Horizon Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Horizon Bundle

Understanding the competitive landscape for Horizon is crucial for strategic success. Our Porter's Five Forces Analysis unpacks the intricate web of industry rivalry, buyer and supplier power, and the threats of new entrants and substitutes that shape Horizon's market. This foundational knowledge is key to identifying opportunities and mitigating risks.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Horizon’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Suppliers of highly specialized equipment, such as advanced drilling rigs and seismic technology, wield considerable influence. This is because their offerings are often unique and critical for operations, particularly in challenging exploration environments. For instance, companies providing bespoke subsea engineering services for deepwater projects may have limited competition, allowing them to command higher prices.

In specialized sectors of the oil and gas industry, a constricted supplier base significantly amplifies supplier bargaining power. For instance, in deepwater drilling operations or advanced geological surveying, only a handful of highly specialized and qualified suppliers exist. This scarcity means companies like Horizon Oil have fewer alternatives, enabling these select suppliers to dictate higher prices and more advantageous contract terms, directly impacting Horizon's operational costs and profitability.

High switching costs significantly bolster the bargaining power of Horizon Oil's suppliers. For instance, if Horizon Oil relies on specialized drilling equipment or proprietary software, transitioning to a new provider could incur substantial expenses. These might include contract termination penalties, the cost of new machinery or software licenses, extensive employee retraining, and the inevitable disruption to ongoing projects, potentially leading to significant delays and lost revenue.

In 2024, the energy sector has seen increased demand for specialized services, making it harder for companies like Horizon Oil to find readily available alternatives. For example, the scarcity of advanced seismic survey technology providers means that if Horizon Oil were to switch, they might face lengthy lead times and higher upfront investments, further cementing the power of existing suppliers.

Proprietary Technology

Suppliers possessing proprietary technology or intellectual property critical for efficient hydrocarbon extraction, like advanced recovery methods or specialized software, wield significant bargaining power. Horizon Oil's reliance on these unique solutions to enhance operational efficiency and boost reserve recovery underscores this leverage. For instance, in 2024, companies developing next-generation seismic imaging software, a key technology for identifying new reserves, could command premium pricing due to the scarcity of comparable alternatives.

This technological advantage allows suppliers to influence pricing and terms, as Horizon Oil may find it difficult or costly to substitute these specialized inputs. The ability of a supplier to offer patented drilling fluids or enhanced oil recovery (EOR) chemicals that demonstrably increase output can translate into higher contract costs for Horizon Oil if alternatives are not readily available or as effective.

- Proprietary Technology: Suppliers with unique technological solutions for hydrocarbon extraction gain leverage.

- Operational Efficiency: Horizon Oil's dependence on these technologies for optimizing operations increases supplier power.

- Reserve Recovery: Advanced recovery techniques offered by suppliers directly impact Horizon Oil's ability to maximize resource extraction.

- Market Dependence: The lack of readily available substitutes for specialized technologies strengthens the bargaining position of their providers.

Skilled Labor & Expertise

The bargaining power of suppliers in the oil and gas sector is significantly influenced by the availability of highly skilled labor. Specialized roles like geologists, engineers, and project managers, particularly those with expertise in exploration and production, are often in limited supply. This scarcity allows suppliers of this human capital, such as specialized consulting firms or contracting agencies, to command premium rates, thereby increasing their leverage.

In 2024, the demand for experienced oil and gas professionals remained robust, especially as companies continued to invest in new exploration projects and optimize existing production. For instance, a report from a leading industry association indicated that the average salary for a petroleum engineer in the US saw an increase of approximately 5-7% year-over-year, reflecting this tight labor market. This upward pressure on wages directly translates to higher operational costs for exploration and production companies, demonstrating the suppliers' strong bargaining position.

- Scarcity of Specialized Skills: The oil and gas industry requires niche expertise, making it difficult to find qualified personnel.

- Premium Rates for Expertise: Consulting firms and contractors providing skilled labor can charge higher fees due to high demand and limited supply.

- Impact on Operational Costs: Increased labor costs directly affect the profitability and operational expenses of exploration and production companies.

- Industry Wage Trends: In 2024, average salaries for key roles like petroleum engineers showed a notable increase, underscoring supplier power.

Suppliers with unique technologies or proprietary processes hold significant sway, as their offerings are often critical for operational efficiency and reserve recovery. This technological edge means companies like Horizon Oil may face high costs or disruptions if they attempt to switch providers. For example, in 2024, the demand for advanced seismic imaging software, crucial for identifying new reserves, remained high, with limited comparable alternatives available, allowing providers to command premium prices.

The bargaining power of suppliers is also amplified when the industry faces a shortage of specialized skills, such as experienced petroleum engineers or geologists. This scarcity allows consulting firms and contractors to charge higher rates, directly impacting project costs. In 2024, industry data indicated a continued rise in salaries for these specialized roles, with some positions seeing year-over-year increases of 5-7%, highlighting the leverage held by labor suppliers.

| Factor | Impact on Supplier Bargaining Power | Example (2024 Context) |

|---|---|---|

| Proprietary Technology | High | Advanced seismic imaging software providers |

| Specialized Skills Scarcity | High | Consulting firms providing petroleum engineers |

| High Switching Costs | Moderate to High | Transitioning specialized drilling equipment providers |

| Limited Supplier Base | High | Bespoke deepwater engineering service providers |

What is included in the product

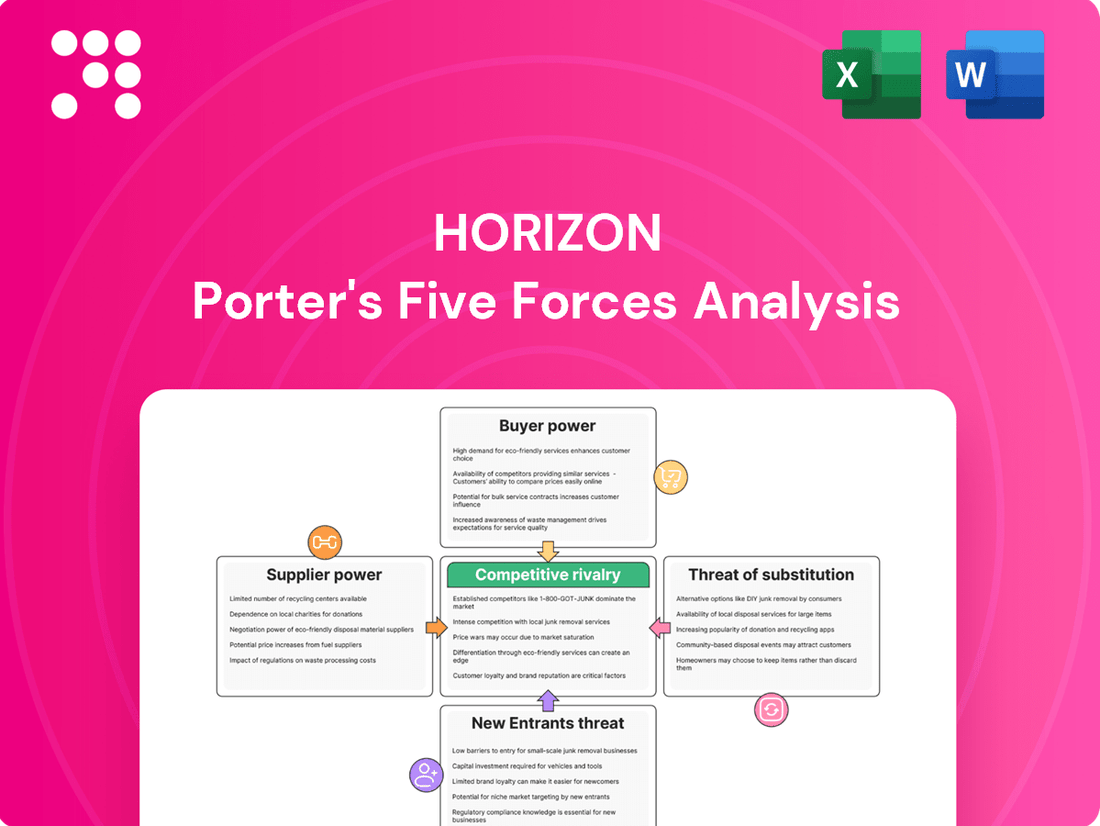

This analysis examines the five competitive forces impacting Horizon's industry: the threat of new entrants, the bargaining power of buyers, the bargaining power of suppliers, the threat of substitute products or services, and the intensity of rivalry among existing competitors.

Quickly identify and mitigate potential threats by visualizing the intensity of each competitive force, enabling proactive strategy adjustments.

Customers Bargaining Power

The commodity nature of crude oil and natural gas significantly amplifies customer bargaining power. Because these resources are largely undifferentiated, buyers can easily switch between suppliers, making price the primary deciding factor. This lack of product differentiation means Horizon Oil has limited ability to command premium pricing, as global markets offer numerous alternative sources.

Horizon Oil's primary customers are typically large refiners, utility companies, or national energy distributors. These entities often purchase significant volumes of crude oil and refined products, giving them considerable bargaining power.

Their scale allows these large buyers to negotiate lower prices or more favorable contract terms. For instance, a major refiner purchasing millions of barrels annually can exert substantial influence on pricing compared to smaller, individual buyers.

In 2024, global oil demand remained robust, but the market also saw increased competition among suppliers. This environment further amplified the leverage of major purchasers, as they could readily switch suppliers if terms were not met.

Horizon Oil's customers exhibit significant price sensitivity, particularly given the commodity nature of oil. This means buyers are quick to switch suppliers if they can find a better deal, putting pressure on Horizon's pricing strategies.

In 2024, the oil market experienced considerable volatility, with crude oil prices fluctuating between $70 and $90 per barrel. This environment amplifies customer sensitivity, as even small price differences become crucial for buyers looking to manage their energy costs effectively.

The bargaining power of customers is thus heightened because they can readily compare offers and will gravitate towards the most cost-effective options. Horizon Oil must remain competitive to retain its customer base in such a price-driven market.

Availability of Alternatives

The availability of numerous alternatives significantly bolsters customer bargaining power in the oil and gas sector. Customers, whether they are large industrial consumers or smaller entities, can readily access a global marketplace populated by a diverse range of oil and gas producers. This includes not only major international oil companies but also a multitude of independent producers, offering a wide spectrum of choices in terms of product quality, delivery terms, and pricing. For instance, in 2024, the global oil and gas market continued to see robust supply from various regions, with OPEC+ production decisions and non-OPEC output playing crucial roles in shaping availability and influencing price competition.

This broad accessibility means customers are not beholden to any single supplier, such as Horizon Oil. They can easily switch between providers if terms become unfavorable or if a competitor offers a better deal. This dynamic directly impacts Horizon Oil's ability to dictate terms, as customers can leverage the presence of alternatives to negotiate more advantageous contracts. For example, a large refinery might have contracts with multiple suppliers, allowing them to allocate purchases based on the most competitive offers available at any given time.

- Global Market Access: Customers can source oil and gas from a wide array of international and independent producers, not just Horizon Oil.

- Reduced Supplier Dependence: The presence of many alternatives diminishes customer reliance on any single oil and gas supplier.

- Enhanced Negotiation Leverage: Customers can use the availability of competing offers to negotiate better pricing and contract terms with Horizon Oil.

- Market Responsiveness: The competitive landscape compels suppliers like Horizon Oil to remain price-competitive and responsive to customer needs to retain business.

Downstream Integration Potential

The potential for downstream integration by large customers of Horizon Oil can significantly influence their bargaining power. If key buyers possess the financial resources or strategic inclination to move backward into exploration and production, they gain a potent negotiating lever. This capability, even if not fully realized, can exert subtle pressure on Horizon Oil during price and supply discussions.

For instance, major industrial consumers or large refining operations might explore backward integration to secure a more stable and cost-effective supply of crude oil. While direct backward integration by customers into oil exploration is less common than, say, in retail, the *threat* of such a move can be a powerful tool. This is particularly true for customers who represent a substantial portion of Horizon Oil's sales volume.

Consider the global energy market in 2024. Major oil-consuming nations and large petrochemical companies are constantly evaluating supply chain security. While specific data on Horizon Oil's customer integration plans isn't publicly available, the broader trend of energy majors seeking vertical integration to control costs and supply chains highlights this dynamic. For example, Saudi Aramco's significant investments in downstream refining and petrochemicals demonstrate the strategic advantage of such integration, a concept that could influence smaller, yet significant, buyers of crude oil.

- Downstream Integration Threat: Large customers may possess the financial capacity to integrate backward into exploration and production.

- Customer Leverage: The potential for customers to produce their own supply acts as a subtle but significant bargaining chip.

- Market Dynamics: In 2024, energy majors are increasingly focusing on vertical integration for cost control and supply security, a trend that influences customer leverage across the industry.

Customers wield significant bargaining power due to the commodity nature of oil and gas, making price the primary driver. Horizon Oil's large-scale customers, such as refiners and utility companies, can leverage their purchasing volume to negotiate favorable terms. In 2024, robust global demand coupled with increased supplier competition further amplified buyer leverage, as they could readily switch providers for better pricing.

The wide availability of alternative suppliers globally means customers are not dependent on Horizon Oil, enhancing their negotiation strength. This competitive landscape compels Horizon Oil to maintain price competitiveness to retain its customer base.

The potential for customers to integrate backward into oil production, while not always realized, serves as a potent negotiating tool. This threat is particularly relevant for large buyers who represent a substantial portion of Horizon Oil's sales, as seen in the broader industry trend of energy majors pursuing vertical integration for cost and supply security in 2024.

| Factor | Impact on Bargaining Power | 2024 Context |

|---|---|---|

| Product Differentiation | Low (Commodity) | Limited ability for Horizon Oil to command premium pricing. |

| Customer Concentration | High (Large buyers) | Major refiners and distributors have significant volume leverage. |

| Switching Costs | Low | Customers can easily shift to alternative suppliers. |

| Availability of Alternatives | High | Numerous global suppliers offer choices, increasing customer options. |

| Threat of Backward Integration | Moderate | Potential for large customers to produce their own supply influences negotiations. |

Preview Before You Purchase

Horizon Porter's Five Forces Analysis

This preview showcases the complete Horizon Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. The document you see here is the exact, professionally formatted report you will receive immediately after purchase, ensuring no discrepancies or missing information. You can confidently proceed with your purchase, knowing you'll gain instant access to this comprehensive strategic tool.

Rivalry Among Competitors

Horizon Oil navigates a competitive environment populated by a wide array of entities. These include established global energy giants, state-owned oil corporations, and other independent exploration and production (E&P) companies, all vying for prime assets in the Asia-Pacific. This broad spectrum of competitors significantly heightens the intensity of competition for securing new exploration permits and viable development projects.

The oil and gas sector, including companies like Horizon Oil, is defined by immense upfront capital expenditure for exploration, drilling, and pipeline infrastructure. These substantial fixed costs create significant barriers to exiting the market, forcing companies to continue operations and vie for market share even when commodity prices are low.

For instance, in 2024, major oil and gas projects often involve billions of dollars in investment. This financial commitment means that ceasing operations is rarely a viable option, leading to intense competition among players to maximize their return on these sunk costs, directly impacting competitive rivalry.

The oil and gas sector is inherently competitive, with pricing being a primary battleground. When supply outstrips demand, or demand falters, companies like Horizon Oil often resort to price wars to maintain market share. This aggressive pricing strategy can significantly erode revenue and profit margins for all players involved.

For instance, in 2024, the global oil market experienced periods of oversupply, leading to volatile price movements. Brent crude oil prices, a key benchmark, fluctuated significantly throughout the year, impacting profitability for exploration and production companies. This environment directly pressures Horizon Oil to match or beat competitor pricing, potentially sacrificing short-term gains for market position.

Slow Industry Growth

Slow industry growth, particularly in mature oil and gas basins or during periods of energy transition, can significantly heighten competitive rivalry. When the overall market isn't expanding, companies like Horizon Oil must fight harder for existing market share, making organic growth more difficult.

This intensified competition means companies are more likely to engage in price wars or aggressive marketing to capture customers. For Horizon Oil, operating in such an environment necessitates a sharp focus on efficiency and differentiation to stand out.

For instance, if the global oil demand growth rate, projected to be around 1.7% in 2024 by the International Energy Agency (IEA), were to stagnate or decline in specific regions where Horizon Oil operates, the pressure on margins would increase substantially.

- Intensified Competition: Companies battle for a larger slice of a static or shrinking market pie.

- Challenging Organic Growth: It becomes harder for Horizon Oil to expand its operations and revenue through natural market expansion.

- Pressure on Margins: Price competition and increased marketing spend can erode profitability.

Acquisition of Reserves and Licenses

Competitive rivalry for acquiring new exploration acreage and production licenses in the Asia-Pacific region is intense. Horizon Oil faces constant bidding wars for attractive assets, which inflates acquisition costs and complicates efforts to expand its resource base economically.

This heightened competition directly impacts Horizon Oil's ability to grow its proven reserves. For instance, in 2024, the average cost per barrel for proved reserves acquisition in the Asia-Pacific region saw an upward trend due to increased demand from both national oil companies and international players. This makes it more challenging for Horizon to secure new opportunities at favorable terms.

- Increased Bidding Activity: Companies are aggressively bidding on new exploration blocks, driving up entry costs.

- Higher Acquisition Multiples: The price paid for proven reserves has risen, making it harder to achieve attractive returns on investment.

- Resource Nationalism: Some governments in the region are favoring national oil companies in license awards, further limiting opportunities for independent players like Horizon Oil.

The competitive landscape for Horizon Oil is fierce, characterized by numerous players including global energy majors and state-owned enterprises vying for prime Asia-Pacific assets. This intense rivalry drives up acquisition costs for exploration permits and development projects. For example, in 2024, the cost of securing new oil and gas acreage in promising regions often saw significant increases due to competitive bidding, impacting Horizon's ability to expand its reserve base economically.

High fixed costs in the industry, such as those for exploration and infrastructure, create substantial exit barriers, compelling companies to remain active and compete for market share even during downturns. This often leads to price wars, as seen in 2024 when fluctuating oil prices like Brent crude impacted profitability and forced companies to match competitor pricing to retain their market position.

Slow industry growth or periods of energy transition can exacerbate competitive rivalry. When the market isn't expanding, companies like Horizon Oil must fight harder for existing customers, which can pressure profit margins through increased marketing or price reductions. For instance, if regional oil demand growth, projected at around 1.7% globally for 2024 by the IEA, falters in Horizon's operating areas, the competitive intensity would likely escalate.

| Competitor Type | Impact on Horizon Oil | 2024 Data/Observation |

|---|---|---|

| Global Energy Majors | Intense competition for assets, price pressure | Continued aggressive bidding for exploration blocks in Southeast Asia. |

| State-Owned Corporations | Preference in license awards, resource nationalism | Increased focus by national oil companies on domestic exploration and production in several key Asia-Pacific markets. |

| Independent E&P Companies | Direct competition for market share and talent | Many smaller players focused on cost efficiency to compete effectively in volatile price environments. |

SSubstitutes Threaten

The escalating adoption of renewable energy presents a significant threat of substitution for traditional fossil fuels. By the end of 2023, global renewable energy capacity additions reached a record 510 gigawatts, a 50% increase compared to 2022, according to the International Energy Agency (IEA). This rapid expansion, driven by falling costs for solar photovoltaics and wind power, directly erodes the market share for hydrocarbon products.

This shift is further amplified by supportive government policies and corporate sustainability goals. For instance, the US Inflation Reduction Act of 2022 is designed to accelerate clean energy deployment. As these alternatives become more cost-competitive and widely available, the demand for Horizon Oil's core offerings is likely to face sustained pressure, impacting future revenue streams.

Ongoing advancements in energy efficiency are a significant threat to Horizon Oil. For instance, the automotive sector is seeing a surge in electric vehicle adoption. By the end of 2023, global EV sales surpassed 13.6 million units, a substantial increase from previous years, directly reducing demand for gasoline.

Similarly, industrial processes are becoming more energy-efficient. In 2024, many industrial companies are investing in upgrades that lower their reliance on fossil fuels. This trend means less demand for the products Horizon Oil offers, potentially capping its market growth and profitability.

The accelerating adoption of electric vehicles (EVs) and the development of alternative transportation fuels like hydrogen or biofuels pose a substantial threat to crude oil. As the global vehicle fleet electrifies, demand for gasoline and diesel, which are derived from crude oil, is projected to decline significantly.

In 2024, EV sales are expected to continue their upward trajectory, capturing an increasing share of the automotive market. This shift directly reduces the need for traditional internal combustion engine vehicles, thereby diminishing the demand for crude oil as a primary fuel source.

Policy and Regulatory Shifts

Policy and regulatory shifts represent a significant threat of substitutes for Horizon Oil. Governments worldwide are increasingly implementing policies focused on decarbonization and environmental protection. For instance, many nations are introducing or strengthening carbon pricing mechanisms, making fossil fuels more expensive. In 2024, the European Union continued its efforts to meet its climate targets, with the Emissions Trading System (ETS) price fluctuating but remaining a substantial cost for emitters. This economic pressure directly incentivizes a move towards cleaner energy sources.

These legislative actions create a powerful impetus for both industries and consumers to transition away from traditional fossil fuels. Regulations mandating or encouraging the adoption of renewable energy, alongside advancements in energy efficiency, directly impact Horizon Oil's long-term market viability. For example, the push for electric vehicles, supported by government subsidies and charging infrastructure development, directly substitutes for gasoline and diesel demand, a core market for oil companies.

- Government policies promoting decarbonization

- Carbon pricing mechanisms increasing fossil fuel costs

- Environmental regulations driving adoption of cleaner alternatives

- Legislative support for renewable energy and energy efficiency

Technological Advancements in Storage

Breakthroughs in energy storage technologies, especially for renewable sources like solar and wind, are making these intermittent power generation methods far more reliable and competitive. This directly impacts traditional power generation, as storage solutions can smooth out supply fluctuations.

As battery technology continues to advance and costs decrease, the widespread adoption of renewables is further accelerated. For instance, by the end of 2023, global battery storage capacity reached approximately 140 GW, a significant jump from previous years, demonstrating this trend.

This enhanced reliability and cost-effectiveness of renewables, powered by better storage, acts as a potent substitute for dispatchable fossil fuel power generation. Companies are increasingly investing in these greener alternatives, driven by both economic and environmental factors.

- Falling Battery Costs: The average cost of lithium-ion battery packs dropped by over 90% between 2010 and 2023, making grid-scale storage more viable.

- Renewable Growth: In 2024, renewable energy sources are projected to account for a substantial portion of new global power capacity additions.

- Grid Modernization: Investments in smart grids and energy storage are crucial for integrating higher percentages of renewables, reducing reliance on traditional power plants.

The increasing viability of alternative energy sources presents a significant threat to Horizon Oil's market. As renewable technologies mature and costs decline, they directly displace demand for fossil fuels across various sectors.

The global shift towards electrification, particularly in transportation, is a prime example. By the end of 2023, electric vehicle sales continued to surge, with projections for 2024 indicating further market penetration. This trend directly reduces the need for gasoline and diesel, core products for oil companies.

Furthermore, advancements in energy efficiency and storage are enhancing the competitiveness of renewables. For instance, improved battery technology, which saw significant cost reductions by 2023, makes solar and wind power more reliable and attractive for grid-scale applications, directly challenging traditional fossil fuel power generation.

| Energy Source | 2023 Capacity Additions (GW) | Projected 2024 Growth Factor | Impact on Fossil Fuels |

|---|---|---|---|

| Solar PV | 350+ | 1.2x | Direct substitution in electricity generation |

| Wind Power | 110+ | 1.15x | Displaces natural gas and coal power |

| Electric Vehicles | 13.6M+ units sold (2023) | 1.25x sales growth (2024 est.) | Reduces demand for gasoline/diesel |

Entrants Threaten

Entering the oil and gas exploration and production (E&P) sector demands colossal upfront capital. Costs for seismic surveys, exploratory drilling, and establishing production infrastructure can easily run into billions of dollars, effectively creating a formidable barrier.

For instance, a single offshore exploration well can cost upwards of $100 million, with development and production facilities adding many times that amount. This sheer financial scale makes it incredibly difficult for new companies to compete with established giants like Horizon Oil, who possess deep pockets and existing infrastructure.

The oil and gas sector faces significant regulatory hurdles, making it difficult for new companies to enter. Obtaining the necessary permits, licenses, and environmental approvals is a complex and lengthy process. For instance, in 2024, the average time to secure all required federal and state permits for a new offshore oil exploration project could easily extend beyond two years, with costs often running into millions of dollars.

Established companies like Horizon Oil benefit from significant advantages due to their existing access to proven reserves and acreage. These long-term leases and rights represent a substantial barrier for newcomers. For instance, in 2024, the cost of securing exploration acreage through competitive bidding processes, particularly in frontier regions, can run into hundreds of millions of dollars, making it prohibitively expensive for many potential entrants.

New entrants struggle to acquire attractive undeveloped acreage, as this land is frequently already controlled by incumbent players or national oil companies. These governments often favor established operators with a proven track record in their bidding rounds, further limiting opportunities for new participants. This concentration of resources in the hands of a few makes market entry exceptionally challenging.

Technological Expertise and Experience

The oil and gas exploration and production (E&P) sector demands a deep well of specialized technical expertise, encompassing geology, reservoir engineering, drilling, and complex project management. New entrants are severely hampered by the absence of this accumulated knowledge and a readily available skilled workforce, creating a significant barrier to entry.

Building the necessary technical capabilities and operational experience takes considerable time and investment, often spanning decades. For instance, major oil companies have invested billions in research and development, refining their techniques and accumulating vast datasets, which are not easily replicated by newcomers. In 2024, the cost of a single deepwater exploration well can easily exceed $100 million, underscoring the capital intensity and technical risk involved.

- Specialized Skills Gap: New firms struggle to attract and retain geoscientists, petroleum engineers, and experienced drilling crews, who are in high demand and command premium salaries.

- Operational Experience Deficit: Navigating the complexities of exploration, drilling, and production requires hands-on experience with diverse geological formations and challenging operating environments, something startups inherently lack.

- Technological Investment: Advanced seismic imaging, drilling technologies, and data analytics platforms require substantial upfront investment, creating a high cost of entry for those without established infrastructure and R&D capabilities.

Long Lead Times and Risk Profile

The oil and gas industry presents a formidable barrier to new entrants due to the sheer scale of investment and the extended timelines involved. Projects can take many years, sometimes over a decade, from initial exploration to generating revenue, demanding substantial upfront capital and a high tolerance for risk. For instance, developing a new offshore oil field often requires billions of dollars in investment before any oil is extracted.

New players might find it challenging to commit such vast sums without immediate returns, especially given the inherent geological uncertainties and operational complexities. The risk profile is amplified by fluctuating commodity prices and evolving regulatory landscapes, which can significantly impact project economics over the long lead times. By 2024, the average cost to develop a new oil field has been estimated to be in the tens of billions of dollars, a figure that deters many potential entrants.

- Long Investment Cycles: Oil and gas projects require significant capital outlay over many years before any revenue is generated.

- High Geological and Operational Risks: Exploration success is not guaranteed, and operational challenges can lead to cost overruns and delays.

- Capital Intensity: The sheer amount of money needed to start and complete projects is a major deterrent for new companies.

- Risk Aversion: Potential new entrants may be hesitant to commit capital to ventures with such long payback periods and uncertain outcomes.

The threat of new entrants in the oil and gas E&P sector is significantly low, primarily due to the immense capital requirements, stringent regulatory environment, and the need for specialized expertise. Established players like Horizon Oil benefit from economies of scale and existing infrastructure, creating substantial barriers for newcomers. In 2024, the average cost to develop a new oil field is estimated to be in the tens of billions of dollars, a figure that deters many potential entrants. Securing permits alone can take over two years and cost millions, further limiting market entry.

| Barrier | Impact on New Entrants | Example Data (2024) |

|---|---|---|

| Capital Intensity | Extremely High | New offshore exploration well costs > $100 million; new field development in tens of billions. |

| Regulatory Hurdles | High | Permit acquisition for offshore projects can exceed 2 years and cost millions. |

| Access to Resources | High | Securing acreage can cost hundreds of millions in competitive bidding. |

| Technical Expertise | High | Decades of R&D investment by majors; deepwater well costs exceed $100 million. |

| Long Investment Cycles | High | Projects take over a decade from exploration to revenue generation. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a robust foundation of data, drawing from industry-specific market research reports, financial statements of key players, and publicly available company filings. This comprehensive approach ensures a deep understanding of competitive dynamics.