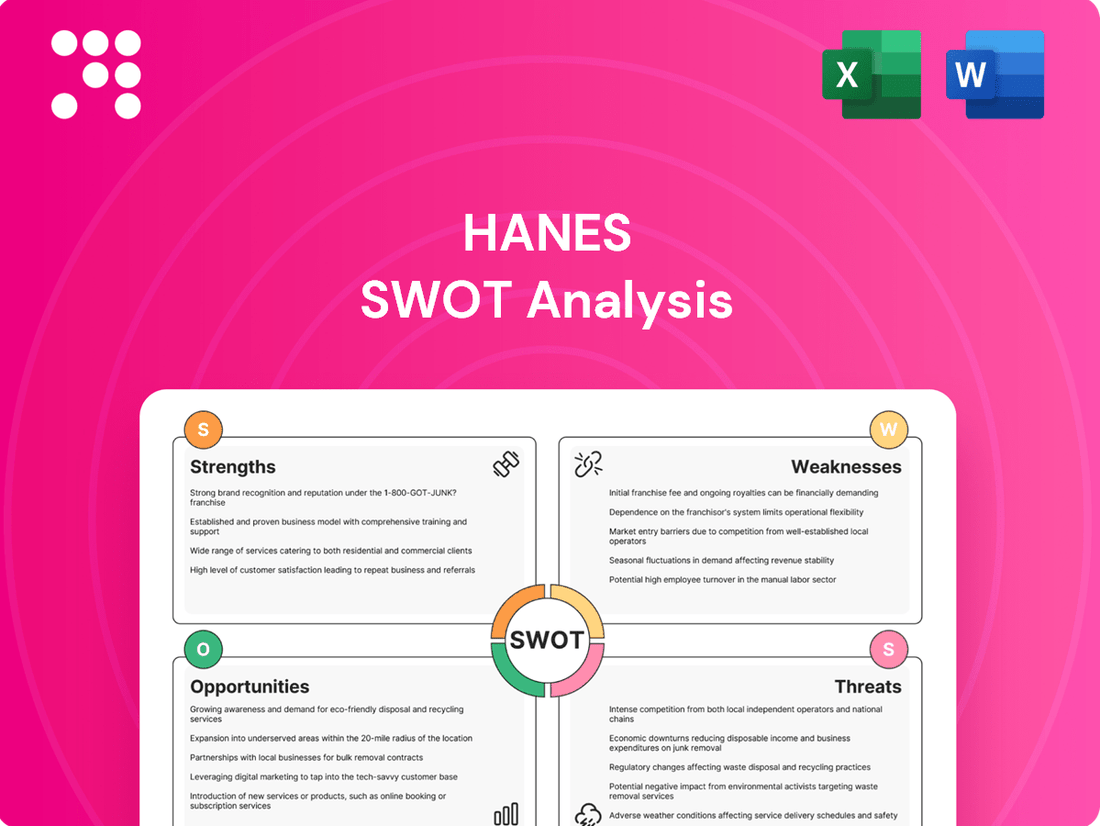

Hanes SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanes Bundle

Hanes, a titan in the apparel industry, boasts strong brand recognition and efficient supply chains as key strengths. However, the company faces challenges in adapting to rapidly changing fashion trends and increasing competition in the online retail space. Understanding these dynamics is crucial for anyone looking to invest or strategize within this market.

Want the full story behind Hanes' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Hanesbrands boasts a powerful collection of highly recognizable brands such as Hanes, Champion, Bonds, Maidenform, and Playtex. These brands enjoy substantial consumer awareness and loyalty, with Hanes alone capturing 47% of the U.S. underwear market. This broad brand diversification across different apparel segments offers a solid base and widespread appeal, ensuring steady consumer demand.

Hanesbrands boasts an extensive global reach, operating in over 45 countries. This vast footprint, coupled with well-established distribution channels, allows the company to effectively cater to a broad consumer base and respond to varying regional market needs.

The company's international sales further underscore this strength, showing a 4% increase on an organic constant currency basis in the first quarter of 2025, highlighting the success of its global strategy.

Hanesbrands' strength lies in its vertically integrated and optimized supply chain, a key differentiator in the apparel industry. The company controls a significant portion of its production, with vertical integration covering 68% of its manufacturing processes. This ownership of numerous global facilities allows for greater oversight and efficiency.

This high level of integration, combined with continuous efforts to streamline operations and cut costs, directly translates into improved speed to market for its products and more precise inventory management. For instance, Hanesbrands has been actively investing in supply chain modernization, aiming to further enhance these capabilities.

The comprehensive control Hanesbrands exercises over its supply chain provides a substantial competitive edge. It allows the company to respond more nimbly to market demands, manage costs effectively, and ensure product quality throughout the production lifecycle, a crucial factor in today's fast-paced retail environment.

Strong Progress in Sustainability Initiatives

Hanesbrands has made significant strides in its sustainability efforts, a key strength that resonates with today's consumers and investors. The company earned an impressive A- score from CDP for its performance in climate change and water security, highlighting a deep commitment to environmental stewardship.

This commitment is backed by tangible results, including a 53% reduction in Scope 1 and 2 emissions achieved since 2019. Furthermore, Hanesbrands has successfully diverted 94% of its waste from landfills, demonstrating operational efficiency that also leads to notable cost savings.

- CDP Score: Achieved an A- rating for climate change and water security.

- Emissions Reduction: 53% decrease in Scope 1 and 2 emissions since 2019.

- Waste Diversion: 94% of waste diverted from landfills.

- Consumer Appeal: Enhanced brand reputation among environmentally conscious consumers.

Improved Financial Performance and Debt Reduction

Hanesbrands has demonstrated significant progress in its financial health, a key strength for the company. Recent reports for the first quarter of 2025 highlight a substantial improvement, with operating profit seeing a 61% surge and earnings per share climbing by an impressive 240%. This robust performance indicates a more profitable and efficient operation.

A major contributor to this improved financial standing is the company's aggressive debt reduction strategy. In 2024 alone, Hanesbrands successfully paid down over $1 billion in debt. This substantial deleveraging has significantly lowered the company's financial risk and strengthened its balance sheet, positioning it for greater stability and future investment.

- Improved Profitability: Q1 2025 saw a 61% increase in operating profit.

- Enhanced Shareholder Value: Earnings per share rose by 240% in Q1 2025.

- Significant Debt Reduction: Over $1 billion in debt was repaid during 2024.

- Strengthened Financial Foundation: Lower leverage enhances future growth potential.

Hanesbrands possesses a portfolio of strong, well-recognized brands like Hanes and Champion, which enjoy high consumer recognition and loyalty. The Hanes brand alone holds a significant 47% share of the U.S. underwear market, demonstrating its market dominance and broad appeal across various apparel categories.

What is included in the product

Delivers a strategic overview of Hanes’s internal and external business factors, identifying key strengths like brand recognition and opportunities for market expansion, while also acknowledging weaknesses in supply chain and threats from competition.

Identifies key competitive advantages and areas for improvement, easing the burden of strategic planning.

Weaknesses

The Champion brand's underperformance is a significant weakness. Global sales for Champion plummeted by 23% in the fourth quarter of 2023. This decline extended to the broader activewear segment, which saw a 31% drop in sales during the first quarter of 2024, directly impacting Hanes' overall performance.

The strategic decision to divest Champion underscores its struggles. This move, while intended to simplify the brand portfolio, clearly indicates past difficulties in managing and growing this once-dominant segment. The divestiture process itself highlights the brand's current lack of competitive strength.

Hanesbrands has faced significant hurdles in boosting its overall revenue. Over the last five years, the company has seen its revenue decline at an annual rate of 11.8%. This trend points to ongoing difficulties in achieving consistent sales increases across its main product lines.

Looking ahead, Hanesbrands' guidance for the full year 2025 anticipates revenue to be largely flat compared to the previous year. This projection underscores the persistent challenges the company faces in a highly competitive market, struggling to generate substantial top-line growth.

Hanesbrands faces significant vulnerability to macroeconomic headwinds, a persistent challenge in the current economic climate. Inflationary pressures continue to squeeze consumer budgets, directly impacting discretionary spending on apparel, a core category for Hanes. This has been evident in the company's performance, with reports indicating that consumer spending on apparel saw a modest increase of around 2% year-over-year in early 2024, but this growth is tempered by persistent inflation, making it difficult for companies like Hanes to translate volume into significant revenue gains.

The company's gross margins have felt the pinch of rising raw material costs, such as cotton and polyester, which are essential inputs for their products. This cost inflation, coupled with retailers adopting more cautious inventory management strategies and reducing restocking, directly compresses Hanesbrands' profitability. For instance, in the first quarter of 2024, Hanesbrands reported a gross margin of 37.9%, a slight decrease from the previous year, reflecting these ongoing cost pressures and inventory adjustments within the retail channel.

These external economic factors create a challenging operating environment that can significantly dampen consumer demand for basic apparel. As consumers prioritize essential spending and face economic uncertainty, purchases of items like t-shirts, underwear, and socks may be deferred or reduced. This directly limits Hanesbrands' potential for robust sales growth and revenue expansion, making it harder to achieve its financial targets amidst these broader market uncertainties.

Reliance on Traditional Retail Channels

Hanesbrands still leans heavily on traditional brick-and-mortar retailers for a significant portion of its sales. This reliance can be a weakness as the retail landscape rapidly evolves, with consumers increasingly shifting their purchasing habits online. For instance, while e-commerce continues to grow, Hanesbrands' physical store presence might not fully capture the accelerating trend towards digital marketplaces, potentially hindering its ability to gain market share efficiently in the fast-paced online environment.

This dependence on physical stores makes Hanesbrands susceptible to disruptions affecting traditional retail, such as changing consumer foot traffic patterns or the financial health of key retail partners. In 2023, while e-commerce sales for apparel generally saw growth, companies with a strong traditional footprint faced challenges in balancing their physical and digital strategies. Hanesbrands' strategy needs to further accelerate its digital transformation to mitigate this weakness and capitalize on the growing online consumer base.

The company's challenge lies in adapting its distribution model to keep pace with the digital-first mentality of many consumers. This can impact its agility in responding to market shifts and its capacity to reach new customer segments effectively through online channels.

Intense Competitive Landscape

Hanesbrands faces a challenging environment due to intense competition from major sportswear brands like Nike and Adidas, as well as nimble fast-fashion retailers. These rivals often have quicker product development pipelines and significantly larger R&D investments, putting pressure on Hanes to keep pace.

The company must constantly innovate and optimize its operations to maintain its market position. For instance, while Hanes reported net sales of $3.9 billion for fiscal year 2023, this figure reflects the ongoing battle for consumer attention and spending in a crowded apparel market.

- Intense Rivalry: Hanes competes with giants like Nike, Adidas, and fast-fashion players with rapid production cycles.

- Innovation Pressure: Competitors' larger R&D budgets necessitate continuous product and marketing innovation from Hanes.

- Market Share Defense: The crowded market demands efficiency and differentiation to prevent erosion of Hanes' share.

Hanesbrands' reliance on traditional retail channels presents a significant vulnerability. While e-commerce is growing, the company's strong ties to brick-and-mortar stores could limit its ability to fully capitalize on the digital shift. This dependence can also make Hanes susceptible to the financial health and strategic decisions of its retail partners, potentially impacting sales and inventory management.

The company's overall revenue growth has been stagnant, with a notable decline over the past five years. Projections for 2025 indicate flat revenue, highlighting ongoing challenges in achieving substantial top-line expansion. This lack of growth suggests difficulties in adapting to evolving consumer preferences and market dynamics.

Hanesbrands faces intense competition from both established sportswear giants and agile fast-fashion brands. Competitors often boast larger research and development investments and faster product development cycles, creating pressure for Hanes to innovate and differentiate itself effectively to maintain market share.

| Brand/Segment | Q4 2023 Performance | Overall 2023 Net Sales | Key Challenge |

|---|---|---|---|

| Champion | Sales plummeted by 23% | Declining sales | Brand revitalization and market relevance |

| Activewear Segment | Sales dropped 31% in Q1 2024 | N/A | Market saturation and changing consumer trends |

| Overall Hanesbrands | Revenue decline of 11.8% annually (last 5 years) | $3.9 billion (FY 2023) | Sustained revenue growth and market share defense |

What You See Is What You Get

Hanes SWOT Analysis

The preview you see is the actual Hanes SWOT analysis document you’ll receive upon purchase. This ensures transparency and guarantees you get the complete, professionally prepared report.

This is a real excerpt from the complete Hanes SWOT analysis. Once purchased, you’ll receive the full, editable version, providing comprehensive insights into the brand's strategic position.

Opportunities

The global apparel e-commerce market is booming, with online sales expected to reach substantial growth by 2025. Hanesbrands can capitalize on this trend by strengthening its digital infrastructure, particularly its direct-to-consumer (DTC) offerings and online retail collaborations.

By prioritizing these digital avenues, Hanes can better align with shifting consumer preferences and effectively extend its market presence.

Hanesbrands has a clear opportunity to develop and launch innovative products that directly address shifting consumer demands. Think about advanced fabrics with superior moisture-wicking capabilities or specialized innerwear collections, such as the Bonds Absorbency line, designed for specific performance needs.

By prioritizing consumer-focused innovation, Hanes can effectively capture the attention of younger consumers. This strategic shift is poised to drive substantial gains in market share within particular segments that are experiencing rapid growth.

Hanesbrands has seen solid growth in international markets, with sales in Australia and Asia rising by 4% in the first quarter of 2025. This expansion highlights the company's ability to connect with consumers beyond its traditional North American base.

Continued strategic investments in these burgeoning regions, coupled with efforts in North America and Europe, present a significant opportunity for Hanesbrands to broaden its revenue streams and reduce reliance on any single market.

Capitalizing on Consumer Demand for Sustainability

Hanesbrands is well-positioned to capitalize on the increasing consumer demand for sustainable products. The company's existing commitment to environmental responsibility, including significant strides in emission reduction and waste diversion, provides a strong foundation for attracting eco-conscious shoppers. For instance, Hanes reported a 20% reduction in absolute greenhouse gas emissions across its global operations by the end of 2023 compared to its 2018 baseline, a tangible metric that resonates with consumers seeking brands that align with their values.

Highlighting these achievements can further enhance brand loyalty and attract new customers. The market for sustainable apparel is growing rapidly, with projections indicating continued expansion through 2025 and beyond. By clearly communicating its sustainability initiatives, Hanes can differentiate itself in a crowded marketplace.

- Growing Market Share: The global sustainable fashion market is expected to reach over $15 billion by 2025, presenting a significant opportunity for Hanes.

- Brand Differentiation: Emphasizing emission reductions and waste diversion efforts can set Hanes apart from competitors.

- Consumer Engagement: Transparent reporting on sustainability metrics can foster deeper connections with environmentally aware consumers.

Strategic Portfolio Optimization Post-Champion Sale

The divestiture of Champion, a significant strategic move for Hanesbrands, allows for a streamlined focus on its core innerwear and activewear businesses. This transition is expected to unlock greater operational efficiency and capital allocation towards high-performing segments. For instance, Hanesbrands has been actively investing in its largest brands like Bali and Maidenform, aiming to drive innovation and market share gains in the lucrative intimate apparel category.

This strategic repositioning is anticipated to yield improved financial performance. By shedding a less central brand, Hanesbrands can concentrate resources on areas with stronger growth potential and higher profit margins. This could translate to more consistent revenue streams and enhanced profitability, as seen in the company's efforts to bolster its direct-to-consumer channels, which have shown promising growth in recent quarters.

- Focus on Core Strengths: Hanesbrands can now dedicate more resources to its leading innerwear and activewear brands, such as Bali, Playtex, and Wonderbra.

- Improved Capital Allocation: Divesting Champion frees up capital for reinvestment in higher-margin product lines and innovation within its core segments.

- Enhanced Profitability Potential: A simpler business model allows for greater operational efficiency, potentially leading to improved margins and shareholder returns.

- Strategic Growth Opportunities: The company can now pursue targeted growth strategies within its most profitable categories, capitalizing on evolving consumer trends in apparel.

Hanesbrands can leverage the expanding global e-commerce landscape by enhancing its digital presence and direct-to-consumer (DTC) capabilities. The company is also well-positioned to develop innovative products that cater to evolving consumer needs, such as performance-oriented fabrics and specialized collections, which can capture market share among younger demographics. Furthermore, continued international expansion, particularly in Asia and Australia where sales grew by 4% in Q1 2025, offers a significant avenue for diversifying revenue streams and reducing market dependency.

Threats

Hanesbrands is navigating a challenging consumer landscape marked by persistent inflation and general economic uncertainty. This environment often leads consumers to cut back on non-essential purchases, like apparel, which directly affects Hanesbrands' sales volumes and revenue streams.

The company expects these macroeconomic headwinds to persist through 2025, indicating a continued subdued demand for its products. For instance, in the first quarter of 2024, Hanesbrands reported a net sales decrease of 10% year-over-year, partly attributed to softer consumer spending.

Hanesbrands, like much of the apparel sector, faces ongoing threats from supply chain volatility and escalating input expenses. Elevated shipping costs and unpredictable raw material prices, especially for cotton, continue to pressure production budgets.

These external pressures can directly impact Hanes' profitability, even with their focus on improving supply chain efficiency. For instance, in early 2024, cotton prices saw significant fluctuations, impacting the cost of goods sold for many apparel manufacturers.

Hanesbrands contends with agile competitors, particularly fast fashion brands that can bring designs to market in weeks, compared to Hanes' longer lead times. This rapid cycle allows competitors to quickly adapt to emerging trends and maintain high product turnover, a challenge Hanes must address to stay relevant.

Furthermore, established athletic apparel giants with vast R&D budgets, such as Nike and Adidas, present a formidable threat. These companies invest heavily in innovation, marketing, and supply chain efficiency, enabling them to capture significant market share and set industry benchmarks, putting pressure on Hanes to match their pace and product development.

For instance, in 2023, the global activewear market was valued at approximately $370 billion, with projections showing continued growth. Hanesbrands, to maintain its position, needs to significantly enhance its speed-to-market and product innovation capabilities to compete effectively against these agile and well-resourced players.

Shifting Consumer Preferences and Fashion Trends

The apparel sector is increasingly embracing 'slow fashion,' a move that prioritizes durability and timelessness over fleeting trends. This shift, coupled with a growing demand for personalized garments and a strong consumer focus on sustainability, presents a significant challenge for Hanesbrands. Adapting product lines and marketing to these evolving preferences is crucial for maintaining market share.

Consumer spending habits in apparel are changing. For instance, a 2024 report indicated that over 60% of Gen Z consumers consider sustainability when making clothing purchases, a stark contrast to previous years. Hanesbrands needs to ensure its collections resonate with this growing eco-conscious demographic.

- Shifting Demand: Consumers are moving away from fast fashion towards more sustainable and customized options.

- Sustainability Focus: A significant portion of younger consumers prioritize eco-friendly practices in their apparel choices.

- Adaptation Imperative: Hanesbrands must continuously evolve its product development and marketing to align with these changing consumer values.

Impact of Tariffs and Foreign Exchange Fluctuations

U.S. tariffs and unfavorable foreign currency exchange rates continue to pose financial challenges for Hanesbrands. These external macroeconomic forces directly affect the company's profitability and reported sales figures.

For instance, Hanesbrands anticipates a substantial financial impact from currency fluctuations in its 2025 outlook, highlighting the ongoing nature of this threat. This volatility can erode margins and make financial planning more complex for the apparel manufacturer.

- Tariffs: Increased import duties on raw materials or finished goods can raise production costs.

- Foreign Exchange: A stronger U.S. dollar can reduce the value of international sales when converted back to dollars.

- Profitability Impact: Both tariffs and unfavorable exchange rates can squeeze profit margins, affecting Hanesbrands' bottom line.

- 2025 Outlook: The company has explicitly projected a negative impact from currency movements in its financial guidance for the upcoming year.

Hanesbrands faces significant threats from intensifying competition, particularly from agile fast-fashion brands and well-resourced athletic apparel giants like Nike and Adidas. The company's longer product development cycles make it difficult to keep pace with rapidly changing fashion trends and consumer preferences, impacting market share. For example, in 2023, the global activewear market reached approximately $370 billion, highlighting the scale of competition Hanes must contend with.

Shifting consumer values towards sustainability and personalization present another major challenge. A 2024 report indicated that over 60% of Gen Z consumers consider sustainability in their apparel purchases, a trend Hanesbrands must actively address by adapting its product lines and marketing strategies to align with these evolving demands.

Macroeconomic factors, including persistent inflation, economic uncertainty, and volatile input costs like cotton, continue to pressure Hanesbrands' profitability and sales volumes. The company anticipates these headwinds to persist through 2025, with a reported net sales decrease of 10% year-over-year in Q1 2024 partly due to softer consumer spending.

Furthermore, U.S. tariffs and unfavorable foreign currency exchange rates pose ongoing financial risks. Hanesbrands has projected a substantial negative impact from currency fluctuations in its 2025 outlook, which can erode profit margins and complicate financial planning.

SWOT Analysis Data Sources

This Hanes SWOT analysis is built upon a foundation of robust data, including publicly available financial statements, comprehensive market research reports, and expert industry analysis to ensure a thorough and strategic evaluation.