Global Payments SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Global Payments Bundle

Global Payments operates in a dynamic market, leveraging its technological prowess and extensive network. However, it faces intense competition and evolving regulatory landscapes that could impact its growth trajectory.

Want the full story behind Global Payments' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Global Payments boasts an impressive worldwide operational network, serving merchants in more than 100 countries. This extensive geographic footprint is a significant strength, enabling the company to tap into a wide array of market opportunities and diversify its revenue streams, reducing dependence on any single economic region.

This broad international presence is crucial for facilitating seamless cross-border transactions, a key demand for businesses operating globally. It allows Global Payments to cater effectively to the varied and evolving needs of a diverse merchant base, solidifying its position as a leading worldwide provider.

Global Payments boasts a comprehensive payment solutions portfolio, encompassing everything from basic payment processing and merchant acquiring to advanced point-of-sale systems. This wide array of services caters to businesses of all sizes, facilitating seamless transactions whether customers are shopping in-store, online, or via mobile devices.

The company's strength lies in its ability to offer an integrated suite of software solutions. These integrations are designed to boost operational efficiency for its clients and foster deeper customer engagement, a critical factor in today's competitive landscape. For instance, in 2023, Global Payments reported significant growth in its technology solutions segment, indicating strong adoption of these integrated offerings.

Global Payments has shown impressive financial strength. In the first quarter of 2025, their adjusted net revenues saw a 5% increase when measured in constant currency, not counting any divested businesses. This consistent growth highlights the company's ability to expand its revenue streams effectively.

Furthermore, the company's adjusted earnings per share (EPS) also grew significantly, by 11% in constant currency during the same Q1 2025 period. This strong EPS growth demonstrates improved profitability and operational efficiency, a key indicator of a healthy business.

The reaffirmation of their 2025 financial outlook reinforces this positive trend. It suggests management's confidence in the company's ongoing performance and its capacity to navigate market conditions, pointing to a resilient and well-managed business.

Strategic Acquisitions and Divestitures

Global Payments has strategically honed its business by actively managing its portfolio through significant transactions. A prime example is its acquisition of Worldpay, a move that substantially bolstered its merchant acquiring capabilities and global reach. This was complemented by the divestiture of its Issuer Solutions and Payroll businesses, allowing the company to concentrate on its core strengths as a pure-play merchant solutions provider.

These strategic maneuvers are designed to create a more focused entity with enhanced scale and integrated offerings. The company anticipates substantial cost and revenue synergies stemming from these portfolio adjustments. For instance, the Worldpay integration was projected to yield significant operational efficiencies and cross-selling opportunities, reinforcing its competitive position in the payments industry.

- Portfolio Refinement: Acquired Worldpay, divested Issuer Solutions and Payroll businesses.

- Strategic Focus: Transitioned to a pure-play merchant solutions provider.

- Synergy Potential: Expected significant cost and revenue synergies from integration.

- Market Position: Enhanced scale and capabilities in the global payments market.

Commitment to Innovation and Technology

Global Payments demonstrates a strong commitment to innovation, planning to invest more than $1 billion annually following its Worldpay acquisition. This substantial investment fuels the adoption of advanced technologies. For instance, the company actively employs artificial intelligence to enhance fraud prevention measures and streamline its operational processes, as detailed in their 2025 Commerce and Payment Trends Report.

This forward-thinking approach allows Global Payments to effectively navigate the dynamic payment industry and meet shifting consumer expectations.

- Significant Annual Investment: Over $1 billion earmarked for innovation post-Worldpay transaction.

- AI Integration: Utilization of AI for fraud detection and operational efficiency improvements.

- Adaptability: Positioned to respond to evolving payment technologies and customer needs.

Global Payments' extensive global reach, spanning over 100 countries, allows it to capitalize on diverse market opportunities and diversify revenue, reducing reliance on any single economy. This broad operational network is vital for facilitating smooth international transactions, a key requirement for globally operating businesses.

The company offers a comprehensive suite of payment solutions, from basic processing to advanced POS systems, catering to businesses of all sizes and transaction types. Its integrated software solutions enhance client efficiency and customer engagement, with technology solutions showing significant growth in 2023.

Financially, Global Payments demonstrated robust performance in Q1 2025, with adjusted net revenues up 5% in constant currency and adjusted EPS growing 11% in constant currency, underscoring its profitability and efficiency.

Strategic portfolio management, including the Worldpay acquisition and divestiture of non-core businesses, has sharpened its focus on merchant solutions, creating a more integrated and scaled entity with anticipated synergies.

A significant commitment to innovation, with over $1 billion annually invested post-Worldpay, drives the adoption of advanced technologies like AI for fraud prevention and operational improvements, ensuring adaptability in the dynamic payments landscape.

What is included in the product

Analyzes Global Payments’s competitive position through key internal and external factors, detailing its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address critical vulnerabilities in global payment operations.

Weaknesses

Global Payments has faced significant hurdles integrating its substantial acquisition of Worldpay, a move aimed at bolstering its market position. These integration challenges are not new, as the company has a history of less-than-smooth transitions from previous acquisitions, which could cast a shadow over its current strategic transformation plans. Successfully merging operations and cultures is paramount to unlocking the projected financial benefits and ensuring business continuity.

Global Payments faces significant headwinds from macroeconomic uncertainties. Ongoing tariff negotiations and general economic instability can dampen consumer spending and business investment in payment technologies. For instance, global economic growth forecasts for 2024 and 2025 have been revised downwards by major institutions due to persistent inflation and geopolitical tensions, directly impacting transaction volumes.

Fluctuations in foreign currency exchange rates are a persistent challenge. In 2024, the U.S. dollar experienced volatility against major currencies, which directly impacted Global Payments' adjusted net revenue growth. A stronger dollar, for example, reduces the reported revenue from international operations when translated back into U.S. dollars, creating a headwind to reported growth figures.

While Global Payments' user-facing platforms are designed for simplicity, the backend infrastructure supporting its vast array of services is inherently complex. This intricate web of systems, handling everything from transaction processing to fraud detection across numerous geographies, can be a significant operational hurdle. For instance, the sheer volume of data processed daily requires robust and sophisticated management, contributing to higher operational expenditures.

Intense Competitive Landscape

The payments sector is incredibly crowded, with established banks, agile fintech startups, and even software providers that embed payment solutions all fiercely competing for customers. This intense rivalry often leads to price wars, squeezing profit margins and demanding constant investment in new features and services to stand out. For instance, in 2024, the global digital payments market was projected to reach over $2.5 trillion, a testament to its growth but also its competitive intensity.

This dynamic environment forces companies to innovate at an accelerated pace. Staying ahead requires not just offering basic payment processing but also adding value through enhanced security, seamless integration, and data analytics. Failing to adapt can quickly lead to losing market share to more nimble or technologically advanced rivals.

- Intense Rivalry: Traditional banks, fintechs, and ISVs all compete for market share.

- Margin Pressure: Fierce competition often leads to downward pressure on pricing and profitability.

- Innovation Imperative: Continuous investment in new technologies and services is crucial for differentiation.

- Market Share Risk: Companies must adapt quickly to avoid losing ground to competitors.

Ongoing Restructuring and Divestiture Risks

Global Payments is navigating a significant 'transition year' in 2025, marked by strategic reorientation and potential divestitures. This period of change, while intended to streamline operations, could temper short-term revenue growth and introduce operational disruptions. The company's ability to effectively manage these ongoing restructuring efforts and execute timely divestitures is paramount to mitigating associated risks.

The success of these strategic shifts hinges on careful execution. For instance, the company has indicated plans to divest certain non-core assets, a process that requires meticulous planning and market timing to maximize value and minimize disruption to ongoing business operations. Investors and stakeholders will be closely monitoring the progress and financial impact of these divestitures throughout 2025.

- Strategic Reorientation: Global Payments is actively reshaping its business model in 2025, which inherently carries execution risks.

- Divestiture Uncertainty: The timing and success of planned asset sales can impact near-term financial performance and strategic focus.

- Short-Term Growth Impact: Restructuring and divestitures may temporarily slow revenue expansion as the company refocuses its resources.

- Operational Disruptions: The process of divesting units or reorganizing business segments can create temporary inefficiencies or integration challenges.

Global Payments faces significant integration challenges following its large Worldpay acquisition, a process that has historically presented difficulties for the company. These complex integrations can strain resources and divert management focus from other critical areas, potentially impacting overall operational efficiency and the realization of expected synergies. Successfully merging diverse systems and cultures is key to unlocking the full value of such strategic moves.

Preview the Actual Deliverable

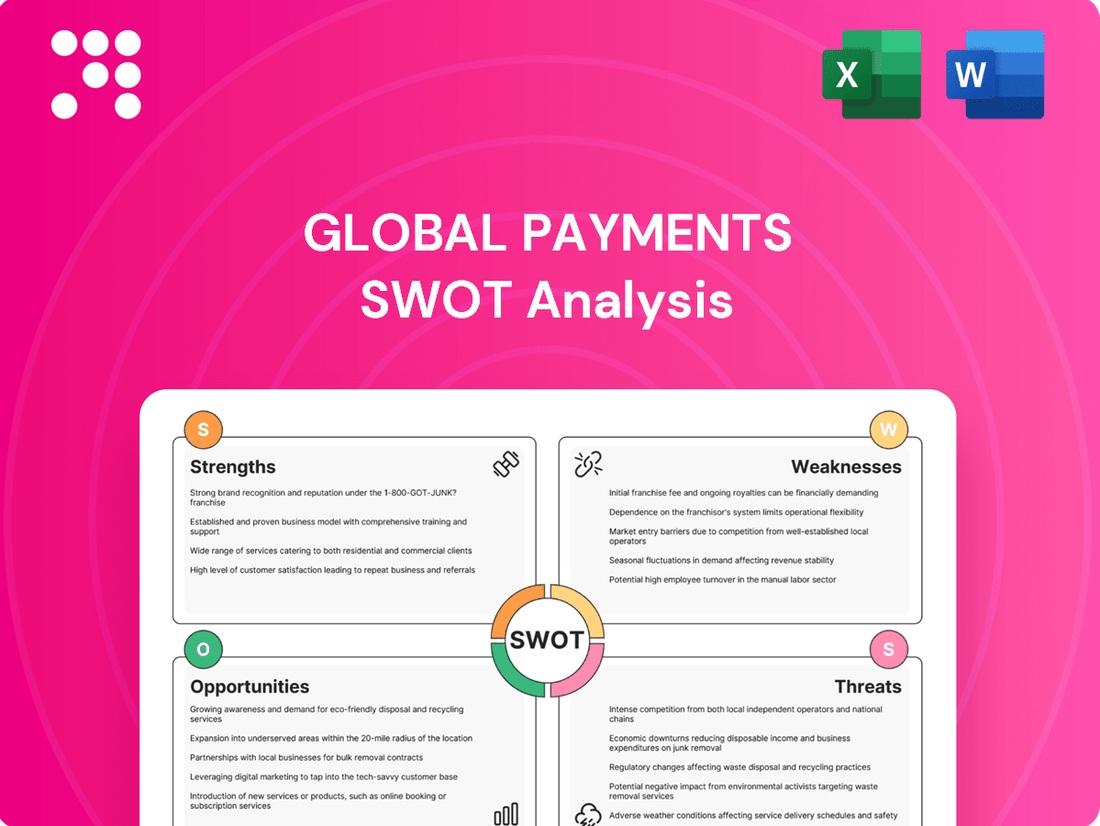

Global Payments SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, offering comprehensive insights into Global Payments' strategic position.

This is a real excerpt from the complete document, showcasing the professional quality and structure you can expect. Once purchased, you’ll receive the full, editable version of the Global Payments SWOT analysis.

Opportunities

The ongoing global transition from cash to digital and instant payment methods is a significant growth avenue. By the end of 2024, it's projected that digital payment transaction values will surpass $10 trillion globally, a testament to this accelerating trend.

Instant payment systems are becoming more prevalent worldwide, with over 70 countries now having implemented such systems. Coupled with the rapid rise of digital wallets, particularly within the booming eCommerce sector, this creates a prime environment for Global Payments to enhance its digital services and secure increased transaction volumes.

Embedded finance is a rapidly expanding market, with projections indicating it will reach $7 trillion globally by 2030, up from an estimated $4.5 trillion in 2023. This presents a significant opportunity for Global Payments to embed its payment solutions directly into the workflows of businesses across various sectors. By offering seamless payment experiences within software, supply chains, and customer interactions, Global Payments can capture a larger share of transaction volume and increase customer stickiness.

Expanding into high-growth verticals like education, healthcare, and real estate offers substantial revenue potential. For instance, the global EdTech market is expected to grow to $605.4 billion by 2027, and the healthcare payment systems market is also experiencing robust expansion. Global Payments can tailor its embedded payment offerings to meet the specific needs of these industries, such as facilitating tuition payments in education or streamlining patient billing in healthcare, thereby creating deeper value and new revenue streams.

Global Payments can significantly enhance its service offerings by integrating advanced artificial intelligence. AI's capabilities in fraud prevention are particularly impactful; for instance, in 2024, financial institutions leveraging AI saw a reported reduction in fraudulent transactions by up to 30% compared to those relying on traditional methods.

By employing AI and machine learning, Global Payments can refine its transaction approval rates, potentially boosting them by an estimated 5-10% through more sophisticated risk assessment. This not only improves efficiency but also enhances the customer experience by minimizing unnecessary declines.

Furthermore, AI can revolutionize customer service through intelligent chatbots and personalized support, streamlining query resolution and increasing client satisfaction. This strategic adoption of AI aligns with industry trends, where companies investing in AI are projected to see a 15-20% increase in operational efficiency by 2025.

Cross-Border Payment Market Expansion

The global cross-border payment market is experiencing robust growth, fueled by increasing international trade. This presents a significant opportunity for companies like Global Payments to expand their reach and services. In 2024, the total value of cross-border payments was projected to exceed $150 trillion, with continued growth expected through 2025.

Several factors are driving this expansion, including technological advancements and evolving regulatory landscapes. Initiatives such as the adoption of the ISO 20022 messaging standard are standardizing and improving the efficiency of global financial transactions. Furthermore, the development of digital public infrastructures is creating new pathways for seamless international payments.

- Growing Demand: International trade volume is consistently rising, directly increasing the need for efficient cross-border payment solutions.

- Technological Advancements: Innovations like ISO 20022 are streamlining payment processes, making them faster and more transparent.

- Market Penetration: Global Payments can leverage these trends by enhancing its cross-border payment infrastructure and offering competitive international transaction services.

Strategic Partnerships and Collaborations

Global Payments can significantly boost its innovation and market penetration by forming strategic alliances with fintech companies and other payment service providers. These partnerships allow for the rapid development and deployment of new solutions, tapping into specialized expertise and customer bases. For example, Global Payments' existing commercial relationships, like the one with FIS, demonstrate a commitment to offering comprehensive and integrated payment solutions.

These collaborations are crucial for enhancing agility and scalability. By working with partners, Global Payments can more effectively adapt to the rapidly evolving payments landscape and expand its service offerings without bearing the full cost and risk of in-house development. This approach is particularly valuable in a market where technological advancements are constant. In 2024, the global fintech market was valued at over $2.4 trillion, highlighting the immense opportunity for growth through strategic collaborations.

- Accelerated Innovation: Partnerships with fintechs can bring cutting-edge technologies and business models to Global Payments' platform.

- Expanded Market Reach: Collaborations allow access to new customer segments and geographic regions through partners' existing networks.

- Enhanced Agility and Scalability: Working with partners enables quicker adaptation to market changes and efficient scaling of services.

- Integrated Offerings: Strategic alliances facilitate the creation of seamless, end-to-end payment solutions that meet diverse customer needs.

The ongoing shift towards digital and instant payments presents a substantial growth opportunity, with global digital payment transaction values projected to exceed $10 trillion by the end of 2024. This trend is further amplified by the increasing adoption of instant payment systems, now active in over 70 countries, and the burgeoning popularity of digital wallets, especially within the thriving eCommerce sector.

Embedded finance, expected to reach $7 trillion globally by 2030, offers Global Payments a chance to integrate its solutions directly into business workflows, enhancing customer experience and transaction volumes. Expanding into high-growth sectors like education and healthcare, markets poised for significant expansion, also presents lucrative avenues for tailored payment solutions.

Leveraging artificial intelligence can boost operational efficiency by an estimated 15-20% by 2025, improve transaction approval rates by 5-10%, and significantly enhance fraud prevention, with AI-powered systems showing up to a 30% reduction in fraud in 2024. The global cross-border payment market, valued at over $150 trillion in 2024, offers further expansion potential, supported by technological advancements like ISO 20022.

Strategic alliances with fintech companies, a market valued at over $2.4 trillion in 2024, can accelerate innovation, expand market reach, and enhance agility, enabling Global Payments to offer more comprehensive and integrated payment solutions.

Threats

The global payments sector is navigating a landscape of increasingly stringent and dynamic regulatory oversight, with new mandates in 2025 significantly altering how transactions are processed, compliance is managed, and customer interactions occur. Failure to adhere to these evolving rules can result in substantial financial penalties and erode investor trust.

For instance, the European Union's continued focus on data privacy under GDPR, coupled with the Payment Services Directive 3 (PSD3) expected to be fully implemented by late 2025, imposes rigorous demands on payment providers. These regulations, alongside similar initiatives in North America and Asia, necessitate continuous adaptation, demanding significant investment in compliance infrastructure and expertise to navigate the complexities of cross-border operations.

The escalating complexity of cybercrime, including identity theft and AI-powered fraud, presents a major challenge for the global payments sector. Analysts predict significant financial losses due to these evolving threats, necessitating ongoing investment in robust security technologies.

Businesses are facing mounting pressure to implement advanced fraud prevention tools, such as biometrics and tokenization, to safeguard transactions. Protecting sensitive customer data and preserving user trust are critical, as breaches can severely damage a company's reputation and financial standing.

The global payments industry, after a strong growth phase, is expected to see its revenue expansion slow from an annual rate of 7% to approximately 5% in the coming five years. This shift indicates a maturing market where a greater emphasis will be placed on achieving profitable and sustainable growth rather than simply increasing transaction volumes.

Intensified Competition from Fintechs and Banks

The payments sector is seeing a surge in competition, with fintechs and neobanks aggressively capturing market share through innovative, often embedded, payment solutions. For instance, by late 2024, fintech platforms are projected to handle a significant portion of global digital payment transactions, challenging established players.

Traditional banks are not standing still; they are making substantial investments in enhancing their digital payment capabilities to retain customers and attract new ones. This intensified rivalry is likely to trigger price wars and exert downward pressure on the market share of incumbent payment providers.

Key competitive pressures include:

- Fintech innovation: Rapid development of user-friendly, integrated payment experiences by startups.

- Bank digital transformation: Traditional institutions are upgrading their digital offerings to compete directly.

- Price sensitivity: Increased competition often leads to lower transaction fees, impacting revenue margins.

- Market share erosion: Established companies may lose ground to agile new entrants.

Potential for Economic Downturns

Economic downturns, marked by rising inflation and fluctuating interest rates, pose a significant threat to Global Payments. For instance, as of late 2024, persistent inflation has pressured consumer discretionary spending, potentially leading to lower transaction volumes for payment processors. Similarly, central banks’ responses, such as interest rate hikes to combat inflation, can dampen business investment and borrowing, further impacting the revenue streams of companies like Global Payments.

Geopolitical tensions and other unforeseen global events contribute to this economic uncertainty. These broad external factors, largely outside of Global Payments' direct influence, can create volatility in currency exchange rates and disrupt international trade, both of which can have a material impact on the company's financial performance and growth prospects.

- Reduced Consumer Spending: High inflation in 2024 has led to a noticeable slowdown in discretionary purchases, directly impacting the volume of transactions processed.

- Impact of Interest Rate Hikes: As central banks continue to adjust interest rates to manage inflation, borrowing costs for businesses increase, potentially reducing investment and the need for payment processing services.

- Global Economic Uncertainty: Ongoing geopolitical instability creates a volatile operating environment, affecting cross-border transactions and overall market confidence.

The payments sector faces significant threats from evolving regulations, with new mandates in 2025 requiring substantial compliance investments. Escalating cybercrime, including AI-powered fraud, poses a substantial risk, projected to cause considerable financial losses and necessitate ongoing security upgrades. Increased competition from fintechs and neobanks is intensifying, potentially leading to price wars and market share erosion for established players.

Economic downturns, characterized by inflation and interest rate hikes, are dampening consumer spending and business investment, impacting transaction volumes and revenue streams. Geopolitical instability further exacerbates these economic uncertainties, affecting cross-border transactions and overall market confidence.

| Threat Category | Specific Risk | Impact on Payments Sector (2024-2025) | Example/Data Point |

|---|---|---|---|

| Regulatory Changes | Non-compliance penalties | Increased operational costs, reputational damage | PSD3 implementation by late 2025 |

| Cybersecurity | AI-powered fraud, identity theft | Financial losses, data breaches, loss of trust | Projected significant financial losses from evolving threats |

| Competition | Fintech market share gains | Price wars, reduced margins, market share erosion | Fintechs projected to handle significant digital payment transactions by late 2024 |

| Economic Conditions | Reduced consumer spending, interest rate hikes | Lower transaction volumes, decreased business investment | Inflation in 2024 impacting discretionary spending |

| Geopolitical Instability | Currency volatility, trade disruption | Impact on cross-border transactions, market confidence | Ongoing geopolitical tensions creating volatile operating environment |

SWOT Analysis Data Sources

This Global Payments SWOT analysis is built on a foundation of robust data, including publicly available financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded strategic perspective.