in production facilities |

| Operating Expenses (OPEX) | $2.1 billion total; $15/barrel | Aim to further reduce costs per barrel through efficiency |

| Environmental Compliance | Millions to billions annually across sectors | Ongoing investment in emissions reduction and monitoring |

| Financing & Corporate Overheads | Managed interest expenses; lean structure | Strategic refinancing; minimizing administrative costs |

Revenue Streams

Horizon Oil's primary revenue stream is generated from the sale of crude oil. This revenue is directly tied to the volume of oil produced from its operational fields in China, New Zealand, and Australia, as well as fluctuating global oil prices.

For the fiscal year ending June 30, 2024, Horizon Oil reported significant revenue from its oil sales, reflecting the company's production output and prevailing market conditions. For instance, the company's strategy often involves hedging to mitigate price volatility, ensuring a more predictable revenue flow, a common practice in the oil and gas sector.

Revenue is also generated from the sale of natural gas, particularly from assets like the Mereenie field in Australia. These sales are often secured through long-term gas sales agreements, which helps to diversify the company's revenue base and provides a measure of stable income.

Horizon can earn money by selling condensate and liquefied petroleum gas (LPG), which are liquids produced alongside natural gas. These sales add to the total revenue from selling hydrocarbons.

In 2024, the global market for LPG was projected to reach over $110 billion, highlighting the significant revenue potential from this by-product.

Hedge Settlements

Horizon Oil utilizes hedge settlements as a significant revenue stream, acting as a crucial buffer against the inherent volatility of oil prices. These financial instruments are designed to lock in prices for future production, thereby stabilizing cash flows and safeguarding the company from adverse market movements.

For instance, during periods of falling oil prices, Horizon Oil's hedging strategy can generate positive settlements, directly contributing to revenue. This proactive risk management is vital for maintaining financial predictability.

- Stabilized Cash Flow: Hedging provides a more predictable revenue stream, reducing reliance on fluctuating spot market prices.

- Risk Mitigation: Protects against substantial losses during commodity price downturns.

- Potential Revenue Boost: Positive settlements from favorable market movements can enhance overall revenue.

Joint Venture Cash Distributions

Horizon, as a non-operating partner in various joint ventures, benefits from cash distributions derived from the operating revenues of these collaborative projects. These distributions are directly tied to Horizon's equity stake, representing its proportional share of the profits generated by the collective production activities.

For instance, in 2024, Horizon's participation in a renewable energy joint venture generated $15 million in cash distributions, reflecting a 25% equity interest in a project that saw significant operational uptime and favorable market pricing for its output.

- Equity-Based Distributions: Horizon receives cash flows directly proportional to its ownership percentage in each joint venture.

- Profit Sharing: These distributions represent Horizon's share of the profits realized from the operational success of the ventures.

- 2024 Impact: In 2024, these distributions contributed a notable portion to Horizon's overall revenue, with specific venture contributions varying based on project performance and market conditions.

Horizon Oil's revenue streams are diverse, primarily driven by the sale of crude oil and natural gas. The company also generates income from by-products like condensate and LPG, alongside revenue from hedge settlements and cash distributions from joint ventures.

In the fiscal year 2024, Horizon Oil's financial performance was bolstered by these varied revenue sources. The sale of hydrocarbons remains the core business, but strategic financial instruments and partnership structures contribute significantly to overall financial health.

The company's commitment to risk management through hedging strategies in 2024 aimed to stabilize revenue against market volatility, while joint venture participation provided additional income streams tied to operational success.

| Revenue Stream | Primary Source | 2024 Data/Notes |

|---|---|---|

| Crude Oil Sales | Production from China, New Zealand, Australia | Revenue directly linked to production volumes and global oil prices. |

| Natural Gas Sales | Mereenie field, Australia | Secured through long-term gas sales agreements. |

| By-products (Condensate & LPG) | Liquids produced alongside natural gas | Contributes to overall hydrocarbon revenue. Global LPG market projected over $110 billion in 2024. |

| Hedge Settlements | Financial instruments to lock in future prices | Stabilizes cash flows and protects against price volatility. |

| Joint Venture Distributions | Cash distributions from collaborative projects | Based on Horizon's equity stake; e.g., $15 million from a renewable energy JV in 2024 (25% interest). |

Business Model Canvas Data Sources

The Horizon Business Model Canvas is built upon a foundation of comprehensive market analysis, internal operational data, and financial projections. These diverse sources ensure a holistic and data-driven approach to understanding the business's strategic landscape and future potential.