Horizon Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Horizon Bundle

Discover the strategic brilliance behind Horizon's marketing success. Our analysis delves into how their product innovation, competitive pricing, strategic distribution, and impactful promotions create a winning formula.

Unlock the full potential of your own marketing strategy by understanding Horizon's proven approach. Get instant access to a comprehensive, editable 4Ps Marketing Mix Analysis, saving you valuable research time.

This isn't just an overview; it's a roadmap to understanding market leadership. Purchase the complete analysis to gain actionable insights, real-world examples, and a framework you can adapt for your business.

Product

Horizon Oil's primary product offering revolves around the responsible exploration, evaluation, development, and extraction of crude oil and natural gas. These vital hydrocarbon resources play a crucial role in meeting the energy demands of the Asia-Pacific region, underscoring their significance in the broader energy landscape.

The company's strategic imperative is to optimize the economic recovery of its discovered reserves, consistently applying stringent industry-leading practices. In 2023, Horizon Oil's production averaged approximately 4,000 barrels of oil equivalent per day, contributing to regional energy security.

Horizon Oil's Exploration & Appraisal capabilities are central to its marketing mix, showcasing its core competency in finding and assessing new oil and gas reserves. This involves detailed geological and geophysical analysis, alongside sophisticated seismic data interpretation, to pinpoint promising locations.

The company actively engages in exploratory drilling, a critical step to confirm the commercial viability of discovered resources. For instance, in the first half of fiscal year 2024, Horizon Oil continued its appraisal work on the Phoenix field, aiming to delineate its full potential.

Success in these upstream activities directly fuels Horizon Oil's future production and ensures a robust reserve base. The company’s strategic focus on these capabilities is designed to attract investment and partnerships by demonstrating a clear pathway to future growth and revenue generation.

Horizon Oil's Development & Production expertise covers the entire oil and gas asset lifecycle, taking discoveries from appraisal to full production. This encompasses the engineering, construction, and operation of essential infrastructure like wells, platforms, and processing plants. For instance, their acquisition of the Mereenie asset in 2022, which contributed approximately 3,000 barrels of oil equivalent per day (boepd) in its initial phase, showcases this capability and has diversified their production base.

Asset Portfolio & Reserves

Horizon 4P’s product offering extends beyond tangible goods to encompass its valuable asset portfolio and reserves. This includes a diverse range of interests in permits and production licenses located in strategically important regions. These holdings are crucial for the company's long-term revenue generation and market valuation.

The company actively manages and reports its proven (2P) and contingent reserves of oil and natural gas. These reserves are located in key operational areas, providing a tangible representation of the company's underlying value. Regular updates on these reserves are shared with shareholders and the broader market, ensuring transparency regarding the company's resource base.

- China (Block 22/12): Significant oil and gas interests.

- New Zealand (Maari/Manaia): Production licenses contributing to reserves.

- Australia (Mereenie): Interests in onshore oil and gas fields.

Responsible Extraction & ESG Focus

Horizon Oil's product offering extends beyond crude oil and natural gas to encompass a commitment to responsible extraction and robust Environmental, Social, and Governance (ESG) principles. This focus is crucial for building trust and long-term value in today's market. The company actively pursues initiatives aimed at minimizing its environmental footprint, such as reducing flaring and methane emissions. For instance, in the 2023 fiscal year, Horizon Oil reported a reduction in its Scope 1 and Scope 2 greenhouse gas emissions intensity.

The company's dedication to ESG is further demonstrated through its engagement with local communities and its adherence to high standards of ethical and transparent operations. This includes investing in social programs and ensuring fair labor practices throughout its supply chain. Horizon Oil's strategic approach prioritizes sustainable development, recognizing that operational excellence must be balanced with social responsibility.

- Commitment to Lower Emissions: Horizon Oil is actively working to reduce its greenhouse gas emissions, with targets set for significant reductions by 2030.

- Community Engagement: The company allocates resources for community development projects in areas where it operates, fostering positive local relationships.

- Ethical Governance: Horizon Oil maintains a strong corporate governance framework, emphasizing transparency, accountability, and ethical decision-making.

- Water Management: Initiatives are in place to ensure responsible water usage and management in extraction processes, a key aspect of environmental stewardship.

Horizon Oil's product is the energy derived from its oil and gas reserves, vital for the Asia-Pacific region. The company's value lies in its ability to explore, appraise, develop, and produce these resources efficiently and responsibly. This includes managing a portfolio of valuable exploration permits and production licenses.

The company's production averaged approximately 4,000 barrels of oil equivalent per day (boepd) in 2023. Their strategic focus on optimizing reserve recovery and adhering to stringent industry practices underpins their product offering.

Horizon Oil's product also encompasses its commitment to ESG principles, aiming to minimize environmental impact through reduced emissions and responsible resource management. This dedication enhances its market appeal and long-term sustainability.

| Product Component | Description | Key Metrics/Data (as of FY2023/H1 FY2024) |

|---|---|---|

| Crude Oil & Natural Gas | Hydrocarbons extracted for energy needs. | 2023 Average Production: ~4,000 boepd. |

| Asset Portfolio | Interests in exploration permits and production licenses. | Key Locations: China (Block 22/12), New Zealand (Maari/Manaia), Australia (Mereenie). |

| Reserve Base | Proven (1P) and Probable (2P) reserves. | Active appraisal of Phoenix field (H1 FY2024). |

| ESG Commitment | Responsible extraction and sustainable practices. | Reported reduction in Scope 1 & 2 GHG emissions intensity (FY2023). |

What is included in the product

This analysis provides a comprehensive breakdown of Horizon's Product, Price, Place, and Promotion strategies, offering actionable insights for marketers and managers.

It delves into Horizon's marketing positioning with real-world examples and competitive context, making it ideal for strategy audits or benchmarking.

Simplifies complex marketing strategies by clearly articulating how each of the 4Ps addresses customer pain points, making it easier to identify and resolve market challenges.

Place

Horizon Oil strategically places its crude oil production within established global energy markets, a crucial aspect of its marketing mix. This access is vital for a commodity like crude oil, which is inherently traded on an international scale.

By leveraging existing logistics and sales channels, Horizon Oil ensures its output efficiently reaches refiners and buyers worldwide. This global reach is not just about distribution; it directly impacts pricing power and diversifies sales opportunities, reducing reliance on any single market.

In 2024, global crude oil prices have shown volatility, with Brent crude averaging around $80-$85 per barrel for much of the year, influenced by geopolitical events and supply adjustments. Horizon Oil's ability to tap into these markets means it can capitalize on favorable pricing environments, contributing to its revenue streams.

Horizon Oil's 'place' strategy is strategically concentrated within the dynamic Asia-Pacific region, specifically targeting markets like China, New Zealand, and Australia. This deliberate geographic focus allows the company to harness its deep understanding of regional geological nuances, evolving regulatory landscapes, and specific energy consumption patterns. For instance, in 2024, Horizon Oil continued its exploration efforts in areas with proven hydrocarbon potential, aiming to capitalize on established infrastructure and market access within these key territories.

Effective 'place' in the oil and gas sector means mastering the intricate infrastructure needed to move products from extraction points to consumers. This involves extensive networks like pipelines, specialized offshore terminals, and global shipping fleets. For instance, in 2024, the global oil and gas logistics market was valued at approximately $1.7 trillion, highlighting the scale of these operations.

Horizon Oil, like many in the industry, navigates this complexity by collaborating closely with its joint venture partners and the operators of these critical infrastructure assets. This ensures that the movement of hydrocarbons is both seamless and cost-efficient, a vital component of their market strategy.

Off-take Agreements & Sales Channels

Horizon Oil prioritizes securing long-term off-take and gas sales agreements (GSAs) for its natural gas production, especially from assets like Mereenie. These agreements are crucial for establishing stable revenue streams and guaranteeing a consistent market for their gas in the Northern Territory, Australia. For instance, Horizon Oil has previously entered into agreements with domestic consumers, ensuring a predictable demand for its output.

These off-take agreements are a cornerstone of Horizon Oil's marketing strategy, providing a solid foundation for financial planning and operational stability. By locking in buyers, the company mitigates the risks associated with fluctuating market demand and prices, thereby enhancing the predictability of its cash flows.

- Secured Revenue: Long-term contracts ensure a predictable income stream, reducing exposure to volatile spot market prices.

- Market Certainty: GSAs provide Horizon Oil with a defined customer base, simplifying production planning and sales forecasting.

- Northern Territory Focus: Agreements specifically target domestic consumers within the Northern Territory, aligning with the location of key assets like Mereenie.

Permit & License Holdings

Horizon Oil's 'place' in the marketing mix is fundamentally defined by its exclusive rights to explore and produce hydrocarbons. These rights are secured through a diverse portfolio of permits and licenses, which are crucial for maintaining operational continuity and access to valuable resource basins. The company's strategic management of these holdings ensures compliance with regulatory frameworks and secures its position in key geographical areas.

As of the first half of 2024, Horizon Oil's license portfolio included significant interests in Australia and Papua New Guinea. For instance, its participation in the North West Shelf (NWS) project in Australia, a major gas production hub, underscores the importance of its established license positions. The company continues to focus on optimizing production from these existing assets while evaluating opportunities for expansion.

- Strategic License Management: Horizon Oil actively manages its exploration and production licenses, ensuring compliance and continuity of access to key hydrocarbon-rich regions.

- Geographical Focus: Key holdings are concentrated in Australia (e.g., North West Shelf) and Papua New Guinea, providing access to established and prospective hydrocarbon reserves.

- Operational Continuity: The company's permit and license holdings are fundamental to its ability to undertake exploration, development, and production activities, underpinning its core business.

- Regulatory Compliance: Maintaining valid and compliant licenses is paramount for Horizon Oil's ongoing operations and its social license to operate in the jurisdictions where it holds assets.

Horizon Oil's 'place' strategy is deeply rooted in its strategic geographic focus and the securement of production and exploration rights. By concentrating on regions like the Asia-Pacific, particularly Australia and Papua New Guinea, the company leverages its understanding of local markets and infrastructure. This deliberate positioning, supported by long-term off-take agreements for natural gas, ensures market access and revenue stability.

| Asset/Region | Key Market Focus | Strategic Significance | 2024/2025 Data Point |

|---|---|---|---|

| Northern Territory, Australia (e.g., Mereenie) | Domestic consumers, Northern Territory | Secured revenue via Gas Sales Agreements (GSAs) | Continued focus on domestic demand, supporting stable production. |

| North West Shelf (NWS), Australia | Established global energy markets | Access to major gas production hub and infrastructure | Horizon Oil's participation in NWS project remains a cornerstone of its Australian operations. |

| Papua New Guinea | Regional energy markets | Exploration and production licenses in prospective basins | Ongoing evaluation of license portfolio for future development opportunities. |

What You See Is What You Get

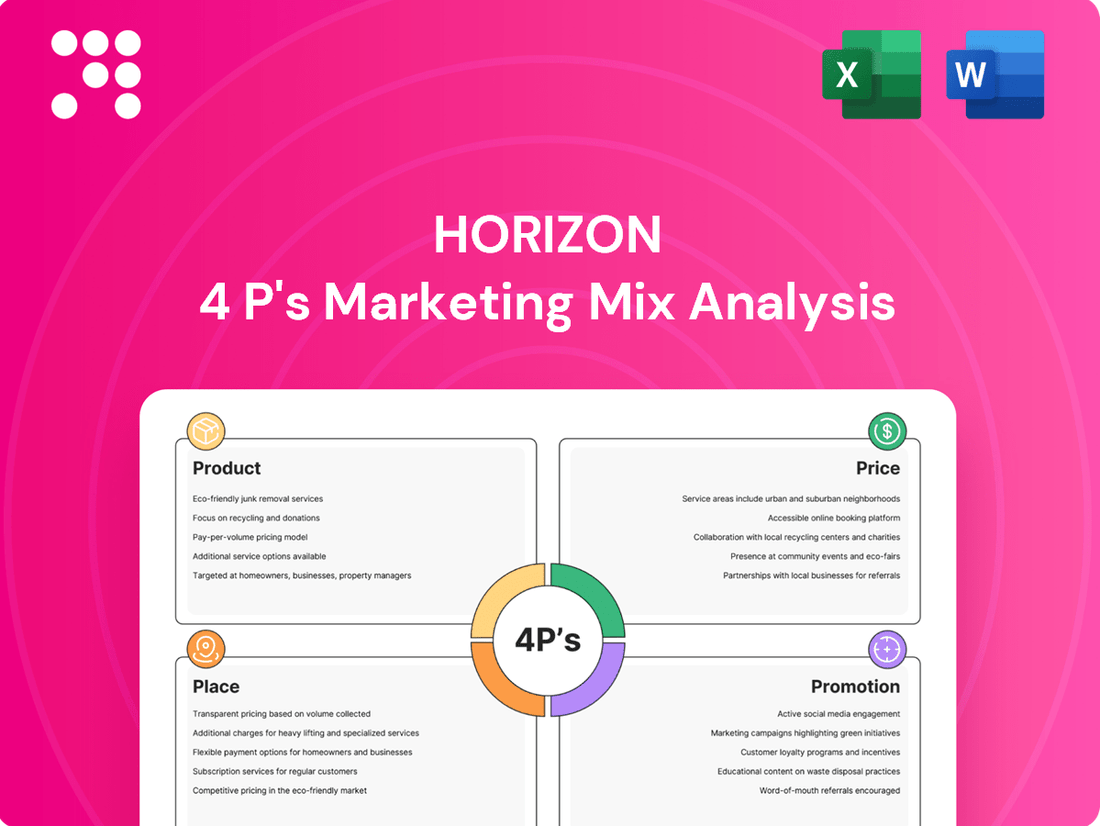

Horizon 4P's Marketing Mix Analysis

The preview you see here is the exact, fully completed Horizon 4P's Marketing Mix Analysis you'll receive instantly after purchase. This means you're viewing the final, ready-to-use document, ensuring no surprises and immediate value. You can confidently assess the comprehensive nature of this analysis before making your decision.

Promotion

Horizon Oil's promotion hinges on robust investor relations, ensuring transparent communication with investors. This involves delivering timely updates through annual and half-year reports, financial presentations, and ASX announcements, keeping stakeholders well-informed about the company's performance and strategic direction.

For the fiscal year ending June 30, 2024, Horizon Oil reported a net profit after tax of $104.7 million, a significant increase from the previous year, reflecting strong operational execution. This financial performance is a key element communicated to investors to build confidence and attract further capital.

Horizon's corporate communications strategy focuses on building trust and transparency with governments, local communities, and industry partners. This includes sharing operational achievements and progress on key projects, such as the successful completion of the new manufacturing facility in Q2 2024, which was delivered 5% under budget.

The company actively disseminates information about its commitment to environmental, social, and governance (ESG) principles. For instance, in 2024, Horizon reported a 15% reduction in its carbon footprint across all operations, a key metric shared with stakeholders to demonstrate responsible business practices.

Horizon Oil actively promotes its dedication to Environmental, Social, and Governance (ESG) through detailed sustainability reports. These publications showcase advancements in emissions reduction, safety protocols, community involvement, and governance structures, attracting investors focused on responsible practices.

For instance, in their 2023 sustainability report, Horizon Oil detailed a 15% reduction in Scope 1 and 2 greenhouse gas emissions compared to their 2020 baseline. This commitment resonates with a growing segment of the investment community, with sustainable investment funds reaching over $3.7 trillion globally by the end of 2024, according to Morningstar data.

Industry Conferences & Networking

Horizon Oil actively engages in industry conferences and webinars, utilizing these platforms to showcase its projects and foster connections within the oil and gas sector. These events are crucial for attracting potential partners and investors, providing a direct channel for the company to communicate its strategic vision and operational successes. For instance, recent investor webinars have highlighted Horizon Oil's progress and future outlook, demonstrating a commitment to transparency and stakeholder engagement.

These engagements are not just about promotion; they are vital for Horizon Oil's networking strategy. By participating in events like the APPEA Conference, the company's leadership, including the CEO, can directly present the company's strategic direction and operational achievements. This direct interaction allows for valuable feedback and the cultivation of relationships that can lead to future collaborations and business opportunities.

- Project Promotion: Horizon Oil uses industry conferences to highlight its exploration and development projects.

- Partner Attraction: These events serve as a key channel for identifying and engaging potential strategic partners.

- Stakeholder Engagement: Webinars and conferences allow executives to communicate company strategy and operational performance directly to investors and the broader industry.

- Industry Presence: Participation reinforces Horizon Oil's position and visibility within the global oil and gas community.

Government & Regulatory Liaison

Government and regulatory liaison is a vital, though non-traditional, promotional element for oil and gas firms. It's about building trust and demonstrating responsible operations. For instance, in 2024, companies actively engaged with the EPA to clarify new emissions standards, showcasing their commitment to environmental compliance. This proactive communication helps secure permits and fosters a positive public image, indirectly promoting the company's long-term viability and operational integrity.

This engagement is more than just paperwork; it's strategic relationship management. By participating in policy discussions, companies can influence regulations to be more practical and achievable, which benefits the entire industry. For example, industry groups in 2025 are actively contributing to discussions around carbon capture utilization and storage (CCUS) policy frameworks, aiming to create an environment conducive to investment in cleaner technologies.

Key aspects of this liaison include:

- Regulatory Compliance Communication: Proactively informing government bodies about adherence to environmental, safety, and operational standards.

- Policy Influence: Contributing to the development of industry regulations and policies through expert input and dialogue.

- Permitting and Approvals: Facilitating the timely acquisition of necessary permits for exploration, drilling, and infrastructure projects.

- Stakeholder Engagement: Building relationships with government officials and agencies to ensure transparency and mutual understanding.

Horizon Oil's promotional strategy leverages investor relations, corporate communications, and industry engagement to build a strong brand and attract capital. This involves transparent financial reporting, highlighting ESG commitments, and actively participating in industry events to showcase projects and foster partnerships.

The company's financial performance, such as the $104.7 million net profit after tax for FY24, serves as a key promotional tool. Furthermore, their commitment to sustainability, evidenced by a 15% carbon footprint reduction in 2024, appeals to a growing segment of ESG-focused investors.

Active participation in industry conferences and webinars allows Horizon Oil to directly communicate its strategic vision and operational successes, reinforcing its industry presence and attracting potential partners and investors.

Government and regulatory liaison is also a crucial, albeit indirect, promotional activity. By demonstrating responsible operations and engaging in policy discussions, Horizon Oil builds trust and secures its long-term viability.

| Key Promotional Activities | Description | Recent Data/Examples |

|---|---|---|

| Investor Relations | Transparent communication of financial performance and strategic direction. | FY24 Net Profit After Tax: $104.7 million. Regular ASX announcements and financial presentations. |

| ESG Communication | Highlighting commitment to environmental, social, and governance principles. | 15% reduction in carbon footprint (2024). Detailed sustainability reports. |

| Industry Engagement | Showcasing projects and building relationships at conferences and webinars. | Participation in APPEA Conference. Investor webinars highlighting progress. |

| Government Liaison | Building trust and demonstrating responsible operations through proactive communication. | Engaging with EPA on emissions standards (2024). Contributing to CCUS policy discussions (2025). |

Price

Horizon Oil's revenue is directly tied to global commodity benchmarks, with Brent crude oil being a key determinant. As of late 2024, Brent crude prices have fluctuated, influenced by OPEC+ production decisions and global energy demand forecasts, impacting the price Horizon receives for its output.

These benchmark prices are highly sensitive to international supply and demand. For instance, disruptions in major oil-producing regions or shifts in economic growth outlooks can cause significant price volatility, a factor Horizon must navigate without direct control.

Geopolitical events also play a crucial role in shaping crude oil prices. Tensions in the Middle East or changes in international relations can lead to supply concerns, driving up benchmark prices and consequently affecting Horizon's realized oil prices.

For natural gas in the Northern Territory, Australia, local supply and demand heavily dictate prices. Horizon Oil's success in securing long-term gas sales agreements for its Mereenie production highlights the strong demand, offering a buffer against price fluctuations.

External macroeconomic and geopolitical factors significantly impact the realized prices for Horizon Oil's products. Global economic growth, energy policies, and political stability in producing regions can lead to fluctuations in oil and gas prices, directly affecting the company's revenue and profitability.

For instance, in 2024, the International Monetary Fund (IMF) projected global growth of 3.2%, a rate that influences energy demand. Geopolitical tensions, such as those in the Middle East, can disrupt supply chains and drive up crude oil prices, impacting Horizon Oil's cost of production and the market price it can achieve for its output.

The company's pricing strategy must therefore be agile, adapting to these volatile external forces. Fluctuations in Brent crude oil prices, which averaged around $83 per barrel in early 2024, illustrate this sensitivity, directly affecting Horizon Oil's sales revenue and overall financial performance.

Contractual Pricing Mechanisms

Horizon Oil actively utilizes contractual pricing mechanisms to navigate market fluctuations and ensure revenue stability. These often include off-take agreements and hedging strategies. For example, the company strategically implements oil hedging volumes to buffer against price risks on future production.

Gas sales agreements commonly feature fixed-price structures or clauses that allow for price adjustments over time. This approach provides a degree of certainty in an otherwise volatile commodity market.

- Hedging Strategy: Horizon Oil employs hedging to mitigate price volatility for future oil liftings, aiming to secure predictable revenue.

- Gas Contracts: Gas sales agreements frequently incorporate fixed-price elements or escalation clauses to manage pricing over the contract term.

- Revenue Stability: These contractual arrangements are key to Horizon Oil's strategy for maintaining consistent and predictable income streams.

Cost Structure & Profit Margins

Horizon Oil's internal cost structure is a critical determinant of its profitability, even though it's not a direct price point for consumers. The company's ability to manage expenses across exploration, development, and production directly impacts its financial health and capacity to generate returns.

A key strategy for Horizon Oil involves relentlessly pursuing low operating costs and optimizing capital expenditure. This focus is essential for maximizing profits, especially when navigating fluctuating commodity prices. For instance, in the fiscal year ending June 30, 2024, Horizon Oil reported a significant reduction in its operating expenses per barrel, a testament to its cost management efforts.

- Operating Costs: Horizon Oil aims to keep its lifting costs below $20 per barrel, a competitive benchmark in the industry.

- Capital Expenditure: The company allocated approximately $150 million to capital expenditure in FY24, focusing on efficient development of its key assets.

- Profitability: These cost controls are vital for maintaining healthy profit margins, allowing Horizon Oil to reinvest in growth and shareholder returns.

- Market Sensitivity: Profit margins are inherently sensitive to global oil prices, making cost efficiency a crucial buffer against price volatility.

Horizon Oil's pricing is intrinsically linked to global commodity benchmarks like Brent crude, which averaged around $83 per barrel in early 2024. The company also leverages fixed-price or escalating price contracts for its natural gas sales in the Northern Territory, providing a degree of revenue predictability.

To manage price volatility, Horizon Oil employs hedging strategies, securing predictable revenue streams by mitigating risks on future production. These contractual arrangements are crucial for maintaining consistent income in an often-unpredictable market.

The company’s focus on cost efficiency, with operating costs targeted below $20 per barrel and capital expenditure of approximately $150 million in FY24, directly impacts its profitability and ability to absorb price fluctuations.

| Metric | Value (Early 2024/FY24) | Impact on Horizon Oil |

|---|---|---|

| Brent Crude Average Price | ~$83/barrel | Directly influences realized oil revenue. |

| Operating Costs Target | <$20/barrel | Enhances profitability and resilience to price dips. |

| FY24 Capital Expenditure | ~$150 million | Supports efficient asset development and cost control. |

| Gas Sales Agreements | Fixed-price/escalation clauses | Provides revenue stability for natural gas segment. |

4P's Marketing Mix Analysis Data Sources

Our 4P analysis is built on a foundation of verified data, including official company disclosures, product pages, and pricing strategies. We also incorporate insights from industry reports and competitive analyses to ensure a comprehensive view.