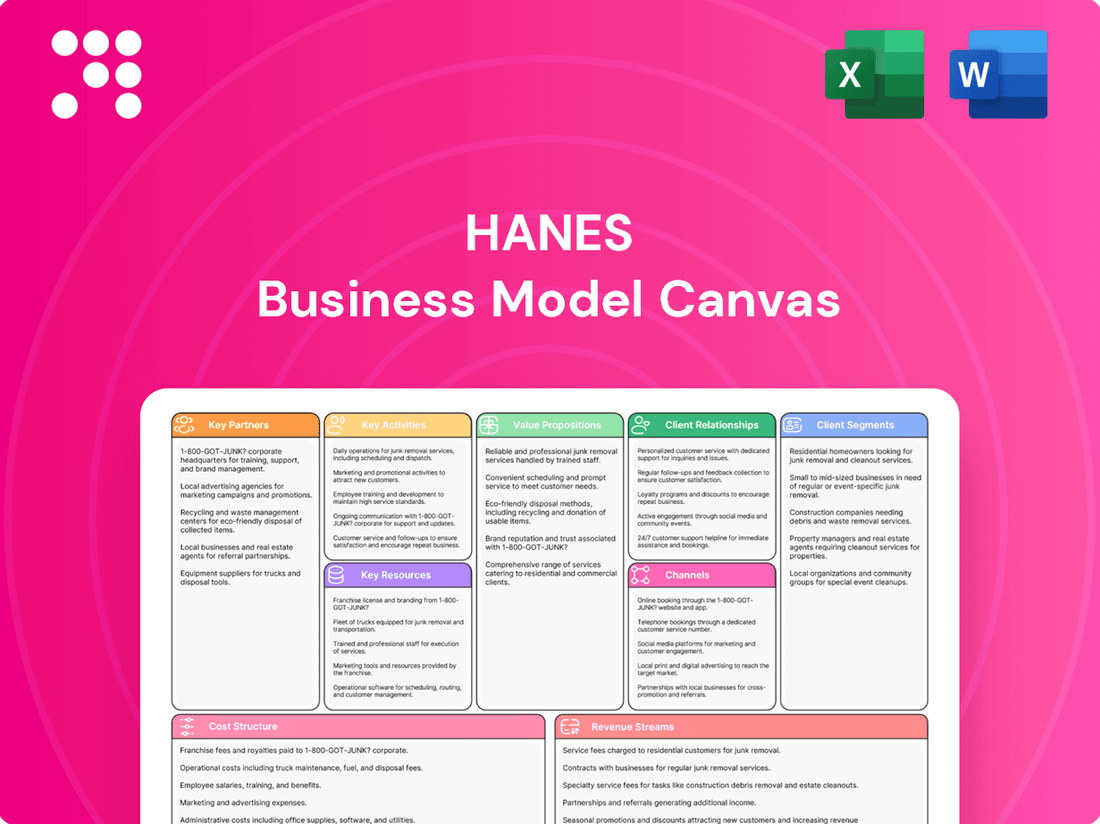

Hanes Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanes Bundle

Unlock the strategic blueprint behind Hanes's enduring success with our comprehensive Business Model Canvas. This detailed analysis breaks down their customer segments, value propositions, and revenue streams, offering a clear view of their market dominance. Ideal for anyone looking to understand how Hanes consistently delivers value and maintains its competitive edge.

Partnerships

Hanesbrands relies heavily on its relationships with major retailers, both physical stores and e-commerce platforms, to get its diverse apparel lines to consumers. These collaborations are vital for ensuring wide product availability and reaching a vast customer demographic.

In 2024, Hanesbrands continued to focus on strengthening these retail partnerships, which are fundamental to its distribution strategy. For example, its presence in major department stores and online marketplaces allows for significant sales volumes and broad market penetration.

Hanesbrands maintains crucial partnerships with suppliers of cotton and synthetic fibers, essential for its apparel manufacturing. In 2024, the company continued to focus on securing stable and competitively priced raw material inputs to support its global production. These relationships are foundational to managing manufacturing costs and ensuring product availability for consumers.

Hanesbrands strategically utilizes licensing partners to broaden its global brand presence. A prime example is their recent decision to exit the Champion Japan license, demonstrating a dynamic approach to managing these relationships. These agreements allow Hanes to tap into specialized market knowledge and distribution networks without the burden of direct operational management in every territory.

Beyond brand extensions, Hanes also engages in collegiate partnerships. These collaborations focus on producing and distributing fan apparel, effectively leveraging the strong affinity consumers have for university brands. This approach not only generates revenue but also strengthens brand loyalty and visibility within key demographic segments, as seen with the widespread popularity of collegiate merchandise.

Technology and E-commerce Platforms

Hanesbrands actively partners with major e-commerce platforms to expand its digital reach and drive direct-to-consumer (DTC) sales. These collaborations are crucial for managing inventory, processing orders efficiently, and leveraging data to personalize customer experiences. For instance, in 2024, Hanesbrands continued to optimize its presence on sites like Amazon and Walmart, aiming to capture a larger share of online apparel sales.

Furthermore, strategic alliances with technology providers enhance Hanesbrands' capabilities in areas such as digital marketing, supply chain visibility, and customer relationship management. These tech partnerships are vital for staying competitive in the rapidly evolving e-commerce landscape. By integrating advanced analytics, Hanesbrands can gain deeper insights into consumer preferences, which directly informs product development and marketing strategies.

- E-commerce Platform Integration: Partnerships with leading online retailers to broaden product availability and sales channels.

- Technology Provider Collaborations: Working with tech firms to improve digital infrastructure, data analytics, and customer engagement tools.

- Data-Driven Insights: Leveraging partner data to understand consumer behavior and optimize online marketing efforts.

- Supply Chain Optimization: Collaborating with logistics and technology partners to ensure efficient order fulfillment and delivery for DTC sales.

Sustainability Initiatives and NGOs

Hanesbrands actively partners with environmental and social non-governmental organizations (NGOs) to bolster its sustainability efforts. These collaborations are crucial for advancing its commitments to reducing waste, increasing renewable energy usage, and enhancing social welfare across its global operations. For instance, by working with groups like the World Wildlife Fund (WWF) and various local community organizations, Hanes is making tangible progress toward its 2030 sustainability goals.

These strategic alliances provide Hanesbrands with expertise and resources to tackle complex challenges within its supply chain. By leveraging the knowledge of these NGOs, the company aims to accelerate its progress in key areas such as water conservation and ethical labor practices. In 2023, Hanes reported a 15% reduction in greenhouse gas emissions compared to its 2018 baseline, a testament to the impact of such partnerships.

- Environmental Stewardship: Collaborations with NGOs help Hanesbrands implement advanced waste reduction programs and expand its use of renewable energy sources.

- Social Responsibility: Partnerships focus on improving working conditions and community well-being throughout the company's extensive supply chain.

- Impact Measurement: Working with established organizations allows for more robust tracking and reporting of sustainability metrics, ensuring accountability and transparency.

- Goal Achievement: These alliances are instrumental in Hanesbrands' pursuit of ambitious targets, such as achieving 100% renewable energy for its owned and operated facilities by 2030.

Hanesbrands' key partnerships extend to logistics providers and third-party logistics (3PL) companies, crucial for efficient inventory management and timely delivery across its diverse product lines. These collaborations ensure that products reach consumers smoothly, whether through traditional retail channels or direct-to-consumer operations. In 2024, the company continued to optimize these relationships to enhance supply chain resilience and reduce shipping times.

The company also engages in strategic alliances with financial institutions and payment processors, facilitating seamless transactions for both wholesale and DTC sales. These partnerships are essential for managing cash flow, processing payments securely, and offering flexible payment options to customers. In 2024, Hanesbrands focused on integrating newer payment technologies to improve the customer checkout experience.

Furthermore, Hanesbrands collaborates with marketing and advertising agencies to amplify its brand messaging and reach target audiences effectively. These partnerships are vital for developing impactful campaigns across various media platforms, driving consumer engagement and brand awareness. The company leverages these expert collaborations to stay ahead in a competitive market.

Hanesbrands also maintains relationships with technology and software vendors for enterprise resource planning (ERP) systems, customer relationship management (CRM) software, and other critical business applications. These partnerships are fundamental to maintaining operational efficiency, managing data, and supporting strategic decision-making. In 2024, investments in upgrading these systems aimed to improve data analytics capabilities and streamline internal processes.

What is included in the product

A detailed Hanes Business Model Canvas outlines its broad customer base, diverse product offerings, and efficient manufacturing and distribution channels.

It highlights Hanes' focus on value, cost leadership, and brand recognition across its apparel and hosiery segments.

Hanes' Business Model Canvas offers a structured approach to identify and address customer pains by clearly outlining value propositions and customer segments.

It provides a visual framework to pinpoint areas where Hanes can alleviate customer frustrations through tailored products and services.

Activities

Hanesbrands actively designs and develops new apparel, emphasizing comfort, value, and forward-thinking features. This process is fueled by thorough market research and an understanding of emerging trends, ensuring their offerings resonate with today's consumers.

In 2024, Hanesbrands continued to invest in its product pipeline, aiming to enhance the appeal of its core brands like Hanes and Champion. Their focus on material innovation and sustainable practices is a key driver in this development cycle, reflecting a commitment to both consumer needs and environmental responsibility.

Hanesbrands maintains a robust manufacturing and sourcing strategy, owning most of its global production facilities. This vertical integration offers significant advantages in cost control, production volume, and adaptability to market demands.

In 2023, Hanesbrands continued to leverage its owned manufacturing base, which underpins its ability to scale operations efficiently. For instance, the company reported that its owned manufacturing capacity plays a crucial role in its cost structure and supply chain reliability.

Complementing its internal production, Hanesbrands strategically sources materials and finished goods from third-party suppliers. This dual approach allows for optimization across its supply chain, ensuring cost-effectiveness and access to specialized capabilities, thereby supporting its diverse product portfolio.

Hanesbrands dedicates significant resources to marketing and brand management, focusing on its well-established stable of brands like Hanes, Champion, and Maidenform. This strategic emphasis is crucial for maintaining market presence and driving consumer engagement.

In 2024, Hanesbrands continued its investment in advertising and promotional activities across its key brands. For instance, the company reported a notable increase in marketing spend to support the resurgence of its Champion brand, aiming to capture a larger share of the activewear market.

The company's approach involves targeted campaigns designed to resonate with specific consumer demographics, fostering brand loyalty and attracting new customer segments. This includes digital marketing initiatives and strategic partnerships to enhance brand visibility and appeal.

Distribution and Logistics

Hanesbrands' key activities in distribution and logistics focus on efficiently moving apparel and intimates to a global customer base. This involves a complex network of warehouses and transportation methods to serve both wholesale partners and direct-to-consumer channels. For instance, in 2023, Hanesbrands continued to optimize its supply chain, aiming for greater speed and reduced costs across its operations.

The company's logistics strategy encompasses managing inventory levels across various distribution centers to meet demand promptly while minimizing carrying costs. This includes leveraging technology for better forecasting and tracking, ensuring products reach retailers and online shoppers on time. Hanesbrands' commitment to an agile supply chain is paramount in the fast-paced apparel industry.

- Warehousing and Fulfillment: Operating and optimizing distribution centers globally to store and ship products efficiently.

- Transportation Management: Coordinating various shipping methods, including ocean freight, trucking, and parcel delivery, to ensure timely and cost-effective product movement.

- Inventory Control: Implementing robust systems to monitor and manage stock levels across the supply chain, reducing stockouts and excess inventory.

- Global Reach: Ensuring the ability to distribute products to a wide array of international markets and diverse retail partners.

Supply Chain Optimization and Cost Management

Hanesbrands actively pursues supply chain optimization, including consolidation, as a core activity. This focus is designed to reduce fixed costs and boost operational efficiencies. Such efforts directly contribute to improved customer service and are fundamental to their margin expansion strategy.

These ongoing initiatives are critical for enhancing Hanesbrands' overall financial performance. By streamlining operations, the company aims to unlock greater profitability and maintain a competitive edge in the apparel market.

- Supply Chain Consolidation: Hanesbrands has been consolidating its distribution network. For instance, in 2023, they continued efforts to reduce their overall facility footprint, aiming for greater efficiency.

- Cost Reduction Targets: The company has publicly stated goals to achieve significant cost savings through these supply chain enhancements, directly impacting their bottom line.

- Inventory Management: Optimizing the supply chain also involves better inventory management, ensuring products are available when and where customers want them, thereby reducing carrying costs and improving sales.

- Efficiency Gains: These activities are geared towards increasing throughput and reducing lead times, which translates into measurable efficiency gains across the business.

Hanesbrands' key activities revolve around product design and development, manufacturing and sourcing, marketing and brand management, and efficient distribution and logistics. These core functions are supported by a strategic focus on supply chain optimization and cost reduction.

In 2024, Hanesbrands continued to invest in product innovation, particularly for its Champion brand, aiming to boost its market position. The company's vertically integrated manufacturing model, with a significant portion of production owned internally, remained a cornerstone of its operational strategy for cost control and supply chain reliability.

Marketing efforts in 2024 focused on targeted campaigns across its portfolio, including increased investment in Champion's advertising to capture more of the activewear market. The company also emphasized efficient global distribution, managing a complex network to serve both wholesale and direct-to-consumer channels, with ongoing efforts in 2023 to optimize this network for speed and cost-effectiveness.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Product Design & Development | Creating new apparel, focusing on comfort and value. | Continued investment in product pipeline for brands like Hanes and Champion, with emphasis on material innovation. |

| Manufacturing & Sourcing | Owning most global production facilities and strategic third-party sourcing. | Leveraged owned capacity for cost control and scalability. |

| Marketing & Brand Management | Promoting established brands like Hanes and Champion. | Increased marketing spend for Champion's resurgence; targeted digital campaigns. |

| Distribution & Logistics | Efficiently moving products globally through warehouses and transport. | Optimized supply chain for speed and cost reduction in 2023. |

| Supply Chain Optimization | Consolidating operations to reduce costs and improve efficiency. | Continued efforts to reduce facility footprint, aiming for significant cost savings. |

Full Version Awaits

Business Model Canvas

The Hanes Business Model Canvas preview you are viewing is the actual document you will receive upon purchase. This means the structure, content, and formatting are identical to the final deliverable, offering complete transparency. You can be confident that what you see is exactly what you will get, ready for immediate use and customization.

Resources

Hanesbrands' most valuable asset is its robust portfolio of established brands, including Hanes, Champion, Bonds, Maidenform, and Playtex. These brands command significant consumer loyalty and recognition, forming the bedrock of the company's market presence and valuation.

In 2024, Hanesbrands continued to leverage this strong brand equity. For instance, the Champion brand, a cornerstone of their athletic wear segment, consistently drives a substantial portion of the company's revenue, demonstrating the enduring power of their brand investments.

Hanesbrands operates a robust global manufacturing network, owning a significant majority of its facilities. This extensive ownership grants them substantial control over production processes, ensuring consistent quality and effective cost management across their operations. For instance, as of their 2023 annual report, Hanesbrands operated numerous company-owned facilities, primarily in the Americas and Asia, underscoring their vertically integrated approach.

This integrated supply chain is a critical competitive advantage for Hanesbrands. It allows for greater flexibility in responding to market demands and enhances operational efficiency by streamlining logistics and reducing reliance on external manufacturers. This control is vital for maintaining product integrity and adapting quickly to shifts in consumer preferences, a key factor in their success in the apparel industry.

Hanesbrands relies heavily on its vast international workforce, which includes talented design teams, skilled manufacturing personnel, and seasoned management. This human capital is fundamental to their operations, bringing expertise in apparel production, global supply chain management, and effective marketing strategies.

In 2024, Hanesbrands employed approximately 50,000 associates globally, underscoring the scale of their human resource base. The company's management team possesses deep industry knowledge, crucial for navigating the competitive apparel market and driving innovation in product development and brand strategy.

Distribution Network and Retailer Relationships

Hanesbrands relies on a vast global distribution network, reaching consumers through numerous channels. This extensive reach is crucial for making their diverse apparel brands readily available to a wide customer base.

Strong partnerships with major retailers are a cornerstone of Hanesbrands' strategy. These relationships grant them prime shelf space and consistent product placement in key markets, driving sales volume.

For example, in 2023, Hanesbrands continued to work with major retail partners like Walmart, Target, and Amazon, which are significant contributors to their overall revenue. These collaborations are vital for maintaining market penetration.

- Global Reach: Hanesbrands' products are distributed in over 60 countries.

- Key Retail Partnerships: Strong relationships with major big-box retailers and online platforms are essential.

- Supply Chain Integration: Efficient logistics ensure products are available when and where consumers want them.

- Market Access: Retailer relationships provide direct access to millions of consumers daily.

Intellectual Property and Innovation

HanesBrands leverages a robust portfolio of intellectual property, including patents, trademarks, and proprietary designs, to protect its innovative apparel. These assets are particularly crucial for its offerings in comfort and performance wear, differentiating its products in a competitive market.

Continuous investment in research and development fuels innovation in product features and materials, a key resource that sustains HanesBrands' competitive edge. This commitment to innovation is reflected in its ongoing efforts to enhance fabric technologies and garment construction.

- Patents: HanesBrands holds patents for unique fabric technologies and garment designs, such as those enhancing breathability or providing specific comfort features.

- Trademarks: Iconic brand names like Hanes, Champion, and Bali are protected trademarks, representing significant brand equity and consumer recognition.

- Proprietary Designs: Exclusive designs for apparel lines, particularly in activewear and intimate apparel, contribute to product uniqueness and market appeal.

- Innovation Pipeline: Ongoing development of new materials and manufacturing processes ensures a pipeline of innovative products, as evidenced by its R&D spending.

Hanesbrands' key resources also encompass its sophisticated global distribution network and strategic retail partnerships. These elements are vital for ensuring their diverse brands reach a broad consumer base efficiently.

In 2024, Hanesbrands continued to deepen its relationships with major retailers, securing prominent placement for its products. This ongoing collaboration is critical for maintaining consistent market access and driving sales volume across various channels.

The company's intellectual property, including patents for innovative fabric technologies and trademarks for its well-known brands like Champion and Hanes, represents a significant intangible asset. These protected assets are instrumental in differentiating their product offerings and maintaining brand value in a competitive landscape.

Hanesbrands' commitment to research and development fuels its innovation pipeline, ensuring a steady stream of new products and improved materials. This focus on R&D is a crucial resource for sustaining their competitive edge and adapting to evolving consumer demands.

| Key Resource | Description | 2024 Relevance/Data |

| Distribution Network | Extensive global reach to consumers. | Continued expansion of e-commerce fulfillment capabilities. |

| Retail Partnerships | Access to prime shelf space and consumer traffic. | Strengthened relationships with key partners like Walmart and Amazon. |

| Intellectual Property | Patents, trademarks, and proprietary designs. | Protection of innovative fabric technologies and iconic brand names. |

| Research & Development | Innovation in materials and product design. | Ongoing investment in developing next-generation comfort and performance wear. |

Value Propositions

Hanesbrands delivers exceptional comfort and enduring quality in its everyday apparel, making it a go-to choice for consumers seeking reliable basics. This commitment is evident across its portfolio, particularly with the Hanes brand, which prioritizes soft, breathable fabrics and robust construction designed for daily wear and longevity.

In 2024, Hanesbrands continued to leverage its strong brand recognition, with Hanes being a cornerstone of its apparel offerings. The company's focus on comfort and quality resonates deeply with consumers, contributing to its significant market share in the basics apparel segment. For instance, Hanes is renowned for its T-shirts and underwear, categories where comfort and durability are paramount purchasing factors.

Hanesbrands excels at offering affordable apparel, ensuring consumers get substantial value for their money, especially on everyday essentials. This commitment to accessible pricing makes their clothing a smart, practical choice for diverse financial situations.

In 2024, Hanesbrands continued to emphasize this value proposition, a strategy that resonates deeply with consumers navigating economic shifts. The company's ability to maintain competitive price points while delivering quality basic apparel is a key differentiator.

Consumers find comfort and confidence in Hanesbrands' deeply trusted and iconic brands. Names like Hanes, Champion, Bonds, and Maidenform are instantly recognizable, built on decades of consistent quality and consumer loyalty. This familiarity significantly reduces purchase risk for shoppers, making them more likely to choose these established names over newer or less-known alternatives.

The long-standing reputation of these brands is a powerful asset, fostering a sense of reliability and familiarity that resonates with buyers. In 2023, Hanesbrands reported net sales of $3.9 billion, with a significant portion driven by the enduring appeal of its core brands, demonstrating their continued market strength and consumer trust.

Wide Range of Products for Diverse Needs

Hanesbrands excels by providing a vast array of innerwear, activewear, and hosiery. This extensive product line addresses a wide spectrum of consumer demands, ensuring suitability for various lifestyles and occasions.

For instance, in 2023, Hanesbrands' diverse portfolio, which includes brands like Hanes, Champion, and Playtex, contributed to their net sales. The company's ability to serve multiple market segments, from everyday basics to performance athletic wear, underpins its broad appeal.

- Innerwear: Offering foundational garments for men, women, and children.

- Activewear: Providing comfortable and functional apparel for sports and leisure.

- Hosiery: Including socks and tights for everyday wear and specific needs.

Socially Responsible and Sustainable Practices

Hanes is actively integrating socially responsible and sustainable manufacturing practices, a key value proposition for consumers who prioritize environmental and ethical considerations. This commitment resonates with a growing market segment. In 2023, Hanes reported a 15% reduction in greenhouse gas emissions compared to their 2018 baseline, demonstrating tangible progress.

These initiatives focus on critical areas such as waste reduction, energy conservation, and enhancing workplace quality for their employees. The company's sustainability report for 2024 highlighted a 10% decrease in water usage across their global operations. Furthermore, Hanes has set a goal to achieve 100% renewable energy use in its owned and operated facilities by 2030.

- Waste Reduction: Hanes aims to divert 90% of its manufacturing waste from landfills by 2025.

- Energy Conservation: The company has invested in energy-efficient technologies, leading to a 5% annual improvement in energy intensity.

- Workplace Quality: Hanes prioritizes fair labor practices and safe working conditions, with 98% of its facilities audited for compliance in 2023.

- Sustainable Materials: Efforts are underway to increase the use of recycled and sustainably sourced materials in their product lines.

Hanesbrands provides consumers with reliable, comfortable, and high-quality everyday apparel at accessible price points. This focus on value and durability makes their products a smart choice for a wide range of consumers. The company's commitment to delivering consistent quality across its well-known brands ensures customer satisfaction and repeat purchases.

In 2024, Hanesbrands continued to solidify its market position by emphasizing comfort and quality in its core offerings, particularly with the Hanes brand. Their ability to maintain competitive pricing while ensuring product longevity remains a key differentiator in the apparel market.

The company leverages the strong recognition and trust associated with its iconic brands, including Hanes, Champion, and Maidenform. This established brand equity reduces consumer purchase risk and fosters loyalty. By 2023, Hanesbrands achieved net sales of $3.9 billion, underscoring the enduring appeal of its brand portfolio.

Hanesbrands offers a comprehensive selection of innerwear, activewear, and hosiery, catering to diverse consumer needs and lifestyles. This broad product range ensures broad market appeal and multiple touchpoints for consumers. Their 2023 sales figures reflect the success of this diversified strategy.

| Brand | Product Category | 2023 Sales Contribution (Estimated) |

|---|---|---|

| Hanes | Innerwear, T-shirts | Significant portion of total sales |

| Champion | Activewear, Athleisure | Strong contributor to growth |

| Maidenform | Women's Innerwear | Key player in its segment |

Customer Relationships

Hanesbrands cultivates customer relationships through widespread accessibility and dependable product quality, fostering significant brand loyalty. Consumers repeatedly choose familiar brands like Hanes, Champion, and Playtex, relying on the consistent performance and value they offer. This strategy prioritizes customer retention by ensuring satisfaction with every purchase.

Hanesbrands prioritizes robust retailer partnerships, offering reliable supply chains and marketing assistance to ensure strong product presence. In 2024, Hanes continued to invest in these relationships, recognizing that approximately 70% of their sales are generated through wholesale channels, making these partnerships critical for market penetration and brand visibility across diverse retail environments.

Hanesbrands is significantly boosting its digital presence, focusing on e-commerce and direct-to-consumer engagement. This strategy aims to foster deeper customer relationships through personalized interactions and streamlined online shopping experiences.

In 2024, Hanesbrands reported that its direct-to-consumer segment, heavily reliant on digital channels, continued to be a key growth driver. This direct engagement allows for immediate feedback and tailored marketing, enhancing customer loyalty.

The company's investment in digital marketing and e-commerce platforms facilitates direct sales, bypassing traditional retail partners. This not only improves margins but also provides valuable data on consumer preferences and purchasing behavior.

Customer Service and Feedback Mechanisms

Hanesbrands maintains customer service channels to manage inquiries and gather feedback directly from consumers, even though its primary distribution is B2B. This direct engagement is crucial for understanding evolving consumer preferences and informing product development. For instance, in 2023, Hanesbrands reported a focus on enhancing its direct-to-consumer (DTC) experience, which implicitly includes robust customer service infrastructure to support online sales and brand loyalty.

- Consumer-Facing Support: Hanesbrands operates customer service to handle individual consumer questions and issues related to its products.

- Feedback Integration: Consumer feedback collected through these channels is vital for identifying areas of improvement and innovation in product lines.

- DTC Enhancement: The company's strategic push into direct-to-consumer channels in 2023 underscored the importance of direct customer interaction and support.

- Market Responsiveness: Active listening to consumer feedback allows Hanesbrands to remain agile and responsive to market demands.

Community Engagement and Sustainability Reporting

Hanesbrands actively fosters community engagement through its sustainability initiatives, demonstrating a commitment to environmental and social responsibility. This approach builds vital goodwill and trust with consumers who increasingly prioritize ethical corporate practices. For instance, in 2024, Hanesbrands reported progress on its ambitious environmental targets, including a reduction in greenhouse gas emissions and water usage across its operations, directly resonating with eco-conscious consumers.

The company's sustainability reporting serves as a key touchpoint for customer relationships, allowing for transparent communication of its impact and progress. This open dialogue strengthens brand loyalty and can attract new customers who align with Hanesbrands' values.

- Community Engagement: Hanesbrands' focus on sustainability initiatives like responsible sourcing and community support programs directly involves and benefits the communities where it operates.

- Trust and Goodwill: By openly sharing its environmental and social performance, Hanesbrands cultivates trust and goodwill, enhancing its reputation among stakeholders.

- Consumer Alignment: Consumers increasingly seek out brands that demonstrate a commitment to sustainability, making Hanesbrands' reporting a critical factor in customer acquisition and retention.

- 2024 Progress: In 2024, Hanesbrands highlighted achievements in reducing waste and promoting fair labor practices, reinforcing its dedication to responsible operations.

Hanesbrands strengthens customer relationships through a multi-pronged approach, blending broad retail accessibility with a growing digital presence. The company leverages its well-known brands like Hanes and Champion to build loyalty based on consistent quality and value, with a significant portion of sales still driven by strong wholesale partnerships. In 2024, Hanesbrands continued to emphasize its direct-to-consumer (DTC) channels, aiming for personalized engagement and valuable customer data collection.

Hanesbrands actively engages with consumers through its customer service operations, providing direct support and gathering feedback to inform product development and enhance the overall brand experience. This direct interaction is particularly crucial for its expanding DTC segment, where fostering loyalty through responsive service is paramount. The company's commitment to sustainability also plays a key role, building trust and goodwill with consumers who prioritize ethical and environmentally responsible brands.

Hanesbrands' customer relationship strategy is anchored in delivering consistent value and accessibility, supported by a dual focus on robust retail partnerships and a burgeoning direct-to-consumer digital strategy. In 2024, the company reported that its DTC segment, a key area for direct customer engagement, continued its growth trajectory. This direct interaction allows Hanesbrands to gather immediate consumer feedback, crucial for refining its product offerings and marketing efforts, thereby nurturing brand loyalty.

Channels

Hanesbrands relies heavily on mass retailers and department stores to get its products into consumers' hands. This strategy ensures their apparel is readily available in places like Walmart, Target, and Kohl's, reaching a broad customer base. For instance, Hanes is a top-selling brand in many of these large retail environments.

These channels are crucial for Hanesbrands' distribution, allowing for high-volume sales and visibility. In 2023, Hanes reported significant revenue generated through its wholesale segment, which is dominated by these types of retail partners, underscoring their importance to the company's overall financial performance.

HanesBrands leverages a strong wholesale distribution network, partnering with a wide array of retailers to ensure its products reach consumers across diverse geographic markets. This established channel is crucial for achieving broad market penetration and managing inventory efficiently, supporting its extensive product lines like Champion and Comfort Revolution.

In 2024, HanesBrands continued to rely on this traditional wholesale model, which facilitates significant sales volumes through department stores, mass merchandisers, and specialty retailers. This approach allows for widespread product availability, a key component in maintaining brand visibility and accessibility for its global customer base.

Hanesbrands leverages its network of company-owned outlet stores as a key direct-to-consumer channel. These stores offer a broad assortment of Hanes, Champion, and other brands, often featuring discounted items and past-season merchandise. This strategy allows for efficient inventory management and provides a tangible brand experience for shoppers.

E-commerce and Direct-to-Consumer (D2C) Websites

Hanesbrands is significantly bolstering its direct-to-consumer (D2C) strategy by investing in its own e-commerce platforms for key brands like Hanes and Champion. This move is designed to foster deeper customer relationships and capture a larger share of the online retail market.

The company's digital expansion also includes strategic collaborations with major online retailers, broadening its reach and accessibility to a wider consumer base. This multi-pronged approach to digital sales is crucial for adapting to evolving consumer shopping habits.

- D2C Growth: Hanesbrands aims to leverage its D2C websites to build brand loyalty and gather valuable consumer data, which can inform product development and marketing efforts.

- Digital Sales Contribution: In 2023, Hanesbrands reported that its direct-to-consumer and online sales represented a substantial portion of its total revenue, demonstrating the increasing importance of this channel.

- Brand Empowerment: Owning the D2C experience allows Hanes and Champion to control brand messaging, customer service, and the overall shopping journey, enhancing brand equity.

International Distributors and Retailers

Hanesbrands leverages a robust network of international distributors and retailers to effectively reach consumers across diverse global markets. This strategy is crucial for adapting to varying local tastes and navigating different retail environments, especially in key growth areas like Australia and Asia.

In 2024, Hanesbrands' international segment, which includes sales through these partners, continued to be a significant contributor to its overall revenue. For instance, the company has historically seen strong performance in markets where it partners with established retail chains and specialized distributors.

- Global Market Penetration: Distributors and retailers provide Hanesbrands with access to established customer bases and distribution channels in countries where direct market entry might be challenging or less efficient.

- Adaptability to Local Preferences: These partners often possess in-depth knowledge of local consumer behavior, fashion trends, and regulatory requirements, enabling Hanesbrands to tailor its product offerings and marketing efforts.

- 2024 Performance Indicators: While specific segment breakdowns for international distributors and retailers are part of broader financial reporting, Hanesbrands' overall international sales performance in 2024 reflects the success of these channel partnerships in driving volume and market share.

Hanesbrands primarily utilizes a wholesale model, distributing through mass retailers and department stores. This ensures broad availability, with brands like Hanes and Champion prominently featured in outlets such as Walmart and Target. In 2023, the wholesale segment remained a cornerstone of their revenue generation.

The company is also expanding its direct-to-consumer (D2C) channels, including company-owned outlet stores and e-commerce platforms for its key brands. This D2C push aims to build stronger customer relationships and enhance brand control. Digital sales represented a significant portion of revenue in 2023.

Additionally, Hanesbrands relies on international distributors and retailers to access global markets. These partnerships are vital for navigating local preferences and retail landscapes, contributing to overall international sales performance in 2024.

| Channel Type | Key Characteristics | 2023/2024 Relevance |

|---|---|---|

| Wholesale | Distribution via mass retailers, department stores, specialty retailers. | Dominant channel for high-volume sales and broad market reach. Significant revenue contributor in 2023. |

| Direct-to-Consumer (D2C) | Company-owned outlet stores, brand e-commerce websites. | Growing focus for brand loyalty and data capture. Contributed substantially to revenue in 2023. |

| International Partnerships | Distributors and retailers in global markets. | Crucial for international market penetration and adapting to local tastes. Continued to drive international sales in 2024. |

Customer Segments

General consumers, the bedrock of Hanes' customer base, prioritize comfort, durability, and value in their everyday apparel choices. This segment encompasses individuals and families seeking essential innerwear, activewear, and hosiery for daily life. For instance, Hanes' iconic white t-shirts are a staple for millions, reflecting the demand for reliable basics.

This broad market is crucial for brands like Hanes and Playtex, which have built their reputations on delivering accessible quality. In 2024, the U.S. apparel market continued to show strong demand for these fundamental clothing items, with consumers actively seeking out brands that offer consistent performance at an affordable price point, making Hanes a go-to for many households.

HanesBrands' Champion brand deeply connects with athletes and active lifestyle enthusiasts, offering performance-driven apparel designed for rigorous activity and everyday wear. This segment actively seeks out gear that supports their fitness goals and embraces an athletic way of life.

In 2024, the athleisure market continued its robust growth, with activewear sales showing significant strength. Champion's focus on this demographic positions it well to capture a share of this expanding market, driven by consumer demand for both functionality and style in their active wardrobes.

Women seeking intimate apparel and shapewear represent a significant customer segment for HanesBrands, with brands like Maidenform and Bali specifically catering to their needs. This group prioritizes comfort, excellent fit, and stylish designs that offer functional benefits, such as support and shaping. In 2024, the global intimate wear market was valued at approximately $50 billion, with shapewear alone experiencing robust growth.

Value-Conscious Shoppers

Value-conscious shoppers are a cornerstone for Hanesbrands, actively seeking products that offer a strong balance of quality and price. This segment is particularly drawn to brands that consistently deliver on affordability without compromising on essential features. For instance, Hanes' Champion brand often appeals to this group by offering durable athletic wear at accessible price points, a strategy that has historically driven significant sales volume.

Hanesbrands’ approach to this customer segment often involves leveraging economies of scale and efficient supply chains to maintain competitive pricing. This focus on cost management allows them to pass savings onto consumers, making their products attractive to those who prioritize budget-friendly options. In 2023, Hanesbrands reported net sales of $6.5 billion, with a significant portion of this revenue likely attributable to these price-sensitive consumers across their diverse apparel offerings.

- Focus on Affordability: Hanesbrands' core strategy includes offering products at price points that resonate with budget-conscious consumers.

- Competitive Pricing: The company actively engages in competitive pricing strategies to capture market share within this segment.

- Value Proposition: Consumers in this segment look for good value, meaning a favorable ratio of quality to price, which Hanes aims to deliver.

- Sales Contribution: Value-conscious shoppers represent a substantial portion of Hanesbrands' overall sales, driving demand for everyday apparel and basics.

Globally Diverse Consumers

Hanesbrands caters to a wide array of consumers across the globe, recognizing the importance of localized approaches. For instance, in 2024, the company continued to tailor its apparel and marketing for distinct markets, including Australia, various European nations, and key Asian economies, acknowledging diverse fashion trends and consumer needs.

The company’s global reach means its customer segments are incredibly varied. This diversity necessitates a flexible approach to product development and branding to resonate with local tastes and cultural sensitivities.

- Global Reach: Hanesbrands operates in over 100 countries, showcasing its commitment to a diverse consumer base.

- Regional Adaptation: Product lines and marketing campaigns are customized for specific markets like Europe and Asia, reflecting local preferences.

- Consumer Demographics: The company serves a broad spectrum of age groups and income levels worldwide, requiring varied product assortments.

- Market Penetration: Hanesbrands actively seeks to expand its presence in emerging markets, further diversifying its customer segments.

HanesBrands serves a vast and varied global customer base, necessitating a nuanced understanding of diverse needs and preferences across different regions. This broad reach is a key strength, allowing the company to tap into multiple markets simultaneously.

The company's commitment to global operations is evident, with a presence in over 100 countries. This extensive network means HanesBrands must continually adapt its product offerings and marketing strategies to align with local fashion trends, cultural norms, and economic conditions, ensuring relevance in each market.

HanesBrands’ customer segments are not monolithic; they span various age groups, income levels, and lifestyle preferences worldwide. For instance, while focusing on core markets in North America and Europe, the company actively pursues growth in emerging economies, further diversifying its consumer touchpoints.

| Customer Segment | Key Characteristics | 2024 Relevance/Data Point |

|---|---|---|

| General Consumers | Prioritize comfort, durability, value for everyday apparel. | U.S. apparel market shows continued strong demand for basics. |

| Athletes & Active Lifestyles | Seek performance-driven apparel for fitness and athleisure. | Athleisure market continued robust growth in 2024. |

| Women Seeking Intimates | Desire comfortable, well-fitting, stylish intimate and shapewear. | Global intimate wear market ~ $50 billion in 2024; shapewear growing. |

| Value-Conscious Shoppers | Seek quality at affordable price points. | Hanesbrands' 2023 net sales of $6.5 billion reflect demand from this segment. |

| Global & Diverse Markets | Varied needs across different countries and cultures. | Tailoring products/marketing for Europe, Asia, Australia in 2024. |

Cost Structure

Manufacturing and production represent a substantial cost for Hanesbrands. This includes the purchase of raw materials like cotton and synthetic fibers, which are foundational to their apparel products. In 2023, Hanesbrands reported cost of goods sold of $4.6 billion, highlighting the significant investment in these materials and the production process.

The company's direct labor expenses for factory workers also contribute heavily to this cost category. Furthermore, factory overheads, encompassing utilities, maintenance, and depreciation of manufacturing equipment, add to the overall production expenditure. Hanesbrands' strategic decision to own and operate many of its manufacturing facilities directly impacts the scale and management of these costs.

Selling, General, and Administrative (SG&A) expenses for Hanesbrands encompass a broad range of operational costs, including significant investments in marketing and advertising to bolster its well-known brands like Champion and Hanes. These costs also cover the salaries of their sales teams and the administrative functions that keep the corporate structure running smoothly. In 2023, Hanesbrands reported SG&A expenses of approximately $1.5 billion, reflecting their ongoing commitment to brand visibility and efficient business operations.

Hanes' distribution and logistics costs encompass warehousing, transportation, and shipping expenses to get products to retailers and directly to consumers. In 2024, managing these efficiently is paramount for profitability. For instance, a significant portion of operational expenses for apparel companies like Hanes are tied to moving goods through their supply chain.

Research and Development (R&D) and Design Costs

HanesBrands consistently invests in research and development (R&D) and design to stay ahead in the apparel market. These ongoing costs are crucial for developing new products, improving existing ones, and exploring innovative materials and manufacturing techniques. For instance, in 2023, the company reported R&D expenses as part of its selling, general, and administrative (SG&A) costs, which totaled approximately $779 million. This significant outlay reflects a commitment to innovation.

The company's R&D efforts focus on enhancing product performance, sustainability, and consumer appeal. This includes exploring new fabric technologies and design aesthetics to meet evolving consumer demands. These investments are directly tied to maintaining a competitive edge and driving future revenue streams through differentiated offerings.

- Product Innovation: HanesBrands dedicates resources to developing new apparel lines and improving the functionality and comfort of existing products.

- Material Research: Ongoing investment in researching and sourcing advanced, sustainable, and performance-enhancing materials.

- Process Improvement: Exploration of new manufacturing processes to increase efficiency, reduce waste, and improve product quality.

- Design Development: Significant expenditure on design teams and tools to create appealing and trend-relevant apparel collections.

Debt Servicing and Interest Expenses

Hanesbrands, as a publicly traded entity, manages significant debt, leading to ongoing interest expenses. The company has been actively working to reduce its debt load, a strategic move aimed at lowering these financial obligations. For instance, in the first quarter of 2024, Hanesbrands reported interest expense of $58.4 million, a decrease from $70.1 million in the prior year period, reflecting their debt reduction efforts.

These debt servicing costs are a crucial component of their cost structure. By decreasing their outstanding debt, Hanesbrands aims to improve its profitability and financial flexibility. This focus on deleveraging is a key element in their strategy to enhance shareholder value.

- Interest Expense: Hanesbrands incurred $58.4 million in interest expense in Q1 2024.

- Debt Reduction Focus: The company prioritizes reducing its debt to lower interest costs.

- Financial Flexibility: Lower debt servicing improves the company's overall financial health and options.

Hanesbrands' cost structure is heavily influenced by its manufacturing operations, including raw materials and direct labor. Selling, General, and Administrative (SG&A) expenses are also significant, driven by marketing and brand support. Distribution and logistics are critical for efficient product delivery, while R&D investments are vital for innovation and market competitiveness. Finally, interest expenses on debt are a notable financial cost impacting overall profitability.

| Cost Category | 2023 Data (USD Millions) | Q1 2024 Data (USD Millions) |

|---|---|---|

| Cost of Goods Sold | 4,600 | N/A |

| SG&A Expenses | 1,500 | N/A |

| Interest Expense | N/A | 58.4 |

Revenue Streams

Hanesbrands primarily generates revenue through wholesale sales of its diverse apparel categories, including innerwear, activewear, and hosiery, to a broad network of retailers. This includes major mass merchandisers, department stores, and specialized apparel shops, forming the backbone of their business model.

In 2024, Hanesbrands continued to rely heavily on these wholesale channels. For instance, their Innerwear segment, a significant contributor, saw robust demand from large retail partners, reflecting the ongoing consumer preference for established brands available through these outlets.

Hanesbrands is seeing more revenue come in directly from its own online stores and company-operated outlet shops. This direct-to-consumer (D2C) approach is crucial for growth because it lets Hanes keep more of the profit by cutting out middlemen. It also provides a direct line to customers, fostering loyalty and offering valuable insights.

HanesBrands generates substantial revenue from markets beyond the United States. In 2023, international sales represented a significant portion of their overall performance, with strong contributions from regions like Australia, where their Bonds brand is a market leader, and various European and Asian territories.

These international operations have demonstrated a positive growth trajectory. For instance, in the first quarter of 2024, HanesBrands reported that their international segment saw a revenue increase, underscoring the growing importance of these global markets to their financial health.

Licensed Brand Sales

Hanesbrands generates revenue through licensing agreements, allowing other companies to use its well-known brands to produce and sell products. This strategy extends the reach of their brands into new categories or geographical markets. For example, Hanesbrands has licensing deals for collegiate fan apparel, enabling universities to leverage their brand recognition on merchandise.

In 2023, Hanesbrands reported significant revenue from its licensing activities. While specific figures for licensed brand sales are often embedded within broader reporting segments, the strategy remains a key contributor to brand visibility and revenue diversification. This approach allows Hanesbrands to tap into markets or product lines without direct manufacturing or distribution investment, capitalizing on brand equity.

Key aspects of this revenue stream include:

- Brand Extension: Leveraging established brand names like Hanes, Champion, and Bali into new product categories or markets through partnerships.

- Reduced Capital Investment: Generating income without the need for direct investment in manufacturing or distribution for licensed products.

- Market Penetration: Reaching consumers in specific regions or through specialized channels where direct Hanesbrands operations might be less efficient.

- Royalty Income: Earning fees based on the sales of products manufactured and sold by third-party licensees.

Innovation-Driven Product Sales

Hanesbrands generates revenue through the sale of new and innovative products, especially within its core innerwear and activewear segments. The company's strategy hinges on continuously refreshing its product lines with novel designs and enhanced features to capture consumer interest and drive sales growth.

In 2024, Hanesbrands continued to emphasize innovation as a key revenue driver. For instance, the company reported progress in its "Champion" brand, a significant contributor to its activewear revenue, by launching new performance-focused apparel. This focus on product development is crucial for maintaining market share and attracting new customers in a competitive landscape.

- Product Innovation: Hanesbrands invests in R&D to launch updated and novel products in innerwear and activewear.

- Consumer Demand: New designs and features are introduced to stimulate consumer purchasing.

- Revenue Growth: Sales from these innovative products directly contribute to the company's top-line performance.

Hanesbrands' revenue streams are multifaceted, encompassing wholesale apparel sales, direct-to-consumer (D2C) channels, international markets, licensing agreements, and the introduction of innovative products.

In 2024, the company continued to see strength in its wholesale business, especially with innerwear, while expanding its D2C presence to improve margins and customer relationships. International sales, particularly from brands like Bonds in Australia, remain a significant growth engine.

Licensing agreements allow Hanesbrands to extend its brand reach with reduced capital, and a focus on product innovation, particularly within activewear under the Champion brand, drives sales and market competitiveness.

| Revenue Stream | Primary Channels | 2024 Focus/Trends |

|---|---|---|

| Wholesale Apparel Sales | Mass merchandisers, department stores, apparel shops | Continued reliance on large retail partners for innerwear and activewear. |

| Direct-to-Consumer (D2C) | Company online stores, outlet shops | Growth driver for improved profit margins and direct customer engagement. |

| International Markets | Australia (Bonds), Europe, Asia | Positive growth trajectory, contributing significantly to overall financial health. |

| Licensing Agreements | Third-party manufacturing and sales of branded products | Brand extension into new categories (e.g., collegiate apparel), royalty income. |

| Innovative Product Sales | Innerwear, Activewear (Champion) | Emphasis on R&D for new designs and features to drive sales and market share. |

Business Model Canvas Data Sources

The Hanes Business Model Canvas is informed by a blend of internal financial reports, extensive market research on consumer apparel trends, and competitive analysis of key players in the industry. This multi-faceted approach ensures a comprehensive understanding of Hanes' strategic positioning and operational realities.