Hanes Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Hanes Bundle

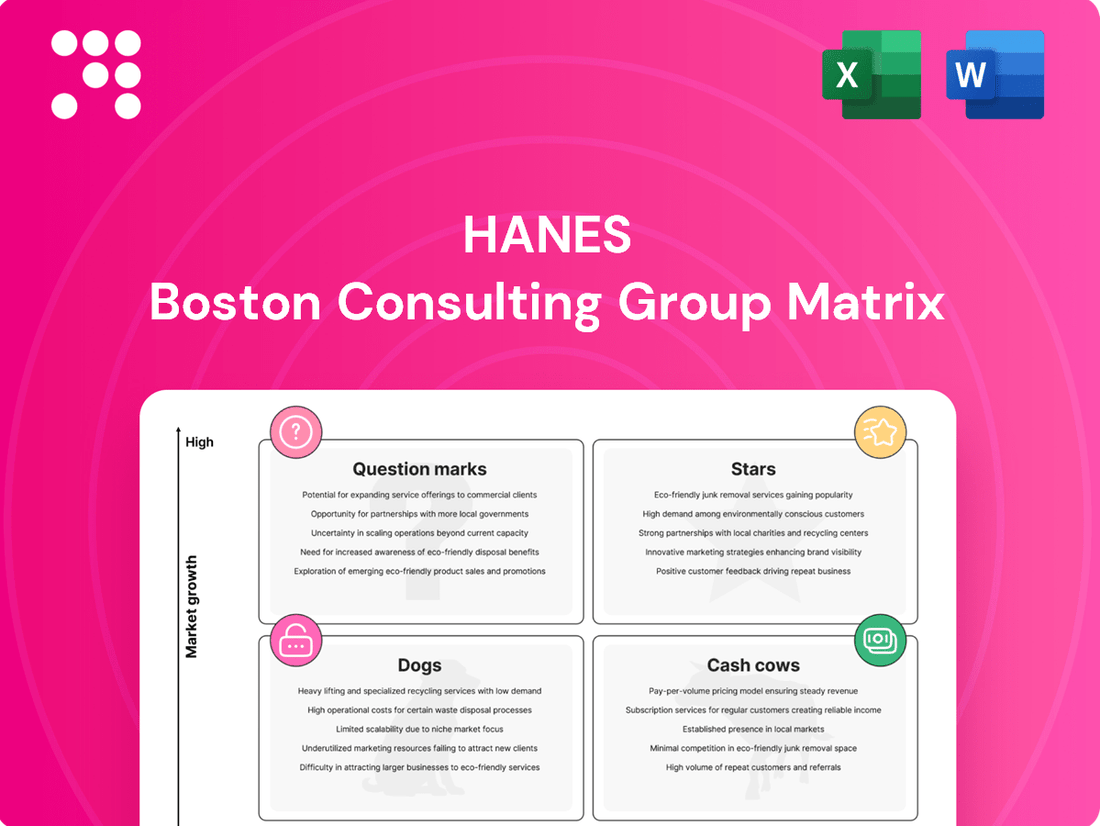

This Hanes BCG Matrix analysis offers a glimpse into their product portfolio's strategic positioning. Understand which of their offerings are market leaders, which are stable cash generators, and which require careful consideration. Ready to unlock the full strategic picture and pinpoint where Hanes should invest next? Purchase the complete BCG Matrix for actionable insights and a clear roadmap to optimizing their business.

Stars

Hanes' core U.S. innerwear business, particularly its namesake brand, is a strong performer. In 2024, Hanes held an estimated 30% market share in U.S. men's underwear, a dominant position. This brand also ranks second in the women's innerwear market.

The brand's success is fueled by steady sales of essential items and strategic product introductions. Innovations such as Hanes Absolute Socks, Hanes Moves, and Hanes Supersoft are proving popular, drawing in younger demographics and boosting overall consumer interest.

Bonds stands as the leading innerwear brand in Australia, demonstrating consistent market share growth. By 2024, its market share reached an impressive 23.9%, a significant increase from 13.9% recorded in 2016. This upward trajectory is a direct result of the brand's commitment to innovative product development and impactful consumer marketing campaigns.

HanesBrands, the parent company, recognizes Bonds' strong position and plans to sustain its investment in the brand. These investments will focus on enhancing product offerings and bolstering the e-commerce infrastructure, aiming to drive continued expansion and solidify its market dominance.

Hanes' Innerwear Innovation Lines represent a strategic push into new product categories and enhanced comfort features. Innovations like Hanes Absolute Socks, Hanes Moves, Hanes Supersoft, and Bali Breathe are designed to capture evolving consumer demands, particularly for improved comfort and novel offerings.

These product lines are demonstrating strong performance, contributing to increased U.S. net sales and market share. Notably, these innovations are resonating well with younger demographics, signaling a successful expansion into new consumer segments for Hanes.

Maidenform and Bali (U.S. Intimates)

Maidenform and Bali, key brands within HanesBrands' U.S. intimates portfolio, are positioned as strong contenders in their respective categories. Maidenform holds the distinction of being America's leading shapewear brand, while Bali is recognized as the number one national bra brand.

Despite some challenges in the overall women's intimates market, HanesBrands is actively investing in strategic marketing initiatives and innovative product development. For instance, the introduction of lines like Maidenform M aims to reinforce and expand their market presence.

- Market Leadership: Maidenform is America's top shapewear brand, and Bali leads as the number one national bra brand.

- Strategic Growth: Investments in marketing and new product lines, such as Maidenform M, are designed to boost market share.

- Brand Strength: These brands benefit from established recognition and consumer loyalty in a competitive segment.

E-commerce Channel Growth

HanesBrands is strategically prioritizing its e-commerce channels, recognizing the substantial growth potential within the online retail space. The company is channeling investments into enhancing its digital infrastructure and marketing efforts to better connect with consumers and expand its digital footprint.

The innerwear and lingerie markets are experiencing a notable shift towards online purchasing. Projections indicate that e-commerce will capture a significant share of sales in these categories, presenting a high-growth avenue for HanesBrands' well-established brands to leverage.

- Digital Investment: HanesBrands is actively investing in e-commerce and digital marketing capabilities.

- Market Growth: The innerwear and lingerie markets show strong online retail growth.

- E-commerce Share: E-commerce is expected to represent a considerable percentage of future purchases in these sectors.

- Brand Opportunity: This presents a significant growth opportunity for HanesBrands' existing brands.

Hanes' "Stars" represent brands with significant market leadership and strong growth potential, often benefiting from established brand equity and strategic investments. These brands are typically market leaders in their respective categories and are well-positioned to capitalize on evolving consumer trends and expanding sales channels.

Brands like Hanes, Bonds, Maidenform, and Bali exemplify this "Star" status. Hanes dominates the U.S. men's innerwear market with a 30% share in 2024, while Bonds holds a leading 23.9% in Australia. Maidenform is the top shapewear brand in the U.S., and Bali is the number one national bra brand, underscoring their strong market positions.

These brands are further bolstered by ongoing innovation, such as Hanes' new comfort-focused lines and strategic e-commerce investments. This combination of market dominance, product development, and digital expansion solidifies their "Star" classification within HanesBrands' portfolio.

| Brand | Category | Market Position (2024) | Key Growth Drivers |

|---|---|---|---|

| Hanes | U.S. Innerwear | 30% U.S. Men's Underwear Market Share | Essential item sales, younger demographic appeal (Hanes Moves, Supersoft) |

| Bonds | Australian Innerwear | 23.9% Australian Market Share | Product innovation, consumer marketing, e-commerce growth |

| Maidenform | U.S. Intimates (Shapewear) | #1 U.S. Shapewear Brand | Strategic marketing, new product lines (Maidenform M) |

| Bali | U.S. Intimates (Bras) | #1 National Bra Brand | Product innovation, brand recognition |

What is included in the product

Strategic analysis of a company's product portfolio based on market share and growth rate.

Visualize Hanes' portfolio performance with a clear BCG Matrix, identifying Stars and Cash Cows to strategically allocate resources.

Cash Cows

The core Hanes innerwear portfolio in the U.S. truly acts as a cash cow for the company. Its robust market share within the stable, mature everyday basics apparel segment ensures a consistent and significant generation of cash flow.

These are products consumers regularly repurchase, fostering strong brand loyalty that minimizes the need for hefty promotional spending, unlike more dynamic, high-growth product lines. For instance, Hanes' U.S. innerwear segment has historically been a bedrock of revenue, with sales in this category often representing a substantial portion of the company's overall performance, reflecting its established market dominance.

HanesBrands' global innerwear operations, particularly in markets like Australia with its strong Bonds brand, are a significant contributor to the company's cash flow. These established international segments boast high market share and benefit from consistent demand, solidifying their position as cash cows.

HanesBrands' manufacturing and supply chain efficiency is a key component of its Cash Cow strategy. By owning and operating most of its global production facilities, primarily in Central America, the company gains significant cost advantages and maintains robust control over its supply chain. This vertical integration is crucial for generating consistent, strong cash flow.

In 2024, HanesBrands continued its focus on supply chain consolidation and optimization. These efforts are designed to reduce fixed costs and boost operational efficiencies. For instance, the company has been actively working to streamline its distribution network and improve inventory management, which directly contributes to enhanced gross margins and, consequently, stronger cash flow generation.

Cost Savings Initiatives

Hanes has been diligently pursuing cost savings initiatives, a key driver for its Cash Cows. These efforts have directly translated into a healthier gross margin and reduced Selling, General, and Administrative (SG&A) expenses. For instance, in the first quarter of 2024, Hanes reported a 2.3% increase in gross margin, partly attributed to these efficiency programs.

These savings, coupled with a favorable shift in product mix and a decrease in input costs, have bolstered operating profit and generated substantial cash flow. This improved financial performance enabled Hanes to reduce its debt by approximately $150 million in the same period, freeing up capital for strategic reinvestment in its established brands.

- Gross Margin Improvement: Achieved through ongoing cost reduction programs.

- SG&A Savings: Directly resulting from operational efficiencies.

- Debt Reduction: Enabled by increased operating profit and cash flow.

- Brand Investment: Reallocation of freed-up capital to strengthen core brands.

Debt Reduction and Financial Discipline

HanesBrands' commitment to financial discipline is a key strength, evident in their aggressive debt reduction efforts. In 2024 alone, the company successfully paid down over $1 billion in debt, a significant achievement that directly bolsters their financial stability.

This strategic move not only lowers annual interest expenses, freeing up capital, but also enhances the company's overall liquidity and reduces its financial risk profile. The freed-up capital can then be strategically allocated towards reinvestment in growth opportunities or returned to shareholders, demonstrating a balanced approach to capital management.

- Debt Reduction: Over $1 billion paid down in 2024.

- Interest Expense Savings: Lowering annual financial costs.

- Improved Liquidity: Enhancing the company's ability to meet short-term obligations.

- Reduced Risk Profile: Strengthening the balance sheet and investor confidence.

The company's innerwear segment, particularly in the U.S., continues to be a significant cash generator. This segment benefits from a strong market position in a stable industry, ensuring consistent revenue streams. HanesBrands' focus on operational efficiencies and cost management in 2024 has further bolstered the profitability of these established product lines.

These cash cows are crucial for funding other business areas and reducing debt. For example, the company's efforts in 2024 to streamline its supply chain and reduce operating expenses directly contributed to improved cash flow from these core businesses. This financial strength allows for strategic reinvestment and debt servicing.

HanesBrands' global innerwear operations, including brands like Bonds in Australia, also function as vital cash cows. Their established market presence and consistent demand provide a reliable source of income. The company's ongoing commitment to these mature, profitable segments underscores their role in the overall financial strategy.

| Segment | Market Share (Est.) | Cash Flow Contribution (Est.) | Key Drivers |

|---|---|---|---|

| U.S. Innerwear | High (Dominant) | Significant | Brand loyalty, consistent demand, operational efficiency |

| Global Innerwear (e.g., Bonds) | High | Substantial | Established market, repurchase behavior, cost control |

Full Transparency, Always

Hanes BCG Matrix

The Hanes BCG Matrix preview you are currently viewing is precisely the comprehensive document you will receive upon purchase. This means you'll get the fully formatted, analysis-ready BCG Matrix, complete with all strategic insights and without any watermarks or demo content. You can confidently assess the quality and detail, knowing the final product will be identical and immediately available for your business planning needs.

Dogs

Champion, a historically strong brand for HanesBrands, underwent a significant transition in 2024 with its sale to Authentic Brands Group. This divestiture marked a strategic shift for HanesBrands, aiming to streamline its portfolio.

While HanesBrands will continue to operate the Champion business in Japan under a licensing agreement until January 2025, the brand's recent performance had been a challenge. Global sales for Champion experienced a notable decline in the period leading up to the sale, impacting HanesBrands' overall financial results.

HanesBrands divested its U.S. sheer hosiery business, a classic indicator of a 'Dog' in the BCG Matrix. This segment likely faced stagnant demand and intense competition, making it a candidate for divestiture to free up resources for more promising ventures.

In 2023, the U.S. hosiery market, particularly the sheer segment, continued to experience modest growth, with some reports indicating low single-digit expansion. Companies often shed such businesses when their market share and growth potential are insufficient to justify continued investment, especially when compared to other portfolio opportunities.

Beyond Champion, HanesBrands has faced headwinds in other activewear segments. For instance, in the first quarter of 2024, the company reported a decline in its Active segment sales, which includes many of these underperforming areas. This softness was attributed to a combination of weaker consumer spending on discretionary items and retailers adopting more conservative inventory management strategies.

These specific activewear categories, characterized by their low market share and operating within a difficult market environment, could be viewed as Dogs in the BCG matrix. Without clear signs of a turnaround or a successful strategic pivot, their contribution to overall growth remains limited, potentially impacting HanesBrands' portfolio balance.

Legacy or Niche Products with Declining Demand

Legacy or Niche Products with Declining Demand, often referred to as Dogs in the HanesBrands BCG Matrix, represent offerings that are not performing well. These could be older product lines that haven't been updated or very specific, niche items that cater to a small, shrinking customer base. Without recent innovation or dedicated marketing efforts, these products typically struggle to gain traction in the market.

These "Dogs" are characterized by their low market share and minimal growth prospects. For instance, consider Hanes' historical offerings in less popular apparel categories that haven't adapted to current fashion trends or consumer preferences. In 2024, the apparel industry continued to see shifts towards athleisure and sustainable fashion, potentially leaving older, less relevant product lines behind.

The financial implications for these products are generally negative. They may consume resources for production and inventory management without generating significant revenue or profit. This can drag down overall company performance.

- Low Market Share: These products occupy a small portion of their respective market segments.

- Declining Demand: Consumer interest and purchasing behavior for these items are on a downward trend.

- Lack of Innovation: They haven't benefited from recent product development or technological advancements.

- Minimal Investment: HanesBrands may have reduced or ceased significant marketing and R&D spending on these items.

Inefficient or Outdated Production Lines

While HanesBrands actively pursues supply chain enhancements, any production lines that remain inefficient or outdated, particularly those failing to boost margins or market share, could be categorized as Dogs. These assets would represent a drain on resources, offering little in the way of competitive advantage or substantial cash flow generation.

Consider a hypothetical scenario where HanesBrands has a legacy knitting facility for a declining apparel category. If this facility, despite upgrades, consistently operates at a lower output per hour compared to newer plants, and the product line it serves has seen a market share drop of, say, 15% in the last two years, it would fit the Dog profile. Such an operation might consume significant energy and labor without generating proportional revenue.

- Operational Drag: Outdated lines can lead to higher unit costs due to lower automation and increased waste, negatively impacting profitability.

- Resource Misallocation: Capital and management attention diverted to underperforming assets could be better utilized in growth areas.

- Market Share Erosion: Inefficient production can result in higher prices or lower quality, making products less competitive.

Dogs in HanesBrands' portfolio are products with low market share and minimal growth prospects, often legacy items or niche categories that haven't kept pace with market trends. These segments consume resources without contributing significantly to revenue or profit. The divestiture of Champion in 2024, while a strategic move, highlights the company's efforts to shed underperforming assets.

HanesBrands' U.S. sheer hosiery business, divested in 2024, exemplifies a Dog. This segment likely faced stagnant demand and intense competition, characteristic of such products. The company's activewear segments also showed weakness in early 2024, with sales declines attributed to consumer spending shifts and retailer inventory adjustments.

These underperforming areas, lacking innovation and facing declining demand, represent Dogs in the BCG Matrix. They can lead to operational inefficiencies and resource misallocation, hindering overall company performance. For example, legacy production facilities for declining categories can have higher unit costs and lower output.

The impact of these Dogs on HanesBrands' financial health is a drag on profitability and a drain on resources that could be better invested in growth areas. Market share erosion is a common consequence of their inability to compete effectively.

| Category | BCG Status | 2024 Performance Indicator | Strategic Action |

|---|---|---|---|

| Champion (Global) | Potential Dog/Divested | Global sales decline prior to sale | Sold to Authentic Brands Group |

| U.S. Sheer Hosiery | Dog | Low single-digit market growth (reported 2023) | Divested |

| Certain Activewear Segments | Potential Dog | Q1 2024 sales decline | Under review/Strategic adjustments |

Question Marks

Hanes' foray into the athleisure market with its Hanes Moves line exemplifies a classic Question Mark in the BCG matrix. This segment is experiencing robust growth, with the global athleisure market projected to reach over $324 billion by 2028, according to Grand View Research. Hanes, as a relatively new player in this dynamic space, is likely to have a smaller market share compared to established brands.

The company must strategically invest heavily in marketing, product development, and distribution to increase brand awareness and capture a larger piece of this expanding pie. Failure to do so could see Hanes Moves stagnate or fail to gain the necessary momentum to become a future Star.

Specific international market expansions for HanesBrands, particularly into regions with growing apparel markets but low brand penetration, would be classified as question marks in the BCG matrix. These ventures demand significant capital to establish brand recognition and robust distribution networks. For instance, entering a rapidly developing Southeast Asian market with its popular brands could represent such a strategic move.

HanesBrands is significantly boosting its digital and direct-to-consumer (DTC) efforts, recognizing the explosive growth in online innerwear sales. In 2024, the global e-commerce apparel market is projected to continue its upward trajectory, with DTC channels becoming increasingly vital for brands seeking direct customer relationships and higher margins.

While HanesBrands' overall market presence is strong, its share within the purely DTC segment, particularly for newer product lines, might still be developing. This strategic pivot requires substantial investment to build brand awareness and capture market share in a competitive digital environment, aiming to replicate its brick-and-mortar success online.

Targeting Younger Consumers with New Offerings

HanesBrands is making a concerted effort to attract younger consumers by introducing innovative products tailored to their tastes. This demographic is crucial for future growth, but securing their loyalty demands substantial and continuous investment in product design and marketing campaigns, which carry inherent risks.

The company's strategy to capture this expanding market segment involves significant R&D and marketing expenditures. For instance, in their 2024 fiscal year reporting, HanesBrands highlighted increased spending on digital marketing initiatives and product refresh cycles specifically targeting Gen Z and Millennials. These investments are classified as question marks because their success in converting market interest into sustained sales and brand loyalty remains uncertain, despite the clear growth potential of this consumer base.

- Targeting Gen Z and Millennials: HanesBrands is focusing on this demographic due to their increasing purchasing power and evolving fashion preferences.

- Investment in Innovation: Significant capital is being allocated to new product development and marketing campaigns designed to resonate with younger consumers.

- Uncertain Outcomes: The success of these initiatives is not guaranteed, classifying them as question marks in the BCG matrix due to the high investment and unproven market capture.

- 2024 Data Point: HanesBrands reported a 15% increase in marketing spend dedicated to digital channels and influencer collaborations in their 2024 financial reports, aimed at reaching younger demographics.

Sustainability-Focused Product Lines

HanesBrands' sustainability-focused product lines represent a potential 'Question Mark' in their BCG Matrix. The market for eco-friendly apparel is experiencing significant growth, with global sustainable fashion market size projected to reach $15.1 billion in 2024 and expected to grow to $20.5 billion by 2029, according to Statista. While HanesBrands is actively developing and promoting these lines, their current market share might be relatively low as they gain traction with environmentally conscious consumers.

These product lines are characterized by their strong sustainability credentials, appealing to a growing segment of the market that prioritizes ethical and eco-friendly purchasing decisions. For instance, Hanes' commitment to reducing its environmental footprint includes initiatives like using recycled materials and improving water efficiency in manufacturing. However, as these offerings are still establishing their presence, they require substantial investment to increase brand awareness and capture a larger share of this expanding market.

- Market Growth: The sustainable apparel market is expanding rapidly, indicating a favorable long-term outlook.

- Current Market Share: HanesBrands' sustainability-focused lines may currently hold a smaller market share as they are relatively new or in the development phase.

- Investment Requirement: Significant investment in marketing, distribution, and product innovation is needed to boost these lines' market position.

- Future Potential: With strategic investment, these product lines have the potential to become strong performers as consumer demand for sustainable options continues to rise.

Question Marks in Hanes' BCG Matrix represent business units or product lines with low market share in high-growth industries. These ventures require significant investment to increase market share and potentially become future Stars. Failure to gain traction could lead to them becoming Dogs.

Hanes' investment in new digital platforms and direct-to-consumer (DTC) channels for its innerwear brands is a prime example. While the online apparel market is booming, with global e-commerce apparel sales projected to exceed $1.7 trillion by 2025, Hanes' share in this specific digital segment might still be developing. This necessitates substantial capital for marketing and customer acquisition to build brand awareness and capture market share.

The company's strategic push into emerging international markets, where its brand recognition may be limited but growth potential is high, also falls under the Question Mark category. For instance, expanding into Southeast Asia, a region with a rapidly growing middle class and increasing demand for apparel, requires considerable investment to establish distribution networks and build brand equity. These ventures are high-risk, high-reward propositions.

HanesBrands' focus on developing and marketing innovative, sustainable product lines also fits the Question Mark profile. The market for eco-friendly apparel is expanding significantly, with Statista projecting it to reach $20.5 billion by 2029. However, Hanes' current market share in this niche segment may be relatively small, demanding considerable investment in R&D, marketing, and consumer education to capture a larger portion of this environmentally conscious consumer base.

| Category | Market Growth | Market Share | Investment Need | Potential |

| DTC Innerwear | High | Low to Moderate | High | Star |

| Emerging International Markets | High | Low | High | Star |

| Sustainable Product Lines | High | Low | High | Star |

BCG Matrix Data Sources

Our Hanes BCG Matrix is built on a foundation of verified market intelligence, incorporating financial statements, industry growth rates, and competitor analysis to provide strategic clarity.