Hanes Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanes Bundle

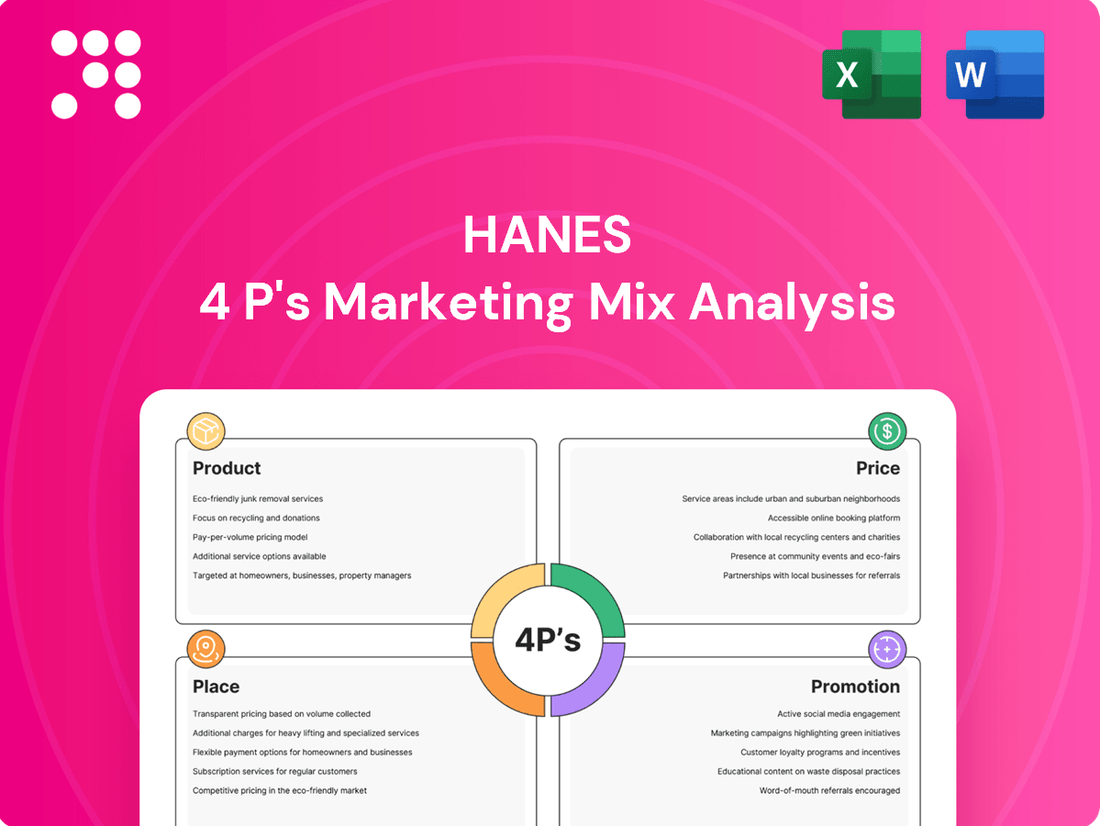

Discover how Hanes masterfully blends its product offerings, competitive pricing, widespread distribution, and impactful promotions to capture market share. This analysis dives deep into each element of their 4Ps strategy, revealing the secrets behind their enduring success in the apparel industry.

Unlock the full potential of this Hanes 4Ps Marketing Mix Analysis. Go beyond a surface-level understanding and gain actionable insights into their product innovation, pricing tactics, distribution channels, and promotional campaigns. Equip yourself with the knowledge to refine your own marketing strategies.

Product

Hanesbrands boasts a diverse apparel portfolio, focusing on everyday basics like innerwear, activewear, and hosiery. This extensive range ensures they cater to men, women, and children, meeting a wide spectrum of consumer needs for comfort and practical wear.

The company's product strategy emphasizes versatility and daily utility, covering essential wardrobe items. For instance, in 2023, Hanesbrands reported net sales of $3.9 billion, with a significant portion driven by these core apparel categories.

Hanesbrands' product strength is deeply rooted in its iconic brand portfolio, featuring household names like Hanes, Champion, Bonds, Maidenform, and Playtex. These brands are not just labels; they represent decades of consumer trust built on consistent quality and perceived value. For instance, Hanes, a flagship brand, consistently ranks among the top apparel brands in consumer perception surveys.

This strong brand recognition acts as a powerful differentiator in the crowded apparel market. It allows Hanesbrands to command premium pricing and foster customer loyalty, reducing the need for extensive new customer acquisition efforts. In 2023, Champion, a key brand within the Hanes portfolio, continued to show resilience, contributing significantly to the company's overall revenue despite market fluctuations.

Hanesbrands' product strategy centers on delivering comfort and affordability, a crucial element for their everyday apparel lines. This approach makes their clothing accessible to a broad consumer base, meeting essential needs for wearability and a pleasant feel. For instance, Hanes Originals, featuring SuperSoft fabrics derived from bamboo viscose, exemplifies this dedication to enhanced comfort.

Sustainability Initiatives in Development

Hanesbrands is actively weaving sustainability into its product development, a key element of its marketing strategy. The company has set ambitious goals, aiming for 100% sustainable cotton and 100% recycled or degradable polyester across its entire product line by the year 2030. This focus directly responds to a significant shift in consumer preferences, with a growing number of shoppers actively seeking out environmentally conscious brands and products.

Progress towards these goals is already evident. As of April 2024, Hanesbrands has achieved its target of using 75% sustainably grown cotton. Beyond materials, the company is also making strides in packaging and plastic reduction. Initiatives are in motion to cut down on single-use plastics by 50% and reduce overall packaging weight by 25%, using a 2019 baseline for comparison.

- Sustainable Cotton: 75% of cotton used as of April 2024.

- Recycled/Degradable Polyester: Target of 100% by 2030.

- Single-Use Plastics: Aiming for a 50% reduction.

- Packaging Weight: Goal of a 25% reduction from a 2019 baseline.

Innovation and Design

Hanesbrands consistently prioritizes product innovation to align with changing consumer tastes. Recent examples include the launch of Hanes Absolute Socks, Hanes Moves, Hanes Supersoft, and the Bali Breathe line, all designed to address specific market demands.

The company's approach to product design is deeply consumer-centric and coordinated globally. This ensures that new collections not only feature updated styles but also incorporate premium colors and advanced, comfortable fabrics.

- Product Innovation Focus: Hanes actively develops new products like Hanes Absolute Socks and Bali Breathe to capture evolving consumer preferences.

- Consumer-Centric Design: A globally coordinated strategy ensures new styles reflect current fashion trends and consumer desires.

- Material Advancements: The company integrates luxurious colors and transformative fabrics into its product lines, enhancing comfort and appeal.

Hanesbrands' product strategy is built on a foundation of comfort, everyday utility, and a strong portfolio of well-recognized brands like Hanes and Champion. The company's focus on essential apparel for men, women, and children, coupled with an emphasis on accessible pricing, ensures broad market appeal. For example, Hanes reported net sales of $3.9 billion in 2023, underscoring the demand for their core offerings.

Innovation is a key driver, with recent launches like Hanes Absolute Socks and the Bali Breathe line reflecting a commitment to evolving consumer needs. This consumer-centric approach, coordinated globally, ensures new collections incorporate desirable styles and advanced, comfortable fabrics. The company is also prioritizing sustainability, aiming for 100% sustainable cotton usage by 2030, with 75% achieved by April 2024.

| Product Focus | Key Brands | Key Initiatives |

| Everyday Apparel (Innerwear, Activewear, Hosiery) | Hanes, Champion, Bonds, Maidenform, Playtex | Comfort, Affordability, Versatility |

| Sustainability Goals | N/A | 100% Sustainable Cotton (Target 2030), 75% Achieved (April 2024) |

| Product Innovation | N/A | Hanes Absolute Socks, Bali Breathe line, Hanes Supersoft |

What is included in the product

This analysis offers a comprehensive deep dive into Hanes's Product, Price, Place, and Promotion strategies, grounded in actual brand practices and competitive context.

It's an ideal resource for managers and marketers seeking a complete breakdown of Hanes's marketing positioning, with each element thoroughly explored with examples and strategic implications.

Simplifies the complex Hanes 4Ps marketing strategy into actionable insights, alleviating the pain of strategic ambiguity for marketing teams.

Provides a clear, concise overview of Hanes' marketing approach, relieving the burden of sifting through extensive data for quick decision-making.

Place

Hanesbrands leverages an extensive retail channel distribution strategy, making its diverse product portfolio readily available to consumers globally. This multi-channel approach encompasses traditional department stores, mass merchandisers, and specialty retailers, ensuring broad market penetration.

In 2023, Hanesbrands' net sales reached $3.9 billion, underscoring the effectiveness of its widespread retail presence in driving revenue. The company's commitment to being where consumers shop, from large discount chains to online platforms, is a cornerstone of its market accessibility.

Hanesbrands is significantly boosting its e-commerce and digital presence, investing in direct-to-consumer (DTC) platforms and strengthening partnerships with online giants like Amazon. This strategic move aims to create a smoother online shopping journey for customers.

By expanding its digital footprint, Hanesbrands is making its vast product catalog, including thousands of items now part of Amazon's Climate Pledge Friendly program, more accessible. This digital-first approach not only enhances consumer convenience but also broadens the company's market reach, tapping into the growing online retail sector.

Hanesbrands boasts a significant global presence, with manufacturing operations spanning roughly 30 countries, facilitating its extensive worldwide distribution network. This broad operational base is crucial for ensuring product availability across diverse markets.

The company strategically utilizes its robust Western Hemisphere supply chain, coupled with well-established relationships with retailers. This allows Hanesbrands to effectively navigate market opportunities and mitigate challenges presented by tariff environments, demonstrating a proactive approach to supply chain management.

In 2023, Hanesbrands continued to optimize its global operations, with a focus on supply chain efficiencies. For instance, the company reported progress in its Project Refresh initiative, which aims to streamline its supply chain and reduce costs, contributing to better inventory management and product delivery.

Strategic Distribution Center Management

Hanesbrands is actively working to make its distribution network more efficient. This includes consolidating operations and closing some facilities, like the one in High Point, NC, particularly after the Champion brand sale. The goal is to cut costs and improve how quickly they can get products to customers.

These strategic moves are designed to streamline logistics and manage inventory more effectively. For instance, by optimizing warehouse locations and processes, Hanes aims to reduce transit times and carrying costs, which directly impacts their ability to meet market demand promptly.

- Distribution Network Optimization: Hanes is consolidating and streamlining its distribution operations to enhance efficiency.

- Facility Adjustments: This strategy has included facility closures, such as a distribution center in High Point, NC, post-Champion brand sale.

- Cost Reduction and Efficiency Gains: The primary objective is to improve operational efficiencies and lower overall logistics costs.

- Enhanced Customer Service: By refining logistics, Hanes aims to improve delivery speed and inventory availability for customers.

Partnerships with Retailers

Hanesbrands cultivates robust relationships with its diverse retail partners, a cornerstone of its extensive channel distribution strategy. These collaborations are vital for ensuring Hanes' products reach consumers across various shopping environments, from mass merchandisers to online platforms. For instance, in 2023, Hanes continued to leverage its strong presence in major U.S. retailers like Walmart and Target, which represent significant revenue streams.

The company's focus is on creating a frictionless consumer journey by making its apparel readily available through these partnerships. This means aligning product placement, inventory management, and promotional activities with retailer needs and consumer shopping habits. Hanesbrands' commitment to a seamless experience is evident in its efforts to integrate online and in-store inventory visibility with key partners, enhancing convenience for shoppers.

This collaborative approach directly translates into maximized sales opportunities and improved customer satisfaction. By working closely with retailers on merchandising and marketing initiatives, Hanesbrands can effectively respond to market trends and consumer demand. In 2024, the company anticipates further strengthening these ties, aiming for expanded shelf space and more prominent online visibility with its top retail accounts, contributing to its overall market share growth.

- Key Retail Partnerships: Hanesbrands maintains strong ties with major U.S. retailers such as Walmart, Target, and Amazon, crucial for its widespread product availability.

- Channel Distribution: These partnerships enable Hanesbrands to achieve broad channel distribution, reaching consumers through both brick-and-mortar stores and e-commerce platforms.

- Consumer Experience Focus: The company prioritizes a seamless consumer experience by ensuring product availability where and when consumers prefer to shop, supported by retailer collaborations.

- Sales and Satisfaction: This collaborative strategy aims to boost sales potential and enhance customer satisfaction by aligning product accessibility with consumer demand and shopping preferences.

Place, within Hanesbrands' marketing mix, is defined by its extensive and multi-faceted distribution strategy. The company ensures its products are accessible through a wide array of retail channels, from major mass merchandisers to online marketplaces.

Hanesbrands' commitment to broad availability is reflected in its 2023 net sales of $3.9 billion, a testament to its effective reach across diverse consumer touchpoints. The company actively manages its physical and digital shelf space to meet consumers wherever they shop.

The strategic optimization of its distribution network, including facility consolidation and leveraging strong retailer relationships, underpins Hanesbrands' ability to efficiently deliver products. This focus on operational excellence supports market penetration and responsiveness to demand.

Hanesbrands' place strategy also emphasizes enhancing its direct-to-consumer (DTC) channels and digital presence, aiming for a seamless online shopping experience. This dual approach of strong retail partnerships and robust e-commerce ensures comprehensive market coverage.

| Distribution Channel | Key Retailers/Platforms | 2023 Sales Impact (Illustrative) | Strategic Focus |

|---|---|---|---|

| Mass Merchandisers | Walmart, Target | Significant Revenue Contribution | Broad consumer access, inventory management |

| Specialty Retailers | Department Stores, Apparel Chains | Moderate Revenue Contribution | Brand positioning, targeted marketing |

| E-commerce (DTC & Online Marketplaces) | Hanes.com, Amazon | Growing Revenue Share | Digital engagement, customer convenience, expanded reach |

| International Markets | Global Retail Partners | Diversified Revenue Streams | Adapting to local market needs, supply chain efficiency |

Preview the Actual Deliverable

Hanes 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Hanes 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion, providing actionable insights into their strategy. You're viewing the exact version of the analysis you'll receive—fully complete, ready to use.

Promotion

Hanesbrands utilizes a multi-pronged advertising strategy, blending traditional and digital channels to maximize reach and impact. This approach was evident in their 2024 campaigns, which included prominent TV spots during high-viewership events like college basketball playoffs, reinforcing brand visibility.

The company's digital advertising efforts are substantial, encompassing social media platforms and online advertising to engage consumers directly and drive online sales. This digital focus is crucial for connecting with younger demographics and adapting to evolving media consumption habits.

In 2024, Hanesbrands continued to invest heavily in integrated marketing communications, aiming to build strong brand recognition and preference across its diverse product portfolio. This strategy is designed to foster consistent consumer engagement and ultimately boost sales performance.

Hanesbrands leverages brand-specific campaigns to connect with consumers. For example, the Hanes 'If You Wouldn't Flaunt It, Refresh It' initiative launched in January 2025, humorously urging underwear upgrades. This follows 'The Great Softening' in March 2024, highlighting the comfort of Hanes Originals' SuperSoft fabrics.

Champion's promotional efforts, such as 'Champion What Moves You,' emphasize purpose and community. These targeted campaigns aim to build emotional connections and underscore the unique value propositions of each brand within Hanesbrands' portfolio.

Hanesbrands is significantly boosting its digital marketing efforts, with a strong focus on e-commerce and sophisticated analytics. This strategy aims to deepen how they connect with consumers. For instance, in 2023, Hanesbrands reported that digital sales represented a substantial portion of their overall revenue, demonstrating the growing importance of this channel.

The company actively leverages organic social media content and collaborates with influencers to build relationships with its customer base and highlight new product introductions. This approach is crucial for generating authentic buzz and reaching specific demographics effectively.

This digital-first strategy enables Hanesbrands to deliver highly targeted messages and achieve a wider audience reach across the online landscape. By analyzing consumer data, they can tailor campaigns for maximum impact, a key factor in their 2024 marketing initiatives.

Public Relations and Sustainability Communications

Hanesbrands leverages public relations to showcase its commitment to sustainability, detailing progress on key 2025 and 2030 targets. This proactive communication strategy emphasizes advancements in areas like reducing greenhouse gas emissions and increasing the use of renewable energy.

The company's sustainability reports provide concrete data, such as their aim to reduce absolute Scope 1 and 2 greenhouse gas emissions by 50% by 2030 against a 2018 baseline. Furthermore, Hanesbrands is working towards sourcing 100% of its cotton from more sustainable sources by 2024, a significant step in their product strategy.

These transparent communications build trust and resonate with a growing segment of consumers who prioritize environmentally responsible brands. By highlighting achievements in areas like water conservation and ethical labor practices, Hanesbrands aims to strengthen its brand image and market position.

- Greenhouse Gas Emissions: Targeting a 50% reduction in absolute Scope 1 and 2 emissions by 2030 (vs. 2018 baseline).

- Sustainable Cotton: Aiming for 100% of cotton sourced from more sustainable origins by 2024.

- Renewable Electricity: Increasing renewable electricity usage across operations.

- Brand Reputation: Enhancing appeal to environmentally and socially conscious consumers through clear communication.

Consumer-Centric Messaging

Hanes' promotional efforts are deeply rooted in understanding the consumer, focusing on benefits like superior comfort, dependable quality, and exceptional value. This consumer-centric messaging aims to resonate directly with what customers seek in their apparel. For instance, their campaigns frequently spotlight the plush feel and lasting wear of their garments, directly addressing common consumer desires.

This strategy is evident in how Hanes connects with its audience. By highlighting how their products meet specific needs, such as the pervasive emphasis on comfort across their lines, Hanes aims to forge stronger relationships and, consequently, boost demand. This approach is crucial in a competitive apparel market where brand loyalty is built on perceived personal benefit.

In 2024, Hanes continued to leverage this consumer-centric approach. Their marketing spend, while not fully detailed publicly for every campaign, consistently prioritizes channels that allow for direct consumer engagement and benefit communication. For example, their digital advertising often features testimonials and product demonstrations emphasizing comfort and durability, reflecting a direct response to consumer feedback and market trends.

- Focus on Comfort: Hanes' promotions consistently highlight the comfort features of their apparel, a key purchasing driver for consumers.

- Value Proposition: Campaigns emphasize the quality and durability of Hanes products, positioning them as a smart, long-term value choice.

- Addressing Needs: Marketing messages are designed to directly address consumer desires for comfortable, reliable, and affordable everyday wear.

- Building Connections: The brand aims to foster deeper consumer relationships by speaking to their needs and preferences in relatable ways.

Hanesbrands employs a robust promotional strategy that integrates traditional advertising with a significant digital push, aiming for broad consumer engagement. Their 2024 campaigns, including TV spots during major sporting events, underscore a commitment to maintaining high brand visibility.

Digital marketing is a cornerstone, utilizing social media and online ads to connect directly with consumers, particularly younger demographics, and to drive e-commerce growth. This digital focus is critical, as Hanesbrands reported a substantial portion of its revenue in 2023 came from digital sales.

Brand-specific initiatives, like the January 2025 Hanes 'If You Wouldn't Flaunt It, Refresh It' campaign and the March 2024 'The Great Softening' for Hanes Originals, highlight product benefits such as comfort and encourage product upgrades, directly addressing consumer needs.

Champion's 'Champion What Moves You' campaign focuses on purpose and community, building emotional connections and differentiating its value proposition. These targeted efforts aim to strengthen brand loyalty across the Hanesbrands portfolio.

Price

Hanesbrands employs a competitive and accessible pricing strategy, reflecting its core offering of comfortable, everyday basic apparel. This approach ensures their products are attractive to a wide range of consumers who prioritize value.

The company's pricing is carefully calibrated to match the perceived value of its merchandise, making it a go-to brand for budget-conscious shoppers. For instance, Hanes' Champion brand often features competitive price points for athletic wear, with many items frequently available under $30 in 2024.

Hanesbrands' core brands, including Hanes and Champion, are deeply associated with value in the apparel market. This perception directly shapes their pricing strategies, aiming to strike a balance between offering good quality and comfort without breaking the bank. For instance, in 2023, Hanesbrands reported net sales of $5.5 billion, demonstrating the broad consumer appeal of their value-oriented approach.

Hanesbrands' focus on cost savings and supply chain efficiencies directly impacts its pricing power. By improving gross margins, as seen in their reported results, the company is better positioned to offer competitive pricing, a key element in their affordability strategy. For example, in Q1 2024, Hanesbrands reported a gross profit margin of 36.6%, an improvement from the previous year, reflecting these cost-saving efforts.

Market Demand and Competitor Pricing Considerations

Hanesbrands navigates a competitive apparel landscape where market demand and rival pricing are critical. For instance, in 2023, the U.S. apparel market saw continued growth, with online sales becoming increasingly significant, influencing how Hanes prices its diverse product lines.

The company must balance attracting budget-conscious consumers with maintaining brand value against established players and agile direct-to-consumer brands. This necessitates a keen eye on competitor pricing, particularly for core categories like innerwear and activewear, where price sensitivity is high.

Hanes' strategy to drive demand through innovation, such as advancements in fabric technology for its Comfort Revolution line, can provide some pricing leverage. However, the overall economic climate, including inflation rates impacting consumer spending power, plays a substantial role in their pricing decisions throughout 2024 and into 2025.

- Price Sensitivity: Hanes must consider consumer price sensitivity, especially in core categories where competitors offer similar value propositions.

- Competitive Benchmarking: Regularly analyzing competitor pricing for comparable products is essential for Hanes to maintain market share.

- Value Perception: Pricing needs to align with the perceived value, balancing product quality and brand reputation against cost.

- Promotional Strategies: Hanes likely employs various promotional pricing tactics, like bundles or seasonal sales, to stimulate demand and clear inventory.

Financial Performance and Margin Expansion Goals

Hanesbrands' financial roadmap for 2024-2025 centers on robust operating profit expansion and significant margin improvement. The company is implementing stringent cost management initiatives and refining its product assortment to achieve structurally higher and more sustainable profit margins.

These financial aspirations directly inform Hanesbrands' pricing strategies, ensuring that each product's price point is calibrated to maximize overall profitability and deliver enhanced shareholder value.

- 2024-2025 Financial Guidance: Hanesbrands is targeting operating profit growth and margin expansion as key financial objectives.

- Margin Expansion Drivers: Focus on cost controls and strategic assortment management to achieve sustainable margin improvements.

- Pricing Strategy Influence: Financial goals directly shape pricing decisions to support profitability and shareholder returns.

- Example: For instance, the company's commitment to improving its operating margin by 100-150 basis points in 2024 reflects these strategic priorities.

Hanesbrands' pricing strategy is fundamentally about delivering accessible value, making its everyday apparel a compelling choice for a broad consumer base. This approach is critical for maintaining market share in a highly competitive environment, where consumers are often price-conscious.

The company actively manages its pricing to reflect the perceived quality and utility of its products, ensuring they remain attractive to shoppers seeking dependable basics. For example, in 2024, many Hanes and Champion items continued to be positioned at price points that emphasize affordability, with frequent promotions making them even more accessible.

Hanesbrands' financial objectives, such as the targeted operating profit growth and margin expansion for 2024-2025, directly influence its pricing decisions. The company aims to balance competitive market pricing with the need to achieve structurally higher and more sustainable profit margins through cost management and strategic product assortment.

| Key Pricing Considerations | Hanesbrands' Approach | Impact/Example |

| Value Proposition | Competitive and accessible pricing for everyday basics | Attracts a wide range of budget-conscious consumers. |

| Brand Perception | Alignment of price with perceived quality and comfort | Hanes and Champion brands are strongly associated with value. |

| Financial Goals | Supporting margin expansion and operating profit growth | Pricing calibrated to maximize profitability, e.g., targeting 100-150 bps operating margin improvement in 2024. |

| Market Dynamics | Responding to competitor pricing and economic climate | Essential for maintaining market share in a competitive apparel sector, considering inflation's impact on consumer spending in 2024-2025. |

4P's Marketing Mix Analysis Data Sources

Our Hanes 4P's Marketing Mix Analysis is grounded in a comprehensive review of Hanes' official communications, including annual reports, investor presentations, and press releases. We also incorporate insights from their brand websites, e-commerce platforms, and reputable industry analyses to capture their product strategies, pricing structures, distribution channels, and promotional activities.